What's the actual cope with Technical Evaluation? Can you actually use it to make buying and selling returns on a constant foundation?

Certainly, that is an in the past previous query which lengthy predates cryptocurrency buying and selling. Some merchants will swear by it whereas others view it as nothing greater than monetary tarot card studying.

As with most issues associated to buying and selling, the reply to this query often comes right down to the person dealer and the belongings being traded. It’s not simply whether or not it’s used however how it’s used.

On this put up, we are going to take a deeper look into technical evaluation idea and whether or not it could successfully be utilized in your cryptocurrency portfolio.

However first, let's begin with some fundamentals…

What’s Technical Evaluation?

Technical evaluation is sort of broadly outlined because the observe utilizing previous value data on a selected asset so as to make forecasts as to the long run course of stated asset.

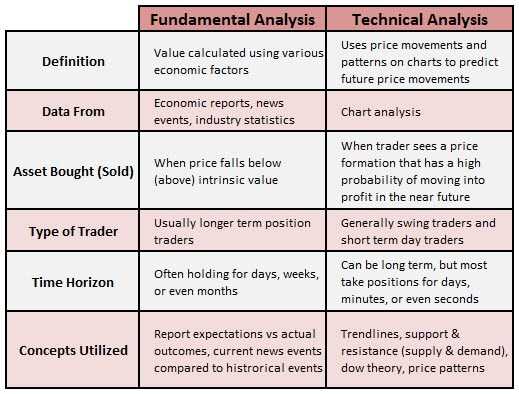

In contrast to elementary evaluation that analyses the underlying asset itself, technical evaluation is merely involved with the value ranges, traits and quantity. It’s a theoretical growth of the notion of behavioral economics.

They imagine that value traits are inclined to repeat themselves because of the collective conduct of those traders. Technicians base their evaluation on crowd psychology and the patterned conduct of the traders.

Provided that technical evaluation is only involved with value information, it may be used to map the value of any asset over any time period. Therefore, they’ve been utilized in broad vary of asset courses with evaluation stretching from years to mere hours.

Whereas that is the textbook definition of what technical evaluation is, many technicians know that it shouldn’t be checked out as an actual science. They view it as a method that may inform their buying and selling and enhance their possibilities of long-term success.

Now that you’ve got an affordable concept of what technical evaluation is, let's check out the opposite facet of the argument.

Arguments In opposition to Technical Evaluation

One of the vital quoted arguments towards the importance of technical evaluation is that of the Environment friendly Market Speculation (EMH). This principally asserts that asset costs absolutely mirror all obtainable data and that value actions observe what is named a "Random Walk".

In different phrases, the asset value will mirror all obtainable data out there and is accurately priced. If there are actions in by some means, these can be associated to pure likelihood and can’t be modeled or predicted.

In fact, the EMH is itself fairly a dogmatic idea that’s typically additionally used to dismiss different types of investing similar to elementary evaluation. In its strictest type, the EMH asserts that probably the most optimum investing technique is to "buy and hold" the market as some other type of lively administration can not yield extra returns in the long term.

Whereas most individuals will keep away from this inflexible method when countering technical evaluation, these are a few of the different arguments which are made:

- Subjective Sample Interpretation: When the technician is attempting to establish charts and patterns within the value of an asset, it’s attainable for them to "see" a sample when it’s actually subjective. In different phrases, it’s attainable that one technical analyst will establish a head and shoulders sample when others aren’t more likely to see it. So the effectiveness of a buying and selling technique based mostly on subjective interpretation is difficult to evaluate.

- Information Mining Bias: That is when a technical analyst will choose one indicator over the opposite provided that this indicator confirms their view of the place the market goes. Even when that indicator is contradicted by a complete host of different technical indicators.

- Stronger Competitors: Even when there are instances when previous value data informs future costs, technicians have some fairly stiff competitors from the likes of quantitative hedge funds and excessive frequency buying and selling corporations. These corporations use sophisticated AI algorithmic buying and selling methods which are capable of learn order stream and actions far more shortly than the common technical analyst can.

Certainly, a few of the most notable traders similar to Warren Buffet don’t view technical evaluation too favorably. He famously as soon as stated:

I spotted that technical evaluation didn't work after I turned the chart the wrong way up and didn't get a special reply

So, do these arguments have any foundation the truth is?

Countering the Critics

These arguments towards technical evaluation are inclined to miss the mark in plenty of methods. It’s because they assume that those that observe technical evaluation view it as some kind of a divine textual content that can not be questioned.

The overwhelming majority of technicians use it as a foundation to tell their opinion and handle dangers. They don’t function in a silo with out consideration of different components that might drive the value of the asset.

Let's take a better take a look at a few of the above arguments and the way they will simply be refuted:

Environment friendly Market Speculation:

That is precisely what the title suggests it’s, a speculation. It’s based mostly on a mathematical idea that markets are all the time rational and that there are by no means any mispricings. There have been numerous research and empirical analysis that may refute this speculation.

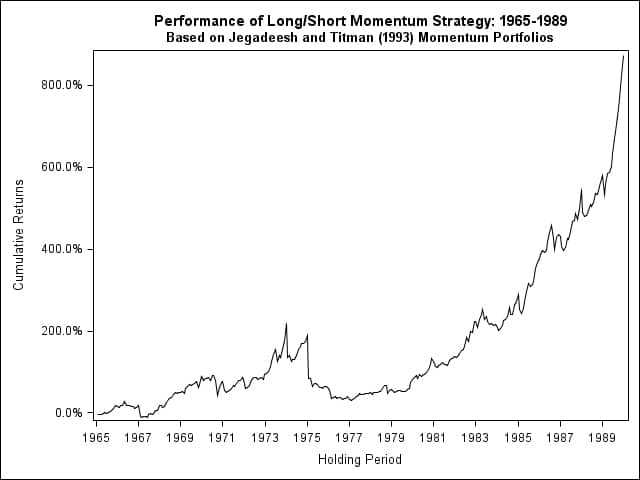

For instance, research similar to these executed by Jegadeesh & Titman have proven the statistical significance of momentum-based buying and selling methods. There have been plenty of different research which have proven the identical statistical significance in different markets.

Momentum research are used recurrently in technical evaluation they usually clearly present that previous returns are associated to the long run returns.

Sample Interpretation

Sure, it’s attainable {that a} technician is noticing a sample that’s solely subjective, nevertheless this argument makes a generalization. It assumes that each one technical analysts lack self-discipline and can "reason" their approach into recognizing and confirming a sample.

Disciplined technical analysts may have clear psychological tips and guidelines of thumbs that they are going to use when figuring out the precise patterns and formations. Getting the setup proper is crucial and a weak sample is more likely to be a much less instructive signal for the technical analyst.

Information Mining Bias

This additionally depends upon the professionalism of the technical analyst. Only a few technicians will use just one or two indicators. They’ll try to mix plenty of them so as to affirm the indicators sure indicators are giving.

If they’ve contradictory readings from one or the opposite then they’re more likely to do extra analysis as a substitute of selecting the one indicator that confirms their view.

Furthermore, the expert technical analyst may also borrow research from different disciplines so as to affirm their view. Merchants ought to by no means function in a vacuum and be hostile to different evaluation and strategies

Stronger Competitors

This argument is definitely irrelevant to the broader query.

So what if a big refined hedge fund is ready to get higher returns than you? That’s not the underlying query. All that issues is whether or not technical evaluation is ready to give you the appropriate instruments and indicators to get higher returns than you’d in the event you didn’t use it.

Whether or not the Excessive Frequency dealer can get higher ranges and sooner execution ought to be irrelevant to your resolution of whether or not you must use it. Their programs prices tens of millions of {dollars} to develop and function, your property PC is incomparable. It's actually evaluating apples and pears.

Furthermore, it misses the broader level about these corporations. Lots of the buying and selling algorithms which are run by these corporations function based mostly on inputs related to those who are utilized in technical evaluation. This could additional add weight to the argument that technical evaluation can work when utilized accurately.

Technical vs. Elementary

No dealer ought to do their evaluation in isolation. They need to try to incorporate different factors of view and evaluation into their resolution making so as to construct a fuller image.

Having stated that, there are no less than two benefits that Technical Evaluation has over the likes of the extra analysis heavy elementary evaluation.

Much less Opinionated

Exterior analysis stories which are based mostly on elementary inputs are sometimes far more subjective. You must draw a conclusion of the long-term prospects of an organization, commodity or cryptocurrency based mostly on a spread of various components (Financial development, sector development, CEO imaginative and prescient).

that are fully verifiable. When you find yourself attempting to interpret a chart, it is just your evaluation that counts. You’re unlikely to be swayed by the view of the one that is drawing up the analysis report.

Higher for Danger Administration:

When an investor is coming into a place based mostly on their elementary analysis, they’re doing so based mostly on their honest worth evaluation of the value of the asset. Which means they are going to often maintain the asset over an extended time period within the hope that the value will finally mirror that.

The issue with that is that they depart little or no room for his or her evaluation being improper. They’ve invested the time and the trouble into their analysis and are approach much less doubtless to surrender on the commerce even whether it is going towards them.

Technical analysts, then again, principally commerce with cease losses. They’ll typically incorporate their cease loss, restrict and take revenue positions based mostly on technical ranges. Therefore, if a pattern doesn’t affirm their evaluation, they are going to have the satisfactory backstops in place.

Technical merchants may be thought of extra methodical on this sense. They haven’t any qualms in giving up a commerce and shortly slicing losses if it seems that they might have been improper.

Crypto Technical Evaluation

So it’s clear that technical evaluation can work when utilized in a threat managed approach by disciplined merchants. However can it’s used successfully within the nascent cryptocurrency markets?

Nicely, it actually depends upon what cash you might be buying and selling.

Technical evaluation is more likely to work extra successfully within the markets which are liquid and the place there’s a better diploma of quantity throughout a spread of exchanges. Making an attempt to learn the charts of some mid and micro-cap cash is far much less efficient.

It’s because there’s quite a lot of market manipulation that takes place within the smaller market cap cash. There are pump-and-dump teams and crypto whales that may try to create motion and curiosity in a coin so as to money out on much less skilled traders.

What you could interpret as a value that has damaged a trendline might merely be the actions of some nefarious merchants goading much less skilled ones. Pump-and-dumps additionally deliver quantity with them which is often additionally one other vital indicator utilized in technical buying and selling.

Furthermore, with skinny markets costs are more likely to hole far more simply. Which means ranges might simply shoot previous your cease orders or be exhausting to exit when you desire to. Synthetic markets and synthetic demand might shortly deplete your portfolio.

What does this imply?

Follow cash that you realize have quite a lot of quantity and aren’t as inclined to market manipulation. For instance, the cash which are within the high 10 of market capitalization are more likely to be probably the most safe from a market effectivity standpoint.

What Makes a Good Technical Dealer?

It is very important observe that technical evaluation is a device and like most instruments, it may be used accurately and incorrectly.

In case you are utilizing technical buying and selling and aren’t doing so in a scientific and methodical approach then you might be playing. In case you are firing off trades based mostly on one or two ranges that you just assume may affirm your view then you might be being unsystematic.

Certainly, there are additionally many technical merchants who attempt to bombard the charts with tons of of indicators and attempt to develop a method that’s comically dangerous. You shouldn’t be doing technical evaluation simply because you’ll be able to.

It is usually vital to level out that feelings ought to be fully disregarded in buying and selling typically and in technical evaluation particularly. Try to be inserting and exiting your trades based mostly solely on what the charts and evaluation is telling you.

You need to by no means run a foul commerce and take away your cease losses to chase losses. You need to take your income on the designated ranges and never permit the "winning streak" mentality to cloud your evaluation.

This isn’t a roulette wheel in Vegas. It is a extremely systematic however typically idiosyncratic market that wants a disciplined and methodical dealer to greatest exploit its inefficiencies.

Complementary Evaluation

As talked about above, one of the best merchants are these which are capable of incorporate different evaluation and use it in a complementary approach. There doesn’t must be a alternative between utilizing technical and elementary evaluation.

Bear in mind, technical evaluation is just not a science and relies on inserting trades which are extra more likely to go within the course that you just predict. In case you are buying and selling based mostly on chance then it could solely add to the case if the basic additionally affirm that view within the medium to long run.

For instance, you’ll be able to create an inventory of cash that you just assume make sense from a elementary / worth perspective over a brief to medium time period horizon. You’ll be able to then use technical evaluation to raised place time the trades in a risk-controlled method.

The identical may be stated for these cash that you just assume are more likely to undergo head winds within the brief to medium time period. These could possibly be prime candidates to position a brief place on assuming that the degrees and indicators level to a possible break decrease.

Doing Efficient Analysis

Regardless of what you consider your technical evaluation means, it’s useful to get opinions and analysis of others. This might additionally make it easier to keep away from any kind of subjective bias when it comes studying patterns.

There are a selection of assets that you should utilize so as to get fairly respectable evaluation. The very best locations are in all probability on charting centered boards similar to Tradingview or the like. The technicians who present evaluation there have verifiable observe information.

If you’ll be able to get into a few of the extra skilled Telegram and Discord channels then that is also place so that you can increase your evaluation.

You need to in all probability keep away from studying an excessive amount of into the charting that’s executed on social media websites similar to Twitter, Fb et al. There may be typically an excessive amount of noise on this area as folks compete for a bigger following.

Conclusion

Technical evaluation is a useful device that can be utilized by merchants to make calculated and risk-controlled trades on a constant foundation. In fact, it’s not with out its limitations and it vital for the consumer to know these limitations.

It’s not a science and it shouldn’t be adopted like a bible. Merchants ought to try to increase their technical evaluation with plenty of different indicators and elementary analysis to guarantee that they’ve one of the best possibilities of buying and selling profitably.

You also needs to guarantee that your buying and selling is completed in a scientific method. Be disciplined round the place you might be inserting your stops and the way you might be exiting your positions. The markets aren’t a on line casino.

In the long run, technical evaluation is like every device. The usefulness of the device relies upon nearly completely on how the device is getting used.