Compound has just lately change into the biggest lending protocol in Decentralized Finance (DeFi).

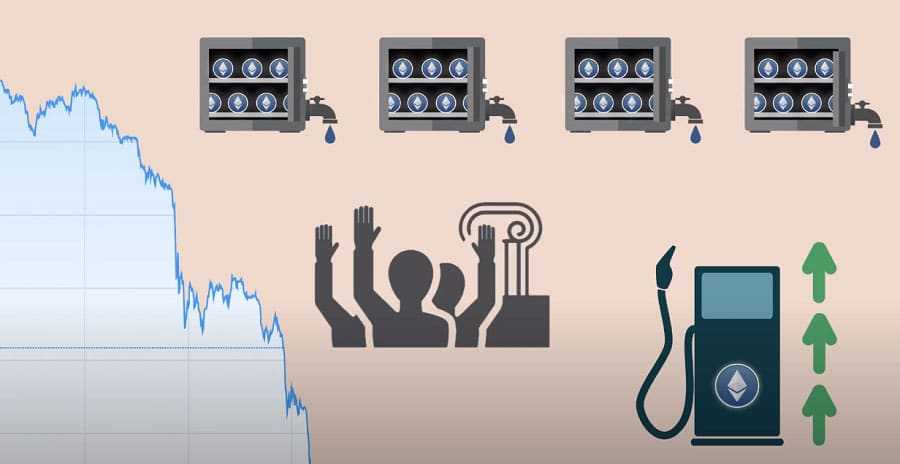

The introduction of its COMP token on June seventeenth despatched the crypto world right into a frenzy as customers rushed to deposit their property and earn unholy quantities of curiosity together with every day rewards paid in COMP for taking part within the ecosystem as a lender and/or borrower.

Hype remains to be on the horizon with Binance itemizing the COMP token on June twenty fifth, inflicting a 25% spike in value on Poloniex. The sudden drop in crypto markets throughout the identical interval has not phased Compound customers, who nonetheless have over 600 million USD price of crypto locked on the platform.

By the tip of this text you’ll perceive why individuals are so enthusiastic about Compound in addition to its significance on this planet of DeFi.

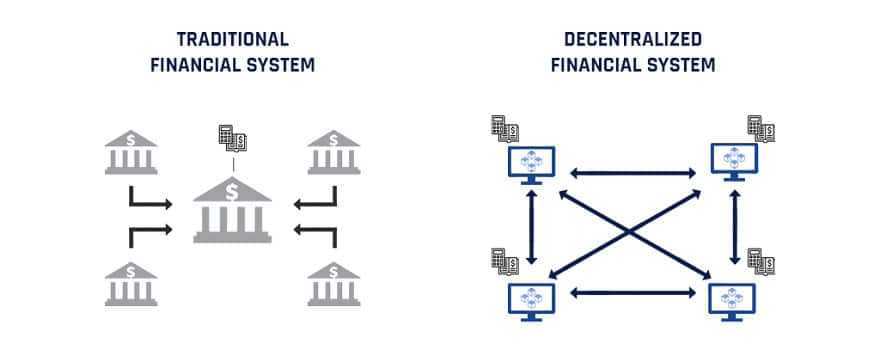

What’s DeFi?

If you wish to wrap your head round Compound Finance, you first must fill it with the data of DeFi. In a sentence, DeFi permits anybody on the web to entry monetary providers in a safe, decentralized, and personal method with out the usage of a intermediary. This consists of saving, buying and selling, lending, and absolutely anything else you’d often do with cash that entails centralized third events reminiscent of banks.

As you may need guessed, this ecosystem entails cryptocurrencies and never fiat currencies (though stablecoin cryptos that are “pegged” to the value of a fiat forex reminiscent of USDT or USDC are generally utilized in DeFi). The overwhelming majority of standard DeFi decentralized functions (Dapps) and the property used inside them are constructed on the Ethereum blockchain.

DeFi has been a sizzling matter in cryptocurrency for fairly a while, effectively earlier than Compound took centre stage. Up till just lately, the highlight in latest months had really been on DeFi protocols reminiscent of Kyber Community, Uniswap, and Bancor which offer decentralized alternate (DEX) providers. The ‘endgame’ of DeFi is successfully the entire elimination of third events in all worth transactions (sure, even Binance).

What’s Compound?

Compound is a decentralized lending platform that was created by Californian firm Compound Labs Inc. in September of 2018. Like many different protocols in DeFi, Compound is constructed on the Ethereum blockchain. Though Compound was initially centralized, the latest launch of its governance token, COMP, marks step one in turning Compound right into a community-driven decentralized autonomous group (DAO).

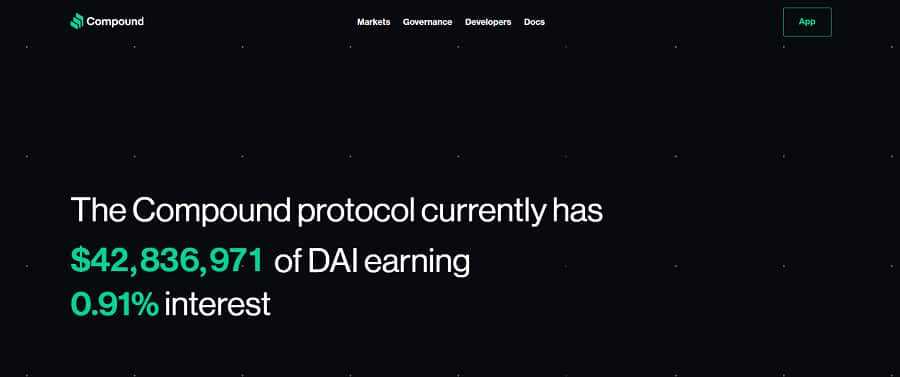

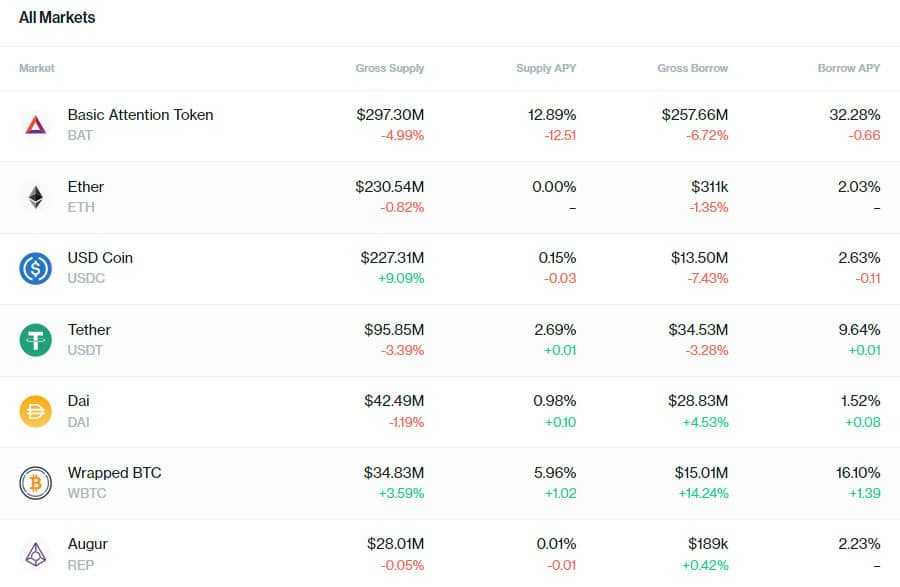

Whereas Compound’s objective has been said in many various methods in many various locations, the underlying concept is that this: put your idle cryptocurrency to make use of. The Compound protocol lets customers to lend and borrow 9 Ethereum-based property together with Fundamental Consideration Token (BAT), 0x (ZRX) and Wrapped BTC (wBTC).

On the time of writing, you possibly can earn annual curiosity (also referred to as APY) of over 25% when lending BAT. No Know Your Buyer (KYC), Anti Cash Laundering (AML) or credit score document is required to make use of Compound.

Customers of the platform don’t simply have the potential to earn loopy rates of interest however are additionally rewarded in COMP tokens for borrowing or lending cryptocurrency. Given the excessive value of the COMP token, this has opened the door to some brain-teaser stage of DeFi gymnastics that has allowed customers to extend their APY to over 100%.

It is a massive a part of why individuals are loopy about compound. We are going to clarify how such insane rates of interest are attainable later in a second. First, we have to cowl how Compound works.

How Does Compound Work?

As talked about, within the Compound protocol customers can deposit cryptocurrency as lenders and/or withdraw cryptocurrency as debtors. As a substitute of lending on to debtors, lenders mix their property into asset swimming pools from which customers can borrow.

There’s a pool for each asset (Fundamental Consideration pool, 0x pool, USDC pool, and many others.). Customers can solely borrow a USD worth in crypto that’s under the collateral they’ve provided (e.g. 60% of the collateral). The quantity they’ll borrow will depend on the liquidity and market cap of the collateral.

Once you lend cryptocurrency on Compound, you obtained an quantity of corresponding cTokens that’s usually a lot bigger than the quantity of crypto you deposited. cTokens are ERC-20 tokens which signify a fraction of the underlying asset.

For instance, on the time of writing, lending 1 DAI would provide you with virtually 49 cDAI in Compound. cTokens exist to permit customers to earn curiosity. Over time, customers should buy extra of the underlying asset they deposited with the identical mounted about of cToken they obtained.

In distinction to legacy borrowing providers, rates of interest are neither mounted nor agreed upon by the 2 events concerned within the transaction. As a substitute, the rate of interest is set by provide and demand and continuously up to date by a fancy algorithm.

As a rule of thumb, the higher the demand there may be for an asset, the upper the rates of interest will likely be for each lenders and debtors. This provides incentive to lenders to lend and deters debtors from over-borrowing. Lenders may withdraw their property at any time.

If a person has borrowed greater than what they had been permitted resulting from a drop within the value of the asset they supplied as collateral, they danger the liquidation of that collateral. Holders of the borrowed asset can select to liquidate the collateral and buy it at a reduced value. Alternatively, debtors pays again a portion of their debt to extend their borrowing capability above the brink of liquidation and keep it up as typical.

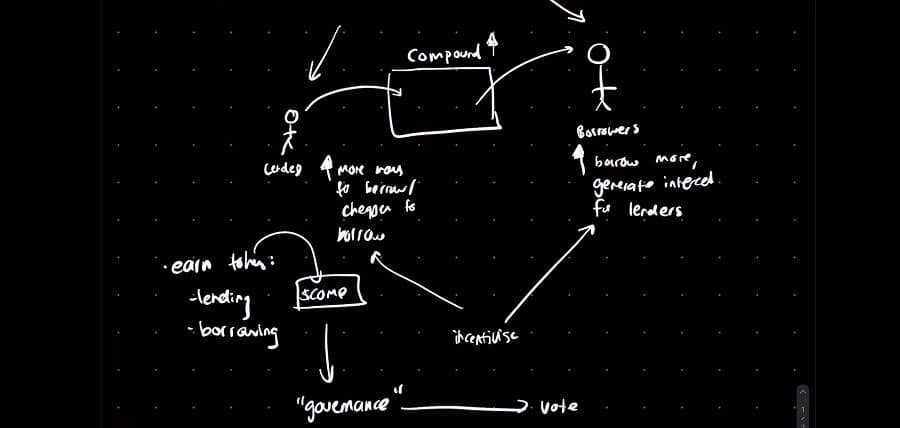

Compound Liquidity Mining

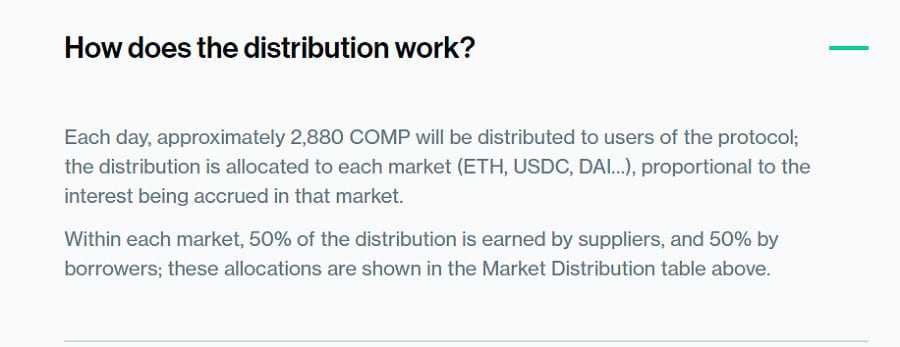

The primary concept behind liquidity mining is to present incentives to each lenders and debtors to make use of the Compound protocol. The reasoning is that failure to do that would lead to a gradual decline of the platform as lenders and debtors progressively drop off or transfer to comparable protocols within the DeFi area. To make sure a constantly excessive stage of liquidity and participation, Compound rewards each lenders and debtors in COMP tokens.

That is achieved utilizing a wise contract and the distribution COMP rewards are based mostly on a handful of things together with the rates of interest of an asset’s lending pool and the quantity of individuals interacting with the lending pool. 2880 COMP tokens are distributed every day with half going to debtors and the opposite half to lenders.

What does the COMP token do?

Along with being the carrot on the stick that motivates customers to make use of Compound, the COMP token offers customers governance over the protocol. This enables customers to have a say in the way forward for Compound. 1 COMP token is required to solid a vote, and votes may be delegated to different customers of the protocol with no need to truly switch the token to them.

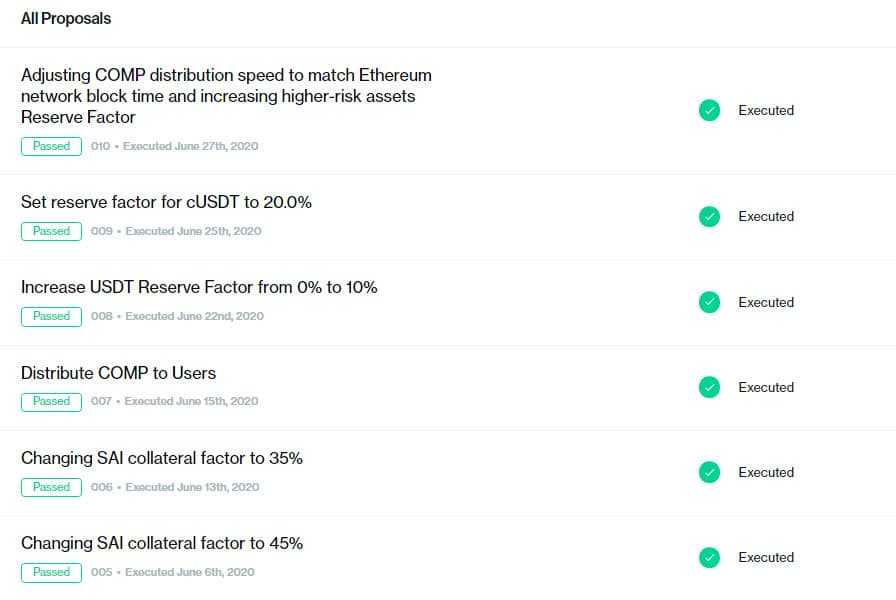

All proposals made in Compound include executable code. A person will need to have 1% of the entire COMP provide available or delegated from different customers to desk a proposal. As soon as submitted, there’s a 3-day voting interval whereby a minimal of 400 000 votes have to be solid. If greater than 400 000 votes affirm the proposal, the brand new change carried out after a 2-day ready interval.

The COMP ICO

There was no preliminary coin providing (ICO) for the COMP token. As a substitute, almost 60% of the ten million token provide was allotted to buyers, founders, present workforce members, future workforce members, and neighborhood development.

Particularly, just below 2.4 million COMP tokens got to shareholders of Compound Labs Inc., simply over 2.2 million got to the Compound founders and workforce, just below 400 000 have been saved for future workforce members, and just below 800 000 have been allotted for neighborhood initiatives.

The remaining 4.2 million tokens will likely be distributed to the customers of the protocol over a 4-year interval (assuming a constant every day distribution of 2880). It’s price noting that the two.2 million COMP tokens given to Compound’s founders and workforce members is outwardly short-term and will likely be ‘returned’ after a 4-year interval. That is to permit for a transition interval whereby the founders and workforce can nonetheless information the protocol through voting because it progressively turns into “fully” autonomous / neighborhood pushed.

Cryptocurrency Yield Farming

Though the philosophical causes for DeFi’s existence are all effectively and good, what actually has individuals dashing to platforms like Compound proper now’s the flexibility to leverage sensible contracts inside and between numerous DeFi protocols to obtain impossibly excessive rates of interest.

Within the cryptocurrency neighborhood this is called yield farming and essentially entails a mind-bending mixture of borrowing, lending, and buying and selling that may put the Federal Reserve to disgrace.

Yield farming is extraordinarily dangerous, and lots of think about it to be a variation of leverage buying and selling. It’s because it makes it attainable for customers to commerce sums of crypto a lot bigger than the underlying quantity they’ve really put down.

You’ll be able to consider it as your individual private pyramid scheme with the pyramid flipped the wrong way up. Your complete construction is reliant on a single asset which should both improve in value or keep the identical or else every little thing comes crashing down.

The specifics of how yield farming works relies upon totally on the asset you are attempting to build up. By way of Compound, yield farming entails maximizing your return in COMP tokens for taking part within the ecosystem as BOTH a lender and borrower.

This successfully permits customers to earn cash from borrowing cryptocurrency in Compound. That is achieved utilizing a platform referred to as InstaDapp, a dashboard that allows you to work together with a number of DeFi apps from a single level of reference.

Compound Yield Farming

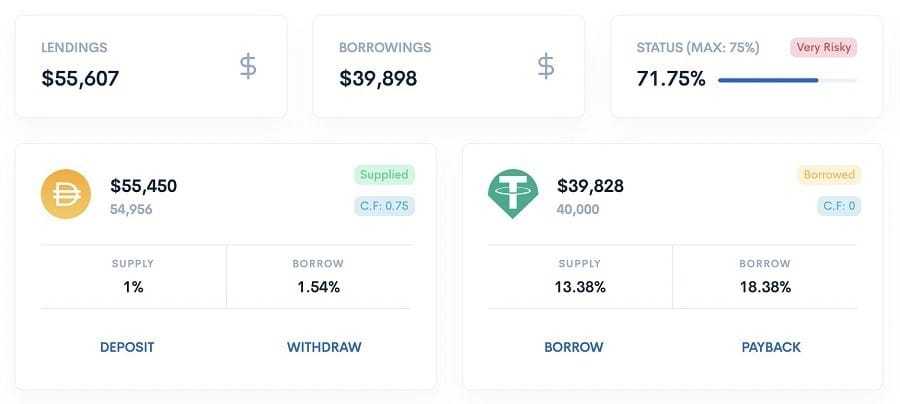

InstaDapp affords a function referred to as “Maximize $COMP mining” which may give you a greater than 40x elevated return in COMP tokens. The in need of it’s that the USD quantity of COMP tokens you obtain outweighs the USD worth of the curiosity you owe on the cash you might have borrowed. How this works was detailed fairly properly on this YouTube video however if you happen to don’t have half-hour to observe it, we are going to break it down for you in a single paragraph.

Suppose you might have 100 DAI. You deposit the 100 DAI into Compound. Since Compound lets you use these funds regardless that they’re “locked”, you utilize the 100 DAI with the “Flash Loan” function in InstaDapp to borrow 200 USDT from Compound.

You then convert the 200 USDT into (roughly) 200 DAI and put the 200 DAI again into compound as a lender. You at the moment are lending 300 DAI and owe 200 USDT. This provides you a return in COMP which supplies you an annual rate of interest in USD that may simply exceed 100% even after accounting for the rate of interest you pay for borrowing the 200 USDT.

Magic, proper?

As talked about earlier, the success of this scheme depends on the soundness or development of the underlying asset. For instance, regardless that DAI is technically a stablecoin, it may nonetheless fluctuate by a fraction that’s massive sufficient to soak the sandcastle and produce it down. This tends to occur to stablecoins when the remainder of the market fluctuates and merchants rush to hedge their losses utilizing fiat-pegged tokens.

The Compound Roadmap

In contrast to many cryptocurrency initiatives, Compound does probably not have a roadmap. Within the phrases of Compound Labs Inc. CEO Robert Leshner “Compound was designed as an experiment”.

This quote is taken from a Medium publish from March of 2019 which seems to be the closest factor to a roadmap yow will discover from Compound. It particulars 3 objectives the undertaking wished to realize: enabling assist for a number of property, permitting every asset to have its personal collateral issue, and changing into a DAO.

Within the months that adopted, Compound posted common improvement updates to Medium. The latest publish was earlier this month and its subtitle states the next: “Our core work on the Compound protocol is done. It’s time for the community to take charge.” Contemplating the event workforce appears to have efficiently achieved the three objectives it outlined simply over a 12 months in the past, it appears that evidently Compound could also be one of many few “finished” cryptocurrency initiatives.

In actuality, the way forward for Compound will likely be decided by its neighborhood. Based mostly on the publicly viewable Governance Proposals inside compound, most seem to contain adjusting reserve components and collateral components for supported property.

In brief, reserve components are a small portion of the curiosity paid on loans by debtors that are put aside as a “liquidity cushion” within the occasion of low liquidity. A reserve issue is the proportion of the collateral you possibly can borrow as a borrower. It’s also possible that extra property will likely be added to Compound as time goes on.

Compound Finance vs. MakerDAO

Up till Compound rushed the stage, MakerDAO was the most well-liked DeFi undertaking on Ethereum. For these unfamiliar, MakerDAO additionally permits customers to borrow cryptocurrency utilizing Ethereum, BAT or wBTC as collateral.

Nonetheless, the cryptocurrency you possibly can borrow will not be “just another” Ethereum-based asset, however an ERC-20 stablecoin referred to as DAI which is ‘soft-pegged’ to the US greenback. In contrast to USDT or USDC that are backed by centralized property held in custody, DAI is totally decentralized and backed by crypto.

As in Compound, MakerDAO doesn’t allow you to borrow the total quantity of the Ethereum collateral you deposited in DAI. As a substitute, you possibly can solely borrow 66.6% of the USD worth of the Ethereum you might have put down as collateral. Because of this if you happen to deposited 100$ price of Ethereum as collateral, you’d have the ability to withdraw roughly 66 DAI as a mortgage. In distinction to Compound, this reserve issue will not be topic to vary and DAI is the one asset which may be borrowed on the platform.

Each MakerDAO and Compound have been used to yield farm. Humorous sufficient, Compound customers had been borrowing DAI on MakerDAO to lend it in Compound when it had the best rate of interest. MakerDAO additionally offers customers the choice to lock up their DAI in return for curiosity.

Whereas there are various variations between the 2 DeFi giants, the 2 most notable are 1) that the objective of MakerDAO is essentially to assist the DAI stablecoin and a pair of) that Compound offers customers further incentive past rates of interest (COMP) to take part within the protocol.

How it’s that Compound overtook MakerDAO so rapidly is kind of simple to grasp once you put the 2 protocols facet by facet. Along with higher incentives for participation, Compound additionally helps considerably extra property for lending and borrowing. This provides it the benefit with regards to yield farming, which is arguably the driving issue behind these sorts of DeFi protocols.

Moreover, Compound is way simpler to grasp and use than MakerDAO, which has elaborate borrowing charges and protocols that exist primarily to make sure the soundness of DAI. You’ll be able to see how that works right here.

COMP Value Evaluation

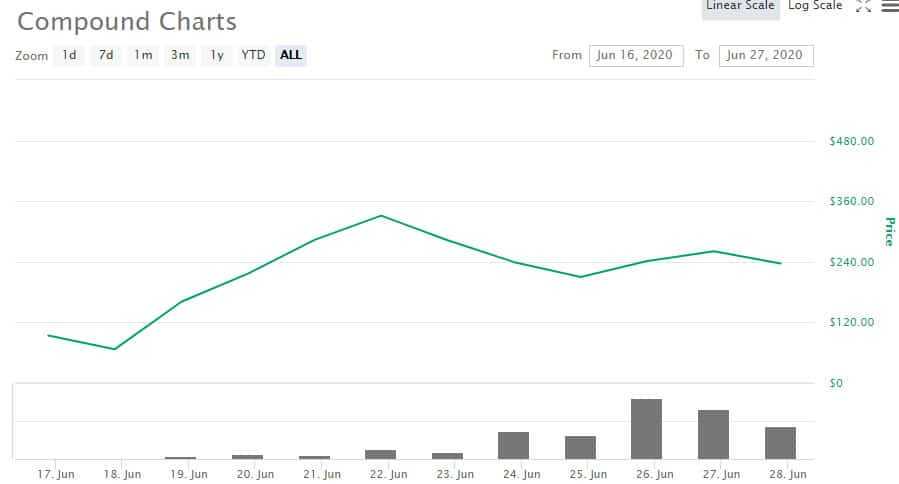

The worth historical past for COMP is kind of restricted contemplating it has solely been on the markets for two weeks. Throughout this time, it went from a value of round 60$USD to over 350$USD in a matter of days. It has since pulled again round 30% however stays regular as cryptocurrency markets slip into unfavourable p.c modifications.

Oddly sufficient, it appears that evidently Compound can be maintaining BAT in optimistic proportion territory since it’s presently the asset with the best rate of interest on the platform (round 25%).

On the time of writing, COMP is as soon as once more rallying up by over 10 p.c following an announcement from Coinbase that the token has formally been listed for buying and selling. Whether or not successive listings by massive exchanges is what’s maintaining the asset nearer to the moon than the Earth can not as of but be stated with certainty.

Contemplating its attraction over comparable protocols reminiscent of MakerDAO, it doesn’t appear possible that this asset will retrace again to 60$USD with out one other black swan occasion (not monetary recommendation!).

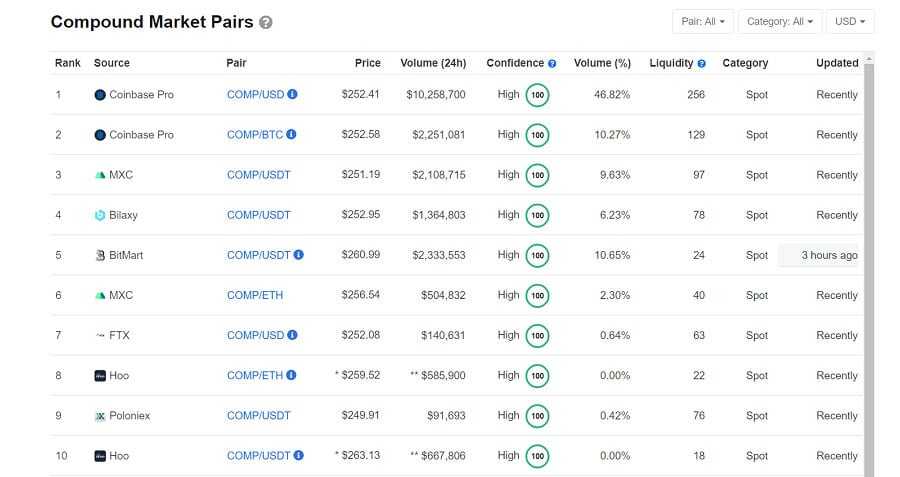

The place to get COMP Cryptocurrency

On the time of writing, you should buy COMP on a few dozen exchanges together with Coinbase, Binance, and Poloniex. Oddly sufficient, the Binance pairings aren’t but listed on CoinMarketCap however embody BTC, USDT, BNB, and BUSD.

When mixed, the 24-hour quantity on Binance is on par with Coinbase Professional. The whole 24-hour quantity is kind of low given its market cap however in case you are seeking to get your arms on COMP there may be completely no scarcity of liquidity on Binance and Coinbase Professional in the interim.

COMP Cryptocurrency Wallets

Since COMP is an ERC-20 token, it may be saved on nearly any pockets which helps Ethereum. The record is lengthy however consists of the likes of Exodus pockets, Belief Pockets, Atomic Pockets, Ledger and Trezor bodily wallets, and browser wallets reminiscent of MetaMask.

If you’re utilizing Compound and don’t intend on voting, be certain to often switch your collected COMP tokens to your individual pockets sometimes. Simply needless to say you should have at the least 0.001 COMP collected if you wish to withdraw it.

What we take into consideration Compound

Whereas we’re stoked about Compound, there are a couple of peculiarities which have surprisingly not attracted a lot consideration. The primary is the exceptionally excessive allocation of COMP tokens to stakeholders, founders, and workforce members. As talked about beforehand, this accounts for round 60% of COMP’s whole provide.

If this had been another token, merchants and buyers would run to the hills. When the founders and backers of a cryptocurrency undertaking have the lion’s share of the asset, this leaves different token holders open to a pump and dump scheme harking back to the ICO craze in 2017-2018.

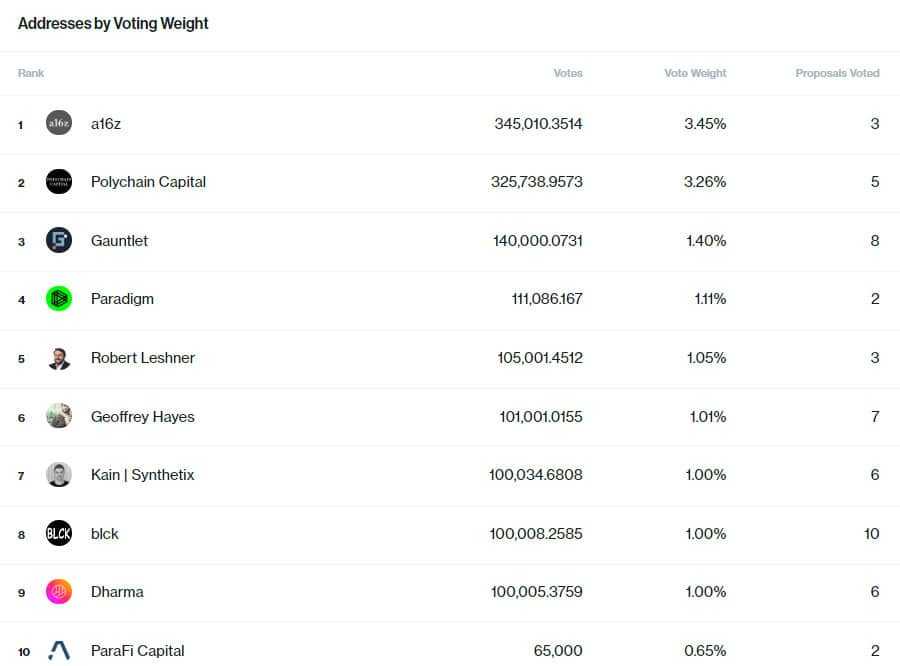

Second, it seems as if the founding members and buyers which backed Compound Labs Inc. are very concerned in Compound’s neighborhood governance. The publicly viewable “Top Addresses by Voting Weight” exhibits that almost all the prime 50 COMP token holders consist of individuals concerned in Compound Labs Inc.

Curiously sufficient, yield farming supplier InstaDapp can be within the prime 10. Because of this regardless of being neighborhood pushed, Compound remains to be very a lot within the arms of its unique inventory.

Third, it’s exhausting to see how lending protocols reminiscent of Compound might have any sensible use in the actual world. That is primarily as a result of it’s considerably pointless to borrow an quantity of an asset that’s lower than what you presently maintain.

In the meanwhile, only a few DeFi protocols will let you borrow greater than you personal. This isn’t a difficulty for these all in favour of yield farming, however in the actual world having the ability to borrow greater than you personal is the central worth proposition of getting lending providers within the first place.

Whereas it’s true that the prospect of saving your cash with a DAO could be extra worthwhile (and even perhaps safer) than doing so although a financial institution, it appears exhausting to think about how these excessive APY charges would stay if there was a sudden surge in lending provide by retail buyers.

Compound’s personal algorithm would decrease the rate of interest to a stage that is perhaps corresponding to a financial institution. It’s because it’s uncertain whether or not there could be an equal surge in individuals desirous to borrow lower than they presently personal.

Black Swan Occasions

Our closing concern with Compound is the way it might deal with a black swan occasion. For these unfamiliar, a black swan occasion is an unexpected exterior circumstance which disrupts markets. The present pandemic is an instance of a black swan occasion because it despatched shares and cryptocurrencies right into a freefall in March of this 12 months.

Whereas centralized establishments have some wiggle room by way of responding to those types of market fluctuations, DAOs working off pre-programmed sensible contracts don’t.

Understanding why this can be a drawback may be finest understood by inspecting what occurred to MakerDAO in the course of the March flash crash. As talked about earlier, the aim of MakerDAO is in the end to uphold the soundness of the DAI token. Merely put, this entails sustaining a steadiness between the USD worth of DAI in circulation and the USD worth of the collateral which backs it. That is achieved by minting and burning DAI in opposition to the present collateral in numerous contexts.

When the March black swan unfold its wings inflicting a pointy drop in cryptocurrency costs, this triggered a major variety of debtors’ “vaults” to have their collateral liquidated. Why? As a result of the quantity of DAI that they had borrowed was out of the blue greater than the 66.6% reserve threshold they should keep under to keep away from liquidation.

As you possibly can think about, the opposite customers within the system which might usually purchase the liquidated collateral at a reduction had been hesitant to take action, that means there was no person to purchase it and produce equilibrium to the protocol (since DAI is used to purchase the collateral and is burned when doing so).

Once you keep in mind that networks can change into extraordinarily congested in instances of volatility, this successfully meant that the ratio of “vaults” containing collateral being auctioned to the quantity of customers prepared and in a position to purchase was simply within the neighbourhood of 100-1.

This allowed some customers to purchase the collateral funds at near-zero costs within the absence of any precise public sale contributors. Though this was nice for the customers who determined to purchase a budget collateral, MakerDAO’s ecosystem was thrown off steadiness.

Whereas Compound has had the fortune of not going by way of the March flash crash in its present ‘DAO’ state, the very fact of the matter is that we’re nonetheless very a lot in risky instances with regards to each cryptocurrency markets and legacy markets.

It could very effectively face a difficulty similar to MakerDAO, the place a sudden drop in value causes the collateral of borrowing customers to be liquidated with out sufficient consumers out there to convey monetary stability and liquidity to the protocol.

Conclusion

Regardless of these considerations, we consider that the Compound protocol maintain some critical promise. In any case, it appears that evidently Compound is without doubt one of the uncommon and up to date cases of a completely functioning DeFi undertaking on par with the likes of Ren’s RenVM, which permits for decentralized, safe, and personal cryptocurrency swaps between blockchains.

Moreover, assuming the operation of the Compound protocol is definitely handed over to the neighborhood, it’s going to hopefully have the ability to refine the platform into one thing that will likely be used exterior the fences of crypto yield farmers with a dollar-green thumb.

Make no mistake, what we’re seeing is the start of a brand new period of finance. MakerDAO, Kyber Community, Uniswap, and Compound are in fact the primary steps on a for much longer journey to a world the place finance is decentralized, clear but personal, safe, and accessible to just about everybody on the planet.

Right here is to hoping that Bitcoin will trigger individuals to inadvertently FOMO into the a number of the most fun applied sciences to this point.