From the start of 2020 till now, the DeFi area may very well be summarised in two phrases: meals struggle. Certainly, it really appears like a brand new ridiculous food-themed DeFi protocol is being added to this culinary carnage each different day. One of the sought-after DeFi delicacies? Sushi, after all!

For many crypto lovers, the introduction of SushiSwap signaled that DeFi had formally gone too far. In reality, the controversial occasions surrounding the undertaking, which unfolded within the brief weeks after its launch, spoiled the urge for food of many within the DeFi area.

Nonetheless, there may be way more than meets the attention (or the tongue on this case!) with regards to SushiSwap. The preliminary 2,500%+ APYs on deposited funds have been simply the tip of the tilapia. In September 2020, the SUSHI token was efficiently listed on Binance, and management over the undertaking was transferred from the unique, nameless founders to disgraced FTX ex-CEO Sam Bankman-Fried. Since then, SushiSwap has rolled out varied options on the protocol, really promising to turn out to be ‘the’ Michelin star Defi Hub.

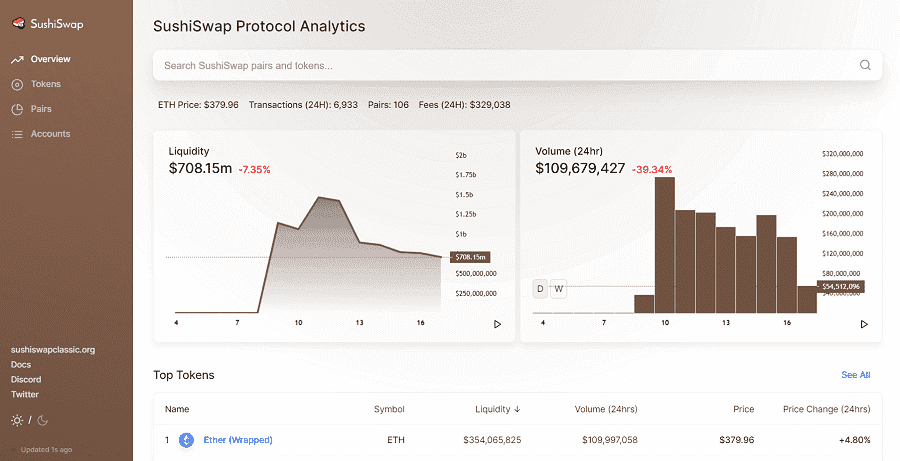

In late 2020, SushiSwap was the most important DeFi protocol in the marketplace. Based on DeFi Pulse, SushiSwap at present stands in eleventh place for Whole Worth Locked (TVL) in DeFi, with $1.51 billion in property on its platform.

It is a clear fall from the final time we lined SushiSwap on the Coin Bureau web site in August 2021. At the moment, SushiSwap held the eighth place for Whole Worth Locked (TVL) in DeFi, with nearly $4 billion in property on its platform. Nonetheless, in 8 months, the DEX has fallen practically 62% in TVL, whereas the TVL of the complete Defi Market has remained nearly unchanged since then.

This raises the query of what has modified for SushiSwap since then. Due to this fact, by the tip of this text, you’ll higher perceive what SushiSwap is, the place it’s headed, and if it will possibly climb again up the rankings once more.

Who Based SushiSwap?

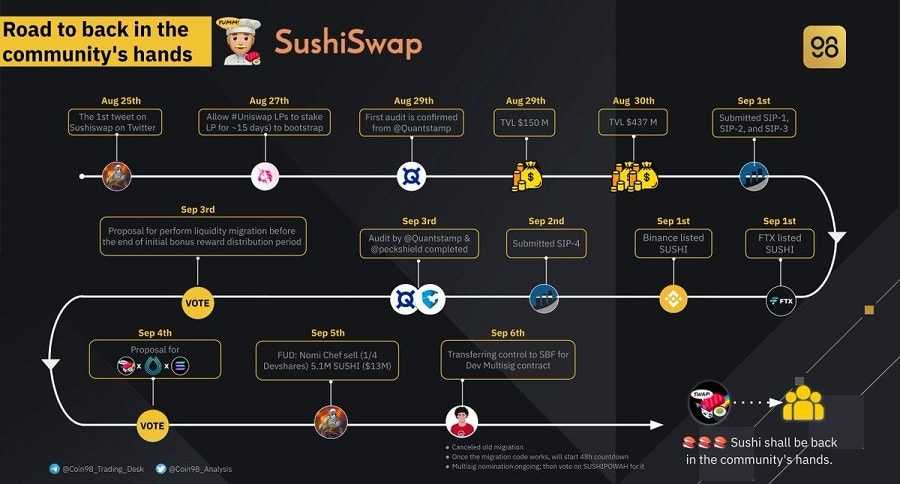

SushiSwap was based by two nameless builders named 0xMaki and Chef Nomi. On August 26 2020, Chef Nomi launched a Medium publish detailing the SushiSwap protocol. This enticed 0xMaki to affix the SushiSwap Discord.

Being one of many first contributors, 0xMaki spoke at size with Chef Nomi and consequently turned the co-founder of SushiSwap. It’s believed that round 5 builders have been engaged on the undertaking on the time of launch.

Whereas not a lot is understood about 0xMaki or Chef Nomi, in an interview from 2020 with the Unchained Podcast, 0xMaki confirmed that Chef Nomi is predicated someplace in Asia. Moreover, the truth that the Hearthstone card sport, from which the Chef Nomi pseudonym originates, is in style in China suggests Chef Nomi may very well be Chinese language.

Given 0xMaki’s French accent, look, and time-zone trace, he’s seemingly based mostly someplace in France or a French-speaking Center Japanese nation. 0x is in reference to the beginning quantity and letter of all Ethereum addresses, and Maki is a well-liked sushi dish.

SushiSwap’s Fishy Historical past

Along with being created by two nameless builders, SushiSwap was not audited earlier than launch. That being mentioned, Chef Nomi overtly invited among the most respected firms, together with Quanstamp and Consensys, to audit SushiSwap’s code within the first Medium publish concerning the undertaking.

Throughout the first week of its launch, SushiSwap had accrued over 1 billion USD in locked funds and briefly surpassed Aave as the most important DeFi protocol. Rates of interest on locked funds exceeded 2,500% APY!

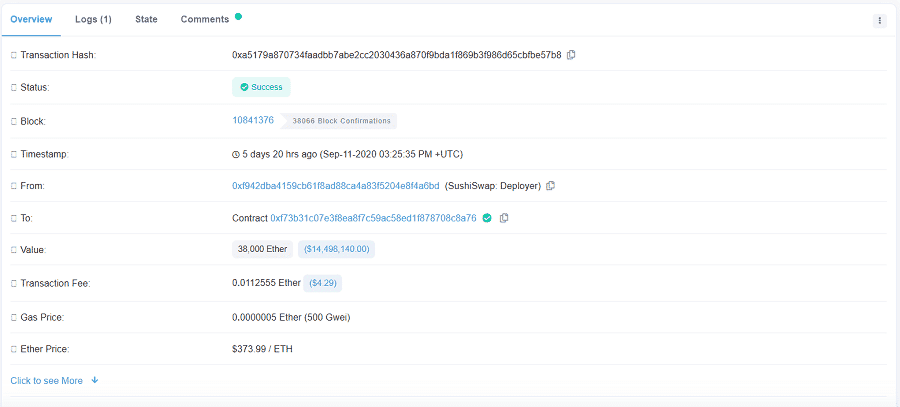

On September fifth 2020, Chef Nomi out of the blue liquidated over 14 million USD of SUSHI tokens accrued as improvement funds by the protocol. In a collection of Twitter posts, he famous he felt entitled to the funds. This drew immense outrage from the cryptocurrency neighborhood, most notably yearn.finance creator Andre Cronje.

Common YouTuber Ivan on Tech additionally remarked that “[SushiSwap] is just as bad as real sushi”. Ivan additionally famous that the sudden sell-off of SUSHI seemingly precipitated a crash within the cryptocurrency market the subsequent day attributable to its impact on the complete DeFi Area.

Chef Nomi subsequently stepped away from Sushiswap and handed it to Sam Bankman-Fried. The SushiSwap builders had additionally thought-about Andre Cronje as the brand new de facto chief of the protocol.

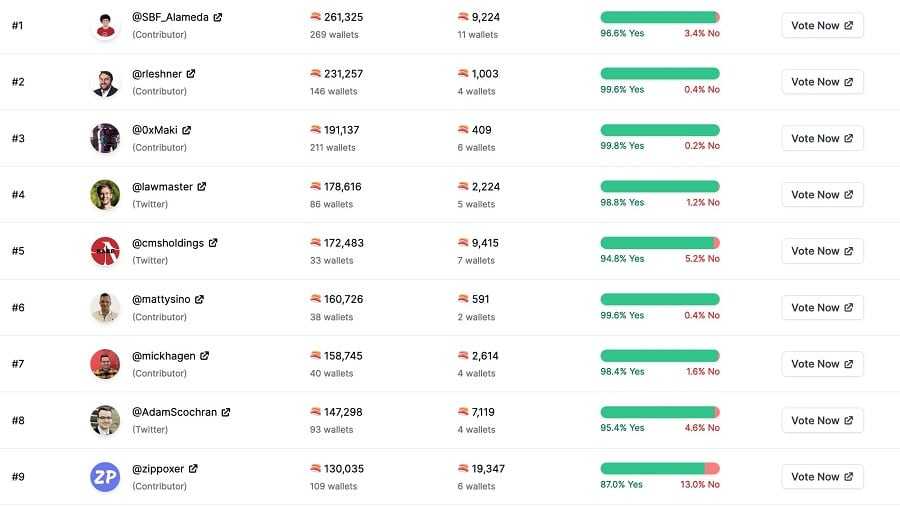

The SushiSwap neighborhood voted to pick out 9 people within the DeFi area, akin to Compound Finance’s founder Robert Leshner to be keyholders for the multi-sig pockets holding SushiSwap’s improvement funds.

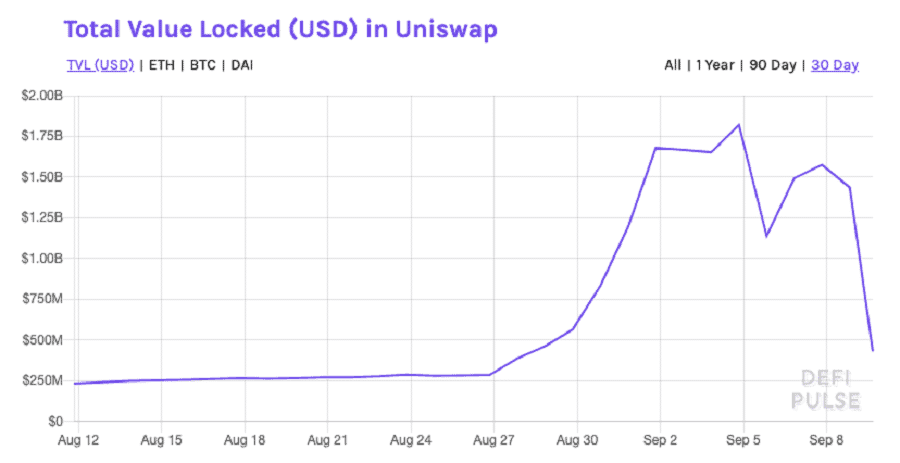

On September ninth 2020, Uniswap was stripped of its title as the most important decentralized alternate when SushiSwap customers migrated over 1.14 billion USD of Uniswap’s 1.9 billion USD locked cryptocurrency property to the brand new SushiSwap platform.

Although this migration had been deliberate for the reason that protocol’s announcement, 0xMaki believed that no various hundred million {dollars} of cryptocurrency could be moved. This sudden liquidity switch from one protocol to a different has been dubbed a vampire assault.

On September eleventh 2020, Chef Nomi out of the blue returned the stolen improvement funds to SushiSwap. Some imagine this was carried out to attract extra consideration to the undertaking. Nonetheless, within the interview talked about above with 0xMaki, he famous that he had issued an ultimatum over Twitter to Chef Nomi, telling him to reply his messages or else he would reveal delicate particulars about SushiSwap (seemingly Chef Nomi’s true id).

Chef Nomi is not concerned with the protocol and now describes himself on Twitter because the “former head chef” at SushiSwap.

What’s SushiSwap?

SushiSwap is a decentralized cryptocurrency alternate (DEX) constructed on the Ethereum blockchain. It goals to be an evolution of Uniswap, the most well-liked Ethereum-based DEX on the cryptocurrency market. It’s nearly similar to Uniswap in each look and performance.

SushiSwap rewards those that deposit cryptocurrency to supply liquidity to the protocol with SUSHI, an ERC-20 token given to liquidity suppliers on SushiSwap, which can be utilized to manipulate the protocol.

Though SushiSwap has a controversial historical past, it was and continues to be closely community-driven and dedicated to the open-source ethos of cryptocurrency. All good contracts and code are simply accessible by anybody by way of SushiSwap’s GitHub and Medium posts.

SushiSwap has additionally been audited by PeckShield and reviewed by Quantstamp. SushiSwap borrows a lot of its code from different in style DeFi protocols, together with Uniswap, Compound Finance, and the notorious Yam Finance.

DEX vs AMM

Earlier than we start taking a look at SushiSwap in-depth, allow us to first clear up what among the abbreviated phrases we come throughout on this article imply!

DEX– ‘DEX’ stands for ‘Decentralised Exchange’. A DEX is a platform that permits its customers to commerce tokens with out an middleman (e.g. centralized alternate). Usually, a DEX doesn’t have custody over the person’s property. As a substitute, the tokens are traded straight between friends by way of good contracts on the platform. Customers additionally needn’t confirm themselves by way of KYC, nor have they got to take care of the CEXs restrictions like withdrawal limits. There are two fundamental sorts of DEXs: Order e-book based mostly and Liquidity pool based mostly.

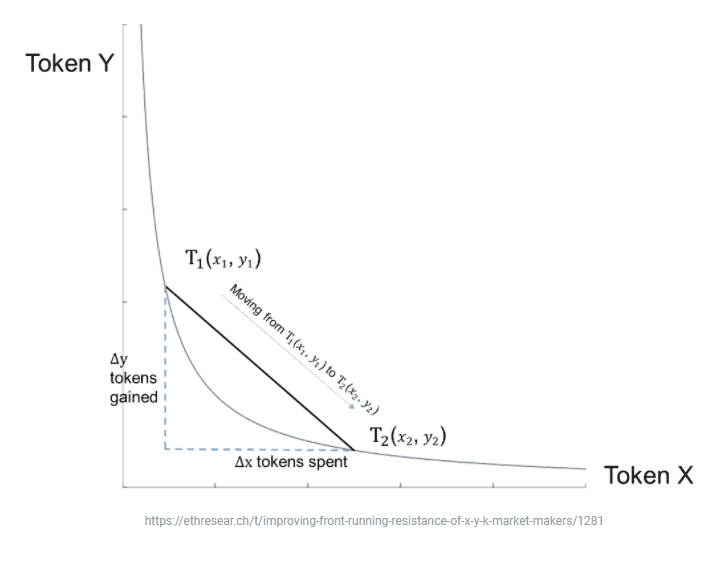

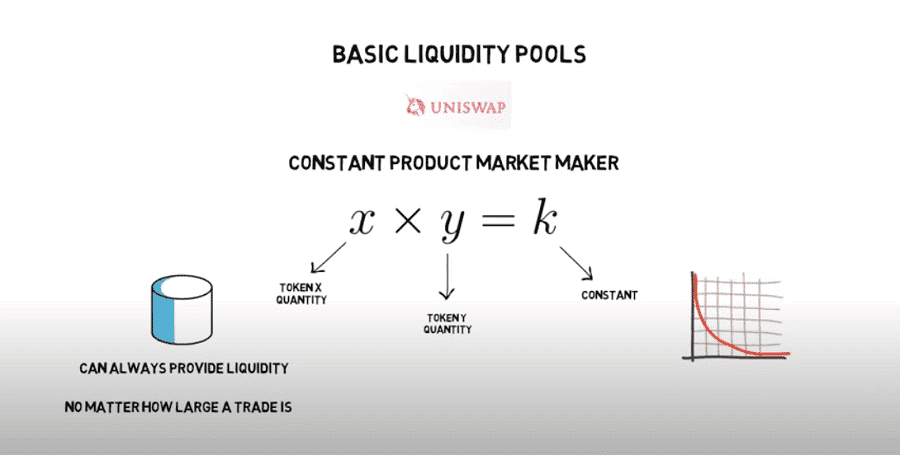

AMM– ‘AMM’ stands for ‘Automated Market Maker’. DEXs like SushiSwap and Uniswap use an AMM to facilitate the alternate of tokens on their platform. Most AMMs are good contracts that use one thing referred to as ‘Constant Product Market Maker’- a mathematical perform that algorithmically determines the value of an asset based mostly on the ratio of property inside the liquidity pool.

The perform is represented as x*y=okay, the place ‘x’ and ‘y’ check with the amount of the 2 property within the liquidity pool and ‘k’ is the product of ‘x’ multiplied with ‘y’. The thought behind the perform is that ‘k’ should at all times stay fixed. To attain that, when the provision of x will increase, the provision of y should proportionally lower and vice versa.

In the event you have been to graph an automatic market maker equation, you’ll see one thing often called a ‘bonding curve’. It exhibits that the extra of an asset in a pool is bought relative to the others, the dearer it turns into, rising exponentially as much as a theoretically infinite value.

This makes it virtually unattainable for anybody to purchase all the cryptocurrency within the pool and provides arbitrage merchants extra incentive to come back in and restore stability when the ratio between the pooled property (and, due to this fact, value) deviates an excessive amount of.

SushiSwap vs. Uniswap

With SushiSwap being a Uniswap fork, each DeFi protocols consequently share architectural and aesthetic similarities. Nonetheless, three key variations needs to be famous right here:

Liquidity Provision Rewards: The primary is a matter current in Uniswap that SushiSwap doesn’t have. Liquidity suppliers (LPs) earn a reduce of the buying and selling charges on each protocols. In Uniswap, the extra liquidity somebody offers, the bigger the reduce of the buying and selling charges from the pool they are going to get. The consequence is that rewards to smaller liquidity suppliers turn out to be diluted because the swimming pools develop. Massive entities akin to cryptocurrency exchanges, mining swimming pools, and enterprise capital funds can and infrequently do get the lion’s share of those buying and selling charges.

Conversely, SushiSwap designed its SUSHI emission in order that early adopters of the protocol would obtain 10x the quantity of SUSHI as those that be part of the protocol later. This SUSHI may very well be used to get a reduce of buying and selling charges from all swimming pools even when the early adopters stopped offering liquidity to swimming pools (by way of the Sushi Bar – extra on this later).

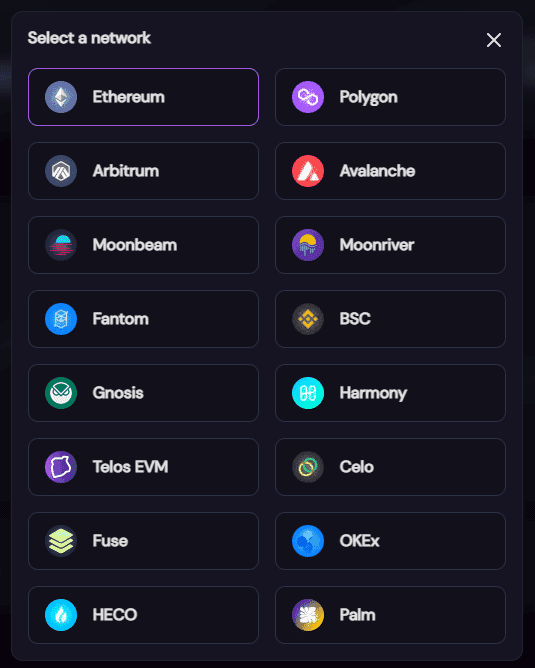

Multi-chain DEX: The second key distinction is the variety of networks that the DEXs function on. Whereas Uniswap is barely current on the Ethereum, Polygon, Optimism and Arbitrum Community, SushiSwap is a very Multichain Automated Market Maker that’s current on over 16 blockchain networks akin to Ethereum, Polygon, BSC, Concord, Fantom, and so on. to call just a few.

Options: The third key distinction is the variety of options provided on the DEXs. Uniswap has historically solely provided the AMM and liquidity pool farming characteristic. SushiSwap, however, has made it a degree to be a pioneer in increasing the companies {that a} DEX can present. A number of the further key options that SushiSwap offers are Kashi (Lending & Leverage), Sushi Bar (Staking), BentoBox (Token Vault), and MISO (IDO Launchpad).

PROS and CONS

Now that we’ve in contrast SushiSwap with Uniswap allow us to have a look at the professionals and cons of the platform.

Execs:

- SushiSwap is a multi-chain DEX current on greater than 16 blockchain networks

- SushiSwap presents its customers extra options (alternate, lending, launchpad, token vault, and so on) than most different DEXs out there

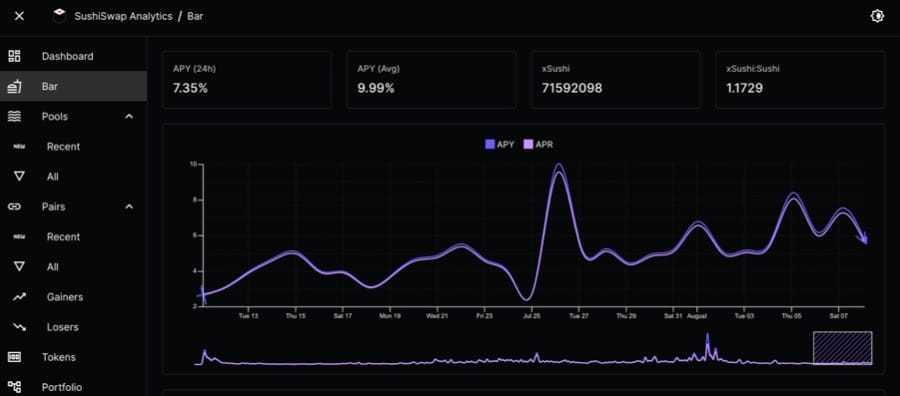

- Follows a revenue sharing model- Staked Sushi (xSUSHI) holders obtain a portion (0.05%) of the buying and selling charges charged by the platform.

- No KYC or obligatory id verification

Cons:

- No cross-chain swap characteristic but

- Shady Previous- Historical past of drama and safety considerations

- Dwindling TVL and market share

- The share of buying and selling charges allotted for liquidity suppliers is decrease for SushiSwap (0.25%) than Uniswap (0.30%)

How Does SushiSwap Work?

Like many different DEXs, SushiSwap basically consists of a number of asset swimming pools. Every pool accommodates two property, akin to ETH and LINK (Chainlink). It’s because it makes use of an Automated Market Maker (AMM). This good contract makes use of the ratio between two property in every pool to find out their value. Moreover, SushiSwap additionally has a restrict order market that customers can use to commerce property saved in BentoBox.

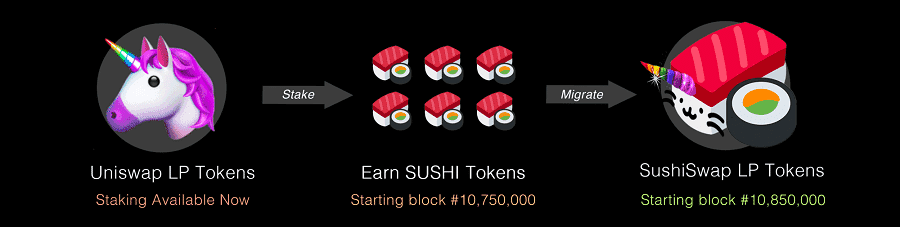

When SushiSwap was initially launched, it centered round Uniswap LP (liquidity supplier) tokens. LP tokens on Uniswap are ERC-20 tokens issued to liquidity suppliers once they deposit property into swimming pools on Uniswap.

These tokens might be exchanged for the underlying deposited funds, utilized in different DeFi protocols, and even exchanged for different LP tokens. Liquidity suppliers additionally obtain a share of the buying and selling charges of the property within the swimming pools they supply liquidity for by way of the LP tokens.

What SushiSwap did was to reward liquidity suppliers on Uniswap for staking their Uniswap LP tokens on the SushiSwap protocol. Their reward? SUSHI tokens! In the course of the first two weeks of the protocol’s launch, 1000 SUSHI tokens have been issued each Ethereum block (~12 seconds) to customers who staked their Uniswap LP tokens into quite a lot of comedically named “pools”.

Given the excessive market valuation of SUSHI on the time, curiosity exceeded 2,500% APY per yr in lots of of those swimming pools. The very best returns have been (and proceed to be) from the Sushi Occasion pool, which gave a further 2x reward in SUSHI for staking Uniswap LP tokens for the SUSHI-ETH pairing.

On the finish of the 2 weeks, 'The Liquidity Migration' occurred. This noticed all of the Uniswap LP tokens robotically despatched again to Uniswap to redeem them for the underlying crypto and ship all of it to SushiSwap's new swimming pools. This occasion drained over 1.14 billion USD from Uniswap inside 24 hours.

After this, SushiSwap successfully turned a carbon copy of Uniswap with further options. SUSHI rewards have been additionally lowered to 100 SUSHI per block. SushiSwap as it’s at present constructed consists of the next menu of purposes: the SushiSwap Alternate (Swap & Restrict Order), SushiSwap Liquidity Swimming pools (Pool), SushiSwap Farming (Farm), BentoBox (Token Vault), Kashi (Lending & Leverage), Sushi Bar (Staking) and Minimal Preliminary SushiSwap Providing (MISO).

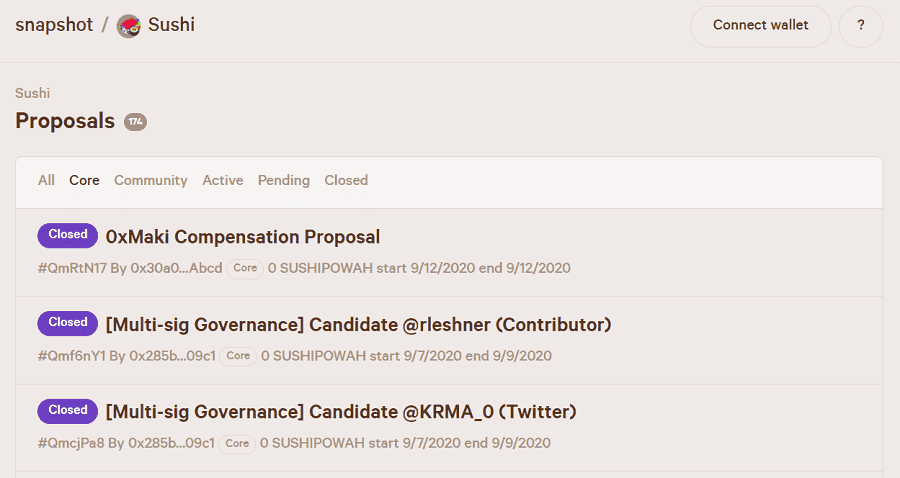

When it comes to governance, SushiSwap is in the end run and ruled by its neighborhood by way of discussion board discussions, and voting proposals held on the SushiSwap Snapshot. For instance, all main infrastructural modifications and use of the event fund pockets are voted on by the SushiSwap neighborhood. In distinction, extra minor modifications affecting operations and farming pairs are selected by 0xMaki and the SushiSwap Core Group.

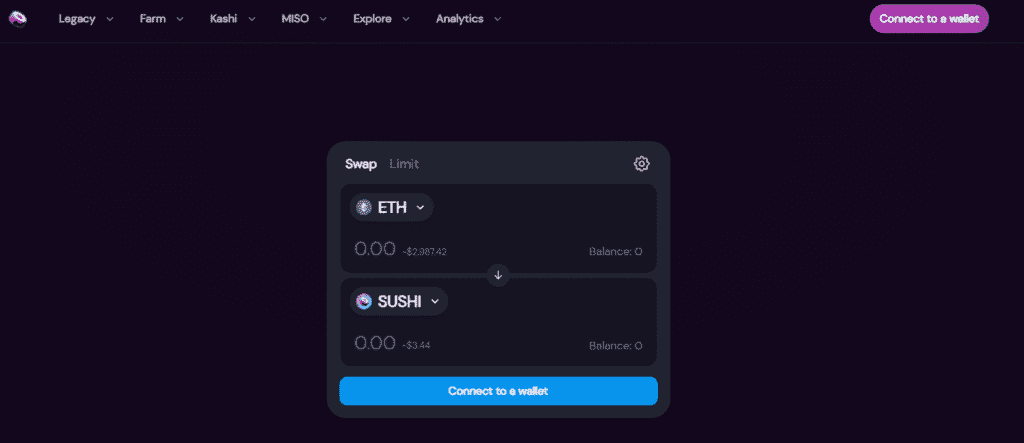

SushiSwap Alternate

The SushiSwap Alternate enables you to simply swap between 100+ ERC-20 tokens. As with Uniswap, no KYC is required to make use of the SushiSwap alternate. All you want is a Internet 3.0 pockets akin to Metamask and a few Ethereum to pay fuel charges to execute swaps.

The SushiSwap Alternate presents its customers two main alternate options- Instantaneous Swapping by way of Liquidity Swimming pools and the Restrict Order V2 characteristic.

Swapping by way of Liquidity Swimming pools

The swap characteristic on the AMM utilises the liquidity current in Liquidity Swimming pools to permit customers of the platform to deposit one token and withdraw the opposite immediately.

The protocol costs a 0.3% buying and selling charge on the whole worth of the asset being swapped. 0.25% of those charges go to these offering liquidity in SushiSwap’s Liquidity Swimming pools, and the remaining 0.05% goes to the Sushi Bar pool (extra on that in a second).

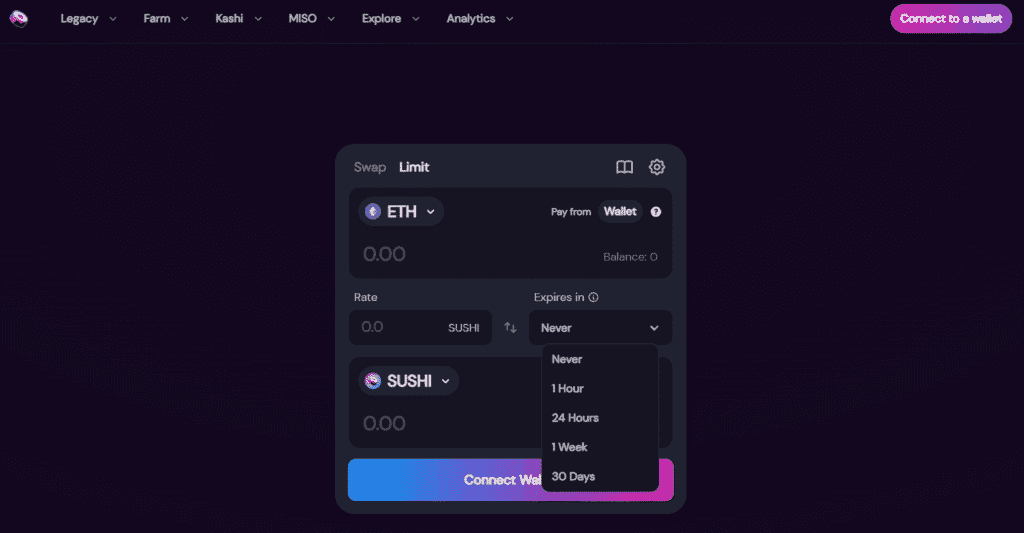

Sushiswap Restrict Order V2

In distinction to order book-driven exchanges, AMMs usually solely settle orders at market value, which is a big constraint. With the debut of the restrict order characteristic, SushiSwap tackles a big AMM ache level.

A restrict order is a request to purchase or promote an asset at a predetermined value. As distinct from a market order, which executes instantly after an order is positioned, a restrict order won’t execute until the asset reaches the value set by the person.

Restrict Orders on SushiSwap are way more capital environment friendly than common restrict orders positioned on CEXs. Not like a CEX, which blocks the related funds when a person locations a restrict order, SushiSwap permits customers to set many alternative restrict orders for a lot of completely different tokens, all utilizing the identical underlying capital.

Restrict Orders on SushiSwap don’t use a conventional order-matching mechanism to match orders between friends. As a substitute, it leverages the underlying AMM mechanism of the DEX to immediately execute a swap within the liquidity pool when the goal value has been hit. As well as, whenever you create a restrict order, the capital used is saved within the BentoBox, so these funds are additionally eligible for added yield.

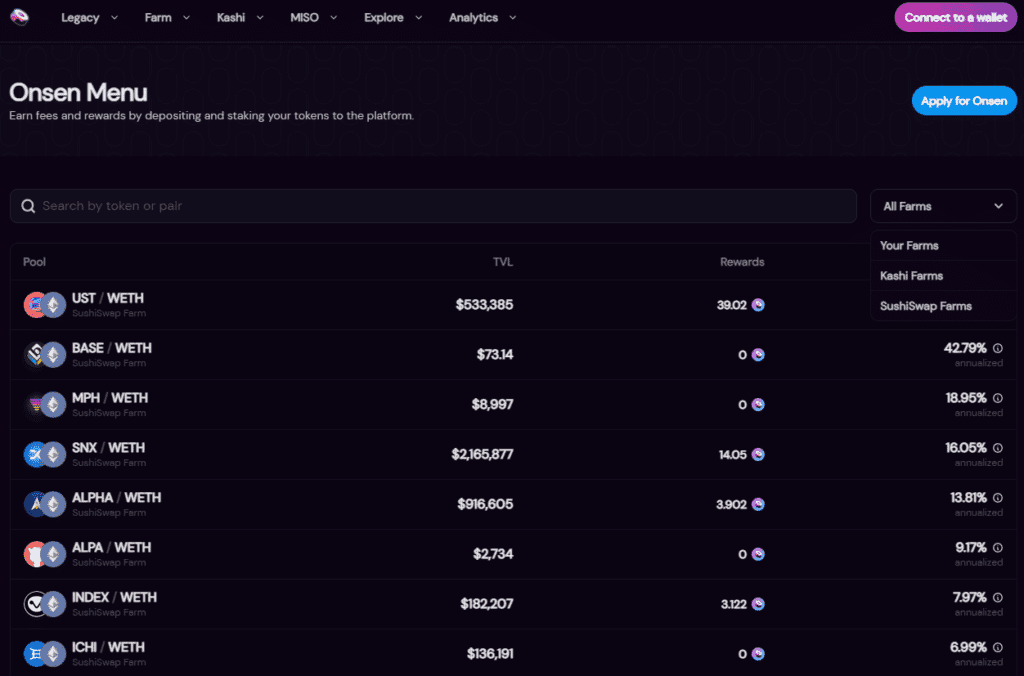

SushiSwap’s Onsen Menu (Farm)

SushiSwap’s Onsen Menu is a liquidity provision reward system for comparatively new tokens. Tokens chosen to be on the Onsen “menu” are allotted SUSHI tokens per block to incentivize liquidity provision. The profit to being on the Onsen menu is that the tasks themselves aren’t pressured to incentivize their communities to supply liquidity for his or her tokens as a result of Sushi does it for them.

Liquidity suppliers are given SushiSwap Liquidity Pool tokens (SLP tokens) which have the identical options as Uniswap's LP tokens. These tokens can then be staked on the farm to obtain yield in SUSHI tokens. And moreover pure SUSHI token farming, SushiSwap presents a wide selection of farming alternatives to its customers, together with an incredible number of asset pairs with completely different danger ranges and APYs.

Customers trying to farm on SushiSwap ought to:

- Head over to Sushi.com.

- Click on 'Enter App'.

- Join Metamask Pockets.

- Click on 'Farm'.

At this stage, farmers will be capable of see all of the out there farms on the SushiSwap platform by way of the 'All Farms', 'Kashi Farms', 'Your Farms' and 'SushiSwap Farms' Tabs.

As soon as the popular Farm is chosen, customers will subsequently have to click on 'Stake' to provoke the farming course of, or 'Unstake', to withdraw funds.

After coming into the specified quantity and clicking on ‘Stake’, customers can then preview their chosen asset pair for the respective farm and make sure the transaction on Metamask. ETH will probably be required to settle the transaction. Relying on the asset pair and farm, APYs can fluctuate drastically from roughly 7% to greater than 600%, which is, after all, consultant of the chance publicity undertaken by farmers at anybody time.

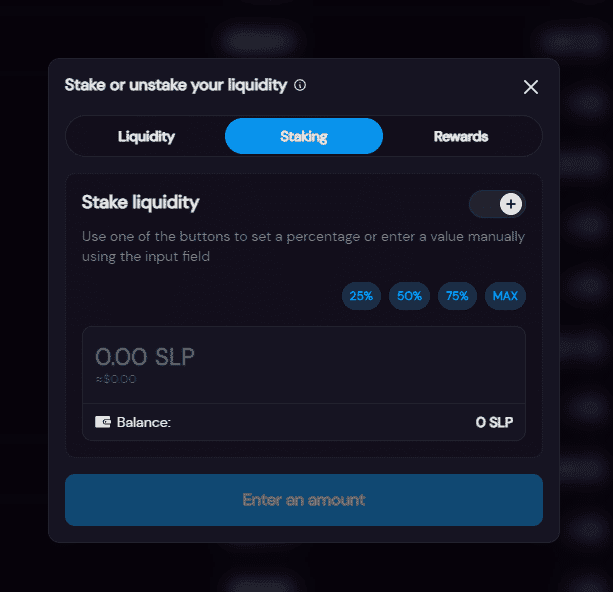

SushiSwap SUSHI Bar (Stake)

SushiSwap’s Sushi Bar is the place you may stake SUSHI tokens to earn extra SUSHI tokens. In the event you surprise the place these rewards come from, recall the 0.05% buying and selling charge famous earlier. 0.05% of all buying and selling charges on SushiSwap are added to the Sushi Bar pool within the type of SLP tokens.

A minimum of as soon as each 24 hours, the rewards contract might be referred to as, which robotically liquidates all SLP tokens within the Sushi Bar pool to purchase SUSHI tokens on the SushiSwap Alternate. These tokens are then distributed to all customers staking SUSHI tokens within the Sushi Bar within the type of xSUSHI tokens, which might be transformed into common SUSHI tokens within the Sushi Bar.

SushiSwap BentoBox (Token Vault)

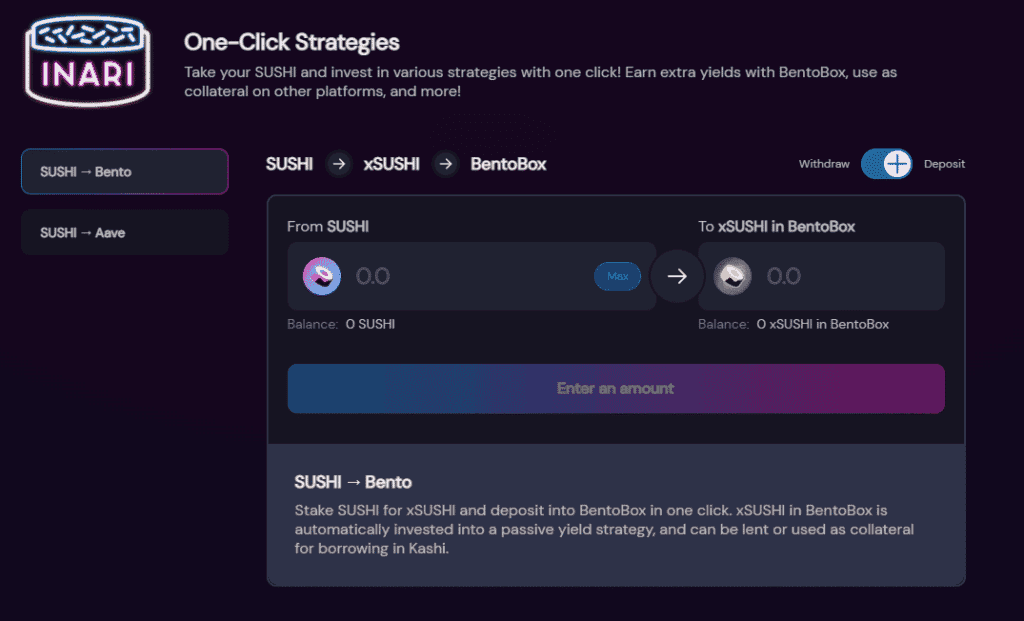

A Bento Field is a Japanese lunchbox crammed with an assortment of dishes that an individual can get pleasure from throughout their meal. Equally, SushiSwap’s BentoBox is a token vault that customers can use to deposit an assortment of various tokens or funds. By doing so, customers obtain additional yield on deposits by way of flash lending, methods, and glued, low-gas transfers amongst built-in dapps, like Kashi markets.

The thought behind the BentoBox is to create a local foundational layer within the type of a vault upon which future monetary merchandise constructed on SushiSwap might be leveraged.

BentoBox’s innovation lies in its capability to trace the person’s deposits by way of synthetic stability, which is used to account for his or her idle funds, whereas the identical funds are concurrently utilized to methods. In a manner, it’s just like the fractional reserve system.

BentoBox is designed to be scalable and serves as the long run infrastructure for upcoming DeFi protocols on SushiSwap, the primary of which is Kashi.

SushiSwap Kashi (Lending & Leverage)

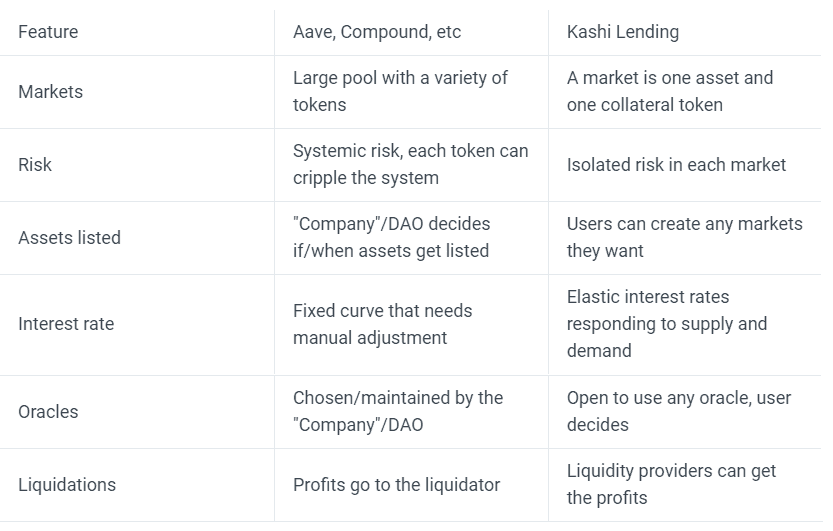

In Japanese, the phrase ‘Kashi’ comes from the verb ‘Kasu’, which suggests ‘to lend’. Equally, SushiSwap’s Kashi can also be a lending and margin buying and selling platform constructed on BentoBox, permitting anybody to create personalized and gas-efficient markets for lending, borrowing, and collateralizing varied DeFi tokens, secure cash, and artificial property.

Kashi permits customers to create ‘isolated’ lending markets. Customers can borrow and lend into an already listed lending pair or create their very own, the place one token within the pair acts because the ‘asset’ and the opposite token within the pair acts because the ‘collateral’. This implies the chance of property inside one lending market doesn’t have an effect on the chance of one other lending market.

Beforehand, customers who wished to leverage an asset by way of direct lending and borrowing needed to borrow on one platform, then lend on one other, and so forth. As a result of Kashi divides markets into pairs, lending and borrowing into the identical market might be mixed with a single click on, permitting Kashi to automate leverage.

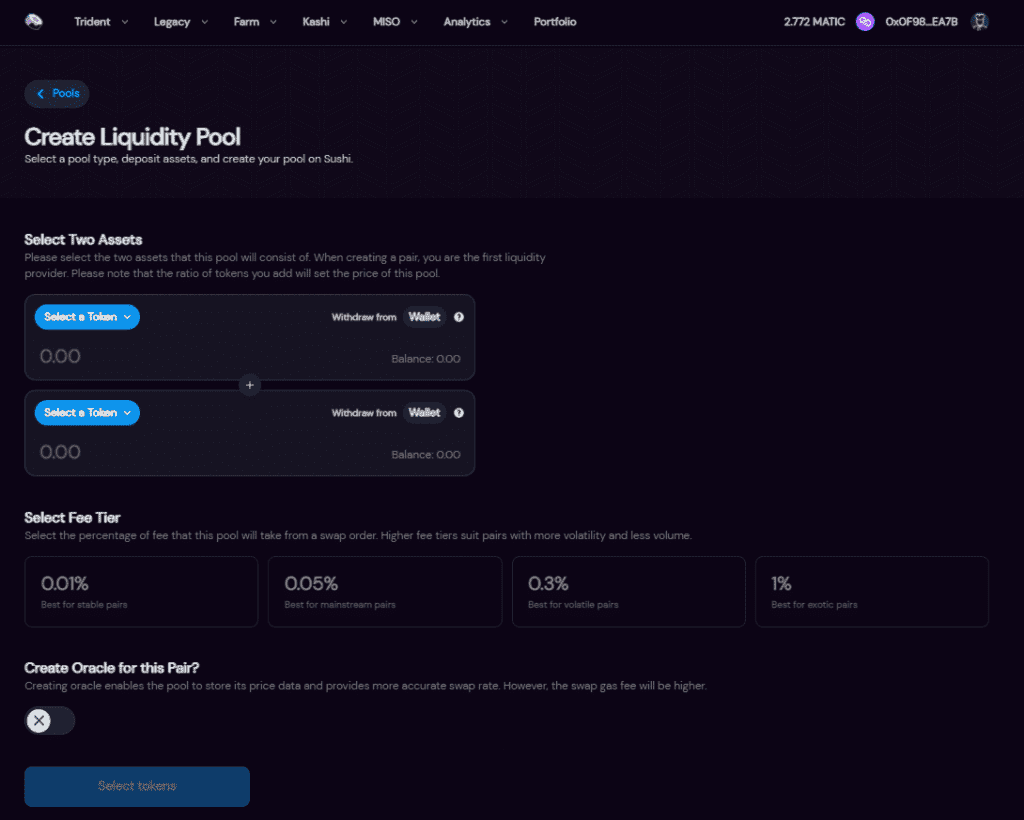

SushiSwap ‘Trident Framework’

Trident is the most recent product from the SushiSwap crew constructed on prime of BentoBox. Trident is a framework for creating and deploying AMMs, however it isn’t an AMM in and of itself. So whereas the Trident code can be utilized to generate AMMs, there isn’t a particular AMM on the coronary heart of Trident. As a substitute, there’s a framework that can be utilized to create any AMM that anybody would require.

The idea behind this framework is to standardise AMM pool sorts, just like how the ERC-20 token normal was wanted for token sorts to turn out to be environment friendly. The Trident Framework will streamline the event course of for creating and designing liquidity swimming pools and AMMs.

At present, the Trident Framework is in its beta on Polygon. Customers can battle and safety take a look at the completely different parts earlier than the crew can clear them for porting them over to different chains.

Minimal Preliminary SushiSwap Providing (MISO)

MISO is a set of open-source good contracts created to ease the method of launching a brand new undertaking on the SushiSwap alternate. The Minimal Preliminary SushiSwap Providing acts as an IDO-like launchpad for SushiSwap. It’s a place for token creators and communities to launch new undertaking tokens. By MISO, SushiSwap goals to create a launchpad for technical and non-technical undertaking founders, permitting communities and tasks entry to all of the choices they want for a safe and profitable deployment to the SushiSwap alternate.

MISO creates a set of out-of-the-box good contracts for non-technical founders to decide on over extra conventional and code-oriented strategies of token launching. At current, SushiSwap’s MISO launchpad presents a choice of NFT property to traders by way of an public sale system to rejoice the launch of recent tokens on its platform. Thus, MISO is a transparent indication of SushiSwap’s forward-thinking, cutting-edge structure because it seeks to encapsulate each the hype-driven world of NFTs and the financial potential of IDOs into its ecosystem.

SushiSwap Governance

The SushiSwap crew is at present creating a governance framework referred to as Omakase DAO which can hand over management of the protocol to the neighborhood. Anybody with SLP tokens acquired from offering liquidity to the SUSHI-ETH pool or these with xSUSHI tokens (which additionally require SUSHI-ETH SLP tokens to get) will be capable of vote for modifications to SushiSwap.

Though the small print are nonetheless being hammered out, it’s anticipated that you will want to stake these tokens for a set period of time to take part in voting.

In the interim, SushiSwap Enchancment Proposals (SIPs) might be tabled and voted on by anybody on the SushiSwap’s SushiPowah web page on Snapshot. Nonetheless, presently, solely proposals posted to the Snapshot voting system by the CORE might be thought-about binding if handed with a quorum. For these unfamiliar, Snapshot is a publicly viewable governance discussion board utilized by DeFi protocols akin to Aave, Balancer, and Yearn.Finance.

‘SushiPowah’ is the voting metric of the governance discussion board. Every Sushi token held within the SUSHI-ETH pool is the same as 2 SUSHIPOWAH. In distinction, every Sushi held by way of the xSushi token equals 1 SUSHIPOWAH for or in opposition to the proposal. For a vote to go and turn out to be binding, it should acquire a quorum of no less than 5 million SUSHIPOWAH.

The SUSHI Token

SUSHI is an ERC-20 token issued to liquidity suppliers (LPs) on the SushiSwap decentralised alternate (DEX). It’s earned by offering liquidity to swimming pools on SushiSwap or by way of farming in alternate for SLP tokens used to manipulate the protocol.

The token was designed to reward early protocol customers by permitting them to proceed incomes a reduce of SushiSwap’s charges even after they’ve stopped offering liquidity to SushiSwap’s swimming pools. This may be carried out by staking SUSHI to earn extra SUSHI on SushiSwap’s Sushi Bar.

SUSHI ICO

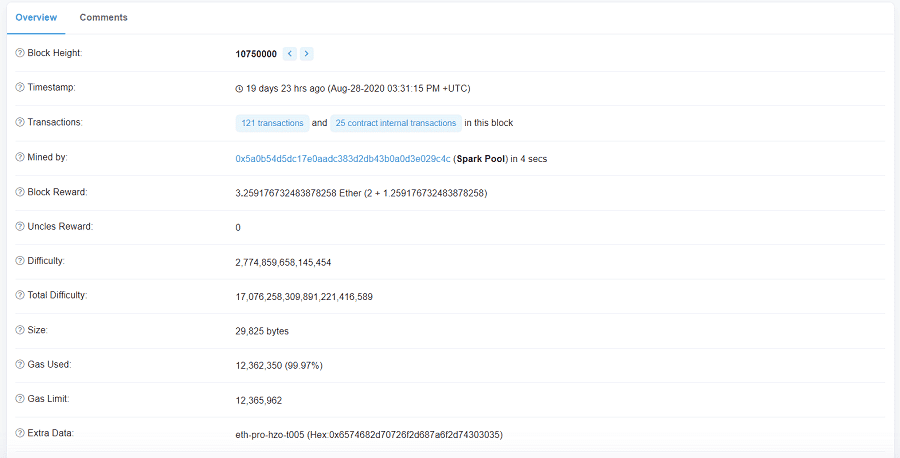

There was no ICO for SUSHI. The issuance of SUSHI started on Ethereum block quantity 10750000. As talked about beforehand, 1000 SUSHI have been being issued each Ethereum block (12 seconds) to these staking Uniswap LP tokens on SushiSwap’s preliminary protocol.

After ‘The Liquidity Migration’ occurred, SUSHI rewards dropped to 100 SUSHI per Ethereum block. This could also be lowered by neighborhood vote. On the time of writing, the circulating provide of SUSHI equates to 241,099,876 SUSHI tokens, with a most provide of 250,000,000 SUSHI.

SUSHI Worth Evaluation

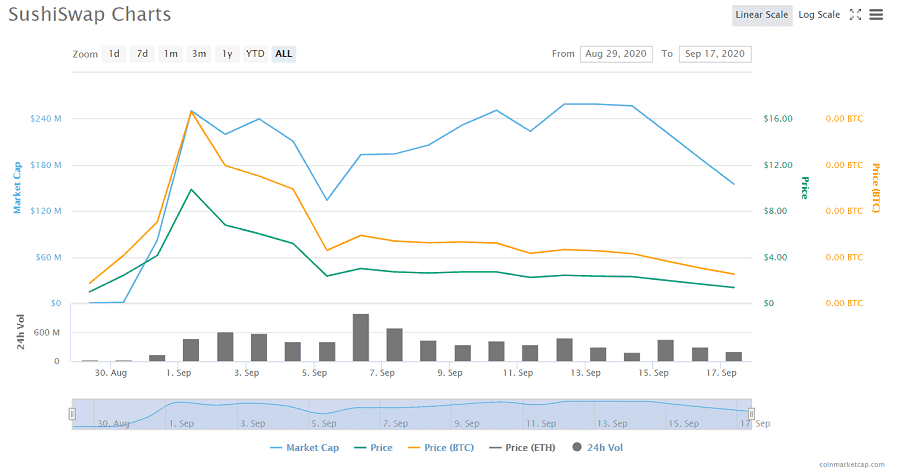

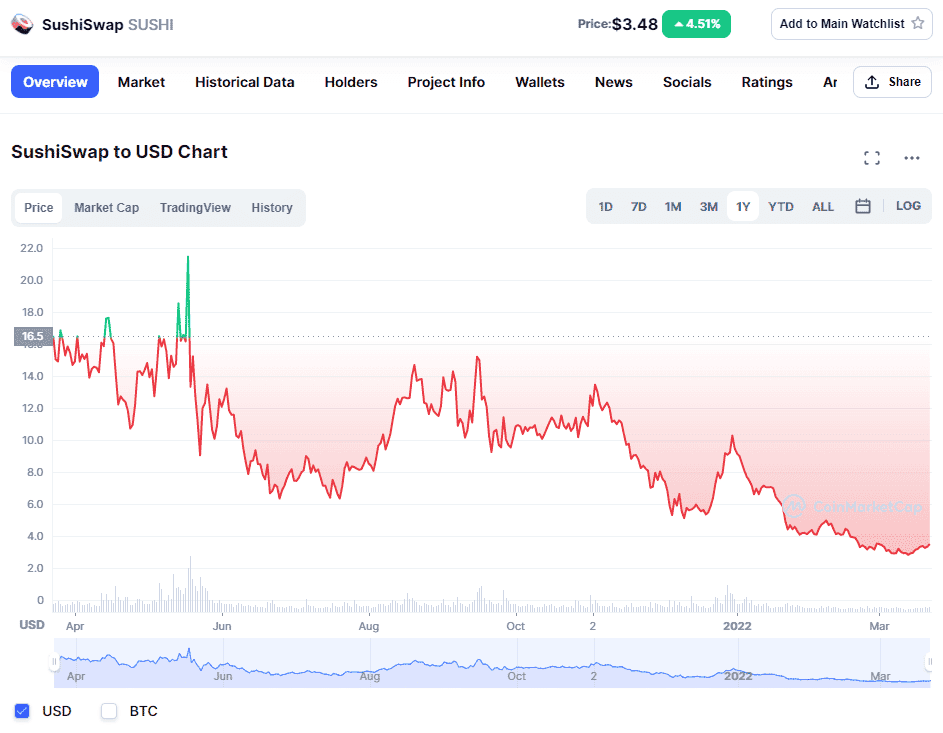

As you may need guessed, SUSHI entered the cryptocurrency market on August twenty eighth 2020, with a near-zero worth. Nonetheless, by September 1st 2020, the value had skyrocketed from just a few cents to over $12 as yield farmers rushed in to capitalize on the insane annual share yields provided by SushiSwap.

Sooner or later later, the value crashed by over 50% to underneath $6 and once more dropped by greater than 50% on September fifth 2020, to round $2.50 when SushiSwap’s co-founder Chef Nomi liquidated over 14m USD value of SUSHI.

SUSHI is at present buying and selling at roughly $3.27 and is down about 86.04% from its March 2021 ATH of $23.38. As one of many largest multichain DEXs within the DeFi area with a confirmed use case and over $1.51 billion in TVL, SushiSwap may doubtlessly make a comeback to its earlier $20+ ranges within the long-term outlook. Inherently, SushiSwap has a lot going for it. It can most certainly keep it up rising alongside the remainder of the Decentralised Finance ecosystem.

The place can I get SUSHI cryptocurrency?

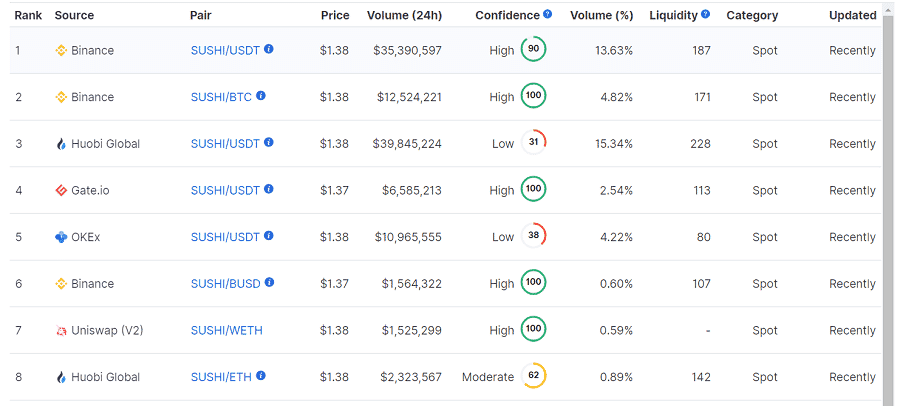

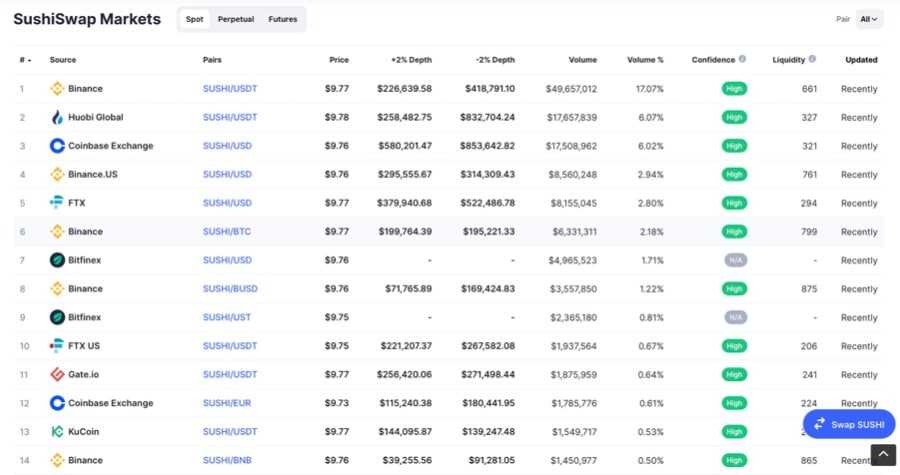

SUSHI is sort of simply as simple to get as genuine sushi. Binance listed SUSHI on September 1 2020, which seemingly precipitated the unbelievable spike in value on the time. Since then, different respected exchanges, together with Huobi and OKX, have listed the token.

In the event you choose decentralized exchanges, SUSHI continues to be out there on Uniswap and might, after all, be bought from the SushiSwap Alternate. Liquidity on all these exchanges could be very excessive, and the 24-hour buying and selling quantity for SUSHI is sort of double its market cap. So you shouldn’t have any points getting your arms (or chopsticks) on this succulent cryptocurrency token.

SUSHI Cryptocurrency Wallets

Since SUSHI is an ERC-20 token, it may be saved in any cryptocurrency pockets that helps Ethereum-based property. The place you need to put your SUSHI relies on what you propose on doing with it.

In case you are considering utilizing SushiSwap to supply liquidity or take part in governance, your greatest wager could be a Internet 3.0 pockets akin to Metamask. Then again, if you happen to plan on holding your SUSHI till the market is hungrier for it, a safe cell pockets such because the Trezor pockets ought to do the trick!

SushiSwap Roadmap

SushiSwap has one aim and one aim solely: to turn out to be the most effective DEX in cryptocurrency. That is fairly a broad aim, and the brand new SushiSwap crew doesn’t at present element any particular future milestones.

The closest doc to a visible roadmap is SushiSwap’s Medium publish dated September 12 2020. Since then, nonetheless, SushiSwap has launched its 2021 extremely bold roadmap, which incorporates its MISO upgrades, its aspiration to construct on Layer-2, AMM 2.0 infrastructure, SushiBar Model 2 and Wrapped SLP tokens for better DeFi utility.

Conclusion

Regardless of the seeming ridiculousness of the undertaking and the chaos it has precipitated in its brief historical past, SushiSwap has nonetheless managed to carry on to round 800 million of the preliminary 1.14 billion it drained from Uniswap. The DEX additionally maintains a mean of 150 million USD of day by day quantity.

Regardless of experiencing a fairly turbulent, bumpy journey at first of its existence, SushiSwap has developed into one of many go-to DEX, yield farming and LP options in DeFi. It may doubtlessly someday even come to steal the crown from Uniswap as the final word DEX platform.

However, it also needs to be famous that the comparatively unprofessional naming and UI of many DeFi protocols, together with SushiSwap, are maybe much more distasteful to critical retail traders than seasoned yield farmers. As well as, controversies akin to Chef Nomi’s exit scams actually damage the area on the finish of the day.

That being mentioned, SushiSwap appears to be serving up extra scrumptious meals than ever underneath new administration. The ambition and dedication of its core builders and neighborhood is admirable and could be sufficient to hold the undertaking ahead properly into the long run.