After spending the previous few days researching the lately launched Ethena protocol, it's clear {that a} deeper exploration of the mechanisms behind the spectacular yields is important. We’ll dive into the origins of those yields, how they’re generated, and how one can get entangled.

Moreover, because the title suggests, we’ll discover the potential dangers and consider whether or not the measures carried out by the Ethena group are ample to reassure those that could have skilled a bit of PTSD from earlier failures in DeFi. We can even make clear a number of the “new-to-us” terminology to make sure an intensive understanding of why Ethena has quickly ascended to over $2 billion in TVL and change into a major speaking level in monetary circles.

What’s Ethena?

It began with a bit of inspiration …

Ethena started by really implementing an concept first proposed by Arthur Hayes in 2023. And, as a pleasant nod to Hayes, they've included a tab on their web site that hyperlinks to the weblog the place Hayes initially shared the idea.

So, what’s this idea?

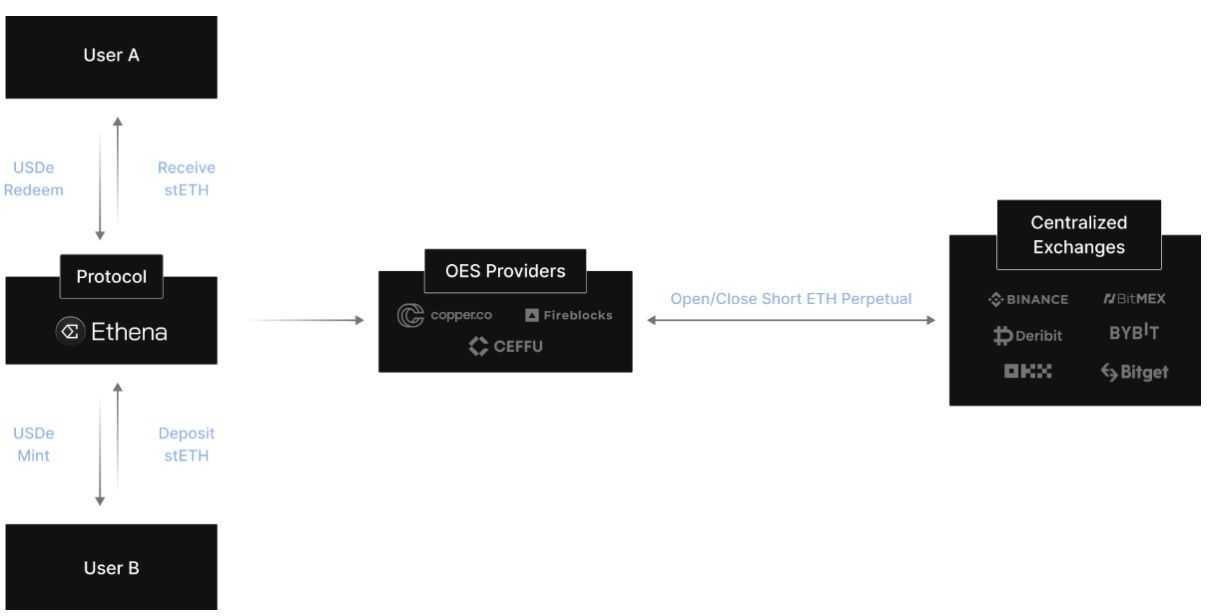

General, the thought is fairly easy: you give us collateral for our artificial greenback (USDe) after which stake it for a good yield. Then, we’ll hold issues balanced by holding a brief derivatives place to counteract the danger related to the collateral you simply deposited. Fairly easy, proper? For probably the most half, sure. However lots of people have been burned with guarantees of excessive APYs in DeFi, so it’s actually essential that we strive to determine precisely what’s occurring behind the scenes right here.

At its core, Ethena's USDe may be likened to a tokenised model of the “cash and carry” commerce.

Right here's the workflow: you begin by depositing collateral into the protocol, which may embrace belongings like stETH, USDC, or USDT. Ethena then engages in what is named "delta hedging" by staking this collateral and concurrently initiating an equal quick place to neutralise the lengthy place held within the collateral. That is the place understanding the definitions offers us a greater understanding of what’s really occurring.

Deciphering Delta Hedging: Key to Ethena's Stability

Delta hedging is a method to cut back the market threat related to the collateral. Take Ethereum for instance: if Ethereum and stETH are the collateral, Ethena would quick Ethereum on centralised and decentralised exchanges with no added leverage —successfully, a completely counterbalanced quick place. This strategy ensures that the worth of your collateral stays unaffected by ETH's market value fluctuations.

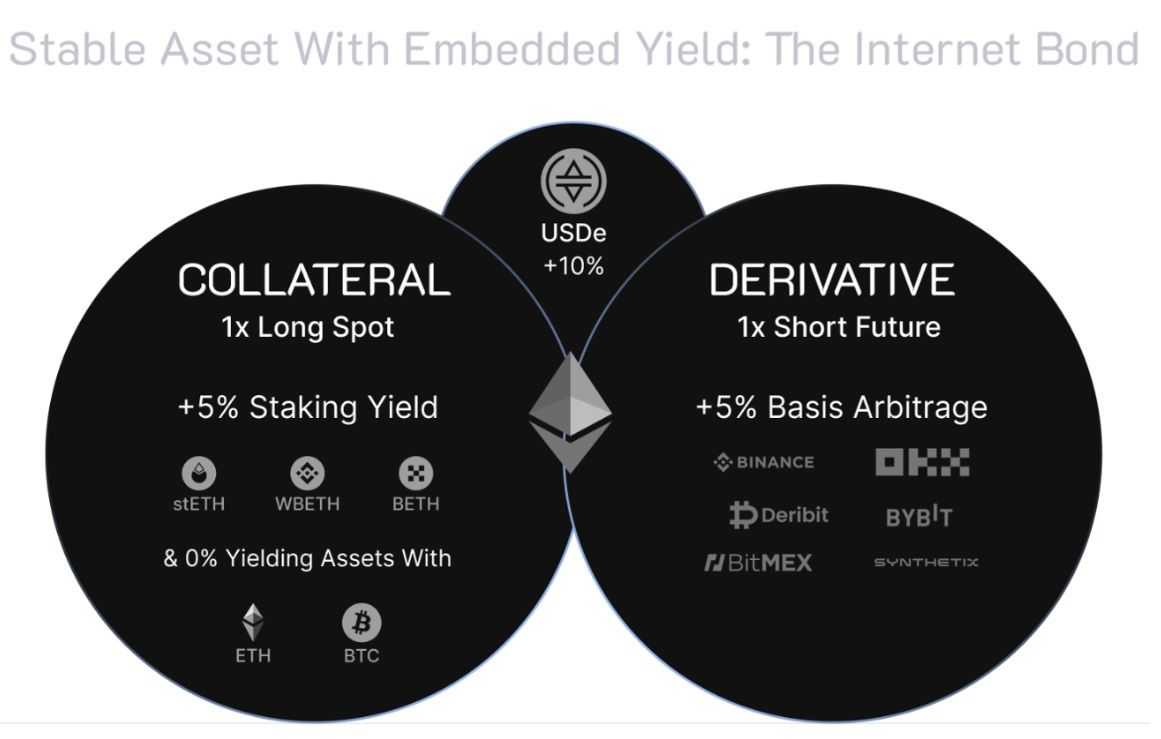

When Ethena stakes ETH, you obtain the native yield from stETH, contributing to the general yield. Nevertheless, the extra substantial portion of the yield stems from the “funding rate” or “carry” — the premium paid by these holding lengthy positions in ETH futures to these briefly positions. This premium may be fairly profitable throughout bull markets and is a major issue within the excessive yields seen with USDe.

This cash-and-carry methodology has been a staple in TradFi for a while. Establishments buy an asset and concurrently set up a corresponding quick place within the futures market. By absolutely delta-hedging, they mitigate any value threat related to the asset and revenue from the carry. This time-tested technique is exactly the mechanism on the coronary heart of USDe's perform.

So, basically, USDe retains its worth steady by making an offsetting countertrade within the derivatives market every time the protocol takes in collateral to stability out any value modifications within the collateral. Consider it as having a seesaw the place USDe sits on one finish and the derivatives place on the opposite, holding every little thing stage irrespective of how the market swings.

Understanding The Funding Charge Inside Ethena

Because the larger a part of the yield will doubtless come from the funding price, we should always in all probability dig in a bit deeper right here. To clarify the idea of the funding price inside Ethena, significantly within the context of perpetual futures, let's break down some key factors:

Perpetual Futures vs. Conventional Futures

Not like conventional futures contracts that you simply would possibly discover on exchanges just like the CME, which have particular expiration dates (month-to-month, quarterly, and many others.), perpetual futures don’t expire. This implies there's no set date when the worth of the long run should converge to the spot value of the underlying asset.

Value Premium and Convergence

Sometimes, perpetual futures commerce at a premium to the spot value of the underlying asset, which may range drastically. This persistent premium is as a result of perpetual nature of those contracts.

Position of the Funding Charge

To handle the premium and align the perpetual futures value extra intently with the spot value, a mechanism known as the "funding rate" is employed. The funding price serves two essential functions:

- Downward Stress: It applies downward strain on the perpetual futures value when it’s considerably larger than the spot value, serving to to tether it again to extra sensible ranges.

- Incentivisation: The funding price supplies a monetary incentive for merchants. In case you purchase (or go lengthy on) a perpetual future, you’ll pay the funding price. Conversely, in the event you promote (or go quick on) the perpetual future, you’ll earn the funding price. This dynamic encourages quick promoting when the futures value is simply too excessive in comparison with the spot value, serving to to stabilise the market.

Variable Charge and Market Circumstances

The funding price is just not fastened; it varies primarily based on market situations, significantly the stability of merchants going lengthy versus these going quick on the perpetual future. The speed adjusts relying on how bullish the market is: the extra merchants count on the worth to rise (going lengthy), the upper the funding price they are going to pay. This larger price discourages extreme lengthy positions and encourages extra quick promoting, selling a stability that retains the futures value in alignment with the spot value.

Market Dynamics and Comparability with Conventional Futures

In conventional futures markets, like these for commodities comparable to crude oil, costs are set for particular future dates, reflecting expectations about future provide and demand. In perpetual futures, the dynamic is extra instant and steady, with the funding price adjusting to replicate present market sentiment and buying and selling behaviors.

By utilizing the funding price, Ethena can preserve a extra steady and sensible pricing surroundings for perpetual futures. This ensures that costs don’t stray too removed from elementary values whereas permitting steady, expiration-free buying and selling. Unquestionably, it’s a fairly stable approach to deal with issues.

How Does Ethena Work?

It’s fairly exceptional how easy and intuitive the consumer expertise is, particularly given the complexity behind the scenes. As an instance this, let’s stroll by way of the straightforward means of buying your artificial greenback, web bond, and the yields they generate.

To acquire USDe tokens, customers should first deposit collateral (some choices are pictured beneath). If you click on “buy,” the USDe tokens are minted. You are actually left with USDe that you may stake on the platform to get some sUSDe, which may then be imported to your pockets whenever you see the immediate. This sUSDe will generate extra yield, and it’s additionally there in your pockets to make use of on different DeFi platforms in the event you select.

It’s actually that easy. You may be arrange inside about 5 minutes of visiting the location and connecting your pockets. Only for clarification, it's the motion of staking your minted USDe that creates what is known as the web bond. Let’s dig a bit of deeper into that idea subsequent.

Ethena's Web Bond

The Web Bond is an modern monetary product that comes from the yield-generating actions of USDe. So whenever you're Ethena's USDe system, consider it in two layers. The underside layer is the USDe itself: you give Ethena some crypto belongings as collateral, they usually do a fragile balancing act. They stake the collateral whereas, on the identical time, they quick it within the futures market to neutralise any value swings. That is meant to maintain the worth of your collateral steady it doesn’t matter what the market is doing.

Now, the highest layer — that's your Web Bond. That is the place issues get fascinating. The staking and the shorting don't simply hold issues steady; additionally they generate yield. A part of this yield comes from the staking rewards, which most of us are accustomed to. However then there's the "carry" or the funding price from the futures market, which may generally be a pleasant little earner, particularly when the markets are feeling bullish.

The Web Bond faucets into this yield. It's type of like a financial savings bond, the place the curiosity comes from the yields generated by the USDe operations. The sweetness is that since all that is occurring within the crypto house, it's decentralised and clear, free from the same old tangles of conventional banking techniques.

So, within the large image, the Web Bond isn't simply sitting there subsequent to USDe; it's immediately linked to it, rising in worth because the protocol effectively manages the aforementioned money and carry commerce technique whereas sustaining USDe's stability and scalability. It’s a robust instrument that strengthens USDe's place as a steady artificial asset and affords a beautiful yield-bearing instrument within the type of the bond.

Is USDe a Stablecoin?

The group will frequently try and make clear this, however most writers and influencers discussing the venture appear to gravitate towards the time period with out mentioning that this isn’t the case. Right here’s a fast clarification as to why it’s not a stablecoin:

Conventional stablecoins, comparable to USDT (Tether) and USDC (USD Coin), purpose to peg their worth to a fiat forex, usually the US greenback, to keep up value stability. They often obtain this peg by holding reserves within the equal fiat forex, through different belongings, and infrequently, by way of algorithms. This implies for each USDT or USDC in circulation, there's imagined to be one actual US greenback or an equal asset tucked away in a financial institution or reserve.

Now, distinction this with Ethena's artificial strategy. As talked about, as an alternative of counting on fiat reserves, Ethena makes use of crypto belongings like USDC or DAI as collateral. It hedges away the volatility of this collateral utilizing derivatives to keep up stability. Ethena's technique permits USDe to be scalable because it’s not restricted by money reserves and supplies a level of censorship resistance because it operates exterior conventional banking techniques.

As well as, the Web Bond idea we simply mentioned affords a singular product that grows with the USDe ecosystem. It is a step away from reserve-backed stablecoins and in the direction of a extra built-in monetary product that leverages blockchain know-how and the crypto-assets themselves to keep up stability and generate returns.

Dispelling Comparability with Terra-Luna

The Ethena group addresses this of their FAQs, however that also doesn’t cease the comparability from popping up just about in each dialogue.

The distinction between this and UST is critical. UST operated a mint and burn mechanism the place Luna, Terra's native forex, was used as collateral. The idea was that Luna would retain some inherent worth, however as we noticed, there was no actual worth to Luna — it was primarily based purely on market notion. The entire system collapsed when folks realised Luna wasn’t price a lot. In distinction, USDe is backed by absolutely liquid collateral like Ethereum, which has a well-understood and observable market worth.

Navigating Dangers: Understanding Ethena's Protocol Vulnerabilities

Ethena’s USDe is just not risk-free. There are a number of dangers concerned. To their credit score, the Ethena group has totally addressed these dangers of their FAQs. For brevity’s sake, we’ll talk about crucial dangers right here, however in the event you’d wish to see the EXTENSIVE threat part that Ethena has addressed in its docs, be at liberty to test it out right here.

Funding Charge Danger

To summarise the funding price dangers for Ethena within the context of destructive funding and using the reserve fund:

Ethena is uncovered to dangers if perpetual futures funding charges flip extra destructive than the yields from stETH. In such conditions, the protocol's reserve fund is designed to cowl settlements, defending the backing of USDe. Nevertheless, if destructive funding endured over a chronic interval, the reserve fund might be exhausted, resulting in a gradual erosion of USDe’s principal and potential depegging. Nevertheless, sustained destructive accrual would doubtless immediate customers to redeem their staked USDe, triggering Ethena to shut out quick positions, which may rebalance funding charges again to impartial or optimistic.

The reserve fund itself is replenished by optimistic funding funds from Ethena's quick positions when perpetual futures funding charges are optimistic. It may well additionally obtain injections from capital raised throughout fundraising. Traditionally, each ETH and BTC funding charges have proven a optimistic bias, even throughout bear markets, averaging between 7% and 9% on an open curiosity or volume-weighted foundation. Just one deal with holds the reserve funds, and its composition is publicly viewable.

Liquidity Danger

Ethena's customers are immediately impacted by the liquidity ranges within the markets, as low liquidity can result in larger slippage throughout the minting or redeeming of USDe. This implies customers may get much less beneficial charges after they commerce, and since Ethena wants to keep up its hedge positions promptly, it generally has to just accept this slippage. That is significantly related when giant positions have to be unwound, and market liquidity isn't adequate to take action with out shifting the worth considerably. Though it’s an unlikely state of affairs, Ethena is ready to handle mass redemptions and has restricted the amount of transactions per block to stop giant, sudden withdrawals that would destabilise the system.

Moreover, Ethena has launched funding mechanics that modify shorts in keeping with provide modifications, often bettering funding charges and market stability. Moreover, a seven-day cooling-off interval for sUSDe prevents the vault from being liquidated too rapidly and affords a buffer towards volatility. As for the liquidity of LST collateral onchain, the first concern is the stETH-ETH Curve pool, the place most stETH liquidity is held. The chance lies with protocols that may’t look ahead to the staking redemption course of and want to make use of the liquidity pool as an alternative. If this pool's liquidity is drained, stETH may depeg, leaving any protocol that should redeem their stETH urgently to face potential losses.

Different dangers embrace liquidity dangers — if giant positions trigger slippage as a result of inadequate market liquidity — and collateral dangers, comparable to a possible depeg from Lido's stETH. There’s additionally the danger of alternate failure, however it's essential to notice that USDe doesn’t deposit your collateral on exchanges; it's held with third-party custodians utilizing MPC know-how. The one issues positioned within the exchanges are the quick positions.

It is usually essential to notice that Ethena has lately added Bitcoin as a backing asset to USDe. This transfer will considerably permit the protocol to scale its provide from $2 billion. Bitcoin’s huge liquidity and better open curiosity on exchanges are key elements that make it appropriate for backing and scaling USDe, providing a safer product for holders. The selection displays the platform's technique to optimize the scalability of USDe, significantly in gentle of Bitcoin's speedy development in by-product markets, that are increasing sooner than Ethereum's, providing enhanced scalability and liquidity for hedging methods.

Custody Danger

Within the occasion of custodian chapter, belongings in segregated vaults like Copper's can be unaffected as they by no means legally belong to the custodian, making certain they continue to be exterior the chapter proceedings. Transfers to different wallets can be potential, albeit with potential minor delays. For Omnibus Options, belongings are held in a belief below English regulation, which suggests they continue to be exterior the custodian's property and will not be topic to creditor claims, although entry to belongings could also be delayed per Copper's insurance policies. In each circumstances, the protocol would modify hedging to keep up its place impartial to market actions.

Staking Withdrawal Danger

If there's a rush to unstake concurrently, customers shall be positioned in a queue and should wait their flip as a result of community capability limits. Nevertheless, this might profit the protocol since it will command a bigger share of the ETH staking yield, a extra substantial a part of the community's stake.

Conclusion: Balancing Enthusiasm with Warning

Regardless of the talked about dangers, the market response has been overwhelmingly optimistic, with USDe issuance skyrocketing and turning into historical past's fastest-growing US dollar-denominated asset. There was additionally vital pleasure across the $ENA airdrop, its governance token, which airdropped about 720 million to members, additional enhancing governance participation.

Finally, the venture was established to deal with the pressing want for decentralised, globally accessible base cash asset within the crypto house, unbiased of conventional banking techniques. Given the vulnerability of DeFi, which regularly depends on conventional stablecoins, they seem to have developed a scalable, crypto-native forex that would help a really unbiased monetary system. This initiative may present 8 billion folks with a censorship-resistant, dollar-denominated possibility for storing capital, assembly an enormous market demand for a steady but decentralised monetary instrument.

Ethena guarantees to remodel the house, significantly by way of its strategy to hedging towards the volatility inherent in cryptocurrency markets. Their use of delta hedging methods and integration of Bitcoin as collateral represents an modern leap in the direction of making a safer artificial greenback. By specializing in liquidity and threat mitigation, comparable to addressing the challenges of destructive funding charges and offering safeguards towards custodian chapter, Ethena positions itself as a forward-thinking participant that would doubtlessly provide buyers a safer haven inside the usually turbulent crypto house.

Notably, their documentation highlights the venture's significance to the house. And, if they will efficiently execute their plans, it’s laborious to doubt their potential. They’ve meticulously ready for numerous situations, from addressing black swan occasions to sustaining a 5% reserve fund to handle extended durations of destructive funding charges—they appear to have a stable reply for every little thing, which is at all times good.

Nevertheless, with that stated, the keenness for the protocol must be tempered with warning. The long-term viability of artificial stablecoins like USDe is just not with out query. They function in uncharted territories, with regulatory landscapes nonetheless in flux and market behaviours being unpredictable. Buyers contemplating such devices should acknowledge the fragile stability between innovation and threat. Artificial stablecoins might be the leading edge of monetary know-how, providing unprecedented yields and novel mechanisms for sustaining stability.

Nevertheless, their resilience within the face of market stresses, regulatory shifts, and technological challenges stays to be seen. The potential investor ought to weigh the potential for top returns towards the potential for unanticipated pitfalls in a market that’s nonetheless maturing. In essence, whereas USDe exemplifies the groundbreaking potential of artificial stablecoins, it additionally serves as a reminder of the necessity for rigorous due diligence and the acceptance of the numerous dangers related to high-reward crypto investments.

Steadily Requested Questions

What’s Ethena and USDe?

Ethena is a decentralized finance (DeFi) protocol that provides the USDe artificial greenback, a stablecoin backed by crypto collateral and derivatives. It goals to supply stability and yield era within the crypto house.

How does Ethena generate yields?

Ethena generates yields by way of a mix of staking collateral, delta hedging, and capturing funding charges from the derivatives market. These mechanisms assist preserve stability whereas providing enticing yields to customers.

What’s delta hedging, and the way does it work in Ethena?

Delta hedging is a method used to offset the danger related to value fluctuations within the collateral. In Ethena, it entails staking collateral and concurrently taking quick positions in derivatives to neutralize market threat.

Is USDe a stablecoin?

No, USDe is just not a conventional stablecoin pegged to a fiat forex. As an alternative, it maintains stability by way of collateralization and hedging methods, making it extra scalable and decentralized in comparison with fiat-backed stablecoins.

How does Ethena examine to different DeFi protocols like Terra-Luna?

Whereas each Ethena and Terra-Luna purpose to supply stability and yield within the DeFi house, they differ of their strategy to collateralization and threat administration. Ethena’s use of crypto collateral and hedging methods units it aside from Terra-Luna’s mechanism.

What are the potential dangers related to utilizing Ethena and USDe?

Dangers embrace funding price volatility, liquidity points, custody dangers, and staking withdrawal dangers. Nevertheless, Ethena has carried out measures to deal with these dangers and preserve stability within the protocol.