Many decentralised exchanges wrestle with liquidity, excessive transaction charges, and clunky consumer experiences, leaving merchants with little selection however to stay with centralised exchanges like Binance and Bybit.

Hyperliquid believes it has cracked the code. In contrast to most DEXs, which depend on present blockchain networks, Hyperliquid has constructed its personal {custom} Layer-1 blockchain designed from the bottom up for high-frequency buying and selling. The end result? A blazing-fast order e book DEX, boasting $12 billion in each day quantity, near-instant transactions, and a buying and selling expertise that rivals CEXs whereas remaining absolutely on-chain.

However Hyperliquid’s fast rise hasn’t come with out controversy. The mission claims to have launched with none VC funding, ICO, or pre-sale, making it one of many few main crypto platforms to take action. As an alternative, its native token, HYPE, was airdropped to early adopters, fueling its fast adoption. But, questions stay about who precisely is behind Hyperliquid—and whether or not its so-called decentralisation is as actual because it claims.

So, is Hyperliquid the way forward for decentralised buying and selling, or simply one other crypto experiment with hidden centralisation dangers? At present, we’re diving deep into who’s behind it, the way it works, and whether or not it may well dwell as much as the hype.

Hyperliquid’s Origins and Staff

The story of Hyperliquid begins with Jeffrey Yan, a Harvard graduate with a background in arithmetic, algorithmic buying and selling, and software program growth. Earlier than diving into crypto, Jeff labored at Google and a proprietary buying and selling agency known as Hudson River Buying and selling, the place he specialised in constructing high-frequency buying and selling (HFT) algorithms—an expertise that might later form Hyperliquid’s structure.

Jeff first grew to become considering crypto in 2018 after discovering Ethereum and its potential for decentralised purposes. His first try at constructing within the house was a Layer-2 prediction market on Ethereum, however after a couple of months, he deserted the mission. As an alternative, he returned to what he knew greatest—buying and selling.

In early 2020, Jeff based Chameleon Buying and selling, a proprietary crypto buying and selling agency and market maker. In response to him, Chameleon grew into a serious participant within the house, however curiously, there’s virtually no public details about it. The agency’s web site, now offline, contained solely a single sentence: “Global proprietary trading and investment firm.” There’s no LinkedIn profile, no firm particulars, and no official data of its buying and selling exercise.

By late 2022, Chameleon Buying and selling had turned its consideration to DeFi, noticing that regardless of the crypto bear market, decentralised exchanges have been nonetheless pulling in important buying and selling quantity. The collapse of FTX, one of many largest centralised derivatives exchanges, left a large hole available in the market—a spot that Jeff and his staff noticed as a possibility.

This led to the beginning of Hyperliquid, a decentralised derivatives trade designed to supply the identical velocity, effectivity, and deep liquidity as centralised exchanges, however with out the dangers of custody and opaque stability sheets.

Hyperliquid's Distinctive Funding Mannequin

We will’t discuss Hyperliquid with out concerning its controversial funding.

One of many boldest claims Hyperliquid makes is that it launched with none VC funding, ICO, or pre-sale. That is virtually extraordinary within the crypto house, the place most initiatives depend on early-stage enterprise capital or token gross sales to bootstrap growth and supply liquidity. As an alternative, Hyperliquid took a distinct method: a large airdrop of its native token, HYPE, to early adopters—immediately creating a big, engaged consumer base with out promoting tokens to insiders.

At first look, this seems to be a good launch, reinforcing Hyperliquid’s decentralised ethos. Nonetheless, if you look deeper, the query of who truly funded Hyperliquid’s growth and preliminary liquidity stays unanswered.

Constructing a {custom} Layer-1 blockchain, deploying a complicated order book-based DEX, and onboarding customers with out exterior funding is not any small feat. With out VC funding, essentially the most logical supply of capital could be Chameleon Buying and selling—the market-making agency that Hyperliquid’s founder, Jeffrey Yan, ran earlier than launching the trade. Given Chameleon’s supposed success as a buying and selling agency, it’s believable that the staff self-funded Hyperliquid utilizing buying and selling income.

But when that’s the case, this raises one other query: Did Chameleon Buying and selling—or different insider entities—obtain a big portion of the HYPE airdrop?

This has led some to take a position that a good portion of the airdrop was claimed by Chameleon Buying and selling or different market-making entities, that means insiders nonetheless management a considerable amount of HYPE, regardless of the looks of decentralization.

That stated, this stays speculative, and if confirmed false, it might be a refreshing change in an area the place early-stage VC funding tends to dominate.

DEX vs. CEX

Decentralised exchanges (DEXs) have lengthy struggled to compete with centralised exchanges (CEXs) with regards to velocity, liquidity, and consumer expertise. Whereas DEXs supply the benefit of self-custody and censorship resistance, they usually endure from excessive fuel charges, sluggish transaction instances, and fragmented liquidity.

Hyperliquid goals to bridge this hole by providing the most effective of each worlds—the velocity and effectivity of a centralised trade, mixed with the transparency and non-custodial nature of a DEX.

To know what makes Hyperliquid completely different, let’s briefly break down how CEXs and DEXs differ from one another:

| Function | Centralised Change | Decentralised Change |

|---|---|---|

| Custody | Customers deposit funds into trade wallets. The trade holds the property. | Customers commerce instantly from their very own wallets. No third-party custody. |

| Liquidity | Centralised liquidity swimming pools and order books managed by the trade. | Liquidity offered by sensible contracts and exterior market makers. |

| Pace | Trades execute immediately as a result of off-chain order books. | Sometimes slower, as transactions are settled on-chain. |

| Charges | Various buying and selling charges. | Fuel charges apply, however buying and selling charges may be decrease relying on the platform. |

| KYC/Regulation | Normally requires KYC for full performance. | Typically no KYC, making it extra personal and accessible. |

| Safety Dangers | Danger of hacks, trade insolvency, or mismanagement (e.g., FTX collapse). | Sensible contract vulnerabilities and liquidity dangers, however no central level of failure. |

The Hyperliquid Blockchain – A Technical Deep Dive

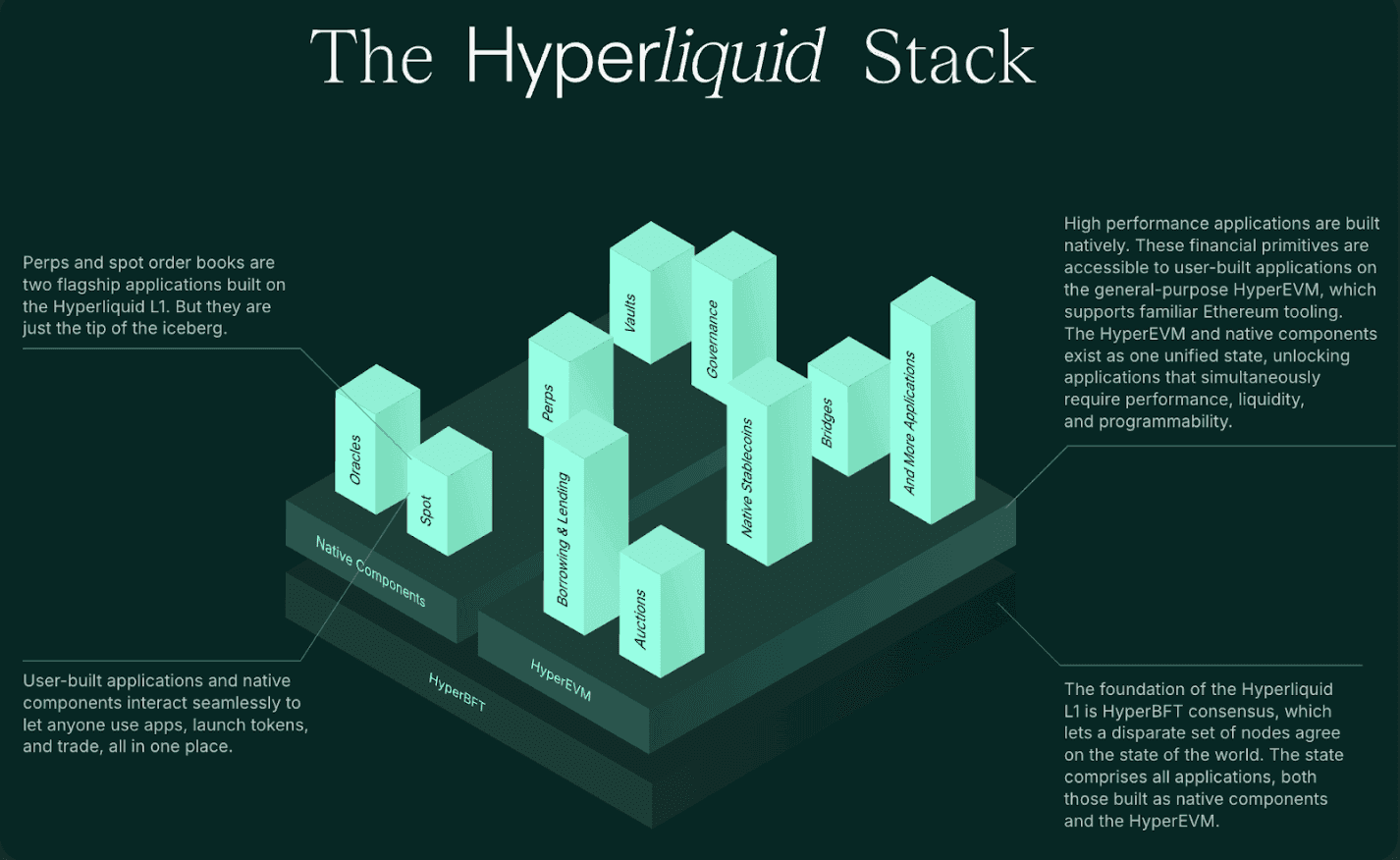

In contrast to most decentralised exchanges, that are constructed on present blockchain networks like Ethereum or Solana, Hyperliquid has taken a distinct method—it operates by itself custom-built Layer-1 blockchain which supplies it an edge by way of velocity, effectivity, and price.

Hyperliquid’s blockchain is powered by two key parts:

- HyperEVM – A custom-built Ethereum Digital Machine (EVM) that permits Hyperliquid to help Ethereum-compatible sensible contracts whereas integrating instantly with its order e book and buying and selling infrastructure.

- HyperBFT – A singular Byzantine Fault Tolerant (BFT) consensus mechanism, designed to deal with high-frequency buying and selling with ultra-low latency.

Collectively, these methods allow Hyperliquid to course of over 200,000 transactions per second (TPS), with a median block time of simply 0.2 seconds—making it one of many quickest blockchains within the business.

HyperEVM

Hyperliquid’s HyperEVM is an Ethereum-compatible execution layer, however not like different EVM implementations, it operates inside the similar consensus layer as Hyperliquid’s L1. This enables for:

- Seamless integration with Hyperliquid’s order e book, enabling sensible contracts to work together instantly with buying and selling capabilities.

- Predictable execution, for the reason that HyperEVM processes transactions sequentially, making certain minimal state discrepancies.

- Fungibility between ERC-20 tokens and Hyperliquid’s native property, permitting for deep liquidity and environment friendly settlement.

In the mean time, HyperEVM just isn’t absolutely general-purpose, that means customers can’t merely deploy any sensible contract they need.

HyperBFT

HyperBFT is Hyperliquid’s {custom} consensus algorithm, impressed by the Hotstuff protocol utilized in another high-performance blockchains. It was designed particularly to deal with high-frequency buying and selling, making certain fast finality whereas sustaining safety.

Right here’s what makes HyperBFT distinctive:

- Sub-Second Block Affirmation – Transactions settle in underneath a second, with a median latency of simply 0.2s.

- Excessive Throughput – The community is able to scaling past 200,000 orders per second.

- Byzantine Fault Tolerance (BFT) – It could actually tolerate as much as one-third of malicious validators whereas sustaining community integrity.

This spectacular velocity, nevertheless, comes at a value—decentralization. When Hyperliquid first launched, it operated with simply 4 validators, a determine that has since elevated to 16.

Easy methods to Fund and Commerce on Hyperliquid

Regardless of its cutting-edge expertise, Hyperliquid just isn’t essentially the most beginner-friendly platform. In contrast to conventional DEXs, which frequently depend on easy swap interfaces, Hyperliquid capabilities extra like a centralised trade with an order e book system—that means customers should first fund their accounts earlier than buying and selling.

There are two main methods to deposit funds into Hyperliquid:

- From a centralised trade like Coinbase or Binance

- Swapping property through a decentralised pockets, similar to Phantom or Metamask

Right here’s how every technique works.

Depositing from a Centralised Change

For these beginning with fiat or crypto on a centralised trade, the method is comparatively simple. Hyperliquid doesn’t help direct fiat deposits, so the most effective method is to purchase USDC on a CEX and switch it to an Arbitrum-compatible pockets earlier than funding a Hyperliquid account.

- Purchase USDC on a CEX – Platforms like Binance, Coinbase, or Kraken permit customers to buy USDC with fiat or different cryptocurrencies.

- Withdraw USDC to an Arbitrum-compatible pockets – Earlier than withdrawing, make sure the receiving pockets helps Arbitrum One. Metamask is essentially the most broadly used possibility.

- Switch USDC to Hyperliquid – As soon as the funds are in Metamask, head to Hyperliquid’s deposit web page, join the pockets, and switch USDC into the trade’s buying and selling account.

As soon as deposited, the USDC will seem within the Perpetuals (PERP) account by default. If the purpose is spot buying and selling, the funds have to be transferred to the Spot Pockets. That is completed by way of the interior switch function on the platform.

Depositing from a Decentralised Pockets

For these already holding crypto in a self-custodial pockets, Hyperliquid may be funded utilizing decentralised swaps.

- Convert crypto to USDC – If holding property like ETH or SOL, use a decentralised trade like Uniswap to swap them for USDC on the Arbitrum community.

- Use a cross-chain bridge if obligatory – If the USDC is on one other community, a cross-chain bridge similar to Mayan Swap can be utilized to maneuver it to Arbitrum.

- Deposit USDC into Hyperliquid – Just like the CEX technique, the funds have to be transferred from the pockets to Hyperliquid’s buying and selling account.

Hyperliquid's Buying and selling Options

Hyperliquid units itself other than most decentralised exchanges by providing a various set of buying and selling choices past easy spot buying and selling. Whereas most DEXs depend on automated market maker (AMM) fashions, Hyperliquid makes use of a completely on-chain order e book, enabling superior buying and selling options sometimes solely discovered on centralised exchanges.

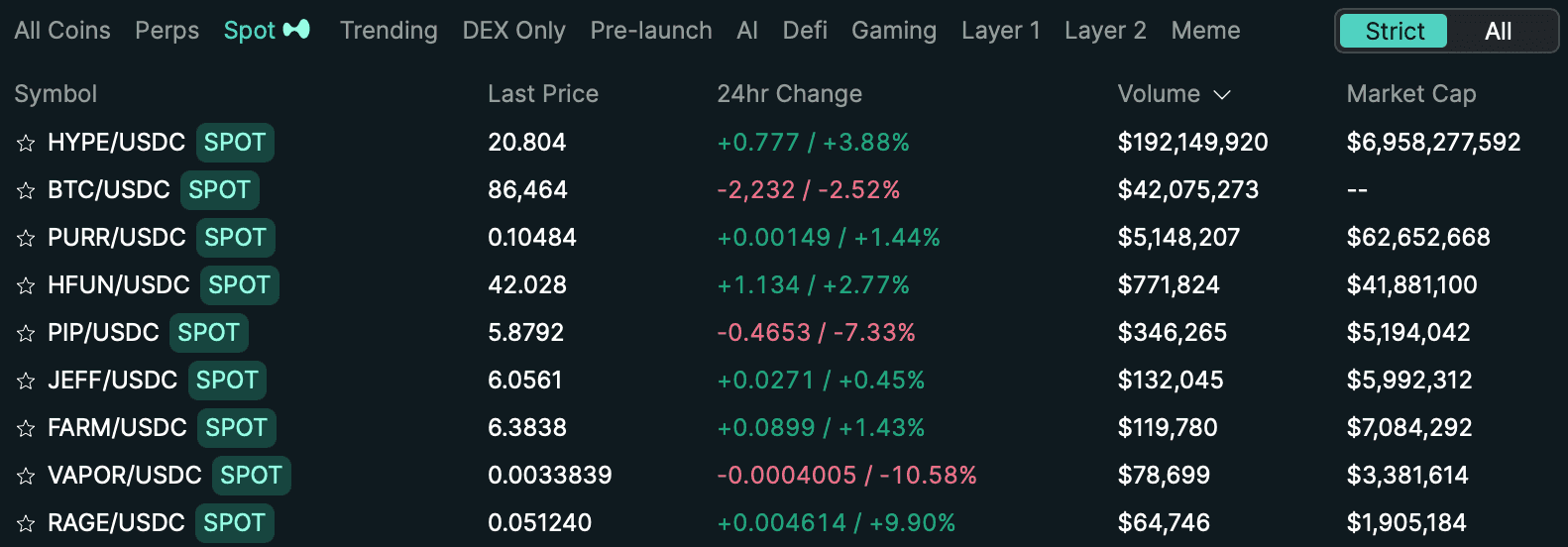

Spot Buying and selling

Hyperliquid’s spot buying and selling market is comparatively small, with simply over a dozen buying and selling pairs obtainable.

Regardless of its restricted choice, Hyperliquid’s spot market advantages from its order e book system, permitting merchants to position market, restrict, stop-limit, and TWAP orders—options that almost all AMM-based DEXs lack.

Nonetheless, spot buying and selling just isn’t Hyperliquid’s main focus. The platform’s actual power lies in its derivatives buying and selling capabilities.

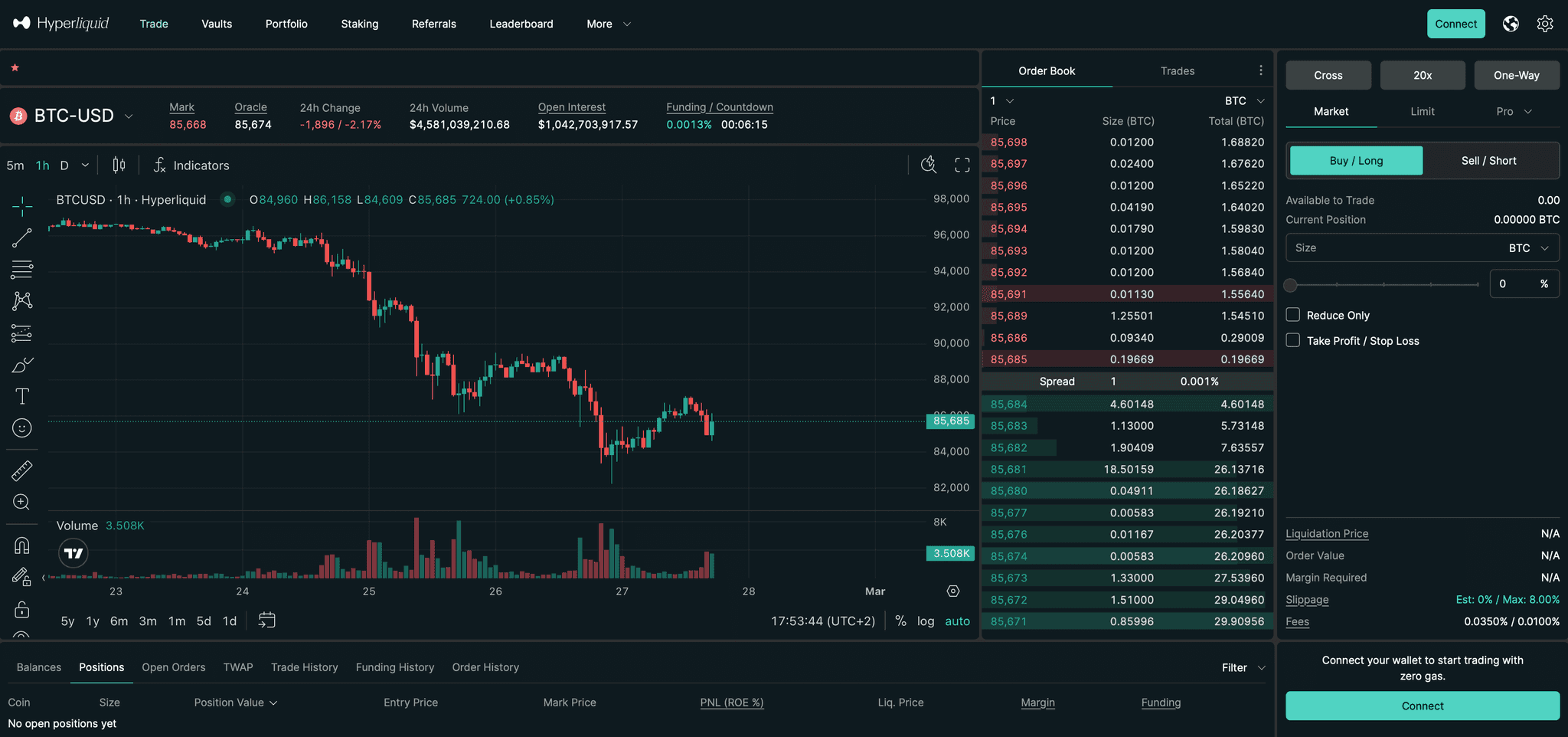

Perpetual Futures

Hyperliquid is primarily designed for perpetual futures buying and selling, providing as much as 50x leverage—a function often reserved for centralised exchanges.

In contrast to conventional futures contracts, perpetual futures don’t have any expiry date, that means merchants can maintain positions indefinitely so long as they keep margin necessities.

Key options of Hyperliquid’s perpetuals market embody:

- A whole bunch of buying and selling pairs, together with BTC, ETH, SOL, XRP, and DOGE.

- Remoted and cross-margin choices – Permitting merchants to handle danger throughout a number of positions.

- Automated liquidations – A system that ensures positions are closed earlier than margin necessities are breached.

These options make Hyperliquid one of the vital superior DEXs for derivatives buying and selling, providing a CEX-like expertise with out requiring KYC or custodial danger.

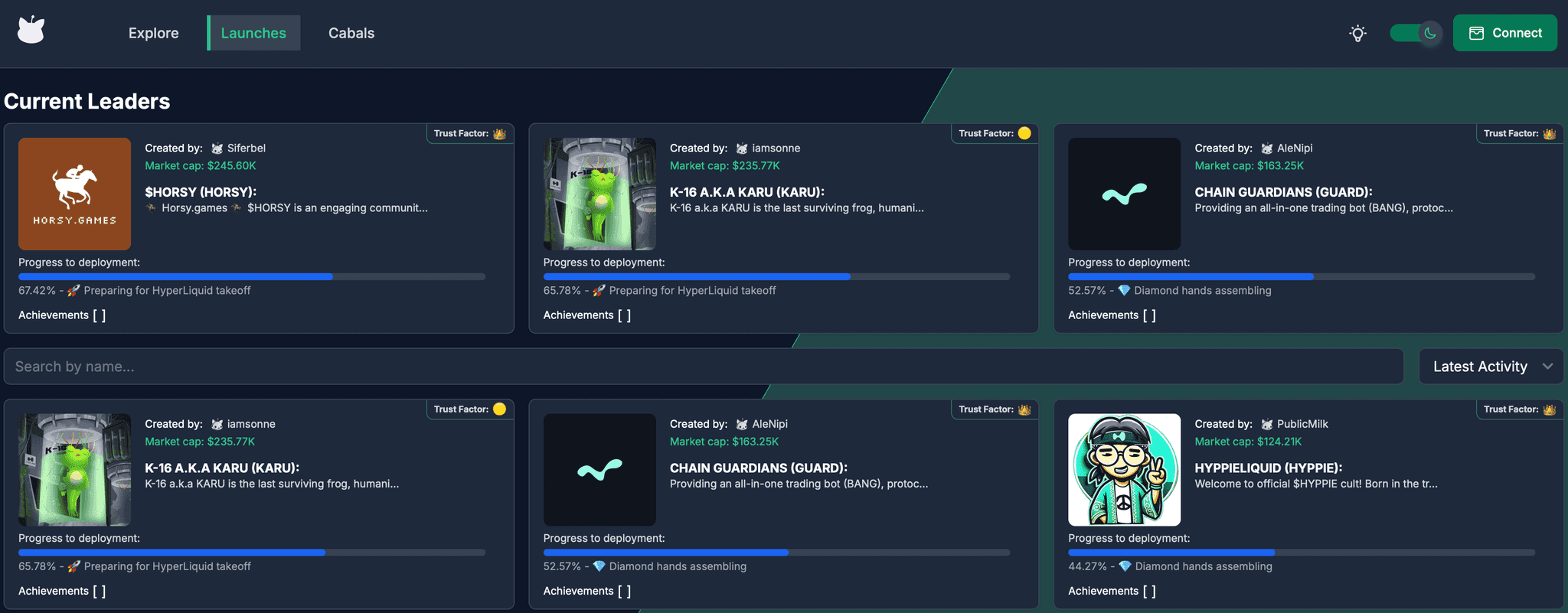

Hyperliquid’s Meme Coin Launcher: Hypurr.enjoyable

In response to the rising reputation of meme cash, Hyperliquid has launched Hypurr.enjoyable, a devoted meme coin launchpad.

Hypurr.enjoyable permits customers to:

- Create and commerce new memecoins and AI brokers instantly on Hyperliquid.

- Use a built-in Telegram buying and selling bot for quick execution.

It’s related in nature to Pump.enjoyable on Solana, however whether or not it may well appeal to the identical stage of consideration stays to be seen—particularly in gentle of latest scandals, such because the failed Libra memecoin launch and allegations of insider promoting surrounding Trump’s personal memecoin.

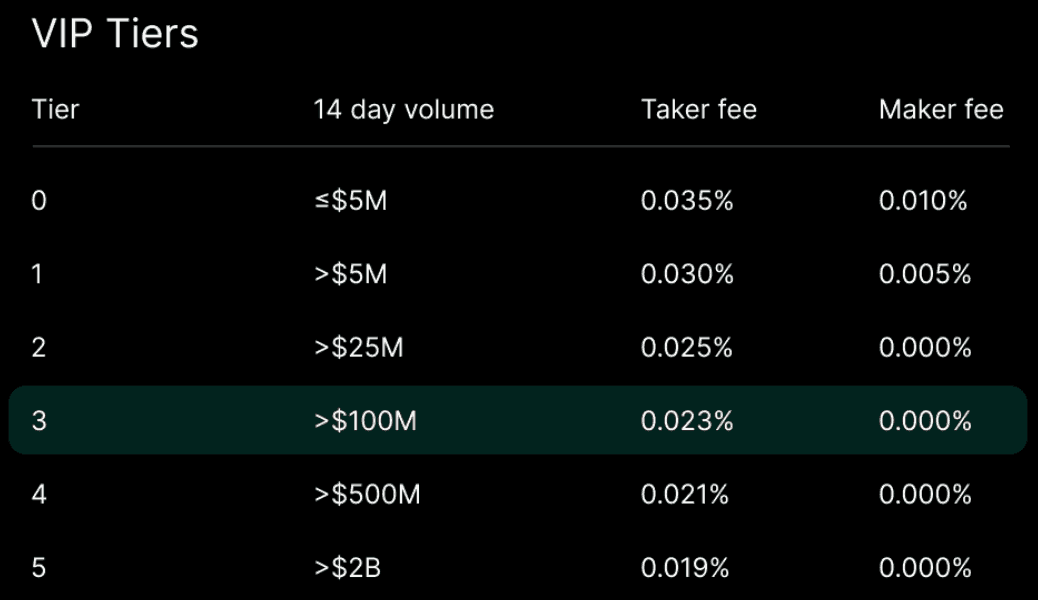

Hyperliquid’s Buying and selling Charges

Hyperliquid operates on a tiered payment construction based mostly on a rolling 14-day buying and selling quantity, with sub-account volumes consolidated underneath the grasp account. In contrast to most exchanges, the place charges primarily profit insiders, Hyperliquid directs all charges to the neighborhood by way of the HLP and help fund.

Under are the payment charges based mostly on the tiered payment construction:

The HYPE Token and Tokenomics

On the coronary heart of Hyperliquid’s ecosystem is HYPE, its native token and like many trade tokens, HYPE performs a key position in staking, governance, and buying and selling incentives.

HYPE’s Utility

HYPE is designed to serve a number of functions inside the Hyperliquid ecosystem. In response to the documentation, the token is used for:

- Staking – Validators and delegators stake HYPE to safe the community and earn rewards.

- Governance – HYPE holders are alleged to have a say in protocol choices, though no clear governance framework has been outlined to this point.

- Fuel Charges – Whereas buying and selling on Hyperliquid is gas-free, transactions on the HyperEVM require HYPE as a fuel token.

- Buying and selling Charge Incentives – Some secondary sources declare {that a} portion of buying and selling charges is used to purchase again and burn HYPE, although this isn’t explicitly said in official documentation.

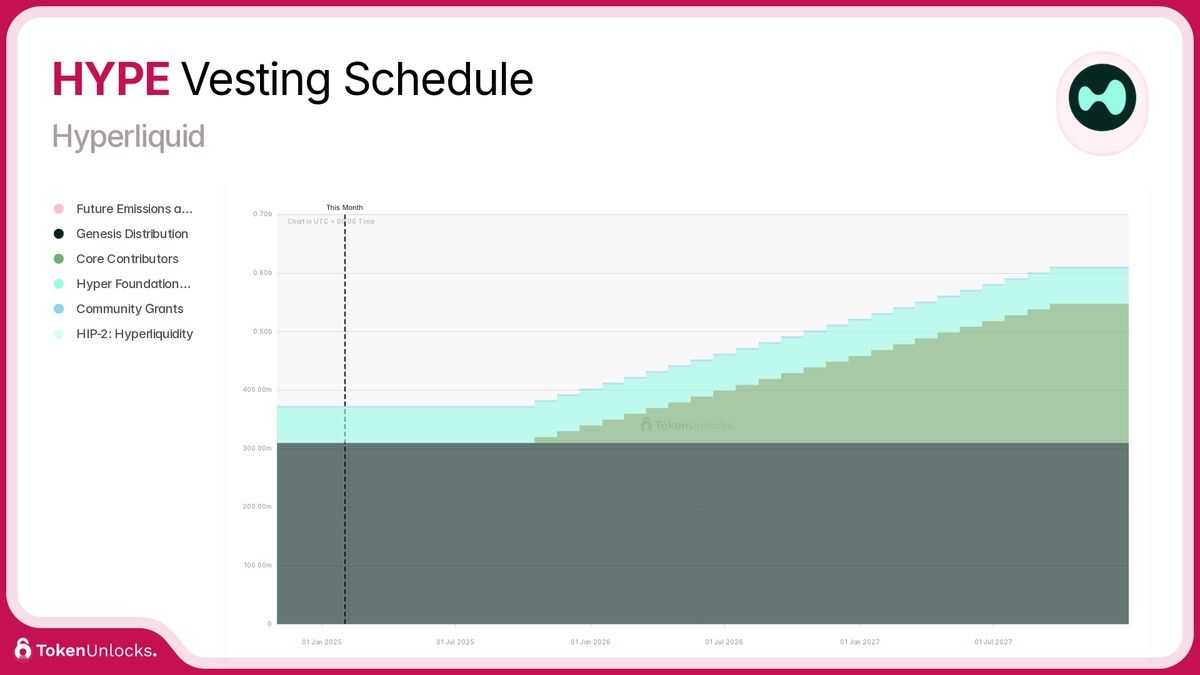

HYPE’s Token Distribution

Hyperliquid’s token allocation is as follows:

- 38% – Future emissions and neighborhood rewards, together with staking incentives.

- 31% – Genesis Distribution, primarily by way of the HYPE airdrop to early customers.

- 23.8% – Contributors, which doubtless contains the core staff and builders.

- 6% – Hyperliquid Basis.

- The rest – Allotted to “Hyper Liquidity,” a vaguely outlined class.

Contributor tokens are locked for one 12 months after the Genesis distribution, with vesting schedules extending till 2028 or past.

Staking

Hyperliquid not too long ago launched HYPE staking, permitting validators and delegators to safe the community in trade for rewards. Nonetheless, the staking mannequin has some notable trade-offs:

- Minimal Validator Stake – The minimal validator stake is about at 10,000 HYPE, with customers having the choice to delegate their tokens to validators. Nonetheless, the documentation doesn’t specify a minimal delegation quantity

- Lockup Durations – Delegation has a one-day lockup, however shifting staked HYPE to a spot account requires a further seven-day withdrawal interval.

- Annual Staking Rewards – Solely 2.3% per 12 months for each validators and delegators, which is considerably decrease than most staking-based networks.

Challenges Going through Hyperliquid

Whereas Hyperliquid has made important strides in constructing a high-performance decentralised buying and selling platform, it’s not with out its flaws. Let’s take a more in-depth take a look at a few of the key challenges it faces.

Centralization and Transparency Issues

One of many greatest considerations surrounding Hyperliquid is its lack of transparency, notably concerning who controls the community and the way governance is dealt with.

- Unclear Governance – Whereas HYPE is meant to be a governance token, there isn’t a governance dashboard, no voting historical past, and no clear mechanism for neighborhood proposals at this stage. This means that decision-making stays centralised inside the core staff.

- Validator Centralization – Because of Hyperliquid’s give attention to velocity and effectivity, its Layer-1 blockchain stays extremely centralised even after growing its validator rely from 4 to sixteen.

Consumer Expertise Hurdles

Hyperliquid is likely one of the most superior buying and selling platforms in DeFi, however its complexity makes it tough for brand new customers to navigate.

A few of the greatest UX challenges embody:

- Funding difficulties – In contrast to CEXs, Hyperliquid doesn’t help fiat deposits, requiring customers to purchase USDC on a separate trade, bridge it to Arbitrum, after which deposit it into the platform. This multi-step course of provides friction for brand new customers.

- Lack of multi-chain help – In contrast to different DEXs that function throughout a number of blockchains, Hyperliquid solely helps Arbitrum for deposits. This limits interoperability and makes funding extra sophisticated in comparison with platforms with native multi-chain help.

These elements might restrict adoption amongst retail merchants, notably those that favor less complicated DeFi platforms like Uniswap or GMX.

Hyperliquid’s Roadmap

In contrast to many crypto initiatives that launch detailed roadmaps, Hyperliquid has taken a extra fluid method to growth, with its staff preferring to adapt based mostly on market situations quite than committing to strict timelines. Nonetheless, insights from interviews with Hyperliquid’s founder, Jeff Yan, present clues about upcoming milestones and long-term ambitions.

Cell App Improvement

One of the extremely anticipated updates is the launch of a Hyperliquid cellular app. On condition that many merchants favor mobile-friendly platforms, this might considerably improve adoption and engagement.

Nonetheless, crypto-related apps usually face strict laws on app shops, notably from Apple and Google, which have beforehand restricted DeFi purposes for compliance causes.

In an interview, Jeff Yan acknowledged that getting approval for a completely purposeful buying and selling app will likely be tough, however the staff is engaged on it. If profitable, this might widen Hyperliquid’s consumer base and enhance accessibility, making it a extra aggressive different to centralised exchanges.

Native USDC Integration

Presently, one of many greatest friction factors for brand new customers is the necessity to bridge USDC from Arbitrum earlier than buying and selling on Hyperliquid. This provides an additional layer of complexity that would deter mainstream adoption.

To deal with this, Hyperliquid plans to combine native USDC through Circle’s CCTP (Cross-Chain Switch Protocol). This implies:

- Customers will be capable to fund their Hyperliquid accounts with USDC from any chain.

- The reliance on third-party bridges like Mayan Swap will likely be decreased.

- The onboarding expertise will turn out to be a lot smoother for brand new customers.

If efficiently applied, this might take away one among Hyperliquid’s greatest limitations to entry, making it way more accessible to each retail and institutional merchants.

Governance

One of many greatest unanswered questions surrounding Hyperliquid is whether or not its governance mannequin will ever be correctly applied.

Whereas HYPE is theoretically a governance token, its governance options are at the moment absent. This has led many to take a position that Hyperliquid’s governance is at the moment centralised inside the core staff.

In the long run, introducing a correct governance system might enhance transparency and decentralization.

Closing Ideas

Hyperliquid has emerged as one of the vital superior decentralised buying and selling platforms, combining CEX-level velocity and effectivity with the self-custody and transparency of DeFi. By constructing its personal Layer-1 blockchain, introducing a completely on-chain order e book, and providing gas-free buying and selling, Hyperliquid has created a DEX not like every other.

Nonetheless, its fast rise has not come with out controversy. Questions on insider management, validator centralisation, and governance opacity elevate considerations about whether or not Hyperliquid is actually as decentralised because it claims. The dearth of fiat on-ramps and multi-chain help might additionally restrict its capacity to scale past skilled crypto merchants.

That being stated, Hyperliquid’s expertise is undeniably spectacular. If it may well tackle considerations about transparency, accessibility, and governance, whereas persevering with to outpace opponents in buying and selling efficiency, it might turn out to be a dominant power in decentralised finance—maybe even difficult centralised exchanges in the long term.

As at all times, solely time will inform.

Often Requested Questions

What’s Hyperliquid, and the way does it differ from different decentralized exchanges?

Hyperliquid is a high-performance decentralized trade (DEX) constructed by itself {custom} Layer-1 blockchain. In contrast to conventional DEXs that use automated market makers (AMMs), Hyperliquid contains a absolutely on-chain order e book, providing CEX-like velocity and deep liquidity whereas sustaining self-custody of property.

How does Hyperliquid obtain such quick transaction speeds?

Hyperliquid’s blockchain is powered by HyperBFT, a {custom} Byzantine Fault Tolerant (BFT) consensus mechanism, enabling block instances of simply 0.2 seconds and throughput exceeding 200,000 transactions per second (TPS). This makes it one of many quickest buying and selling platforms in DeFi.

Is Hyperliquid actually decentralized?

Whereas Hyperliquid markets itself as a decentralized platform, considerations stay over its validator rely and governance mannequin. Initially, the community had solely 4 validators which was later elevated to sixteen. Moreover, HYPE token governance has not been absolutely applied, that means the platform should function underneath a centralized construction.

How do I fund my Hyperliquid account?

Hyperliquid doesn’t help fiat deposits. Customers should:

- Purchase USDC on a centralized trade (CEX) like Binance or Coinbase.

- Withdraw USDC to an Arbitrum-compatible pockets (e.g., Metamask).

- Deposit USDC into Hyperliquid through the platform’s deposit web page.

Alternatively, crypto holders can use decentralized swaps and cross-chain bridges to maneuver funds from different blockchains.

What buying and selling options does Hyperliquid supply?

Hyperliquid offers:

- Spot buying and selling – Shopping for and promoting property instantly.

- Perpetual futures buying and selling – As much as 50x leverage on derivatives contracts.

- HyperFun meme coin launcher – A platform for meme coin hypothesis and buying and selling.