ZKsync is without doubt one of the many layer 2 scaling options on Ethereum. The Ethereum layer 2 ecosystem has blown up with innovation in current occasions. These networks are bettering quickly due to Ethereum's current narrative shift to advertise increased use of layer-2 networks for on a regular basis on-chain actions. It promotes this shift by introducing upgrades that make layer-2s quicker, cheaper, and safer.

This ZKsync evaluate will clarify to readers what it’s all about and the way ZKsync differs from different scaling options in Ethereum. We can even discuss a couple of rising tendencies in Web3, akin to account abstraction and the way ZKsync incorporates these to boost consumer expertise and community efficiency.

ZKsync Period Overview

ZKsync Period is a layer 2 rollup on Ethereum. It’s a trustless blockchain protocol that makes use of zero-knowledge validity proofs to supply low-cost transactions on Ethereum. A rollup is a scalability resolution the place transactions are executed and saved off the Ethereum chain. The transaction information is bundled right into a compressed package deal and despatched to Ethereum with validity proofs to show their legitimacy. Layer 2 chains inherit a lot of the safety ensures from Ethereum, albeit at a decrease price than layer 1 transactions.

Key Options:

- It provides Ethereum-like safety. It inherits Ethereum's safety with zk-proofs with out utilizing third-party validators.

- It helps permissionless EVM-compatible good contracts.

- ZKsync provides quick proof proof era whereas additionally sustaining Ethereum compatibility.

- It consists of native account abstraction and paymaster options.

- It provides enhanced multi-layered scalability with a community of interconnected ZK Chains.

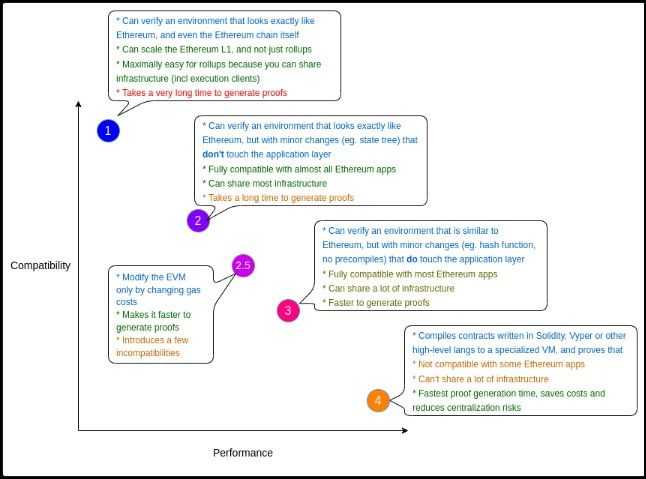

Kinds of ZK-EVMs

Have you ever ever puzzled why there are such a lot of zero-knowledge layer 2 chains in Web3, and aren't all of them the identical? Vitalik Buterin classifies zk-based chains by EVM compatibility, describing 4 ZK-EVM varieties:

- Sort -1: Fully Ethereum equal. These ZK-EVMs can confirm Ethereum blocks as they’re right this moment. Deploying Ethereum functions on type-1 ZK-EVMs calls for no extra overheads. Scroll and Taiko are some type-1 ZK-EVMs.

- Sort -2: Fully EVM-equivalent. If not Ethereum, EVM equivalence ensures compatibility with Ethereum on the execution stage. Most Ethereum DDpps will work completely on EVM-equivalent ZK-EVMs with none extra overheads. Whereas nonetheless sluggish, proof era time is best than that in type-1. Polygon zkEVM and ConsenSys are some type-2 ZK-EVMs.

- Sort-3: Virtually EVM-equivalent. Such ZK-EVMs designs worth throughput over Ethereum compatibility. Sooner proof era is achieved at the price of extra incompatibility. Ethereum DApps should work after minimal rewriting efforts from builders.

- Sort-4: Solely language stage equal. Solely high-level code, akin to Solidity and Vyper, is made ZK-friendly. Porting DApps from Ethereum could face challenges like completely different contract addresses and intensive debugging necessities, however with very quick proving occasions. ZKsync and StarkNet are constructing type-4 zk-EVMs.

ZKsync is a Sort 4 ZK-EVM, that means that the proof era occasions are extraordinarily quick, transaction pace is excessive, and centralization dangers are lowered. The ZKsync group has improved EVM compatibility by introducing customized compilers, zksolc and zkvyper, that allow builders write good contracts in Solidity or Vyper. Builders can even use current instruments and libraries from Ethereum, addressing a number of compatibility drawbacks of type-4 ZK-EVMs.

How Does ZKsync Work?

To know how ZKsync works, we should find out how rollup operations work as a layer 2 scaling resolution for Ethereum. The first job of a rollup is to cut back the load on layer 1, like Ethereum, with out giving up its safety ensures and decentralization.

The ethos of rollups is off-chain transaction execution. The first throughput bottleneck for Ethereum is its lack of ability to course of many transactions in a short while. Nonetheless, its sluggish pace is a trade-off for safety since its transactions are verified by an enormous community of trustless nodes interacting and collaborating in Ethereum's PoS consensus protocol. Due to this fact, a rollup scales Ethereum by executing many transactions off-chain after which submitting a single, compressed abstract of the transactions to Ethereum for verification and storage, which treats the batch as a single transaction. The prices related to Ethereum are cut up between all of the transactions included within the batch, making them extremely low cost.

Zero-Information Rollups

Zero-Information Rollups use zk-proofs for blockchain scalability. On this design, the layer 2 operator, known as a sequencer, bundles or “rolls up” a number of L2 transactions and creates a zk-proof, a cryptographic validity proof of the batch. The generated proof is shipped to Ethereum for verification and to finalize the rollup batch. ZKsync makes use of a type of zk-proofs known as SNARKs (Succinct Non-interactive Arguments of Information).

ZKsync Protocol Elements

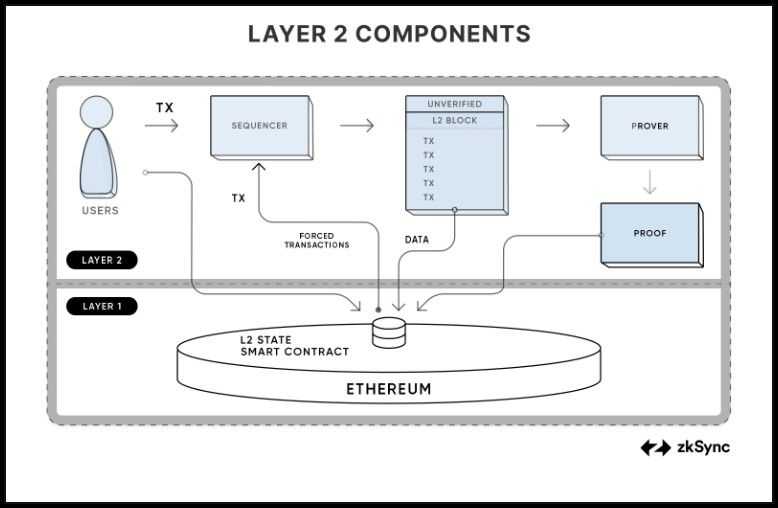

The lifecycle of a ZKsync transaction begins when the consumer initiates a transaction and ends when it achieves finality on Ethereum. There are a number of roles concerned in serving to the transactions finalize on Ethereum, and they’re mentioned right here:

Sequencers

The Sequencer gathers, executes, and organizes consumer transactions into blocks on ZKsync's Layer 2. It performs a crucial position in making certain the effectivity and pace of transaction processing on the zkRollup layer. It has the next features:

- Transaction Assortment: The Sequencer collects transactions submitted by customers. It could possibly obtain transactions immediately on L2 or by way of L1 (pressured transactions).

- Execution: Utilizing the zkEVM (Zero-Information Ethereum Digital Machine), the Sequencer executes these transactions, making certain they adhere to the community guidelines.

- Block Formation: After execution, the Sequencer teams transactions into blocks for additional processing. It provides customers a fast, tender affirmation as soon as their transactions are included in a block.

- Compelled Inclusion: The Sequencer should embody pressured transactions submitted by way of L1, making certain they’re processed within the subsequent block.

Provers

The prover is tasked with validating the correctness of the transactions executed by the Sequencer. It generates cryptographic proofs to substantiate that the transactions inside a block have been processed precisely. It’s tasked with the next features:

- Proof Technology: After receiving an unverified block from the Sequencer, the prover generates a zk-SNARK cryptographic proof. This proof attests to the validity of all of the transactions within the block.

- Submission to L1: The Prover submits the generated proof and the state diff information to the Ethereum L1 contract for closing verification and state replace.

Unverified Blocks

An unverified block is a group of transactions that the Sequencer has executed, however the prover has not but validated them with cryptographic proof. These blocks are briefly held till the prover confirms their validity.

- Holding Stage: Unverified blocks are basically in a holding stage between preliminary execution and closing proofing. They be sure that transactions are grouped and ready for the prover.

- Batching for Proofs: A number of unverified blocks could also be mixed into batches, that are then processed collectively by the prover. This batching method enhances the effectivity of proof era.

Proofs

Proofs in ZKsync consult with the cryptographic proof that confirms the proper execution of transactions inside a block. They’re a core a part of zkRollup know-how, offering safety and integrity.

ZKsync makes use of zk-SNARKs, a sort of zero-knowledge proof that permits one occasion to show to a different {that a} assertion is true with out revealing any particular details about the assertion. Right here's the proving course of:

- Proof Creation: After the Prover receives an unverified block, it generates a zero-knowledge proof that certifies the block's correctness.

- Information Submission: Alongside the proof, solely the modifications within the blockchain state (state diff) are despatched to L1, optimizing the quantity of information transmitted.

- Verification and State Replace: The Ethereum L1 good contract then verifies this proof. If legitimate, it updates the rollup's state on the Ethereum blockchain, making certain the integrity and safety of the transaction information.

To summarize:

- Sequencers act because the preliminary gatekeepers, accumulating, executing, and organizing transactions into blocks and offering fast consumer confirmations.

- Provers validate the transactions by producing cryptographic proofs, making certain that every one transactions are executed accurately and securely.

- Unverified Blocks function momentary collections of executed transactions awaiting validation.

- Proofs are cryptographic attestations that affirm the correctness of those transactions and facilitate safe and environment friendly updates to the blockchain's state.

Collectively, these parts be sure that ZKsync can present scalable, safe, and environment friendly transaction processing on Ethereum.

ZKsync Transaction Life Cycle

ZKsync transactions or any on-chain operation on layer 2 should comply with an automatic technique of verifications and consensus that finally results in its finality. Finality within the context refers back to the transaction getting recorded in a finalized Ethereum block after its consensus course of. Each transaction achieves nice execution pace on ZKsync and top-notch safety from Ethereum.

One noteworthy characteristic of ZKsync is pressured transactions. A ZKsync sequencer could censor (ignore) a layer 2 transaction mistakenly or with malicious intent. The consumer can then emit a pressured transaction, a layer 2 transaction submitted on to Ethereum by the consumer. Such transactions could price considerably greater than traditional ZKsync transactions, however direct submission will assure its inclusion within the ZKsync block. Here’s a step-wise breakdown of the ZKsync transaction lifecycle:

- Consumer Transaction Submission:

- Customers submit their transactions to the ZKsync system. These transactions are despatched to the Sequencer.

- Transactions will be despatched on to layer 2 (ZKsync) for quick processing or pressured by way of layer 1 (Ethereum) to make sure their inclusion, offering censorship resistance.

- Transaction Assortment and Execution:

- The Sequencer gathers the submitted transactions and organizes them into blocks.

- It executes these transactions utilizing the zkEVM (Zero-Information Ethereum Digital Machine), which features equally to Ethereum's EVM however is optimized for zkRollups.

- Gentle Affirmation: After executing the transactions, the Sequencer provides customers a tender affirmation. This ensures that customers get fast suggestions about their transaction standing earlier than the ultimate verification.

- Dealing with Compelled Transactions: If customers submit transactions by way of L1, these are labeled as pressured transactions. The Sequencer should embody these within the subsequent block it processes, making certain that no transaction is unjustly ignored.

- Block Formation: As soon as transactions are executed, they’re grouped into an Unverified L2 Block by the Sequencer. These blocks are collections of transactions awaiting cryptographic proof and closing submission to L1.

- Proof Technology: The Prover takes the unverified L2 block and generates a cryptographic zk-proof of the block's execution. This proof verifies that every one transactions throughout the block have been executed accurately.

- Information Submission to L1:

- The generated proof and the mandatory information in regards to the transactions are submitted to a ZKsync good contract on Ethereum.

- ZKsync optimizes this step by sending solely the 'state diff' or modifications within the blockchain state, which reduces the quantity of information despatched to L1, making transactions cheaper, particularly those who modify the identical storage slots.

- Verification and State Replace on L1:

- The L1 good contract verifies the cryptographic proof and the completeness of the information submission.

- Upon profitable verification, the contract updates the rollup's state on Ethereum, reflecting the modifications from the executed transactions.

- Distinction Between Blocks and Batches: In ZKsync, a distinction is made between blocks and batches. Whereas blocks are collections of transactions, batches are bigger collections of those blocks. Batches are processed collectively by the prover, enhancing the effectivity of proof era and submission to L1.

- L1<>L2 Communication: Transactions initiated through L1 facilitate communication between L1 and L2. This mechanism helps trustless bridges to L1 and ensures that transactions can movement seamlessly between the 2 layers.

ZKsync ensures environment friendly and safe transaction processing by following these steps and leveraging zkRollups to keep up Ethereum's scalability and safety.

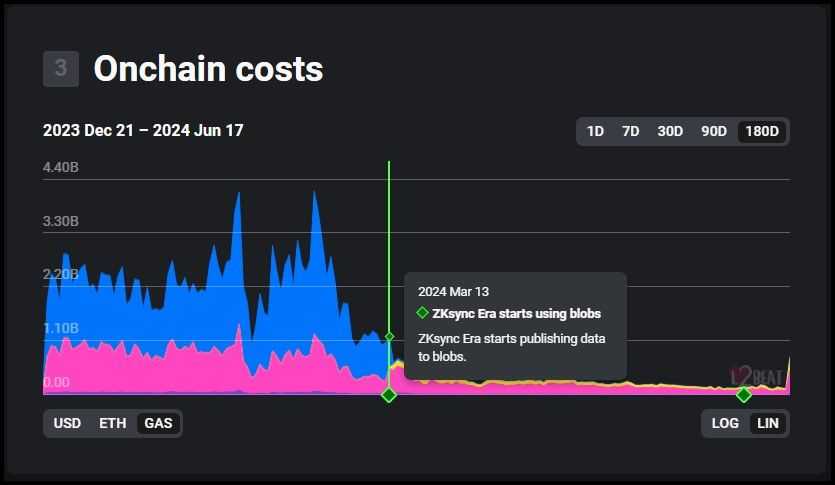

ZKsync Charge Mechanism

A ZKsync transaction is topic to charges from layer 3 and Ethereum. The transactions face intrinsic inclusion in layer 2 blocks, the proofs and obligatory transaction information for that are despatched to Ethereum, which then costs for computation and storage. We’ll now talk about some components that affect ZKsync transaction prices and analyze the price the protocol has charged traditionally.

Components influencing ZKsync price construction:

- Transaction Publication Charges: ZKsync must publish obligatory rollup information on Ethereum, akin to transaction information, validity proofs, and state transitions. These information require reminiscence and value fuel on Ethereum.

- ZK-Proof Complexity: Zero-knowledge proof operations like era and verification are mathematically advanced and differ from customary CPU operations. ZK-proofs incur excessive prices as a result of this complexity and CPU calls for.

- Intrinsic Prices in ZKsync: The prices within the ZKsync layer primarily compensate for the sequencers and provers. Not like Ethereum, these prices are associated to the transaction's mathematical complexity relatively than its storage in bytes.

The graph above charts out the transaction price historical past of ZKsync. An acute drop in charges is clear on March 13, when the Ethereum community handed a monumental improve known as proto-danksharding. The improve enabled an upwards of 90% drop in charges for almost all layer 2 networks. You’ll be able to consult with our piece on Ethereum Improvements to study extra about proto-danksharding.

Account Abstraction and Paymasters

Account Abstraction (AA) and Paymasters on zkSync signify important developments in blockchain account administration, providing enhanced performance, flexibility, and consumer expertise.

Account Abstraction

Historically, Ethereum accounts are categorized into two varieties:

- Externally Owned Accounts (EOAs): These accounts are managed by personal keys and may provoke transactions. Nonetheless, they can not execute advanced logic immediately.

- Contract Accounts (CAs): These accounts are good contracts that may execute arbitrary code however can not provoke transactions independently; they require an EOA to set off actions.

This bifurcation can complicate use circumstances that require each transaction initiation and complicated logic execution, akin to good contract wallets or privateness protocols. On customary Ethereum, such use circumstances usually necessitate the involvement of L1 relayers, including friction to the consumer expertise.

zkSync Period's Method to Account Abstraction:

- Unified Account Mannequin: zkSync Period introduces a unified account mannequin the place accounts can provoke transactions (like EOAs) and execute arbitrary logic (like CAs). This mannequin, generally known as Good Accounts, simplifies the interplay between account varieties and enhances performance.

- Good Accounts: These accounts are programmable, supporting customizations like distinctive signature schemes, native multi-signature (multi-sig) capabilities, spending limits, and application-specific restrictions. This flexibility permits builders to implement superior options immediately into accounts with out the necessity for intermediaries or relayers.

Paymasters

Paymasters are a key element of zkSync's AA implementation, offering an progressive strategy to handle transaction charges and facilitate consumer transactions.

- Transaction Sponsorship: Paymasters can sponsor transaction charges on behalf of customers. Which means customers can transact with out holding ETH, the native token usually required to pay fuel charges.

- ERC-20 Charge Funds: Customers pays transaction charges in ERC-20 tokens, not simply in ETH. This flexibility makes transactions extra accessible and user-friendly, particularly for individuals who maintain belongings in numerous tokens.

- Enhanced Consumer Expertise: By enabling price funds in varied tokens and sponsoring transactions, Paymasters cut back friction for customers and help extra seamless interactions with Dapps.

Implementation and Impression:

- Good Accounts and Customized Logic: Good Accounts in zkSync Period can implement any logic, much like good contracts, whereas nonetheless being able to provoke transactions. This mixture permits for advanced functions akin to good contract wallets, the place accounts can implement spending limits or multi-signature approvals immediately.

- Paymasters and Consumer-Pleasant Transactions: Paymasters introduce flexibility in price administration, permitting transactions to be funded in tokens apart from ETH. This functionality is especially helpful for functions that take care of various token economies or purpose to onboard customers with minimal crypto expertise.

- Safety and Flexibility: With AA and Paymasters, zkSync enhances safety and adaptableness. As an example, companies can deploy Good Accounts with custom-made safety measures, like multi-sig setups or transaction whitelists, immediately throughout the account.

- Broader Adoption: These options decrease obstacles to entry for brand new customers and builders, facilitating the broader adoption of blockchain know-how by simplifying interactions and decreasing the necessity for intensive token administration.

Account Abstraction and Paymasters on zkSync are transformative in making blockchain interactions extra accessible, versatile, and safe. By permitting accounts to provoke transactions and execute arbitrary logic, and enabling transaction charges to be paid in varied tokens, zkSync is pioneering a user-centric method to blockchain know-how. This evolution holds important potential for the way forward for decentralized functions and blockchain ecosystems.

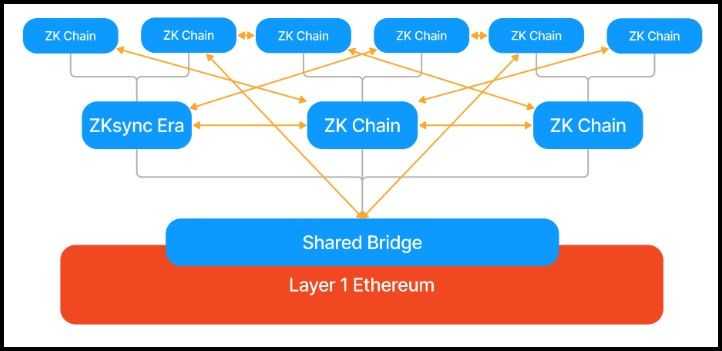

ZK Chains

ZK Chains shouldn’t be a single blockchain however a framework to intrinsically join a number of blockchains with shared infrastructure. Just like Polygon 2.0, the ZKsync group realized that Web3 in Ethereum is fragmented throughout many chains in a number of layers. The fragmentation is ready to worsen with the rise of the appchain narrative – an idea that proposes a singular chain for each decentralized utility. The group launched ZK Chains below the current v24 improve and notably highlighted the next inefficiencies in Ethereum's multi-chain panorama:

- Inefficient Interoperability and Message Passing: Present blockchain ecosystems battle with seamless communication between completely different chains. Protocols like Cosmos and Polkadot give attention to interoperability however usually depend on trust-based mechanisms. This introduces safety and effectivity points, particularly when contemplating the last word purpose of trustless and decentralized methods. This trust-based method exposes vulnerabilities and may result in important safety dangers and inefficiencies.

- Inefficiencies in Present Bridging Options:

- Liquidity Bridges: These are pricey as they require important capital to be locked as much as facilitate transactions between chains.

- Lock-Mint Bridges: They’re much less safe as a result of the locking mechanism usually turns into a goal for hacks, as seen in a number of high-profile blockchain breaches.

- Chain Laborious Forks: When chains exhausting fork, current bridges usually require reprogramming, including to the operational burden and threat.

- Financial Incentives for Hacks: As a result of worth locked in bridges, they grow to be profitable targets for hackers, presenting a persistent safety risk.

Answer: ZK Chains and Hyperbridges

ZK Chains are customized Layer 2 or Layer 3 blockchains constructed utilizing zkSync's ZK Stack. They’re designed to function independently but seamlessly work together with one another and the Ethereum layer 1 by way of Hyperbridges. Right here's how they resolve the challenges:

- Belief-Minimized Interoperability

- ZK Chains leverage zk-based bridges for environment friendly message passing amongst one another. All of the token liquidity is locked in a shared bridge contract on Ethereum in order that token transfers occur seamlessly by way of burning and minting. As a substitute of those bridges individually finalizing on Ethereum, all of the zk-proofs are mixed within the shared bridge contract earlier than verification on Ethereum, which serves as the last word supply of reality. This design will solely demand Ethereum to handle one bridge contract, decreasing fuel and transactional overheads considerably.

- Via Hyperbridges, ZK Chains can talk effectively, abstracting away the complexity of cross-chain interactions from the consumer, due to account abstraction. This implies customers expertise seamless interactions with out worrying in regards to the underlying technical steps.

- Enhanced Scalability and Effectivity

- A shared prover mechanism aggregates proofs from a number of ZK Chains. As a substitute of every chain submitting particular person proofs to Ethereum L1, the shared prover consolidates them right into a single proof, drastically decreasing the load on L1. This aggregation not solely saves sources but additionally will increase the scalability of the whole system.

- This technique permits ZK Chains to attain near-instantaneous transaction finality throughout completely different chains whereas sustaining excessive safety and cost-effectiveness.

Advantages of ZK Chains and Hyperbridges

- Sovereignty and Flexibility: ZK Chains can function as unbiased entities throughout the ecosystem. They will be part of or depart the system in a permissionless method, including or eradicating their belongings from the shared pool. This sovereignty ensures chains can tailor their options and operations to their particular wants whereas benefiting from the collective ecosystem.

- Seamless Consumer Expertise: With account abstraction, advanced interactions involving a number of chains are simplified for customers. They now not have to manually provoke calls on vacation spot chains; the method is automated and managed by exterior relayers and decrease charges on rollups, offering a smoother and extra intuitive consumer expertise.

ZK Chains and Hyperbridges thus signify a major development in blockchain interoperability, offering a safe, scalable, and environment friendly framework for cross-chain communication and liquidity sharing throughout the Ethereum ecosystem and past.

The ZK Token

The ZK token is the official token of the ZKsync ecosystem. It was unveiled in June 2024 with the announcement of a ZK token airdrop and suits into the ecosystem's narrative of offering seamless interoperability and cross-chain communication with the assistance of novel applied sciences like zkbridges and account abstraction.

ZK Token Utility:

- Take part within the ZKsync protocol governance processes by introducing and voting on protocol upgrades.

- Pay for charges. The protocol leverages its native account abstraction method to let customers pay fuel charges on any ZK chain with the ZK token. Whereas the ZKsync Period is the primary ZK chain, many protocols just like the Lens Community, Cronos zkEVM and GRVT are set to hitch the ecosystem within the months following the token launch.

- Use the ZK token for staking and different DeFi-related features.

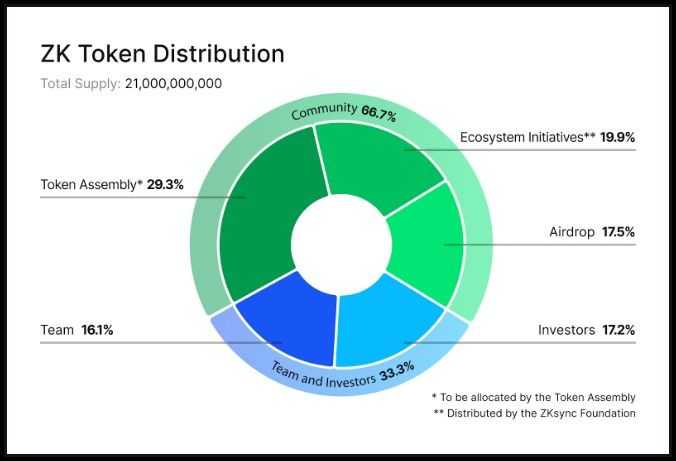

Tokenomics and Allocation

zkSync's ZK token is designed to align the ecosystem's progress with its core values and neighborhood imaginative and prescient.

Right here's an in depth breakdown of the tokenomics:

Group Allocation (~67%):

- Airdrop (17.5%): To honor early adopters and supporters, 17.5% of the full ZK token provide shall be distributed by way of a one-time airdrop. This allocation rewards those that believed in zkSync's potential from the start.

- Ongoing Ecosystem Initiatives (49.5%):

- Managed by the zkSync Basis, this portion shall be used to help the continuing growth and enlargement of the zkSync ecosystem. The distribution is guided by the ZK Nation governance course of, making certain that the neighborhood has a major say in how these tokens are utilized.

- This allocation goals to incentivize new customers to hitch and interact with the ecosystem, fund growth tasks, and help dApps that improve the zkSync protocol.

The substantial neighborhood allocation underscores zkSync's dedication to decentralization and neighborhood engagement. By inserting a good portion of the tokens within the arms of those that share and advance zkSync's imaginative and prescient, the protocol ensures sustained progress and alignment with its core values.

Traders and Staff Allocation (33.3%)

- Investor Allocation (17.2%):

- This section is reserved for the buyers who’ve supported zkSync's growth. It displays their perception within the long-term success of the mission.

- These tokens are locked for the primary 12 months post-issuance and can steadily unlock over a three-year interval from June 2025 to June 2028. This lock-up interval aligns investor pursuits with the protocol's long-term targets, decreasing the probability of sudden large-scale gross sales that might destabilize the token worth.

- Staff Allocation (16.1%):

- Allotted to the Matter Labs group, these tokens reward the contributors who’ve constructed and proceed to drive the zkSync mission.

- Just like the investor tokens, these are locked for the primary 12 months after which unlock over three years, making certain that the group stays dedicated to the protocol's long-term success and progress.

Abstract

- The ZK tokenomics are designed to foster a community-driven and sustainable ecosystem. The key factors embody:

- Group-Centered Distribution: Two-thirds of the ZK provide is allotted to the neighborhood by way of direct airdrops and ecosystem initiatives, reinforcing zkSync's dedication to decentralization and consumer empowerment.

- Incentivizing Early Adoption and Progress: By rewarding early customers and repeatedly supporting new entrants and builders, zkSync ensures ongoing engagement and growth inside its ecosystem.

- Lengthy-Time period Alignment with Traders and Staff: The lock-up and gradual launch of tokens for buyers and the group align their pursuits with the protocol's long-term imaginative and prescient, selling stability and sustained progress.

This considerate allocation technique highlights zkSync's dedication to constructing a decentralized, user-centered protocol that encourages lively participation and long-term dedication from all stakeholders.

The place to Purchase ZKsync Token?

The token will be purchased through Binance, OKX, Bybit and KuCoin, amongst others. Additionally, take a look at our prime picks for one of the best crypto exchanges.

You may as well purchase the token by way of decentralized exchanges akin to OpenOcean and Jupiter. We even have an article on one of the best decentralized exchanges.

ZKsync Evaluate: Closing Ideas

Reviewing ZKsync, I’ve observed a transparent pattern evolving in Web3, which additionally permeates by way of different scalability tasks as nicely. This pattern is of enhancing consumer expertise by decreasing their technological overheads. Polygon, ZKsync, and plenty of different layer 2 tasks are adopting ZK Chains-like architectures to enhance seamless cross-chain communication.

Account abstraction can also be not an idea anymore, permitting higher account programmability and customizability. These developments are constructing in direction of a future the place the consumer won’t have to know what set of chains they're utilizing when on a selected utility or what tokens they’re paying fuel in. These developments are essential for mainstream Web3 adoption.

Incessantly Requested Questions

What’s ZKsync?

ZKsync is a Layer 2 scaling resolution for Ethereum that makes use of zero-knowledge rollups (zkRollups) to boost transaction throughput whereas sustaining the safety of the Ethereum mainnet. By bundling a number of transactions right into a single proof and submitting them to Ethereum, ZKsync considerably reduces fuel charges and accelerates transaction processing. This method permits for prime scalability with out compromising decentralization or safety, making it excellent for dApps, DeFi, and NFT functions.

How Does ZKsync Use Account Abstraction?

ZKsync leverages account abstraction to unify the performance of externally owned accounts (EOAs) and contract accounts. In ZKsync Period, accounts can provoke transactions like EOAs whereas executing arbitrary logic like good contracts. This innovation, known as Good Accounts, simplifies advanced interactions and enhances flexibility. Good Accounts help options like customized signature schemes and multi-signature capabilities, enabling superior use circumstances akin to good contract wallets and enhanced safety protocols with out counting on exterior relayers.

What’s the Utility of the ZK Token?

The ZK token is integral to ZKsync’s ecosystem, designed to align with its community-driven ethos. It facilitates governance, permitting token holders to affect the event and administration of ZKsync by way of the ZK Nation governance course of. A good portion of ZK tokens is allotted to early adopters, ecosystem initiatives, and ongoing neighborhood help. Moreover, ZK tokens can be utilized for transaction charges and incentivizing community participation, selling sustained progress and engagement

How is ZKsync Totally different From Different Layer 2 Scaling Options?

ZKsync differentiates itself by using zero-knowledge proofs (zkRollups) to make sure scalability whereas preserving safety and decentralization. Not like optimistic rollups, which depend on fraud proofs and introduce latency, zkRollups present instantaneous finality by validating transaction proofs instantly. Moreover, ZKsync’s native account abstraction and progressive options like Paymasters for versatile price funds improve consumer expertise and developer flexibility. These capabilities make ZKsync uniquely positioned to help advanced functions and seamless cross-chain interactions.

What are ZK Chains?

ZK Chains are customized Layer 2 or Layer 3 blockchains constructed utilizing ZKsync’s ZK Stack framework. These chains function independently however can work together seamlessly by way of Hyperbridges, enabling environment friendly cross-chain communication and liquidity sharing. Every ZK Chain leverages zero-knowledge proofs for safe and scalable transactions, whereas Hyperbridges guarantee trust-minimized interoperability throughout the zkSync ecosystem. This setup helps modular and sovereign blockchain options, offering builders with the pliability to create tailor-made, interoperable functions.