Ethereum is the platform that drives blockchain innovations. This platform is the first to introduce new uses and offers a decentralized, secure base on which decentralized applications can be built using smart contracts. They range from games to finance and other Defi-services like liquid stakes. This article takes a fresh look at the Ethereum eco-system to discover new Dapps for 2024.

Explore the top 10 Ethereum DApps.

What is Ethereum Dapps?

Ethereum’s smart contracts, which allow open-source software to be built using the blockchain and its advantages to benefit developers, have taken blockchain technology to a new level.

Decentralized blockchains allow for decentralized applications. They have no central ownership or authority. After a Dapp goes live, even its developers can no longer control it.

Ethereum Dapps are characterized by:

- Open Source: Ideal DApps are open-source programs whose code can be scrutinized and verified to be free from malicious code.

- Decentralized: Ethereum DApps run on a distributed blockchain and should only be changed by a consensus vote of the users.

- Incentivized: Digital tokens can be used to reward users for validating transactions.

- Protocol: In order to prove value, the community must decide on a cryptographic algorithm. This is the current Proof-of-Stake algorithm in Ethereum.

Ethereum Dapps: Types

The list below focuses on the sectors that are most relevant to Ethereum today.

Liquid Staking / Restaking / Liquid Restaking

Liquid staking emerged with Ethereum's complete transition to Proof-of-Stake following the merge. The liquid staking tokens, which are derivatives from staked Ether and accrue rewards for staking while remaining liquid, allow the holder of the token to use it in DeFi. EigenLayer introduced Restaking after liquid staking grew in popularity. Restaking uses staked Ether for additional slashing needs and Active Validated Services, or AVS, to support new protocols. It earns more staking rewards compared to Ethereum.

Liquid Restaking goes one step beyond the standard business model by issuing a liquid token that will represent an individual’s investment in a layer of restaking, such as EigenLayer. These liquid tokens are rewarded by the Ethereum Staking Layer as well as Restaking Layer.

Lend / Collateralized debt positions

DeFi’s lending protocols let users lend or borrow cryptocurrency in a non-centralized way, usually without any intermediaries. Users can earn interest by depositing their assets into liquidity pool, and borrowers may access this money through the use of collateral. Aave and Compound are examples.

The Collateralized debt position (CDP), on the other, allows users to use their cryptoassets as collateral for minting stablecoins and other synthetic assets. Solvency is ensured by ensuring that collateral exceeds the value or the assets minted. MakerDAO uses the well-known CDP Protocol, where users can lock up ETH and mint DAI. If the collateral's value drops too much, the position can be liquidated to maintain the system's stability. DeFi’s lending protocol and the CDP protocol are both key elements. They offer liquidity and leverage opportunities, while also promoting an ecosystem that is free of trust.

Yield Aggregators

Yield aggregator protocols in DeFi optimize the returns on users' crypto assets by automatically reallocating funds across various yield farming opportunities. The protocols combine assets of multiple users to deploy them in the most profitable strategies, like staking or lending. Automating the process saves users both time and money while also ensuring higher yields than manual management. Yearn Finance, Harvest Finance are examples. The protocols continuously adjust their positions in response to changing market conditions, yield rates and other factors. This ensures optimal performance across DeFi platforms and an efficient allocation of capital.

Real World Asset Protocols

Real-World Assets (RWAs) are DeFi platforms which bring financial assets to the blockchain. They tokenize financial assets such as real estate and commodities. The protocols improve the accessibility, liquidity and transparency of assets through their integration into blockchain. Ondo Finance is one example, tokenizing U.S. Treasury securities, while Centrifuge is a project that aims to bring real-world invoices or loans onto the blockchain. RWA protocol aims to fuse the stability of conventional finance with innovation in DeFi.

This list is updated regularly and includes new Ethereum Dapps from different Decentralized Finance industries.

Lido

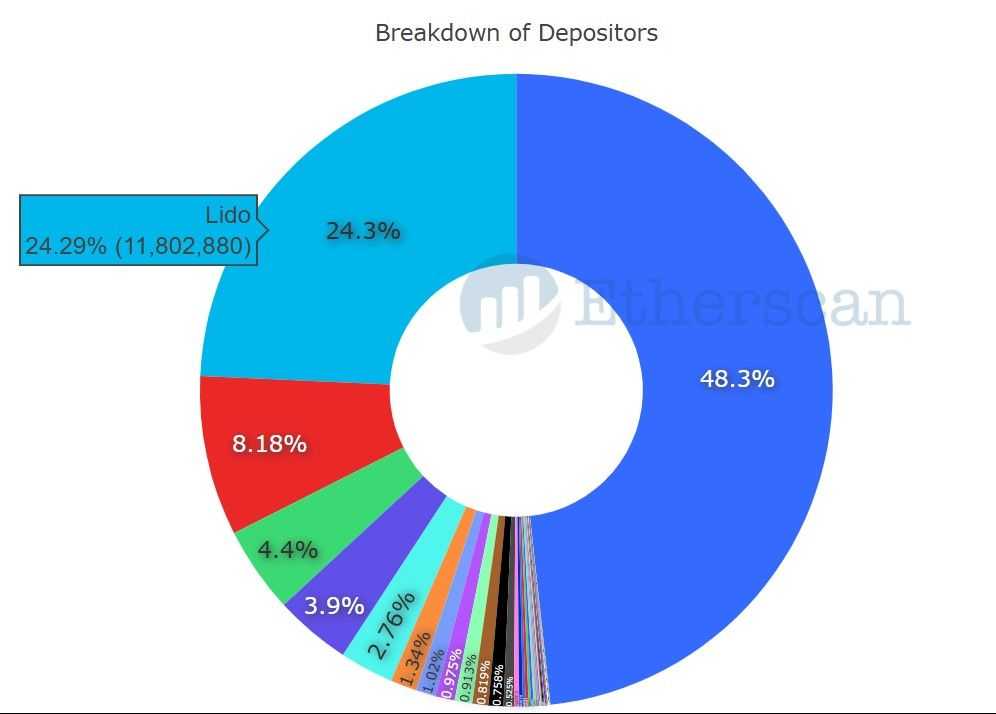

Lido’s decentralized liquid staking is a protocol that has a fixed value of 29.78bn dollars in August 2024. (Data from DefiLlama). Etherscan states that Lido’s ETH is the biggest depositor on the Ethereum staking level.

Lido has close to 450,000 users and 9,8 million ETH staked. Staking protocol charges 10% of staking rewards, which are split equally between DAO Treasury (the DAO Treasury is the DAO node operator) and staking participants. The APR is 2.9% for Ethereum. Lido has updated metrics on its website.

Puffer Finance

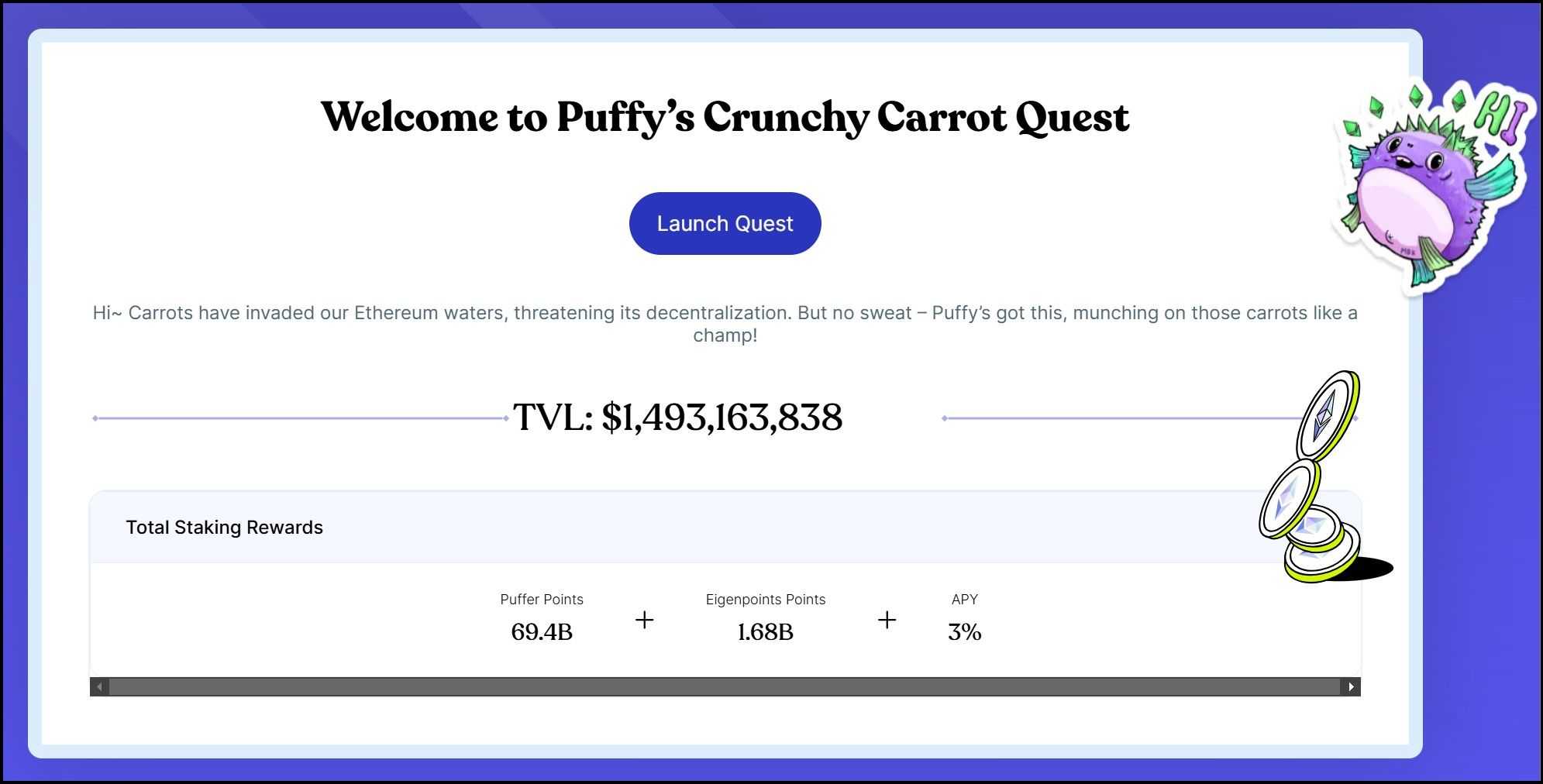

The Puffer Finance protocol is built on Ethereum and uses liquid restaking. Restaking ether using EigenLayer’s restaking algorithm increases return. It allows users to participate with 1 ETH, and uses liquid PufETH as a representation of the deposit. This creates a double-source rewards system.

Puffer Finance has a TVL in August of 2024 that is $1.49bn. The APY is 3% and it offers additional Eigen points as well as Puffer points. Learn more about the protocol on the Puffer Finance Review.

Renzo

Renzo Protocol is similar to Puffer in that it offers liquid restaking service by minting a $ezETH token, which represents the users’ ETH/LST positions at Renzo. Actively Validated Services are used to secure $ezETH and generate rewards for both restaking and staking.

According to Renzo, in August 2024, Renzo's liquid restocking token, $ ezETH, has $1.5 bn in TVL and offers an APR of 3.3%.

Pendle Finance

Pendle Finance allows for the trading of yields without permission. It gives users advanced tools to help them manage their yields. These key components include:

- Yield Tokenization: Pendle wrapping yield-bearing tokens into Standardized Tokens of Yield (SY) which then are split into principal tokens (PT), and Yield Tokens(YT). This allows the trading of yield components separately.

- Pendle AMM Pendle’s Automated market maker (AMM) allows for the trading of PT and T, facilitating yield and liquidity management.

- vePENDLE: This token brings traditional finance's interest derivative market into DeFi, enabling strategies such as fixed yield, long yield, and risk-free yield enhancement by providing liquidity.

Pendle unlocks all the potential in DeFi’s yield by providing fixed yield, enhanced yield and long-term yield strategies.

Spark Protocol

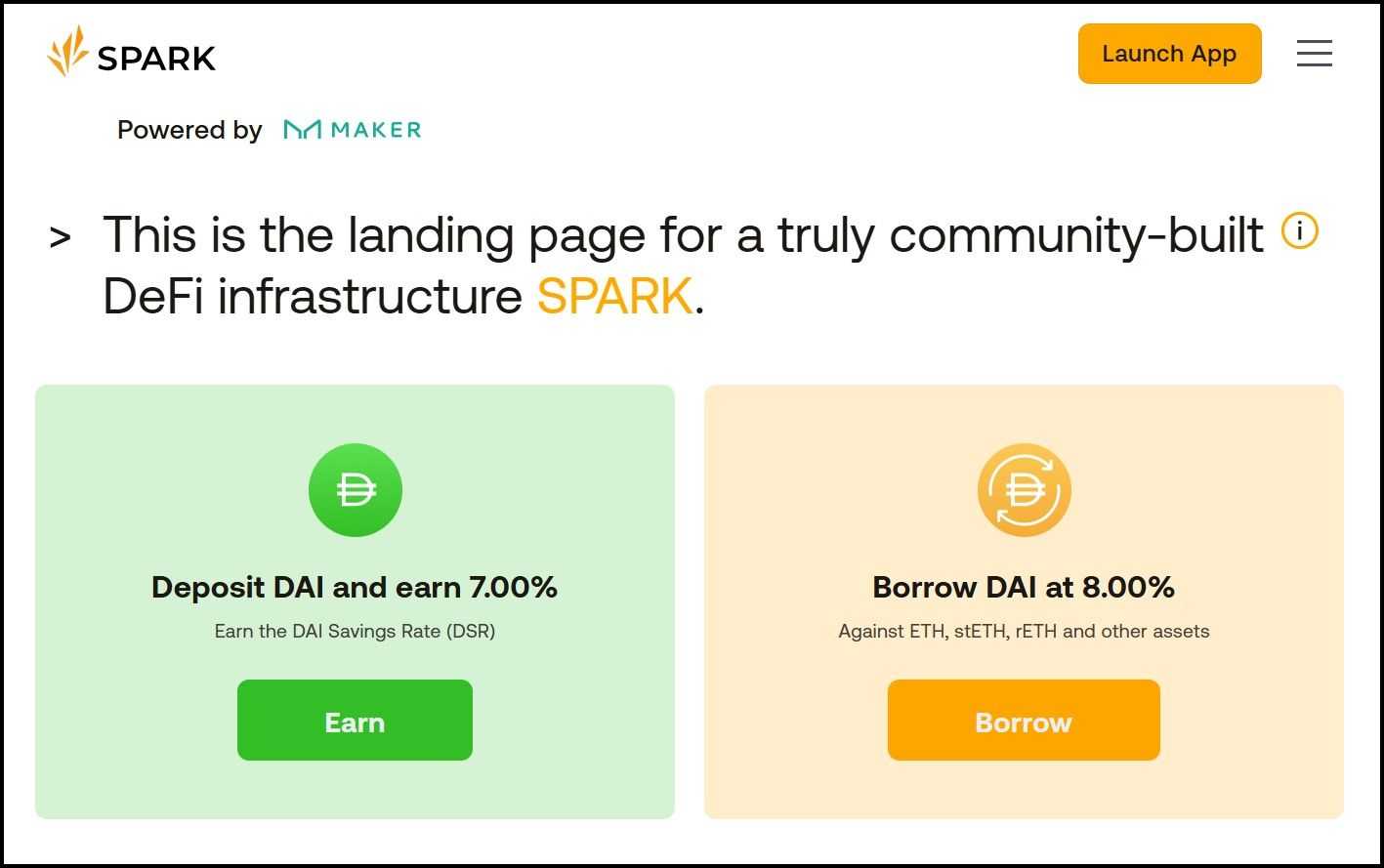

The Spark Protocol, which will be launched on May 9th, 2023, is an addition to Maker’s ecosystem. It offers a front end for borrowing and lending assets. The sDAI yield bearing stablecoin is introduced, which leverages DSR in order to create an ERC-4620 vault token named sDAI. The users deposit DAI in Spark. This is placed into the DSR contract and produces sDAI in exchange. They gain interest as the DSR contracts increase in value. The sDAI offers flexibility to users, as they can trade, stake or lend with DAI. It also allows immediate redemption of DAI.

Spark Protocol has approximately $3.5 billion in TVL by August 2024, and pays 7% to depositors.

Aave

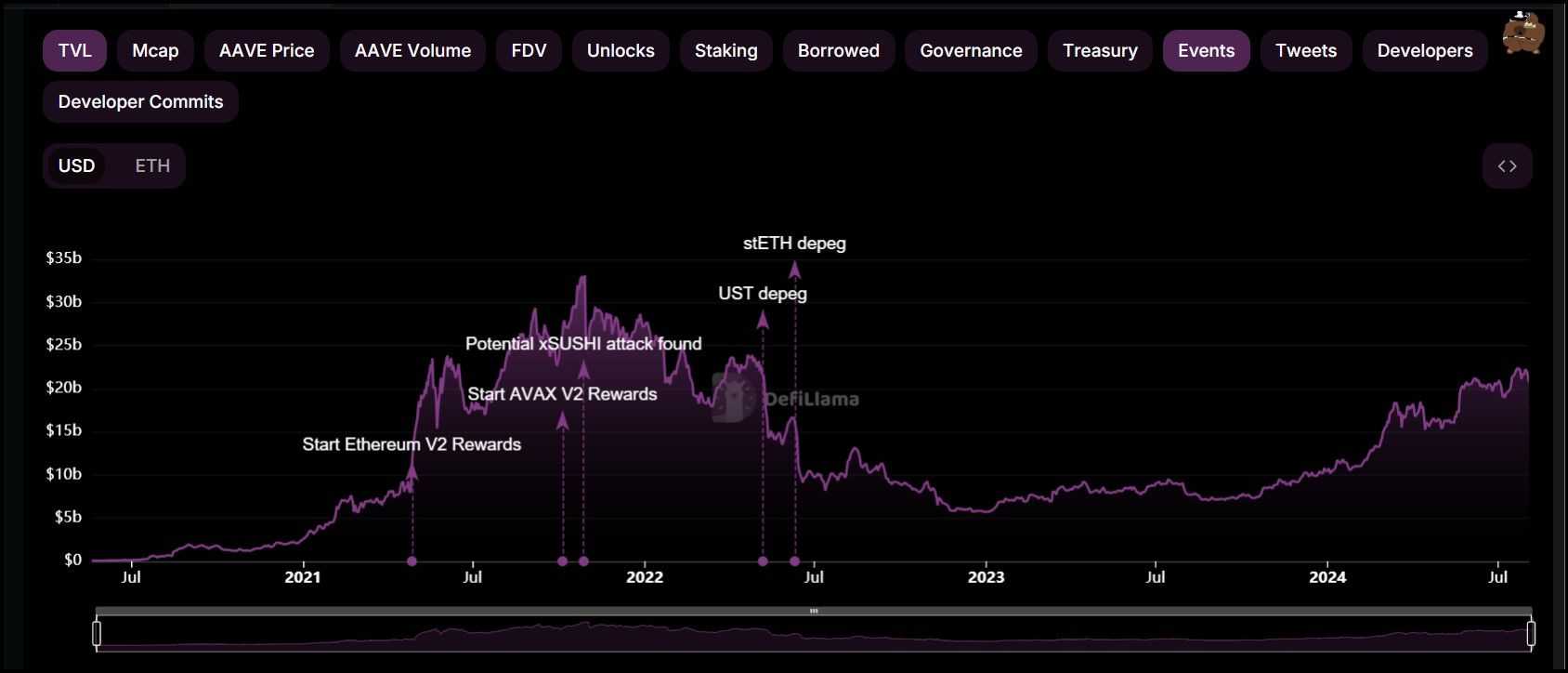

The second-largest Ethereum DApp by TVL is Aave, an open-source, non-custodial protocol to earn interest on deposits and borrow assets.

Aave will drive the majority of its 20.76 billion TVL by August 2024 through Ethereum. The rest is distributed through Polygon, Avalanche and other platforms.

Security is a major focus of the protocol. TRM Labs provides blockchain intelligence to the protocol, which uses real-world investigation and on-chain data in order to detect financial crimes and other illegal activities.

Ether.fi Liquid

Ether.fi Liquid automates DeFi strategy Vaults, simplifying token DeFi strategies. Tokens can be deposited and then the vault will automatically allocate tokens to various DeFi positions. Seven Seas offers the strategy to these vaults. Liquid offers these strategies at the moment:

- Users of King Karak can invest liqui-staked assets such as wETH or weETH in the vault, which will then be invested into Veda and Karak.

- Symbiotic Super LRT: A vault with an automatic system that gives you Symbiotic and Veda, as well as ether.fi point on all liquid stake assets.

- Earn ETH yield: A vault automate that gives you yields from your ether.fi asset.

- The Liquid Market-Neutral Dollar: A vault automate that gives you yields for your stablecoins.

Ondo Finance

Ondo Finance offers real-world asset (RWA) access on the chain, bridging decentralized (DeFi), and traditional (TradFi), finance. It is focused on providing stable, low-risk returns with regulatory-compliant finance products. Ondo Finance's key offerings include:

- OUSG:

- BlackRock iShares Treasury Bond Short ETF tokenized ownership.

- Liquid exposure to U.S. short-term Treasury Securities.

- With a $100,000 minimum investment, we attracted more than $165,000,000 in TVL.

- USDY:

- A stablecoin that pays interest and is backed by U.S. Treasury bills in short term as well as bank deposits.

- This is designed to allow holders to receive the largest portion of their yield through daily redemptions.

- Accessible worldwide with a $500 minimum investment.

The products combine TradFi security with DeFi innovation to offer a range of investment solutions that are both compliant and secure.

Evergreen Apps for Ethereum

The evergreen applications on Ethereum are those that maintain their value and relevance over time. They provide users with innovation, stability and community support. Three such applications are Uniswap Curve Compound Finance.

Uniswap

Uniswap (Decentralized Exchange Protocol) is a DEX protocol which facilitates automated trading for Ethereum-based Tokens using liquidity pools. This is due in part to its role as a pioneer of DeFi. It also has an easy-to-use interface and constant updates.

- The Latest MilestonesUniswap v3 has introduced concentrated liquidity. This allows liquidity providers to allot capital in specific price ranges and optimize returns. In 2023, Uniswap's deployment on various layer-2 solutions, including Optimism and Arbitrum, reduced gas fees and enhanced scalability.

Curve Finance

Curve Finance has been optimized to trade stablecoins. It is known for low slippage, and for efficient stablecoin exchanges. The evergreen character of Curve Finance is a result of its specialization and integration with DeFi protocols.

- The Latest MilestonesCurve v2 was launched, expanding the types of liquid assets that can be included in its pools while maintaining a low level of slippage. The introduction of the Curve DAO and CRV token has incentivized liquidity provision and governance participation, enhancing its ecosystem.

Compound Financial

Compound Finance, a decentralized protocol for lending and borrowing cryptocurrencies, allows its users to do both. This is due in part to its pioneering role in DeFi and continual improvements in user experience and security.

- The Latest MilestonesCompound’s Compound Treasury targets institutional investors, offering them a fixed rate of 4% on US dollar, and bridging the gap between DeFi (digital finance) and traditional financial services. The protocol's governance token, COMP, has facilitated community-driven upgrades and decision-making, ensuring its adaptability and growth.

The apps are evergreen because of their role as the foundation for DeFi. They also have a robust ecosystem, which attracts users and developers.

You can also read our conclusion.

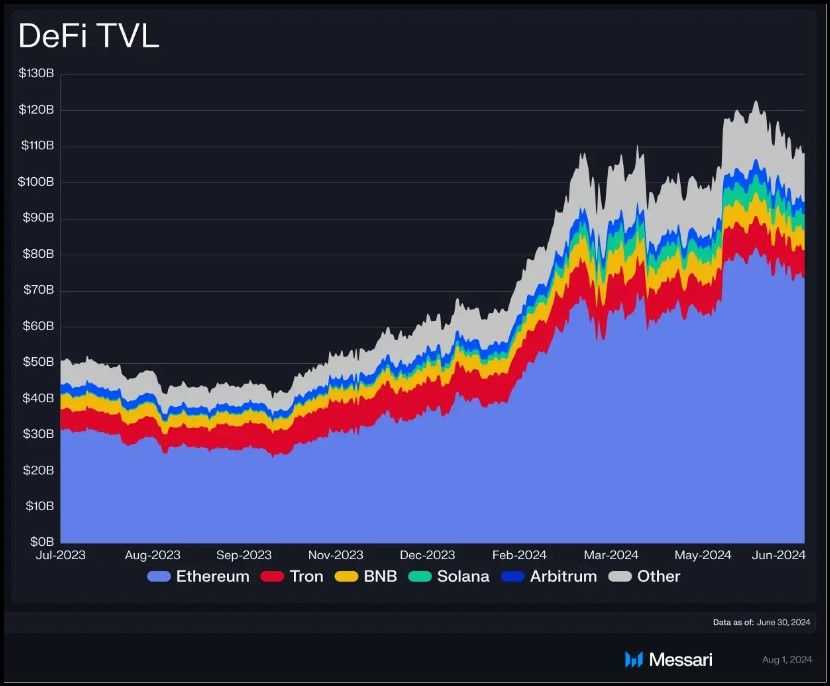

Over the past couple of years, DApps have exploded on the Ethereum chain.

Number of DApps are likely to explode as Ethereum grows. The blockchain and smart contracts are able to be used in order to build DApps for anything with a centralized app or infrastructure.

DApps are expected to become the norm, not the exception, in the future.

FAQs

What are some of the most popular Ethereum DApps available?

Everyone has their own definition of “best” Ethereum DApps are a lot, but top 10 of them relate to DeFi.

Ethereum: the leading blockchain innovator.

Ethereum invented smart contracts that revolutionized the market. These contracts have played a key role in the adoption of DApps such as DeFi, NFTs and others.