Cryptocurrencies supply thrilling alternatives however typically include wild value swings, leaving many questioning the right way to stability threat and reward.

Stablecoins, like USDC and USDT, promise the most effective of each worlds: the innovation of crypto with the steadiness of conventional forex. However how do they actually work? Which one is safer? Which must you select for buying and selling, saving, or sending cash overseas?

On this USDC vs. USDT evaluation, we’ll dive deep into these two stablecoins, exploring their key variations, use circumstances, and what you might want to know to make your best option in your monetary wants.

What are Stablecoins?

Stablecoins like USDC or USDT are a sort of cryptocurrency designed to take care of a steady worth, sometimes pegged to the US greenback. In contrast to conventional cryptocurrencies like Bitcoin, that are vulnerable to vital value volatility, stablecoins supply value stability, making them a dependable medium of alternate and retailer of worth throughout the crypto ecosystem.

The first function of stablecoins is to mix the steadiness of fiat currencies with the advantages of cryptocurrencies. By pegging their worth to a steady asset, stablecoins permit customers to have interaction within the crypto market with diminished publicity to cost swings. This stability is achieved by way of varied mechanisms:

- Fiat-Collateralized: Backed by reserves of fiat currencies just like the US greenback, these stablecoins preserve a 1:1 peg. Examples embody USDC and USDT.

- Crypto-Collateralized: Backed by different cryptocurrencies, these stablecoins are sometimes over-collateralized to account for the volatility of their reserves. An instance is DAI.

- Algorithmic: These stablecoins use algorithms and sensible contracts to handle their provide and preserve their peg, with out counting on collateral.

Stablecoins play a vital position within the cryptocurrency market by enabling seamless transactions, facilitating buying and selling, and serving as a secure haven throughout market turbulence. They’re additionally central to the decentralized finance (DeFi) ecosystem, the place they’re used for lending, borrowing, and incomes curiosity.

Significance of Stablecoins within the Crypto Ecosystem

Stablecoins have shortly turn into the Swiss Military knife of the cryptocurrency world, providing a flexible toolset that enhances how we work together with digital belongings. Whether or not you’re buying and selling, hedging in opposition to volatility, sending remittances, or diving into the world of DeFi, stablecoins are an ideal choice.

Use Instances: Buying and selling, Hedging, and Remittances

Stablecoins like USDT (Tether) and USDC are the MVPs. Merchants love them as a result of they will swiftly transfer out and in of positions with out the trouble of changing belongings again to fiat. This implies extra flexibility, sooner trades, and higher portfolio administration. Plus, when the market turns right into a rollercoaster experience, stablecoins are a dealer’s security harness. By changing unstable belongings into stablecoins, buyers can experience out the storm with out watching their portfolios plummet.

However stablecoins aren’t only for the buying and selling professionals — they’re revolutionizing remittances too. Sending cash throughout borders has historically been sluggish and costly, however stablecoins are altering the sport. They permit individuals to switch worth throughout the globe at lightning velocity and at a fraction of the fee, making them a no brainer for people and companies alike.

Position in DeFi and Lending Platforms

In DeFi, stablecoins present the liquidity that powers all the pieces from lending to staking. Think about incomes curiosity in your stablecoins or taking out a mortgage with out ever coping with a financial institution — that’s the magic of DeFi. Stablecoins make all of it attainable, giving customers the liberty to take part in a monetary system that’s open to everybody, 24/7.

Adoption by Crypto Exchanges and Wallets

Stablecoins have additionally received the hearts of cryptocurrency exchanges and wallets. Main exchanges supply buying and selling pairs with stablecoins, making it simpler for customers to commerce in a steady setting. In the meantime, digital wallets are embracing stablecoins, permitting customers to retailer, ship, and obtain them similar to conventional currencies, however with all the advantages of crypto.

Overview of USDC

USDC is a stablecoin developed and issued by Circle and was formally launched in September 2018. USDC is presently supported on 16 blockchain networks, together with Ethereum, Solana, and Polygon, amongst others. This broad blockchain integration has enabled USDC to turn into a big participant within the world crypto market, with the token now obtainable in over 100 international locations.

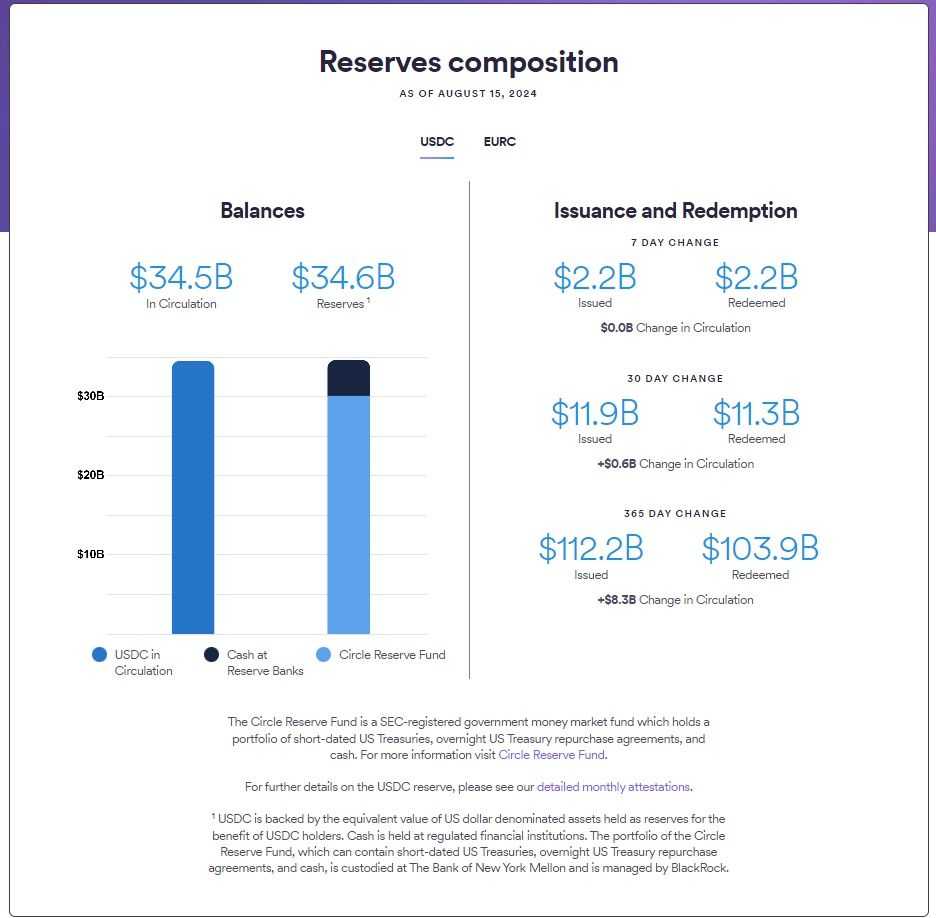

USDC is a fiat-collateralized stablecoin, which means it’s backed by a reserve of US {dollars} and U.S. Treasury devices held in custody by regulated monetary establishments. Since its launch, USDC has grown quickly, with over $17 trillion in on-chain transactions and a circulating provide of round $34.85 billion as of 2024. One notable milestone is that USDC overtook (USDT) in transaction quantity in 2024, highlighting its growing adoption and significance within the crypto area.

Key Options of USDC

- Fiat-Collateralized Stability: USDC is backed 100% by extremely liquid money and cash-equivalent belongings and is at all times redeemable 1:1 for US {dollars}. For extra info, you may test Circle's transparency web page.

- Regulatory Compliance: USDC is designed with compliance in thoughts. Circle works carefully with regulators and monetary establishments to make sure the stablecoin adheres to all related rules, making it a reliable choice for companies and people.

- Multi-Blockchain Assist: USDC operates on a number of blockchains, together with Ethereum, Solana, and Algorand. This broad help permits cross-chain compatibility and integration with varied decentralized purposes, enhancing its utility.

- Broad Adoption: USDC is extensively accepted on main cryptocurrency exchanges and platforms, providing excessive liquidity and ease of conversion between digital belongings. This widespread adoption additionally facilitates its use in varied buying and selling methods and DeFi purposes.

How USDC Works

The issuance and redemption course of for USDC includes the conversion between US {dollars} and USDC tokens. When a consumer sends USD to the issuer's checking account, an equal quantity of USDC is created utilizing a wise contract. The changed US {dollars} are then held in reserve.

To redeem USDC for USD, the method is reversed. The consumer requests an alternate of USDC for USD, and the issuer burns the tokens whereas releasing the corresponding quantity of USD from the reserves to the consumer's checking account.

USDC operates totally on the Ethereum blockchain as an ERC-20 token. Nevertheless, it’s also obtainable on different blockchains, together with Algorand, Solana, and Stellar, enabling cross-chain compatibility and enhancing its utility in varied decentralized purposes.

Overview of USDT (Tether)

Tether (USDT) was launched in 2014, initially underneath the identify "Realcoin," by Brock Pierce, Reeve Collins, and Craig Sellars. The thought was to create a digital asset pegged to the US greenback, bringing the steadiness of fiat forex to the fast-paced world of cryptocurrency. Not lengthy after, the venture rebranded as Tether.

Tether’s progress has been nothing in need of explosive. From a modest circulating provide of $10 million in January 2017, USDT ballooned to virtually $2.8 billion by September 2018. Quick ahead to 2024, and Tether's circulating provide has surpassed $117 billion, solidifying its place as probably the most extensively used stablecoin. As of Aug. 1, 2024, Tether reported a considerable $118.4 billion in reserves, with a market capitalization exceeding $114 billion. Moreover, Tether's internet fairness stands at $11.9 billion, reflecting its sturdy monetary place throughout the stablecoin market.

Nevertheless, Tether’s journey hasn’t been with out its bumps. The corporate has been dogged by controversy, particularly across the transparency of its reserves. In 2017, questions on whether or not Tether was absolutely backed by US {dollars} sparked widespread concern. Issues escalated in 2019 when the New York Legal professional Normal accused Tether and its sister firm Bitfinex of utilizing reserves to cowl up an $850 million loss. Tether settled the case by paying an $18.5 million nice in 2021.

Key Options of USDT

- Multi-Blockchain Assist: USDT isn't confined to a single blockchain. It operates throughout a number of blockchains, together with Algorand, Avalanche, Celo, Cosmos, Ethereum, EOS, Liquid Community, Close to, Polkadot, Solana, Tezos, Ton, and Tron. This versatility permits USDT for use on a big selection of platforms and purposes, making it extremely accessible and built-in throughout the crypto ecosystem.

- Excessive Liquidity: USDT is likely one of the most liquid stablecoins obtainable, with large every day buying and selling volumes. This makes it a most popular alternative for merchants who want fast and environment friendly conversion between cryptocurrencies with out worrying about slippage or lack of liquidity.

- Broad Adoption: USDT is accepted on almost each main cryptocurrency alternate and is utilized in varied buying and selling pairs, making it straightforward for customers to commerce, ship, and obtain worth. Its widespread use additionally extends to DeFi platforms, the place it serves as a dependable asset for lending, borrowing, and different monetary actions.

- Secure Worth Pegged to the USD: Whereas that is inherent to all stablecoins, USDT’s worth stays persistently pegged to the US greenback, making it a dependable choice for hedging in opposition to market volatility or transferring worth with out the fluctuations seen in different cryptocurrencies.

- Transaction Pace and Prices: Because of its presence on a number of blockchains, customers can select the community that most accurately fits their wants, balancing transaction velocity and prices. For instance, USDT on the Tron community typically presents sooner and cheaper transactions in comparison with Ethereum.

How USDT Works

The issuance and redemption course of for USDT includes the conversion between US {dollars} and USDT tokens. When a consumer sends USD to Tether's checking account, an equal quantity of USDT is created utilizing a wise contract. The changed US {dollars} are then held in reserve.

To redeem USDT for USD, the method is reversed. The consumer requests an alternate of USDT for USD, and Tether burns the tokens whereas releasing the corresponding quantity of USD from the reserves to the consumer's checking account.

USDT operates on a number of blockchain networks, together with Omni, Ethereum, Tron, Algorand, and EOS. This multi-blockchain help permits for higher flexibility and integration with varied decentralized purposes and platforms.

You’ll be able to take a look at our pockets information that can assist you determine the right way to retailer your USDT securely. And by the way in which, Tether is about to launch a brand new stablecoin pegged to UAE's Dirham. We will certainly be maintaining a tally of that too.

USDC vs. USDT: A Aspect-by-Aspect Comparability

Whereas each are designed to take care of a steady worth pegged to the US greenback, they differ considerably by way of market capitalization, transparency and regulatory compliance. This USDC vs Tether comparability will discover these variations intimately, specializing in market dynamics and compliance measures.

| Function | USDC | USDT (Tether) |

|---|---|---|

| Launch Yr | 2018 | 2014 |

| Issuer | Circle | Tether Restricted |

| Reserve Administration | Totally backed by US {dollars} and U.S. Treasuries, with common attestations | Claims full backing, however transparency has been questioned |

| Transparency | Month-to-month audits by impartial corporations | Restricted transparency, periodic attestations |

| Regulatory Compliance | Excessive – adheres to U.S. rules, absolutely compliant | Restricted, with a historical past of authorized challenges |

| Blockchain Assist | Ethereum, Solana, Polygon, Algorand, Stellar, and so on. | Ethereum, Tron, Algorand, Omni, and plenty of others |

| Market Capitalization (2024) | $34.9 billion | $117 billion |

| Main Use Instances | DeFi, lending, remittances, long-term holding | Buying and selling, liquidity, remittances, arbitrage |

| Adoption & Liquidity | Extensively adopted, however barely much less liquid in comparison with USDT | Highest liquidity amongst stablecoins |

| Transaction Pace & Prices | Varies by blockchain | Varies by blockchain |

| Most popular by | Customers in search of compliance, transparency, and safety | Merchants in search of excessive liquidity and buying and selling pairs |

| Reserve Foreign money | Primarily US {dollars} | Blended reserves together with money and different belongings |

| Regulatory Challenges | Few, proactive in compliance | Confronted authorized challenges, together with NY Legal professional Normal case |

| Recognition in Buying and selling | Decrease liquidity, fewer buying and selling pairs in comparison with USDT | Most traded stablecoin, with in depth pairs |

| Safety Incidents | Reserves held in respected monetary establishments | Hacking incident in 2017 ($30 million loss) |

Market Capitalization and Adoption

As of August 2024, USDT holds a commanding market capitalization of over $117 billion, making it the biggest stablecoin by a considerable margin. In distinction, USDC presently has a market cap of round $34.9 billion, positioning it because the second-largest stablecoin out there. This distinction in market capitalization might be attributed to USDT's longer presence out there, having launched in 2014 in comparison with USDC's introduction in 2018.

Each stablecoins have achieved vital adoption throughout varied cryptocurrency exchanges and platforms. USDT is extensively built-in into buying and selling pairs, permitting customers to commerce in opposition to it on just about all main exchanges. Its excessive liquidity makes it a most popular alternative for merchants seeking to shortly enter and exit positions.

The liquidity swimming pools involving each USDC and USDT are important for the functioning of DeFi platforms. Nevertheless, USDT's increased liquidity typically results in extra aggressive buying and selling situations, attracting a broader vary of customers and purposes.

Transparency and Regulatory Compliance

When evaluating Tether vs USDC, transparency performs a key position, with USDC typically seen as extra clear as a result of common audits.

USDC is thought for its strong auditing practices, offering month-to-month reviews from impartial accounting corporations that confirm its reserves. This dedication to transparency helps construct belief amongst customers and regulators alike.

In distinction, Tether has confronted scrutiny relating to its auditing practices. Whereas it has made efforts to publish attestations of its reserves, the frequency and element of those reviews have been questioned. Tether's historic lack of transparency has led to considerations about its credibility, particularly in mild of previous controversies and authorized challenges.

Regulatory compliance is one other space the place USDC stands out. It adheres to U.S. cash transmission legal guidelines and works carefully with regulators to make sure compliance, which boosts its repute as a safe and dependable stablecoin. Tether, alternatively, has confronted authorized challenges, together with investigations by the New York Legal professional Normal, which have raised questions on its operational practices and reserve administration.

Fiat-Backing and Reserve Administration

Each USDC and USDT are fiat-collateralized stablecoins, which means they’re backed by a reserve of US {dollars}. Nevertheless, the transparency and administration of those reserves differ between the 2 as we already highlighted.

USDC is thought for its dedication to full reserve backing, with common attestations from impartial auditors confirming that the reserves are ample to again all USDC tokens in circulation. Circle, the corporate behind USDC, holds the reserves in accounts at regulated monetary establishments in the US. This transparency helps preserve confidence in USDC's stability and reduces the danger of a lack of peg.

In distinction, Tether's reserve administration practices have been a supply of controversy. Whereas Tether claims its reserves are absolutely backed, it has confronted allegations of solely partially backing USDT with fiat reserves. Tether has been sluggish to supply detailed audits, relying as a substitute on periodic attestations that don’t present the identical degree of assurance as a full audit. This lack of transparency has led some to query the steadiness of USDT and its capacity to take care of its peg throughout instances of market stress.

Pace and Value of Transactions

USDC and USDT each function on a number of blockchain networks, permitting for flexibility in transaction velocity and price. USDC is out there on Ethereum, Algorand, Solana, and Stellar, whereas USDT might be discovered on Ethereum, Tron, Omni, and different networks.

The velocity and price of transactions rely on the particular blockchain getting used. For instance, transactions on the Ethereum community might take longer and incur increased charges in comparison with transactions on Tron or Algorand. Nevertheless, each stablecoins typically supply quick and low-cost transactions, making them appropriate for a variety of use circumstances, together with remittances, buying and selling, and DeFi purposes.

Safety and Danger Components

USDC and USDT each make use of customary safety measures to guard in opposition to hacking and fraud, equivalent to multi-signature wallets and common safety audits. Nevertheless, no system is fully proof against threat, and each stablecoins have confronted challenges previously.

In 2017, USDT was the goal of a hacking assault that resulted within the lack of $30 million value of tokens. Whereas the incident didn’t immediately influence the steadiness of the peg, it highlighted the potential dangers related to holding digital belongings. USDC, alternatively, confronted a problem in 2023 when Silicon Valley Financial institution, the place a portion of its reserves have been held, collapsed. Nevertheless, Circle was in a position to shortly switch the affected reserves to a brand new banking associate, minimizing the influence on USDC's peg.

Counterparty threat is one other concern for each stablecoins. As centralized entities, USDC and USDT depend on the steadiness and trustworthiness of the businesses behind them. The chance of mismanagement, fraud, or regulatory motion might probably influence the steadiness of the stablecoins. Nevertheless, USDC's dedication to transparency and regulatory compliance might assist mitigate this threat in comparison with USDT's historic opacity.

Use Instances: When to Use USDC vs. USDT

Under, we discover the important thing eventualities the place one is likely to be extra advantageous than the opposite.

Buying and selling on Cryptocurrency Exchanges

Relating to buying and selling on cryptocurrency exchanges, liquidity is king. USDT, with its large market capitalization and widespread acceptance, is the go-to stablecoin for a lot of merchants. Its deep integration throughout exchanges means extra buying and selling pairs and higher arbitrage alternatives, which may result in higher value execution and decrease slippage throughout trades. USDT’s liquidity makes it a favourite amongst those that want fast and environment friendly trades.

However, whereas USDC is gaining traction, it sometimes has fewer buying and selling pairs and barely decrease liquidity in comparison with USDT.

DeFi and Yield Farming

Within the DeFi area, each USDC and USDT are heavy hitters, however they cater to completely different crowds. USDC is commonly the popular alternative for these diving into DeFi, due to its sturdy integration with varied platforms. Whether or not you’re staking, lending, or yield farming, USDC supplies engaging alternatives, particularly in liquidity swimming pools the place you would possibly earn governance tokens or further yields.

In fact, the dangers related to DeFi — like sensible contract vulnerabilities and market volatility — apply to each stablecoins. USDC’s transparency and common audits would possibly supply some peace of thoughts, however keep in mind that the DeFi ecosystem continues to be fraught with dangers, no matter which stablecoin you select.

Cross-Border Transactions and Remittances

For cross-border transactions and remittances, each USDC and USDT supply vital benefits over conventional strategies. USDC stands out for its velocity and low value, making it a sensible choice for worldwide transfers. Many remittance corporations are adopting USDC, permitting customers to ship funds shortly and at a fraction of the fee in comparison with conventional companies, which regularly include excessive charges and sluggish processing instances.

USDT additionally excels on this area, particularly for customers who need easy accessibility to fiat conversions. Nevertheless, remember the fact that relying on the community, USDT can have increased transaction charges, which is likely to be a downside in comparison with USDC's sometimes decrease prices. You would possibly wish to control the various charges on completely different networks to make higher choices relating to your funding.

Hedging In opposition to Volatility

Each USDC and USDT are nice instruments for hedging in opposition to market volatility, however they enchantment to completely different preferences. In turbulent markets, USDC is commonly seen because the safer guess as a result of its transparency and strict regulatory compliance. Traders seeking to protect their capital throughout downturns would possibly desire USDC, trusting its full backing and common audits.

In the meantime, USDT’s sheer market presence and liquidity make it a favourite for merchants who want to maneuver shortly out and in of positions. Whereas it may additionally act as a secure haven, ongoing considerations about its reserve administration and transparency would possibly lead some customers to decide on USDC for long-term worth storage.

Regulatory Panorama and Future Outlook

The stablecoin area has been underneath growing scrutiny from regulators worldwide. Each USDC and USDT are impacted by evolving rules, significantly in the US and Europe.

Present Regulatory Setting

Within the U.S., rules surrounding stablecoins are nonetheless in flux. The 2024 bipartisan Lummis-Gillibrand Cost Stablecoin Act goals to ascertain clear guidelines for stablecoin issuers, requiring stablecoins to take care of 100% reserves in liquid belongings. This laws particularly bars algorithmic stablecoins and mandates that solely regulated monetary establishments can problem stablecoins, driving increased transparency and safety expectations throughout the board.

Throughout the Atlantic, the European Union has carried out its Markets in Crypto Property (MiCA) regulation. MiCA enforces a 1:1 reserve ratio for stablecoins like USDT and USDC and requires no less than 30% of their reserves to be held with impartial credit score establishments. These strikes mirror a pattern in the direction of tighter management and client safety, requiring stablecoins to align with stringent liquidity and transparency requirements.

Regardless of these developments, the U.S. regulatory framework stays fragmented. Businesses just like the SEC and CFTC have but to problem complete steerage for stablecoins, which poses ongoing compliance challenges for issuers.

Way forward for Stablecoins

Trying forward, the stablecoin market is anticipated to evolve in response to regulatory pressures. Circle's emphasis on transparency and regulatory compliance might place USDC because the stablecoin of alternative for establishments and companies. In distinction, USDT, with its wider market adoption, might nonetheless dominate buying and selling volumes, significantly in additional speculative areas of the crypto market.

Technological developments equivalent to enhanced reserve administration and blockchain interoperability will additional form the stablecoin panorama. Central Financial institution Digital Currencies (CBDCs) might additionally play a pivotal position. Though CBDCs would possibly current competitors, USDC and USDT are prone to retain their significance in DeFiand cross-border transactions.

USDC vs. USDT: Which Stablecoin Ought to You Select?

Selecting between USDC and USDT in the end relies on your particular wants and priorities within the cryptocurrency area. Each stablecoins supply distinct benefits, however they cater to completely different consumer profiles and use circumstances.

Abstract of Key Variations

USDC and USDT, whereas each pegged to the U.S. greenback, differ considerably of their method to transparency, regulatory compliance, and market presence. USDT boasts increased liquidity and wider adoption, making it the go-to alternative for merchants who worth quick execution and entry to quite a few buying and selling pairs. Nevertheless, it has confronted criticism for its reserve administration and lack of transparency. In distinction, USDC is lauded for its rigorous regulatory compliance and transparency, frequently audited to make sure full backing. This makes USDC extra interesting to customers who prioritize safety and regulatory adherence.

Suggestions Based mostly on Use Case

In case your main focus is on buying and selling, significantly on main exchanges, USDT is the clear winner. Its in depth integration and excessive liquidity imply you may commerce with minimal slippage and entry a broad vary of buying and selling pairs.

For individuals who prioritize regulatory compliance and transparency, USDC stands out. Its dedication to sustaining full reserves, coupled with common audits, makes it a safer choice, particularly for institutional customers or those that desire a stablecoin with a robust regulatory standing.

In the event you're contemplating long-term holding or utilizing stablecoins as a secure haven throughout market volatility, USDC's transparency and regulatory backing supply peace of thoughts. Whereas USDT is extensively used, ongoing considerations about its reserve practices would possibly make USDC a extra prudent alternative for long-term security.

Closing Ideas

Because the stablecoin market continues to evolve, it’s essential to remain knowledgeable about regulatory developments and the technological developments that would influence the utility and security of those belongings. Whereas USDC might achieve a regulatory edge sooner or later, USDT's liquidity and market dominance are laborious to disregard. Customers ought to weigh these elements fastidiously, staying agile and cautious in a quickly altering setting. In the end, the most effective stablecoin for you’ll rely on balancing the necessity for liquidity with the need for safety and compliance.

Ceaselessly Requested Questions

Is USDC safer than USDT?

USDC is mostly thought of safer as a result of its transparency and common audits, guaranteeing full reserve backing. USDT, whereas extremely liquid, has confronted scrutiny over its reserve practices and lack of constant auditing.

Which stablecoin has decrease charges?

Charges for USDC and USDT rely on the blockchain community. USDC on Solana or Algorand sometimes has decrease charges, whereas USDT on Tron presents low-cost transactions. Ethereum-based transactions for each might be costly.

Can I earn curiosity on USDC or USDT?

Sure, you may earn curiosity on each USDC and USDT by way of varied platforms like DeFi protocols, crypto exchanges, and lending companies, with charges various based mostly on market situations and platform threat.

What occurs if a stablecoin loses its peg?

If a stablecoin loses its peg, it might drop under its goal worth, resulting in potential losses. Restoration mechanisms fluctuate however typically contain shopping for or burning tokens to revive the peg, although success is not assured.

How to decide on the suitable stablecoin for my wants?

Contemplate your priorities: select USDT for liquidity and buying and selling, USDC for transparency and regulatory compliance, and the blockchain with decrease charges if value is a priority. Consider based mostly in your particular use case.