One of many key developments usually talked about by analysts and observers, together with us on the Coin Bureau staff by way of our Crypto Developments 2024 video, is the tokenization of real-world property.

It may simply turn into the buzzword of 2024 and plenty of see it as the following logical transfer within the digital evolution. With all of the discuss floating round, it's time we get to the nuts and bolts of what it’s, why it issues, the advantages and dangers it carries, and a few crystal ball gazing right into a future with it on the forefront.

We may also focus on a number of blockchain initiatives which might be engaged on real-world asset tokenization. Who is aware of, perhaps one among them may turn into the following family identify that may assist onboard the following cohort of crypto fans.

What are Actual-World Property (RWAs) in Blockchain?

How do property in the true world seem on the blockchain? These two ideas look like contradictory however that isn’t the case.

Actual-world property could be represented on the blockchain by tokenization. I'm not proposing constructing a duplicate of your home in a metaverse like Decentraland or The Sandbox. Slightly, it's the paperwork and legality that comes with proudly owning property that’s being digitized and data positioned on the blockchain. On the most elementary stage, it signifies that bodily properties shall be represented by a digital token. This makes the switch of possession straightforward, and you’ll hint the provenance of an asset on-line with relative ease, given the appropriate permissions.

Briefly, tokenization has to do with every part associated to the possession of a real-world asset. With information stored on the blockchain, it could show the switch of property between two events.

Does that imply every part I personal could be tokenized? Technically, sure. However, it makes extra sense to tokenize objects which have worth within the secondary market. A photograph album of my childhood pics most likely gained't be very worthwhile to anybody else aside from me (except hackers wish to use them to create new identities, however that's a subject for an additional day). Nevertheless, my assortment of uncommon stamps or previous cash and notes may be of worth to those that gather them. There are two varieties of real-world property on your consideration, a few of that are no-brainers:

Bodily Property

- Actual Property – proudly owning any sort of property wherever as of late is a measurement of getting achieved a sure stage of wealth, even when the property in query is a rundown one in a really rural space. It's nonetheless value one thing.

- Artworks together with work, sculptures, pottery and so on. Principally, something straightforward to determine possession and subsequent transference. Residing artwork performances most likely don't fall into this class. It'll be a collection of NFTs at greatest.

- Commodities – gold, silver, oil or wheat, soybeans, espresso beans, olives and so on, you get the image. I'd additionally embody any jewelry or heirlooms you bought out of your grandparents on this class. PAXG can be an excellent instance of a tokenized commodity.

Non-physical property

- Treasury bonds – particularly the US ones due to the greenback being the world's reserve foreign money (although it might have some “friends” becoming a member of it within the not-so-far future), however actually, any nation's bonds.

- Debt – could be a person's debt however extra doubtless institutional debt from corporations.

- Shares/Shares

- Funding alternatives – that is what could be owned with tokenization, as we’ll see later within the article.

The Tokenization of Property

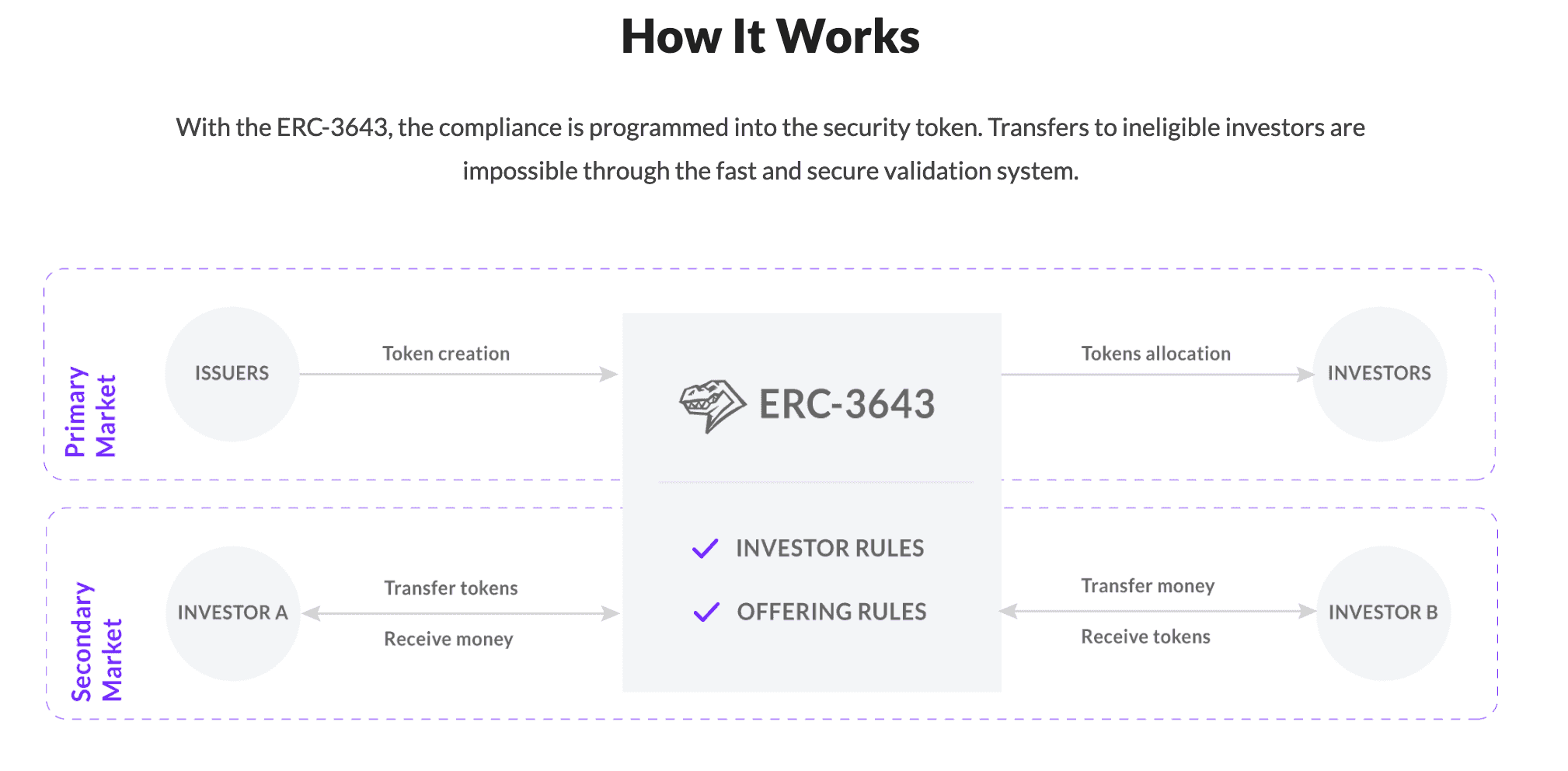

ERC3643

Similar to ERC20 and NFTs with ERC721, RWA tokens even have their requirements, often known as ERC3643. Not like earlier token requirements that are permissionless, it is a permissioned token the place eligibility as a token holder is set by way of pre-defined circumstances baked into the sensible contract. There may be an extra element often known as ONCHAINID, a decentralized id framework, like an on-chain model of KYC, that verifies the token holder's id. This set of requirements permits for the issuance, administration, and switch of the RWA tokens from one celebration to a different.

Token issuers may monitor possession because it passes from one token holder to a different. Think about the time, working hours, charges and paperwork (to not point out the timber) saved by insurance coverage corporations when all the knowledge they want can merely be pulled up from a database. Prolonged waits for claims processing may very nicely be a factor of the previous.

This is sensible since you won’t care who has a monkey image however the regulation cares if a home is getting used as a meth lab as legal responsibility may fall on the house owner, to not point out the repairs that go along with the place being trashed as a consequence. We want some safeguards in place for an orderly transition that permits real-world property to maneuver to the on-chain digital infrastructure. Tokenization requirements additionally assist to advertise its usability. Simply take a look at what ERC721 did for NFTs and ERC20 did for DeFi.

Beforehand often known as the T-Rex Protocol, the proposal was first unveiled on July ninth 2021 by Joachim Lebrun, Tony Malghem, Kevin Thizy, Luc Falempin, and Adam Boudjemaa. Since we talked about that RWA tokens are safety tokens, a special algorithm govern their utilization, together with being compliant with rules.

This token commonplace makes use of the ERC20 as the bottom however with 10x extra capabilities built-in to cater to the varied regulatory wants.

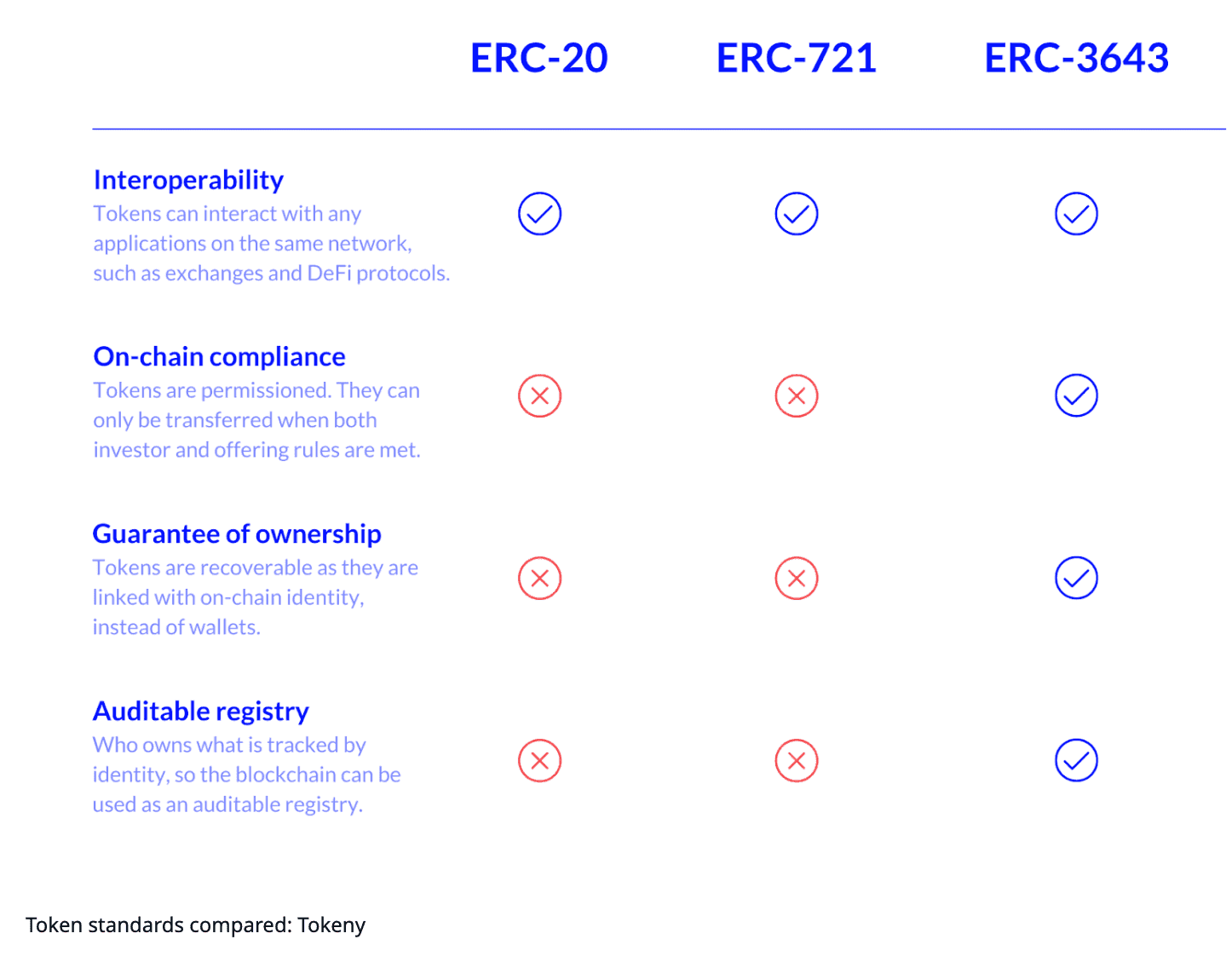

Here’s a temporary comparability of ERC3643 with the opposite token requirements on your reference:

In case you are concerned about discovering out extra about this token commonplace, be happy to take a look at the whitepaper. The unique proposal can be obtainable as public studying materials for individuals who wish to geek out on the code.

With regards to tokenizing a real-world asset, the overall define is as follows:

- Choose the asset you wish to tokenize. It might be a good suggestion to tokenize one thing that has a sure stage of demand within the secondary market.

- Select a DApp that may give you tokenization companies. Pay attention to which blockchain it's on as a result of this can have an effect on the transaction charges.

- The DApp/tokenization supplier works with an Oracle supplier to examine and keep the worth of the asset over time with real-world knowledge offered by the Oracle.

- As soon as all of the containers have been checked, the token can now be issued.

Advantages of RWA Tokenization

An essential factor that tokenization brings to the possession of real-world property is partial or fractional possession. This type of possession is already starting to realize acceptance within the artwork world with NFTs of artworks offered to artwork fans who wish to personal a bit of Banksy or Andy Warhol. Fractional possession of shares is widespread as of late so it’s a matter of time earlier than fractional possession of property goes to be on the desk.

One other good thing about tokenization of real-world property is permitting retail traders entry to funding devices historically reserved for establishments and the ultra-rich. The hole between the haves and have-nots has by no means been wider. A part of that’s as a result of capital attracts capital. The extra deployable dry powder you’ve got, the extra methods you need to use it to get much more. For normal people, methods to realize capital are restricted. Tokenization permits for the flexibility to have some piecemeal motion that, with sufficient accumulation, can appeal to decent-sized capital in the long term.

Small companies additionally stand to learn from tokenization. Small enterprise homeowners seeking to broaden have restricted assets of their instant neighborhood that they’ll draw upon. Tokenization is usually a worthwhile strategy to elevate capital to fund their companies. Traders could be from wherever around the globe. On-chain credit score profiles could be developed, just like the credit score historical past required by banks in securing loans. On this case, although, the credit score historical past is accessible to anybody with permission to view the info, so the enterprise homeowners don't want to determine credit score histories with a number of events.

Conversely, traders can have the choice of investing in different companies abroad in the event that they so want. At present, the one approach for traders to take a position abroad is thru authorities bonds issued by that nation or shopping for ETFs of explicit sectors which might be chosen by asset managers. If let's say, you visited an excellent neighbourhood as a vacationer or had the great fortune to spend a while in a neighborhood in another country, and also you wish to proceed investing in that neighborhood, tokenization of the neighborhood's companies lets you spend money on them. That is helpful in areas the place corruption is rampant and a number of the official investments from abroad don’t essentially make it again to the neighborhood however relatively, into some authorities officer's pockets.

Issuers of tokenized RWAs can set circumstances on the saleability of the asset, maybe even together with what varieties of traders are preferable relying on the character of the asset in query. Programmability, whereas not desired in CBDCs by customers (solely by issuers), may very well be a welcome function for tokenized RWAs.

Different benefits additionally embody:

- Transparency – anybody with permission can see all knowledge associated to the tokenized asset, thus enhancing belief and accountability for all events concerned.

- Effectivity – not solely will the tokens be traded 24/7, vastly lowering settlement occasions, middlemen are virtually eradicated, which improves the velocity of the transactions.

- Ease of transference of possession – provenance could be simply established (just like NFTs)

Drawbacks of Asset Tokenization

Asset tokenisation is, merely put, one other approach for folks to take a position and become profitable. With regards to contributing to the productiveness of an financial system, its results are oblique and maybe minimal in some circumstances. Listed below are some dangers to contemplate earlier than leaping in:

Fractional possession

Fractional possession works solely by way of funding. In case you personal 1/sixteenth of a bit of art work, like a portray or a sculpture, you won’t get to hold the precise art work in your front room, however you’ll be able to nonetheless get a duplicate finished and say you personal 1/sixteenth of the unique. Who will get the unique art work of their front room for a way lengthy? Or does nobody get it as a result of it stays in a safety vault? If that’s the case, who pays for the safety? Is the insurance coverage worth additionally included within the worth of the art work?

With regards to housing, it's even trickier. You may gather hire even in case you personal 1/sixteenth of a London penthouse and be OK with getting 1/sixteenth of the hire. That is purely an funding property as a result of there's no approach any of the homeowners can keep in it except the homeowners determine to divide up the time they’ll spend within the property. Conversely, if no tenant could be discovered, everybody contributes to the mortgage worth proportional to how a lot they paid for the property, if there may be an impressive mortgage on it. Issues can get difficult if one of many homeowners desires to dwell in it. Will they be staying as an proprietor or as a tenant? These are the phrases and circumstances that can must be outlined on the time of token creation.

Degens can actually gamble their property away by utilizing the tokenized model as collateral. Beforehand, they may solely borrow cash from the financial institution/cash lender/mortgage sharks, whereas the lenders would maintain onto the deed or any sort of authorized paperwork. This course of can take fairly some time however with tokenization, the processing for all this shall be sped up.

Regulatory points and authorized dangers

The principles for governing tangible property are well-defined as they’ve been round for a very long time and lengthy improved. Nevertheless, not all these guidelines could be utilized wholesale to tokenized RWAs. Traders might want to tread very rigorously in an effort to keep inside the regulation. These legal guidelines themselves are topic to scrutiny and modifications to adapt to the brand new actuality of what a holder of a tokenized RWA actually means.

Operational and market valuation dangers

Mismanagement and different delays related to the RWA might adversely have an effect on the tokenised model in a direct method. There's additionally the dealing with of the tokens themselves that may very well be trigger for concern. With regards to market valuation dangers, even the methodology used to worth the asset could also be referred to as into query as to how correct it may be. Different elements similar to liquidity circumstances and worth fluctuations must also be thought of.

Oracle dangers

Oracles play a key function as they’re the bridge between the real-world and the blockchain. If there may be an public sale taking place for a property, oracles would have entry to the newest offered worth and put up this on the blockchain in order that properties of comparable traits could be outlined by the brand new “market price”. Protocols similar to Chainlink have already stepped as much as present the required companies and even constructed a protocol that works cross-chain, anticipating the necessity for such transactions within the not-so-far future. Nevertheless, they will also be susceptible to exterior assaults.

A method for oracles to safeguard themselves is by working in a Trusted Execution Setting (TEE), a kind of {hardware} system that lets applications execute in whole isolation from different elements of the community. This makes it troublesome for unknown events to tamper with the programming for the reason that {hardware} system itself is remoted.

Safety dangers

Dangers of this nature have an effect on each the tangible asset and the tokenized model. Any type of calamity, be it a market crash or excessive climate might critically jeopardize the asset itself. In the meantime, its digital counterpart might encounter sensible contract bugs, and hacks to the platforms storing or issuing the tokens.

Final however not least, liquidity danger determines how shortly/simply traders can convert their investments into money based mostly on the extent of demand for the underlying asset. There are additionally KYC and AML dangers as these processes are nonetheless finished by people so biases should still exist.

How are RWAs Utilized in DeFi?

There has by no means been a neater time to lend and borrow cash than now. Since DeFi burst onto the scene, traders immediately discovered a brand new strategy to put their cash to work. In its heyday, DeFi merchandise had been producing insane yields, giving rise to “yield farming." If you know anyone who quit their day job to yield-farm, you know what I'm talking about. (*wink wink*). To be fair, the conditions for that to happen were also circumstantial. The key reason was the zero interest rates that banks in the world were offering (or not).

Since then, with rising interest rates aimed at curbing inflation worldwide, other less risky ways to make a decent buck and the YOLO ways that DeFi offered became something that warranted a second (or a third) look. DeFi itself also went through a growth spurt and gradually steadied itself while looking for its footing in the new environment it finds itself in. What can be done in DeFi has pretty much been milked dry at this point, so DeFi is looking for fresh inspiration. Enter the RWA.

A key use of RWA is as collateral for DeFi lending and borrowing. Previously, most DeFi platforms utilized over-collateralization to safeguard lenders' capital. However, that limited DeFi users to crypto-only participants because only on-chain assets were accepted. With RWA tokenisation, not only does the act of tokenization bring on more crypto participants, it vastly opens up the types of collateral available. This is great news for both lenders and borrowers. Borrowers have access to a wider range of liquidity sources and lenders get more choices in where they want to put their money.

RWAs can also act as a gateway for TradFi folk to get into DeFi and for DeFi investors to get a piece of the TradFi action. TradFi has more capital in its corner than DeFi. For even a smidgen of that capital to make its way to DeFi would be champagne-popping days for everyone.

The settlement time of illiquid assets has long been a pain for many investors. The amount of time it takes to settle a transaction for ownership transference, not to mention the middlemen involved, all taking a cut of fees, leaves both the buyer and seller crying their eyes out. With smart contracts, most of the middlemen can be eliminated, costly fees go flying out the window and the settlement times are greatly reduced.

Top RWA Crypto Projects

RWA projects haven't gotten to the point of being a dime a dozen… yet. Nevertheless, there are already a few visionaries who foresee the potential opportunities this new space offers and have braved the waters. Besides being first movers, they are also contributing to the development of the space with their services and garnering feedback from their users to make improvements. Anyone who is interested to join in this experiment can refer to the projects in this section for starters. Just know that it's still early days so there are lots of kinks to be ironed out, therefore there are still considerable risks involved.

The projects listed here are by no means exhaustive.

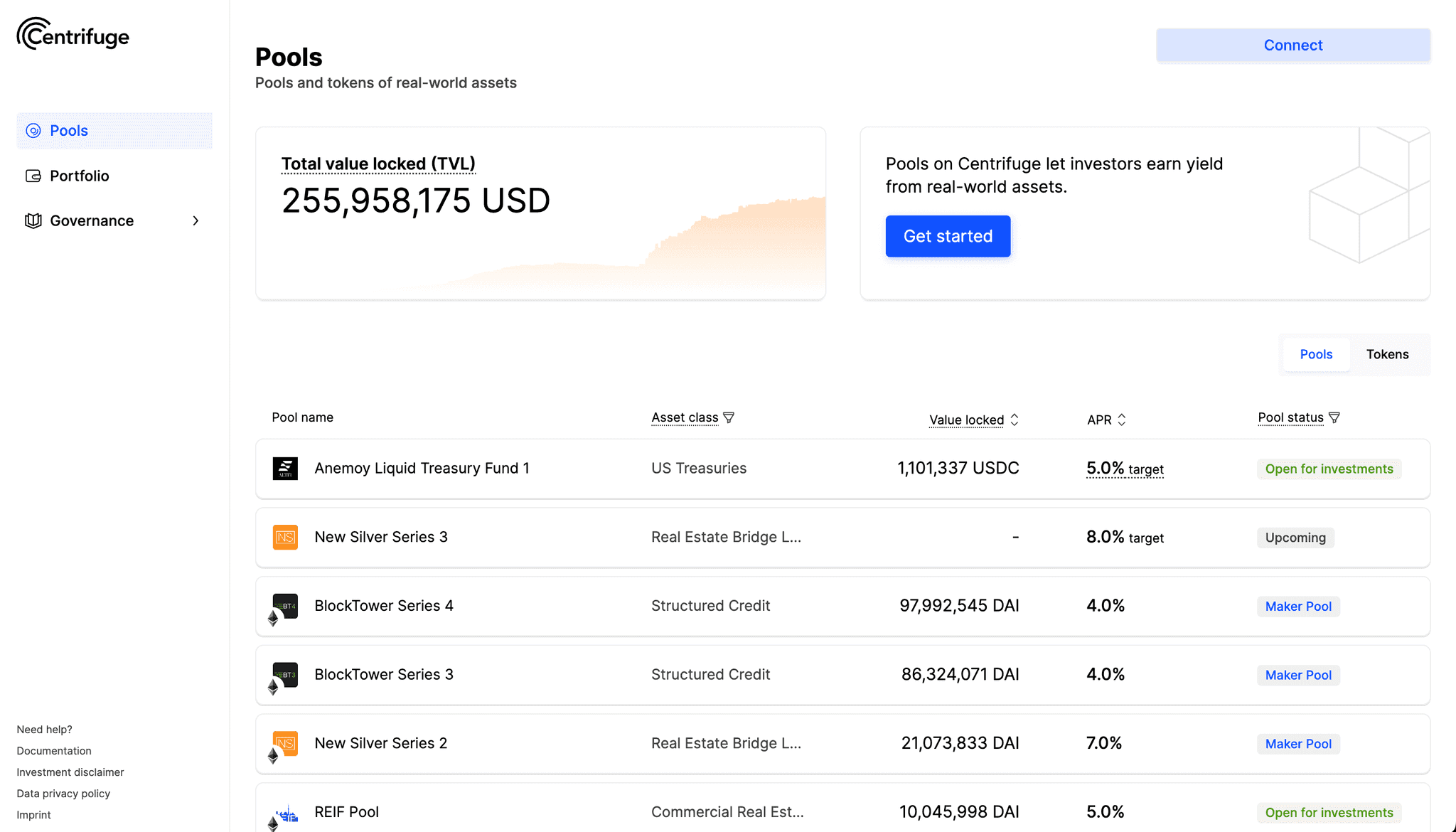

Centrifuge (CFG)

I first came across Centrifuge two years ago when it was applying for a parachain slot on the Polkadot network. If you've not heard of parachains, Guy's got a great video for you. The project was built on Parity substrate, a toolkit and framework developed by the Polkadot/Kusama team for blockchain developers to get a blockchain up and running in no time. Centrifuge is also compatible with Ethereum.

That was the first time I came across RWAs. The concept made sense to me at the time: transform your actual assets into a token so that you can use it as collateral. Alternatively, you can get investors to invest in your project through a platform like Centrifuge. So I plopped down some DOT into their parachain auction. Disclaimer: I hold some CFG in my portfolio.

The Centrifuge DApp is where investors and businesses, known as asset originators, come together to make each other happy. Asset originators can mint an NFT token on Centrifuge that represents the asset they want to use as collateral. It can be a mortgage, royalties, rental income etc. They hand over these tokens to the Issuer, a legal entity known as SPV, which manages the pools and issues senior/junior tokens to investors. The NFTs can have their own private pool or be mixed in with other assets to create a single pool.

Investors can choose which pool they want to invest in based on the description provided. They can also choose the risk level they are most comfortable with. Senior tokens (previously known as DROP) are less risky and offer a more stable but lower yield compared to Junior (TIN) tokens. The latter bears the higher risk but also the higher rewards when things go right. The types of investments currently available include but are not limited to: tokenized US Treasury bills, cargo and freight Invoices, and commercial real estate.

The Centrifuge team works with multiple partners in setting up these pools for investors to invest in. Some of them are high-profile like AAVE, MakerDAO, and Frax Finance to name a few. Investors can choose to deposit via Base, Arbitrum, and Ethereum networks.

The protocol itself has also been audited by several well-known crypto audit companies such as Trail of Bits and Consensys Diligence.

Centrifuge Prime is the latest product from the team, targeted at DAO treasuries. The idea is to help the treasuries grow their yield through the investments of RWAs.

The CFG token is the utility and governance token for the Centrifuge protocol. Aside from giving token holders voting rights, they can also be staked to help secure the network.

Some stats for consideration:

- $496 million worth of assets financed

- 1,378 tokens issued

- 121% TVL growth (YoY)

- CFG market cap $233.34 million

- CFG TVL $481,211.00

Goldfinch (GFI)

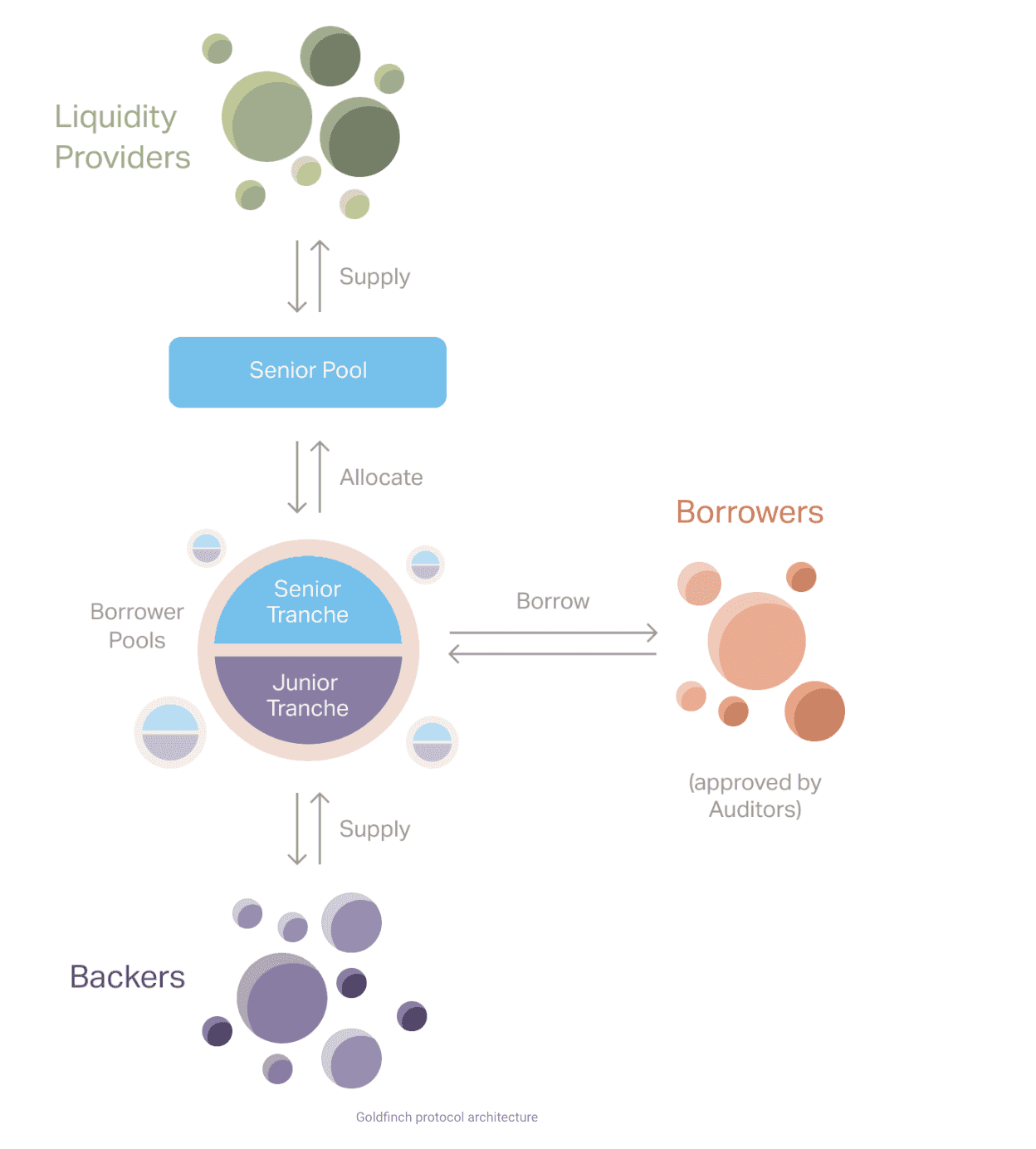

One of Centrifuge's competitors is Goldfinch, a lending and borrowing platform for institutions. Unlike most DeFi protocols that rely on overcollateralized collateral to secure loans, Goldfinch allows for the complete collateralization of loans using assets and income in the real world. In addition, it uses a “trust through consensus” mechanism, essentially a credit scoring system to assess the borrower's creditworthiness based on past behaviour. Instead of trusting a handful of individuals, the mechanism is based on the collective assessment made by other participants of the borrower, not just the strength of the borrower's crypto assets.

Here's how it works: Borrowers talk to an Auditor who will do the necessary checks before allowing them to proceed. Once they pass the checks, Borrowers can propose a Borrowers Pool where the terms and conditions of the loan are defined in the smart contract.

Those who want to invest can do it either as a Backer or a Liquidity Provider. The former reviews the individual Borrowers Pool to determine the risk of ploughing their funds in, with the understanding that they stand to lose their capital if things go pear-shaped but they can also make very nice gains if things go right. The money goes into what's called a Junior tranche (kinda like the Junior tokens in CFG). Backers get an NFT representing their share of the investment and track how much is redeemed, which can be done at any time.

If that's too risky, then they can become a Liquidity Provider by chucking their money into the Senior Pool (with a Senior tranche), which then distributes the funds to the various Borrowers Pool. The risk is less, i.e. not putting all your eggs in one basket, but lower yields. LPs get a token called FIDU which is then put into a Withdrawal Request when the investor wants their money back.

Goldfinch also uses something called the “leverage model” that plays a key role in the “trust through consensus" mechanism. Principally, the extra Backers spend money on a specific Borrower Pool, the pool may also get the next ratio of funds from the Senior pool. One of these mechanism mustn't fall prey to Sybil assaults. therefore each Backer, Borrower, and Auditor must undergo a course of often known as Distinctive Entity Verify. This course of utilises Distinctive Id (UID), the world’s first NFT for id verification.

GFI is Goldfinch's governance token held by Members who stake them in Membership Vaults to safe the community and earn rewards for doing so. They will vote on protocol modifications, auditor staking, and numerous different actions that govern the protocol.

The protocol has fairly a powerful line-up of traders in its protocol, together with a16z, Invoice Ackman, and Coinbase Ventures, the place the founders used to work earlier than beginning Goldfinch in 2020. The goal recipients of the protocol's loans are targeted on rising markets like Nigeria, Kenya, Uganda, and the Phillippines. That is the place actual progress can occur and these traders are pleased to leap on the bandwagon.

Some stats for the mission for consideration:

- Lively mortgage worth – $99.470. 695

- 30-day Protocol income – $100,138

- GFI Market Cap $85.51 million

- GFI TVL $5.59 million

Maple Finance (MPL)

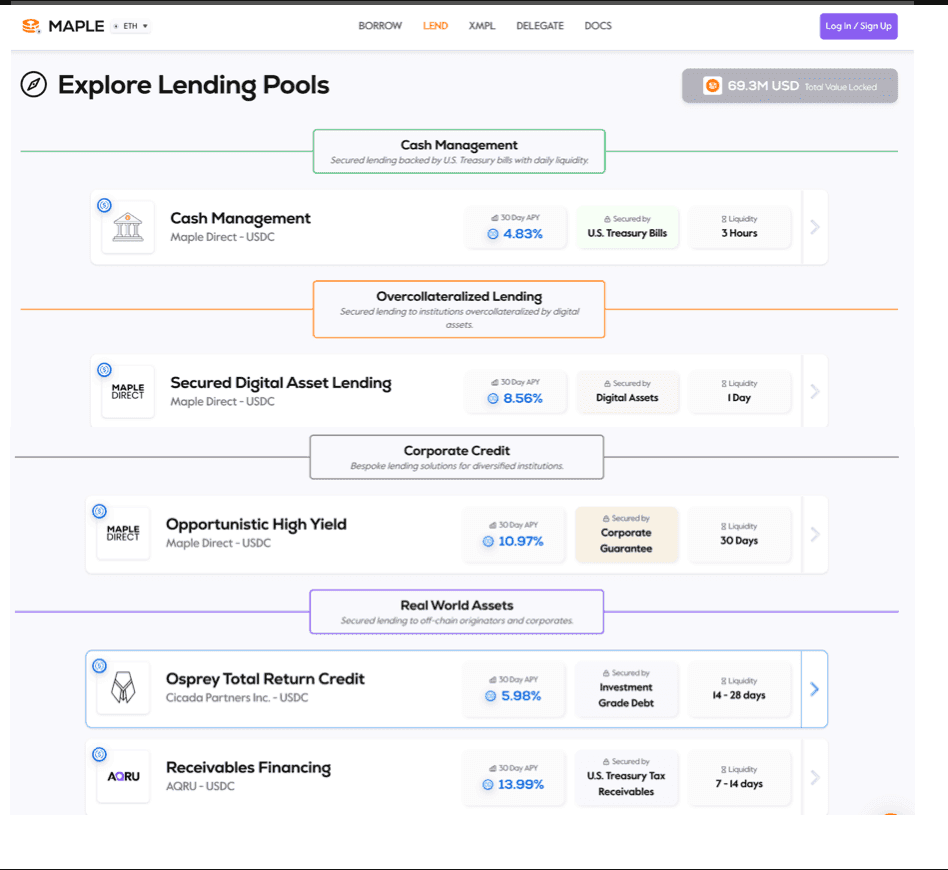

Just like Goldfinch, Maple Finance additionally serves establishments on its platform. Whereas Goldfinch goes full collateralization, Maple heads the opposite route with undercollateralization. This already sounds a bit dangerous and it’s as a result of Maple has had loans defaulted whereas Goldfinch has but to endure from the identical destiny. The protocol overhauled its withdrawal course of in 2022 to forestall related future occurrences.

Let's dive a bit deeper into how the protocol works to know how the default may have occurred.

Pool delegates play a key function in Maple Finance. These are people handpicked by the Maple Finance staff and their job is to vet the institutional debtors. That is finished by checking up on their creditworthiness and can affect what sort of mortgage they’ll get. As soon as they move the required checks, their pool is open to obtain investments and the borrower pays an “institution charge” that goes in direction of the DAO and the pool delegates. Right here, we will see that pool delegates are incentivized to move by way of as many debtors as they’ll as a result of they get a sort of kickback from the charges paid by debtors.

Lenders are accredited traders and solely lend in USDC. They undergo their very own onboarding course of, verifying they’re who they are saying they’re. Their wallets are additionally checked for anti-money laundering. The minimal lending quantity is USDC100,000 for his or her Money Administration Pool and the APY they get is identical, no matter mortgage dimension. Then, there are permissioned swimming pools that require particular entry. Loans are made up of Open Time period (no mounted date to repay) and Mounted Time period.

Maple Finance works on each Ethereum and Base. They used to additionally assist Solana however that acquired discontinued throughout their overhaul. They had been not directly a part of the collateral harm from the FTX implosion as two of its debtors, Auros International and Orthogonal Buying and selling turned bancrupt.

The Base community solely has the Money Administration Pool obtainable for funding while the Ethereum community has 5 swimming pools.

The MPL token is the platform's governance token. It was that you may stake MPL to earn yield and the lending swimming pools would settle for each USDC and MPL tokens. Nevertheless, what the staff has discovered is that token holders dump the MPL token when issues don't go nicely, thus inflicting the token to lose its worth, which impacts the lending quantity.

The platform's fundamental stats are as beneath:

- Complete loans issued – $3,196,525,723

- Complete deposited – $82,748,228

- Lending Pool TVL on the Ethereum community – $69.5 million

- Lending Pool TVL on the Base community – $503,800

- MPL Market Cap – $105.12 million

- MPL TVL $42.29 million

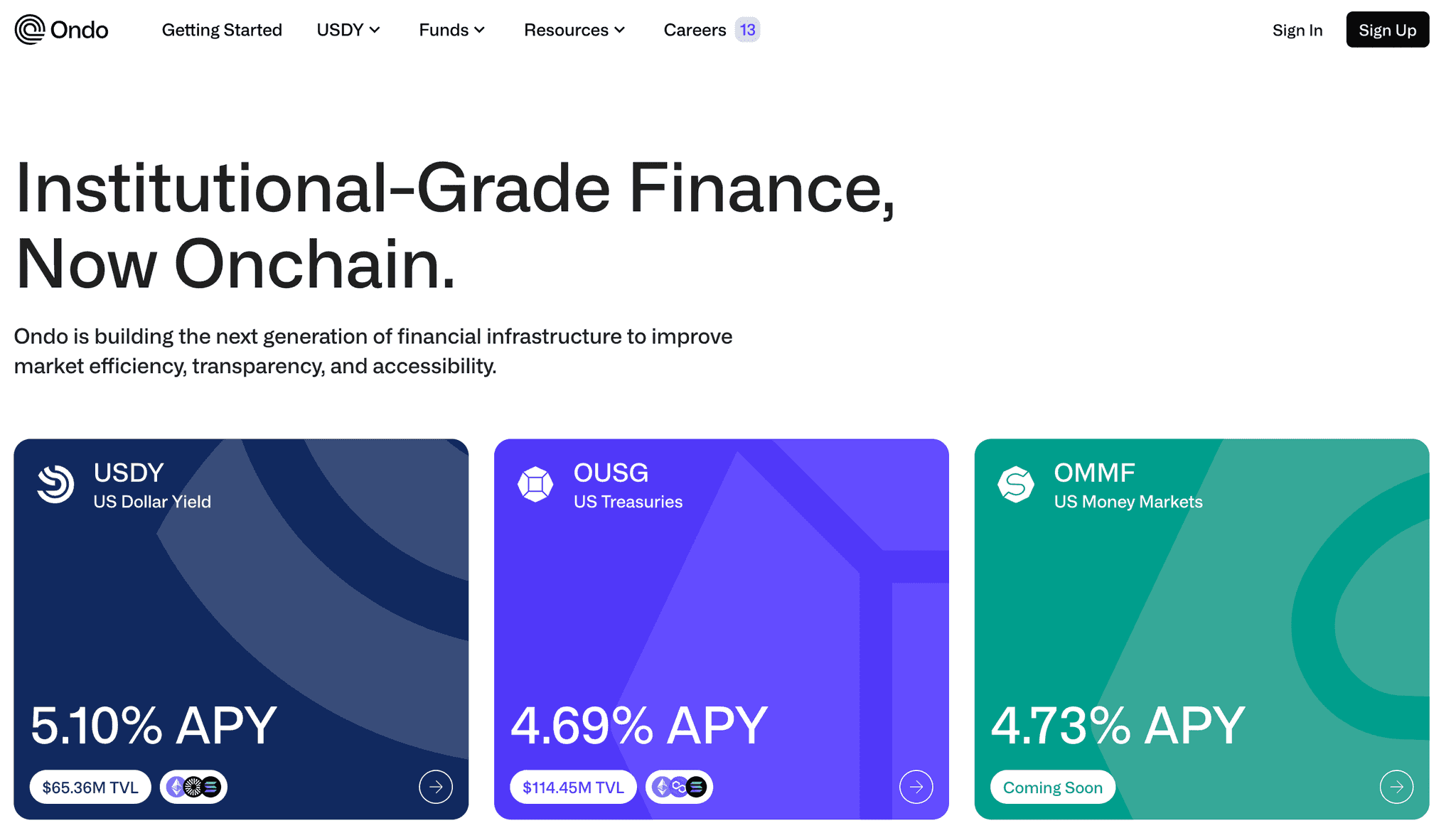

Ondo Finance

The three earlier platforms we lined are within the credit score and lending area, which explains the similarity you could discover of their modus operandi. Ondo Finance performs in a special nook of the RWA sandbox. This platform's primary choices are tokenized securities, specifically US Treasury Payments, and most lately, their very own stablecoin USDY, often known as US Greenback Yield. What actually makes Ondo stand out from the pack is its array of strategic partnerships with different heavy hitters in each the DeFi and the TradFi world.

One in all its star merchandise is the OUSG fund, a tokenized model of BlackRock's iShares Brief Treasury Bond ETF. For sure, BlackRock is intimately concerned on this product. Accredited traders deposit USDC or USD to the fund (min $100,000 as stipulated by the SEC), that are then transformed to USD (the place relevant) to purchase the shares within the ETF, mint new tokens and deposit them again to the traders' pockets addresses, which might've handed AML scrutiny earlier than getting used. As soon as the tokens are redeemed, they’re burnt. The USDC/USD conversion is dealt with by Coinbase.

The most recent providing, USDY, is a tokenized notice secured by short-term US Treasuries and financial institution demand deposits. This product is just obtainable to non-US traders and there may be additionally an inventory of nations that aren’t eligible to take part. The property are transferable 40-50 days after buy. Whereas this wouldn't be tremendous modern, utilizing short-term securities and financial institution deposits because the property underpinning the stablecoin offers holders confidence within the worth of the token. On the very least, it wouldn't do a UST cliff-dive and the collateral itself isn't stagnant.

The platform is accessible on Ethereum and Polygon. Final December, it additionally launched on the Solana chain, which supplies that community fairly a lift.

Polymath (POLY)

Many individuals acquired into crypto by way of ICOs, particularly again in 2017 when it was all the fashion. As a result of unregulated nature of those choices, coupled with dangerous actors making the most of the scenario, greater than half the ICOs failed. Two guys from Canada with fintech and authorized information noticed a possibility to offer a extra sturdy providing to each traders and lenders whereas additionally slicing down the quantity of crimson tape and middlemen concerned. That is how Polymath was based, because the brainchild of Trevor Korvekos and Chris Housser. They designed Polymath to be a one-stop platform for all issues associated to the issuance and sale of safety tokens.

Polymath was the primary platform to supply safety tokens and launched the ERC1400 commonplace for the standardization of the tokens. Issuers must fill out an in depth questionnaire with the related info relating to the token. This info may also be utilized by traders to evaluate the token for funding functions. The following step is selecting a Authorized Delegate to work with to carry the product to market, so to talk. Issuers might want to do their analysis in deciding who to decide on to help them. It is a key function because the delegate additionally works with the sensible contract builders to craft a tailored sensible contract for that token.

The platform leverages the Accredited Investor construction to make sure that all members are totally KYC'ed and recognized to the regulators. This vastly reduces any unexpected exterior regulatory dangers that would pose a menace to their choices and even to the platform itself. You possibly can say that compliance and regulation are baked into the token from day one.

The POLY token could be very a lot the de rigueur token for transactions on the Polymath community. It’s used for Authorized Delegates to pay the builders and obtain POLY from the issuers. Anyplace that includes fee on the Polymath community makes use of POLY, thus maintaining it at a sure stage of demand. There’s a restricted provide of 1 billion tokens created on the launch of the platform and roughly a few quarter was offered at its personal ICO.

The Polymesh community is a part of the Polymath platform. It's a Layer-1 permissioned blockchain that runs on the Polkadot community. It stands out from different blockchains with its forkless structure. That is essential as you don't need a number of copies of a property to be claimable on numerous blockchains. This is among the few blockchains designed with compliance for safety tokens in thoughts. POLYX is the blockchain's native utility token. There's additionally a POLY:POLYX Improve Bridge that permits customers emigrate their POLY tokens to POLYX.

We've acquired a improbable in-depth evaluate of Polymath for individuals who are concerned about discovering out extra about this OG platform in RWA tokenisation.

The Way forward for RWA Tokenization

Complete Worth Locked, which is how a lot cash is invested within the DeFi area, is $56.274 billion, in response to DeFi Llama. Any of the “Magnificent Seven” corporations within the S&P dwarf that quantity many occasions over. Numbers communicate the loudest and right here is a few for context:

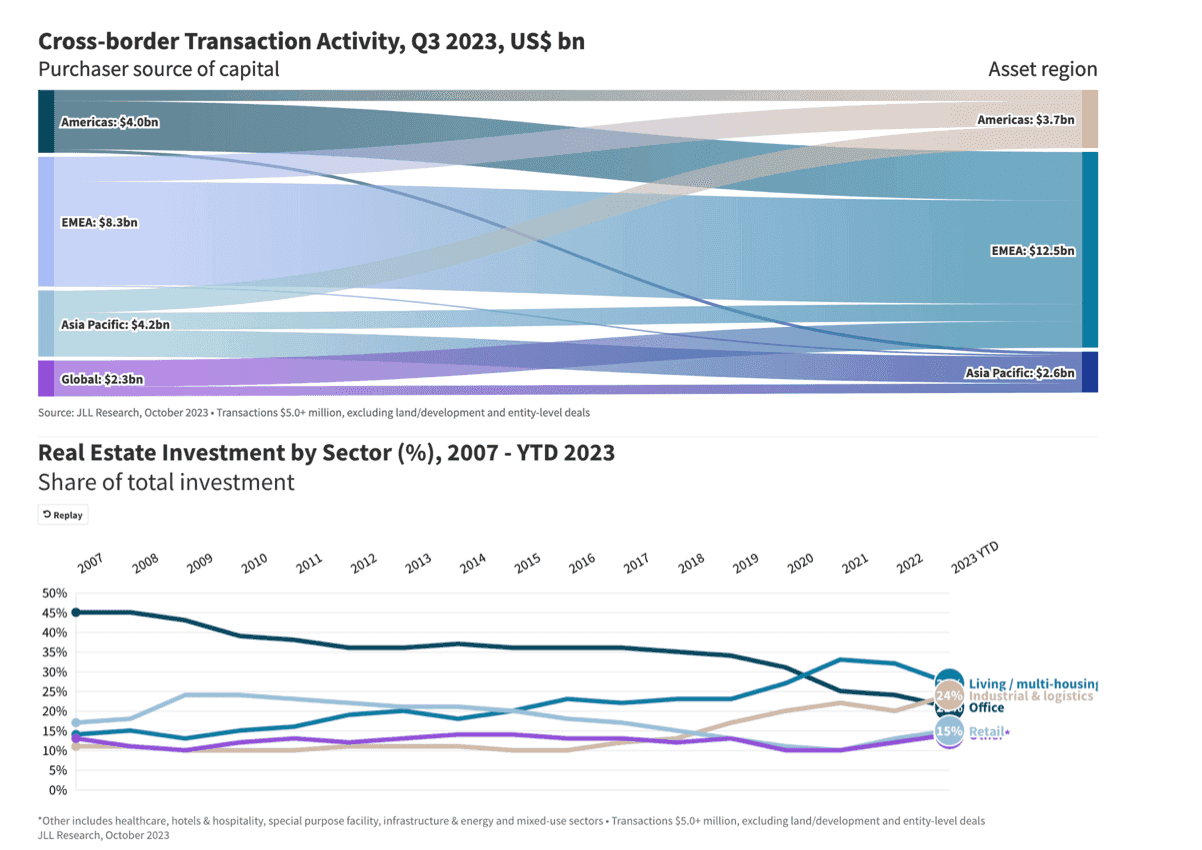

As of 2021, the worldwide actual property market was value about $3.69 trillion. Between 2022 and 2030, it's anticipated to develop at a compounded annual charge of 5.2%, in response to a report issued by Grandview Analysis, a advertising and consultancy firm based mostly within the US. Jones Lang and LaSalle, generally often known as JLL, additionally issued a report stating that cross-border transactional exercise in actual property was round $18.8 billion as of Q3 2023, with the bulk within the EMEA area. The lion's share, 27% of it, is in worldwide residential property adopted carefully by industrial/logistics at 24%.

The worth of different international markets, introduced on this visually-arresting graph, is as beneath:

- Derivatives – $12.4 trillion

- Gold – $11.5 trillion

- Equities – $95.9 trillion

In the meantime, your entire cryptocurrency market is just $1.85 trillion. If even 1% of what's within the markets above mixed makes its approach into the crypto area, it'll make the all-time highs of 2021 appear to be chump change. There is no such thing as a doubt that the tokenisation of real-world property goes to be an essential a part of crypto within the coming years.

RWA tokenisation remains to be very a lot in its early days proper now. How a lot longevity the initiatives that we lined on this article have in the long term remains to be anybody's guess. First-mover benefit is essential, however it additionally wants the legs to complete the marathon. Within the meantime, there shall be different upstarts chomping at their heels. This type of pleasant competitors bodes nicely for the general growth of the area. I can simply think about a future the place RWA tokenisation is the norm. Mortgages, rental leases (ohhh..completely tokenise that!), and all method of paperwork will at some point all get replaced by digital tokens. Future generations will look again and surprise how we stood dwelling in a paper-based world for therefore lengthy. Who is aware of, we’d even have the ability to tokenise our time however that's one thing I'll go away to sci-fi authors to ponder over.

Incessantly Requested Questions

How Does Asset Tokenization Work?

Those that have a real-world asset that they wish to tokenise discover out which platforms deal with tokenisation. They then undergo the KYC checks which might be normally obligatory as a result of regulatory governance. The platform helps the issuer get their property tokenised and provides it on their platform for traders to evaluate.

What’s Tokenized Actual Property?

The brief, candy reply is a token that represents a bit of actual property, be it a bit of farmland, a residential dwelling, an workplace constructing, or any sort of property.

Is an NFT a Tokenized Asset?

It relies upon. If the NFT represents a bodily piece of art work like a portray or a sculpture, then it may be thought of as a tokenized asset. If it’s a purely digital art work, just like the profile footage which might be well-liked amongst merchants, then it’s not a tokenized asset.

What’s the distinction between a tokenized asset and a digital asset?

A tokenized asset is a digital illustration of a bodily asset. Examples of this are the deeds to a property, an artwork piece, or the possession papers for a automobile. A digital asset is one thing that’s created solely in digital type. There is no such thing as a underlying bodily asset related to it.

You possibly can say that the tokenized asset is a digital asset of types, solely in a digital type.