The method of lending and borrowing property, items, commodities and valuables has characterised societal economies for hundreds of years, if not millennia. From the extremely outdated, considerably prehistoric barter system to essentially the most avant-garde, twenty first century FinTech improvement, the monetary incentive to alternate, commerce, lend and borrow property, or something of worth, has at all times constituted a timeless element of human tradition and of its financial modus operandi.

Immediately, in an ever-changing world full of dynamic functions and relentless technological developments, monetary ecosystems discover themselves being on the cusp of a serious inner revolution, spearheaded by the proposition of Decentralised Finance. DeFi, the truth is, has come to encapsulate a complete new atmosphere of different financial constructions and monetary paradigms, and could be very doubtless destined to totally disrupt the best way folks have interaction with cash, worth and conventional banking methods.

The infrastructure put ahead by protocols within the DeFi area is due to this fact set to doubtlessly refashion the deeply-rooted mechanisms inherent in conventional monetary methods, forging a extra subtle, cutting-edge and clear financial framework.

Within the post-Bitcoin period, new DeFi-influenced worth propositions are being architected frequently, with lending and borrowing protocols, decentralised exchanges (DEXes), yield farming and staking packages being on the forefront of the twenty first century monetary revolution.

Other than blockchain-enabled decentralised and trustless lending and borrowing protocols, among the many many different DeFi-related issues, it is very important emphasise the important position performed by stablecoins within the digital asset economic system. It’s because, with out stablecoins, DeFi and the entire crypto area wouldn’t be capable of perform nor function accurately.

The truth is, stablecoins resembling USDC, USDT and DAI, supply merchants and buyers a method out of the crypto market volatility and supply stability inside the digital asset economic system. At current, there exists a really thrilling protocol seeking to merge each stablecoin technology, as asset-backed collateral, and DeFi lending and borrowing, synthesising the proper atmosphere for the event of DeFi and, subsequently, of Finance 2.0.

We’re after all referring to Maker DAO, the decentralised platform by which anybody, anyplace can generate the DAI stablecoin towards crypto collateral property.

About MakerDAO

MakerDAO is an organisation creating know-how for borrowing and financial savings, in addition to a stablecoin crypto asset known as DAI on the Ethereum blockchain. MakerDAO has created a protocol permitting anybody with ETH and a Metamask pockets to lend themselves cash within the type of DAI stablecoin. By locking up some ETH in MakerDAO’s good contracts, community individuals can create a certain quantity of DAI, with the extra ETH locked up, the extra DAI generated.

When customers wish to unlock their ETH, which serves as collateral for his or her DAI mortgage, they merely pay again the mortgage alongside any present charges. Thus, MakerDAO may be described as a decentralised organisation devoted to bringing stability to the cryptocurrency economic system by the DAI stablecoin.

The Maker Protocol employs a two-token mannequin, with the primary being the collateral-backed DAI stablecoin, and the second being the protocol’s governance token MKR. The Maker Basis, along with the MakerDAO neighborhood, strongly imagine {that a} decentralised stablecoin is required for any particular person or blockchain enterprise to leverage and benefit from the advantages supplied by digital capital.

The second element of Maker’s two-token system is MKR, a governance token that’s utilised by stakeholders to take care of the system and handle the DAI stablecoin, making MKR holders the true decision-makers in the case of MakerDAO’s governance.

Finally, MakerDAO seeks to unlock the ability of DeFi for anybody across the globe by creating an inclusive infrastructure for particular person financial empowerment, permitting customers to realize entry to its permissionless borrowing market and trustless monetary functions. Earlier than diving deep into the functionalities and use instances of the Maker Protocol and the DAI stablecoin, a quick introduction to the challenge appears productive.

A Temporary Historical past Of MakerDAO

Technically talking, MakerDAO originates as an Ethereum-based, open-source challenge working as a Decentralised Autonomous Organisation (DAO) system, therefore its title. A Decentralised Autonomous Organisation, or DAO, is outlined as an organisation represented by guidelines encoded as a pc program that’s absolutely clear, managed by the organisation’s members and disintermediated from the affect of a central authorities.

Whereas an entire implementation of DAO infrastructures is but to be absolutely realised, DAOs embody the guts and soul of decentralisation in blockchain and, extra particularly, in good contract ecosystems.

Good contracts are extraordinarily helpful for automating transactional processes, and for decreasing the enter that people should provide for comparatively easy duties. The purpose of a Decentralised Autonomous Organisation isn’t simply to cut back human inputs—it’s to eradicate them fully. Although nonetheless largely an on-paper thought somewhat than one which’s been perfected in observe, a DAO is successfully a enterprise that makes use of an interconnected internet of good contracts to automate all its important and non-essential processes. ‘DAOs, Blockchain, and the Potential of Ownerless Business’, Investopedia

Launching in 2015, the MakerDAO challenge started working with builders all over the world working collectively on the primary iterations of code, proof of idea, structure and first documentation. In December 2017, the primary MakerDAO Whitepaper was printed, introducing the unique DAI stablecoin system. The 2017 Whitepaper described how anybody may generate DAI stablecoin by MakerDAO by leveraging Ethereum as collateral by way of distinctive good contracts referred to as Collateralised Debt Positions (CDPs).

On condition that Ethereum was the one obtainable asset for collateralisation on the Maker Protocol, the DAI generated was named Single-Collateral DAI (SCD), or SAI. Moreover, the 2017 Whitepaper additionally described the group’s intention to improve Maker’s SCD to a Multi-Collateral DAI (MCD) system, an intention which then materialised in November 2019. At current, the DAI stablecoin system accepts any ERC-20 asset as collateral that has been authorized by MKR token holders, who should first vote on the danger ranges of every ERC-20 earlier than they’re on-boarded onto the Maker Protocol.

The Maker Protocol

MakerDAO is likely one of the largest, most well-established dApps on the Ethereum blockchain, and it holds a substantial proportion of the overall liquidity within the DeFi ecosystem. The truth is, when the Complete Worth Locked (TVL) of ETH in DeFi first surpassed the $1 billion mark in June 2020, round 60% of ETH was held by the MakerDAO protocol.

Presently, on the time of writing, Maker stands in fifth place for Complete Worth Locked after Aave, Compound, InstaDApp and Curve Finance, with over $8 billion in property locked on its platform.

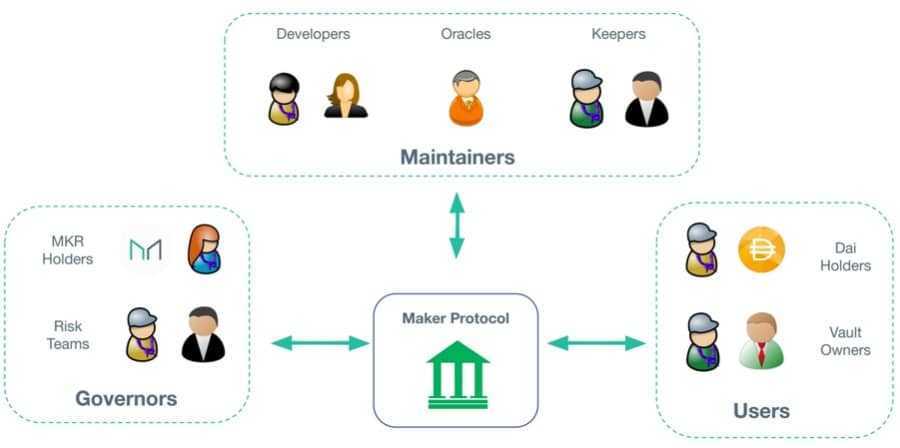

Because it stands, the Maker Protocol is managed by folks across the globe who maintain its native governance token, MKR. By MakerDAO’s governance system, primarily based on Govt Voting and Governance Polling, MKR holders can handle, run and govern the Protocol in addition to the monetary dangers of DAI to make sure its stability, effectivity and community transparency.

Maker’s Two-Token System

The Maker governance token, MKR, was created by the MakerDAO Protocol with a purpose to basically help the soundness of the DAI stablecoin and allow governance for the DAI credit score system. MKR is an ERC-20 asset working on the Ethereum blockchain and it may be minted or burned proportionally to how shut the DAI stablecoin is to the US greenback.

This inherently implies that the creation of MKR relies on the soundness of DAI as a complete. As an example, if DAI stays secure, extra MKR is burned lowering the overall provide, whereas, if DAI fluctuates too removed from the one greenback peg, extra MKR is minted subsequently growing the overall provide.

Since MKR holders profit financially from the soundness of the MakerDAO system and the DAI stablecoin, holders are incentivised to behave in the most effective curiosity of the MakerDAO protocol. Thus, MKR holders can vote on governance selections and proposals resembling how excessive to set charges and which collateral sorts may be accepted as collateral by the protocol. Within the MakerDAO ecosystem, one MKR token equates to at least one vote so entities and organisations with substantial MKR holdings can have a bigger affect on voting outcomes.

The DAI Stablecoin

The DAI stablecoin is the second financial element in MakerDAO’s two-token mannequin, after MKR. Stablecoins emerged as considerably of a center floor between the legacy monetary market and the nascent digital asset one.

Monitoring the worth of fiat currencies whereas working as cryptographic property, these blockchain-based tokens had been initially engaging to merchants as a strategy to lock-in and realise their earnings. At current, the preferred types of stablecoins are fiat-backed ones resembling USDC and USDT, that are sometimes collateralised by the US greenback, however commodity-backed stablecoins do additionally exist.

When Bitcoin first emerged, the message was clear: Pure disruption of dysfunctional centralised monetary methods by decentralised foreign money and blockchain. By distributing knowledge throughout a community of computer systems, the primary occasion of blockchain know-how allowed any group of people to embrace financial transparency versus central entity management.

Whereas BTC has significantly succeeded as a crypto asset on many various ranges, it isn’t nonetheless essentially the most optimum medium of alternate as a consequence of its fastened provide and volatility. The DAI stablecoin, then again, succeeds the place Bitcoin has maybe failed, in that it’s actually designed to minimise worth volatility and cut back aggressive worth fluctuations.

Maker’s DAI stablecoin is a decentralised, unbiased, collateral-backed crypto asset that’s softly-pegged to the US greenback. On the MakerDAO protocol, customers can generate DAI by depositing collateral ERC-20 property into Maker Vaults, creating the liquidity essential to take out loans on the protocol.

As soon as purchased, acquired or generated, DAI may be deployed identical to some other crypto asset, that means that it may be despatched to different customers, traded and exchanged for different cryptos, used as cost for providers and even held as financial savings by Maker’s DAI Financial savings Charge (DSR).

You will need to observe that each DAI token in circulation is backed by extra collateral, that means that the worth of the collateral is larger than the DAI debt, and each transaction with DAI is publicly seen and verifiable on the Ethereum blockchain.

DAI’s Monetary Properties

As an Ethereum-based stablecoin, DAI is designed to carry out 4 principal features within the broader crypto area and, extra particularly, within the MakerDAO ecosystem. These features embrace:

- Retailer Of Worth: With DAI being a stablecoin, it might perform as a retailer of worth by preserving relative stability within the risky crypto markets.

- Medium Of Alternate: The DAI stablecoin is extensively used throughout the crypto and DeFi area as an environment friendly medium of transaction and alternate.

- Unit Of Account: DAI has a goal worth of $1, as it’s softly-pegged to the US greenback. Throughout the MakerDAO protocol, DAI features because the go-to unit of account.

- Commonplace Of Deferred Cost: DAI is used to settle money owed within the MakerDAO protocol.

Maker Collateral Vaults

DAI is generated and stored secure by the collateral property deposited into Maker Vaults on the MakerDAO Protocol. Maker’s collateral property are ERC-20 tokens which have been voted on and authorized by MKR token holders by governance.

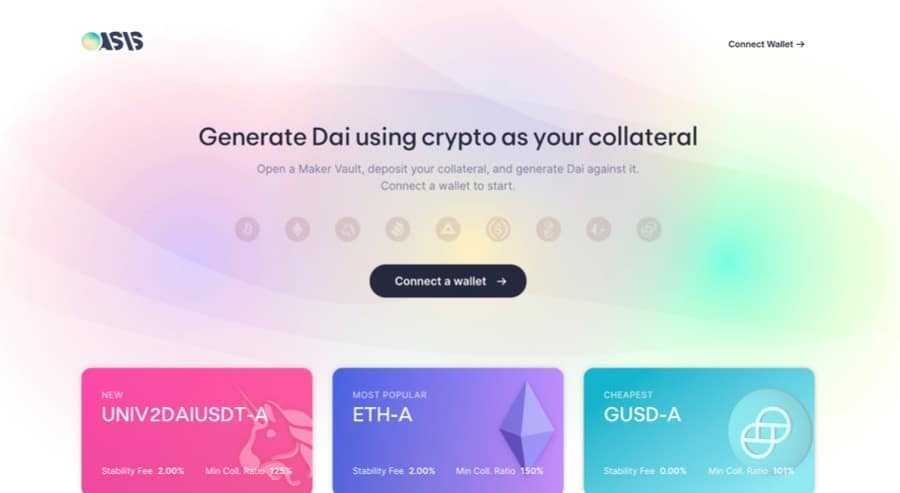

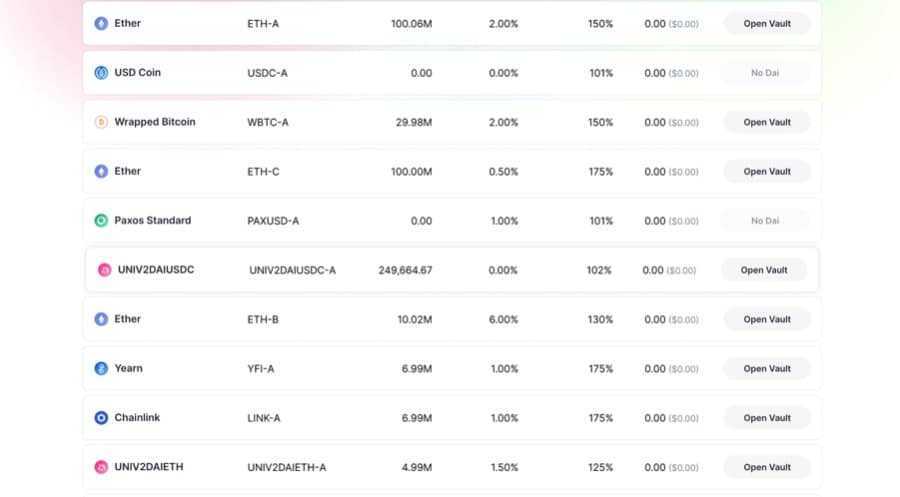

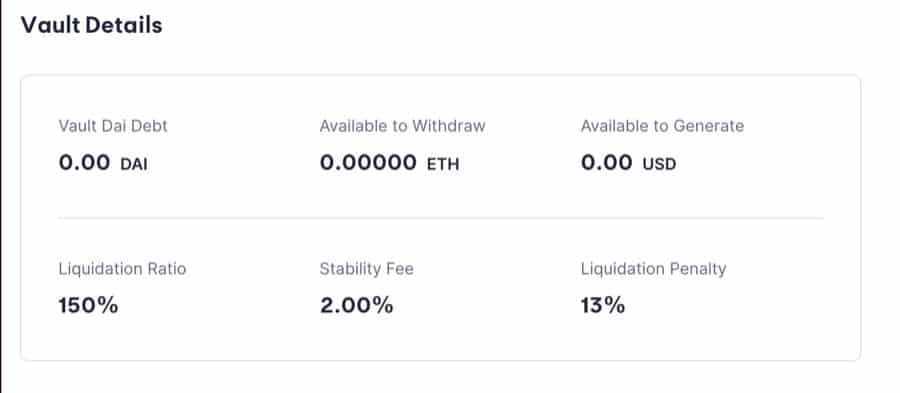

To ensure that an ERC-20 token to be accepted as collateral on Maker, MKR holders should first approve its Threat Parametres and deem it a secure asset for collateralisation. Community individuals can generate DAI by opening a Maker Collateral Vault by way of MakerDAO’s Oasis App dashboard and depositing collateral.

These Maker Vaults, beforehand known as Collateralised Debt Positions (CDPs), are good contracts that run on the Ethereum blockchain and maintain collateral in escrow till the borrowed DAI is returned. The worth of the collateral deposited should exceed the worth of the DAI issued to the person and, whereas this may appear fairly disadvantageous, the good thing about locking up collateral is that customers can put in riskier property and obtain stablecoin in return, mitigating their danger publicity general.

Some frequent examples of accepted ERC-20 collateral property on Maker are ZRX, BAT, OMG and ETH, amongst many others. Thus, as soon as customers have deposited their collateral property, they will redeem their borrowed DAI and redeploy them in different DeFi protocols for staking, yield farming or commerce them for different property or NFTs, for example.

Opening A Maker Vault

Opening a Collateral Vault on MakerDAO is definitely a somewhat easy course of. With a purpose to open Maker Vaults, customers might want to:

- Head To Oasis.App. Oasis is a platform the place customers can Commerce, Borrow or Save utilizing DAI.

- Join Most well-liked Pockets. Oasis accepts quite a lot of totally different wallets together with Metamask, WalletConnect, Coinbase Pockets, Portis, MyEtherWallet, Ledger and Trezor.

- Customers Can View Their Lively Vaults On The ‘Your Vaults’ Tab.

- To Open A New Vault, Click on ‘Open new vault’.

At this stage, customers will be capable of see all of the obtainable Vaults on Oasis/MakerDAO, together with DAI availability for the Vault, Stability Charges, Minimal Collateral Ratios and the Quantities Deposited.

Choose Most well-liked Vault And Click on ‘Open Vault’.

After having chosen their most popular Vault, customers will be capable of see their Liquidation Costs and Ratios, Worth Of Their DAI Debt, Stability Charges and Liquidation Penalties.

- Configure Vault And Deposit Desired Quantity.

- Click on ‘Enter Amount’.

- Affirm Transaction On Metamask And Obtain DAI In Pockets.

Now that customers have locked up their most popular collateral property and acquired DAI, they’re offered with a couple of choices. As an example, let’s assume {that a} person locked up ETH as collateral on MakerDAO to generate DAI. They may, doubtlessly:

- Use DAI to purchase ETH once more and deposit it right into a Vault.

- Redeploy DAI in different DeFi functions, resembling farming or excessive APY staking.

- Lend DAI on DeFi platforms resembling Compound to earn curiosity.

- Create Collateral Leverage.

Utilizing Maker Vaults To Create Collateral Leverage

Maybe probably the most environment friendly methods to make use of DAI generated from Maker Vaults is to create collateral leverage. For instance, a person redeploys the DAI generated to purchase extra ETH as collateral and deposits it right into a Maker Vault. If the worth of ETH will increase, the Vault proprietor stands the revenue. The person may additionally borrow from the Vault as a type of decentralised leverage. As a result of Maker Vaults require a minimal of 150% collateralisation for ETH lockups, the utmost leverage obtainable is 3x. Let’s now take into account the next state of affairs:

- 1 ETH is value $100, for simplicity, and Person X deposits 15 ETH value $1,500 into their Maker Vault.

- Person X generates 1,000 DAI towards it, the utmost doable given the 150% collateralisation requirement. (1500/3 = 500; 1500-500 = 1000)

- Person X redeploys the 1,000 DAI and buys 10 ETH this time, which they deposit into one other Vault.

- Person X can now generate a further 667 DAI towards the additional $1,000 in ETH collateral.

- Buying $667 of ETH permits Person X to generate an extra 444 DAI. Repeating this course of supplies Person X with an extra 296 DAI, then 198 DAI, 131 DAI, 88 DAI and 59 DAI.

- Finally, this equates to a complete of three,000 DAI that may be generated towards the unique 15 ETH, enabling Person X to leverage the preliminary stake by 200%.

MakerDAO’s Threat And Collateral Mechanisms

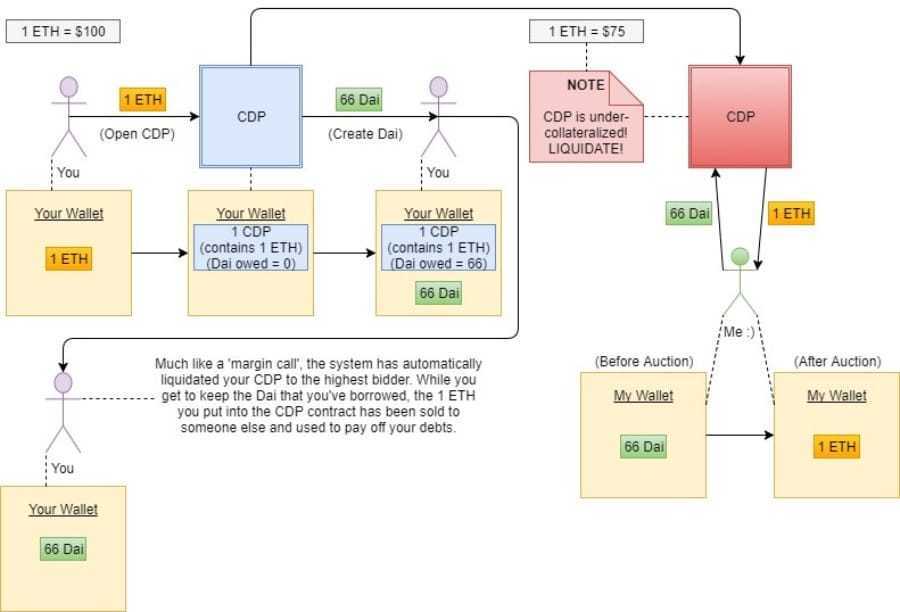

By the DAO, MKR token holders assign Threat Parametres to every collateral asset that define the quantity of debt that may be created by that collateral kind, the quantity of volatility the asset is anticipate to expertise, and what occurs if the collateral must be liquidated within the occasion that it can not any longer cowl the excellent DAI debt borrowed towards it.

Within the occasion that there’s elevated market volatility and the collateral deposited not covers the excellent debt, the collateral can be liquidated by way of an automatic course of. Automated market actors, known as Keepers, who benefit from arbitrage alternatives bid in DAI for the collateral from a liquidated vault. This DAI is then utilised to pay again the vault’s debt, plus a liquidation charge.

Keepers bid in DAI for the vault’s collateral by an public sale course of, and if there may be sufficient DAI acquired within the public sale to cowl each the debt reimbursement and the penalty charge, the leftover collateral can be returned to the respective vault proprietor. Furthermore, within the Maker Protocol, Keepers symbolize these market individuals that assist DAI preserve its stability and $1 goal worth, as they purchase DAI when the market worth is under the $1 degree and promote it when the market worth is above it.

However, if the public sale fails to build up sufficient DAI to cowl the vault proprietor’s debt, this debt then turns into ‘protocol debt’ and is roofed by the Maker Buffer, a liquidity pool containing the charges denominated in DAI and paid on collateral withdrawals along with the proceeds from the collateral public sale. If there may be inadequate DAI within the Maker Buffer pool, a debt public sale can be triggered and the protocol will mint MKR and promote it to bidders for DAI to recapitalise the pool and repay the excellent debt.

Thus, DAI, MKR and ERC-20 collateral property work as an automated system of checks and balances, with every functioning to counteract the opposite and preserve the system’s stability and decentralisation.

Maker’s Worth Oracles

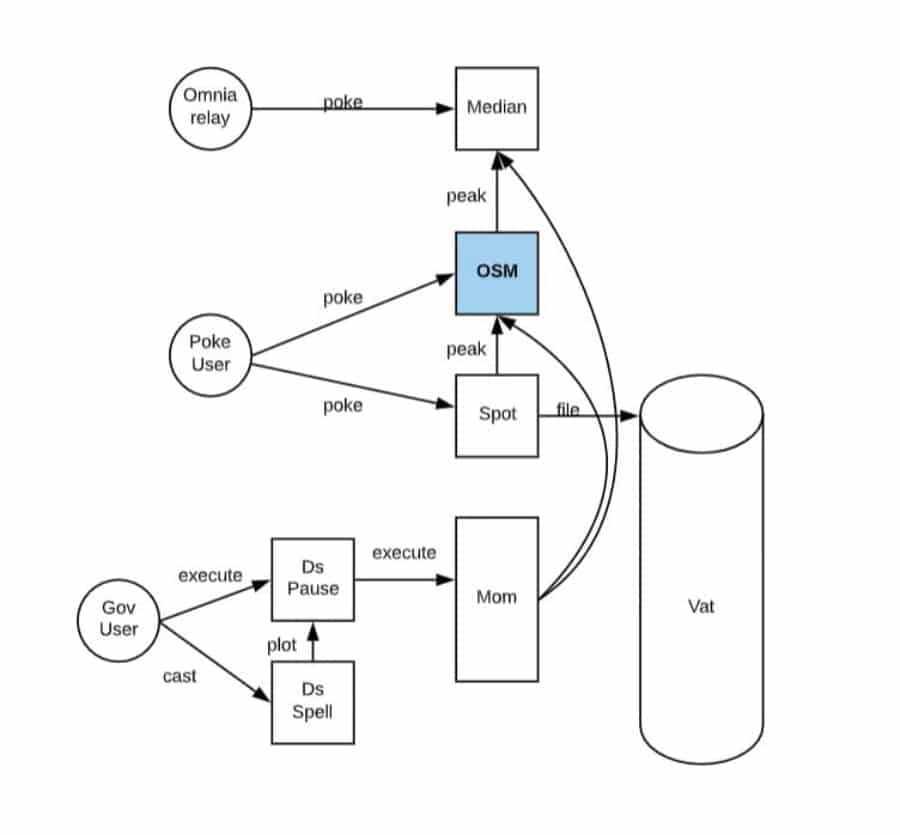

Oracles play a elementary position in MakerDAO’s collateral assessments. The truth is, with a purpose to assess the collateral deposited on the platform, Maker should have info on the worth of collateral ERC-20 property. To do that, Maker leverages a decentralised community of trusted oracles chosen by governance by MKR token holders. Nevertheless, for safety causes, the protocol doesn’t truly obtain worth knowledge immediately and instantaneously from these trusted oracles.

As an alternative, it receives info by the Oracle Safety Module (OSM), a wise contract that delays worth reception and communication by 1 hour. The primary purpose of the Oracle Safety Module is to periodically feed delayed costs to the MakerDAO protocol for a specific collateral kind.

This oracle worth delay perform permits emergency oracles, a particular kind of oracle chosen by MKR holders by governance voting, to basically freeze the unique oracle offering the worth feed whether it is compromised or corrupt. Emergency oracles, the truth is, may set off emergency shutdowns, a mechanism put in place to guard MakerDAO from hacks and exterior assaults.

MKR Tokenomics

As beforehand talked about, MKR is MakerDAO’s native governance token used to vote on governance proposals and protocol updates, in addition to guarantee the soundness of the MakerDAO Protocol and the DAI stablecoin. The MKR token launched in 2017, however the MakerDAO Workforce intentionally determined to not maintain any explicit ICO to bootstrap their token. The truth is, within the phrases of Jessica Salomon, a member of the MakerDAO Workforce on the time:

Initially MKR had been offered by way of non-public gross sales to family and friends, in addition to buyers like Andreessen Horowitz and Polychain. The method was and has been far more private that what you see with a typical ICO. The purpose was to create an possession neighborhood that’s cohesive and dedicated to long run success and never simply quick time period acquire […] The purpose of getting accountable “owner/operators” is a part of the explanation Maker by no means had a wild and loopy ICO. Jessica Salomon, Hackernoon

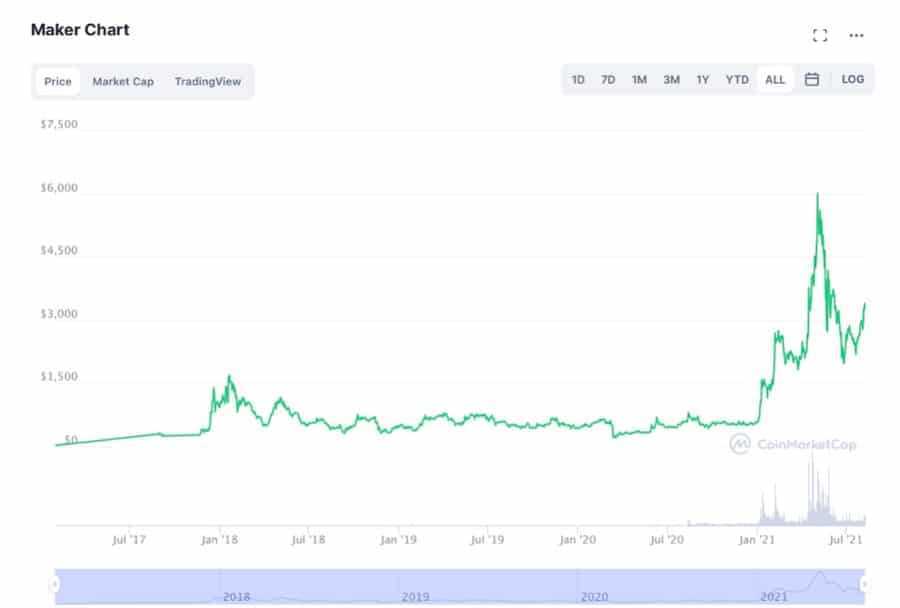

On the time of writing, MakerDAO’s native asset MKR is buying and selling at roughly $3,280 and is at present down 48% from its all-time-high of $6,339.02, which it reached in early Might 2021. The market capitalisation of MKR equates to greater than $3.2 billion, and it has a most token provide of 1,005,577 MKR.

MakerDAO has confirmed to be an extremely strong, useful challenge with some extensively adopted use instances throughout the digital asset ecosystem. The DAI stablecoin is certainly method too vital for the DeFi area for it to be doubtlessly ever uncared for. Thus, as a consequence of its lending and borrowing functionalities, its collateralised property and its use of the DAI stablecoin, the MKR token ought to keep it up rising alongside the remainder of the MakerDAO ecosystem, leading to a basic upward momentum over the medium to long-term outlook.

Workforce

The MakerDAO Protocol has at all times had one elementary purpose in thoughts: Final Decentralisation By A Decentralised Autonomous Organisation (DAO). Thus, with a purpose to obtain this, Maker has by the years developed and constructed a powerful group of blockchain engineers, builders and progress specialists round it to assist the challenge attain its long-term aims.

MakerDAO was based by Rune Christensen who, since 2015, has been targeted on delivering the organisational construction of the MakerDAO protocol and devoted to bootstrapping the financial foundations of the DAI stablecoin in DeFi.

Earlier than diving into the crypto area, Christensen based a enterprise that recruited Westerners to show English in China, which he continued to handle whereas finding out on the College of Copenhagen and Copenhagen Enterprise Faculty. After discovering Bitcoin in 2011, Christensen offered the enterprise, invested within the asset, turned focused on stablecoins and ultimately turned the founding father of MakerDAO.

At current, the MakerDAO Workforce consists of:

- Rune Christensen – Founder

- Derek Flossman – Head of Protocol Engineering

- Phil Inje Chang – Product Chief

- Andrew Chorlian – Blockchain Developer

- Michael Elliot – Blockchain Engineer

- Krzysztof Kaczor – Senior Software program Engineer

- Matthew C. – Enterprise Growth Supervisor

- Coulter Mulligan – Head of Advertising and marketing

Conclusion

In immediately’s world, monetary infrastructures are beginning to really feel the consequences of digitisation, technological development and, in the end, DeFi. Decentralised Finance, the truth is, is slowly however absolutely restructuring monetary paradigms as we all know them by its blockchain-enabled functionalities and decentralised functions.

Over the course of the final 4 years or so, a really intriguing protocol has arisen within the DeFi area seeking to merge each stablecoin technology, as asset-backed collateral, and decentralised lending and borrowing functionalities, and this protocol is not any apart from MakerDAO.

MakerDAO is likely one of the largest, most well-established dApps on the Ethereum blockchain, and it holds a substantial proportion of the overall liquidity within the DeFi ecosystem. With its two-token mannequin, MKR and DAI, MakerDAO permits just about anybody across the globe to realize entry to financial empowerment by its trustless, permissionless, DAO-like monetary platform.

The Maker Protocol allows community individuals to lock up quite a lot of totally different property as collateral on Maker Vaults and generate collateral-backed DAI stablecoin in return. Customers can then go forward and deploy their newly generated DAI on different DeFi protocols, have interaction in yield farming or staking, and even redeploy DAI to deposit extra property as collateral in Maker Vaults to leverage their positions.

Within the grand scheme of issues, MakerDAO has come such a great distance since its inception and, for the foreseeable future, it should most certainly keep it up creating its infrastructure, increasing its use instances and financial utilities and, doubtlessly, even discover itself on the very forefront of Finance 2.0.