One of many over-arching themes we discover all through the decentralized finance neighborhood is the need to present entry to monetary instruments and sources to these which were underserved by conventional banking and finance establishments.

The necessity for this has come about because of the extremely concentrated nature of the worldwide monetary markets, the place a big share of the world’s wealth is held by a comparatively small variety of people and firms.

It’s additionally notable that a lot of the world’s wealth is confined to sure geographical areas. Due to this focus of wealth, most of the world’s residents haven’t had entry to the essential monetary providers and instruments that many take as a right.

In recent times it’s been instructed that creating tokenized property on permissionless blockchains is the way in which ahead if we want to give all international residents entry to monetary providers and markets. As well as, these decentralized finance programs are anticipated to enhance the effectivity of present monetary markets, whereas additionally offering a variety of different advantages.

Sadly asset tokenization has some actual points when it comes to regulatory pressures and the know-how essential to make them work correctly. Due to this early tasks bumped into regulatory points and issues with incompatible applied sciences. Some early tasks have targeted totally on digitizing bodily property similar to actual property and gold, and these have seen a modicum of success.

Transferring into the present blockchain trade we will see a pattern in direction of tokenizing extra summary property similar to shares and bonds. The continuing DeFi revolution has created a tsunami of latest merchandise, primarily in two classes: Asset-Backed Tokens and Artificial Belongings.

Anybody acquainted with DeFi will likely be acquainted with the preferred asset-backed tokens, that are backed by the bodily or different asset they symbolize. For instance, many DeFi protocols are actually utilizing an abstracted type of Bitcoin generally known as Wrapped Bitcoin (WBTC). This isn’t precise Bitcoin, however is a one-to-one illustration of the Bitcoin that’s held by BitGo. It’s a easy and intuitive design that’s straightforward to know and works so nicely for its functions.

Nonetheless these asset-backed tokens usually are not supreme. They nonetheless endure from centralized custody dangers, regulatory hurdles for the issuers, and generally extreme charges. Nonetheless there’s one other means. That’s artificial property, and one of many tasks main the way in which on this space is the Mirror Protocol.

The Mirror Protocol guarantees the flexibility to commerce equities (U.S. equities at the moment) 24/7 wherever on the earth by any individual. The venture does this by minting artificial property, or what they’ve named Mirror Belongings (mAssets). It was created by and runs on the Terra Community, and is powered by good contracts. The way in which they’re designed, any mAsset created is supposed to reflect the value conduct of the underlying represented real-world asset.

On this means anybody on the earth may, for instance, commerce in artificial mirrored shares of Tesla 24/7 from wherever on the earth, and the value could be precisely the identical as the value of the particular Tesla inventory. All of the buying and selling is secured by the blockchain in a permissionless system. That is a particularly highly effective creation, particularly contemplating the occasions seen on the Robinhood change in early 2021.

Mirror Protocol Overview

The mAssets created by the Mirror protocol are artificial variations of their real-life counterparts. They mimic the value of the underlying property, and could be traded on secondary markets similar to the underlying property.

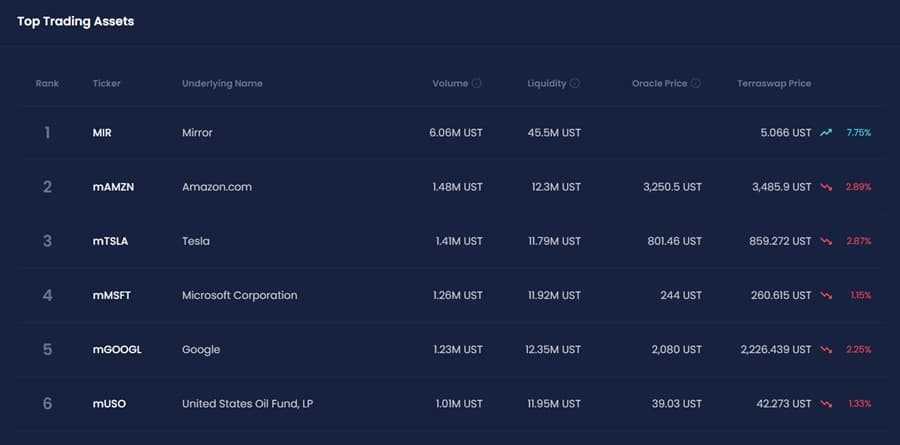

These embody the Terraswap AMM from Terra and Ethereum’s Uniswap. In its present state the mAssets created mirror main U.S. equities and ETFs, however there are extra property deliberate for the longer term. You may see the platform and a full itemizing of the at the moment accessible property right here.

The entire system is ruled utilizing the MIR token, and it’s also used to incentivize staking to safe the system. There are 5 major customers within the Mirror ecosystem:

- Merchants

- Minters

- Liquidity Suppliers

- Stakers

- Oracle Feeders

Merchants

That is the most important group of Mirror customers. They’re those shopping for and promoting mAssets utilizing the Terra UST stablecoin as a peg. That is finished at Terra’s Terraswap AMM or on the Uniswap AMM run on Ethereum. All the system has vital implications for opening up entry to overseas buying and selling markets and to different asset courses usually not accessible by the overwhelming majority of humanity.

For instance, a dealer in Hong Kong can now commerce a spinoff that offers them publicity to any U.S. inventory with out paying extreme capital beneficial properties taxes, with out utilizing costly worldwide inventory brokers, and with out going via an onerous KYC course of. Mirror Finanace is permitting folks to sidestep the stringent capital controls which have advanced over time as a method to regulate the world’s wealth.

Minters

That is the group accountable for the creation and issuance of the mAssets. These mAssets are created by locking up collateral at an overcollateralization ratio that’s set by the governance parameters of Mirror. It really works in an identical method to the issuance of DAI by Maker.

Minters lock up their collateral in a collateralized debt place (CDP) which could be backed by UST or by one other mAsset. Minters want to observe their positions and add extra collateral if the ratio drops under a set minimal, in any other case they might face the liquidation of their place. Minters are additionally capable of withdraw their place at any time, and it ends in the burning of the mAsset and the return of the CDP collateral.

Liquidity Suppliers

This group provides the liquidity wanted by AMM swimming pools. Similarly to Uniswap, the liquidity suppliers put in an equal worth of UST and the mAsset on the AMM and as a reward they obtain LP tokens which can be funded by the buying and selling charges of the pool.

Stakers

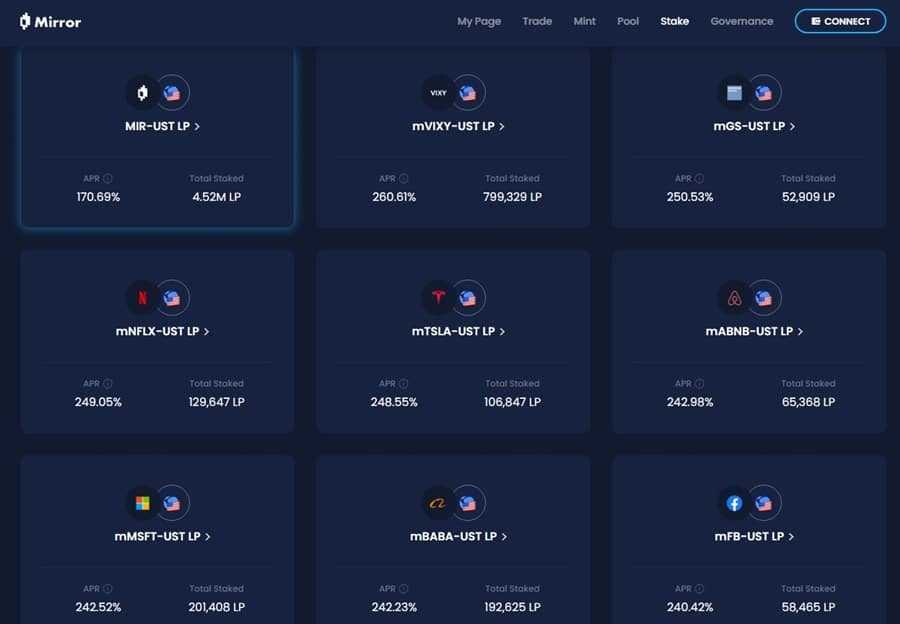

There are two kinds of stakers discovered on Mirror. The primary are the liquidity suppliers who’re capable of stake the LP tokens they obtain and obtain staking rewards within the type of native MIR tokens based mostly on the emission schedule. The second sort of staking is completed by MIR token holders who stake that MIR and earn the withdrawal charges from the CDP.

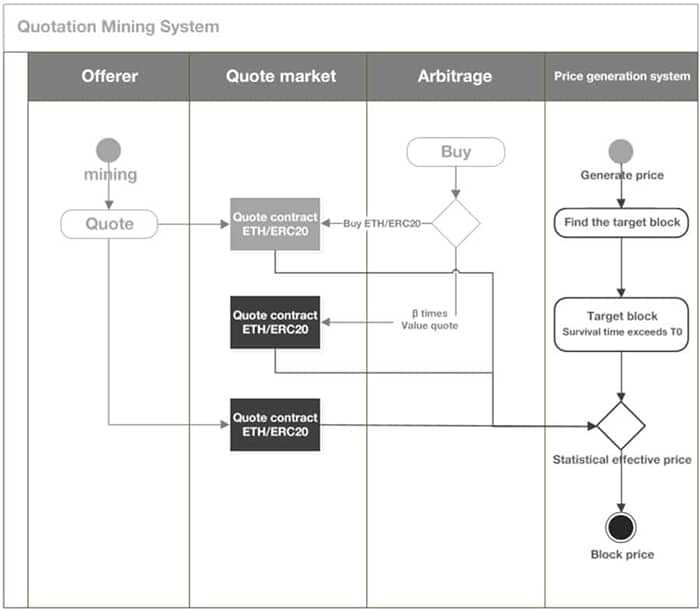

Oracle Feeder

The Oracle Feeder is essential to the Mirror ecosystem since it’s the mechanism used to make sure that the mAssets retain a match with their underlying property. The Oracle Feeder is an elected place and as of February 2021 the place is operated by the Band Protocol. The Oracle value and the change value create an incentive construction to buying and selling by creating arbitrage alternatives. This additionally maintains the mAsset value in a decent vary close to the precise value of the underlying.

For instance, when the value of an asset is increased on the change than it’s from the Oracle value market contributors have an incentive to mint and promote that asset on Terraswap to generate a revenue. Consequently additionally they tighten the value distinction between the change and oracle. The identical is true when the change value is under the oracle value. On this case there’s an incentive to buy and burn the mAsset, which brings the 2 costs again nearer collectively.

Mirror contributors have their incentives balanced in such a means that worth creation is promoted, and adoption is inspired. The MIR token acts as an ingenious when staked, and can also be used as a governance token for probably altering the parameters utilized by Mirror, such because the minimal collateral ratios. It can be staked in polls for whitelisting mAssets.

Who’re Terraform Labs

As a result of Mirror Finance was created by Terraform Labs and runs on the Terra Community you will need to know the background and who Terraform Labs is.

Terraform Labs is an organization based mostly in South Korea that was based in January 2018 by Do Kwon and Daniel Shin. With $32 million backing from massive enterprise capital companies similar to Polychain Capital, Pantera Capital, and Coinbase Ventures they quickly launched the stablecoin LUNA.

In addition they created the Terra Community, which was designed to be a decentralized international cost system. It options minimal transaction charges and is ready to settle a transaction in simply 6 seconds. Whereas it hasn’t gained traction but in Europe and the Americas it does have over 2 million month-to-month distinctive customers producing over $2 billion in month-to-month transaction volumes.

The majority of those are via the South Korean cost platform CHAI and the Mongolia-based MemePay. The LUNA token is considerably distinctive amongst stablecoins because it distributes yield again to its holders. That yield comes from the transaction charges, that are returned 100% to LUNA holders. You may study extra within the Terra Cash whitepaper.

What are mAssets?

The Mirror Protocol is absolutely decentralized and neighborhood pushed. Terraform Labs and its founders and workers don’t have any particular administrative features on the platform, and there was no premine of the MIR tokens.

The primary bridge created by the Mirror Protocol was to the Ethereum Community, which enabled buying and selling on Uniswap. Extra lately the Mirror Protocol was bridged to the Binance Sensible Chain (BSC), permitting the BSC neighborhood entry to the tokenized artificial property created on Mirror.

At the moment the property which were tokenized are U.S. equities, nonetheless the Mirror Protocol permits for any bodily of summary asset to be created as an mAsset. Which means future use instances may see paintings, actual property, treasured metals, commodities, fiat and crypto currencies, and different asset varieties added as mAssets. There may be already curiosity in minting bonds, futures, and different derivatives as mAssets.

There have been 14 property that had been added to the Mirror Protocol when it initially launched. These are MIR (Mirror), AMZN (Amazon), TSLA (Tesla), MSFT (Microsoft), GOOGL (Alphabet), BABA (Alibaba), AAPL (Apple), NFLX (Netflix), TWTR (Twitter), IAU (iShares Gold Belief), SLV (iShares Silver Belief), QQQ (Invesco QQQ Belief), VIXY (ProShares VIX), and USO (United States Oil Fund LP). In January 2021 a governance vote authorized the addition of BTC, ETH, ABNB (Airbnb), GS (Goldman Sachs Group), and FB (Fb) to the unique 14.

In idea nearly something with worth may very well be tokenized on Mirror and it brings all the next advantages:

- 24/7 permission-less buying and selling wherever on the earth

- No want for intermediaries; all transactions will likely be on the permission much less blockchain ledger.

- The tokenization permits customers to commerce fractions of an asset.

- For some property, the tokenization will enable for higher liquidity.

- Using good contracts on the blockchain will considerably reduce authorized and operational prices.

- By the tokenization, property will likely be extra accessible; the fractional possession will enable much less liquid customers to take part.

The artificial property minted on the Mirror Protocol are all referred to as mAssets since they use the prefix of “m” within the ticker for the artificial asset. So Tesla (TSLA) turns into mTSLA and Apple (AAPL) turns into mAAPL. The entire mAssets share the next fundamental mechanics:

- To create an mAsset customers should lock up 150% of UST's present asset worth or 200% if utilizing different mAssets as collateral.

- If positions go beneath the minimal collateral ratio extra collateral have to be added, in any other case they are going to be liquidated; this measure regulates and secures the minting course of.

- When redeeming any mAsset, customers should burn an equal quantity of mAssets issued when opening the CDP to get again the supplied collateral.

- Belongings are listed and could be traded on numerous AMM DEXs like PancakeSwap (BSC), TerraSwap (Terra), and Uniswap (Ethereum). A few of the buying and selling charges movement again as an incentive for liquidity suppliers.

- A value Oracle that updates each 30 seconds ensures that the mAsset is pegged to the actual asset. When oracle and change costs differ it incentivizes merchants to arbitrage and produce the costs again to equilibrium.

mAssets could be traded in hypothesis, they are often held, or they can be utilized for different functions similar to including collateral in creating new mAssets, creating artificial secure swimming pools, creating liquidity swimming pools for decentralized exchanges, and lots of different makes use of.

The good contracts used to create the artificial property and maintain the collateral for such have been absolutely audited by the cyber-security agency Cyber Unit and have been discovered to be safe.

Binance Sensible Chain and Mirror

As talked about above, the Binance Sensible Chain is the most recent community so as to add Mirror. On January 22, 2021 the Mirror Protocol was added to BSC, starting with a partnership with PancakeSwap.

It is a profitable transfer for each side as Mirror advantages from the added person base and adoption, whereas Pancake Swap turns into an innovator because it provides 4 of the tokenized mAssets to the AMM, permitting its customers to offer liquidity and to earn yield within the course of.

Binance Sensible Chain started with just some of the Mirror contracts tradeable on the PancakeSwap platform. These 4 had been mAMZN, mGOOGL, mNFLX, and mTSLA. Extra are deliberate for the longer term.

The MIR Token

The MIR token is the native token of the Mirror Protocol and it’s used for governance, for staking, and to reward liquidity suppliers. The rewards paid out come from the charges which can be paid for closing positions on mAssets, for creating polls, and buying and selling charges.

Mir was created with a hard and fast provide of 370,575,000 tokens, all of which will likely be launched over a interval of 4 years.

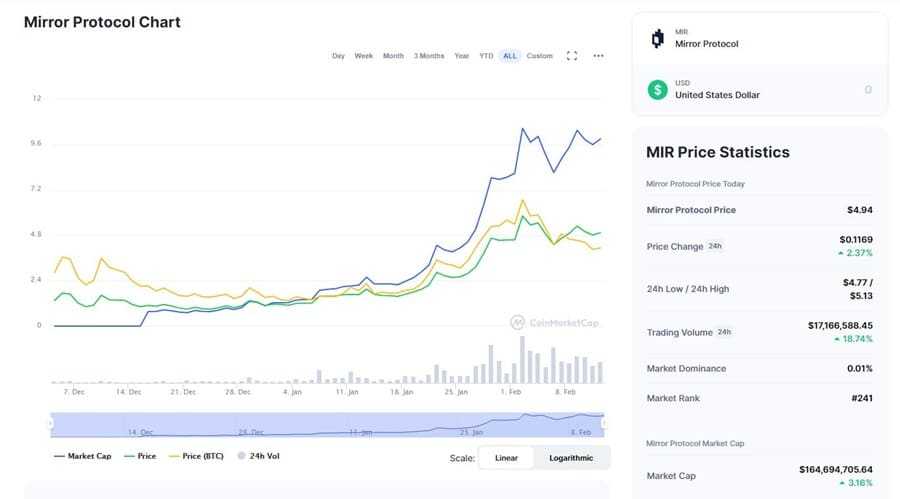

As of February 2021 there are 33,425,682 MIR in circulation. The market capitalization of the token is sort of $165 million and the token is #241 when it comes to market capitalization on Coinmarketcap.com. The token shouldn’t be confused with the Mir Coin, which makes use of the identical ticker, however is a transactional coin with its personal blockchain and ecosystem.

Those that want to earn MIR tokens can accomplish that in three other ways:

- By staking $LUNA, this requires the usage of the Station Pockets desktop app.

- By offering liquidity to MIR/UST pair.

- By offering liquidity to any mAsset/UST pool pairs (non-BNB)

There was no pre-mine or ICO concerned with the MIR token and the preliminary 18.3 million MIR tokens had been airdropped to holders of LUNA and UNI. On November 23, 2020 every person with LUNA staked obtained MIR on a pro-rata foundation and every UNI holder with at the very least 100 UNI obtained 220 MIR.

As you may see from the chart above the value of MIR closed on its first day of buying and selling on December 4, 2020 at $1.41 and declined initially, in all probability as a few of these early airdrop recipients cashed in, however by late December 2020 the coin had hit a backside and commenced recovering.

Since then it has surged increased alongside the broader crypto markets and as of mid-February 2021 it’s buying and selling round $5.00. That’s a reasonably good return for an airdropped token, and those that’ve held on are probably fairly happy.

Mirror Protocol Future

The Mirror Protocol went stay on December 3, 2021 and has seen wonderful adoption within the quick time it’s been in existence. Along with the net app that permits for buying and selling, minting, staking, and governance, there’s additionally a cellular app for buying and selling. Moreover, Mirror has created bridges to Ethereum and to Binance Sensible Chain that permits for seamless porting of mAssets between the chains. The Ethereum bridge was the primary ever cross-chain bridge for artificial property.

Mirror has been very energetic in creating partnerships throughout its first two months of existence, and we might count on that they are going to proceed spreading the provision of mAssets to as many platforms as potential, growing liquidity and the person base as they go.

As Mirror heads into its third month of existence its TVL has greater than tripled, at the moment at $330 million inside two months of launch. On common, 30,000 transactions are carried out and $36 million in property are traded on a 24 hour foundation. Liquidity (the full worth of all mAssets and UST in liquidity swimming pools) stands at $160 million.

These solely within the buying and selling function of Mirror have a number of choices. Apart from the net app there’s additionally a cellular app launched by ATQ Capital and accessible for Android gadgets (there’s a hyperlink for an iOS model on the Mirror web site, however it’s a useless hyperlink and we couldn’t find an iOS model of the app).

There’s additionally a partnership with Masks Community that permits customers to buy mAssets proper on Twitter.

It’s additionally been good to see the governance function working fairly nicely within the early days of the venture. The primary vote noticed 5 new property added to Mirror, and over 60 on-chain proposals for the neighborhood to think about. It’s a wonderful begin, and ultimately the purpose is to create a listing that spans a whole lot, if not hundreds of property and mix it with a smooth person interface that rivals even one of the best of the net brokers.

One of many extremely anticipated additions to Mirror is the Anchor Protocol product, a financial savings protocol on the Terra blockchain that provides yield powered by block rewards of main Proof-of-Stake blockchains. Anchor gives a principal-protected stablecoin financial savings product that pays depositors a secure rate of interest.

It achieves this by stabilizing the deposit rate of interest with block rewards accruing to property which can be used to borrow stablecoins. Anchor will thus provide DeFi’s benchmark rate of interest, decided by the yield of the PoS blockchains with highest demand. In the end, the Terra workforce envisions Anchor to change into the gold customary for passive earnings on the blockchain.

Whereas the workings beneath the hood are little doubt complicated, there’s no denying it’s nicely price creating. The artificial property being supplied by Mirror are extraordinarily highly effective. Future use instances may dramatically stage the enjoying discipline on the subject of wealth creation throughout the globe, particularly when a user-friendly interface like Mirror is a part of the method. Maybe Mirror is the start of a brand new technology of merchants who will know nothing greater than mAssets and their like.

Mirror Protocol Governance

Governance within the Mirror Protocol is managed by the MIR token. Anybody who’s staking MIR tokens can take part within the governance of the system. The voting energy of the person is decided by the quantity of MIR that’s being staked, and the extra MIR staked, the better the voting energy.

It’s potential for anybody to create a brand new governance proposal, generally known as a ballot, and within the first month of its operation Mirror noticed 50 discussion board proposals and 60 on-chain proposals put ahead. Notice that with the intention to make a proposal it’s essential to stake a deposit of MIR tokens and if the proposal is just not adopted that deposit is forfeit.

Within the occasion a proposal meets all the required threshold and quorum parameters and is then voted “yes” by the neighborhood, the Mirror Governance Contract robotically executes the parameters specified within the proposal. This governance contract is ready to invoke any of the features which can be outlined to be used within the Mirror good contracts. So, there isn’t any must replace the core protocol to implement proposals.

There isn’t a exterior affect in any of this, and no third-party, not even the Terra Labs founders, has any particular administrative privileges over the protocol. It’s absolutely permissionless and decentralized, working solely on a neighborhood ruled precept.

Conclusion

Being able to tokenize any asset and commerce it freely from wherever on the earth at any time of the day or night time is an incredible lead ahead for finance. It permits folks to enter markets they in any other case would by no means have entry to, and it ranges the enjoying discipline when it comes to monetary freedom. Because the utilization of mAssets grows we are going to change into free of the constraints which were positioned on buying and selling, investing, and saving. That is the ability of decentralized finance.

The Mirror platform can also be fairly beneficiant when it comes to incentives paid out to those that stake or present liquidity for the platform. Because the attain of the mAssets grows these incentives can solely enhance in worth.

The dedication of the Terraform Labs workforce to the venture, and their selflessness in releasing it with no pre-mine, and with out some maintain on the venture is admirable. And with the robust neighborhood that’s constructing across the venture it’s pretty sure it’s going through an thrilling future.

Younger merchants have little belief or religion in Wall Avenue and the establishments that kind our fashionable monetary programs. Mirror Finance provides them a wonderful different, and because the platform grows, so too will the quantity, breadth and vary of property accessible as mAssets.

Total the Mirror Protocol is an modern and wanted service that’s come alongside at precisely the correct time. You may keep updated on Mirror Protocol’s progress by following them on Twitter and of their Telegram group.