All through historical past, finance has primarily operated inside centralized methods managed by authoritative entities, from historical temples to trendy legislative our bodies. These methods, essential for financial capabilities, have been based mostly on belief and authority, exemplified by Mesopotamia's granaries and the medieval church's monetary energy. This centralization was vital as a consequence of technological and societal limits, with smaller communities and no idea of worldwide interconnectedness.

The emergence of the web and blockchain expertise introduces a big shift in the direction of decentralized finance (DeFi), transferring away from centralization. DeFi leverages blockchain to create a clear, environment friendly, and accessible monetary ecosystem free from conventional gatekeepers. This technological and societal revolution challenges the need of centralized monetary methods. As we method this new period, DeFi represents an thrilling evolution in scalability, governance, and international financial interactions, marking a transition from historical centralized finance to a decentralized, interconnected framework, signifying a transformative section within the communalization of finance within the digital age.

The Pitfalls of CeFi

Centralized finance (CeFi), whereas foundational to the worldwide financial system, faces important pitfalls which have led to requires extra inclusive and environment friendly monetary methods like decentralized finance (DeFi). Right here's an exploration of those challenges, supported by real-world examples and instances.

1. Restricted Entry and Monetary Exclusion

Globally, 1.7 billion adults stay unbanked, in keeping with the World Financial institution. This isn’t merely a mirrored image of poverty but in addition of the boundaries posed by documentation and crimson tape in banking relationships. As an example, in areas like sub-Saharan Africa, the shortage of formal ID paperwork and bodily banking infrastructure limits entry to monetary companies, perpetuating monetary exclusion.

2. Inefficient Interoperability and Geographical Division

CeFi establishments function in silos. Companies from one financial institution are usually not simply transferable to a different, complicating buyer mobility. For instance, transferring accounts or companies between banks throughout the identical nation might be cumbersome, not to mention throughout borders. Furthermore, worldwide remittances, a lifeline for tens of millions, usually take days to course of and include excessive charges, as seen in conventional banking methods in comparison with blockchain-based options providing near-instant and cheaper transfers.

3. Cash is Permissioned

The disparity within the worth of currencies exacerbates the financial divide between nations. For instance, the Venezuelan Bolivar's hyperinflation has rendered the native forex almost nugatory, pushing residents in the direction of cryptocurrencies as a extra secure retailer of worth. Decentralized cryptocurrencies are permissionless, which means there may be no one able to limiting entry, which isn’t the case for a lot of nationwide currencies.

4. Opacity of Monetary Establishments

The 2008 monetary disaster highlighted the hazards of opaque monetary practices, the place the shortage of transparency in mortgage-backed securities contributed to a world financial meltdown. This opacity diminishes the auditability of transactions and forces a reliance on belief in establishments whose pursuits could not at all times align with these of their clients and will even be immoral.

5. Technological Maturity

The dominance of established monetary establishments has stifled innovation throughout the CeFi area. For instance, the reluctance of main banks to undertake new applied sciences for quicker funds has saved methods like SWIFT in place, regardless of their inefficiencies, as a result of they profit the incumbents.

6. Monetary Subordination

Depositors at banks successfully lose management over their property, topic to the financial institution's phrases of service, which can embrace the correct to freeze accounts. This was seen within the Cyprus banking disaster in 2013 when depositors confronted unprecedented levies on their financial savings as a part of a bailout plan.

7. Too Many Intermediaries

The finance sector's reliance on intermediaries like brokers and bankers provides layers of value and complexity and will increase the potential for systemic failures. The collapse of Lehman Brothers in 2008 serves as a stark reminder of how middleman failures can result in widespread financial disruption.

8. Vulnerability and Lack of Composability

The dearth of composability and interoperability throughout the conventional banking sector is by design, to maintain clients inside an ecosystem. Nonetheless, this lack of flexibility might be detrimental, as seen within the 2008 disaster, the place the interconnectedness of monetary establishments led to a cascading failure. Conversely, DeFi promotes an open ecosystem the place companies might be seamlessly built-in and composed, providing larger resilience and innovation.

These examples underline the necessity for a shift in the direction of extra clear, inclusive, and environment friendly monetary methods, a void that DeFi seeks to fill by addressing the inherent limitations of CeFi.

A Challenger Emerges

The pitfalls of CeFi referred to as for a self-sovereign monetary system. The Bitcoin community emerged proper after the 2008 monetary disaster and marked the start of trustless, borderless, and permissionless finance.

Bitcoin is a dwelling instance of a financial system working with out authoritarian management. It sparked a hope of constructing a self-sustaining monetary framework that might problem the attain and management of centralized finance. For a Decentralized Monetary system to exist, sure traits have been paramount:

- Decentralization: It should function with out a government. No sole physique should have the authority to find out the foundations of issuance, regulation, and administration of cash and monetary companies.

- Transparency and No Want for Belief: Conventional finance depends on belief in centralized entities. DeFi ought to signify a system the place transactions are seen, verifiable by anybody, and can’t be altered, which reduces the necessity for belief in a central social gathering.

- Safety: The system should get rid of single factors of failure and accommodate means to mitigate cascading failures.

- Programmability: The phrases of settlement throughout the monetary system have to be programmable and autonomously enforceable.

- Interoperability and Composability: The totally different monetary companies and merchandise needs to be simply built-in and constructed upon one another like Legos. This stage of interoperability and composability was not possible in conventional finance as a result of siloed nature of monetary establishments and companies.

The invention of sensible contract-powered blockchain networks was the primary resolution that might successfully serve these wants. Subsequently, the launch of the Ethereum community marked the start of Decentralized Finance.

What’s Decentralized Finance?

Decentralized Finance (DeFi) is a transformative method to banking and monetary companies, leveraging blockchain expertise to take away intermediaries from monetary transactions. At its core, DeFi represents a shift from conventional, centralized monetary methods—managed by establishments like banks, brokers, and governments—to a decentralized mannequin the place transactions are executed immediately between individuals. That is facilitated by sensible contracts on blockchain platforms, primarily Ethereum, which automate and safe monetary operations with out human intervention.

DeFi encompasses a broad spectrum of monetary companies, together with lending and borrowing platforms, decentralized exchanges (DEXs), stablecoins, insurance coverage protocols, and yield farming, amongst others. These companies intention to duplicate and enhance upon conventional monetary choices, offering larger accessibility, transparency, and effectivity. Customers can earn curiosity, take out loans, alternate property, and entry a variety of monetary merchandise with out going by a centralized authority or present process conventional banking procedures like credit score and background checks.

The attraction of DeFi lies in its potential to supply monetary inclusion to the unbanked, cut back transaction prices, and enhance transaction speeds. Nonetheless, it additionally poses challenges, together with regulatory uncertainty, scalability points, and safety vulnerabilities. Regardless of these challenges, DeFi continues to develop, pushed by the promise of a extra open, interoperable, and versatile monetary system.

How Does DeFi Work?

Decentralized Finance contains property, applications, and identities constructed on blockchain expertise. Good contracts type the bedrock of DeFi protocols. They’re an ordinary for making a monetary system that operates independently of conventional, centralized establishments like banks, brokers, and insurance coverage firms.

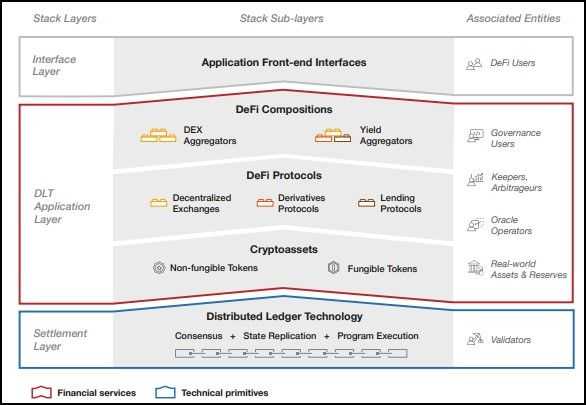

DeFi isn’t a single course of however a mess of on-chain interactions and worth alternate facilitating capital and monetary companies the place sensible contract applications change conventional monetary establishments, cryptocurrencies change fiat currencies and pockets addresses change individuals. The DeFi Stack is a hen's eye illustration of those interactions:

The DeFi Stack

The DeFi Stack outlined within the diagram above offers a structured framework to grasp the layers and parts that represent the DeFi ecosystem. This mannequin is conceptualized as an example the technical primitives, monetary capabilities, and compositions of DeFi protocols. Right here's an in depth breakdown of the DeFi Stack:

Settlement Layer

- Function: This foundational layer shops a file of accomplished monetary transactions and establishes consensus on the blockchain system's present state.

- Performance: Sometimes offered by Distributed Ledger Know-how (DLT), which implements consensus protocols and replicates the state globally throughout all distributed pc nodes. DLTs like Ethereum or Solana additionally provide an execution setting for sensible contracts, that are core to DeFi protocols.

- Parts: DLT platforms include a local token (e.g., ETH for Ethereum), which facilitate transactions and interactions throughout the community.

Utility Layer

- Function: Within the software layer, blockchain entities work together and alternate data and sources to facilitate monetary transactions.

- Performance: It’s a platform for executing sensible contract operations based mostly on the values and directions offered by on-chain addresses. A number of applications are composed on prime of each other to construct extra advanced applications and monetary companies.

- Parts: The appliance layer contains a Digital Machine (e.g., Ethereum Digital Machine), a decentralized digital pc that executes these operations.

Interface Layer

- Function: Gives graphical front-end interfaces to DeFi customers, facilitating interplay with the underlying protocols and companies while not having to work together immediately with the sensible contracts or blockchain.

- Performance: It acts because the interface between a consumer and the blockchain community, offering an intuitive platform to entry the parts of DeFi.

- Parts: It contains an online consumer that’s related to a node by which customers relay their instructions to the blockchain community.

This DeFi Stack Mannequin offers a complete framework for understanding the advanced construction of the DeFi ecosystem, illustrating how numerous parts work together to supply decentralized monetary companies. It emphasizes the layered and composable method of DeFi, from the foundational blockchain expertise to the consumer interfaces that permit for interplay with the ecosystem.

How DeFi is Used

Decentralized finance is rooted in the identical financial rules of provide and demand, lending and borrowing. It presents merchandise that serve the identical objective as conventional banking and monetary establishments, albeit moulded to respect the elemental rules of DeFi. Let's put these merchandise in distinction with their CeFi counterparts to get a way of what DeFi platforms provide:

| Monetary Transaction | CeFi | DeFi |

|---|---|---|

| Banks and Financial savings Accounts | Conventional banks provide financial savings accounts, the place clients can deposit their cash, earn curiosity, and use numerous monetary companies. | Decentralized protocols provide yield farming and liquidity mining, the place customers can deposit cryptocurrency right into a liquidity pool or lending protocol to earn curiosity or rewards (e.g., Compound Finance). |

| Loans and Credit score | Banks and credit score establishments present loans and credit score services, which require an software course of, credit score checks, and infrequently collateral. | Decentralized lending platforms permit customers to borrow and lend cryptocurrencies with out a government, utilizing sensible contracts to automate the method. Rates of interest are sometimes decided algorithmically (e.g., Aave) |

| Exchanges and Buying and selling Platforms | Centralized exchanges (CEXs) facilitate asset shopping for, promoting, and buying and selling. These platforms act as intermediaries and custodians of customers' funds. | Decentralized exchanges (DEXs) allow peer-to-peer buying and selling with out an middleman, utilizing liquidity swimming pools and automatic market makers (AMMs) to facilitate trades immediately between customers' wallets. (e.g., Uniswap) |

| Asset Administration and Funding Companies | Monetary advisors and funding companies provide asset administration companies, managing investments in shares, bonds, and different property on behalf of purchasers. | DeFi platforms provide decentralized asset administration by protocols that allow automated funding methods, permitting customers to spend money on a diversified portfolio of crypto property (e.g., Yearn Finance). |

| Fee Techniques | Conventional cost methods contain banks, bank card firms, and on-line cost platforms like PayPal, facilitating the switch of cash between events. | Decentralized cost protocols permit for immediate, borderless, and low-cost transfers of cryptocurrency immediately between events, with out the necessity for conventional cost processors (e.g., Bitcoin, Curve Finance). |

| Insurance coverage | Insurance coverage firms present insurance policies to guard in opposition to numerous dangers, utilizing a centralized mannequin for coverage issuance, premium assortment, and declare settlements. | Decentralized insurance coverage protocols use sensible contracts to pool dangers and automate claims processing, providing protection in opposition to sensible contract failures, hacking incidents, and different dangers (e.g., Nexus Mutual). |

| Id and Verification | Monetary establishments require id verification (Know Your Buyer, KYC) and anti-money laundering (AML) checks to adjust to regulatory requirements. | Whereas DeFi has largely operated with out KYC/AML procedures, there's a rising emphasis on decentralized id options and privacy-preserving verification strategies to reinforce safety with out compromising consumer anonymity (e.g., Proof of Humanity). |

Past DeFi, blockchain expertise itself solves quite a few real-world issues and has discovered modern purposes. Try Coin Bureau's evaluation of Blockchain Use Instances and Purposes.

Adoption and Progress of DeFi

Yearly, Chainanalysis conducts complete analysis on international crypto adoption to measure the extent of cryptocurrency adoption throughout international locations. The index consists of 5 sub-indexes, every reflecting the utilization of various cryptocurrency companies. The method contains:

- Rating International locations: Rating international locations based mostly on their crypto utilization and adjusting them based mostly on inhabitants and buying energy parity (PPP) per capita.

- Geometric Imply Calculation: The geometric imply of every nation's rankings throughout all 5 sub-indexes is calculated to combine the various elements of crypto adoption right into a single metric.

- Normalization: Normalizing the information between a scale of 0 to 1, the place a rating of 1 signifies excessive adoption price.

- Estimating Transaction Volumes: The analysis makes use of net site visitors and protocol utilization patterns to estimate transaction volumes. It additionally acknowledges this method’s limitations as a consequence of VPNs and privacy-protecting instruments.

The important thing takeaway from their analysis report is that Central and Southern Asia and Oceania areas dominated the index. The report claims that crypto adoption peaked round This fall of 2021 and bottomed across the FTX saga. Nonetheless, adoption has been rising because the starting of 2023, and India has led the pack round this cycle, adopted by Nigeria, Vietnam, the USA, and Ukraine, constituting the highest 5.

Advantages of DeFi

Decentralized Finance presents a mess of advantages reshaping the panorama of monetary companies:

- Accessibility: DeFi offers international entry to monetary companies, eradicating geographical boundaries and providing inclusion for the unbanked or underbanked populations.

- Decreased Prices: DeFi considerably lowers the charges related to transactions and monetary companies by eliminating intermediaries like banks and brokers.

- Transparency: Transactions and contracts are recorded on a public blockchain, guaranteeing transparency and permitting anybody to confirm transactions.

- Safety: Using blockchain expertise, DeFi presents enhanced safety features, lowering the danger of fraud and unauthorized entry in comparison with conventional monetary methods.

- Programmability: Good contracts automate transactions and agreements, enabling advanced monetary devices and companies to be executed with out human intervention.

- Interoperability: DeFi protocols are designed to work collectively seamlessly, permitting for modern monetary services that may be simply built-in.

- Permissionless: Anybody with an web connection can entry DeFi platforms while not having approval from a governing physique or monetary establishment.

- Innovation: DeFi's open-source nature encourages steady innovation, with builders freely constructing on current protocols to introduce new companies and enhancements.

- Monetary Sovereignty: Customers have full management over their property with out counting on third events, enhancing privateness and management over private funds.

These advantages illustrate DeFi's potential to create a extra inclusive, environment friendly, and clear monetary ecosystem, though it additionally comes with its personal set of challenges and dangers.

Challenges of DeFi

Decentralized Finance presents a number of challenges and dangers alongside its modern advantages:

- Good Contract Vulnerabilities: Bugs or flaws in sensible contract code can result in important monetary losses, as seen in numerous exploits and hacks.

- Scalability Points: Excessive demand can result in community congestion, gradual transactions, and elevated charges, notably on platforms like Ethereum (the idea of Scalability Trilemma explores this attribute).

- Regulatory Uncertainty: The dearth of clear regulatory frameworks for DeFi poses challenges for compliance and will result in authorized points for customers and builders.

- Complexity and Usability: The technical nature of DeFi platforms might be daunting for newcomers, making it troublesome for the common particular person to navigate and perceive DeFi merchandise safely.

- Market Volatility: Cryptocurrencies' excessive volatility can have an effect on DeFi protocols, impacting investments' stability and collateral worth.

- Liquidity Dangers: Some DeFi platforms could face liquidity points, making it troublesome to enter or exit positions with out important value impression.

- Impermanent Loss: Offering liquidity to automated market makers (AMMs) can result in impermanent loss, the place the worth of deposited property decreases in comparison with holding them.

- Lack of Insurance coverage: In contrast to conventional banks, DeFi platforms usually don’t provide deposit insurance coverage, growing the danger of whole loss in case of a platform failure or hack.

- Interoperability Dangers: Whereas interoperability is a profit, it additionally will increase the complexity and potential for systemic dangers throughout interconnected protocols.

These challenges spotlight the necessity for ongoing growth, improved regulatory readability, and enhanced consumer schooling to mitigate dangers and absolutely understand DeFi's potential.

DeFi within the Future

In 2024, DeFi stands at an evolutionary crossroads, propelled by innovation and regulatory shifts, notably by tokenizing real-world property (RWAs) like shares, bonds, and actual property and introducing DeFi-native companies like RaaS (Rollups as a Service). This transfer in the direction of integrating RWAs is ready to considerably improve liquidity and cut back prices, marking a departure from excessive, usually unsustainable APYs to a concentrate on actual, sustainable yields.

But, the trail ahead is fraught with regulatory challenges. The business's quest for a steadiness between privateness and transparency is essential, aiming to safe operations whereas aligning with evolving international requirements. 2024 might be decisive for DeFi, as regulatory readability will both catalyze its integration into the broader monetary ecosystem or stymie its progress as a consequence of compliance hurdles.

The way forward for DeFi hinges on its capacity to navigate these regulatory landscapes, innovate responsibly, and foster the tokenization development. Success and sustainability in DeFi will largely rely on its adaptability and the continued convergence of conventional and decentralized finance, promising a transformative but unsure horizon for the sector.

Closing Ideas

Decentralized Finance represents a paradigm shift from conventional, centralized monetary methods in the direction of an open, blockchain-based ecosystem. By leveraging sensible contracts on platforms like Ethereum, DeFi presents a spread of monetary companies — from lending and borrowing to buying and selling and insurance coverage — with out intermediaries. Its emergence addresses points like monetary exclusion, inefficiencies, and transparency within the current system.

Nonetheless, DeFi additionally faces challenges, together with regulatory uncertainties, scalability points, and safety vulnerabilities. The way forward for DeFi is poised for development, pushed by improvements just like the tokenization of real-world property and the mixing of stablecoins, but hinges on navigating regulatory landscapes and technological developments. As DeFi evolves, it goals to redefine monetary companies, emphasizing accessibility, effectivity, and consumer sovereignty, albeit with a cautious eye on overcoming its inherent challenges.

Ceaselessly Requested Questions

What Does Decentralized Finance Do?

Decentralized Finance (DeFi) makes use of blockchain expertise to supply monetary companies reminiscent of lending, borrowing, buying and selling, and insurance coverage with out conventional intermediaries like banks. By leveraging sensible contracts on blockchain networks, DeFi goals to create a extra accessible, clear, and environment friendly monetary system. This innovation permits for peer-to-peer transactions, improved monetary inclusion, and the democratization of finance, enabling customers worldwide to entry monetary companies immediately by their digital units.

How Do I Make Cash With DeFi?

Making a living with DeFi includes participating in actions like yield farming, liquidity mining, staking, and buying and selling on decentralized exchanges (DEXs). Buyers can earn curiosity on their crypto property by lending them out or offering liquidity to buying and selling swimming pools. Nonetheless, these actions include their dangers and require a superb understanding of the DeFi ecosystem, sensible contract interactions, and market dynamics. It is essential to analysis and assess the dangers earlier than investing in any DeFi mission.

Is investing in DeFi protected?

Investing in DeFi carries dangers just like these in conventional and crypto markets, together with market volatility, sensible contract vulnerabilities, and regulatory uncertainty. Whereas DeFi presents excessive returns on funding, it is necessary to notice the potential for important losses as a result of aforementioned dangers. Buyers ought to conduct thorough analysis, perceive the expertise behind DeFi tasks, and think about diversifying their investments to mitigate dangers.

How Does DeFi Problem Conventional Banking?

DeFi challenges conventional banking by providing monetary companies in a decentralized method, eliminating the necessity for intermediaries and lowering prices for customers. It offers larger accessibility, permitting anybody with an web connection to take part. DeFi additionally presents transparency and effectivity by blockchain expertise. It poses a problem to conventional banks by probably diverting clients and funds away from typical monetary merchandise.

Is Bitcoin A part of Decentralized Finance?

Bitcoin, as the primary cryptocurrency, laid the groundwork for the event of blockchain expertise however isn’t immediately a part of DeFi. DeFi primarily operates on blockchain platforms like Ethereum, which assist sensible contracts, enabling the creation of decentralized purposes (DApps) for monetary companies. Nonetheless, Bitcoin’s rules of decentralization and digital forex are foundational to the ethos of DeFi, and a few DeFi platforms bridge Bitcoin into their ecosystems by wrapped tokens.