The digital asset market and the diverse ecosystem it supports are not going anywhere. Apart from ongoing regulatory uncertainty, the banning of crypto in various geographical areas and the FUD that surrounds the disruptive technology of crypto, one of the topics most discussed in the industry is the energy and computing power consumption of blockchain.

Blockchain technology is best known as the digital ledger used to create cryptocurrencies. This foundational layer forms a relatively new and exciting financial infrastructure.

Blockchain was introduced in 2009 as the public ledger of Bitcoin. It has since given birth to thousands of unique, value-rich crypto assets. In addition, it has pioneered a new ecosystem of uses in many fields including supply chains.

Blockchain is defined by the European Union Agency for Network and Information Security as follows:

… a public ledger consisting of all transactions taking place across a peer-to-peer network. It is a data structure consisting of linked blocks of data … This decentralised technology enables the participants of a peer-to-peer network to make transactions without the need of a trusted central authority and at the same time relying on cryptography to ensure the integrity of transactions. ENISA (2019).

Blockchain ledgers, unlike the traditional ledgers used for decades by governments and banks, are transparent and decentralised. There is in fact no exclusive central manager for the ledger. The main functions of this ledger are to store, update and verify transactions.

Blockchain stores, shares and synchronises data as ‘chains of blocks’ using cryptographic techniques. Blocks represent a set of recorded transactions and each new block of transactions is linked to the previous one, creating an ever-growing ‘block’ chain. The creation of each block must be approved by all network participants and this process can be achieved through a ‘consensus mechanism’ that establishes the rules for transaction verification and validation.

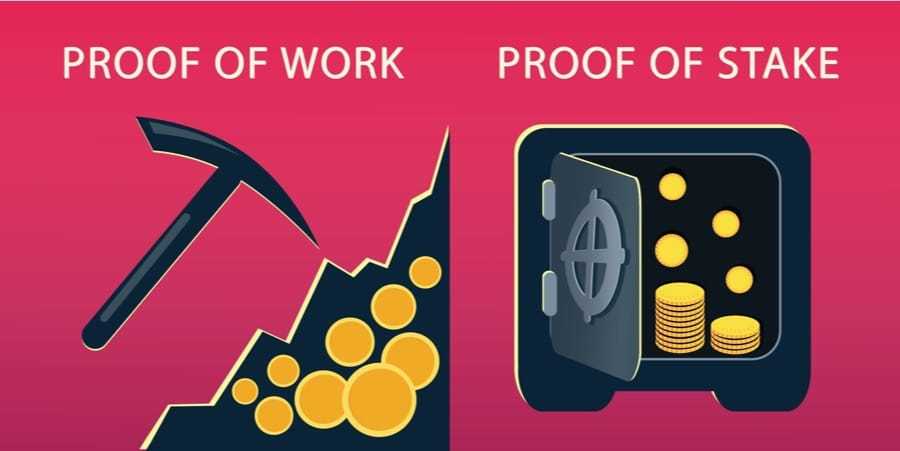

One of the most common approaches is ‘mining’, which relies on the Proof-of-Work (PoW) mechanism. With PoW, in order to add a block of transactions to a blockchain, network participants compete to find a solution to a complex mathematical problem based on cryptographic algorithms, and these network participants are commonly referred to as ‘miners’. After other network participants validate the miner’s solution, a block of transactions will be added to the Blockchain.

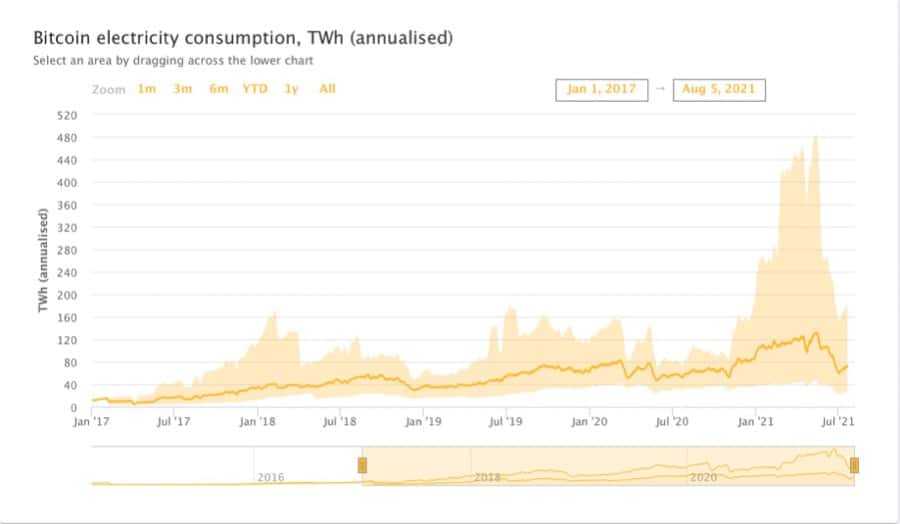

PoW is a method that allows Bitcoin, Monero and other crypto-assets to be processed peer-to-peer, in an unintermediated and secure manner. However, PoW on a large scale demands huge amounts of computing power. This computational power only grows as more miners are added. Staking is a more viable solution.

What is Staking?

You can think of staking as a resource-efficient alternative to mining. This mechanism is based on holding cryptocurrency in an online wallet that supports the operation and security of a network. Staking, in essence, is locking up crypto assets for rewards. Some compare it to receiving blockchain dividends. To understand what staking really is, it is necessary to first analyze the Proof-of Stake algorithm.

Proof-of-Stake is a different consensus method from Proof-of-Work. It allows for blockchains to be more energy-efficient while still maintaining a high level of decentralisation.

Proof-of-Stake

The amount of computing power needed to make it work correctly is a concern for many in the industry.

The complex puzzles miners compete to solve are not for anything other than to ensure that the network is secure. Although one might argue that PoW makes excessive use of the resources available, it does NOT make this the optimal way to process data.

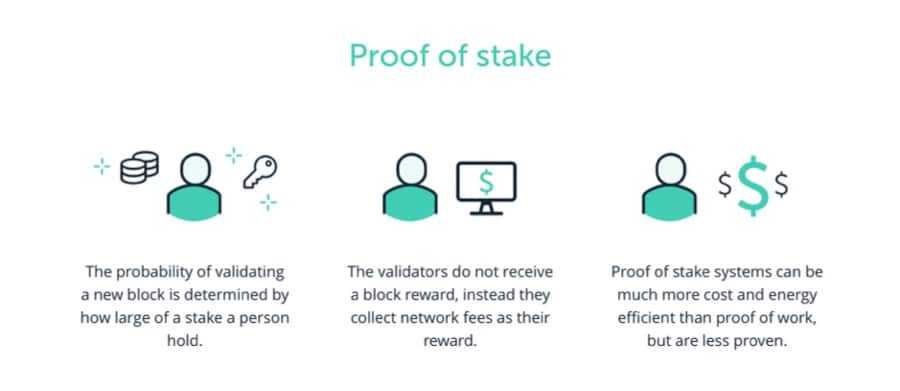

Proof-of-Stake, on the other hand, was developed as an alternative for Proof-of-Work (PoW) and designed to address some of its issues. PoS works by allowing network users to lock in their crypto-assets into a protocol which, when a certain time comes, will assign the right for one participant to verify the next block.

The amount of tokens a user holds determines the likelihood of being chosen to validate a block transaction. The amount of staked assets determines who creates a block, not their algorithmic ability, as in Proof-of-Work.

Proof of Stake may be a more complex and scalable Blockchain solution, due to its ability to mine a fraction of the transactions in relation to their stake.

Theoretically, this would mean that someone who owns 5% (or less) of all crypto assets can only mine about 5% of transaction blocks. This greatly reduces computing power needed to validate the transactions.

PoS’s scalability is one of main reasons Ethereum has migrated to Proof-of-Stake from Proof-of-Work with ETH2.0.

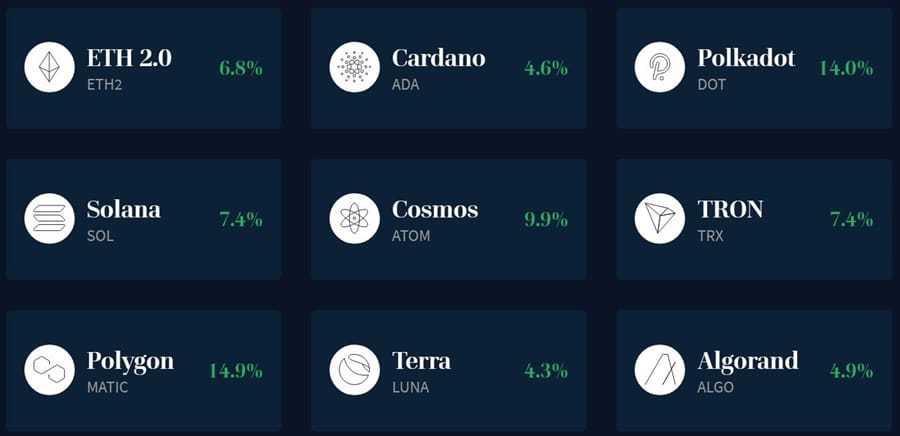

Proof-of-Stake is used by some of the biggest blockchain networks, including:

- Ethereum

- Cosmos

- Solana

- Cardano

- Avalanche

- Tezos

- Algorand

Delegated Proof of Stake (DPoS).

Delegated proof-of-stake (DPoS), an alternative to PoS, allows participants of the network to use their token balances to cast votes. Voting power is proportional with token amount. The votes from these tokens are used to elect several delegates, who will manage the blockchain for their respective voters and ensure consensus.

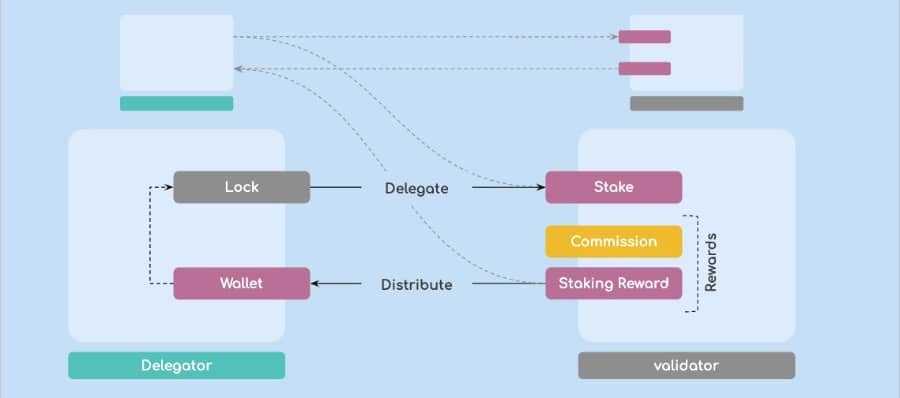

The staking awards are typically distributed to elected delegate who distribute them to their respective electors in proportion to their contributions.

DPoS works by allowing a smaller number of nodes to validate a given consensus. As a result, the network’s performance is improved and its processing speed increases.

Tron, EOS and Nano are notable blockchain networks using DPoS.

What is Staking?

In addition to what was already mentioned, Proof of Work chains rely on miners for validation and adding transaction blocks to blockchain. Proof-of Stake chains, on the other hand, validate new blocks and add them to the blockchain through staking. Staking is a term that refers to the act of pledging cryptocurrency assets to a crypto protocol in order to receive rewards.

Users who stake assets on a protocol are contributing to its security and receive native tokens as a reward.

The higher the pledged assets, the greater the reward. The staking rewards will be distributed all on-chain. This means the rewards can only be received by the staker and not any other third party.

This staking rewards mechanism, quite frankly, constitutes a brilliant value proposition for many digital asset enthusiasts as it allows for consistent asset compounding and brings life to the ultimate entrepreneurial dream of ‘earning while you sleep’!

What Are the Rewards?

As shown in the above image, Proof-of Stake assets like Cosmos, Solana Cardano Tezos Polkadot allow users to stake their assets and receive rewards. There are essentially two different types of reward that can be distributed.

- Inflationary rewards (Staking Rewards)

- Transaction fees

Users stake crypto assets to receive staking reward with Proof-ofStake nodes. The user’s total net worth will increase if the node they have delegated successfully attests or signs blocks. The user could lose a significant amount of their assets if the node was unresponsive or malicious.

The staking reward is beneficial to both the individual staker and the protocol node. On the one hand they encourage users, in exchange for native token rewards, to secure their assets, while on the other they increase the security and integrity of the protocol. These rewards are known as inflationary rewards when stakers receive newly minted native assets in exchange for being selected to validate blocks.

It means, essentially, that each time a new block is validated, tokens are created and given out as stake rewards. “inflationary”.

In terms of transaction fees, every transaction has a fee attached to it. This makes it easier for nodes to select transactions that should be included in the block. All fees collected from transactions are also sent to the node.

In blockchains, transactions are at the core of the technology. They can play many different roles depending on how the protocol is designed. Transactions can range from smart contracts to token transfers. Despite the differences in the transaction types, they all get grouped together into one block.

You can participate in stakeouts by following these simple steps

The staking tool is a good investment for those who have assets that are sitting idle in their crypto wallets and do not generate any passive income. Staking can be performed in two ways:

- Validation: Best for Blockchain companies and enthusiasts.

- The majority of crypto-asset holders will benefit from delegating.

In order to become a validator in a Proof-of-Stake network (PoS), crypto assets holders must stake their tokens instead of spending electricity, as it is with the Bitcoin PoW. Validators, as previously stated, are chosen randomly to validate and create blocks. The probability that a validator will be selected is dependent on the tokens staked. PoS participants are able to vote for on-chain governance by using their staked tokens.

PoS Validators can vote by using their own assets for blocks of transactions which they consider valid. The majority must agree to receive the stake reward. Otherwise, the stakers risk losing the entire stake. The system creates an infrastructure that is balanced by encouraging the growth of nodes while discouraging malicious behavior.

It is also important to remember that not everybody can be a validator of a network. Validators must meet certain protocol requirements and the entry barrier is usually high. In order to be a validator one may need to meet the following requirements:

- A minimum number of tokens is required. In the case of ETH2.0, a stake minimum of 32 ETH must be made.

- Install a performant and safe infrastructure.

- Create a dedicated team of engineers and developers to be responsible for upgrading and developing the infrastructure.

Delegation

Many crypto enthusiasts may find it difficult to justify owning large amounts of a single digital asset. Many PoS systems anticipate this problem and provide ways for asset owners to stake tokens using a validator they don’t run. The process of stake assets via a validator, also known as delegation, is referred to.

By delegating assets, you contribute towards the stake of the validator in exchange for a certain percentage of staking rewards. A delegator can deposit tokens to a contract smart and then specify the influence they would like to give a validator in the network. As rewards from the validation process rise, so do the stake rewards.

Pools of Stakes

A stake pool is an association of cryptocurrency asset owners who combine their resources and increase their chances to validate blocks. Holders combine their stake power in a pool and receive rewards proportional to the amount they contributed.

Pool providers may charge an additional fee on top of the stake rewards that are distributed to participants. This is because setting up a pool requires a high level of experience and substantial capital. The protocol will usually specify a period of time during which the stake must be fixed.

It is also likely that the stake pool will ask participants to have a certain minimum number of tokens in order to be eligible as contributors. This disincentivises any malicious behavior.

Liquid Staking

Some DeFi protocols are now implementing a new staking mechanism called Liquid Staking, which is an alternative to the traditional mechanisms that have been discussed so far. Liquid Staking describes protocols that create token representations of staked asset, which can then be used for other DeFi applications.

Liquid Staking is the process of creating a token on the blockchain to represent the staked value. This makes staked assets liquid and ready for trading. Tokenised stake representation also allows users to bypass some limitations of certain networks, such as the lock-up or unbonding period.

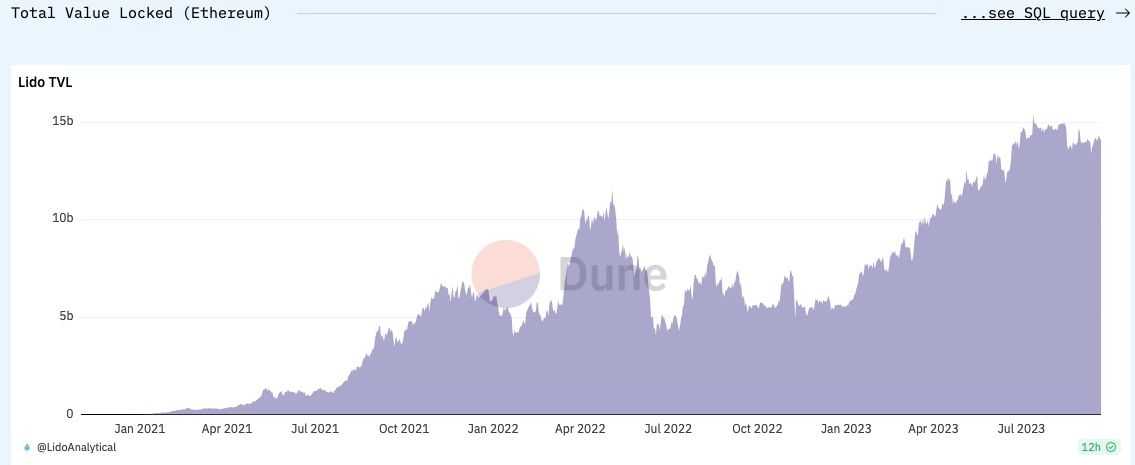

Liquid Staking allows stakers to take advantage of a range of opportunities, including investment and trading. It creates tokenised capital which can be used for yield farming, high APR and liquidity protocols. Tokenised stake representation, due to its advantages and functions, is becoming a popular trend within the DeFi industry. This includes projects like Lido Finance and RocketPool.

Staking vs. Yield Farming

It is easy to become overwhelmed by the complexity and definitions of crypto due to its incredible variety. While staking, yield farming, and other forms of crypto-related activity do share similarities, they are also distinct. This is to prevent confusion in the DeFi world.

Staking, as well as yield farming, involve the user providing liquidity in exchange for rewards. Yield farming, also known as liquidity mining, is defined as the process of providing liquidity to earn ‘mining’ rewards. It is important to note that Liquidity-Mining should not confuse with Proof of Work Mining, where blocks are validated by solving mathematical equations.

When users supply liquidity to a protocol or decentralised exchange, they do so by providing ETH for example, in order to ensure that there are enough assets to make the exchange.

The user will then pay the fee to the protocol, which will in turn reward the provider of liquidity for providing the asset. Yield farming, in a sense, is rather similar to staking but it actually involves the more dynamic process of actively moving assets around different protocols to essentially ‘farm’ the best rewards possible.

Staking, in general, is meant for long-term or medium-term investments. The tokens will be locked for a certain period of time. Staking, in contrast to yield-farming, is considered the less risky and safer investment. It also results in an average return. On the other hand, yield farming and liquid mining carry higher risks, such as temporary loss, which is why they usually have some of the best APYs.

In the past, users of CAKE tokens who have provided them to PancakeSwap received an annual APY (annual percentage yield) of 95%. This is unheard-of in conventional financial infrastructures. While yield farming is not without its risk, it allows investors to access ROI rates that are unheard of in traditional financial infrastructures.

Final Thoughts

It is a term that refers to the act or pledge of crypto assets for a cryptocurrency protocol in order to receive rewards. Users who stake assets into a protocol are contributing to its security and receive native tokens as a reward.

Proof of Stake may be a more complex and scalable Blockchain solution, due to its ability to mine a fraction of the transactions that reflect their ownership.

Proof-of-Work, although it has been proven as a reliable mechanism for validating blocks of transactions, and while many Proof-of-Work advocates feel that PoW offers greater security than PoS does, is neither eco-friendly, nor is the processing speed the fastest. The staking solution is less resource intensive and allows the users to validate transactions directly, either by delegating or becoming network validators.

The network participants with substantial capital could become protocol validaters and earn staking reward for verifying the transactions. Or they might even create their own pool of staking and invite potential contributors to it, charging them a management fee.

Staking is a good investment for those who have assets that are sitting idle in their crypto wallets and not generating passive income. As a result, staking not only offers a faster processing method but is also an excellent way for crypto investors to grow their net assets over the course of a medium- to long term outlook.