Because the world continues to shift in direction of digital options, the way in which we ship and obtain cash has remained caught up to now — slowed down by excessive charges, lengthy settlement instances, and obstacles that exclude billions from the worldwide monetary system. However what if blockchain know-how might bridge that hole? What if the following evolution in funds isn’t simply sooner and cheaper however smarter and extra inclusive?

Enter PayFi. Brief for Fee Finance, PayFi is an idea that sits on the intersection of conventional finance and decentralised finance (DeFi).

So, why do you have to care? As a result of PayFi might be the important thing to mass crypto adoption. By integrating blockchain’s transparency and effectivity with DeFi’s monetary instruments, PayFi goals to supply a seamless fee expertise—suppose real-time settlements, minimal charges, and entry to world finance, even for the unbanked.

On this article, we’ll discover what PayFi is, the way it suits into the evolving world of DeFi, and why it would simply be essentially the most thrilling improvement in crypto funds so far. Let’s dive in.

Would fairly watch a video as a substitute? Now we have you lined:

What’s PayFi?

You may be questioning—what precisely is PayFi, and why is it creating such a buzz within the crypto house?

At its core, PayFi is the fusion of fee processing and decentralised finance (DeFi). It leverages blockchain know-how to create a sooner, extra environment friendly, and cost-effective system for dealing with monetary transactions. However PayFi isn't nearly making funds faster; it’s about unlocking the Time Worth of Cash (TVM)—an idea in conventional finance that highlights how cash out there right now is price greater than the identical quantity sooner or later because of its potential incomes energy.

In easier phrases, it allows customers to entry future money flows immediately, permitting companies and people to make higher use of their funds in real-time.

How Is PayFi Completely different From Conventional Fee Methods?

Conventional fee programs, like banks and bank card networks, depend on a fancy net of intermediaries. This implies transactions typically take days to settle, particularly when crossing borders, and include hefty charges to cowl the prices of middlemen. Plus, these programs are vulnerable to restricted accessibility (particularly for the unbanked) and a scarcity of transparency.

PayFi flips this mannequin. Through the use of blockchain know-how, it eliminates intermediaries, enabling immediate peer-to-peer (P2P) funds with minimal charges. Transactions are settled in real-time, instantly on-chain, making certain transparency, safety, and value effectivity. And because it operates on decentralised networks, anybody with an web connection can take part—no checking account required.

PayFi’s Position in DeFi and Blockchain Expertise

One of the crucial thrilling elements of PayFi is the way it integrates with DeFi and blockchain. Whereas DeFi has already revolutionized lending, borrowing, and staking, PayFi focuses on real-time funds and settlements, bridging the hole between conventional finance and decentralised ecosystems.

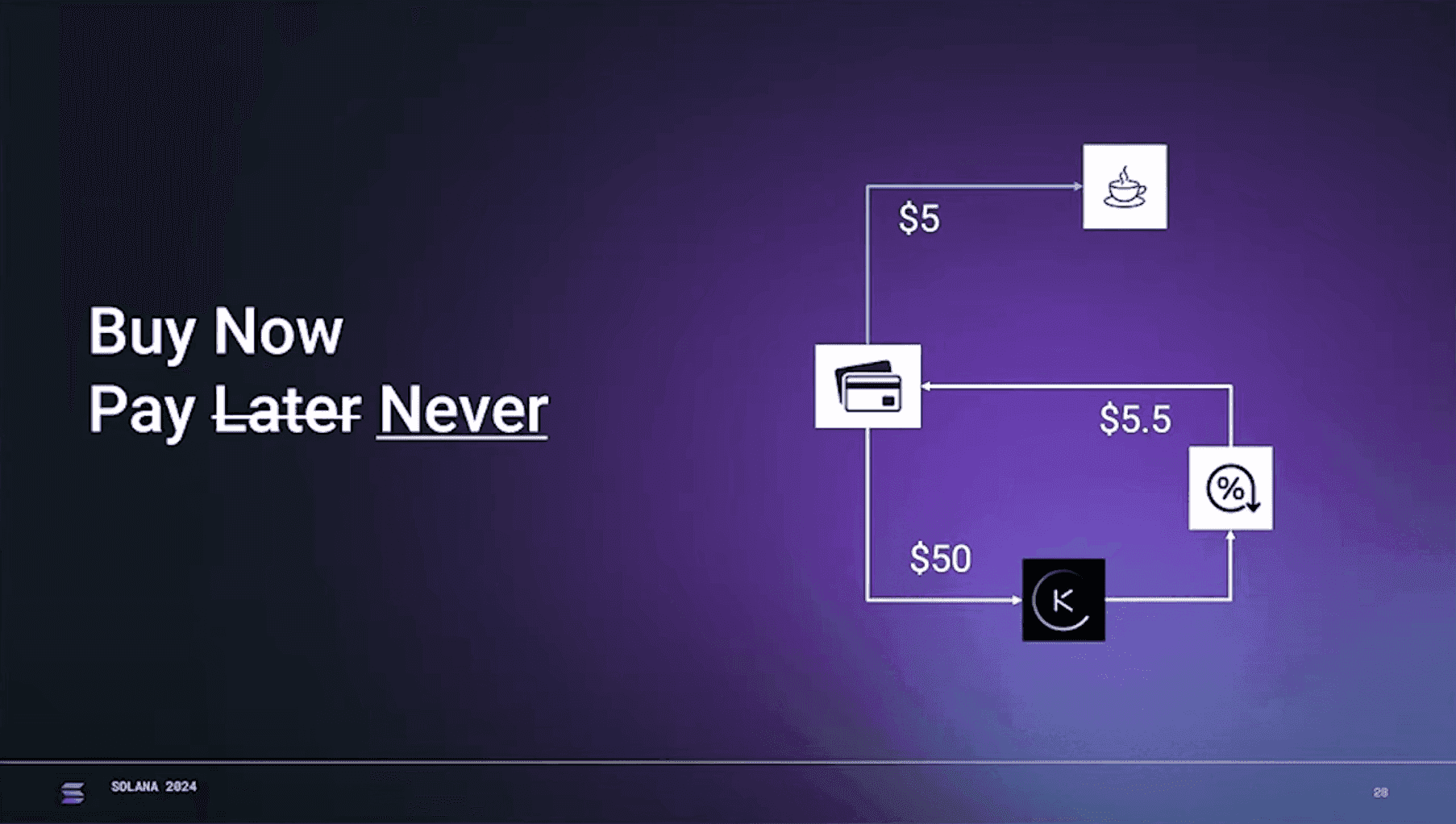

It additionally performs a key position in bringing real-world property (RWAs) on-chain, enabling issues like “Buy Now, Pay Never”—the place curiosity from staked property covers the price of purchases.

The Evolution of Digital Funds and PayFi’s Position

Digital funds have come a good distance because the early days of on-line banking and bank card transactions. From swiping magnetic stripes to tapping telephones on contactless readers, every innovation aimed to make funds sooner, safer, and extra handy. But, regardless of these advances, the worldwide funds ecosystem stays riddled with inefficiencies—sluggish settlement instances, excessive charges, and obstacles that exclude billions from collaborating within the monetary system.

Conventional Fee Gateways

Conventional fee gateways—suppose Visa, MasterCard, or PayPal—function on a centralised infrastructure. Once you make a fee, the transaction passes via a number of intermediaries: fee processors, buying banks, issuing banks, and sometimes forex exchanges if it’s a cross-border fee. Every of those layers provides time delays, charges, and potential factors of failure.

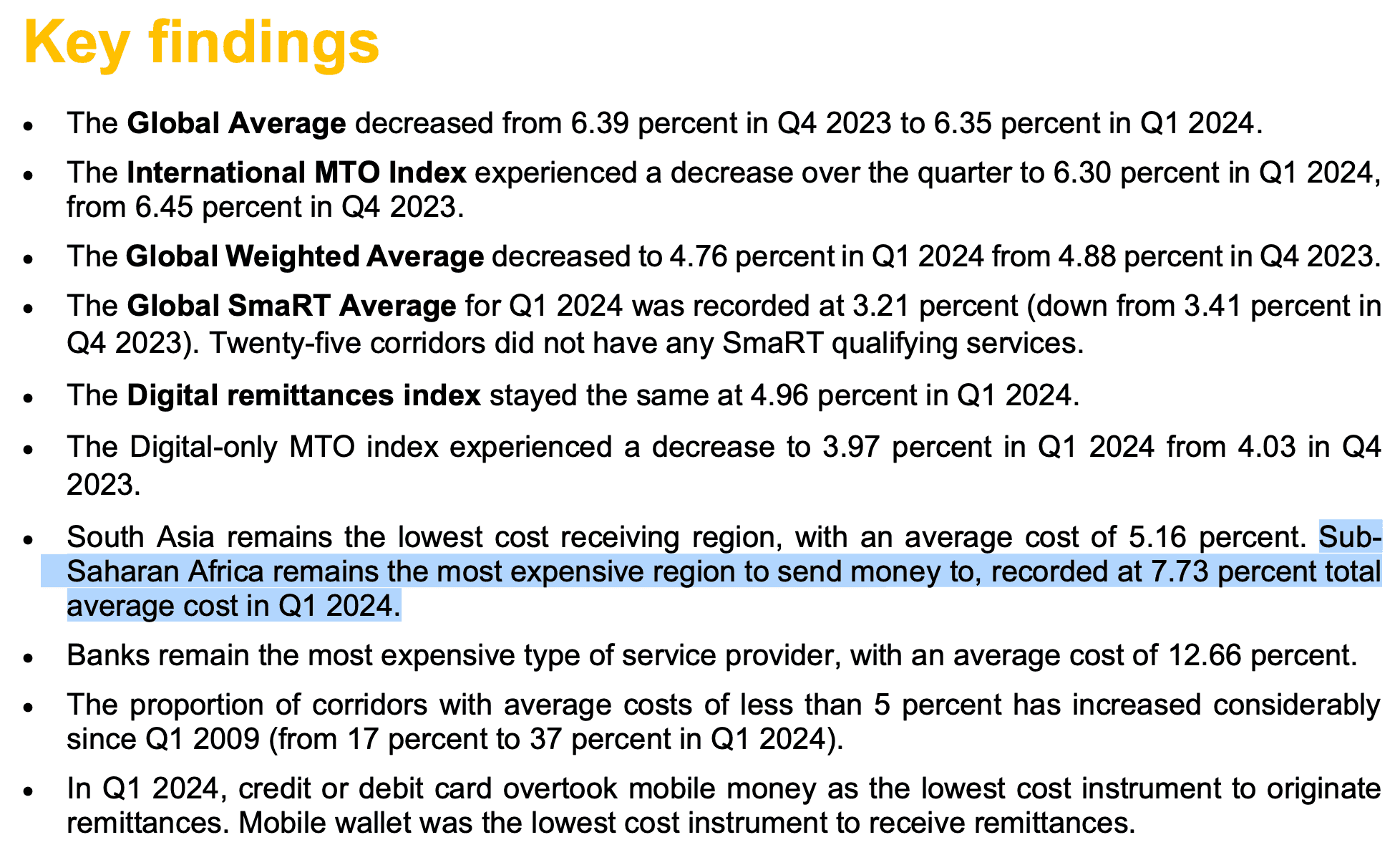

Take cross-border remittances, for instance. A easy worldwide wire switch can take 3-5 enterprise days to clear and comes with a mean price of 6.35%, based on the World Financial institution. And that’s not even contemplating hidden prices like unfavorable trade charges or pre-funding necessities for banks.

How PayFi Leverages Blockchain for Monetary Transactions

So, what makes PayFi’s method so groundbreaking? All of it boils all the way down to the way it makes use of the core strengths of blockchain know-how:

- Decentralisation: In contrast to conventional fee networks managed by banks and companies, PayFi operates on decentralised blockchains. This implies no single level of failure and open entry for anybody with an web connection.

- Actual-Time Settlement: Conventional funds typically depend on delayed settlement processes. PayFi, alternatively, makes use of blockchain's capability to course of transactions immediately, typically settling funds inside seconds, no matter borders or time zones.

- Transparency and Safety: Each PayFi transaction is recorded on a public, immutable ledger. This eliminates fraud dangers and improves belief between events, as all funds are verifiable in real-time.

- Programmable Cash: Maybe one among PayFi’s strongest options is its use of sensible contracts. These self-executing contracts enable for automated fee flows, reminiscent of splitting funds between a number of events or enabling complicated financing fashions with out intermediaries.

How PayFi Works?

Now that we perceive what PayFi is and the position it performs within the evolving funds panorama, let’s dive into the way it truly works.

Key Options of PayFi

1. Decentralised Fee Processing

- In contrast to conventional fee programs that depend on centralised intermediaries (banks, fee processors, and many others.), PayFi allows peer-to-peer (P2P) transactions instantly on the blockchain. This removes the necessity for middlemen, considerably lowering transaction prices and settlement instances. Each transaction is processed via decentralised nodes, making certain that funds are each trustless and censorship-resistant.

2. Safe and Clear Transactions

- PayFi leverages blockchain’s immutable ledger to make sure each transaction is safe and clear. Since every fee is recorded on-chain, there’s no room for manipulation or fraud. Each events in a transaction can confirm the fee in real-time, fostering belief with out counting on centralised authorities.

3. Prompt Peer-to-Peer (P2P) Funds

- One in all PayFi’s largest benefits is real-time settlement. Conventional cross-border funds can take days to course of, however with PayFi, funds will be transferred globally inside seconds. By eliminating intermediaries and leveraging blockchain’s native settlement layers, PayFi ensures that funds are each quick and environment friendly, even throughout totally different time zones and jurisdictions.

4. Low-Value Cross-Border Funds

- Cross-border transactions via conventional monetary programs are notoriously costly, typically saddled with a number of layers of charges—from forex conversion to middleman costs. PayFi drastically reduces these prices by enabling direct blockchain-based funds, typically for a fraction of a cent.

5. Automated Funds:

- Think about a system the place funds will be cut up between a number of events routinely, or the place funds are solely launched as soon as sure circumstances are met. Sensible contracts make this doable, eradicating the necessity for handbook oversight and lowering the danger of errors.

6. Cross-Chain Compatibility:

- Many PayFi platforms are cross-chain appropriate, enabling funds to be made throughout totally different blockchains with out customers needing to manually bridge property. This ensures a smoother consumer expertise and broadens the potential attain of PayFi options.

Advantages of PayFi in Monetary Transactions

PayFi affords actual, tangible advantages that might redefine how we method funds and monetary transactions. From drastically lowering prices to enhancing safety and dashing up transactions, let’s break down the important thing advantages that make PayFi stand out.

Decrease Transaction Charges and Value Effectivity

One of the crucial fast and impactful advantages of PayFi is the numerous discount in transaction charges.

In conventional finance, sending cash—particularly throughout borders—will be costly. Fee processors, banks, and different intermediaries every take a reduce, resulting in cumulative charges that always surpass 6% for worldwide remittances. Even easy bank card transactions can rack up 2-3% in charges, to not point out hidden prices like forex conversion costs.

PayFi cuts out the middlemen. By leveraging blockchain’s decentralised structure, transactions happen instantly between events, eliminating the necessity for banks, fee processors, and clearinghouses. This considerably reduces prices, typically bringing charges all the way down to fractions of a cent.

For example, utilizing PayFi options constructed on high-performance blockchains like Solana—which boasts sub-$0.01 transaction charges—customers can ship funds globally with out worrying about extreme costs.

Enhanced Safety and Fraud Prevention

Safety is a serious concern on the planet of digital funds, with fraud, chargebacks, and unauthorized entry costing companies billions yearly.

At its core, PayFi depends on blockchain’s immutable ledger, which information each transaction in a tamper-proof method. As soon as a fee is confirmed and added to the blockchain, it might’t be altered or deleted.

Moreover, cryptographic encryption ensures that delicate information stays safe all through the transaction course of, providing a stage of transparency and integrity that conventional programs battle to match.

In contrast to conventional fee gateways that always retailer consumer information in centralised databases—making them prime targets for hacks—PayFi platforms use decentralised networks, minimizing single factors of failure.

Sensible contracts additionally play a significant position in fraud prevention. These self-executing contracts be certain that funds are solely processed when particular circumstances are met, eliminating the danger of chargebacks and unauthorized withdrawals.

Velocity and Scalability

Sluggish transaction instances generally is a main bottleneck. PayFi eliminates this situation by delivering lightning-fast, scalable fee options.

Conventional banking programs typically take 3-5 enterprise days to course of cross-border funds as a result of involvement of a number of intermediaries and compliance checks. Even home transfers can expertise delays throughout weekends or holidays.

PayFi affords real-time settlements, enabling funds to be transferred throughout the globe inside seconds. By leveraging high-speed blockchains, transactions will be accomplished virtually immediately, no matter geography or time zones. For instance, Solana’s 400ms block instances and capability for over 65,000 transactions per second (TPS) make it probably the most scalable options for PayFi functions.

Use Instances of PayFi in Crypto and Finance

PayFi is already reshaping monetary transactions throughout a number of sectors. From e-commerce to DeFi, right here’s how PayFi is making an influence.

E-Commerce and On-line Transactions

PayFi empowers retailers to simply accept crypto funds instantly, eliminating the necessity for conventional fee processors. Transactions settle immediately on the blockchain, with decrease charges and no intermediaries. Sensible contracts handle funds securely and transparently, making certain retailers obtain funds with out delays.

With lowered charges and real-time settlements, PayFi enhances the e-commerce expertise for each retailers and clients. It additionally opens world markets to underbanked areas, permitting retailers in creating international locations to achieve worldwide clients and settle for crypto funds seamlessly.

Cross-Border Funds and Remittances

Conventional cross-border funds are sometimes sluggish and costly, involving a number of banks and intermediaries. PayFi streamlines this course of, enabling real-time, peer-to-peer funds utilizing stablecoins and cryptocurrencies. This removes hidden charges and drastically reduces prices.

Advantages for Freelancers, Companies, and Expatriates embody:

- Freelancers can receives a commission instantly in crypto with decrease charges and immediate entry to funds.

- Companies simplify B2B funds, paying suppliers and contractors throughout borders with out delays or excessive banking charges.

- Expatriates sending remittances residence profit from decrease prices and sooner transactions, making certain households obtain extra money with out lengthy wait instances.

DeFi Lending and Borrowing

PayFi integrates with DeFi protocols to supply real-time lending and borrowing. Sensible contracts automate mortgage approvals, disbursements, and repayments, enabling customers to entry funds immediately whereas lowering reliance on conventional banks.

Challenges and Dangers of PayFi

Whereas PayFi affords quite a few benefits, it’s not with out its challenges. From navigating complicated rules to making sure safety and driving adoption, a number of hurdles stand in the way in which of its widespread implementation.

Regulatory Uncertainty

One of the crucial important challenges PayFi faces is navigating the regulatory grey areas surrounding decentralised funds. Many governments are nonetheless formulating insurance policies on how one can regulate blockchain-based monetary programs, particularly these facilitating cross-border transactions and stablecoin settlements. Regulatory inconsistencies throughout international locations create uncertainty for PayFi platforms, making world adoption extra complicated.

PayFi platforms should additionally grapple with conventional monetary compliance frameworks like KYC (Know Your Buyer) and AML (Anti-Cash Laundering) rules. Hanging a stability between decentralisation and regulatory compliance is difficult. Whereas some PayFi options combine KYC processes, others face challenges in assembly strict monetary oversight, probably resulting in regulatory pushback or authorized obstacles.

Safety Vulnerabilities

Whereas sensible contracts automate PayFi transactions, they aren’t resistant to vulnerabilities. Coding errors or loopholes will be exploited, resulting in lack of funds or unauthorized entry. Excessive-profile DeFi hacks and exploits have highlighted the significance of strong sensible contract auditing—a necessity for PayFi platforms to take care of belief and safety.

Adoption Limitations

Regardless of PayFi’s advantages, adoption stays a hurdle. Many retailers and shoppers are hesitant to embrace crypto funds because of:

- Value volatility of cryptocurrencies

- Restricted understanding of blockchain know-how

- Issues over safety and regulatory readability

Even with stablecoins and extra user-friendly interfaces, skepticism round crypto funds persists, slowing PayFi adoption.

Way forward for PayFi

As PayFi continues to realize traction, its future appears to be like promising, particularly within the evolving world of decentralised finance (DeFi). With fast developments in blockchain know-how and shifting monetary landscapes, PayFi is poised to play a pivotal position in shaping how we deal with funds within the years to come back.

Improvements in Fee Expertise

The way forward for PayFi will possible concentrate on bettering effectivity, accessibility, and safety inside decentralised fee programs. Key developments could embody:

- Cross-chain interoperability, permitting seamless funds throughout a number of blockchain networks with out handbook conversions.

- Superior privateness options like zero-knowledge proofs to make sure consumer information safety whereas sustaining transaction transparency.

- Extra intuitive consumer interfaces that simplify crypto funds for mainstream customers, bridging the hole between conventional and decentralised programs.

Will PayFi Substitute Conventional Fee Methods?

Whereas PayFi could not totally change conventional fee programs anytime quickly, it’s positioned to considerably disrupt them. With its sooner settlements, decrease charges, and borderless capabilities, PayFi affords a compelling various to legacy programs, notably for cross-border transactions, remittances, and DeFi providers.

As regulatory readability improves and blockchain adoption grows, PayFi might turn out to be a mainstream possibility for companies and shoppers searching for environment friendly and clear fee options.

Conventional banks are additionally taking discover. Many are exploring methods to combine blockchain into their providers, with some even experimenting with their very own blockchain-based fee networks. Others are partnering with PayFi platforms to remain aggressive and provide sooner, cheaper providers to their clients.

That stated, the decentralised nature of PayFi challenges the centralised mannequin of conventional banking. As PayFi continues to evolve, banks might want to adapt—both by embracing decentralised applied sciences or by creating hybrid fashions that mix the strengths of each programs.

Closing Ideas

PayFi is quickly redefining how we take into consideration funds and monetary transactions. By bridging the hole between conventional finance and DeFi, PayFi introduces a extra environment friendly, clear, and cost-effective system that provides real-time settlements, decrease charges, and higher accessibility. It addresses long-standing inefficiencies in world funds whereas unlocking new potentialities like immediate cross-border transactions, modern lending fashions, and expanded monetary inclusion.

The importance of PayFi within the DeFi ecosystem continues to develop as extra platforms and customers acknowledge its potential to streamline complicated fee processes and scale back reliance on conventional intermediaries. As blockchain know-how advances and regulatory readability improves, PayFi is well-positioned to turn out to be a core part of the worldwide monetary infrastructure.

Staying knowledgeable about PayFi’s developments is essential because the house evolves quickly. Whether or not you’re a crypto fanatic, a enterprise proprietor, or somebody exploring new monetary applied sciences, understanding PayFi’s position in reshaping the fee panorama will allow you to keep forward on this dynamic and transformative sector.

Steadily Requested Questions

What’s PayFi and the way does it work?

PayFi, or Fee Finance, is a blockchain-based fee system that allows real-time, low-cost, and peer-to-peer transactions by leveraging sensible contracts and decentralised networks, eliminating intermediaries and bettering fee effectivity.

How is PayFi totally different from conventional fee programs?

In contrast to conventional programs that depend on banks and fee processors, PayFi operates on decentralised blockchain networks. This enables for fast settlements, lowered charges, elevated transparency, and broader monetary accessibility with out intermediaries.

Is PayFi safe for transactions?

Sure, PayFi leverages blockchain’s immutable ledger and sensible contracts to make sure safe and clear transactions. Common sensible contract audits, encryption, and privateness options like zero-knowledge proofs additional improve safety.

What challenges does PayFi face when it comes to adoption?

PayFi faces hurdles like regulatory uncertainty, safety vulnerabilities in sensible contracts, and hesitations from retailers and shoppers because of unfamiliarity with blockchain-based fee programs. Training and clearer rules will play key roles in overcoming these obstacles.

How does PayFi deal with cross-border transactions?

PayFi makes use of blockchain networks and stablecoins to allow real-time, low-cost cross-border funds with out intermediaries. This method eliminates excessive charges and lengthy settlement instances sometimes related to worldwide funds.

Which blockchain platforms are main in PayFi adoption?

Solana, Ethereum (particularly its Layer 2 options), Stellar, and Algorand are among the main blockchain networks supporting PayFi use instances, providing excessive transaction speeds, scalability, and liquidity for fee finance functions.