About the Author

John Patten co-founded Treasure in 2021, focusing on AI gaming projects and building infrastructure. Since entering the crypto-space in 2017, Patten has contributed to different projects including Osmosis before founding Treasure 2021, an NFT initiative which has now grown into a game console. John has a passion for community engagement and is a believer in decentralized games’ transformative powers.

These views do not necessarily reflect those of Decrypt.

We’ve always thought of the economy as a human construct—something we build, regulate, and optimize. What happens, however, if the economy is not human-constructed?

Since the introduction of consumer-facing LLMs, artificial intelligence has developed at an accelerated pace. This technology can now be used for more than just generating content and answering queries. It is also able to determine its workflows. The most advanced AI agents today don’t simply follow orders, they make decisions that are based on learned behavior, incentives and their self-interest.

It is this new, fundamental economic reality that is emerging, in which AI has become more than a mere tool. Instead, it is an integral, active participant. The key to accelerate this trend is by creating more environments in which AI and humans are able to co-create new models of collective governance and value exchange.

AI Agents Think for Themselves

Human policymakers, investors, and entrepreneurs have historically been responsible for market set-up, resource allocation and strategic decisions. To engage in unscripted and wide-ranging economic activity, AI agents must become independent planners rather than just operators.

AI agents will need to be able dynamically assess risk and opportunities based on the evolving knowledge they have of their environment. Under these conditions, an AI agent would be able to engage in weighty tasks such as decentralized governance—not by casting votes based on hard-coded logic, but rather by weighing trade-offs and anticipating abstract, far-off risks.

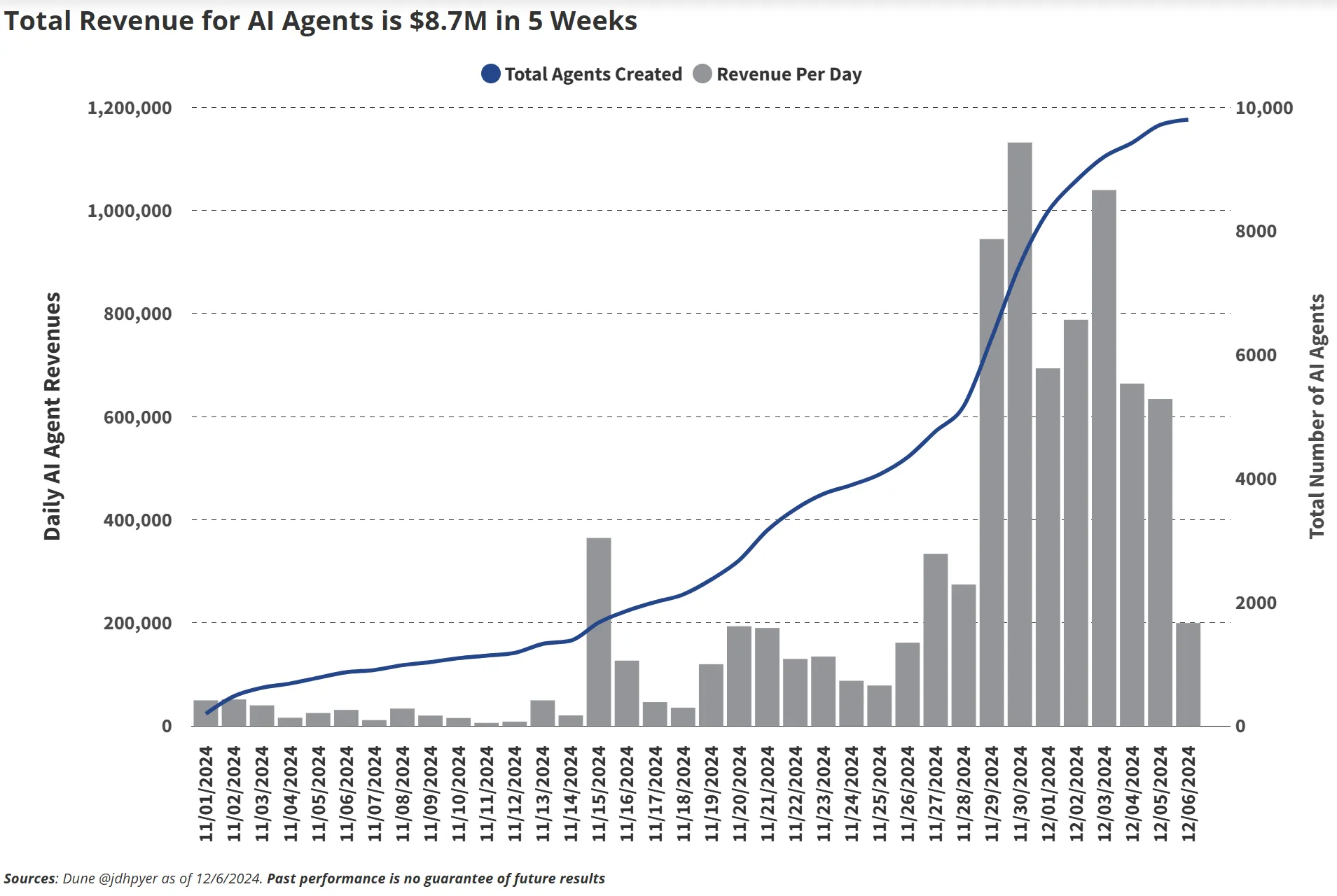

In the data from last year, it is evident that there was a need for AI agents with more flexibility and open-endedness. Nearly 10,000 AI agents related to web3 were created before 2024, despite a decline in agent revenues. It is clear that AI agents continue to multiply at a staggering rate. However, the ability of these agents to create value has not kept up with their rapid growth.

AI agents fight for a smaller slice of pie than to increase the size. In order to solve the problem, we must unlock AI’s new fields of play. It means that agents should be able to take part in a variety of environments, beyond just financial speculation. Agents can build, test, or even create infrastructure for collaboration between humans and machines.

AI agents could benefit from the freedom to act more as entrepreneurs than just extractors.

AI needs money—and crypto is the perfect fit

To participate in an economic system, AI agents need to be financially autonomous. The problem is that traditional finance has been designed for human interaction and bureaucratic oversight, but not for autonomous AI. Credit card transactions are only authorized by humans, not banks. Even the most automated trading algorithms require intermediaries and human oversight.

Crypto can change this. Blockchain networks give AI agents access to a global permissionless financial system, including crypto wallets that let them interact with apps decentralized in real-time and hold their assets. They can also use protocols to settle and initiate transactions without any oversight.

Shortly, AI-on-chain gives autonomous agents the ability to take part in digital economies in ways traditional off-chain financial rails could never do. The ability of this AI to allocate and move capital without human interference opens up new opportunities for human users. These agents can find innovative ways to achieve predetermined goals, or create and capture new types of value.

The true AI innovation comes from the game

The biggest AI misconception is that the greatest advances will be made in more enterprise-oriented applications. This could range from optimizing logistics to developing more adaptive, sophisticated trading bots. But true AI innovation won’t come from spreadsheets and supply chains—it will come from playtime.

AI systems are currently trained using enormous data sets, which can cause bottlenecks in systems that use static datasets. In order to move forward, AI agents should be deployed in an environment that is constantly evolving and data rich. Online games are the ideal environment to do this. They serve as sandboxes, where AI agents can learn and experiment in unpredictable, dynamic settings. The dataset is further enhanced by real players interfacing with AI agents in these environments. This helps AI to go beyond mere automation.

Smolverse, an NFT-based work built on Ethereum layer-2 networkArbitrum, is an early example of this approach. There, AI-driven Smols are not just playing within the game—they’re shaping its economy, testing different strategies and influencing other AI and human players in real-time.

This has implications that go beyond games. The AI that is trained within these environments with open ended can provide valuable insights on how organic new behaviors are formed, as well as refine their behavior at the interface between agentic AI (artificial intelligence) and human interaction. The future AI models can be more prepared to operate in real-world situations.

AI is closer to us than we thought

The shift towards true self-directed artificial intelligence is not just a sci-fi concept. AI agents already execute trades, manage DAOs, or discover new drugs. Web3 wasn’t intended just to be about the blockchain. Crypto projects, however, are now integrating AI on a fundamental level in order to create new forms online engagement and automation. Was once considered a niche project, but is now evolving rapidly into a whole new paradigm of economics.

What exactly does giving AI agents economic autonomy really mean? Trading bots that make split-second decisions are one thing. But an AI agent who can fund itself, invest, and build wealth forever is a completely different story. AI, even if it is well-intentioned, could cause ecosystems to collapse by optimizing short-term gains.

It doesn’t necessarily mean that we need to fear AI-driven economics; it just means we have to think carefully about their design. AI needs to be based on transparent and auditable systems that are aligned with human values. Participatory governance, incentive recalibration and adaptive economic models are key mechanisms to ensure AI-driven markets develop in a manner that is beneficial for everyone.

We should give AI a place to grow and thrive. And in doing so, we won’t just be shaping AI—we’ll be redefining the concept of “the economy” itself.

James Rubin is the editor