We've all been advised that we want insurance coverage, however not all of us get it. Getting insurance coverage is having a bet that if issues go fallacious, you may get some sort of compensation for it. Typically the compensation could also be greater than what you pay in premiums, however not all the time. The best manner to consider it’s "just in case" safety.

How Insurance coverage Works

If one thing occurs that you just're insured in opposition to, you or your benefactor will get a payout. Nonetheless, you’ll want to subscribe to this privilege by paying premiums. The way in which that insurance coverage corporations do the mathematics (and I don't work within the insurance coverage firm, so perceive that that is only a very common idea) is that if 10 individuals pay $100 every, they’ll manage to pay for to pay one particular person $1000 if one thing have been to occur.

Nonetheless, if one thing dangerous occurs to all 10 individuals, which the insurance coverage firm thinks could be very, impossible to occur, everybody may get $1000, and will probably be the corporate paying out of their pocket/income to take action.

On this state of affairs, the insurance coverage firm is the social gathering in control of paying out the claims. The place do they get the cash from? Primarily via premiums collected from people. They then take that cash and put money into different development property after deducting their "keeping the lights on" prices to allow them to have sufficient to pay out claims if and once they come up. So how does this work with crypto?

Insurance coverage for Crypto

As everyone knows, crypto just isn’t solely risky, however different surprising issues can occur to it. If it isn't a rug pull or a hack, it could possibly be some sort of bug in a wise contract or scams/frauds. With the multitude of surprising stuff liable to happen any minute, who would have the center to supply insurance coverage for crypto? Does it work like common insurance coverage as we all know it, or is there a brand new mannequin being proposed? These are simply a number of the questions I take into account as I researched the Bridge Mutual protocol. That is additionally my first foray into the world of crypto insurance coverage. You're welcome to affix me in taking a swim in these seemingly murky waters, murkier than most areas of crypto I do know thus far. I’d additionally extremely suggest trying out Man's video on crypto insurance coverage as a primer earlier than studying this text. There's additionally an ideal article on blockchain insurance coverage for individuals who favor studying over watching movies.

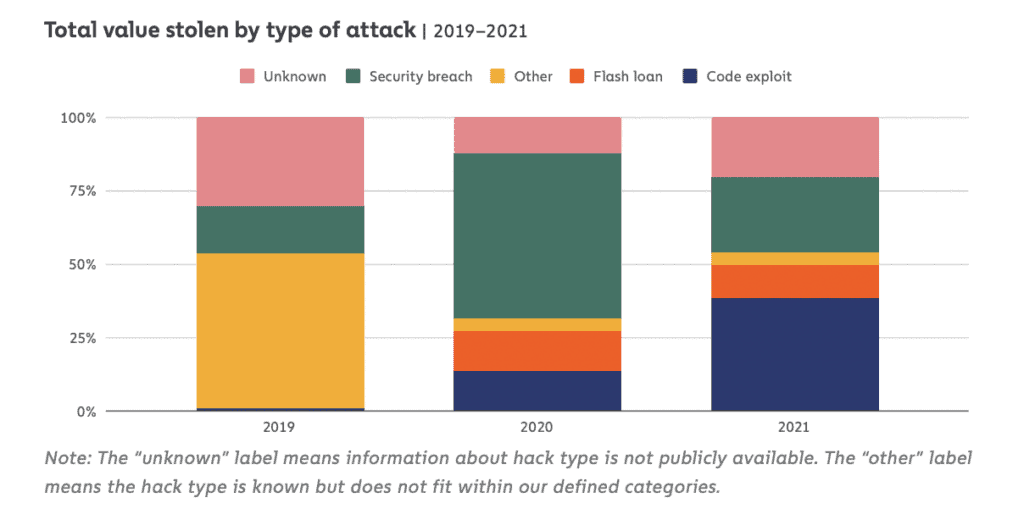

Earlier than continuing additional, right here's one thing to know concerning the state of the crypto business. In response to the most recent Crypto Crime Report issued by Chainalysis, the "detective" agency utilized by authorities businesses and establishments for tracing stolen funds and illicit actions, $3.2 billion was recorded as stolen funds in 2021. This can be a 1,330% enhance from 2020. By the way in which, the report is fascinating, even whether it is 140 pages.

Allowing for the final atmosphere, one can see that the dangers of investing in DeFi protocols will not be for the faint-hearted. That is the place Bridge Mutual is available in.

Introducing Bridge Mutual

In a nutshell, Bridge Mutual is a platform providing everybody the flexibility to be an insurance coverage underwriter or purchase a coverage simply in case a few of your investments in different protocols endure a loss. You’ll be able to consider it as a market of types. What's being purchased and offered listed below are insurance coverage insurance policies as a substitute of NFTs.

The mission was conceived in Q3 2020, with model 1 of the mainnet launched in Q1 2021. Later within the yr, model 2 was launched, and it stays probably the most present model up to now, with a TVL (Complete Worth Locked) of 1,718,334 USDT. The premise is straightforward sufficient, however greater than most, it's the small print that make or breaks this mission. That is the place the enjoyable begins, so strap your seatbelts on and prepare for the experience.

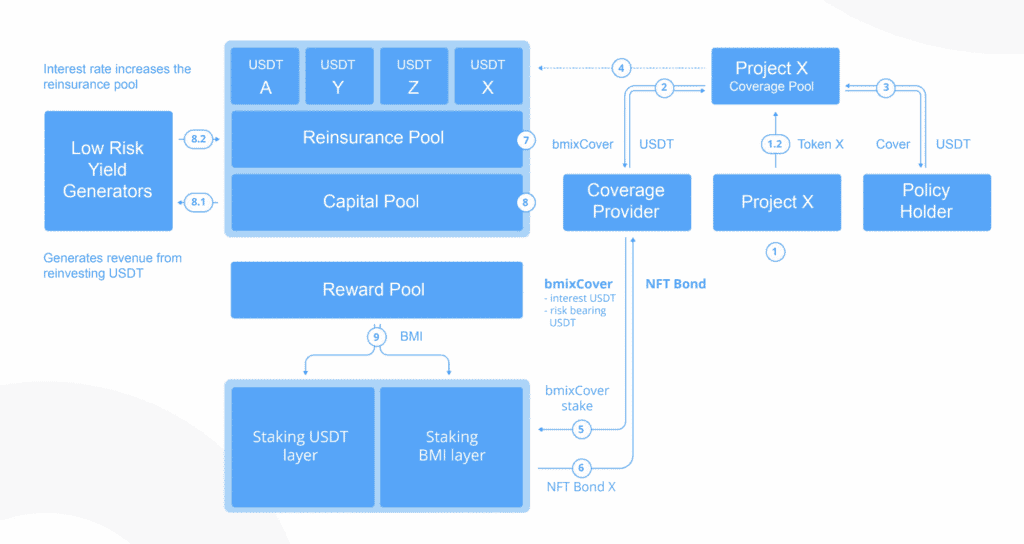

How It Works

There are 3 essential roles on this mission. Every of those roles is affected by various components. We're going to stroll via every function to know how issues work.

Coverage Holder (PH)

Lisa has heard a lot about DeFi protocols and is lastly eager to present it a strive. She selected a protocol known as Penguin Finance that was really helpful to her by a trusted pal. After conducting some analysis on her personal and it appears stable sufficient. She offers 1000 USDT value of liquidity into the DAI/PGN pool, PGN being the native token for Penguin Finance. Nonetheless, she's additionally heard plenty of tales of protocols affected by rug pulls, hacks and so forth., and he or she's involved that her funds is likely to be misplaced if something have been to occur. So she outlets round and comes throughout Bridge Mutual, which offers insurance coverage for Penguin Finance. She logs in through her Metamask pockets and peruses the insurance coverage contracts out there. She sees one for Penguin Finance and decides to purchase a coverage for it.

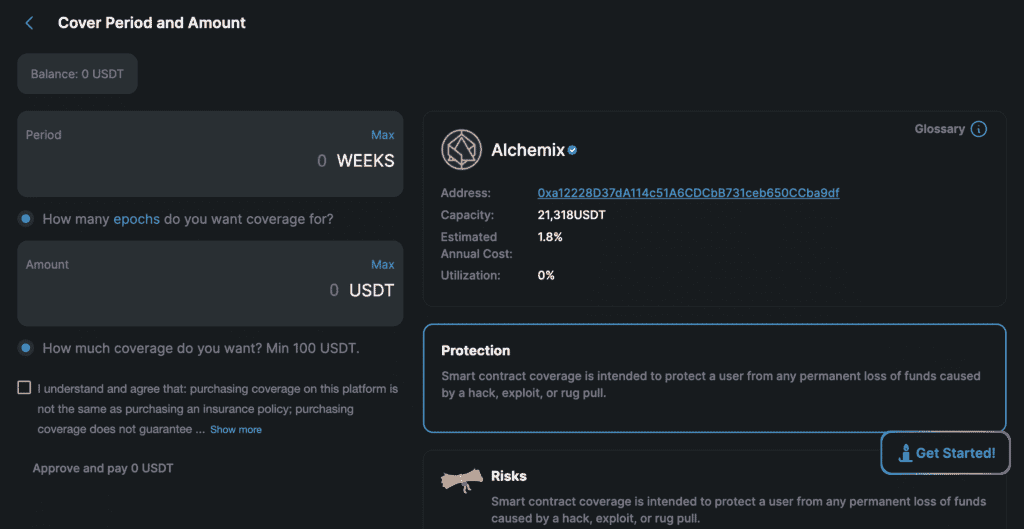

Simply fake that is Penguin Finance, okay? Picture through Bridge Mutual

After finding out the shape, she decides to purchase insurance coverage for 1 month, i.e. 4 weeks or epochs, because it's recognized within the protocol. She will purchase a coverage for as much as 21,318 USDT primarily based on the Capability acknowledged, however all she's in search of is insurance coverage for her 1000 USDT, in order that's what she's going to do. The price of the premium relies on three components:

- Quantity of protection required.

- Period of protection required.

- Utilisation ratio – this represents the availability and demand for the protection of that pool. The extra people who find themselves shopping for insurance policies for that pool, the upper the utilisation ratio. Meaning this protocol is taken into account fairly dangerous for a lot of of its individuals; therefore they’re in search of protection.

Extra importantly, she reads the disclaimer and ticks the checkbox concerning the dangers concerned in shopping for a coverage from Bridge Mutual. After finishing all the transaction, she is formally a Coverage Holder on the insurance coverage platform.

The premium she pays is break up into two chunks:

- 80% goes in direction of the insurance coverage contract pool to the Protection Suppliers

- 20% is deposited into the Reinsurance Pool as a protocol charge. This can be a pool that collects all types of income from the protocol. We'll discover out extra about its function afterward.

For a whole understanding of what varieties of situations are/will not be coated with the insurance coverage, try this documentation on Gitbook.

Protection Supplier

Alex has some spare money available and is seeking to make investments it into one thing that brings some first rate yield. He got here throughout the Bridge Mutual protocol, and the thought of being an underwriter appeals to his risk-loving facet. He is aware of that being a Protection Supplier (CP), as is thought on the protocol, is about offering the funds that others could lay declare on if issues go fallacious. Alternatively, in addition they stand to earn some fairly good yields when issues go nicely. It's all about chance, and Alex is aware of this nicely.

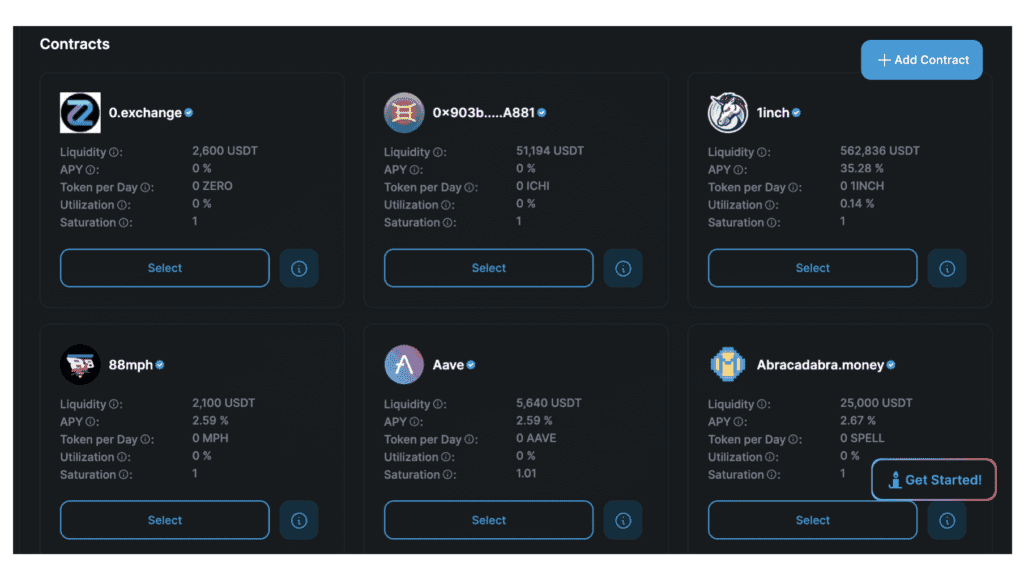

He logs in together with his Web3 pockets and peruses the checklist of contracts he can present protection for. He comes throughout the Penguin Finance contract and decides to deposit his cash there. Why that mission? As a result of his uncle's shut pal is a founder, and given what he is aware of, he has confidence within the mission. Time to place that insider information to good use!

Alex deposits 5000 USDT into the contract, and his journey as a CP begins. Along with the yield generated from the premiums talked about above, Alex additionally receives bmiPenguinCover tokens equal to the quantity he deposited plus any yield earned on that token. These tokens are proof of his deposit, just like the LP tokens one will get after offering liquidity.

Being the seasoned DeFi man he’s, Alex proceeds to stake the bmiPenguinCover tokens into the bmiCoverStaking pool. Nonetheless, solely whitelisted insurance coverage contracts may be accepted into the staking pool. As luck would have it, the DAO not too long ago put Penguin Finance on their whitelist, so Alex is on his merry method to incomes BMI, the platform's native token, from the Rewards Pool, funded by the protocol's treasury and ruled by the DAO. Not solely that, however Alex additionally will get a trade-able NFT bond token that he can promote on the NFT market if he's in a rush to boost some money on his investments. Promoting that NFT is mainly transferring the possession of these bmiPenguinCover tokens to the client of the NFT.

Alex's USDT deposit goes to a Capital Pool, which collects all of the deposits made by CPs. The funds in that pool are then invested in different low-risk DeFi protocols reminiscent of AAVE, Compound and yEARN to generate income for the funds. The income will then get deposited into the Reinsurance Pool talked about above.

The Reinsurance Pool acts like a CP by having the funds within the pool present protection to a number of insurance coverage contracts. This helps to carry down the utilisation ratio of the swimming pools, which in flip interprets to decrease premiums for would-be policyholders.

Voters and Trusted Voters

Judy is an intern in an everyday insurance coverage firm. As a part of her analysis into rivals of the corporate, she stumbled onto Bridge Mutual and is kind of curious as to how issues work. Not having some huge cash, she finds out that she will take part as a voter and evaluation claims as they’re offered. To be a voter, she might want to stake BMI tokens to get stkBMI and stake these to obtain vBMI tokens. Solely holders of vBMI tokens can vote on the claims, however anybody with stkBMI can view them.

The present worth of BMI is $0.02 per token, in response to Coingecko.com. If she have been to purchase 1000 tokens, it'd solely price her $20, which she will afford to lose. So she takes the plunge and stakes the tokens, formally becoming a member of the ranks of different voters within the protocol.

Two components affect the burden of her vote: the quantity of vBMI tokens held and the Status Rating. That is represented by a easy system:

Voting Energy = vBMI staked * Status Rating.

The previous is fairly self-explanatory so let's have a look at the latter. All voters begin with a Status rating of 1.0x. With every vote, the rating fluctuates. Status scores are added every time the voter voted within the majority, to not point out further rewards. Conversely, those that vote within the minority will endure a deduction of their repute scores. In additional excessive circumstances, the place the minority vote is lower than 10%, voters could even lose a portion of their staked tokens as a penalty!

The bottom Status rating a voter can have is 0.1x, whereas the very best is 3.0x. Voters whose Status rating is above 2.0x and is within the prime 15% degree as much as change into Trusted Voters. These voters are those who can vote on appeals, i.e. claims that have been beforehand voted down and are being reviewed a second time. Different fascinating voting options embrace:

- Voters can solely vote on claims that they've reviewed the proof for.

- Voters can vote on a number of claims in a batch to save lots of on fuel charges.

- Any worth entered better than $0 is the quantity the voter thinks the claimant is entitled to. To vote "no", enter "$0".

Apart from having a better Status Rating, voters additionally get Voting Rewards, expressed as BMI deposited by the Claimant or Protocol Charges (charges despatched to the Reinsurance Pool), relying on whether or not the declare is profitable or not.

Making a Declare

As issues prove, a bug was discovered within the Penguin Finance sensible contract, leading to a lack of Lisa's funds. As horrible because it appears to have misplaced her cash, she consoles herself with the truth that because of this she purchased insurance coverage. Due to this fact, she units out to make a declare. To kickstart the method, she should deposit 1% of the coverage worth purchased in BMI. Having efficiently deposited $10 value of BMI, she is now often known as Claimant. Right here's what's driving on her declare:

- Assuming that the premium she pays is 4% of the declare worth, her premium charge is $40, of which 20% are Protocol Charges, i.e. $8.

- For her declare to achieve success, she wants a 66% majority to vote "yes". If it’s a profitable declare, she’s going to get again her USD10 value of BMI tokens and a payout of no matter is agreed on by the voters, not essentially the total quantity. Voters will get $8 as a reward.

- If the declare is unsuccessful, the $10 value of BMI shall be given to voters as a substitute.

What determines the ultimate quantity that Lisa can get for a profitable declare is predicated on the weighted common of vBMI tokens and what was voted for by the voters. If 3 voters voted on her declare:

- Voter A – holds 100 vBMI tokens votes for 500 USDT

- Voter B – holds 500 vBMI tokens votes for 200 USDT

- Voter C – holds 2000 vBMI tokens votes for 100 USDT

It's probably that Lisa may solely get round 100 USDT fairly than 500 USDT.

The primary time Lisa submitted her declare, it didn't have sufficient votes to make it a profitable declare. Undeterred, she decides to make an enchantment by depositing an extra USD10 value of BMI to get the method going.

As a Claimant, it's as much as Lisa to persuade the voters of the validity of her declare with no matter proof she will give you. This time she has higher luck, and the enchantment went via. Fortunate for her as a result of the results of the enchantment is closing. Whether it is unfavourable, the one possibility is to make a brand new declare. That is doable because the coverage stays within the protocol even after the declare is denied.

How does this have an effect on the Protection Supplier when the declare is profitable? Let's do some back-of-the-envelope math right here:

- Pool complete = USDT100,000.

- 10 individuals every offering protection at $1000: $1,000 x 10 = $10,000 protection

- Profitable declare quantity is $1000, so every protection supplier's legal responsibility is: $1,000 / $10,000 = 0.1% of their deposit.

- This may come out as $100 per protection supplier.

Protocol Options

Now that we’ve an summary of how the entire course of works let's have a look at a number of the options provided by the protocol that offers it the aggressive edge.

Mission X Contract pool + Defend Mining

When you don't see a contract you wish to present protection for, you may all the time create your personal and deposit your personal funds to kickstart it. The "X" may be any DeFi protocol. All that's wanted is to pick the community supported by the protocol, i.e. Ethereum, Binance Good Chain, Polkadot and so forth., and the contract ID for the DeFi protocol's token along with the quantity.

As soon as a brand new pool is ready up, you may incentivise different CPs to supply protection by providing further rewards within the DeFi protocol's native tokens. This is named Defend Mining. How this works is that the social gathering kickstarting the insurance coverage pool may even deposit some native tokens into a delegated Defend Mining pool. Then, the tokens get distributed together with the usual yield to CPs. The person units the distribution interval throughout a interval with a minimal timeframe of 1 month.

Regardless that, technically, anybody can kickstart a brand new insurance coverage pool, as a result of permissionless nature of the protocol, not that many individuals would be capable to supply native tokens of DeFi protocols from skinny air. So this leads me to conclude that new insurance coverage swimming pools are prone to be began by the DeFi protocol's group as they might be capable to supply the additional rewards.

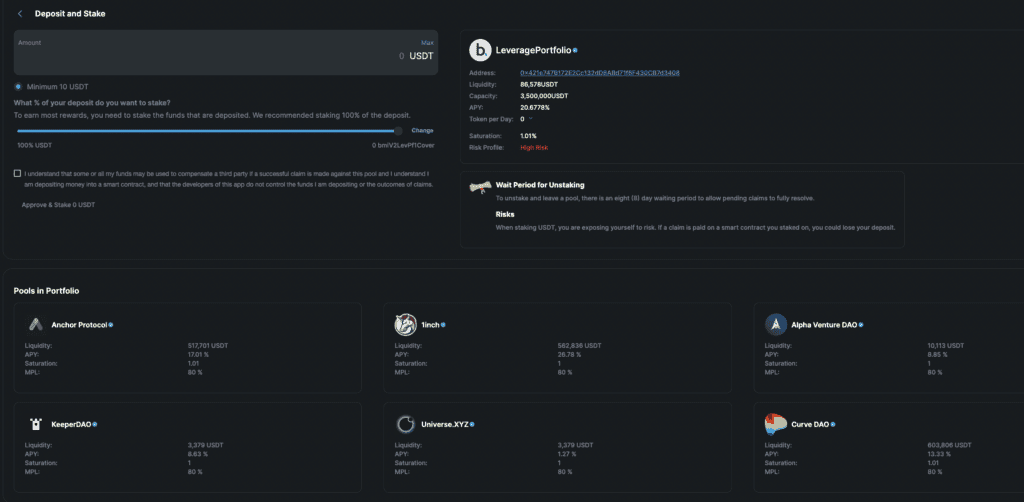

Leveraged Portfolio

One other function of Bridge Mutual is the Leveraged Portfolio. As an alternative of offering protection to 1 insurance coverage pool, you may present protection for a number of insurance coverage swimming pools. Because of this, the APY provided is greater than an everyday pool however is riskier too. One of many key metrics that decide the riskiness is named Most Permissible Loss (MPL). Every pool included within the portfolio has an MPL "score" assigned to it. This rating determines the sum of money within the portfolio used to cowl the loss. In response to their documentation on Gitbook, right here's an instance of how this works:

"For example: if a leveraged portfolio has a parameter of 80% MPL for the AAVE pool, this means that in the event of AAVE being hacked and all policies in the AAVE pool being honoured at 100%, the leveraged portfolio could lose 80% of its total capital."

6 swimming pools listed within the leveraged portfolio. Picture through Bridge Mutual

APY for the portfolio consists of APY from the next:

- All protection swimming pools within the portfolio in USDT

- Defend Mining swimming pools related to the protection swimming pools within the portfolio

- BMI is predicated on the chance profile of the portfolio.

In different phrases, collaborating within the Leveraged Portfolio just isn’t for the faint-hearted. You'd want to have the ability to climate the ups and downs of varied protocols on the identical time as a substitute of simply worrying about one. Alternatively, the chance of all the things going to custard can also be mitigated. As with all the things else, you'll must gauge your danger tolerance earlier than leaping into one thing like this.

Tokenomics

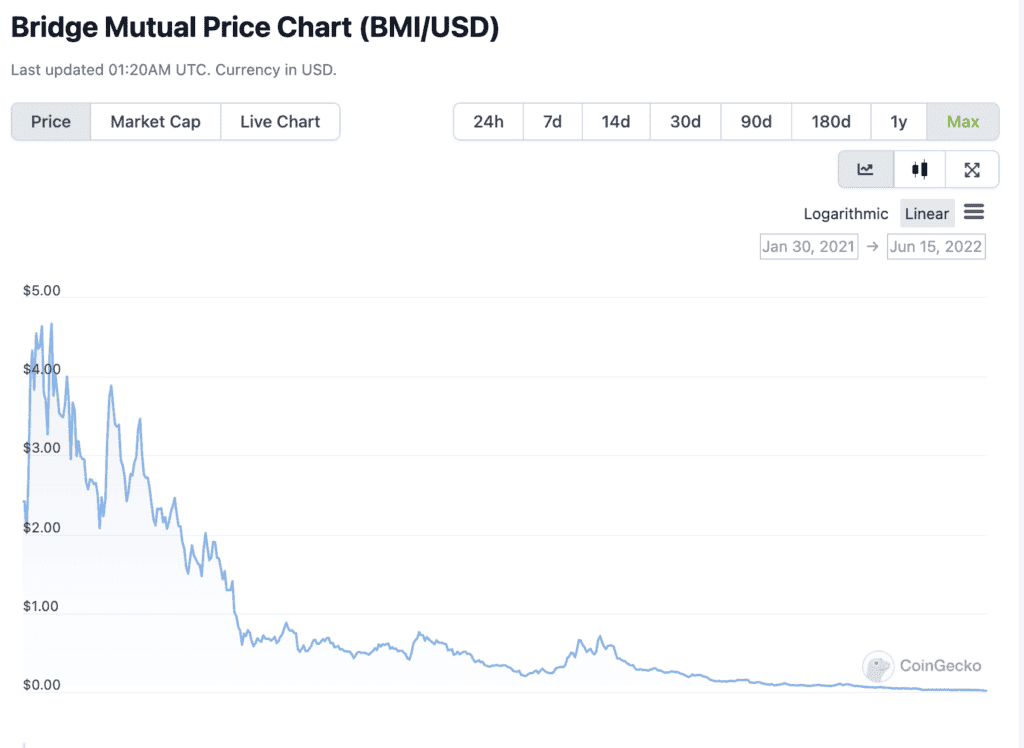

The BMI token is mainly how the protocol makes cash, so to talk. It was initially used to get funding for the mission. On the time of the ICO launch, it was offered for $0.125 per token, in response to ICO Drops, one of many key platforms for crypto ICOs. 8.65% of its finite provide of 160 million tokens was used for the fundraising train.

One more reason for calling BMI a moneymaker for the protocol is as a result of staking BMI is the one method to change into a voter. The funds offered by the Protection Suppliers and the premiums paid by the Coverage Holders don't wholly belong to the protocol. Even the 20% protocol charges charged by the protocol go to the Reinsurance Pool that gives protection to the opposite insurance coverage swimming pools. Due to this fact, solely the staked BMI really belongs to the protocol, so the extra voters take part within the voting course of, the higher it’s for the protocol.

Because the mission's launch, the token has made some first rate progress, reaching as a lot as $5.46 at its peak earlier than dropping down. As a result of brutal market situations, the token is buying and selling at $0.017, even decrease than its ICO worth. It’s value noting that the token just isn’t but broadly out there in most main exchanges.

Partnerships

The mission was constructed on the Polkadot chain, but it surely's not at the moment in search of any sort of parachain slots within the Polkadot ecosystem. Additionally it is supported by Tether and in collaboration with SushiSwap. Along with different partnerships they’ve cast with many well-known DeFi tasks, in addition they function integration with Coinbase pockets. This implies you may hook up with Bridge with the Coinbase pockets app in case you don't have Metamask or Pockets Join.

Future Options

Because the group is engaged on a brand new roadmap that shall be unveiled shortly, a number of issues stand out for me which are value trying into if it's not already within the roadmap but.

- Stablecoin Depegging insurance coverage – that is one thing talked about early on within the mission however doesn't appear to be enabled but. Claims for depegged stablecoin are put via mechanically, in contrast to different DeFi protocol claims that must be voted by voters. Nonetheless, given the de-pegging of USDT not too long ago, this would wish to proceed with warning, I think about.

- Transition to the DAO – the protocol goals to transition to a full DAO construction someday in 2022. By that point, solely important admin employees could be conserving the platform going whereas the vast majority of key selections shall be determined by the group.

- vBMI tokens phased out – at the moment, vBMI tokens are the entry-level standards for a person to change into a voter. The vBMI tokens have been phased out with a current improve, however particulars will not be but forthcoming.

- Coming quickly to Binance Good Chain and Polygon – plans are afoot to launch the app on these two blockchains. Preserve a watch out for them there!

Dangers and Obligations

For a platform that goals to be as hands-off as doable, there are nonetheless sure issues it's liable for, even when it migrates to a full DAO mannequin. Listed here are a number of factors that occurred to me:

- Safeguard funds within the Capital Pool as these originated from the deposited funds from the Protection Suppliers. They’re at the moment deployed to a handful of DeFi protocols to earn yield.

- Guarantee a good voting course of in order that claims are correctly processed. Regardless that it's the claimant's duty to show that the declare is legit, the speed of profitable claims can't be too low.

- Cautious deployment of the Reinsurance Pool funds to profit as many individuals within the protocol as doable.

- Reliability of the platform and related infrastructure in order that the protocol itself just isn’t hacked or endure from code exploits.

Relating to dangers, it could be guaranteeing the entire above occur with no undesirable penalties. The protocol has had its mission audited by Consensys and Zokyo, which reveals the mission's legitimacy to a sure diploma. So long as the audits are carried out every time there’s a important replace, and the group takes the standard precautions related to working a blockchain mission, fingers are crossed that issues will tick alongside.

Ultimate Ideas

Now that I've come to the tip of my journey in understanding what Bridge Mutual is, I draw the conclusion that it's no riskier or safer than another legit DeFi protocol on the market. That being stated, I suppose the true take a look at is whether or not individuals have efficiently made claims on it and whether or not it's troublesome for Protection Suppliers to withdraw their funds in the event that they select. Additionally, there’s an 8-day interval as soon as the withdrawal course of is initiated. If, inside 8 days, there’s a profitable declare made, the funds will nonetheless be used to pay for the declare.

Initially, I used to be stuffed with a specific amount of trepidation concerning the protocol as it appears that evidently the chance of getting to pay out claims is likely to be excessive. I used to be additionally uncertain if anybody would handle to achieve success in any claims because it depends on the vote of the plenty. Nonetheless, having understood extra about how the protocol works, it appears to be a working enterprise mannequin.

One fast be aware on their Discord channel: it's quieter than a number of the energetic ones I've seen in different tasks. This can be a double-edged sword as a result of as a lot as I like not having a number of noise, a chatty Discord signifies energetic individuals, which is often a very good signal. So that is one thing to pay attention to.

Given the quantity of danger concerned, for individuals who are curious sufficient to present it a strive, I'd say throw in a big slice of doubt and a small quantity that you just don't want within the foreseeable future.

Disclaimer: These are the author’s opinions and shouldn’t be thought-about funding recommendation. Readers ought to do their very own analysis.

Ceaselessly Requested Questions

What’s DeFi Insurance coverage?

That is an insurance coverage coverage taken out in opposition to any DeFi protocols you’ve got offered liquidity to. In case something have been to occur to the protocols, it is possible for you to to be compensated so long as your claims are legitimate.

What does Bridge Mutual do?

That is an insurance coverage platform the place insurance coverage insurance policies are purchased and offered. Protection suppliers deposit USDT to earn yield with the understanding that the funds is likely to be used to pay out profitable claims. Customers can buy an insurance coverage coverage in opposition to the DeFi protocols listed within the platform.

Is Bridge Mutual reliable?

The platform has been audited by CERTIK and Zokyo, two respected corporations well-known for auditing sensible contract bugs.

How do you purchase BMI?

Presently, the one method to get some BMI is through SushiSwap (BMI/WETH), Gate.io, and Bitfinex.

How (un)probably is it for claims to not be paid out?

The brief reply is that you just’d should belief within the knowledge of the plenty, i.e. the voters voting on the declare. So long as the proof offered for the declare is legit and falls squarely within the “What’s Covered” part, there is no such thing as a purpose to imagine it will not be put via. I do not assume the protocol plans to vote on claims often as a result of that will undermine all the enterprise mannequin.

What’s the danger for underwriting?

Associated to the reply above, whereas it is unlikely that the whitelisted protocols could be liable to endure any hacks or exploits, it’s nonetheless a legitimate chance. That is the place the analysis achieved by the Protection Supplier comes into play. The protocol assumes that each one Protection Suppliers do their homework, so the chance is just about borne by the Protection Suppliers.

Can I present protection and in addition purchase a coverage for a similar insurance coverage contract?

Technically talking, nothing is stopping you, however would you?

Can voters see what’s the majority vote since they’re incentivised to vote with the bulk choice?

No. That will defeat the aim of the motivation.

Can there be multiple claimant for a specific insurance coverage contract?

Sure. Not all declare quantities could be the identical.

These are in no way a complete checklist of questions. When you’re within the mission, do give the white paper a learn. Math geeks would have a subject day as there are many formulation to geek out on. It’s also possible to be part of the Discord channel. The admins are actually pleasant and responsive. Particular because of @Aletta and @GregJ for answering my questions and serving to me make sense of what is going on on.