There is no such thing as a solution to sugar-coat the truth that crypto costs are down within the dumps, and plenty of of our favorite belongings are falling sooner than my grandfather falls asleep after a 7 pm dinner. Whereas lots of our portfolios could also be within the crimson, as crypto merchants, there are methods we are able to make a revenue even in a bear market. So, is short-selling crypto a good suggestion? Effectively, that’s exactly what we’re going to be exploring as we speak.

As somebody who was an energetic dealer for years, was a member of aggressive buying and selling groups and attended “trading schools”, I’ve had greater than my justifiable share of errors and triumphs over time. I’m glad to have the ability to carry this text and my expertise to our neighborhood as we speak, as training is so necessary on this trade. Far too many influencers are making ridiculous claims about buying and selling and primarily promoting the modern-day model of magic beans and snake oil. This text will characteristic no BS information about crypto buying and selling that can assist you perceive if shorting crypto is best for you.

What’s Shorting Crypto?

There are a few methods to strategy investing and buying and selling, and this goes for shares, foreign exchange, commodities, crypto, and nearly any asset that may be discovered on a chart. Heck, a lot of the data on this article is as related to belongings similar to gold, corn, cotton, soybeans, or oil as it’s to crypto. You title it; if it has a chart, it may be traded and shorted.

Whereas the commonest strategy to investing is shopping for one thing and holding it, hoping it will increase in worth earlier than you promote it, there are methods that buyers and merchants can make the most of falling costs. This is named quick promoting or just shorting. I’ll use Bitcoin for instance, however this is applicable to any asset.

Bitcoin shorting is the act of promoting the cryptocurrency within the hope that it falls in worth, then shopping for it again at a lower cost, or just cashing out and working laughing to the financial institution as revenue was earned within the worth distinction between when the promote place was opened and when it was closed.

the basic investing mantra, “buy low and sell high,” shorting is actually that, however in reverse.

Merchants can revenue from the distinction in worth actions, so if Bitcoin is at 25k and a dealer anticipates it’ll go decrease, they will “sell” at 25k, then shut out the place in revenue any time Bitcoin worth is under 25k (after charges, in fact).

To open a brief place, a dealer borrows a cryptocurrency and sells it on an change on the present worth or a specified set off worth. The dealer then buys the cryptocurrency later when the place is closed and repays the capital borrowed. If the value has dropped, the dealer will make a revenue on the distinction between shopping for and promoting.

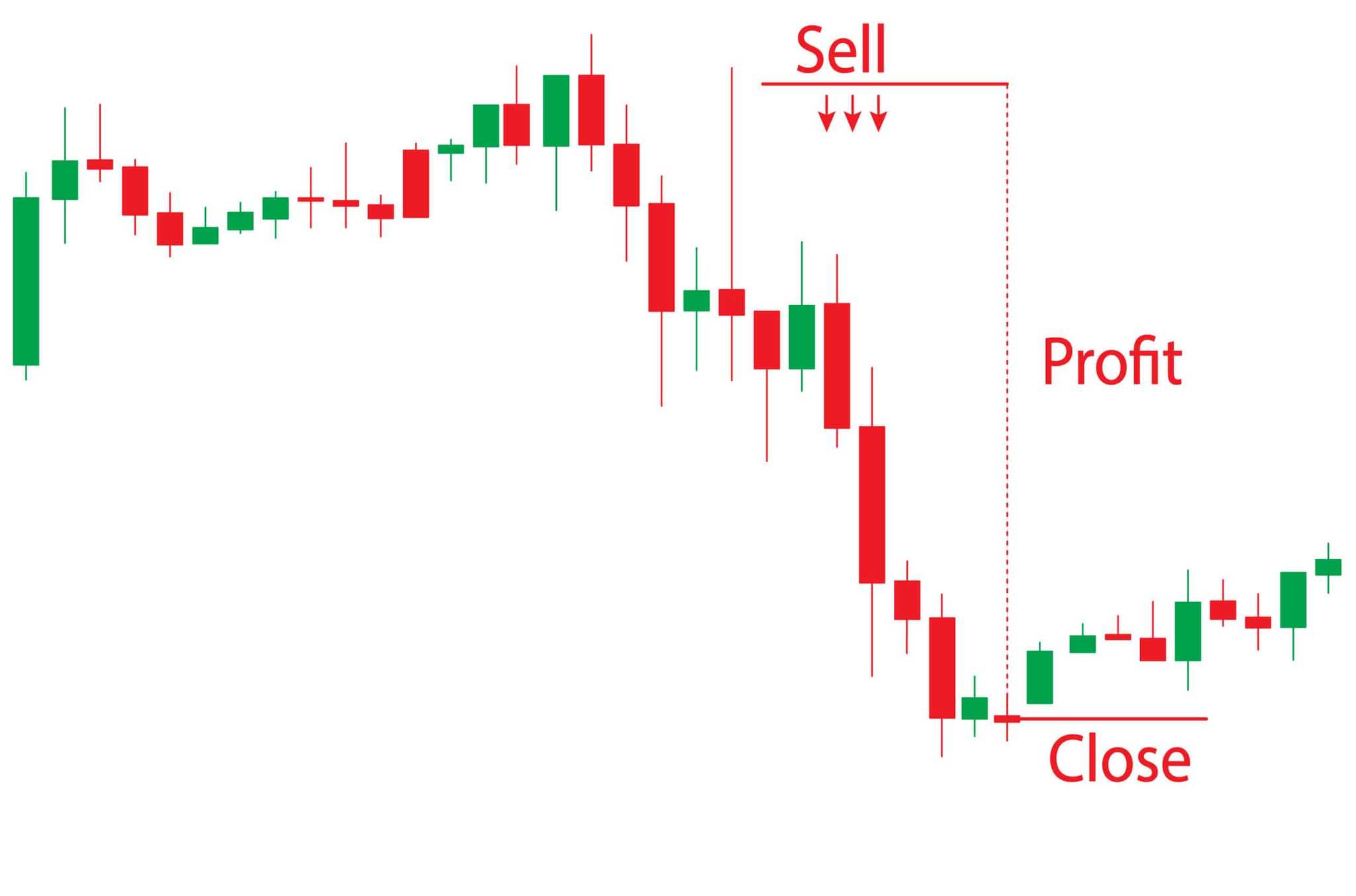

Right here is a good visible from DailyFX that explains this. The instance is of promoting shares, however the idea is identical for crypto:

This may increasingly sound fairly difficult, however most of this occurs behind the scenes. This occurs by a dealer merely hitting the “sell” button to open their place, then the “close” button, or setting a revenue or loss goal to shut the place. All of it occurs with a few clicks of a button.

Let’s take a look at an instance to verify we totally grasp this idea:

- A dealer needs to quick one Bitcoin when the market worth is 40k. By hitting the promote button, the dealer borrows one Bitcoin from the change and is seeking to shut the place at market worth later. The dealer now holds 1 BTC value 40k in what is named an “open,” or “floating” place.

- The value of Bitcoin drops to 30k.

- If the dealer had their revenue goal hit right here or closed their commerce, that motion primarily buys one Bitcoin at this worth of 30k and returns it to the dealer. Keep in mind that you solely owe the dealer 1 Bitcoin at market worth, so although you borrowed 1 BTC at 40k, you solely have to pay again that 1 BTC, which is now solely value 30k (plus buying and selling charges, in fact).

- The dealer retains the distinction between the sale and buy worth, that means $40,000 – $30,000= $10,000 revenue minus any curiosity, charges, and never contemplating leverage.

That is how the commonest technique of shorting crypto works when buying and selling on margin or the spot market with leveraged devices. Nevertheless, there are extra superior strategies of shorting crypto utilizing futures, choices, and CFDs that work in another way. I’ll point out these later however can’t go into element right here on the way it all works with out turning this text right into a textbook.

Why Quick Promote Crypto?

Merchants who quick Bitcoin or any asset have a bearish view of the marketplace for the time-frame they’re buying and selling inside. It’s doable to have a long-term bullish outlook on crypto however anticipate that it’s going to drop in worth over the following couple of minutes, hours, days, weeks, or months. The truth is, many merchants can have long-term purchase trades open as they could really feel the asset will likely be larger in worth in every week or month, for instance, however might have promote positions over the following few hours or days as they anticipate it might drop earlier than then.

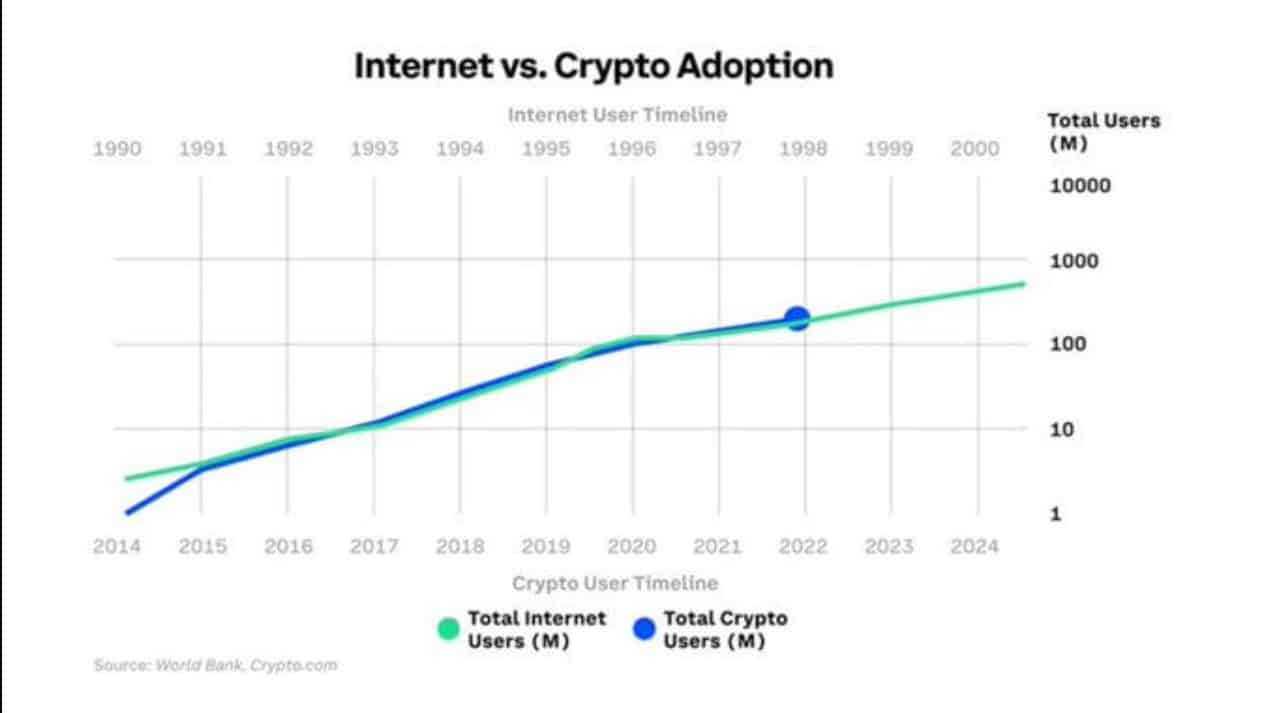

It’s important for merchants who intend to quick Bitcoin, or any asset, to maintain updated with information and modifications within the trade which can have an effect on the value and volatility of the asset. Whereas many merchants might quick crypto within the quick time period, it’s good to take into account that this trade is seeing numerous rising optimism. Many banks, establishments, and even governments are optimistic about the way forward for crypto and blockchain, and adoption is quickly rising.

This results in long-term short-sell positions or investments carrying the next diploma of threat as Bitcoin’s worth has appreciated considerably on an extended time horizon, and plenty of really feel it’ll proceed its long-term upwards worth trajectory over time.

Bitcoin has been topped as the best-performing asset class of the previous decade. Its reputation and adoption are rising sooner than the expansion of the web within the early 90s.

This results in many buyers believing {that a} long-term guess on Bitcoin dropping in worth might not be the soundest funding alternative, as that is typically in comparison with betting in opposition to the web within the 90s. This, in fact, shouldn’t be funding recommendation and is just my opinion and the opinions of many merchants and buyers. If you’re a crypto skeptic and don’t consider within the long-term potential of blockchain innovation, you aren’t alone. Many crypto-critics fortunately make investments and commerce in methods that can revenue if the crypto market crumbles; solely time will inform the end result.

Eight Methods to Quick Bitcoin and Different Cryptocurrencies

There are numerous methods for buyers and merchants to capitalize on the value of Bitcoin and digital belongings going decrease. Some are fairly simple, similar to shorting on the spot or margin market, whereas others might be extra complicated similar to accessing binary choices buying and selling, CFDs or Inverse ETPs. Let’s cowl a few of these under:

Margin Buying and selling

The most typical solution to quick Bitcoin is thru a cryptocurrency buying and selling platform similar to Binance or OKX that helps margin buying and selling. This manner is frequent because it provides merchants entry to leverage and makes it straightforward to grasp and execute trades.

Margin buying and selling can also be essentially the most extensively featured buying and selling kind accessible on most cryptocurrency exchanges. Margin buying and selling permits buyers and speculators to “borrow” cash from a dealer to make a commerce. Crypto exchanges supply anyplace between 1x leverage as much as 125x leverage.

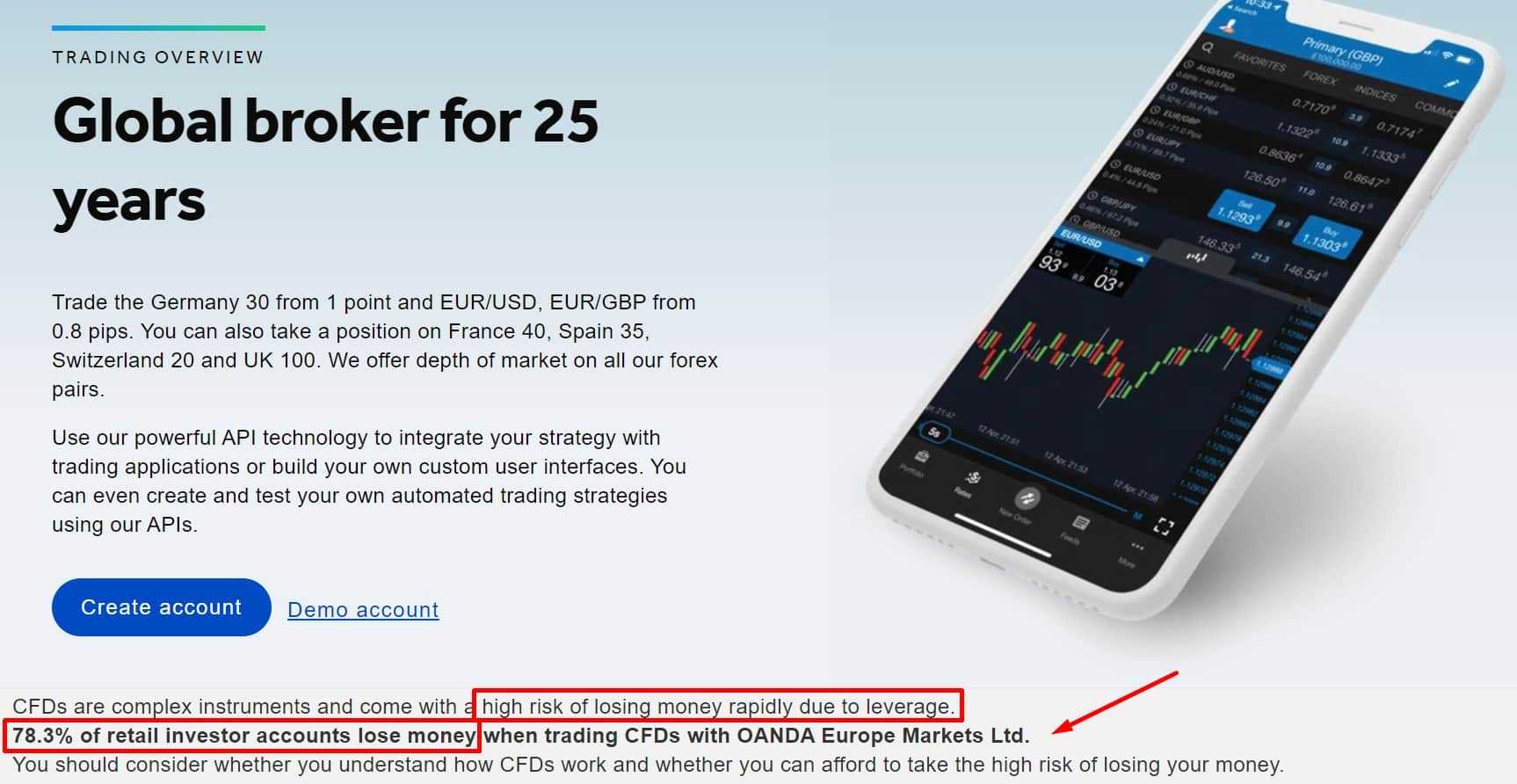

Security Discover ⚠️: Using excessive leverage is extraordinarily dangerous, and the vast majority of merchants lose funds. Excessive leverage can lead to the lack of a dealer’s total capital. Margin buying and selling is so dangerous that by legislation, many regulated brokerages will need to have a disclaimer informing merchants that over 70% of merchants who use margin lose funds. Nevertheless, many consider this quantity to be as excessive as 90%.

See the 90-90-90 rule, which states that 90% of merchants lose 90% of their cash in 90 days. Leverage is a instrument greatest utilized by skilled merchants with a confirmed profitable buying and selling technique and observe report. {Most professional} merchants might make the most of 3x or 5x leverage at most, and 100x leverage is taken into account irresponsible by {many professional} merchants and is without doubt one of the largest criticisms in opposition to crypto exchanges for providing such harmful merchandise to inexperienced merchants.

Because of the dangers related to excessive leverage, exchanges similar to Coinbase have stopped providing margin buying and selling altogether, and Kraken capped it to 5x in what was seemingly a transfer to keep away from regulatory scrutiny and shield inexperienced merchants from getting wrecked.

Futures Market

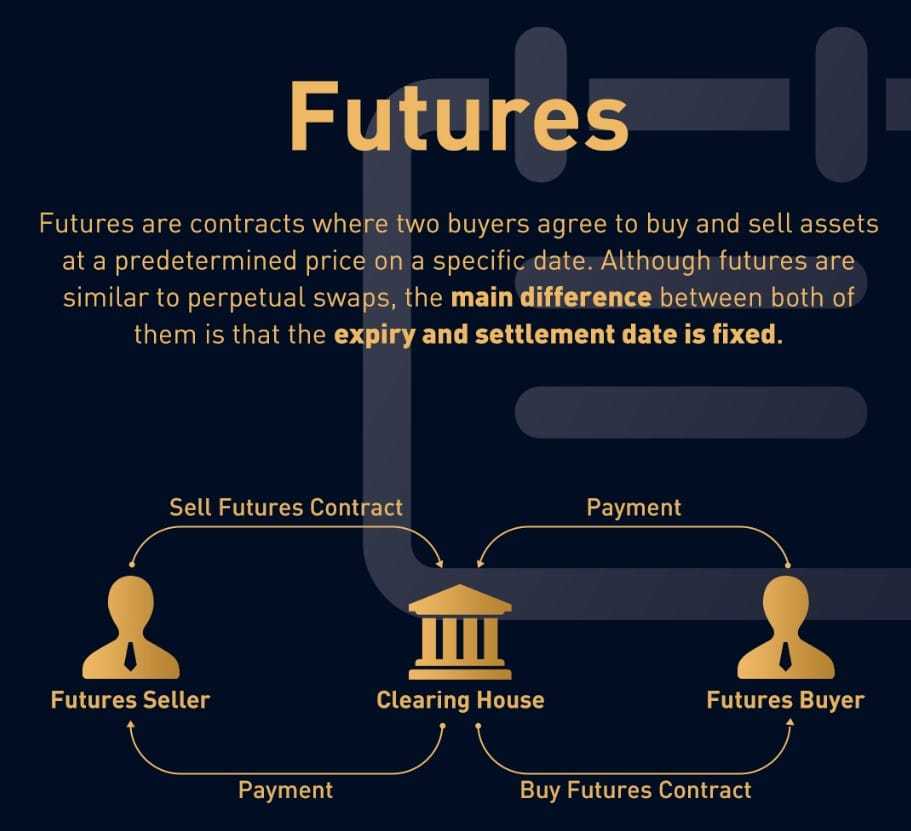

Futures are one other in style instrument for merchants to lengthy or quick their favorite crypto belongings. In a futures commerce, a purchaser agrees to buy a safety contract that specifies when sooner or later and at what worth level the safety will likely be offered.

As a substitute of attempting to elucidate it, right here is a good graphic from Bybit Study that sums it up properly:

When a dealer buys a futures contract, they’re betting that the safety worth will rise, making certain they will get a great worth on it at a future date. When merchants promote a futures contract, it’s a prediction that the asset will decline in worth.

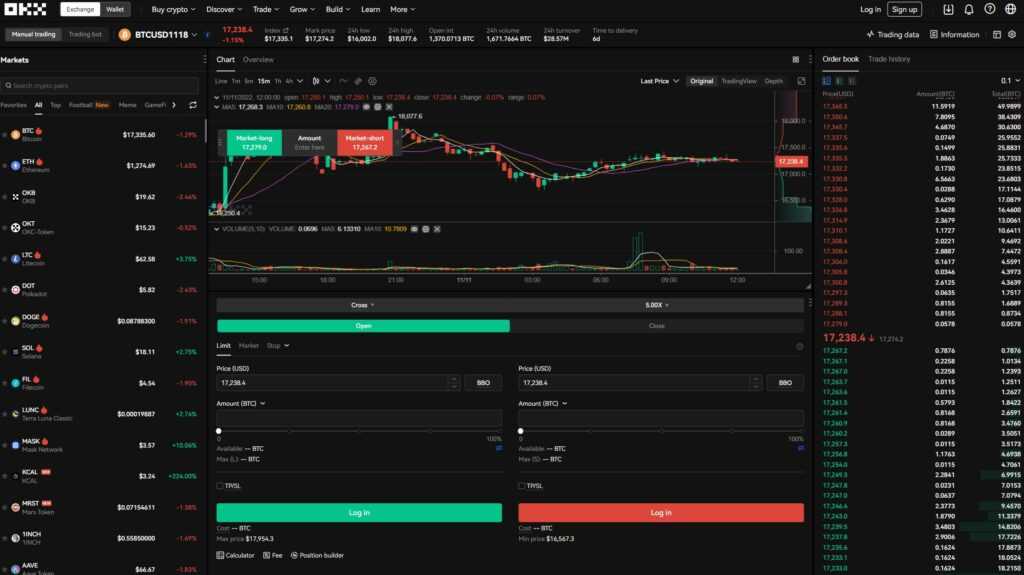

Here’s a take a look at the Futures buying and selling interface on the favored change OKX:

Futures buying and selling is out there on a lot of the main exchanges. If you wish to perceive extra about buying and selling futures and the way it works, Investopedia has an excellent article that covers the ins and outs of Futures Buying and selling.

Binary Choices Buying and selling

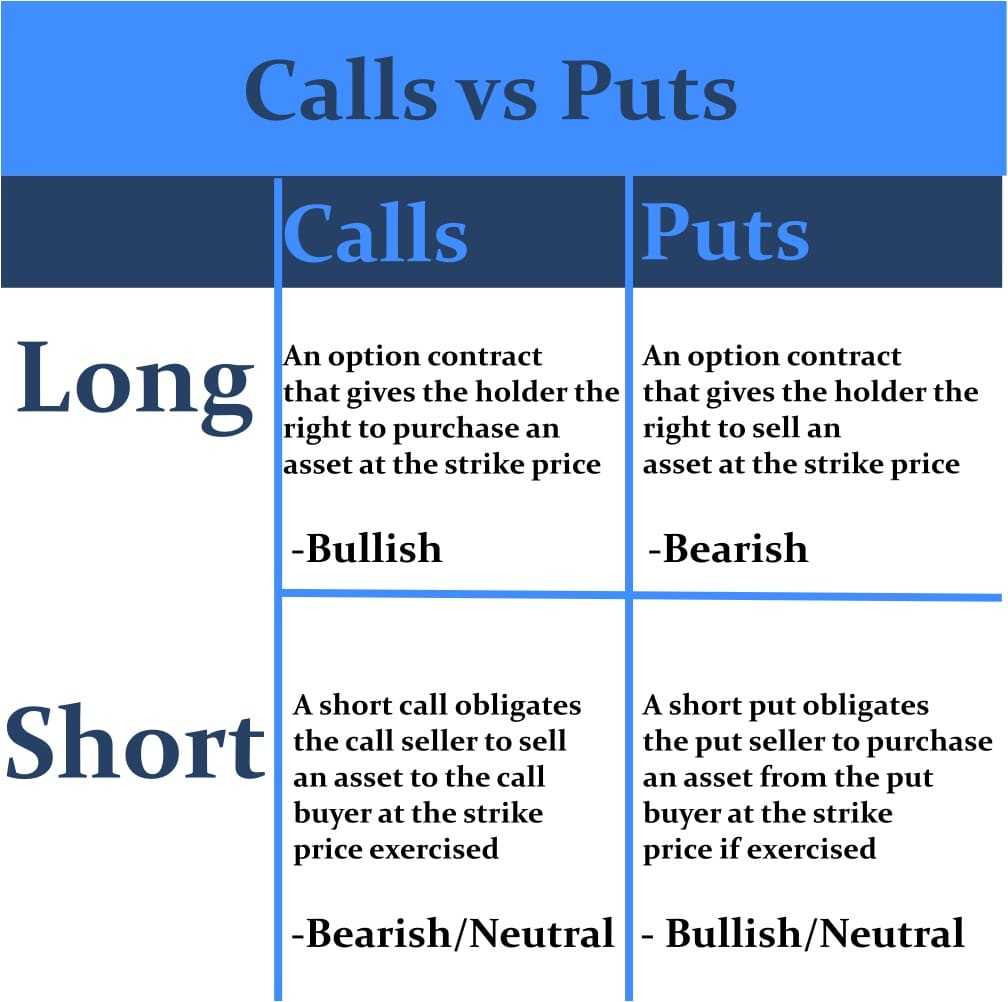

Binary Choices present merchants with what are often called put and name choices, enabling them to be lengthy or quick Bitcoin and different belongings. When a dealer needs to quick an asset, they’ll place a put order, and if they’re lengthy or bullish on an asset’s worth, they’ll place a name order. Because of this a dealer could be aiming to have the ability to promote the forex at as we speak’s worth, even when the value drops or rises afterward.

A number of exchanges supply Binary Choices buying and selling, although you will need to notice that this kind of buying and selling is taken into account larger threat. One of many benefits of choices over futures is that merchants can restrict their losses by selecting to not promote their put choices, resulting in the losses being restricted to the value that the dealer paid for them. Certainly one of my favorite platforms for choices buying and selling is OKX.

If you wish to be taught extra about Choices Buying and selling, Man has a unbelievable video the place he covers that:

Prediction Markets

Prediction Markets are, because the title implies, a manner for merchants to foretell the outcomes of occasions. Merchants can place bets and guess whether or not the value of an asset will respect or depreciate as a result of consequence of an occasion, occasions created by customers of the platform, or the platform itself.

A preferred instance of this was throughout the US elections. FTX had a predictions market the place merchants might lengthy or quick belongings by predicting whether or not or not Trump would win the election. With prediction markets, merchants can revenue in the event that they accurately predict if an asset will decline or improve by a sure margin or proportion, after which one other dealer can take the other aspect of the guess.

If this feels like one thing you’ll be involved in, take a look at our article on the Prime 7 Crypto Prediction Markets.

Quick-Promoting Belongings

This technique is akin to “timing the market” or “buying low and selling high”. That is the place merchants will unload an asset at a worth they’re pleased with, watch for the value to drop, after which purchase the tokens once more.

The danger right here is that if the value doesn’t alter as a dealer expects, they will lose some huge cash. Additionally they threat promoting too early and lacking out on features, or shopping for belongings falling in worth, sometimes called “catching a falling knife”, leading to buying at costs that worth might by no means get well.

Let’s take a look at an instance of when this wouldn’t have been a great technique.

A dealer buys Ethereum at $300 and sells it at $500 with the expectation of shopping for again as soon as ETH dips again under $500. As a substitute, the value of Ethereum continues climbing to $1,000, $2,000, $3,000 and so on. and by no means drops again down under $500. This dealer missed out on 1000’s in revenue, and in the event that they need to purchase again into ETH, it will likely be at a a lot larger worth level.

Earlier than making an attempt this technique, you will need to notice that traditionally talking, for each shares and cryptocurrency buying and selling, merchants who attempt to time the market utilizing this technique have been proven to underperform easy buy-and-hold methods on common considerably. Subsequently, this method is greatest for individuals who are consultants in technical and sentiment evaluation and have a profound understanding of market cycles and developments and a great understanding of the asset class.

If you’re involved in studying technical evaluation, remember to take a look at our article on Easy methods to Carry out Technical Evaluation or Man’s three-part video sequence on performing TA:

Bitcoin CFDs

A CFD stands for contract for distinction. It’s a monetary market that pays out cash based mostly on the value variations between the open and shutting costs for settlement. Bitcoin CFDs are much like Bitcoin futures, in that they’re bets on a cryptocurrency’s future worth. Merchants should purchase a CFD that predicts that the worth of an asset will decline which is one other technique to quick Bitcoin.

One of many benefits right here is that CFDs are settled in fiat, so merchants don’t want to fret about proudly owning or storing Bitcoin or different digital belongings.

CFDs have a extra versatile settlement tenure than futures, which make the most of predetermined settlement dates. Additionally, some CFD markets will enable merchants to enter right into a contract based mostly on Bitcoin’s efficiency relative to different fiat currencies or different crypto belongings.

Inverse Alternate-Traded Merchandise

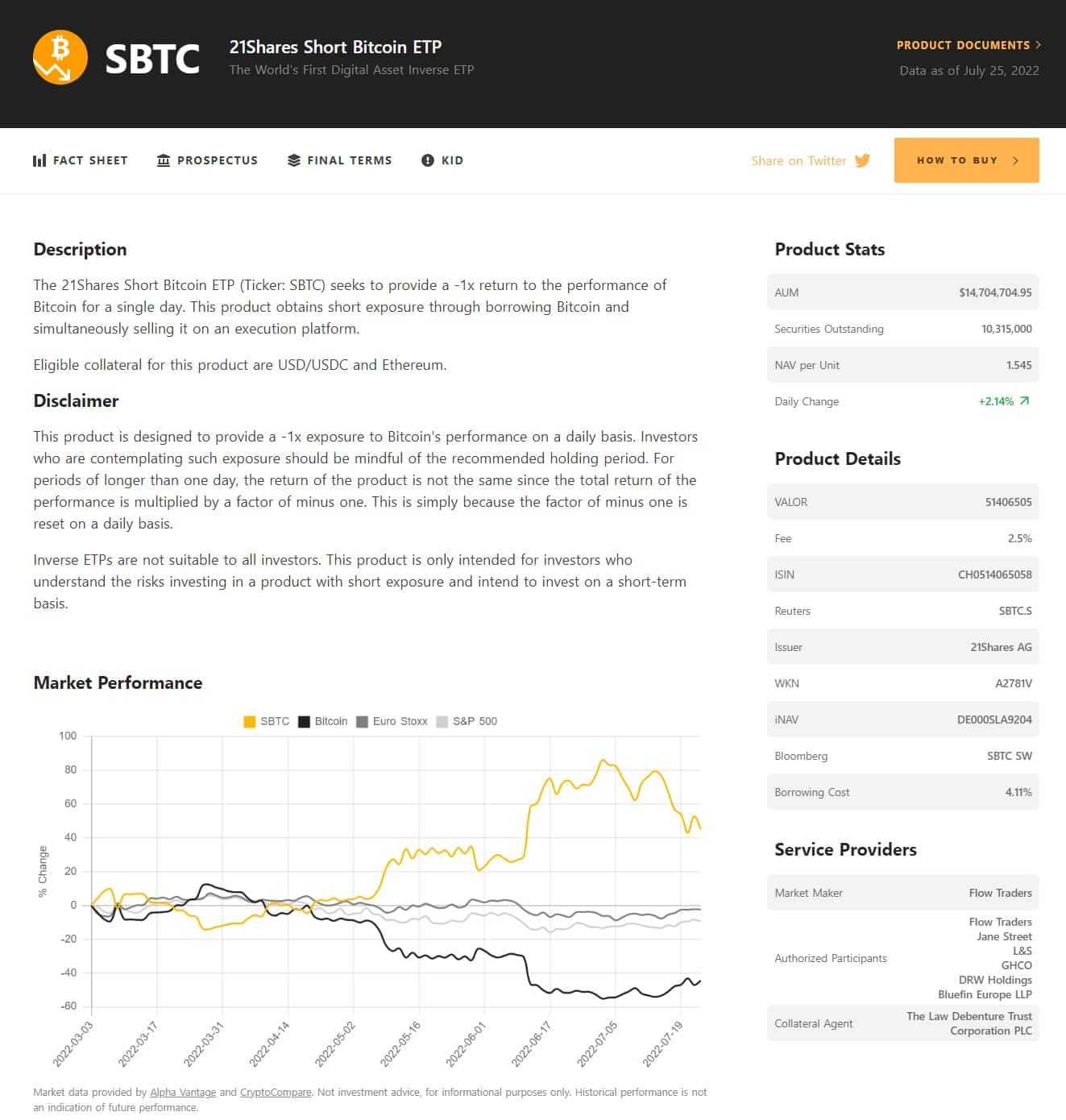

Inverse Alternate-Traded Merchandise or Inverse ETFs are the place buyers can put fiat down in an funding product in anticipation that an underlying asset’s worth will decline. They’re much like futures contracts and use them together with different derivatives to supply returns, however are supplied by brokerages and buying and selling corporations.

These are regulated tradeable markets which might be issued by funding corporations and brokerages and can’t be discovered on fundamental cryptocurrency exchanges.

Residents of the US can look into the ProShares Quick Bitcoin Technique ETF (BITI), Canadian buyers can spend money on the BetaPro Bitcoin Inverse ETF, and European buyers can think about the 21Shares Quick Bitcoin ETP.

Crypto ETPs and ETFs have gotten so in style for buyers seeking to each lengthy or quick crypto that there at the moment are dozens of various funding merchandise accessible.

Leveraged Tokens

Of all of the mentions on the listing, that is considered one of my favorite choices for longing or shorting crypto belongings with entry to safe-ish quantities of leverage, whereas eradicating the complexities and dangers of margin buying and selling.

Many in style crypto exchanges similar to Binance, KuCoin, Huobi and Gate.io supply what are often called leveraged tokens. These are tokens that commerce on the spot market and supply merchants with publicity to 2x, 3x or 5x leverage. Some great benefits of these leveraged tokens are that they commerce on the spot market, as talked about, and there’s a decreased threat of liquidation and margin calls.

Every platform makes use of completely different ticker symbols for its leveraged tokens. To make use of Gate.io for instance, merchants can go lengthy on Ethereum by discovering the token image:

ETH5L– that means 5x leverage lengthy Ethereum

And to go quick, they would choose the token image:

ETH5S– that means 5x leverage quick Ethereum

Professionals and Cons of Shorting Crypto

Quick promoting might be very profitable for expert (or fortunate) merchants. Nevertheless, it ought to solely be undertaken by skilled merchants with a confirmed worthwhile buying and selling technique. On the similar time, the quick ETPs are greatest suited to buyers allocating funds they will afford to lose and have sturdy convictions for believing that crypto belongings will likely be of decrease worth sooner or later.

- Excessive-profit potential.

- Hedge in opposition to lengthy positions.

- The power to revenue even when an asset is reducing in worth.

- Traders can entry inverse ETPs and ETFs with a detrimental outlook on the way forward for cryptocurrencies.

- Restricted capital is required if accessing margin/leverage.

- A number of platforms can be found to commerce, and crypto is the one market that may be traded 24/7.

Cons

- Excessive probability of losses.

- Utilizing leverage can considerably enlarge losses. Merchants can lose all the worth of their accounts.

- Common belongings similar to Bitcoin and Ethereum have seen astronomical features in worth over the long run, leaving many buyers with longer-term quick positions with heavy losses.

- Quick squeezing and unpredictable market circumstances can amplify losses.

Easy methods to Quick Bitcoin

Perceive Bitcoin

This goes for any asset class. To be a profitable dealer, you want to perceive the trade and the asset class, together with the micro and macro-economic occasions which might be more likely to impression worth. Value historical past needs to be studied to seek out patterns and robust areas of help and resistance to the place the value is anticipated to be attracted. Issues like Bitcoin's 4-year cycles and the evolving regulatory panorama must also be nicely understood.

Select The way you Need to Quick Bitcoin

You’ll want to totally perceive the strategies acknowledged above to decide on which market or funding car is most fitted for you. Schooling is significant; make sure you perceive the dangers related to every technique and which one most accurately fits your buying and selling type. Margin and Leveraged tokens are the commonest as they’re essentially the most handy, easy-to-understand, and most generally accessible. The ETP merchandise are typically geared toward buyers versus merchants, fund and portfolio managers however are completely appropriate for retail buyers.

Handle Danger

This one is necessary! Buying and selling can, and infrequently does, outcome within the dealer shedding every part. Be certain you perceive threat, particularly if selecting to make use of excessive margin. You’ll want to use accountable threat administration, set your cease losses, buying and selling setups ought to virtually all the time make the most of a optimistic risk-to-reward ratio, and by no means commerce with extra money than you possibly can afford to lose. It is strongly recommended that merchants perceive and examine efficient threat administration methods earlier than buying and selling with reside funds.

Open Your Place

After getting all of your sentimental and technical evaluation carried out, are assured in your commerce setup, and have deployed a correct threat administration technique, that is when merchants execute their commerce. As soon as the commerce is open, it’s important to keep watch over information occasions and trade developments that may impression the asset's worth.

Dangers and Elements to Contemplate Earlier than Shorting Crypto

Buying and selling or investing in any asset carries threat as there may be all the time an opportunity of shedding funds. Nevertheless, our beloved crypto market carries the next threat than another asset class as a consequence of its regulatory nature and smaller market capitalization, which ends up in considerably extra unstable swings and modifications in worth which might be troublesome to anticipate.

Many conventional markets similar to foreign exchange and commodities are way more predictable than crypto, making actions simpler to anticipate and these belongings simpler to commerce. It is because they’re influenced by macro and micro-economic occasions which might be typically recognized beforehand as merchants and buyers find out about upcoming rate of interest bulletins, earnings reviews, employment figures, and so on.

Most of those asset lessons have a long time of historic information accessible for examine, enabling merchants and buyers to make better-informed predictions of how these asset lessons are seemingly to reply to financial occasions.

Cryptocurrency markets are far much less predictable and don’t observe most of the recognized developments of conventional markets. The shortage of historical past additionally makes it unclear how they’re more likely to react to sure financial circumstances. Because of this, cryptocurrency is a brand new tradable panorama that merchants have to learn to navigate.

Crypto is Risky

Most avenues to quick crypto are based mostly on derivatives. These derivatives are based mostly on crypto asset pricing, and fluctuations in worth have a domino impact on merchants’ features and losses. If in case you have by no means analysed inventory/commodity/actual property/foreign exchange costs, then it’s possible you’ll not know that crypto belongings are distinctive by way of volatility.

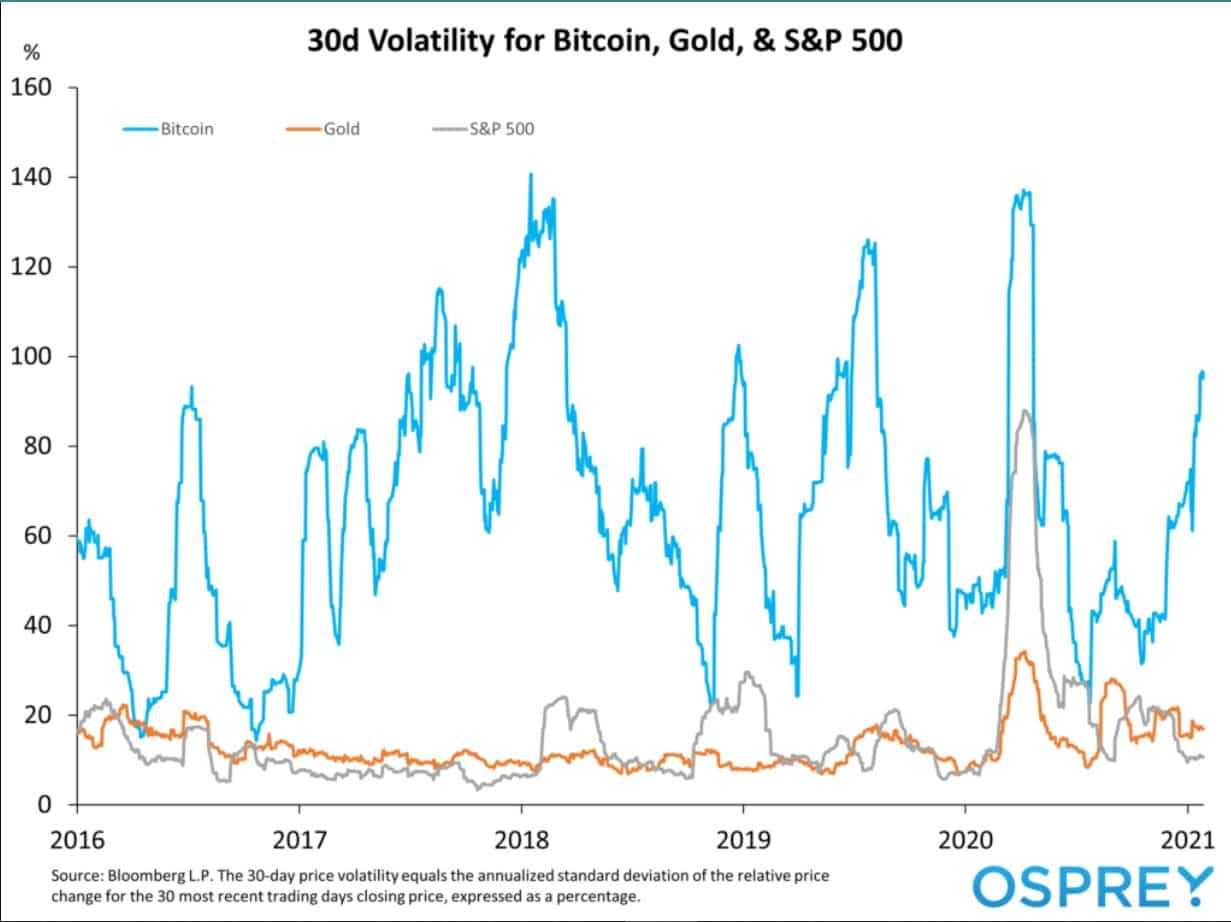

For instance, check out Bitcoin’s 30d volatility vs gold and the S&P 500:

And do not forget that Bitcoin is the least unstable crypto asset.

As crypto merchants, we’re used to common modifications in worth of 10% or extra in a single day. Actions like these are virtually remarkable in different asset lessons. It’s a large deal if a inventory index strikes one p.c in a day, not to mention the ten%+ actions like we see in crypto every day. This makes crypto buying and selling riskier than different belongings, however with that threat comes the potential for larger reward, which is what attracts merchants to this trade.

Have you ever ever heard the reliable criticism from job seekers about not with the ability to get a job as a result of they don’t have any expertise, they usually can’t get any expertise as a result of they can’t get a job? And round it goes…

This additionally occurs in crypto and is without doubt one of the largest elements contributing to the volatility. The acute volatility is an element as a result of small market cap. Market cap refers back to the amount of cash invested in an asset class. For instance, gold has a market cap of 11 trillion {dollars}, and Bitcoin is 440 billion on the time of writing. Let’s check out why that’s necessary.

Fake that gold is a big lake – 11 trillion {dollars} is the quantity of water within the lake.

Fake Bitcoin is a small puddle, with solely 440 billion {dollars} representing the water.

Fake $100,000 is a rock the dimensions of a grapefruit. This $100,000 is the amount of cash a dealer is trying to make use of to purchase that asset.

Throw that rock into the lake, and it’ll trigger minimal disruption. The water stage will barely rise from displacement. Will probably be so insignificant that these standing on the shore won’t even discover the rise in water stage or any waves or splashes from the stone forged into the water on the opposite shore.

Now throw that same-sized rock right into a puddle, and all hell breaks free. Water will splash up over the perimeters, the water stage will rise noticeably, and everybody trying on the puddle will see the disruption.

This works much like how a big commerce will have an effect on the gold vs Bitcoin market. No person will discover half a billion {dollars} being added to or drained from an 11 trillion-dollar asset class, however half a billion will definitely disrupt a market with beneath a trillion {dollars} invested.

So, to return to the “can’t get a job” analogy. As a result of crypto is so unstable, many buyers don’t need to become involved, ensuing available in the market cap remaining small. The small market cap leads to excessive volatility, which makes buyers not need to become involved, so identical to our job seeker, round and round it goes.

It’s anticipated that as extra buyers understand Bitcoin’s potential, and as soon as a spot Bitcoin ETF is permitted in the US, the quantity of institutional cash which will pour into Bitcoin might considerably cut back its volatility and the asset might begin behaving extra like indices or commodities.

Lack of Historical past

In comparison with different belongings, Bitcoin has solely been round for simply over a decade, that means there may be not sufficient enough historic information to assist buyers make enough educated selections on worth behaviour or developments.

The shortage of historical past is a deterrent, as many buyers and merchants might examine weeks, years, and even a long time of historic worth information to make knowledgeable funding selections.

Regulatory Standing is Unclear

That is one other case much like the can’t get a job with out expertise and can’t get expertise with out a job state of affairs. As a result of crypto is deemed so dangerous, unstable, and a speculative asset class, it’s unclear to the authorities the way it needs to be regulated. And since crypto stays unregulated, it stays dangerous and unstable as buyers can’t become involved in an unregulated asset, which once more results in Bitcoin and cryptocurrency’s market cap remaining typically small, contributing to the danger and volatility. It’s just like the world’s most complicated merry-go-round.

The absence of regulatory oversight signifies that exchanges can get away with shenanigans and choices that aren’t allowed throughout regulated markets. We see this with issues like exchanges providing excessive ranges of leverage and plenty of rumours of wash buying and selling and exchanges entrance working their clients, including to the already excessive ranges of threat related to crypto buying and selling.

Crypto Exchanges that Enable Quick Promoting

This isn’t an exhaustive listing, however a number of the in style exchanges that enable quick promoting are:

Binance

Kraken

Bitfinex

Bybit

OKX

Phemex

Quick Promoting Crypto: Closing Ideas

One of many principal benefits that merchants have over buyers is that buyers primarily earn money when costs go up and lose cash when costs go down, versus merchants who can earn money on the way in which up or down by quick promoting. This isn’t together with buyers who spend money on inverse merchandise, which isn’t a quite common funding car.

Certainly one of my largest gripes is that numerous YouTubers, web sites, social media teams, and adverts lead inexperienced merchants to suppose that buying and selling is simple, anybody can do it, and you can also make a fortune buying and selling out of your cellphone in a single day. In fact, if it have been as straightforward as they might have you ever consider, everybody could be sitting poolside sipping margaritas whereas buying and selling from our telephones.

Don’t be fooled; there’s a purpose why {most professional} merchants have a setup that appears one thing like this:

In my days of extra energetic buying and selling, I noticed dozens of ridiculous posts each day of individuals exhibiting their 1000% earnings by buying and selling, typically utilizing nothing however their telephones. Any skilled Wall Avenue dealer will inform you that this isn’t possible nor doable to maintain.

Anybody making these kinds of earnings has both scored a few fortunate trades, is utilizing insanely excessive quantities of leverage which is able to result in blown accounts, and are cherry-picking outcomes seemingly from demo accounts. It’s a unhappy actuality that over 90% of merchants fail and lose cash and that buying and selling has change into an especially predatory trade the place conmen prey on new and unsuspecting merchants.

Run the opposite manner if you happen to see a “trader” posing in entrance of a Lambo and throwing hundred-dollar payments within the air. Profession merchants usually are not influencers, and influencers usually are not merchants. If a dealer has was an influencer, it’s more than likely as a result of they failed as a dealer and want one other solution to earn money.

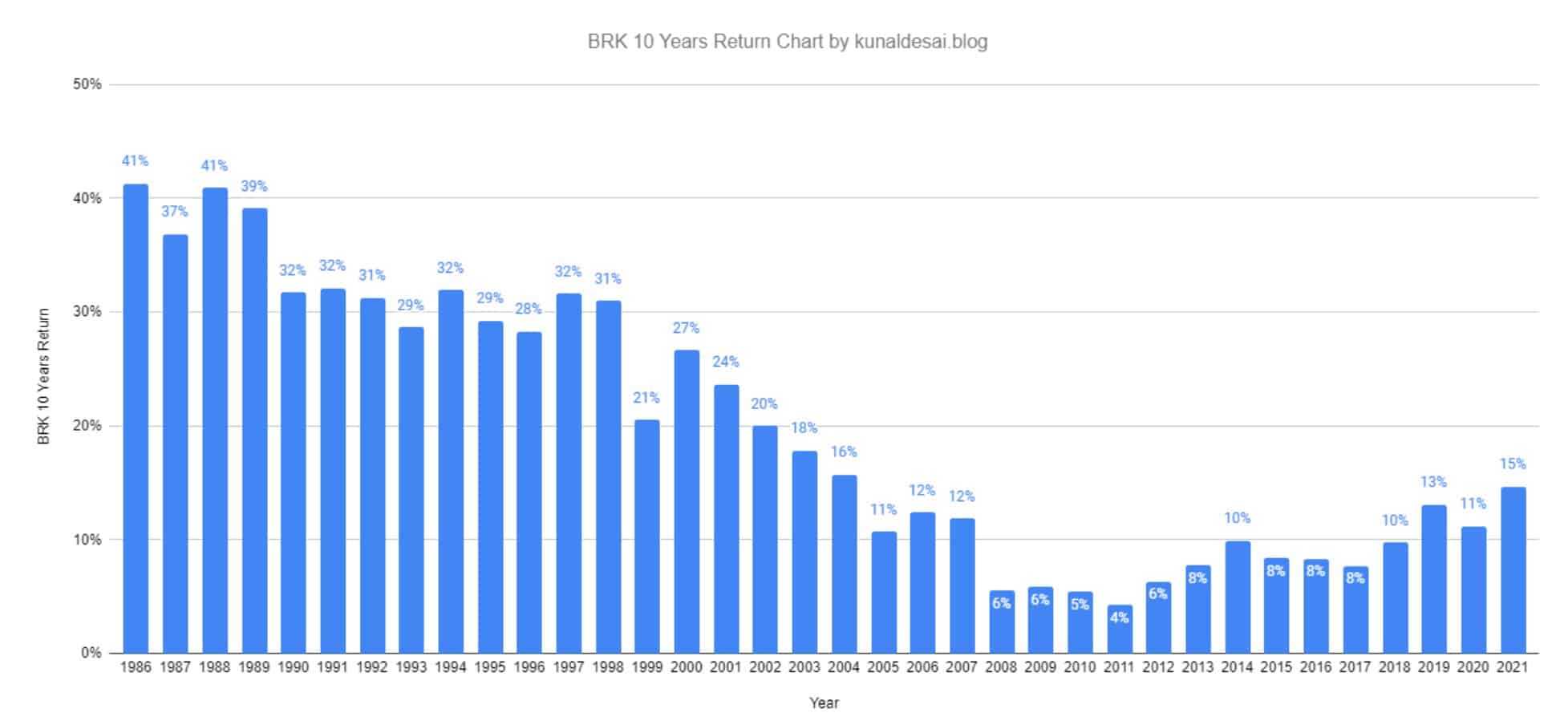

It’s priceless to take into account that a number of the greatest merchants on this planet, asset and portfolio managers who earn tens of millions a yr in wage and work for the most important corporations on Wall Avenue shoot for 10-30% per yr. Warren Buffett, who is usually thought-about the very best dealer/investor of all time, has constantly made a historic common of 20-30% per yr for many years. Merchants want to noticeably think about whether or not they can realistically outperform the “Oracle from Omaha” for a sustained period earlier than they dedicate their lives to the craft.

You will need to have lifelike expectations when going into buying and selling and perceive that turning into a millionaire in a single day is inconceivable at greatest. It additionally helps first to think about the quantity of funds you possibly can allocate to buying and selling. Merchants typically want a 6-figure buying and selling account or a very long time horizon to construct a small account to make buying and selling worthwhile, as 10% revenue per yr on a 500-dollar buying and selling account isn't sufficient to outlive.

Additionally, take into account that these skilled merchants who’re pleased with 10%-30% per yr typically have entry to instruments, analysis groups, analytical charts and extra that retail merchants don’t have, which is without doubt one of the causes we’re known as "dumb" cash. Many retail merchants consider they will outperform a billion-dollar hedge fund with a military of analysts watching charts across the clock and state-of-the-art analytical instruments. I'm not saying it’s not possible, as some merchants make it, however it’s extremely troublesome. For each crypto dealer who purchased Bitcoin at 500 {dollars} and have become a millionaire, 1000’s of others have misplaced cash.

I’m not saying all this to place you off buying and selling. I’m simply attempting to supply lifelike expectations as there are too many individuals shilling buying and selling as a simple solution to earn money as they need you to make use of their sign-up affiliate hyperlink or join their course or one thing they’re attempting to advertise. If these individuals are making a lot cash buying and selling, why do they want your cash?

Any profitable long-term dealer will inform you that buying and selling takes years of analysis, dedication and observe and that it’s excessive stress, excessive threat, and never a solution to get wealthy fast. Buying and selling might be extremely profitable and a unbelievable profession if you happen to really feel you possibly can change into a part of the few merchants who truly make it within the recreation. I all the time advocate beginning with a demo account, researching buying and selling methods, backtest methods, and scrolling by means of historic worth motion, looking for patterns and developments. It’s a good suggestion solely to threat reside cash after getting confirmed which you can be worthwhile on a demo account for a sustained interval.

Continuously Requested Questions

What Does Shorting Crypto Imply?

Shorting crypto is the act of speculating the value of a crypto asset goes to say no. Merchants can commerce sure markets or devices that enable them to revenue from the autumn in an asset’s worth.

Is Shorting Bitcoin a Good Concept?

For skilled merchants, shorting Bitcoin generally is a profitable play within the quick time period. Many crypto merchants have a long-term bullish outlook on Bitcoin however will make the most of short-term actions to the draw back.

Wanting on the long-term worth efficiency of Bitcoin, because it has been the very best performing asset class of the final decade, many wouldn’t think about shorting Bitcoin a good suggestion as a long-term funding play.

The place Can I Quick Crypto?

Many in style exchanges similar to Binance, Kraken, OKX, Bitfinex and others help belongings the place merchants can quick crypto.

Is Shorting Crypto Unlawful?

Shorting crypto is just one other manner of buying and selling crypto. As with most different tradeable belongings, it’s completely authorized in most jurisdictions. You’ll want to verify the precise legal guidelines that pertain to your location. If an change is regulated in your nation and provides methods to quick crypto, then you don’t have anything to fret about.

What Are the Dangers of Shorting Crypto?

As with every commerce or funding, there may be all the time the danger of shedding cash. For instance, if a dealer shorts or invests in a manner that speculates on the value drop, i.e. “shorts” an asset, and that asset appreciates, they threat having a cease loss hit, being margin known as, or having their web value lower in worth.

Shorting crypto can lead to the whole lack of funds. Furthermore, the dangers of shorting crypto vs different belongings are larger as a consequence of larger volatility, irresponsible entry to larger quantities of leverage, and the truth that crypto is unregulated and regarded a extremely speculative asset class.

Can I quick Crypto Utilizing Leverage?

In lots of jurisdictions, crypto exchanges enable merchants to quick crypto utilizing leverage. I like to recommend Binance.US or Kraken for US residents, and for international customers, Binance, Bitfinex, and OKX are value contemplating.