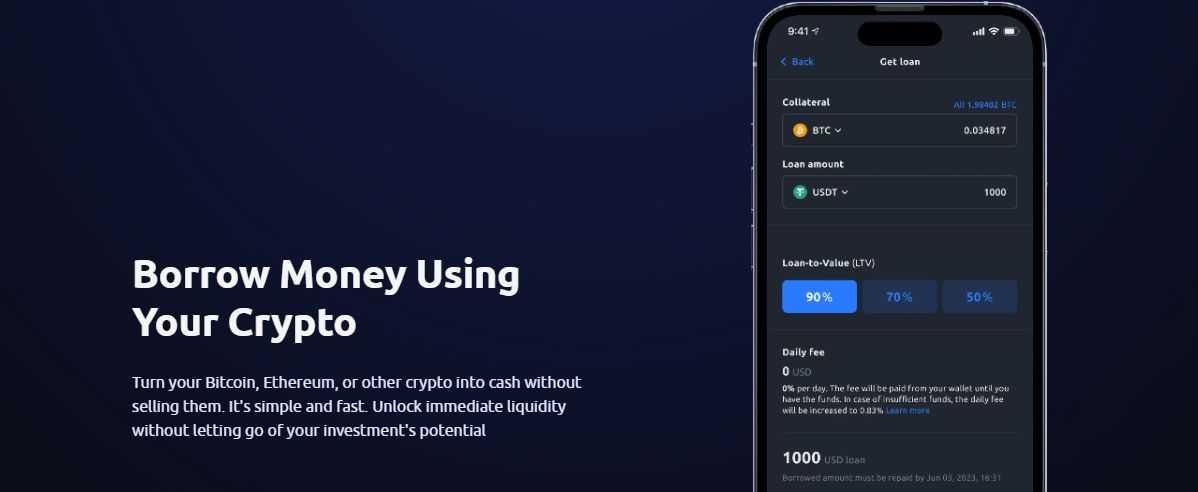

Think about proudly owning Bitcoin or Ethereum and placing it to work, incomes passive revenue or utilizing it as collateral for a mortgage. That’s the enchantment of crypto lending—it permits customers to keep up their holdings whereas tapping into their worth.

Crypto lending platforms act as bridges between lenders, who wish to earn curiosity on their crypto, and debtors, who want liquidity with out parting with their belongings. The idea is straightforward: lend your crypto and earn curiosity, or borrow funds backed by your digital holdings. However whereas the method is simple, choosing the proper platform will be difficult, particularly with so many choices, every providing distinctive options and charges.

From decentralized choices like Aave and Compound to extra conventional platforms like Binance Loans, the crypto lending panorama has one thing for everybody.

This information dives into the very best crypto lending platforms, the dangers concerned, and tips on how to profit from crypto lending.

What’s Crypto Lending?

In easy phrases, crypto lending is a monetary service that allows customers to lend their crypto belongings in alternate for curiosity or use these belongings as collateral for a mortgage. This mannequin affords flexibility for crypto fans who wish to develop their wealth with out the necessity to promote their holdings.

Crypto lending's rising reputation will be attributed to a couple components:

- It supplies excessive accessibility in comparison with conventional loans. As an alternative of counting on credit score scores or prolonged financial institution approvals, crypto lending solely requires that debtors publish ample collateral within the type of crypto belongings.

- There's potential for top returns. By lending their digital belongings, buyers can earn curiosity that always surpass conventional financial savings accounts.

- Debtors profit by gaining fast entry to liquidity, whether or not they’re utilizing funds for additional investments, enterprise bills, or on a regular basis bills.

That stated, the recognition of crypto lending comes with its share of challenges, together with market volatility. Nonetheless, for many who perceive and may tolerate dangers, crypto lending stays an progressive technique to generate passive revenue.

How Crypto Lending Works

On this part, we'll break down the mechanics of crypto lending, the kinds of platforms out there and the components that affect mortgage phrases and rates of interest.

In crypto lending, there are two important individuals:

- Lenders deposit their cryptocurrency—reminiscent of Bitcoin, Ethereum or stablecoins—right into a platform the place it’s pooled and made out there for lending. In return, they earn curiosity on their deposits, which may fluctuate by platform and asset kind.

- Debtors obtain loans by locking up an equal or higher quantity of crypto as collateral. This collateral serves as safety, permitting the platform to liquidate belongings if a borrower defaults.

Forms of Crypto Lending Platforms: CeFi vs. DeFi

There are two main kinds of crypto lending platforms: Centralized Finance (CeFi) and Decentralized Finance (DeFi). Let's perceive each with a bit extra element.

• Centralized Platforms (CeFi): CeFi platforms are often managed by firms that oversee deposits, loans, and safety. These platforms usually require customers to undergo Know Your Buyer (KYC) and Anti-Cash Laundering (AML) checks to fulfill regulatory requirements. Centralized platforms are standard amongst newcomers to crypto lending as a result of they provide buyer help and a extra acquainted person expertise.

• Decentralized Platforms (DeFi): DeFi platforms, reminiscent of Aave and Compound, are constructed on blockchain expertise and use good contracts to execute and handle loans. These platforms are totally peer-to-peer, eliminating the necessity for an middleman. Customers on DeFi platforms work together instantly with good contracts, which handle collateral, mortgage phrases, and curiosity funds transparently. Nonetheless, as a result of there’s no central authority, customers are absolutely accountable for managing their belongings, which can require extra technical information and threat tolerance.

Curiosity Charges and Mortgage Phrases

Rates of interest and loan-to-value (LTV) ratios fluctuate throughout platforms. Charges are influenced by components reminiscent of the precise cryptocurrency being lent or borrowed, the platform’s liquidity, and total market circumstances. For lenders, returns usually exceed conventional financial savings charges, particularly when lending stablecoins, that are pegged to fiat forex. Debtors, in flip, can entry funds based mostly on the collateral they supply, with LTV ratios figuring out the mortgage dimension relative to the worth of their collateral.

Find out how to Select The Greatest Crypto Lending Platform

Choosing the proper crypto lending platform is essential, as each affords totally different options, safety measures, and phrases.

Curiosity Charges and Mortgage Phrases

One of the vital vital components in selecting a crypto lending platform is the rate of interest supplied on deposits or charged on loans. Rates of interest can fluctuate broadly, usually relying on the precise cryptocurrency concerned and the platform’s liquidity. Some platforms provide excessive rates of interest for standard cash like Bitcoin and Ethereum, whereas others present extra aggressive charges on stablecoins, which may enchantment to these in search of secure returns.

Equally essential are the loan-to-value (LTV) ratios supplied, which dictate how a lot you may borrow towards your collateral. Increased LTV ratios can help you borrow extra however usually include greater rates of interest and elevated liquidation threat if the asset worth falls. Reviewing these phrases fastidiously helps make sure the platform meets your monetary wants with out taking over pointless threat.

Platform Safety

Safety needs to be a prime precedence when selecting a crypto lending platform. Search for platforms that implement sturdy safety protocols reminiscent of multi-factor authentication (MFA), chilly storage for belongings, and insurance coverage protection for potential breaches or hacks. Many respected centralized platforms additionally conduct third-party safety audits to reassure customers.

Some platforms provide insurance coverage funds or insurance policies to guard customers’ belongings. As an illustration, some have insurance policies that defend belongings within the occasion of a breach, including an additional layer of safety for lenders and debtors alike.

CeFi or DeFi

Crypto lending platforms fall into two important classes: CeFi and DeFi. CeFi platforms are typically extra user-friendly and provide buyer help, regulatory compliance, and safety measures that new customers could discover reassuring. These platforms act as intermediaries, managing person belongings and infrequently conducting KYC checks to adjust to native rules.

However, DeFi platforms like Aave function with out intermediaries, relying as a substitute on good contracts to automate the lending course of. DeFi platforms can provide extra enticing charges and higher transparency, however they require customers to handle their very own safety and bear full duty for his or her funds.

Repute and Person Expertise

A platform’s repute and person opinions can provide precious insights into its reliability. It’s important to analysis the platform’s historical past, together with its safety observe report, the benefit of withdrawing funds, and the standard of customer support. Checking unbiased opinions and searching into the platform’s historical past of regulatory compliance can present further peace of thoughts earlier than committing funds.

Person expertise can be key, particularly for inexperienced persons. A well-designed interface could make it simpler to watch your belongings, evaluation rates of interest, and provoke transactions. Many CeFi platforms emphasize person expertise, making them perfect for these new to crypto lending.

Supported Belongings and Flexibility

Lastly, think about the vary of supported belongings on the platform. Some platforms help solely a handful of main cryptocurrencies, whereas others provide a wider choice, together with altcoins and stablecoins. A various vary of supported belongings permits for flexibility in lending and borrowing, catering to customers with totally different funding portfolios.

Sure platforms additionally present further flexibility by options like mounted and versatile mortgage phrases, early withdrawals, and customizable curiosity payout schedules. Should you’re seeking to handle a various set of crypto belongings, choose a platform that accommodates this want.

Inquiries to Ask Earlier than Selecting a Platform

When deciding on a crypto lending platform, there are key inquiries to information your determination. Begin by analyzing the charges, APY charges, and payout schedules to grasp potential earnings and related prices. Platforms fluctuate broadly, so figuring out the precise price construction and timing of curiosity funds is crucial. Subsequent, inquire about withdrawal limitations or lock-up durations. Some platforms limit entry to funds for set durations, which may influence liquidity.

It’s additionally essential to confirm if the platform is regulated and compliant with legal guidelines. This helps defend you from sudden restrictions or authorized points, particularly since crypto rules differ by area. Confirming compliance ensures your funds are safeguarded by applicable oversight. Lastly, verify person opinions to realize insights into the platform’s reliability and buyer help, as these components considerably affect the general expertise.

Greatest Crypto Lending Platforms

With an rising variety of crypto lending platforms out there as we speak, buyers have quite a lot of choices for incomes passive revenue or accessing loans backed by digital belongings. Nonetheless, discovering the very best platform will depend on a number of components, together with rates of interest, safety, flexibility, and supported cryptocurrencies.

| Platform | LTV Ratios | Curiosity Charges | Supported Belongings |

|---|---|---|---|

| Binance Loans | As much as 80% (most belongings capped at 65%) | Aggressive, calculated minute-by-minute | 30+ cryptocurrencies, together with BTC, ETH, stablecoins |

| Aave | As much as 80% (relying on collateral) | Dynamic, based mostly on provide and demand (ETH < 3% APR, USDC > 16% APR) | ETH, stablecoins, belongings on Polygon, Avalanche, Arbitrum |

| Compound | As much as 80% (relying on collateral) | Algorithm-driven, stablecoins < 4% APR | ERC-20 tokens, primarily stablecoins |

| CoinRabbit | As much as 90% (relying on collateral) | 12%–17% APR (calculated month-to-month) | 70+ cryptocurrencies, together with BTC, ETH, stablecoins |

| Unchained Capital | As much as 70% (Bitcoin solely) | Above 14% APR (varies by mortgage phrases and collateral) | Bitcoin solely |

| Alchemix | As much as 50% | Self-repaying through collateral yield | DAI, ETH, USDC, USDT |

| Crypto.com | As much as 80% (relying on collateral) | Diminished to eight% APR for CRO stakers, greater with out CRO staking | 13 cryptocurrencies (BTC, ETH, CRO, USDT) |

| Wirex | As much as 80% | Begins at 8% APR (varies by collateral and quantity) | BTC, ETH (restricted choice) |

| YouHodler | As much as 97% (for some belongings) | 12%–26.07% APR (relying on LTV and asset kind) | 50+ belongings, together with BTC, ETH, stablecoins |

Right here, we’ll take a more in-depth take a look at a few of the most respected crypto lending platforms, exploring their options, safety measures and advantages.

1. Binance Loans

Binance Loans is a crypto lending platform operated by Binance, one of many world’s largest exchanges. Customers can safe loans by collateralizing a variety of cryptocurrencies, together with Bitcoin, Ethereum, and stablecoins, with disbursement occurring virtually immediately. The platform integrates seamlessly inside the Binance ecosystem, permitting debtors to entry different Binance providers alongside their loans. Nonetheless, Binance Loans is just not out there within the U.S., U.Okay., or Canada, and is presently accessible in nations reminiscent of France, Spain, Australia, and New Zealand. We suggest you try our detailed evaluation on Binance.

- LTV Ratios: As much as 80% for choose belongings, with most belongings capped at 65%.

- Charges: Aggressive rates of interest, calculated minute-by-minute to make sure real-time accuracy.

- Supported Belongings: Over 30 cryptocurrencies can be utilized as collateral.

- Platform Safety: Consists of chilly storage for belongings and multi-factor authentication (MFA) for enhanced security.

- Dangers: As a centralized platform, customers face typical CeFi dangers, together with platform management over collateral.

Key Options:

- On the spot mortgage disbursement, no credit score checks required

- Excessive asset flexibility with aggressive LTV ratios

- Actual-time rate of interest calculations

2. Aave

Aave is without doubt one of the oldest and most revered platforms in decentralized finance (DeFi), offering a non-custodial, peer-to-peer lending expertise. Constructed on Ethereum, Aave helps a number of blockchain networks, together with Polygon, Avalanche, Concord, and Arbitrum, enabling customers to earn curiosity on belongings or borrow instantly from decentralized liquidity swimming pools. Along with normal loans, Aave affords flash loans—a novel function permitting skilled buyers to make the most of arbitrage alternatives with out collateral, though this requires coding experience.

As our detailed evaluation additionally highlights, Aave’s platform is standard with DeFi customers, but it surely requires lively monitoring of positions to keep away from liquidation, which can be difficult for brand new customers. Rates of interest on Aave fluctuate broadly based mostly on asset kind and market demand. As an illustration, borrowing charges for ETH could also be underneath 3% APR, whereas stablecoins like USDC might exceed 16% APR.

- LTV Ratios: As much as 80% for choose belongings, relying on the kind of collateral.

- Curiosity Charges: Dynamic, based mostly on provide and demand; varies considerably by asset (e.g., ETH under 3% APR, USDC above 16%).

- Supported Belongings: Consists of ETH, stablecoins, and different standard belongings throughout Ethereum and extra networks like Polygon and Avalanche.

- Platform Safety: Decentralized, managed by good contracts; customers are accountable for monitoring their Well being Issue to stop liquidation.

Key Options:

- Decentralized, automated lending through good contracts

- A number of charge choices and Well being Issue threat software

- Excessive LTV flexibility for numerous crypto belongings

3. Compound

Compound is a well-established DeFi platform. Constructed on Ethereum, Compound permits customers to lend or borrow crypto belongings. Not like many different platforms, Compound imposes no minimal borrowing necessities, which supplies flexibility for customers of all portfolio sizes. Nonetheless, the platform’s interface and DeFi-focused design could also be difficult for inexperienced persons. We now have this and extra in our detailed evaluation of Compound.

Compound’s rates of interest regulate algorithmically based mostly on provide and demand in its liquidity swimming pools, making charges attentive to market circumstances. The platform helps a restricted vary of ERC-20 tokens, together with stablecoins, with stablecoin APRs usually underneath 4%.

- LTV Ratios: Usually as much as 80% for particular belongings, relying on the collateral.

- Curiosity Charges: Algorithmically pushed; stablecoin charges typically underneath 4% APR.

- Supported Belongings: Restricted choice, primarily Ethereum and some ERC-20 tokens.

- Platform Safety: Open-source codebase with group governance through COMP token; clear, decentralized protocol.

Key Options:

- Algorithm-driven charges based mostly on provide and demand

- Excessive LTV ratios and numerous asset help

- Neighborhood governance by COMP tokens

4. CoinRabbit

CoinRabbit is a user-friendly crypto lending platform providing fast, no-credit-check loans in over 70 cryptocurrencies, together with Bitcoin, Ethereum, and stablecoins. Identified for its streamlined software course of, CoinRabbit permits debtors to obtain funds virtually immediately. Customers can select their most popular mortgage time period, with no mounted compensation deadlines, which affords flexibility for managing repayments.

CoinRabbit is a user-friendly crypto lending platform providing fast, no-credit-check loans in over 70 cryptocurrencies, together with Bitcoin, Ethereum, and stablecoins. Identified for its streamlined software course of, CoinRabbit permits debtors to obtain funds virtually immediately. Customers can select their most popular mortgage time period, with no mounted compensation deadlines, offering flexibility for managing repayments.

- LTV Ratios: As much as 90%, relying on the collateral.

- Curiosity Charges: 12% to 17% APR, calculated month-to-month for clear value construction.

- Supported Belongings: Over 70 cryptocurrencies, together with main belongings like Bitcoin and Ethereum.

- Platform Safety: Belongings held in chilly storage; nonetheless, some opinions point out considerations about safety and transparency.

Key Options:

- Fast mortgage approval with no credit score checks

- Versatile compensation phrases and excessive asset help

- Rates of interest based mostly on month-to-month calculations

5. Unchained Capital

Unchained Capital makes a speciality of Bitcoin-backed loans, catering primarily to high-net-worth buyers with a minimal mortgage requirement of $10,000. The platform includes a collaborative custody mannequin with multi-signature expertise, permitting debtors to retain partial management over their collateral. This setup enhances transparency and lowers the chance of platform failure, as Unchained Capital doesn’t reinvest person collateral. Identified for its slick interface and powerful buyer help, Unchained Capital supplies a dependable borrowing expertise.

- LTV Ratios: As much as 70% on Bitcoin collateral.

- Curiosity Charges: Typically above 14%, relying on mortgage period and collateral.

- Supported Belongings: Bitcoin solely.

- Platform Availability: Not out there in New York, Vermont, Massachusetts, North Dakota, South Dakota, New Mexico, and Idaho.

- Safety: Chilly storage for belongings and multi-signature custody for added safety.

Key Options:

- Bitcoin-focused loans with multi-signature custody

- Versatile mortgage phrases from 3 to 36 months

- Clear charges and enhanced borrower management

6. Alchemix

Alchemix introduces a novel method to crypto lending, permitting customers to borrow towards the yield generated from their deposited collateral. Constructed on Ethereum, Alchemix permits customers to deposit belongings reminiscent of DAI, and the mortgage basically repays itself over time utilizing the yield from the collateral. With this setup, debtors keep away from conventional fee schedules, and there aren’t any compelled liquidations. Moreover, customers can customise particulars about their loans, reminiscent of yield era, to suit their monetary targets.

Nonetheless, as a result of Alchemix depends on different protocols for yield era, there may be some threat if these underlying functions expertise failures or safety breaches. You possibly can try our detailed evaluation on Alchemix for extra data.

- LTV Ratios: Borrowing is capped at 50% of the collateral worth.

- Supported Belongings: Restricted to DAI and wETH as collateral choices.

- Reimbursement Construction: Self-repaying; no guide funds required.

- Platform Threat: Depending on the soundness of underlying yield-generating protocols, which might have an effect on compensation if compromised.

Key Options:

- Self-repaying loans by future yield

- LTV ratios of as much as 50%

- Totally decentralized, hands-off borrowing expertise

7. Crypto.com

Crypto.com supplies versatile crypto-backed loans that combine seamlessly with its ecosystem, permitting customers to leverage their belongings with no need to promote. The platform helps a variety of 13 cryptocurrencies as collateral, together with BTC, ETH, CRO, and USDT. Customers can borrow quantities beginning as little as $100, making it accessible for quite a lot of debtors. Moreover, Crypto.com affords diminished rates of interest for customers who stake greater than 100,000 CRO, decreasing APR to as little as 8%. Nonetheless, rates of interest are greater for many who don’t stake CRO, and as a centralized platform, it could not enchantment to customers searching for DeFi options. We suggest you check out our detailed evaluation of Crypto.com.

- LTV Ratios: As much as 80%, relying on the asset used as collateral.

- Curiosity Charges: Diminished to eight% APR for these staking over 100,000 CRO; charges greater with out CRO staking.

- Supported Belongings: 13 totally different cryptocurrencies, together with BTC, ETH, CRO, and USDT.

- Minimal Mortgage Quantity: $100.

- Platform Sort: Centralized, a part of the Crypto.com ecosystem.

Key Options:

- Versatile mortgage phrases with LTV ratios as much as 80%

- Diminished charges for CRO token holders

- Person-friendly cellular app for mortgage administration

8. Wirex

Wirex affords a user-friendly crypto lending service built-in into its ecosystem, permitting customers to borrow funds by collateralizing belongings like Bitcoin and Ethereum. Identified for its 24/7 buyer help and streamlined interface, Wirex makes borrowing easy, although its collateral choices are restricted in comparison with different platforms. Borrowed funds can be found solely in stablecoins, making Wirex perfect for these searching for secure crypto-backed loans. Safety is powerful, with collateral protected by Fireblocks, a trusted digital asset custody platform. Nonetheless, Wirex loans are unavailable to U.S. customers, and as a centralized platform, it could not enchantment to DeFi-focused buyers.

- LTV Ratios: As much as 80%, offering sturdy borrowing capability.

- Curiosity Charges: APR begins at 8%, with charges various by collateral kind and quantity.

- Supported Collateral: Restricted cryptocurrency choice, together with BTC and ETH.

- Borrowed Belongings: Solely stablecoins can be found for loans.

- Platform Restrictions: Not out there to U.S. customers.

Key Options:

- Excessive LTV ratios of as much as 80%

- Early compensation flexibility with no penalties

- Built-in multi-currency account and card providers

9. YouHodler

YouHodler is a flexible crypto lending platform identified for providing excessive loan-to-value (LTV) ratios, as much as a formidable 97% for sure belongings, positioning it among the many highest within the business. This makes YouHodler notably interesting to customers aiming to maximise their borrowing capability. The platform helps a wide array of over 50 belongings, together with standard choices like Bitcoin, Ethereum, and stablecoins, and affords versatile mortgage phrases from 30 to 180 days. Whereas YouHodler is user-friendly, it skilled an information breach in 2019, affecting the privateness of tens of millions of customers. Moreover, it’s unavailable to customers in the US. You possibly can try our detailed evaluation on YouHodler for higher understanding.

- LTV Ratios: Excessive LTV ratios, as much as 97% for some belongings.

- Curiosity Charges (APRs): Begin at round 12%, various based mostly on LTV, asset kind, and mortgage phrases (e.g., USDT charges beginning at 26.07% APR).

- Supported Collateral: 50+ belongings, together with BTC, ETH, and stablecoins.

- Mortgage Availability: Not out there within the U.S.

- Platform Safety: Skilled an information breach in 2019 however has since improved safety measures.

Key Options:

- Trade-leading LTV ratios of as much as 90%

- Versatile mortgage phrases from 30 to 180 days

- Modern “Multi HODL” function for asset progress

Dangers of Crypto Loans

Whereas crypto lending affords a spread of alternatives, it comes with inherent dangers that customers ought to perceive.

Market Volatility

Crypto markets are identified for his or her excessive volatility, with asset costs able to speedy and vital modifications. This volatility instantly impacts the collateral that debtors use to safe loans. If the worth of a borrower’s collateral falls sharply, they might face a liquidation occasion, the place the lending platform sells off the collateral to cowl the excellent mortgage. For lenders, this market fluctuation can imply a sudden discount within the worth of collateralized belongings, impacting the mortgage’s safety.

Platform Safety and Custodial Dangers

Since crypto lending platforms maintain person belongings, they’re prime targets for cyberattacks. The chance of hacks and safety breaches is a serious concern, particularly for centralized platforms that custody funds. Whereas many platforms implement in depth safety protocols, together with chilly storage and multi-factor authentication, there may be nonetheless the chance of potential vulnerabilities. Customers needs to be conscious that if a platform suffers a safety breach, their funds could also be in danger, and restoration might not be assured.

Counterparty and Credit score Dangers

In crypto lending, counterparty threat arises when a borrower fails to repay their mortgage or when the platform faces liquidity points. This threat is extra pronounced on centralized platforms the place the platform itself manages mortgage funds. In circumstances the place a borrower defaults, lenders could undergo losses, notably if the platform lacks ample collateralization measures. Moreover, credit score threat could emerge if a platform mismanages person funds or operates with inadequate reserves, affecting customers’ skill to withdraw belongings.

Regulatory Uncertainty

The regulatory panorama for crypto lending is evolving and varies broadly throughout areas. Governments are more and more scrutinizing crypto monetary merchandise, together with lending, as a result of considerations about investor safety and monetary stability. Regulatory actions can influence platform operations, person entry, and even asset withdrawals, particularly on centralized platforms. Customers partaking in crypto lending ought to keep knowledgeable about their area’s regulatory stance and think about how potential authorized shifts may have an effect on their investments.

Greatest Crypto Lending Platforms: Closing Ideas

Crypto lending has remodeled the best way individuals take into consideration their digital belongings. Now not only a retailer of worth, crypto can now earn curiosity or function collateral—making it an lively a part of your monetary technique. However, like all monetary software, it’s important to method crypto lending with care. Whereas the rewards will be enticing, the dangers are simply as actual, with market volatility, safety considerations, and regulatory shifts all enjoying a job within the house.

The fantastic thing about crypto lending lies in its variety. From decentralized, automated choices like Aave and Compound to the safety and help of centralized platforms like Binance Loans, there’s a match for each kind of person. Every platform brings one thing totally different to the desk, making it price your time to fastidiously think about which aligns finest together with your wants.

As with all investments, understanding the small print and managing your threat is essential. With the appropriate platform and a very good grasp of the fundamentals, crypto lending generally is a precious addition to your monetary toolkit. So whether or not you’re right here to lend, borrow, or discover, keep in mind: the very best methods include each warning and curiosity.

Often Requested Questions

Can I borrow cash towards my crypto?

Completely. Most crypto lending platforms allow you to borrow funds through the use of your crypto as collateral, with mortgage quantities decided by your asset’s worth. This fashion, you may entry liquidity with out promoting your holdings, although you’ll have to repay with curiosity to retrieve your belongings.

What are the very best crypto lending platforms?

The perfect platforms fluctuate based mostly in your wants, however standard selections embody Aave and Compound for decentralized lending, and Binance Loans and Crypto.com for many who favor centralized choices. These platforms provide a mixture of versatile phrases, supported belongings, and safety measures. All the time analysis to seek out the platform that aligns finest together with your targets.

Are crypto lending platforms secure?

Security will depend on the platform. Many respected platforms implement sturdy safety features, like chilly storage and multi-factor authentication. Nonetheless, dangers stay, together with market volatility and potential safety breaches. Choosing well-established platforms with sturdy opinions and clear insurance policies can scale back threat.

Are you able to earn money with crypto lending?

Sure, by lending your belongings, you may earn curiosity in your crypto holdings, usually at charges greater than conventional financial savings accounts. Charges fluctuate by platform and asset kind, so returns rely upon the phrases you select and the platform’s APY choices.