Aave has turn into a standout in decentralized finance (DeFi). Based by Stani Kulechov in 2017, Aave began as ETHLend earlier than rebranding and revolutionizing DeFi.

Aave's distinctive options, like flash loans, allow superior monetary methods with out collateral. Its Excessive-Effectivity Mode optimizes borrowing energy, guaranteeing customers get essentially the most out of their belongings. Sturdy safety measures, together with rigorous audits and bug bounty applications, are in place as effectively.

Ruled by the group by means of the AAVE token, Aave evolves with enter from its customers, guaranteeing transparency and inclusivity.

As we go deeper into this Aave evaluation, we are going to check out its options, safety protocols, and governance mannequin.

What’s Aave

Aave is a DeFiprotocol that enables customers to lend and borrow with no need a central middleman. Based by Stani Kulechov in 2017 as ETHLend and rebranded to Aave in 2018, the identify "Aave" means "ghost" in Finnish, symbolizing its mission to create an open, clear monetary system.

Aave makes use of an Ethereum-based protocol. Lenders deposit their cryptocurrencies into liquidity swimming pools to earn curiosity, whereas debtors present collateral exceeding the mortgage quantity to keep up system stability and safety.

Aave helps a variety of cryptocurrencies, permitting it to draw a various consumer base. One standout function is "flash loans," which permit customers to borrow belongings with out collateral if the mortgage is repaid inside the similar transaction block. This innovation has enabled alternatives for arbitrage, collateral swapping, and different superior buying and selling methods.

Aave's governance is dealt with by a decentralized autonomous group (DAO). AAVE token holders suggest and vote on protocol adjustments, guaranteeing the platform evolves in line with the group's pursuits.

Aave's complete worth locked (TVL) exceeded $11 billion as of mid-2024. Its success has led to the event of complementary services, equivalent to Aavegotchi, a blockchain-based sport, and Aave Professional, a platform for institutional traders.

Aave's dedication to safety consists of common audits and collaborations with high safety companies. Its strong safety measures and clear operations have earned it a popularity as a dependable and safe DeFi platform. In a world the place "with great power comes great responsibility," Aave takes its function severely.

How Does Aave Work?

Aave operates as a decentralized monetary system, permitting people to lend and borrow digital belongings with out a government. Lenders earn curiosity on their deposits, whereas debtors pay curiosity to entry funds. This part explores how Aave features, highlighting key options and improvements.

Aave's core functionalities revolve round lending and borrowing. Customers deposit their cryptocurrencies into liquidity swimming pools, changing into lenders, and these swimming pools can be found for different customers to borrow from. Rates of interest for lending and borrowing are decided algorithmically primarily based on provide and demand. As an illustration, if the demand for borrowing an asset is excessive, the rate of interest will increase, encouraging extra customers to deposit that asset.

Lending on Aave is easy. Customers deposit their belongings into Aave's liquidity swimming pools and earn curiosity over time. This course of is much like incomes curiosity on a financial savings account in conventional finance however with doubtlessly greater returns as a result of dynamic nature of DeFi. The deposited belongings are tokenized into aTokens, which accrue curiosity in real-time and will be redeemed at any level.

Borrowing from Aave requires customers to offer collateral that exceeds the mortgage's worth. This over-collateralization ensures system solvency and reduces default danger. Debtors can select between secure and variable rates of interest, managing their publicity to market volatility. Secure charges present predictability, whereas variable charges would possibly provide price financial savings when market situations are favorable.

Flash loans permit customers to borrow belongings with out offering collateral, so long as the mortgage is repaid inside the similar transaction block. This distinctive functionality permits refined monetary methods equivalent to arbitrage, collateral swapping, and self-liquidation. Flash loans showcase Aave's dedication to innovation and adaptability.

Threat Administration

Aave employs a number of danger administration mechanisms to guard customers and preserve platform integrity. Over-collateralization ensures that debtors present collateral price greater than the mortgage quantity, overlaying potential losses. If a borrower's collateral worth falls under a sure threshold, their place is robotically liquidated to repay the mortgage, sustaining system solvency. Moreover, a portion of the curiosity paid by debtors is allotted to a reserve fund, which might cowl sudden losses or unhealthy debt.

Supplying on Aave

In terms of supplying belongings on Aave, one of many key benefits is the platform's wide selection of supported belongings. Aave presents lending and borrowing choices for a far larger checklist of belongings in comparison with opponents like Compound. That is notably useful for customers holding a various portfolio of altcoins who wish to earn curiosity on their holdings.

Moreover, Aave operates on a number of blockchain networks equivalent to Avalanche, Fantom and Polygon, demonstrating its interoperability and flexibility within the evolving DeFi panorama.

Learn how to Provide Belongings on Aave

Supplying on Aave is fairly simple:

1. Join Your Pockets: Customers want to attach a suitable pockets equivalent to MetaMask or Ledger to the Aave platform.

2. Deposit Belongings: After connecting, customers choose the asset they want to provide and specify the quantity to deposit. The deposited belongings are then transferred into Aave's liquidity swimming pools.

3. Obtain aTokens: Customers obtain aTokens, which accrue curiosity in actual time. For instance, supplying DAI provides you aDAI. These tokens signify the consumer's share of the liquidity pool and will be redeemed anytime.

4. Earn Curiosity: Rates of interest are algorithmically decided primarily based on provide and demand. Greater demand for borrowing an asset will increase its rate of interest, incentivizing extra customers to provide that asset.

Let's discover this additional with the assistance of an instance:

Suppose you may have 1,000 USDT and determine to provide it to Aave. Right here’s the way it works:

- Join your pockets to the Aave platform.

- Choose USDT and deposit 1,000 USDT into the Aave liquidity pool.

- Obtain aUSDT, that are interest-bearing tokens.

- Over time, your aUSDT stability will improve as you earn curiosity.

Total, Aave's intensive asset help, multi-chain performance, and user-friendly interface make it a superior alternative for these seeking to earn curiosity on their cryptocurrency holdings.

Borrowing on Aave

Aave's standout function is its help for flash loans, which permit customers to borrow belongings with out offering any collateral, so long as the mortgage is repaid inside the similar transaction block.

This permits refined monetary methods like arbitrage and collateral swapping. Moreover, Aave makes use of a single-asset danger mannequin, guaranteeing {that a} crash in a single asset solely impacts that asset. It additionally employs a protocol-based liquidation system, which may end up in decrease penalties for debtors.

Borrowing on Aave works just about like supplying:

- Join Your Pockets: Customers want to attach a suitable pockets.

- Deposit Collateral: To borrow belongings, customers should first deposit collateral that exceeds the mortgage worth. This over-collateralization ensures system solvency and reduces default danger. The collateral required relies on the asset's Mortgage-to-Worth (LTV) ratio.

- Choose Borrowing Choices: After depositing collateral, customers choose the asset to borrow from supported cryptocurrencies.

- Affirm the Borrowing Transaction: Customers verify the transaction phrases. Borrowed belongings are transferred to the consumer’s pockets, and curiosity begins accruing. If the collateral worth falls under a threshold, the place is robotically liquidated to repay the mortgage.

Let's have a look at this with the assistance of an instance.

Suppose you may have 2 ETH and must borrow USDT. Right here’s the way it works:

- Join your pockets to the Aave platform.

- Deposit 2 ETH as collateral. If the LTV ratio for ETH is 75%, you may borrow as much as 1.5 ETH price of USDT.

- Choose USDT from the supported belongings and select between a secure or variable rate of interest.

- Affirm the transaction to obtain USDT in your pockets. Over time, you’ll accrue curiosity on the borrowed quantity primarily based on the chosen price.

Aave V3 Overview

In January 2022, Aave launched the technical paper for Aave V3, enhancing options like aTokens and rate of interest fashions to enhance its $30 billion peak liquidity.

V3 targeted on 4 key areas:

- Capital Effectivity: Growing income for lenders and permitting debtors to mortgage extra towards the identical collateral by optimizing borrowing energy, lowering excessive gasoline prices on the Ethereum mainnet, and minimizing liquidity segregation.

- Protocol Security: Implementing superior protection mechanisms to guard towards threats like infinite minting and oracle manipulation.

- Decentralization: Modifying the governance framework to scale back gatekeeping, selling a extra inclusive ecosystem.

- Consumer Expertise: Enhancing seamless cross-chain worth and liquidity transfers for a extra intuitive and accessible platform.

Aave V3 ensures the protocol's competitiveness and relevance within the evolving DeFi area.

Aave V3 launched new options and enhancements geared toward enhancing effectivity and consumer expertise. Key upgrades embody:

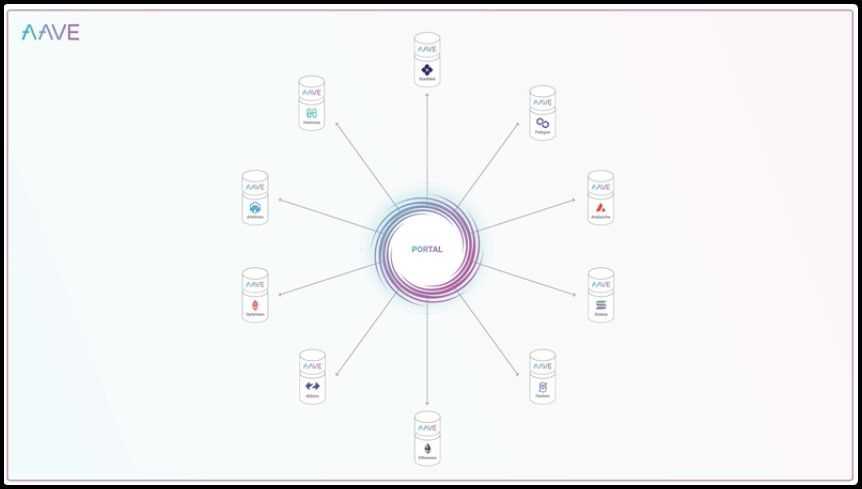

Portal

Aave operates throughout a number of markets, together with:

- Ethereum

- Optimism

- Metis

- Arbitrum

- AMM

- Polygon

- Avalanche

- Solana

The Portal function in Aave V3 permits cross-chain liquidity by utilizing governance-backed bridges like Connext and Hop Protocol. It permits customers to provide collateral on one community, equivalent to Ethereum, and borrow funds on one other, like Arbitrum or Polygon. The Portal achieves this by burning aTokens on the supply chain and minting an equal quantity on the vacation spot chain, facilitating seamless cross-chain liquidity circulation.

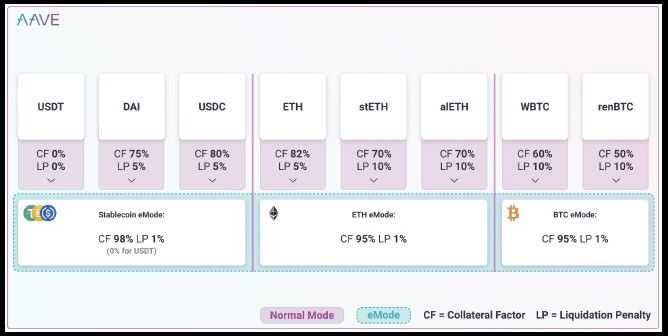

Effectivity Mode (eMode)

Effectivity Mode (eMode) in Aave V3 optimizes danger parameters for debtors utilizing correlated digital belongings as collateral, equivalent to totally different stablecoins or related tokens like ETH and stETH.

By recognizing the predictable volatility of those correlated belongings, eMode overrides Aave's customary calculations for LTV, curiosity, and liquidation. This permits customers to borrow extra capital from the identical collateral, growing capital effectivity by as much as 23% in eventualities like stablecoin eMode.

Different Enhancements

Aave V3 consists of a number of nuanced enhancements:

- Isolation Mode: Approves new tokens as collateral with a debt ceiling and limits entry to stablecoins.

- Siloed Borrowing: Restricts borrowing of configured belongings to particular person loans, stopping them from being included in a basket of borrowed belongings.

- Provide and Borrow Caps: Permits designated admins to set caps on particular person reserves.

Repaying with aTokens: Allows customers to repay loans utilizing aTokens if the underlying asset is locked within the liquidity pool. - Configurable Rewards: Helps a number of rewards per token and permits customers to say rewards to totally different accounts or a number of forms of rewards in a single transaction.

- Migration Instrument: Offers a device for migrating positions from V2 to V3, summarizing danger parameters for knowledgeable decision-making.

GHO Stablecoin

GHO Stablecoin is Aave's native decentralized stablecoin, designed to supply stability and liquidity inside the Aave ecosystem. Pegged to the US greenback, GHO offers a dependable medium of change and retailer of worth for customers taking part within the Aave protocol. This part explores the core ideas, mechanisms, and advantages of GHO Stablecoin.

GHO is minted towards varied collateral varieties inside the Aave protocol. Customers can mint GHO by depositing collateral belongings into Aave's liquidity swimming pools, guaranteeing the stablecoin is absolutely backed and over-collateralized. This mechanism maintains the steadiness and worth of GHO, guaranteeing it stays pegged to the US greenback.

GHO's stability is maintained by means of market arbitrage. If GHO's worth exceeds $1, merchants will revenue by swapping GHO for different stablecoins, bringing its worth again to $1. If GHO's worth falls under $1, repaying debt with GHO turns into worthwhile, lowering its provide and serving to to revive the peg to $1.

Minting and Redeeming GHO

- Minting GHO: Customers deposit eligible collateral belongings into Aave, guaranteeing they meet particular necessities and are over-collateralized. As soon as deposited, customers can mint GHO tokens proportional to their collateral's worth.

- Redeeming GHO: Customers can redeem GHO by repaying the borrowed stablecoin and unlocking their collateral. This course of entails burning the GHO tokens, lowering the provision and sustaining the stablecoin's peg to the US greenback.

Listed here are just a few advantages of the stablecoin

- Stability: GHO maintains a secure worth pegged to the US greenback.

- Decentralization: GHO operates with out central authority management, leveraging Aave's decentralized infrastructure for transparency, safety, and belief.

- Collateral Range: GHO will be minted towards varied collateral varieties, together with totally different cryptocurrencies supported by Aave, enhancing flexibility.

- Integration with Aave Ecosystem: GHO integrates seamlessly into Aave, enabling its use for borrowing, lending, and taking part in liquidity swimming pools, enhancing its utility inside DeFi.

- Low cost Technique: Customers staking AAVE tokens within the Security Module (stkAAVE) obtain a reduction on borrowing GHO, offering an added incentive.

- Arbitrage Alternatives: GHO helps refined monetary methods equivalent to arbitrage, providing further worth for customers.

GHO incorporates a number of danger administration mechanisms to make sure its stability and safety:

- Over-Collateralization: Every GHO stablecoin is backed by extra worth in collateral than the stablecoin itself, lowering the danger of under-collateralization.

- Liquidation Mechanisms: If collateral worth falls under a threshold, it’s robotically liquidated to keep up GHO's stability and peg to the US greenback.

- Transparency and Governance: GHO operates transparently on the blockchain. Governance choices associated to GHO are made by AAVE token holders, guaranteeing decentralized management and group involvement.

- Facilitators: Managed by the Aave DAO, facilitators play a key function in managing GHO's provide and guaranteeing clean operations inside the protocol.

The Path to Decentralizing Aave

Aave's journey towards decentralization has been essential to its evolution, guaranteeing the protocol stays open, clear, and community-governed. This part explores Aave's steps towards decentralization, its governance mechanisms, and the advantages of this method.

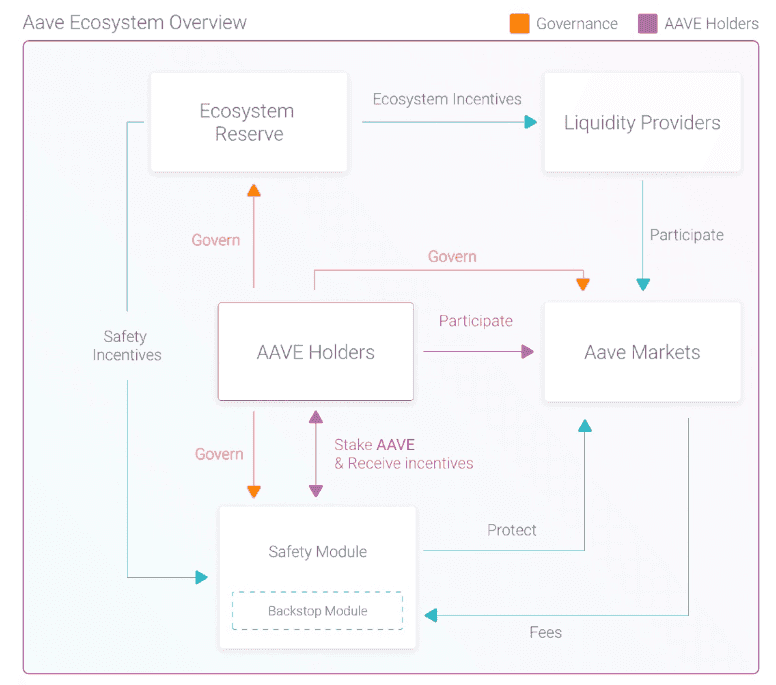

Aavenomics is Aave's framework for decentralization, distributing governance energy and financial incentives inside the protocol. The aim is to create a system the place customers management the protocol's improvement and decision-making processes, guaranteeing Aave evolves in line with the group's collective imaginative and prescient.

Governance Mechanisms

Aave employs a number of governance mechanisms to keep up decentralization:

- AAVE Token: Central to Aave's governance mannequin, AAVE token holders can suggest and vote on protocol adjustments, equivalent to danger parameter updates and new asset listings. This decentralized governance ensures the protocol is managed by its customers somewhat than a government.

- Aave Enchancment Proposals (AIPs): AIPs are the formal course of for proposing, discussing, and implementing adjustments to the Aave protocol. Any AAVE token holder can submit an AIP, which is reviewed and voted on by the group, guaranteeing transparency and reflecting the collective will of token holders.

- Governance Modules: Aave makes use of governance modules like Governance Core, Governance Technique, and Governance Timelock to handle varied features of the protocol. These modules play roles in proposing, voting on, and executing authorized proposals.

Steps In direction of Decentralization

Aave has taken many steps in direction of decentralization:

- Preliminary Distribution and Incentives: The preliminary distribution of AAVE tokens was designed to advertise broad possession and participation in governance. Incentives like staking rewards and liquidity mining applications additional encourage consumer engagement and long-term dedication to the protocol.

- Staking and Safety: Aave's staking mechanism permits AAVE token holders to stake their tokens within the Security Module (SM), a decentralized insurance coverage fund defending the protocol towards shortfalls. Stakers earn rewards, aligning their pursuits with Aave's safety and stability.

- Protocol Upgrades: Aave has undergone a number of upgrades to boost decentralization and performance. Every improve, from Aave V1 to V2 and now V3, has launched new options and enhancements whereas sustaining the community-driven governance mannequin.

AAVE Token

The AAVE token is a pivotal a part of the Aave ecosystem, serving roles in governance, staking, and consumer incentives. Let's systematically undergo the makes use of of AAVE inside the Aave ecosystem, its tokenomics, and sensible info on buying and storing AAVE.

Makes use of of AAVE within the Aave Ecosystem

- Governance: The AAVE token is central to Aave’s decentralized governance. Token holders can suggest and vote on protocol adjustments, equivalent to danger parameter updates and new asset listings, guaranteeing group involvement within the platform’s improvement.

- Staking and Safety: AAVE holders can stake their tokens within the Security Module (SM), a decentralized insurance coverage fund designed to guard the protocol from shortfalls and dangers. Stakers earn rewards, aligning their pursuits with Aave's long-term safety and stability.

- Incentives: AAVE tokens incentivize liquidity suppliers and debtors. By providing AAVE as a reward, the protocol encourages extra customers to provide and borrow belongings, boosting total liquidity and engagement.

Tokenomics of AAVE

The tokenomics of AAVE are structured to make sure sustainability and worth inside the Aave ecosystem:

- Complete Provide: AAVE's complete provide is capped at 16 million tokens, serving to preserve worth by stopping inflation.

- Distribution: AAVE tokens are distributed by means of preliminary gross sales, staking rewards, and liquidity mining applications, selling decentralization and broad governance participation.

- Burning Mechanism: A portion of the protocol’s charges is used to purchase again and burn AAVE tokens, lowering total provide over time and doubtlessly growing worth.

- Incentive Alignment: The distribution and use of AAVE tokens are designed to align the pursuits of builders, stakers, liquidity suppliers, and debtors, fostering a sustainable ecosystem.

The place to Purchase AAVE Tokens

AAVE tokens can be found on a few of the main, established cryptocurrency exchanges, equivalent to the next:

- Binance

- Coinbase Change

- Kraken

- KuCoin

You’ll be able to retailer your AAVE tokens in a collection of crypto wallets, equivalent to Belief Pockets, MetaMask and the Ledger {hardware} pockets.

Aave Safety

Safety is paramount for any DeFi platform, and Aave has applied intensive measures to make sure the security and integrity of its protocol.

Good Contract Audits

Aave's sensible contracts automate lending, borrowing, and different transactions. To make sure these contracts are safe, Aave undergoes common audits by top-tier safety companies:

- Path of Bits: Conducts a number of audits of Aave's sensible contracts, offering detailed studies to deal with any points.

- OpenZeppelin: Focuses on performance and safety to supply further assurance.

- Certora: Makes use of formal verification strategies to investigate Aave’s contracts, proving the code's correctness.

Bug Bounty Applications

Aave operates an ongoing bug bounty program to incentivize the invention and reporting of vulnerabilities. By providing rewards to moral hackers and safety researchers, Aave leverages the broader safety group to boost its protocol’s resilience. Immunefi companions with Aave, providing substantial rewards for locating and responsibly disclosing safety vulnerabilities.

Safety Modules

Aave has applied a number of safety modules to guard the protocol and its customers from varied dangers:

- Security Module (SM): Permits AAVE token holders to stake their tokens as a security internet. In case of a shortfall, the staked tokens can cowl losses, guaranteeing platform stability. Contributors earn rewards for his or her contribution.

- Protocol Governance: Decentralized governance permits AAVE token holders to suggest and vote on adjustments, enhancing and securing the protocol. This ensures safety choices are clear and replicate group knowledge.

Decentralized Oracle Networks

Aave makes use of decentralized oracle networks to offer dependable and tamper-proof information for its operations. These oracles provide essential info, equivalent to asset costs, enabling correct calculations for lending and borrowing. It additionally built-in Chainlink oracles to safe its worth feeds, guaranteeing the information utilized by Aave is correct and immune to manipulation.

Incident Response

Aave has a complete incident response technique to deal with potential safety breaches. This consists of predefined procedures for incident detection, evaluation, and mitigation, guaranteeing a swift and efficient response to threats. Its Emergency Pause Mechanism can briefly halt operations in response to a safety menace, permitting the staff to deal with and resolve points earlier than resuming regular operations.

Aave Overview: Closing Ideas

Aave has carved a distinct segment for itself within the DeFi area, providing modern options like flash loans, Excessive-Effectivity Mode, and cross-chain interoperability that present customers with versatile instruments to boost their monetary methods.

The platform's robust dedication to safety is obvious by means of common audits, a bug bounty program, and the Security Module, guaranteeing strong safety for consumer funds. Moreover, Aave’s decentralized governance mannequin empowers the group, guaranteeing transparency and inclusive decision-making.

Nonetheless, Aave isn’t with out its challenges. The complexity of its instruments will be daunting for newcomers, and the evolving regulatory panorama presents potential hurdles. Furthermore, the requirement for over-collateralization is usually a barrier for customers with restricted belongings.

Aave's strengths lie in its steady innovation, strong safety measures, and community-driven governance. These attributes place Aave as a number one drive within the DeFi area, balancing each alternatives and challenges.

Often Requested Questions

What’s Aave?

Aave is a decentralized finance (DeFi) protocol that enables customers to lend and borrow cryptocurrencies with no need a central middleman. Based by Stani Kulechov in 2017 as ETHLend and rebranded to Aave in 2018, it goals to create an open, clear monetary system.

How does Aave work?

Aave operates as a decentralized monetary system the place lenders deposit their cryptocurrencies into liquidity swimming pools to earn curiosity, whereas debtors present collateral exceeding the mortgage quantity to keep up system stability and safety. Customers may also benefit from distinctive options like flash loans and Effectivity Mode (eMode).

What are the important thing enhancements in Aave V3?

Aave V3 consists of a number of enhancements:

- Isolation Mode: Approves new tokens as collateral with a debt ceiling and limits entry to stablecoins.

- Siloed Borrowing: Restricts borrowing of configured belongings to particular person loans.

- Provide and Borrow Caps: Permits designated admins to set caps on particular person reserves.

- Repaying with aTokens: Allows customers to repay loans utilizing aTokens.

- Configurable Rewards: Helps a number of rewards per token and permits customers to say rewards to totally different accounts or a number of forms of rewards in a single transaction.

- Migration Instrument: Offers a device for migrating positions from V2 to V3.

What’s GHO Stablecoin?

GHO Stablecoin is Aave’s native decentralized stablecoin, designed to supply stability and liquidity inside the Aave ecosystem. Pegged to the US greenback, GHO is absolutely backed and over-collateralized, guaranteeing its stability and worth.

The place can I purchase AAVE tokens?

AAVE tokens will be bought on main cryptocurrency exchanges equivalent to Binance, Coinbase Change, Kraken, and KuCoin.