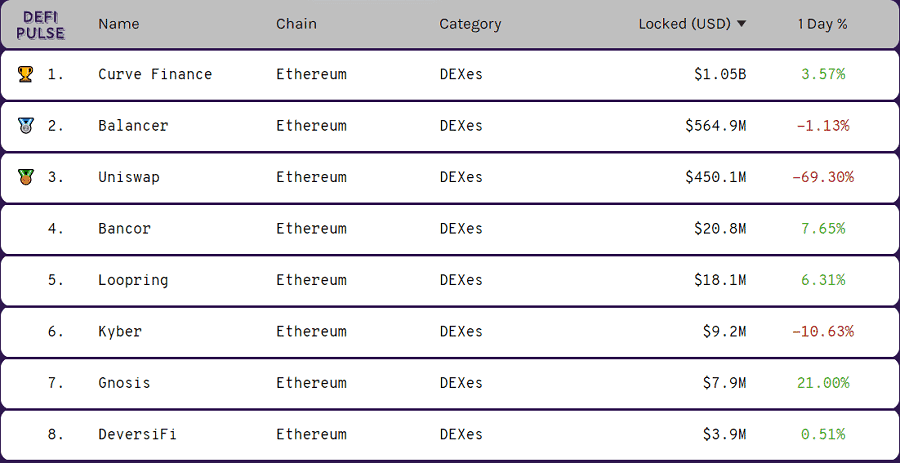

Second earlier than this text was accomplished, Uniswap was instantly forged from the throne as the biggest decentralized alternate. Practically 70% of Uniswap’s belongings have moved to a different DEX known as SushiSwap.

This has consequently made Curve Finance the gold medalist on the DEX leaderboard. Though it isn’t even a 12 months previous, Curve Finance now additionally sits because the third largest DeFi platform by complete worth locked.

A few of you could know Curve Finance as being the engine of the now well-known DeFi aggregator, yearn.finance. Nevertheless, it was final month’s notorious launch of CRV, Curve Finance’s governance token, which actually put Curve Finance on the map. Why? As a result of when the token launched, the market cap of CRV was briefly bigger than Bitcoin’s. As you will notice, Curve Finance is way more than simply one other DEX.

Who made Curve Finance?

Curve Finance was created by Russian physicist Michael Egorov. Egorov is a seasoned cryptocurrency veteran. He started by investing in Bitcoin throughout its peak in 2013 and regardless of dropping on his preliminary funding, continued to make use of Bitcoin as technique of transferring cash throughout borders and even briefly mined Litecoin.

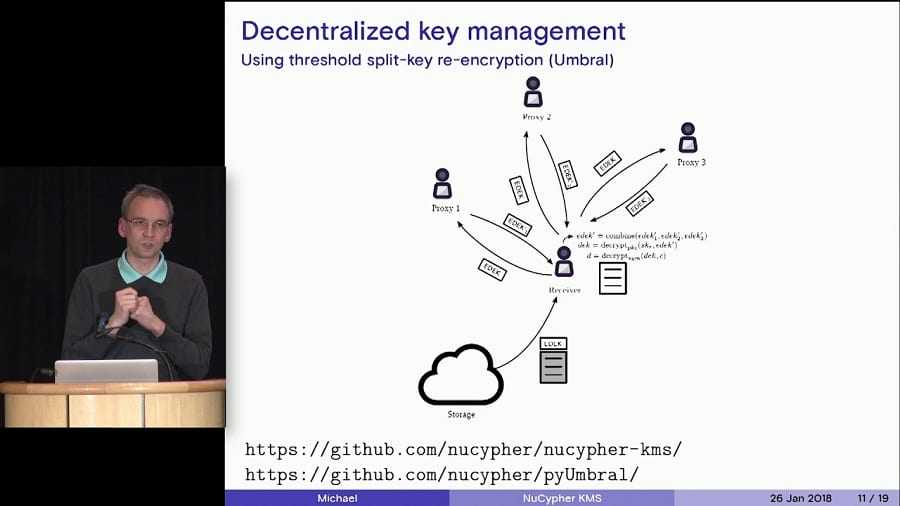

In 2016, Egorov based an organization known as NuCypher, a fintech firm which focuses on encryption. NyCypher morphed right into a blockchain/cryptocurrency venture that raised over 30 million USD in a 2018 ICO and a acquired an extra 20 million USD in non-public funding in 2019. Sadly, the NU token is at the moment not listed on any main exchanges.

Egorov has additionally been taking part in with DeFi protocols since 2018, beginning with MakerDAO. In 2019, he was buying round for a superb DEX and was not very impressed Uniswap. This prompted him to develop a brand new DEX known as StableSwap for which he revealed a whitepaper in November of 2019.

After coding it and debugging it, he launched the protocol to the general public in January of this 12 months beneath the title Curve Finance, with a rainbow Klein bottle as its eye-catching brand.

In Might of 2020, Curve Finance hinted they might be issuing their very own governance token, CRV. In an interview, Egorov famous that a big a part of the transition to a decentralized autonomous group was to bypass any authorized points the Curve Finance staff might face. The present Curve Finance staff is predicated in Switzerland and consists of 5 individuals together with Egorov. Of the remaining 4, one is a developer and the opposite three are concerned in social media and advertising.

What’s Curve Finance?

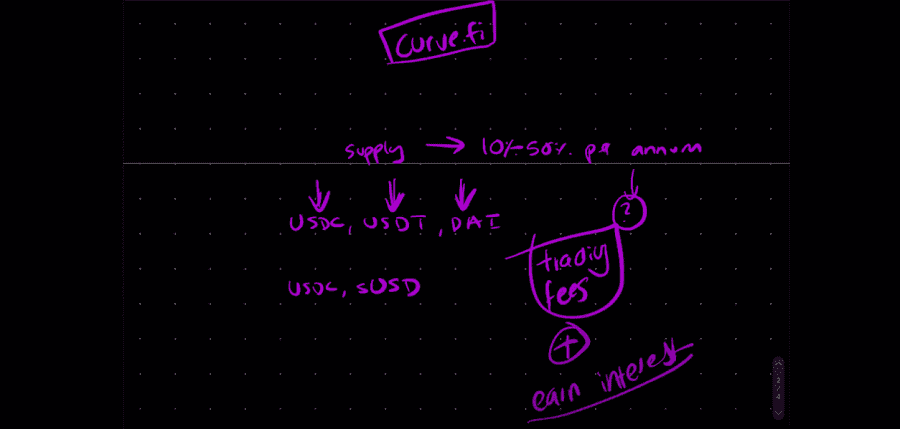

Curve Finance is a decentralized alternate constructed on Ethereum. It’s particularly designed to offer environment friendly buying and selling between cryptocurrencies of the identical worth and supply excessive annual curiosity returns on cryptocurrency funds deposited into Curve Finance by liquidity suppliers. The latest launch of its governance token, CRV, turned Curve Finance right into a decentralized autonomous group (DAO).

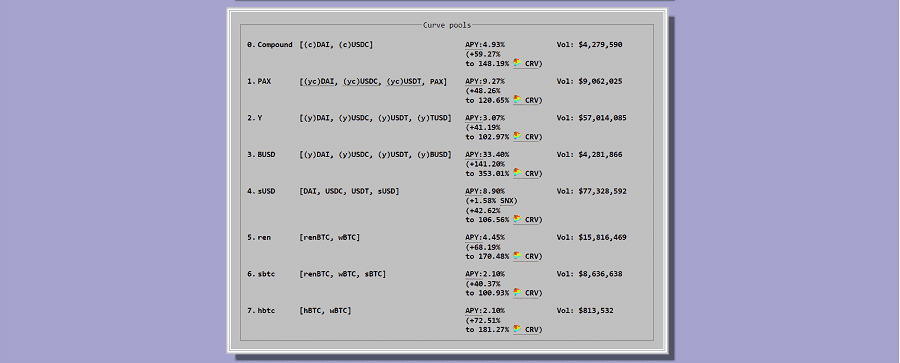

Curve Finance will be conceived of as a sequence of asset swimming pools. All these swimming pools include cryptocurrencies which are price the identical worth. In the mean time, 3 of the 7 swimming pools on Curve Finance contain stablecoins, and the remaining 4 contain varied variations of wrapped Bitcoin akin to wBTC, renBTC, and sBTC. These swimming pools may give extremely excessive curiosity on deposited funds, at the moment returning over 300% per 12 months to liquidity suppliers (for the BUSD pool).

You is perhaps questioning how that is potential. The straightforward, quick reply is that Curve Finance makes use of these deposited funds to offer liquidity to different DeFi protocols akin to Compound. Doing this generates curiosity in Compound and Curve Finance principally passes on that curiosity to liquidity suppliers, plus a lower of buying and selling charges from the Curve Finance platform, plus some CRV tokens. Yearn.finance takes this to the subsequent degree by utilizing Curve Finance to robotically swap stablecoins to the Curve Finance swimming pools with the very best yields.

Not like many different DeFi protocols, Curve Finance may be very upfront in regards to the potential dangers of utilizing their platform. Curve Finance’s DEX code has already been audited twice and the CRV token contract and DAO have been audited thrice.

Egorov has careworn that it’s essential to always assessment the code to make sure there aren’t any points. As such, Curve Finance provides bug bounties price as much as 50 000$USD to anybody who can discover any errors of their DEX, CRV, or DAO code.

How does Curve Finance work?

If the final two paragraphs left you scratching your head, don’t fret. To completely perceive how Curve Finance works, it’s essential to brush up on some necessary terminology.

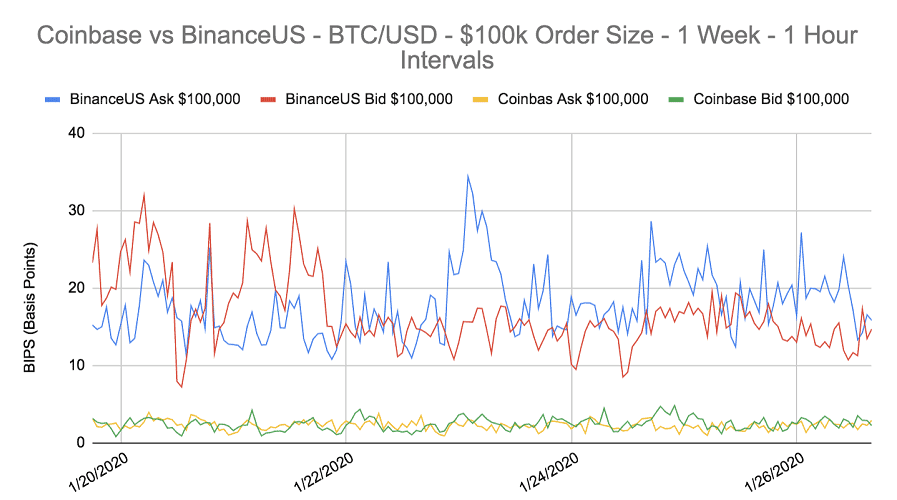

Figuring out these can even enable you to perceive how it’s potential for Curve Finance and comparable DEXs to have extremely excessive liquidity in comparison with centralized exchanges and execute monumental trades with near-zero slippage.

What’s a liquidity supplier?

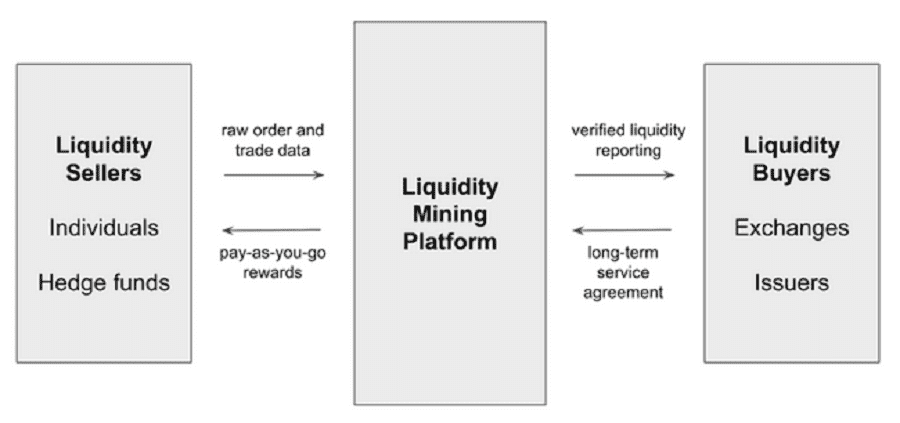

A liquidity supplier is the time period used to explain somebody who deposits cryptocurrency right into a DeFi protocol, normally a decentralized alternate. That is accomplished to extend the standard of the DEX for people who find themselves utilizing it, as they won’t have to attend without end for his or her commerce to finish.

In lots of circumstances, liquidity suppliers can earn some good-looking rewards for offering liquidity. These rewards usually come from a lower of any charges on the protocol, and from being awarded protocol tokens (if there are any). These incentives are generally known as liquidity mining schemes. The observe of discovering the very best annual curiosity returns on deposited funds is known as yield farming.

What’s an Automated Market Maker?

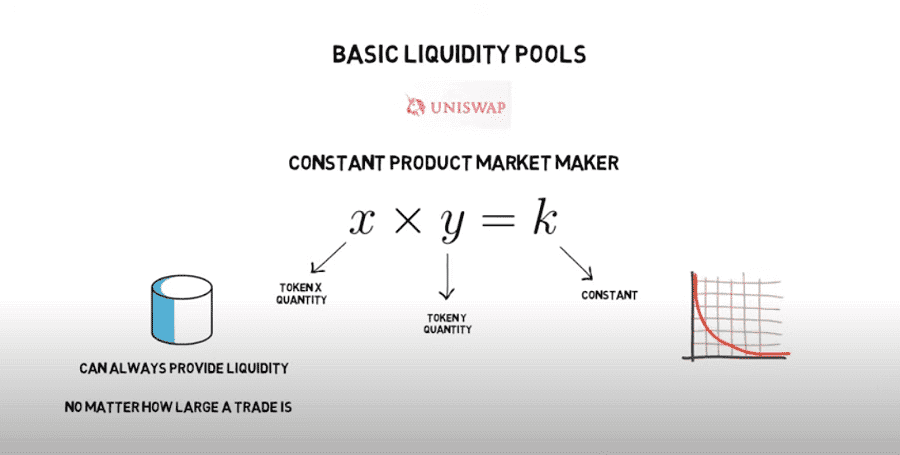

An automatic market maker is any protocol which depends on a sensible contract quite than an order e book to find out the value of an asset. On centralized exchanges, there’s a tug of struggle between consumers and sellers.

You’ve gotten in all probability observed the completely different buying and selling charges on centralized exchanges supplied to market makers and takers. Makers are these which put a proposal to purchase or promote a crypto on the order books for a worth aside from the present worth, and takers are these which merely purchase the asset for the present itemizing worth.

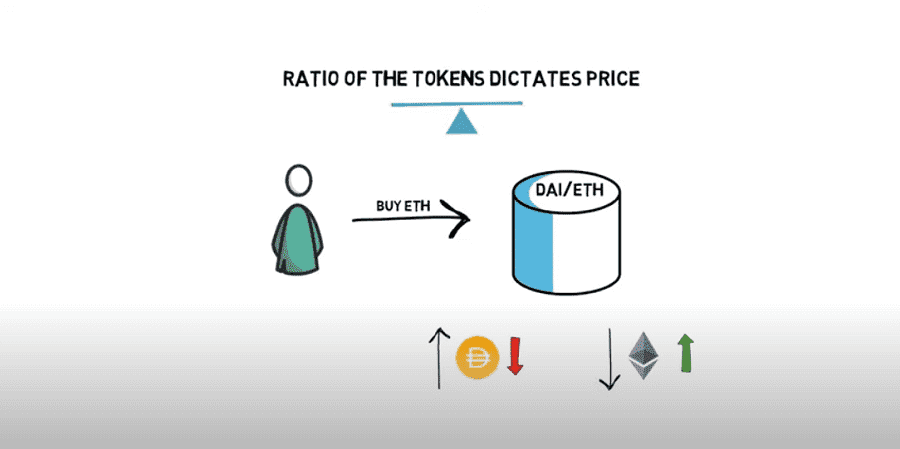

Holding this terminology in thoughts, automated market makers as a substitute use the ratio of belongings in a given pool to find out the value of the asset. Liquidity suppliers are incentivized to offer sure belongings to those swimming pools to make sure the ratios additionally stay balanced. That is what DEXs like Uniswap and Curve Finance do, and why liquidity suppliers should present equal ratios of two (or extra) cryptocurrencies to begin a liquidity pool on these platforms.

For instance, think about you may have 10 Ethereum and 1000 USDC in a pool. This implies every Ethereum is price 100 USDC, because the ratio is 1-100. Suppose somebody comes and buys 1 Ethereum from the pool. Now that ratio has modified, and when you math it out, the value of Ethereum is now 111$USD.

This offers incentive to somebody to arbitrage (benefit from a worth distinction on two buying and selling platforms) and purchase 100$USD on one other alternate like Coinbase, and promote it on this hypothetical pool for 111$USD, restoring the equilibrium (which is the precise present market worth of the asset – 100$USD).

What’s a bonding Curve?

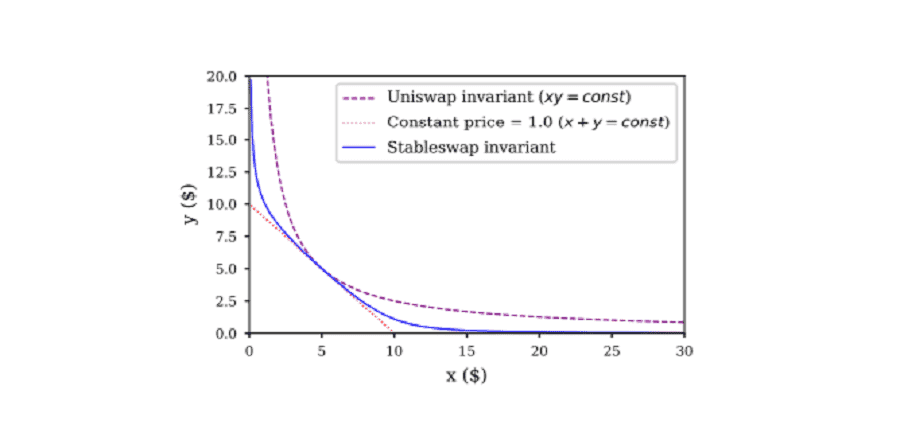

In the event you have been to graph an automatic market maker equation, you’d see one thing that is called a bonding curve. What it reveals is that the extra of an asset in a pool is bought relative to the others, the costlier it turns into, rising exponentially as much as a theoretically infinite worth.

This makes it virtually unimaginable for anybody to purchase the entire cryptocurrency within the pool and offers arbitrage merchants extra incentive to come back in and restore stability when the ratio between the pooled belongings (and subsequently worth) deviates an excessive amount of.

Curve Finance makes use of a novel bonding curve – distinctive as a result of it’s designed to squeeze the value right into a narrower margin (1$USD for stablecoins). This curve appears to be like extra just like the aspect of an octagon than an precise curve consequently. In plain English, it provides extra wiggle room for the ratio between the stablecoins within the pool to deviate.

This implies which you could purchase extra with out experiencing slippage. Egorov notes {that a} common bonding curve wouldn’t work effectively for stablecoins or pegged belongings for the explanations outlined earlier (their costs would fluctuate an excessive amount of with a daily bonding curve).

What’s slippage in Crypto?

Slippage can occur rather a lot on centralized exchanges and it’s one thing you may have in all probability skilled for those who ever went to purchase an altcoin with low quantity. You may see that there’s 100 of an altcoin up for grabs for the present market worth, however the subsequent 100 being bought within the order e book is perhaps for a worth that’s 5% greater. This improve in worth as you purchase from costlier sellers is slippage.

Curve Finance has extraordinarily low slippage due to its distinctive bonding curve and the extremely excessive quantity of cryptocurrency deposited by liquidity suppliers. Egorov has claimed that you might simply execute a commerce on Curve Finance price greater than 5 million USD and expertise lower than 0.4% slippage. Think about for those who tried shopping for that quantity of a stablecoin on a cryptocurrency alternate – you’d wipe out the order books after quite a lot of slippage!

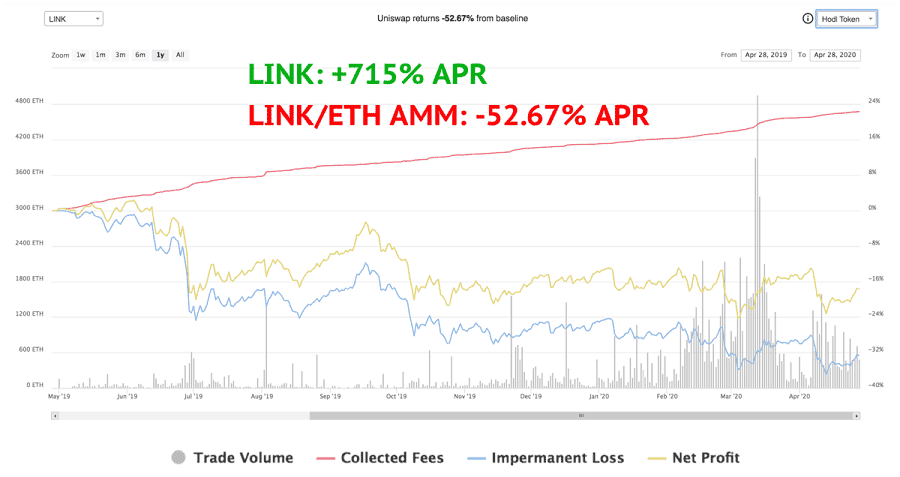

What’s Impermanent Loss?

Merely put, impermanent loss is the potential loss a liquidity supplier experiences for depositing their cryptocurrency right into a protocol as a substitute of simply holding it. Impermanent loss can occur when, say, somebody buys 1 ETH from the aforementioned hypothetical pool of 10 ETH and 1000 USDC.

If the value of ETH is rising, the liquidity supplier might miss out on an additional few {dollars} of revenue if they’d held all 10 ETH as a substitute of the ensuing 9 ETH + additional USDC deposited by the one who purchased the 1 ETH.

As you possibly can see, this “loss” is commonly small and normally non permanent however can turn out to be everlasting if a consumer withdraws their funds. The truth that Curve Finance makes use of stablecoins (and different pegged belongings) implies that impermanent loss can be a lot decrease in comparison with different platforms akin to Uniswap as a result of the value of the asset doesn’t range to the identical diploma.

Curve Finance Roadmap

Curve Finance doesn’t have a clearly outlined roadmap. Nevertheless, there’s one crucial factor to notice. Egorov talked about in an interview that the Curve Finance staff was taking part in with the concept of including extra cryptocurrencies to Curve Finance, and never simply stablecoins.

He defined that this could require the creation of extra bonding curves which might higher assist extra risky belongings. This potential change in addition to any others are essentially as much as CRV holders to vote on.

The CRV cryptocurrency token

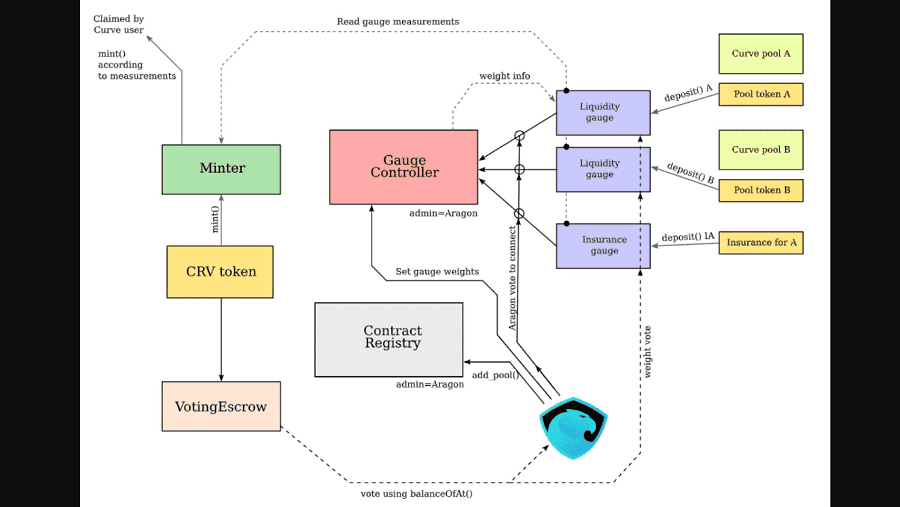

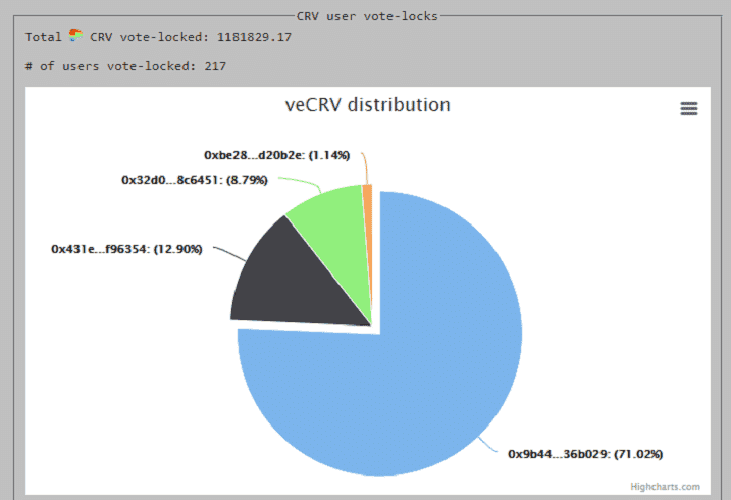

CRV is an ERC-20 token used for governance within the Curve Finance DAO. Whereas the DEX itself can’t be modified, CRV holders can lock their CRV (which turns it into veCRV – vote escrowed CRV) to vote so as to add new yield swimming pools, change current payment buildings, and even introduce token burning schedules for CRV.

Voting energy will be elevated relying on how lengthy CRV tokens are locked. The present most lock is 4 years, which provides 2.5x voting energy to these devoted CRV holders (within the type of veCRV).

Any consumer with at the very least 2500 veCRV can desk a proposal by posting within the Curve Finance DAO governance discussion board. No less than 33% of current veCRV should take part in voting for the proposal to be thought of, with a 50% voting quorum (greater than 50% of veCRV should vote within the affirmative). Any modifications to DEX parameters are applied by the Curve Finance staff. The Curve Finance DAO itself is constructed utilizing Aragon.

CRV Cryptocurrency ICO

The CRV token didn’t have an ICO. As a substitute, the token had a shock launch on August thirteenth when a Twitter with the deal with 0xc4ad (0xChad) instantly deployed a CRV sensible contract by paying over 8000$USD in Ethereum gasoline charges.

He/she/they have been ready to do that by utilizing the code on Curve Finance’s Github as reference. The staff initially rejected the token launch however surprisingly accepted it as professional after reviewing the code.

If you’re questioning precisely how these CRV tokens have been distributed, you’re in for a little bit of a headache. As you’ll have guessed, 0xChad apparently pre-mined over 80 000 CRV tokens which have been promoting for a whopping 3.1 ETH (1275$USD) per CRV on Uniswap moments after launch, briefly giving CRV a jaw dropping market cap of over 3.8 trillion USD.

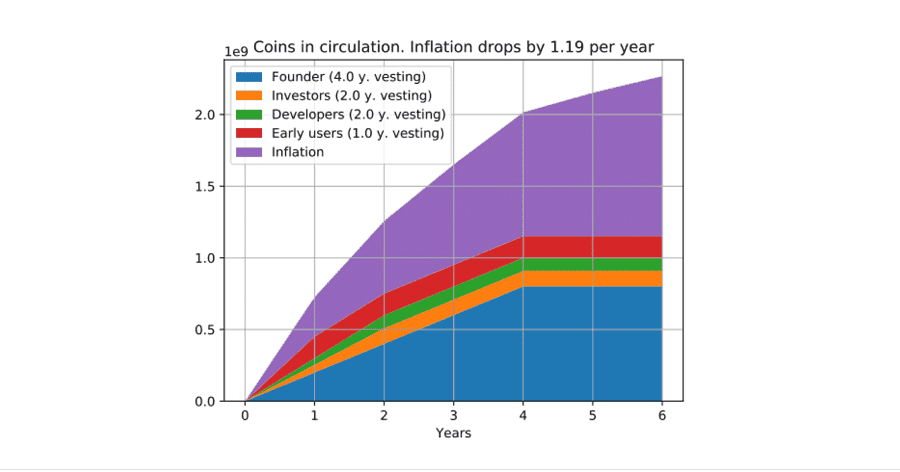

The whole provide of CRV is simply over 3 billion. 5% (151 million) CRV shall be issued to addresses which supplied liquidity to Curve Finance previous to the token launch in proportion to how a lot liquidity they supplied. These funds will unlock step by step each day for one 12 months (twelve months).

One other 5% will go to Curve Finance DAO reserves, 3% will go to Curve Finance workers with the identical unlock schedule as early liquidity suppliers, and 30% will go to shareholders (Egorov plus 2 angel traders) with a 4 12 months and a pair of 12 months launch interval, respectively.

The remaining 62% of tokens (1.86 billion) shall be given to present and future liquidity suppliers on Curve Finance. 766 000 CRV shall be distributed to liquidity suppliers every day. This every day quantity shall be diminished by 2.25% annually. While you do the mathematics, which means that it can take round 300 years for all CRV tokens to be issued.

CRV Value Evaluation

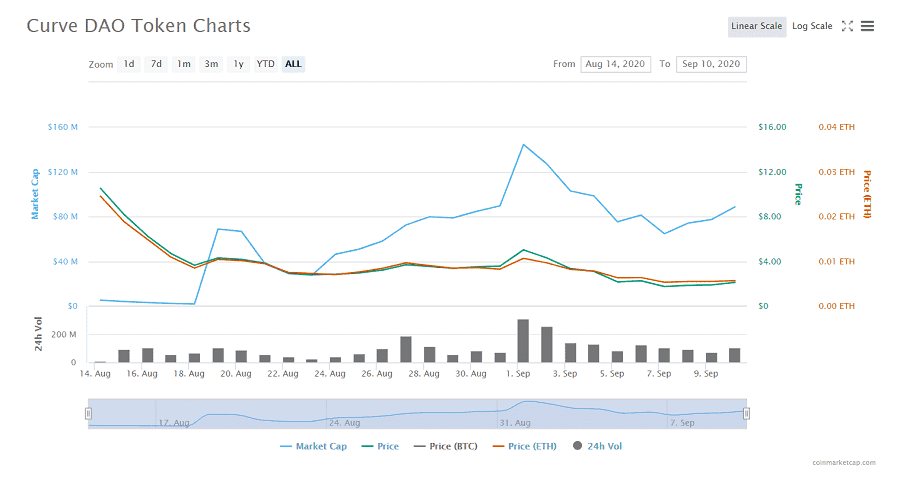

As talked about within the earlier part, CRV was initially buying and selling at a worth of 1275$USD on Uniswap moments after launch. This was as a result of Uniswap’s AMM equation works in a lot the identical approach as Curve Finance’s.

Which means the low ratio of CRV tokens in Uniswap swimming pools relative to different cryptocurrencies gave CRV this preposterous worth. As extra tokens have been added to the pool, the ratio grew to become extra balanced so the value of CRV fell accordingly.

The worth of CRV continued to fall for about 10 days earlier than stabilizing at a worth of round 3$USD by the tip of August. Earlier this month, CRV spiked to just about 5$USD earlier than crashing all the way down to beneath 2$USD. This was together with many different DeFi-oriented tokens, which noticed an over 50% pullback in worth over a 3-day interval. CRV has hovered round 2$ since then, displaying a slight uptrend in latest days.

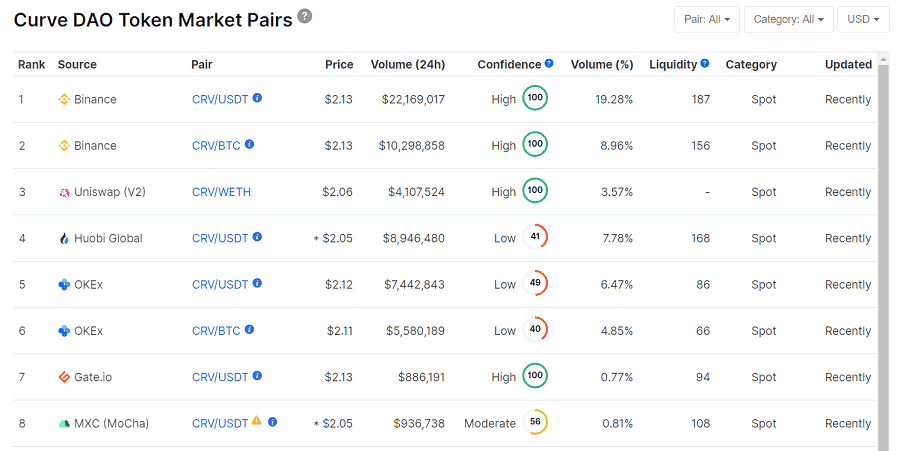

The place to get CRV cryptocurrency

Consider it or not, Binance introduced they might be itemizing the CRV token inside 24 hours of the botched launch. By August 14th, CRV was buying and selling on Binance and has since been listed on different respected exchanges akin to OKEx and HTX.

You too can nonetheless get CRV on Uniswap, however you could be higher off merely farming it by offering liquidity to Curve Finance swimming pools if in case you have some spare stablecoins beneath your sofa pillows.

CRV Cryptocurrency Wallets

Since CRV is an ERC-20 token, you’ll be able to retailer it on nearly any pockets which helps Ethereum-based belongings. CRV cryptocurrency wallets embody Atomic Pockets (desktop and cell), Exodus Pockets (desktop and cell), Trezor ({hardware}), and Ledger ({hardware}).

You too can use a Net 3.0 browser pockets like Metamask. That is particularly handy for those who plan on utilizing your CRV to vote, because you require a Net 3.0 pockets to work together with the Curve Finance DEX and its DAO.

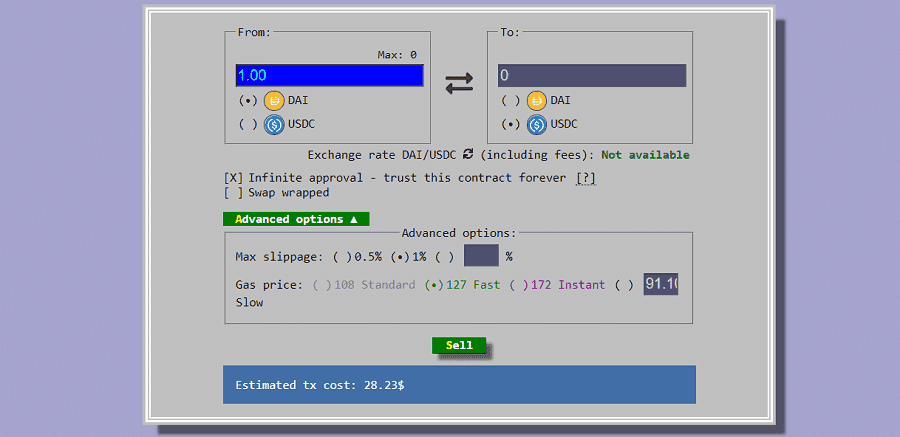

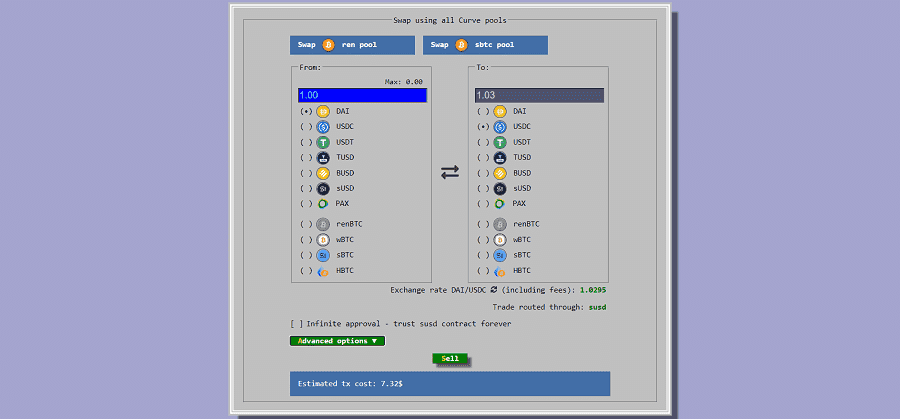

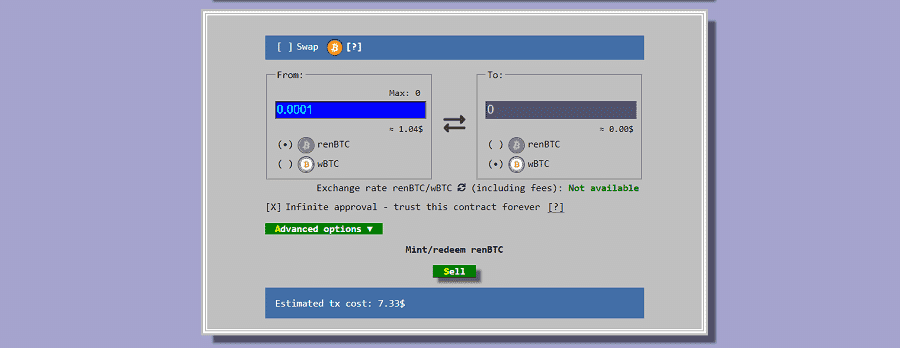

(A brief) Curve Finance Tutorial

Utilizing Curve Finance is simple. As we simply famous, you’ll need a Net 3.0 pockets akin to Metamask. Whereas the retro interface of the DEX can really feel a bit overwhelming (or nostalgic), principally all the pieces it is advisable know is on the principle web page of Curve Finance.

If you’re there to swap between stablecoins and wrapped Bitcoins, the primary field titled “Swap using all Curve pools” is the one you wish to work together with. You possibly can modify superior settings simply above the “Sell” button.

Scrolling down will reveal a few of the greenest pastures in yield farming – Curve Finance’s swimming pools. The third column reveals the completely different APY (annual rates of interest) you’ll achieve for offering liquidity to every pool, together with the belongings you’ll get in return (if any).

As you possibly can see, each pool is giving CRV tokens to liquidity suppliers, and once you issue out there worth of CRV, that is what turns an already insane 34.76% annual rate of interest right into a heart-stopping 337% annual rate of interest.

Upon getting determined which pool you wish to present liquidity to, merely click on on it and deposit the suitable stablecoin (or wrapped Bitcoin). Notice that it will price some quantity of Ethereum gasoline charges, which is estimated for you.

Be certain that to issue this into your calculations! Curiosity is accrued each Ethereum block (roughly 15 seconds), and compounds robotically. CRV accrues each second. You possibly can withdraw at any time to say your funds and amassed CRV however keep in mind that it will price gasoline.

You possibly can consult with final month’s YouTube video evaluating prime DEXs for a extra in-depth walkthrough have a look at how all of this works, and likewise try the detailed guides on Curve Finance.

The Curve-Vyper Exploit

On July 30, 2023, a number of Curve liquidity swimming pools on Curve Finance have been exploited in a hack, accumulating damages of about $61 million in varied crypto tokens. Following the incident, Curve set a bounty supply of $1.85 million on the hacker’s identification.

How did the Exploit Transpire?

The Curve Finance protocol is fabricated from a number of liquidity swimming pools, that are sensible contracts that function on the blockchain. Like each different software program, programming sensible contracts includes utilizing a compiler, an atmosphere the place programmers write and take a look at the code to iron out bugs and prime them for deployment on the blockchain mainnet.

The liquidity swimming pools (sensible contracts) that suffered from the hack have been programmed utilizing the Vyper compiler, notably variations 0.2.15, 0.2.16, and 0.3.0. These variations have been plagued with a difficulty, making the sensible contracts complied on them susceptible to reentrancy assaults, by which an attacker can trick the contract’s stability calculations and steal funds.

What’s attention-grabbing about this assault is that it sourced a vulnerability from the sensible contract compiler and never the Curve codebase itself. Swapping out a cook dinner’s salt jar for pepper would spoil the dish even when the cook dinner follows the recipe impeccably, equally, a superbly compiled sensible contract should still be susceptible if the compiler itself is inherently susceptible.

Whereas sensible contract protocols run strong bounty packages to maintain their code in examine, compilers don’t obtain comparable consideration, which is maybe why this vulnerability might slip previous Curve Finance’s watchdogs all this time. Whereas a number of white hat hackers have chipped in to mitigate the assault, it’s price mentioning that Curve swimming pools complied with Solidity (one other sensible contract compiler) stay unaffected and function as meant.

Our tackle Curve Finance

The attraction and potential of Curve Finance shouldn’t be all that obvious at first look. Chances are you’ll be asking what the purpose is of getting a platform which solely permits you to commerce between belongings price the identical quantity.

To be sincere, we surprise the identical factor, however it appears that there’s professional demand for these kind of swaps in DeFi. Additionally, the attraction of Curve Finance essentially boils all the way down to the excessive curiosity yields on funds deposited by liquidity suppliers.

The potential of Curve Finance is one thing which has been vastly underestimated. We briefly famous within the Roadmap part of this text that the Curve Finance staff is taking part in with the concept of supporting belongings past stablecoins and varied flavors of wrapped Bitcoin. If this have been to occur, Curve Finance might turn out to be one of the vital energy DEXs in the marketplace.

Whereas there’s virtually nothing unfavourable that could possibly be mentioned in regards to the Curve Finance DEX, the Curve Finance DAO is a little bit of a unique story. This all boils all the way down to the unbelievable voting energy which Egorov has in comparison with different token holders since he holds probably the most CRV by a large margin.

Yearn.finance creator Andre Cronje publicly criticized Egorov for this. Egorov responded by giving his phrase that he wouldn’t abuse this energy (a sensible contract could be higher than his phrase, nonetheless).

On the brilliant aspect, as extra CRV tokens are launched to former Curve Finance liquidity suppliers and issued to new liquidity suppliers, the extra decentralized the DAO will turn out to be. It’s also price noting that Egorov’s immense voting energy shouldn’t be as a lot of a risk as in different DAOs, because the variety of variables which will be modified in Curve Finance by token holders is way more conservative in comparison with another group ruled DEXs and protocols.

All in all, Curve Finance appears to have an extremely vivid future forward. Egorov himself has mentioned that the venture has no points forming new partnerships. The truth that the Curve Finance Workforce is subsequent door to different big DeFi tasks akin to Aave (which can be based mostly in Zug, Switzerland’s “Crypto Valley”) implies that that is really only the start for Curve Finance, and consequently the worth of the CRV token. It is going to in all probability by no means be price greater than Bitcoin once more although!

A giant thanks to Curve Finance's very personal Michael Egorov who helped our us fill within the blanks when writing this text.