Within the dynamic world of cryptocurrency, derivatives have emerged as pivotal devices for merchants looking for to hedge danger, speculate on worth actions, or achieve publicity to the crypto market with out holding the underlying property. The inception of the first-ever crypto spinoff in 2011, identified by the ticker ICBIT, marked a major milestone within the evolution of digital finance. This innovation laid the groundwork for a burgeoning market that, based on Crypto.com, was valued at over $2 trillion in 2023.

This text will discover cryptocurrency derivatives and establish the highest exchanges which have contributed most to this monumental development. We may even focus on the complexities and challenges merchants face and provide insights on effectively navigating this profitable but intricate panorama. This introduction units the stage for a deeper investigation into crypto derivatives, underlining their significance within the broader monetary ecosystem.

What are Crypto Derivatives?

Quite a few cryptocurrencies exist, serving a myriad of use instances. Bitcoin is a retailer of worth asset, whereas cryptocurrencies like Ethereum and Solana gas sensible contract blockchains. No matter utility, each asset, within the cryptosphere or in any other case, has a financial worth that fluctuates over time. Derivatives are monetary devices that isolate an asset's worth potential from its different intrinsic traits like utility and possession. They observe the value of an underlying asset, permitting merchants to assemble preparations that may capitalize on market occasions.

How do Crypto Derivatives Work?

Crypto derivatives are monetary contracts between two or extra events that derive their worth from the value of one other crypto asset, reminiscent of bitcoin or ether. They’re a method of gaining publicity to cryptocurrency worth fluctuations with out proudly owning them in on-chain wallets.

Let’s perceive the functioning of crypto derivatives via the principle kinds of contracts: futures, choices, and swaps. Right here’s how every of those derivatives works:

Futures Contracts

A futures contract is an settlement to purchase or promote a particular amount of a crypto asset at a predetermined worth at a specified future date. These will be:

- Standardized Contracts: Traded on exchanges, permitting merchants to take a position on the long run worth of the cryptocurrency or hedge towards potential worth actions.

- Perpetual Contracts: A sort of futures contract with out an expiry date, permitting merchants to carry positions indefinitely, with periodic funding charges to make sure the market worth is anchored to the spot worth.

Choices Contracts

Choices give the client the correct, however not the duty, to purchase (name possibility) or promote (put possibility) a certain quantity of a cryptocurrency at a predetermined worth (strike worth) earlier than or at a particular date. Choices can be utilized for hedging or speculative functions, offering an uneven payoff profile:

- Name Choices: Merchants purchase name choices in the event that they anticipate the value of the cryptocurrency will rise above the strike worth earlier than the expiry date.

- Put Choices: Merchants purchase put choices in the event that they count on the value of the cryptocurrency to fall under the strike worth earlier than the expiry date.

Man has put collectively this nice video that covers Bitcoin Choices intimately:

Swaps

Swaps are personal agreements between events to change money flows or the monetary devices of 1 cryptocurrency for an additional, based mostly on a specified notional quantity. Within the crypto context, this usually takes the type of:

- Curiosity Price Swaps: Events may change fastened for floating fee funds in cryptocurrency.

- Forex Swaps: Exchanging one cryptocurrency for an additional, with agreements to reverse the swap at a later date at a predetermined worth.

Working Mechanism

- Worth Hypothesis: Merchants can speculate on the value motion of cryptocurrencies, taking lengthy positions in the event that they imagine the value will improve or brief positions in the event that they imagine it can lower.

- Leverage: Many crypto derivatives enable the usage of leverage, enabling merchants to open bigger positions with a smaller capital outlay. Whereas this could amplify earnings, it additionally considerably will increase danger.

- Hedging: Traders holding cryptocurrencies can use derivatives to hedge towards adversarial worth actions, securing a sure sale worth for his or her holdings even when market costs fall.

- Market Effectivity: Derivatives contribute to cost discovery and liquidity within the crypto market, serving to to stabilize costs and permit for extra environment friendly market functioning.

Execution Platforms

- Exchanges: Many crypto derivatives are traded on regulated or decentralized exchanges, offering a platform for standardized contracts with liquidity and worth transparency.

- Over-the-Counter (OTC): Personalized contracts between events will be executed exterior of exchanges, providing flexibility however with probably increased counterparty danger.

Crypto derivatives are advanced monetary devices that require understanding of the market and danger administration practices. They play a vital position within the cryptocurrency ecosystem by offering instruments for hypothesis, hedging, and leveraging positions.

Why Commerce Crypto Derivatives?

Buying and selling crypto derivatives opens entry to distinctive methods and devices which will assist a crypto investor optimize their funding portfolio to accommodate the distinct nature of the digital property market. A few of these optimizations are harking back to utilizing derivatives in conventional markets, whereas some provide distinctive benefits over the unstable nature of this market. Listed below are some key the reason why traders embody derivatives of their funding portfolios:

- Leverage: Most crypto spinoff platforms provide a leverage facility the place an investor pledges collateral to open considerably increased positions available in the market. Leverage is a instrument to achieve multiplied earnings with loss restricted to the collateral. Leverage multiplies sensitivity to volatility, which amplifies earnings or a possible loss in case of poorly positioned trades.

- Hedging Volatility: The cryptocurrency market is thought for its excessive volatility. Merchants can use derivatives like futures and choices to hedge towards worth fluctuations of their crypto holdings, securing a predetermined worth for a future date and thus managing their publicity to market actions.

- Possession: Derivatives are useful when an investor is solely concerned with an asset’s worth potential and desires to keep away from the effort of bodily possession, like key administration and storage.

- Entry to Restricted Markets: Some traders might face regulatory or logistical limitations when making an attempt to buy particular cryptocurrencies straight. Crypto derivatives provide a method to achieve publicity to those property with out direct possession, bypassing sure restrictions and complexities.

- Value Effectivity: Buying and selling derivatives will be extra cost-efficient than straight buying and selling underlying cryptocurrency. Derivatives merchants can keep away from the prices related to on-chain transactions, safety, and pockets administration of precise cryptocurrencies.

- Revenue Era: By way of methods reminiscent of writing coated calls or promoting futures contracts, merchants can generate earnings from their current cryptocurrency holdings, including one other layer of utility to their funding technique.

- Threat Administration: Derivatives provide subtle danger administration instruments that allow merchants to successfully implement advanced methods to guard their investments from adversarial market strikes.

Buying and selling crypto derivatives requires understanding of the derivatives market and the underlying cryptocurrency property. Whereas providing vital alternatives, it additionally comes with excessive danger, exemplified by the leverage concerned and the inherent volatility of the crypto market. As such, merchants should method crypto derivatives with a well-thought-out technique and a transparent understanding of the dangers.

What to Search for in a Crypto Derivatives Alternate

Deciding on the appropriate derivatives change that fits your wants and preferences is a pivotal choice for merchants. This selection can considerably influence their buying and selling effectivity, danger administration, and general expertise within the crypto market. With numerous platforms providing various companies, understanding the important components distinguishing an exemplary change from a mean one is essential. Listed below are some components to think about when searching for a crypto derivatives change:

Open Curiosity (Liquidity)

Open curiosity, indicating the overall variety of excellent spinoff contracts, is a main measure of an change's liquidity. Excessive open curiosity suggests a vibrant market with ample merchants, facilitating simpler entry and exit at aggressive costs. Liquidity is essential for minimizing slippage, particularly for big orders, and ensures that the market can take in trades with out vital worth impacts.

Regulatory Compliance

Compliance with regulatory requirements could also be paramount if you’re searching for a centralized platform for derivatives buying and selling, which usually gives increased regulatory assurance, present process strict oversight to guard customers towards fraud and insolvency. Decentralized exchanges circumvent regulation and provide privateness. Merchants ought to weigh the trade-offs between regulation and privateness to find out their excellent possibility.

Charges

Understanding an change's payment construction is crucial. This construction consists of change charges, which may differ extensively amongst platforms, fuel charges for decentralized platforms, and deposit and withdrawal charges. Excessive prices can erode earnings, particularly for high-frequency merchants, making selecting an change with a aggressive payment construction that doesn’t compromise different essential companies crucial.

Consumer Expertise

The platform's interface and ease of usability play a major position in buying and selling success. A user-friendly interface, complete charting instruments, and environment friendly commerce execution capabilities can improve decision-making and buying and selling pace. Moreover, dependable buyer help is essential for resolving points promptly, contributing to a optimistic buying and selling expertise.

Non-essential Elements

Whereas not deal-breakers, sure non-essential components may also affect the selection of an change:

- Safety: Though paramount, most main exchanges now provide sturdy safety measures. Due to this fact, whereas necessary, safety won’t be the first differentiator.

- Product Choices: The number of derivatives (futures, choices, perpetuals, swaps) can cater to completely different buying and selling methods however ought to align with the dealer's experience and pursuits.

- Leverage Restrict: Excessive leverage can amplify earnings but additionally dangers. Merchants ought to contemplate their danger tolerance and buying and selling technique over the utmost leverage provided.

- Deposit and Withdrawal Choices: The flexibleness of depositing and withdrawing in each fiat and cryptocurrencies is handy however secondary to components like liquidity and charges.

Selecting the best crypto derivatives change is a nuanced choice that hinges on balancing necessary and non-essential components. In the end, the objective is to pick out a platform that aligns with one's buying and selling technique, gives a safe and environment friendly buying and selling atmosphere, and fosters a optimistic person expertise.

Greatest Crypto By-product Exchanges

This part will discover some platforms for buying and selling crypto derivatives choices obtainable. The exchanges talked about right here have been chosen based mostly on the components talked about beforehand. Not each change talked about right here excels in each side, so we are going to cowl the strengths and weaknesses of each various mentioned right here.

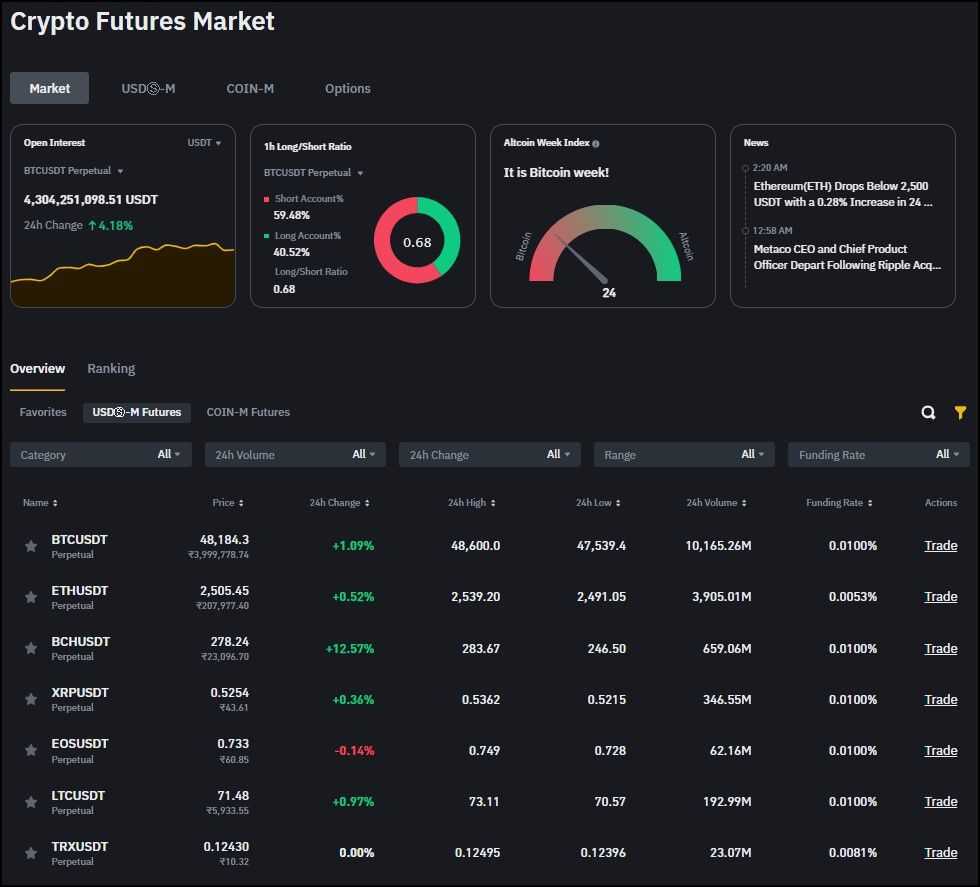

Binance

Binance, as one of many world's main cryptocurrency exchanges, gives a complete platform for derivatives buying and selling, making it a horny possibility for a lot of merchants. Evaluating it towards the important components talked about:

- Open Curiosity (Liquidity): Binance excels in liquidity, boasting excessive open curiosity throughout numerous derivatives merchandise. Ample liquidity ensures merchants can execute giant orders with minimal slippage, making it a super platform for retail or institutional merchants.

- Regulatory Compliance: Binance operates in a posh regulatory atmosphere. It has made efforts to adjust to regulatory requirements in numerous jurisdictions, together with acquiring vital licenses and adhering to KYC/AML laws. Nevertheless, potential customers ought to concentrate on ongoing developments and be sure that Binance meets their native compliance necessities. Binance shouldn’t be licensed to supply derivatives within the US.

- Charges: Binance is thought for its aggressive payment construction, providing comparatively low buying and selling charges that may lower additional based mostly on buying and selling quantity and BNB token holdings. The platform additionally maintains clear insurance policies relating to deposit and withdrawal charges, that are usually favorable in comparison with the {industry} normal.

- Consumer Expertise: The platform gives a user-friendly interface, superior charting instruments, and a responsive buying and selling system appropriate for novice and skilled merchants. Buyer help is accessible, aiding numerous channels, though response instances can differ.

Concerning non-essential components, Binance offers sturdy safety measures for numerous merchandise, together with futures, choices, perpetual swaps, versatile leverage choices, and various deposit and withdrawal strategies, catering to a broad spectrum of buying and selling methods and preferences.

In conclusion, Binance stands out for its liquidity, aggressive charges, and complete person expertise, making it a powerful contender for derivatives buying and selling. Nevertheless, merchants ought to repeatedly monitor regulatory compliance and contemplate their particular wants and danger tolerance when buying and selling on the platform. You’ll find extra particulars about Binance and its choices within the Binance Evaluate on Coin Bureau.

ByBit

ByBit, a distinguished participant within the crypto derivatives market, gives a specialised buying and selling platform specializing in futures and perpetual contracts. Let’s study the traits of ByBit.

- Open Curiosity (Liquidity): ByBit usually ranks among the many prime exchanges when it comes to open curiosity for crypto derivatives, notably for BTC and ETH perpetual contracts. Whereas particular numbers can differ, its open curiosity is usually within the billions of {dollars}, indicating a deep market that may help giant trades with out vital worth influence. In comparison with smaller exchanges, ByBit's liquidity is superior, facilitating higher worth discovery and tighter spreads.

- Regulatory Compliance: ByBit has made efforts to navigate the advanced regulatory panorama by participating with regulatory our bodies and adhering to worldwide compliance requirements. Nevertheless, its decentralized nature and the regulatory challenges confronted in some jurisdictions (e.g., the UK and the USA) might require merchants to make use of further warning and conduct their due diligence.

- Charges: ByBit's payment construction is clear, with maker charges usually round -0.025% (offering a rebate to makers) and taker charges round 0.075%. These charges are aggressive when in comparison with different main exchanges, which may have taker charges as excessive as 0.075% or extra. Nevertheless, the precise profit is determined by whether or not a dealer's technique entails making or taking liquidity.

- Consumer Expertise: ByBit gives a complicated buying and selling interface that caters to each newbies and skilled merchants. Its platform offers a variety of instruments and charts, high-speed commerce execution, and a cellular app for buying and selling on the go. Buyer help is strong, that includes 24/7 availability via dwell chat and different channels.

Non-essential Elements

- Safety: ByBit employs industry-standard safety measures, together with chilly storage for shopper funds, two-factor authentication, and SSL encryption, that are on par with the safety protocols of main exchanges.

- Product Choices: Specializing in derivatives, ByBit gives a big selection of merchandise, together with futures, perpetual contracts, and choices, with a give attention to the most important cryptocurrencies. This choice matches or exceeds the variability discovered on many competing platforms.

- Leverage Restrict: ByBit offers leverage as much as 100x on sure contracts, aligning with the choices of different main derivatives exchanges. Such excessive leverage permits for vital place sizing but additionally introduces elevated danger.

- Deposit and Withdrawal Choices: ByBit helps a number of cryptocurrencies for deposits and withdrawals, offering flexibility for merchants. Whereas it doesn't help fiat deposits straight, it gives fiat gateway companies, which is a typical apply amongst crypto-only platforms.

ByBit stands out for its aggressive charges, excessive liquidity, and user-friendly buying and selling atmosphere. Its method to regulatory compliance and the breadth of its product choices make it a compelling selection for crypto derivatives merchants. Nevertheless, as with all change, merchants should contemplate their particular wants, buying and selling methods, and the regulatory atmosphere they function in. Learn the ByBit overview on Coin Bureau and be taught extra concerning the change.

👉 Readers of the Coin Bureau can stand up to $50,000 in sign-up bonuses, 0 charges for 30 days and a $30 airdrop by utilizing our Coin Bureau Signal-Up Hyperlink

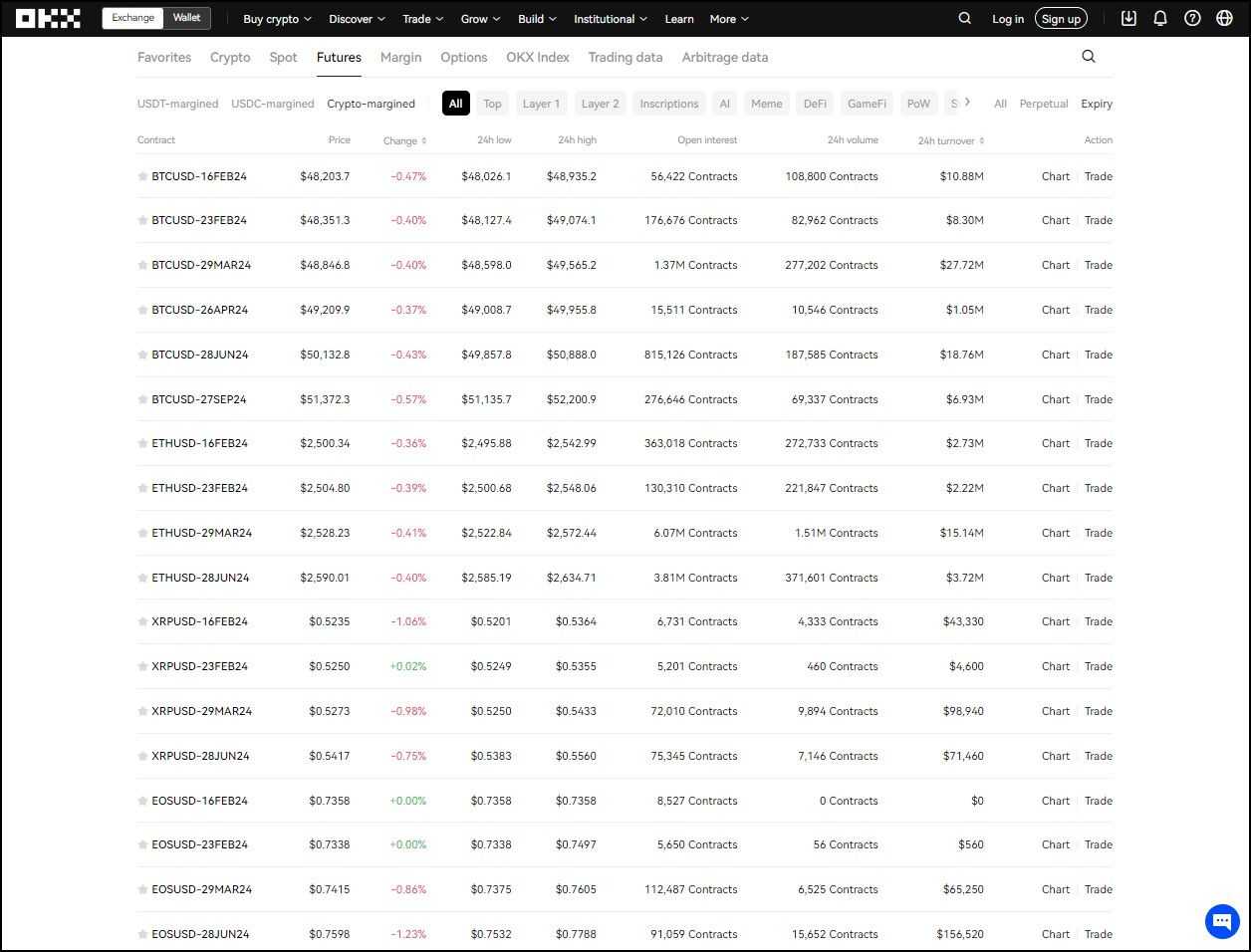

OKX

OKX is a complete cryptocurrency change providing a variety of economic companies, together with a sturdy platform for crypto derivatives buying and selling. Right here’s an evaluation based mostly on the necessary and non-essential components talked about earlier:

- Open Curiosity (Liquidity): OKX persistently ranks excessive when it comes to open curiosity for crypto derivatives, showcasing its place as one of many main platforms for liquidity. With billions of {dollars} in open curiosity throughout numerous contracts, OKX facilitates environment friendly commerce execution, even for big orders, minimizing slippage and making certain aggressive pricing.

- Regulatory Compliance: OKX operates with a eager give attention to regulatory compliance, adapting to the worldwide regulatory panorama by implementing strict KYC and AML procedures. This dedication enhances its credibility and trustworthiness amongst customers, though the regulatory stance in particular jurisdictions might have an effect on its accessibility and the vary of companies provided to customers in these areas.

- Charges: The payment construction on OKX is designed to be aggressive, with maker charges usually round -0.02% to 0.02% and taker charges between 0.05% to 0.075%. These charges are enticing, particularly for high-volume merchants, and are according to or higher than these provided by many different exchanges. Moreover, OKX offers tiered payment ranges, the place merchants with increased 30-day buying and selling volumes or bigger OKB (OKX's native token) holdings profit from decrease charges.

- Consumer Expertise: OKX gives a complicated but user-friendly buying and selling platform, appropriate for each novice merchants and seasoned professionals. It options an intuitive interface, complete charting instruments, and superior order sorts. The change additionally offers sturdy buyer help via numerous channels, making certain well timed help for customers.

Non-essential Elements

- Safety: OKX emphasizes safety with a multi-tier and multi-cluster system structure, cold and warm pockets applied sciences, and two-factor authentication (2FA) for enhanced account safety. Its safety measures are sturdy and on par with {industry} requirements.

- Product Choices: The change boasts a various vary of derivatives merchandise, together with futures, perpetual swaps, and choices, throughout a wide array of cryptocurrencies. This selection permits merchants to make use of numerous methods and hedge their positions successfully.

- Leverage Restrict: OKX gives leverage as much as 100x on sure derivatives merchandise, just like different main exchanges. Whereas this enables for vital revenue potential, it additionally carries a excessive stage of danger, particularly for inexperienced merchants.

- Deposit and Withdrawal Choices: OKX helps a broad array of deposit and withdrawal choices, together with quite a few cryptocurrencies and fiat currencies via financial institution switch and different fee strategies. This flexibility makes it accessible to a worldwide person base.

OKX stands out as a premier selection for crypto derivatives buying and selling as a consequence of its wonderful liquidity, dedication to regulatory compliance, aggressive charges, and user-friendly platform. Its complete safety measures and big selection of merchandise improve its enchantment to a various buying and selling viewers. Like every change, merchants ought to assess how OKX aligns with their buying and selling wants and techniques, particularly contemplating the dynamic nature of crypto laws and market situations. OKX’s place available in the market and its service choices make it a powerful contender for merchants searching for a dependable and environment friendly spinoff buying and selling platform—the OKX overview on Coin Bureau dives deeper into the change nuances.

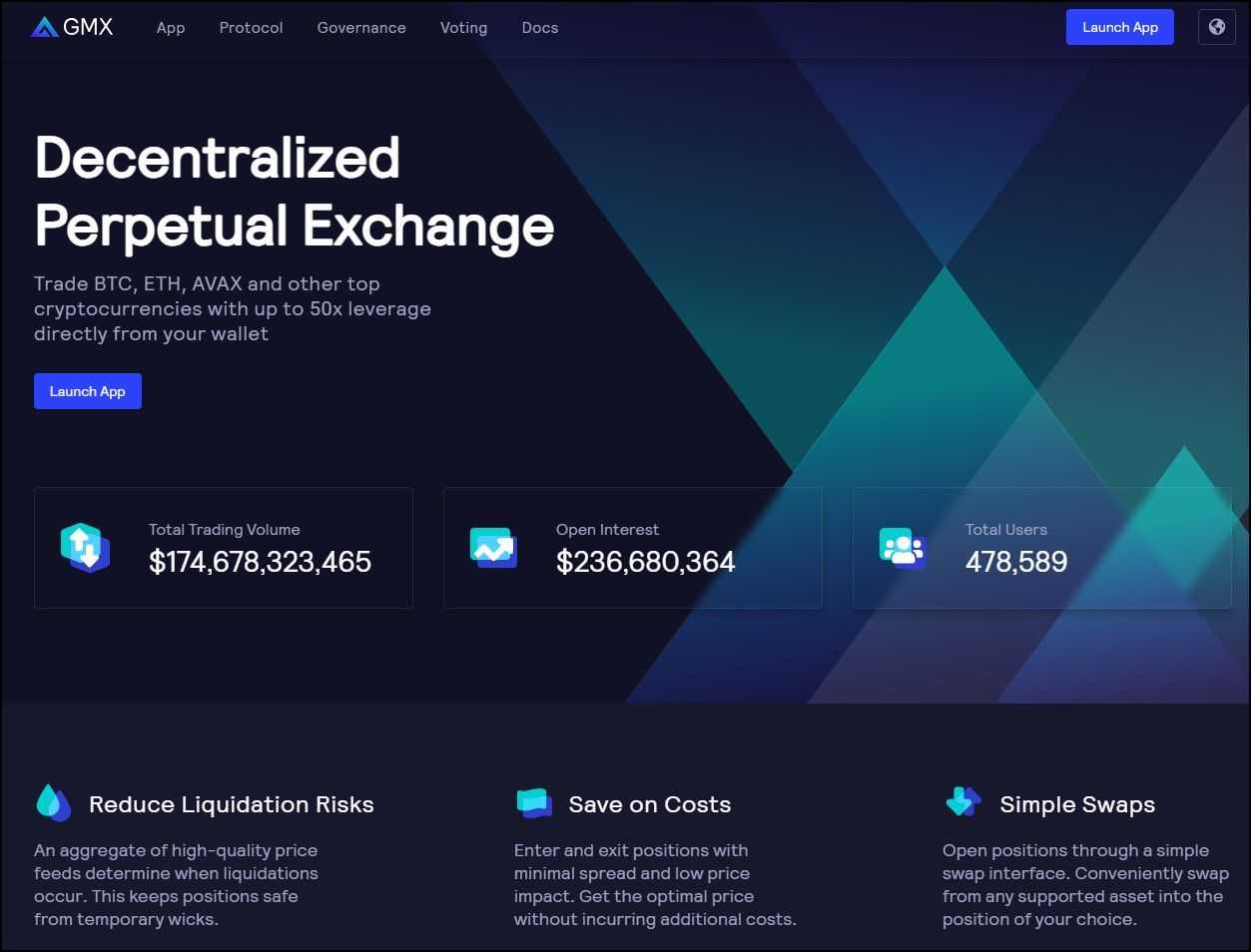

GMX

GMX, though newer to the scene in comparison with giants like ByBit and OKX, has carved out a distinct segment within the decentralized finance (DeFi) house, specializing in offering a user-friendly platform for buying and selling crypto derivatives with a novel method. Right here's an evaluation based mostly on the required necessary and non-essential components:

- Open Curiosity (Liquidity): As a decentralized change (DEX) specializing in derivatives, GMX gives liquidity that, whereas rising, might not match the depth of extra vital centralized exchanges. Nevertheless, GMX makes use of a novel liquidity pool system for environment friendly commerce execution with minimal slippage, making it aggressive inside the DeFi ecosystem. The platform's modern method to liquidity, together with options like zero worth influence trades for sure sizes, is a major draw.

- Regulatory Compliance: Working within the DeFi house, GMX leverages blockchain expertise to supply a permissionless and decentralized buying and selling atmosphere. On-chain existence equates to GMX inherently going through fewer regulatory hurdles relating to person entry but additionally implies a distinct type of regulatory danger, because the DeFi house is much less clear-cut and quickly evolving. Merchants concerned with GMX ought to concentrate on the regulatory atmosphere of their jurisdictions and the inherent dangers of DeFi platforms.

- Charges: GMX distinguishes itself with a clear and aggressive payment construction. Buying and selling charges are comparatively low, and the platform employs a novel mechanism the place merchants can earn a share of the platform's buying and selling charges by staking the native GMX token. The token can offset some buying and selling prices and incentivize participation within the platform's ecosystem.

- Consumer Expertise: The platform prioritizes a clean person expertise with an intuitive interface catering to newbies and skilled merchants. Being a DEX, it gives the benefit of wallet-to-wallet buying and selling with out the necessity for conventional account setups. Buyer help is primarily community-driven, with assets like boards and social media channels aiding.

Non-essential Elements

- Safety: GMX strongly emphasizes security as a DEX, with sensible contracts audited by respected companies. Nevertheless, buying and selling on DEXs inherently carries completely different safety concerns in comparison with centralized exchanges, primarily associated to sensible contract vulnerabilities.

- Product Choices: GMX focuses on a concise vary of derivatives merchandise, primarily perpetual swaps for a choice of main cryptocurrencies. Whereas the product vary could also be narrower than on some centralized exchanges, it covers probably the most traded property.

- Leverage Restrict: The platform gives leverage as much as 30x for buying and selling, which is decrease than some centralized counterparts however is designed to stability alternative with danger within the unstable crypto market.

- Deposit and Withdrawal Choices: Being a DEX, GMX helps cryptocurrency transactions straight from customers' wallets. There aren’t any fiat deposit or withdrawal choices straight on the platform, however customers can entry cryptocurrencies via different means earlier than buying and selling on GMX.

GMX gives a compelling possibility for merchants looking for a decentralized method to crypto derivatives buying and selling, combining modern liquidity options with a user-friendly interface and aggressive charges. Whereas it might not match the sheer liquidity and product number of bigger centralized exchanges, its distinctive options and community-driven ecosystem make it a noteworthy platform, particularly for these prioritizing decentralization and direct management over their buying and selling atmosphere.

Merchants contemplating GMX ought to weigh the advantages of its DeFi mannequin towards the completely different danger profiles in comparison with conventional centralized platforms. In case you want to know extra about this change, the GMX overview on Coin Bureau has obtained you coated.

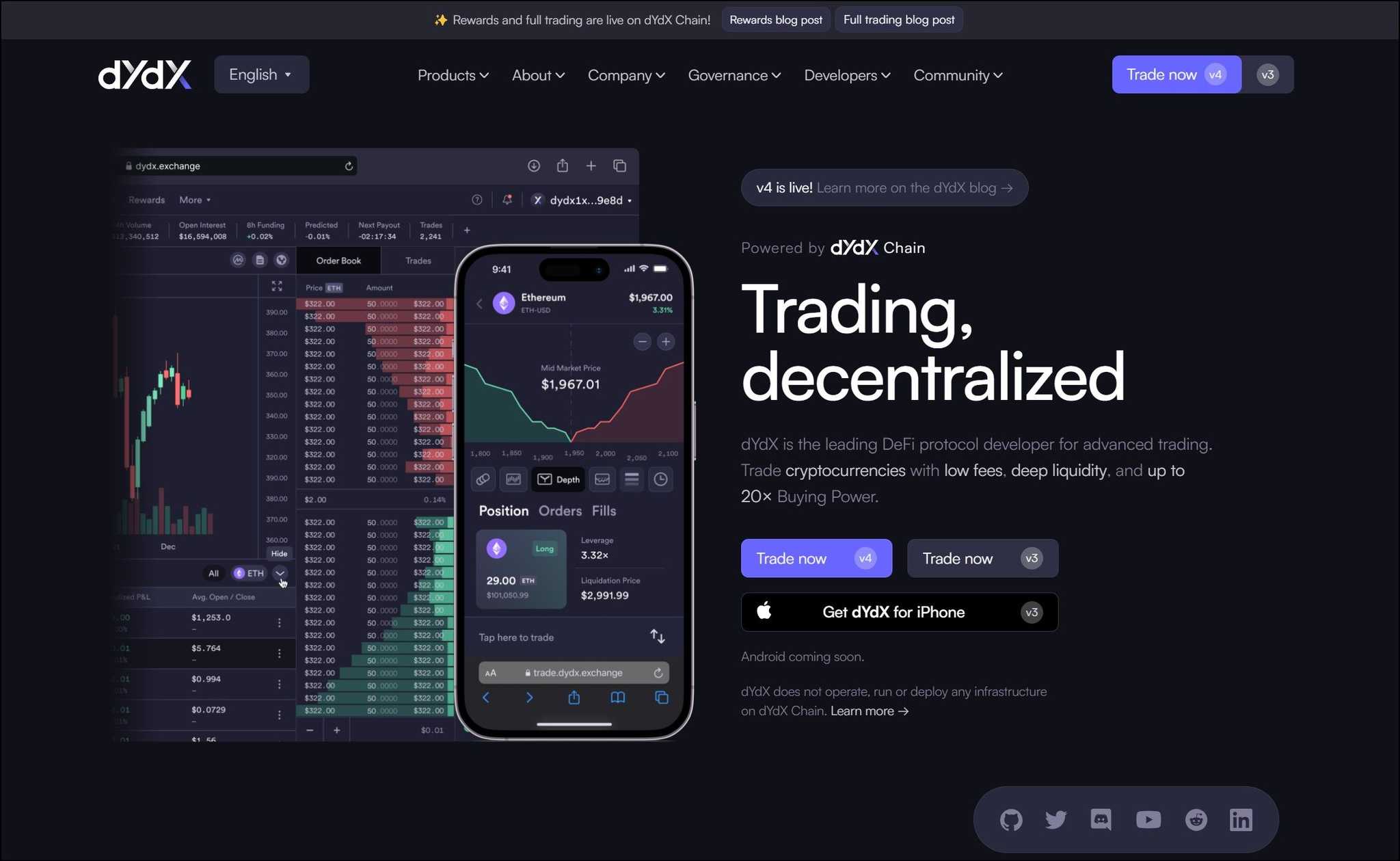

dYdX

dYdX operates as a standout platform inside the decentralized finance (DeFi) panorama, providing superior crypto derivatives buying and selling specializing in perpetual contracts. Right here’s an in-depth evaluation based mostly on the necessary and non-essential components beforehand outlined:

- Open Curiosity (Liquidity): dYdX showcases sturdy liquidity for a decentralized change, notably in its perpetual contracts market. This liquidity is supported by its modern funding mechanisms and the participation of liquidity suppliers, making certain aggressive spreads and environment friendly order execution for merchants. Whereas it might not rival the biggest centralized exchanges, dYdX's liquidity is commendable inside the DeFi house, facilitating sizable trades with decreased slippage.

- Regulatory Compliance: As a decentralized platform, dYdX gives a permissionless buying and selling atmosphere, bypassing many regulatory constraints that centralized platforms face. This method offers merchants worldwide with entry to derivatives buying and selling with out conventional KYC processes. Nevertheless, the evolving regulatory panorama for DeFi means merchants ought to stay knowledgeable about potential implications of their jurisdictions.

- Charges: dYdX's payment construction is aggressive, notably for its goal DeFi viewers. It employs a maker-taker payment mannequin, the place makers can earn rebates for liquidity, and takers pay a payment for market orders. This construction incentivizes liquidity provision and aligns with dYdX's objective of sustaining deep market liquidity. Buying and selling charges are transparently outlined, making it simpler for merchants to grasp their potential prices.

- Consumer Expertise: The platform excels in providing a complicated but intuitive buying and selling interface. dYdX caters to the wants of each novice and skilled merchants by offering detailed charting instruments, a wide range of order sorts, and a seamless buying and selling expertise. Whereas buyer help is decentralized, dYdX gives complete guides and a community-driven help system to help customers.

Non-essential Elements

- Safety: dYdX prioritizes safety, with its sensible contracts present process rigorous audits. The decentralized nature means customers preserve management over their funds till executed inside trades, mitigating particular central factors of failure.

- Product Choices: dYdX primarily focuses on perpetual contracts for numerous cryptocurrencies. Whereas this focus might restrict selection in comparison with exchanges with a broader vary of derivatives, it permits dYdX to specialize and innovate inside its area of interest.

- Leverage Restrict: The platform gives as much as 25x leverage on perpetual contracts. This leverage stage is designed to strike a stability between providing merchants the potential for prime returns and managing the chance inherent in leveraged buying and selling.

- Deposit and Withdrawal Choices: As a DEX, dYdX helps direct cryptocurrency transactions from customers' wallets for buying and selling actions. The platform doesn’t deal with fiat currencies straight, encouraging customers to transform fiat to crypto via different companies earlier than buying and selling.

dYdX stands out as a premier decentralized platform for buying and selling crypto derivatives, notably for these concerned with perpetual contracts. Its liquidity, aggressive charges, and user-friendly interface make it a compelling selection for merchants seeking to leverage the advantages of DeFi. Whereas it gives fewer product varieties and decrease leverage than some centralized counterparts, dYdX's give attention to perpetuals and its modern method to liquidity and safety place it as a key participant within the decentralized buying and selling house.

Merchants interested in the autonomy and innovation provided by DeFi platforms will discover dYdX's choices notably interesting, offered they’re snug navigating the distinctive dangers and alternatives of decentralized derivatives buying and selling. Coin Bureau additionally covers dYdX in depth in a devoted overview.

Different Centralized Alternate options for US Nationals

US residents have a number of avenues to entry crypto derivatives inside a regulatory-compliant framework.

Centralized Alternate options

Centralized platforms like Kraken and Gemini provide a safe and controlled atmosphere for buying and selling a wide range of crypto derivatives. Kraken, identified for its superior buying and selling options and low charges, caters to each novice and skilled merchants. It gives margin buying and selling and different advanced buying and selling companies inside the regulatory confines of the U.S., aside from a number of states. Gemini, alternatively, emphasizes safety and regulatory compliance, interesting to institutional merchants with its sturdy platform that adheres to stringent U.S. laws, together with these of New York State.

CME Crypto Futures

Moreover, for these seeking to commerce Bitcoin and Ethereum futures inside a regulated market, the Chicago Mercantile Alternate (CME) offers a viable possibility. The CME lists Bitcoin and Ethereum futures contracts which might be cash-settled and based mostly on reference charges that mixture the commerce movement of main spot exchanges. Listed below are the important thing particulars concerning the cryptocurrency futures obtainable on the CME:

1. Ether Futures

- Ticker Image: ETH

- Contract Unit: The contract measurement for Ether futures is 50 ether per contract.

- Settlement: Money-settled based mostly on the CME CF Ether-Greenback Reference Price, which serves as a day by day reference fee of the U.S. greenback worth of Ether.

- Buying and selling Hours: Just like Bitcoin futures, Ether futures commerce from Sunday to Friday, 5 p.m. to 4 p.m. Central Time (CT).

2. Micro Bitcoin Futures

- Ticker Image: MBT

- Contract Unit: Every Micro Bitcoin futures contract is value 1/10 of 1 bitcoin.

- Settlement: These are additionally cash-settled based mostly on the CME CF Bitcoin Reference Price.

- Advantages: Provides the identical options of Bitcoin futures however with smaller capital necessities, making it accessible for a broader vary of merchants.

3. Micro Ether Futures

- Ticker Image: MET

- Contract Unit: Every Micro Ether futures contract is value 1/10 of 1 Ether.

- Settlement: Money-settled based mostly on the CME CF Ether-Greenback Reference Price.

- Advantages: Just like Micro Bitcoin futures, these contracts present merchants with a chance to commerce Ether in a extra capital-efficient method.

For probably the most present and detailed details about these and probably different cryptocurrency futures contracts listed on the CME, together with specs, buying and selling hours, and settlement procedures, it's finest to go to the CME Group's official web site.

Dangers of Buying and selling Crypto Derivatives

Buying and selling crypto derivatives carries distinctive dangers, because of the inherent traits of each the derivatives market and the cryptocurrency market:

- Volatility Threat: The cryptocurrency market is very unstable, with costs fluctuating extensively briefly durations. Such fluctuations can result in vital positive factors or losses in derivatives buying and selling.

- Leverage Threat: Crypto derivatives usually contain leverage, which may amplify earnings but additionally amplify losses, probably resulting in the lack of greater than the preliminary funding.

- Regulatory Threat: The crypto market faces unsure regulatory environments throughout completely different jurisdictions. Modifications in laws can influence the accessibility and worth of crypto derivatives.

- Counterparty Threat: In over-the-counter (OTC) derivatives, the counterparty might default on its obligations, resulting in monetary loss.

- Liquidity Threat: Some crypto derivatives might undergo from low liquidity, making it troublesome to enter or exit positions with out affecting the market worth.

- Operational Threat: Technical points, reminiscent of change downtime or transaction delays on the blockchain, can influence commerce execution and settlements.

- Market Manipulation Threat: The crypto market is vulnerable to manipulation, which may result in distorted costs and unfair buying and selling situations.

- Complexity Threat: Crypto derivatives are advanced devices that require an intensive understanding to handle successfully. Misunderstanding these merchandise can lead to unintended losses.

Understanding these dangers is essential for anybody contemplating buying and selling within the crypto derivatives market. Correct danger administration methods and ongoing schooling are important to successfully navigate this dynamic and evolving house.

The way to Commerce Crypto Derivatives Effectively

To commerce crypto derivatives effectively, contemplate the next methods and practices:

- Perceive the Product: Acquire an intensive understanding of the precise spinoff (futures, choices, swaps) you plan to commerce, together with the way it capabilities and its settlement mechanisms.

- Begin with a Plan: Develop a transparent buying and selling technique, together with entry and exit factors, and stick with it to keep away from emotional selections.

- Use Leverage Cautiously: Whereas leverage can amplify positive factors, it additionally will increase the chance of losses. Take into account the volatility of the crypto market when utilizing leverage.

- Handle Threat: To restrict potential losses, make use of danger administration methods, reminiscent of setting stop-loss orders.

- Keep Knowledgeable: Sustain-to-date with market developments, information, and technical analyses that may influence the value actions of the underlying cryptocurrency.

- Observe with a Demo Account: Many platforms provide demo accounts, permitting you to apply buying and selling with digital cash and perceive the platform's options with out monetary danger.

- Diversify: Unfold your investments throughout completely different property and spinoff merchandise to mitigate danger.

- Monitor the Regulatory Atmosphere: Pay attention to regulatory adjustments in your jurisdiction that might have an effect on crypto derivatives buying and selling.

- Select a Respected Platform: Commerce on respected exchanges that provide sturdy safety measures, clear payment buildings, and dependable buyer help.

- Steady Studying: The crypto market is quickly evolving. Interact in fixed studying to remain abreast of recent merchandise and techniques.

Environment friendly buying and selling in crypto derivatives requires self-discipline, a strong understanding of the market, and adherence to danger administration rules.

Closing Ideas

As we method the tip of our exploration as we speak, let’s recap what we coated on this piece. We started by understanding the fundamentals of crypto derivatives and why they’ve large potential to develop as a serious international asset market. Following the introduction, we realized that derivatives should not simply speculative devices but additionally important instruments for portfolio optimization that may mitigate dangers if utilized accurately.

Shifting ahead, we coated 5 crypto spinoff buying and selling suppliers, three centralized and two decentralized exchanges that provide distinctive advantages and trade-offs. The rise of strong layer-2 networks like Arbitrum and Polygon has confirmed phenomenal in rising the recognition of decentralized options. Layer-2s are lastly maturing, providing enough safety ensures to spinoff DEXs that serve retail traders.

Following the comparative evaluation, we additionally explored the dangers of crypto derivatives and a few methods to mitigate them. I’ll shut this piece by iterating that greater than competing in a unstable market, buying and selling derivatives is a wager towards one’s buying and selling prowess. Fortunately, buying and selling is a ability that one can hone with expertise, studying, and practising.

Ceaselessly Requested Questions

What Are Crypto Derivatives and How Do They Work?

Crypto derivatives are monetary contracts whose worth is derived from the underlying cryptocurrency property. These devices enable merchants to take a position on future worth actions with out proudly owning the precise cryptocurrencies. Widespread sorts embody futures, choices, and swaps. Merchants can leverage these merchandise to hedge towards worth volatility, interact in arbitrage, or speculate on worth actions, offering a versatile and complicated method to crypto buying and selling.

What Are The Dangers of Buying and selling Crypto Derivatives?

Buying and selling crypto derivatives carries vital dangers, together with market danger from unstable crypto costs, leverage danger the place losses can exceed deposits, liquidity danger affecting the flexibility to enter or exit positions, counterparty danger in OTC markets, and regulatory danger from altering legal guidelines. These dangers necessitate cautious danger administration and an intensive understanding of the spinoff merchandise being traded.

What Are The Advantages of Buying and selling Crypto Derivatives?

Buying and selling crypto derivatives gives quite a few advantages, reminiscent of leverage, which permits merchants to achieve larger publicity with much less capital; hedging alternatives to guard towards adversarial worth actions; entry to a variety of markets; and the flexibility to take a position on worth actions with out holding the underlying asset. These benefits make derivatives a flexible instrument for strategic buying and selling within the unstable crypto market.

What Are The Greatest Centralized Crypto Derivatives Exchanges?

The very best centralized crypto derivatives exchanges embody Binance, ByBit, and OKX, identified for his or her intensive product choices and liquidity. For US nationals, Kraken and Gemini are viable choices, offering regulated platforms that guarantee compliance with US legal guidelines. These exchanges provide numerous derivatives merchandise like futures and choices, catering to a variety of buying and selling methods and preferences.

What Are The Greatest Decentralized Crypto Derivatives Exchanges?

dYdX and GMX stand out as the most effective decentralized crypto derivatives exchanges. dYdX gives a non-custodial buying and selling expertise with a give attention to perpetual contracts for numerous cryptocurrencies. GMX, alternatively, permits for leveraged trades and offers a novel liquidity mannequin that facilitates low-slippage buying and selling on main crypto property. Each platforms provide the advantages of decentralized finance (DeFi) with excessive liquidity and modern buying and selling options.