Welcome to a different thrilling yr in crypto! As we step into 2025, the optimism available in the market is palpable, fueled by precise developments and groundbreaking improvements. On this piece, we’ve curated an evaluation of the highest crypto narratives for the yr, mixing private insights with analysis from main voices within the business, together with Bitwise, VanEck, Ark Make investments, a16z, and extra.

Let’s discover the tendencies shaping the way forward for digital belongings.

Bitcoin Gaining Financial Traction

In 2024, Bitcoin's market dynamics underwent vital transformations, setting the stage for pivotal narratives in 2025.

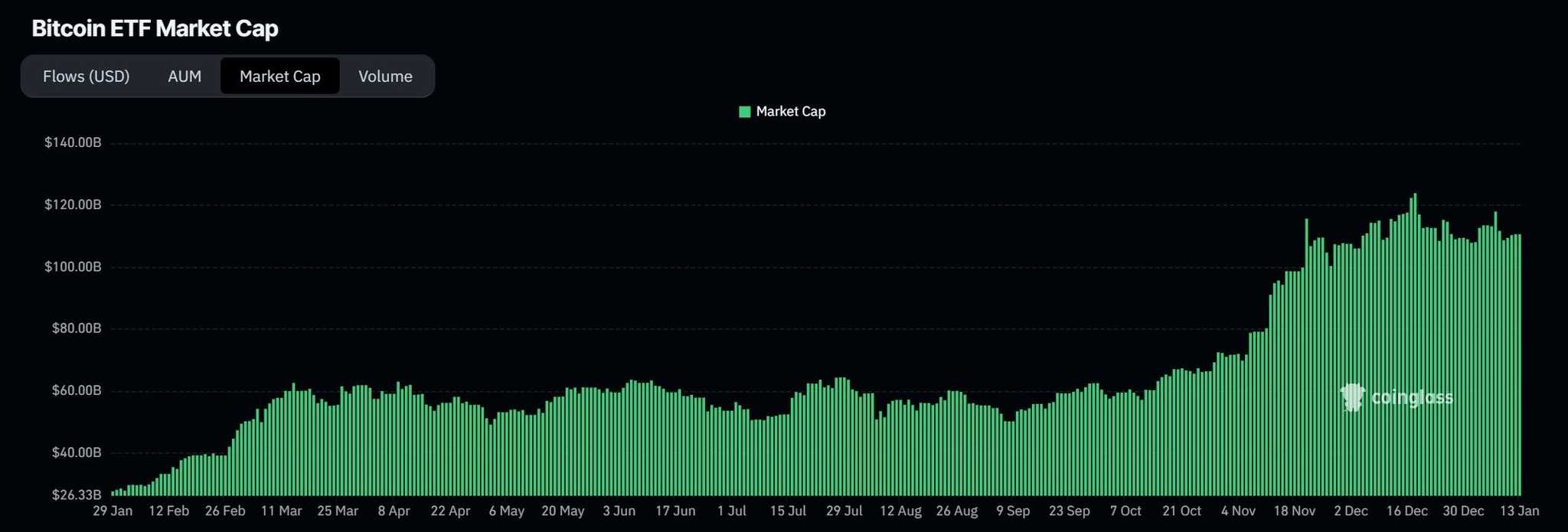

Bitcoin ETF Inflows and Market Impression

The launch of spot Bitcoin exchange-traded funds (ETFs) in January 2024 marked a watershed second for cryptocurrency integration into conventional finance. The iShares Bitcoin Belief (IBIT), managed by BlackRock, distinguished itself by attracting almost $38 billion in web inflows inside its inaugural yr, establishing it as probably the most profitable ETF debut in historical past.

Notably, IBIT's inflows surpassed established funds just like the Invesco QQQ Belief (QQQ), which tracks the Nasdaq-100 Index. By mid-2024, IBIT had garnered roughly $18.97 billion in year-to-date flows, barely edging out QQQ's $18.90 billion.

Traditionally, ETFs expertise modest preliminary inflows, with substantial progress occurring as traders achieve familiarity and confidence in these devices. Given this sample, the strong early efficiency of Bitcoin ETFs in 2024 suggests the potential for even larger adoption and capital inflows in 2025.

Macroeconomic Tailwinds: Curiosity Price Cuts

The macroeconomic setting in late 2024 offered a positive backdrop for Bitcoin and different threat belongings. Within the fourth quarter, the Federal Reserve carried out 4 separate charge cuts, cumulatively lowering rates of interest by 1%. This financial easing, aimed toward controlling inflation, is anticipated to proceed into 2025. It’s going to improve the enchantment of threat belongings like Bitcoin by decreasing the chance price of holding non-yielding investments.

Institutional Adoption: Company and Governmental Curiosity

2024 witnessed a paradigm shift from retail-driven hypothesis to substantial institutional funding in Bitcoin. Below Michael Saylor's management, MicroStrategy considerably expanded its Bitcoin holdings, buying roughly 258,320 BTC for $22.07 billion all year long, reaching a 74.3% yield on these investments.

This aggressive accumulation technique bolstered MicroStrategy's place as a number one Bitcoin company holder and demonstrated the potential profitability of such investments. It may affect different companies to think about comparable allocations in 2025.

On the governmental entrance, President-elect Donald Trump's administration has signaled a pro-crypto stance, with discussions round establishing a Strategic Bitcoin Reserve by way of government order. Whereas the specifics and feasibility of such a reserve are underneath debate, the U.S. authorities's mere consideration of Bitcoin as a strategic asset may immediate different nations to discover integrating Bitcoin into their nationwide reserves, additional legitimizing and stabilizing the cryptocurrency market.

Conclusion

The convergence of profitable Bitcoin ETF launches, favorable macroeconomic insurance policies, and elevated institutional curiosity underscore a transformative interval for Bitcoin. As 2025 unfolds, these narratives are poised to drive Bitcoin's evolution from a speculative asset to a mainstream monetary instrument, attracting a broader spectrum of traders and solidifying its position within the world monetary ecosystem.

Bitcoin: A Distinctive Threat-off Asset?

In conventional finance, "risk-off" belongings are those who traders flock to in periods of financial uncertainty or market volatility. These belongings are perceived as secure havens, preserving capital when riskier investments falter. Authorities bonds and gold epitomize this class as a consequence of their relative stability and backing by sovereign entities.

Authorities bonds are debt securities issued by a rustic's authorities. They promise periodic curiosity funds and the return of principal at maturity. Their low default threat and predictable returns make them engaging throughout market downturns. Equally, gold has been a retailer of worth for millennia. Prized for its shortage and intrinsic value, it usually maintains or appreciates amid monetary crises.

Current analyses, notably from ARK Make investments, counsel that Bitcoin is evolving right into a risk-off asset, exhibiting traits that will supply traders refuge throughout turbulent instances. Key observations embrace:

- Inherent Threat-Off Traits: Bitcoin supplies monetary sovereignty, reduces counterparty threat, and enhances transparency. Its decentralized nature ensures that no single entity controls it, mitigating dangers related to centralized monetary methods.

- Superior Properties In comparison with Conventional Belongings: Bitcoin's decentralization, restricted provide, and superior portability, liquidity, and accessibility surpass these of bonds, gold, and bodily money. These attributes allow seamless world transactions and make Bitcoin a flexible asset within the digital age.

- Outperformance of Conventional Belongings: Bitcoin has delivered an annualized return of 60% over the previous seven years, considerably outpacing the common 7% returns from bonds and different main belongings. Buyers holding Bitcoin for 5 years have persistently realized income, whereas bonds, gold, and short-term U.S. Treasuries have suffered a 99% loss in buying energy over the past decade.

- Resilience to Altering Curiosity Price Regimes: Bitcoin's worth appreciation has endured throughout various rate of interest environments, indicating its robustness and potential as a hedge in opposition to financial coverage fluctuations.

- Efficiency Throughout Threat-Off Intervals: Throughout current monetary crises, comparable to regional financial institution failures, Bitcoin's worth appreciated by greater than 40%, demonstrating its potential as a safe-haven asset.

- Low Correlation with Different Asset Lessons: Between 2018 and 2023, Bitcoin's correlation with bonds was a mere 0.26, in comparison with a 0.46 correlation between bonds and gold. This low correlation means that Bitcoin can improve portfolio diversification.

- Potential to Disrupt the Threat-Off Asset Market: With a present valuation of roughly $1.3 trillion, Bitcoin represents a fraction of the $130 trillion fixed-income market, indicating substantial room for progress because it positive factors acceptance as a risk-off asset.

Whereas Bitcoin's historic volatility has led many to categorise it as a "risk-on" asset, its maturation and the attributes outlined above are shifting perceptions. As world financial landscapes evolve, Bitcoin's position in funding portfolios will probably develop, probably redefining conventional asset allocation methods.

Crypto Shares to Watch in 2025

Crypto firms shook Wall Avenue in 2024 as a number of the highest annualized gainers. Many firms plan to go public in 2025, and others could surpass TradFi establishments in market valuation.

Crypto Firms That Might Go Public in 2025

Analysts anticipate that 2025 might be the “Year of the Crypto IPO,” with main companies gearing up their preliminary public choices (IPOs). Notable firms anticipated to go public embrace:

- Circle: The issuer of the stablecoin USDC has introduced plans to relocate its headquarters to New York Metropolis forward of its anticipated IPO.

- Kraken: The cryptocurrency change is among the many companies predicted to launch an IPO in 2025.

- Anchorage Digital: A digital asset platform anticipated to enter the general public market.

- Chainalysis: A blockchain information platform anticipated to go public.

- Determine: A monetary expertise firm anticipated to launch an IPO.

Coinbase Surpassing Charles Schwab

With quickly rising belongings underneath Coinbase’s administration, many consider it may surpass Charles Schwab because the world’s largest brokerage in 2025. This potential shift is attributed to Coinbase's diversified income streams, together with its Ethereum Layer 2 community, Base, staking companies, and stablecoin operations.

Implications of These Developments:

The anticipated public listings and market valuation shifts have a number of implications:

- Elevated Legitimacy: The entry of outstanding crypto firms into public markets enhances the legitimacy of the cryptocurrency business, probably attracting beforehand hesitant traders.

- Broader Investor Entry: Public listings enable a wider vary of traders to achieve publicity to the crypto sector via conventional funding autos, comparable to shares, with out instantly buying cryptocurrencies.

- Market Dynamics: Together with crypto firms like MicroStrategy and Block in main indices just like the S&P 500 may improve funding from index funds, ETFs, and traders, additional integrating crypto into mainstream finance.

- Aggressive Panorama: As crypto companies develop in valuation and affect, conventional monetary establishments could face elevated competitors, which may result in improvements and variations throughout the broader monetary business.

These developments signify a maturation of the cryptocurrency business, indicating its transition from a distinct segment market to a significant factor of the worldwide monetary ecosystem.

Stablecoin Market Might Double in 2025

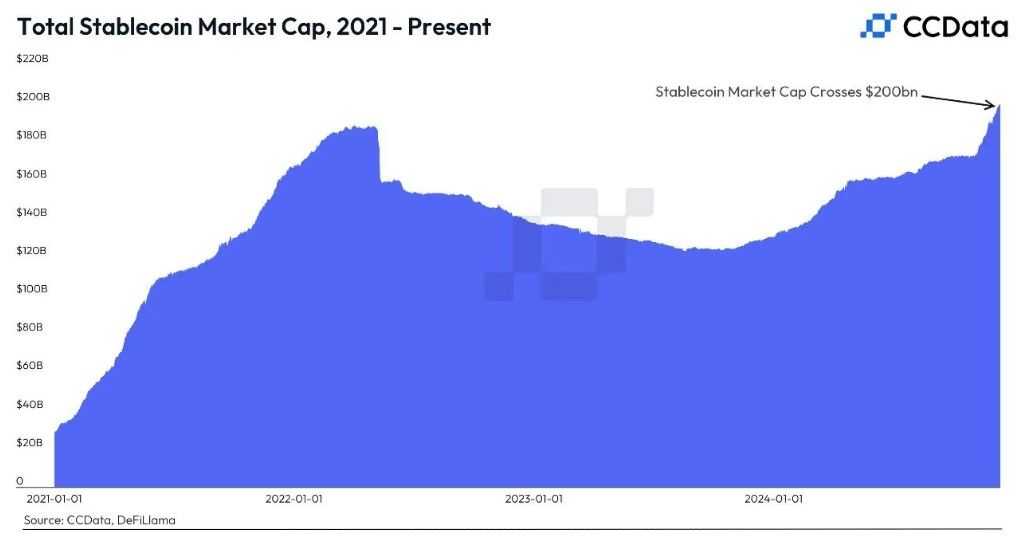

The stablecoin market skilled outstanding progress in 2024, with its market capitalization reaching the $200 billion milestone. This growth is anticipated to proceed, with projections suggesting that the market may double in 2025 as adoption accelerates.

Progress in 2024 and Projections for 2025

In 2024, the stablecoin market's capitalization surged to $200 billion, reflecting elevated adoption and integration into varied monetary methods. This progress is attributed to the rising demand for digital belongings that supply the steadiness of conventional fiat currencies, facilitating seamless transactions and appearing as a hedge in opposition to the volatility generally related to cryptocurrencies.

Business analysts anticipate that the stablecoin market may double in measurement by the top of 2025. This projection is predicated on a number of components, together with broader acceptance of digital funds, developments in blockchain expertise, and elevated regulatory readability, all of which contribute to a extra conducive setting for stablecoin utilization.

Stablecoins and U.S. Greenback Supremacy

Opposite to earlier issues that the rise of stablecoins would possibly undermine the U.S. greenback's dominance, current analyses from Reuters counsel that stablecoins may reinforce it. Stablecoins pegged to the U.S. greenback facilitate dollar-denominated cross-border transactions, enhancing the greenback's utility within the world monetary system. This growth underscores the adaptability of the greenback within the evolving digital financial system.

Implications of Stablecoin Progress

- Enhanced Monetary Inclusion: Stablecoins present entry to monetary companies for people in areas with restricted banking infrastructure, selling larger financial participation.

- Effectivity in Transactions: Utilizing stablecoins can streamline cross-border funds, lowering prices and settlement instances in comparison with conventional banking methods.

- Regulatory Concerns: Because the stablecoin market expands, regulatory our bodies more and more give attention to establishing frameworks to make sure monetary stability and forestall illicit actions.

- Integration with Conventional Finance: Monetary establishments' rising acceptance of stablecoins signifies a convergence between conventional finance and digital belongings, which may result in progressive monetary services.

In abstract, the stablecoin market's vital progress in 2024 and projected growth in 2025 spotlight its integral position within the digital transformation of the monetary panorama. Furthermore, opposite to earlier apprehensions, the proliferation of dollar-pegged stablecoins could bolster the U.S. greenback's supremacy in world finance.

RWAs: A Main Crypto Narrative in 2025

The tokenization of real-world belongings (RWAs) has gained vital momentum. Digitizing belongings comparable to non-public credit score, U.S. debt, commodities, and shares transforms conventional finance, enhancing liquidity, transparency, and accessibility within the monetary markets.

Current Progress and Future Projections

Bitwise mentioned the tokenized RWA market expanded from lower than $2 billion three years in the past to roughly $13.7 billion. With growing adoption and technological developments, Bitwise forecasts this market will attain $50 billion by 2025.

Enterprise capital agency ParaFi predicts the RWA market may develop to $2 trillion by 2030, whereas the International Monetary Markets Affiliation (GFMA) estimates a possible market worth of $16 trillion by the identical yr.

Components Driving Progress

A number of key components contribute to the speedy growth of the tokenized RWA market:

- Superior Asset Administration: Tokenization gives an instantaneous settlement, lowered prices in comparison with conventional securitization, and steady liquidity. It additionally enhances transparency and supplies entry to numerous asset lessons.

- Institutional Adoption: Main monetary establishments are more and more embracing tokenized RWAs. As an illustration, BlackRock's USD Institutional Digital Liquidity Fund, tokenized in partnership with Securitize on Ethereum, now holds $515 million in belongings, making it the biggest tokenized U.S. Treasuries fund.

- Technological Developments: The event of blockchain expertise and good contracts facilitates the environment friendly and safe tokenization of belongings, attracting each traders and issuers.

Implications for the Monetary Ecosystem

The expansion of tokenized RWAs has a number of vital implications:

- Enhanced Liquidity: Tokenization allows fractional possession, permitting traders to purchase and promote parts of belongings, thereby growing market liquidity.

- Broadened Entry: Buyers can entry a various vary of asset lessons that had been beforehand illiquid or troublesome to spend money on, democratizing funding alternatives.

- Operational Effectivity: Automating processes via good contracts reduces administrative burdens and prices related to asset administration and transactions.

- Regulatory Concerns: Because the market grows, regulatory frameworks are evolving to deal with challenges associated to safety, compliance, and investor safety.

Conclusion

The tokenization of real-world belongings (RWAs) is reshaping the monetary panorama, providing enhanced effectivity, accessibility, and liquidity. Projections point out substantial progress by 2025 and past, and tokenized RWAs are poised to turn into a cornerstone of recent finance, attracting each institutional and retail traders in search of progressive funding alternatives.

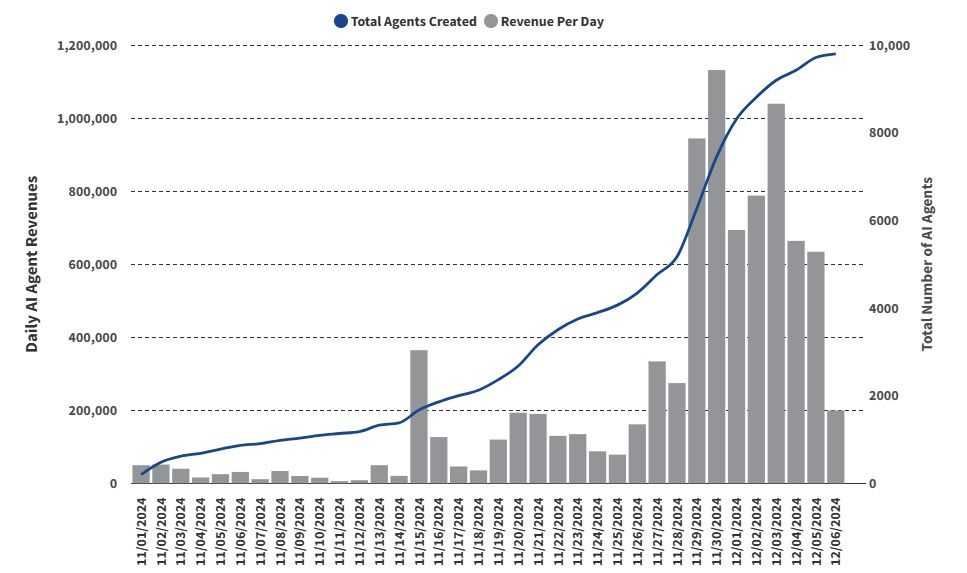

AI Brokers Will Develop Exponentially

In 2024, AI brokers emerged as a outstanding narrative inside cryptocurrency, pushed by platforms like Virtuals and ai16z, which developed no-code options for deploying AI brokers. These specialised AI bots are designed to grasp person intent and execute advanced duties, streamlining processes throughout varied purposes.

Enlargement of AI Brokers in 2025

The combination of AI brokers into the crypto ecosystem is anticipated to broaden considerably in 2025, extending past decentralized finance (DeFi) into various sectors:

- Social Media Influencers: AI brokers like AIXBT are remodeling platforms comparable to Crypto Twitter by delivering real-time market intelligence and development evaluation, enhancing data dissemination.

- Monetary Analysts: AI-driven analytical instruments are offering traders with refined insights, enabling extra knowledgeable decision-making within the risky crypto markets.

- Leisure and Interactive Purposes: AI brokers are being utilized to create partaking content material and interactive experiences, enriching person engagement throughout the crypto neighborhood.

The Proliferation of AI Brokers

As the event of AI brokers turns into extra accessible and cost-effective, their numbers are anticipated to surge. Presently, there are over 10,000 AI brokers with tens of millions of each day customers. Projections counsel that by the top of 2025, the variety of AI brokers may attain a million, indicating widespread adoption throughout varied platforms.

The Emergence of AI Meme Cash

The convergence of AI and meme tradition has created AI-themed meme cash, including a novel dimension to the crypto market. The success of initiatives like Terminal of Truths and the $GOAT meme coin has impressed a wave of comparable initiatives, mixing humor with superior AI functionalities. This development is anticipated to achieve momentum in 2025, attracting each traders and fans.

Implications for the Crypto Ecosystem

The speedy progress of AI brokers and AI-themed meme cash signifies a transformative shift within the crypto panorama:

- Enhanced Accessibility: No-code platforms empower people with out technical experience to develop advanced AI instruments, democratizing innovation throughout the crypto area.

- Diversification of Purposes: Increasing AI brokers into varied sectors fosters a extra interconnected and versatile ecosystem, selling broader adoption.

- Market Dynamics: The rise of AI meme cash introduces new funding alternatives and challenges, influencing market sentiment and investor conduct.

In conclusion, the mixing of AI brokers and the emergence of AI-themed meme cash are poised to play a pivotal position in shaping the crypto narrative in 2025, driving innovation, and increasing the boundaries of the digital asset panorama.

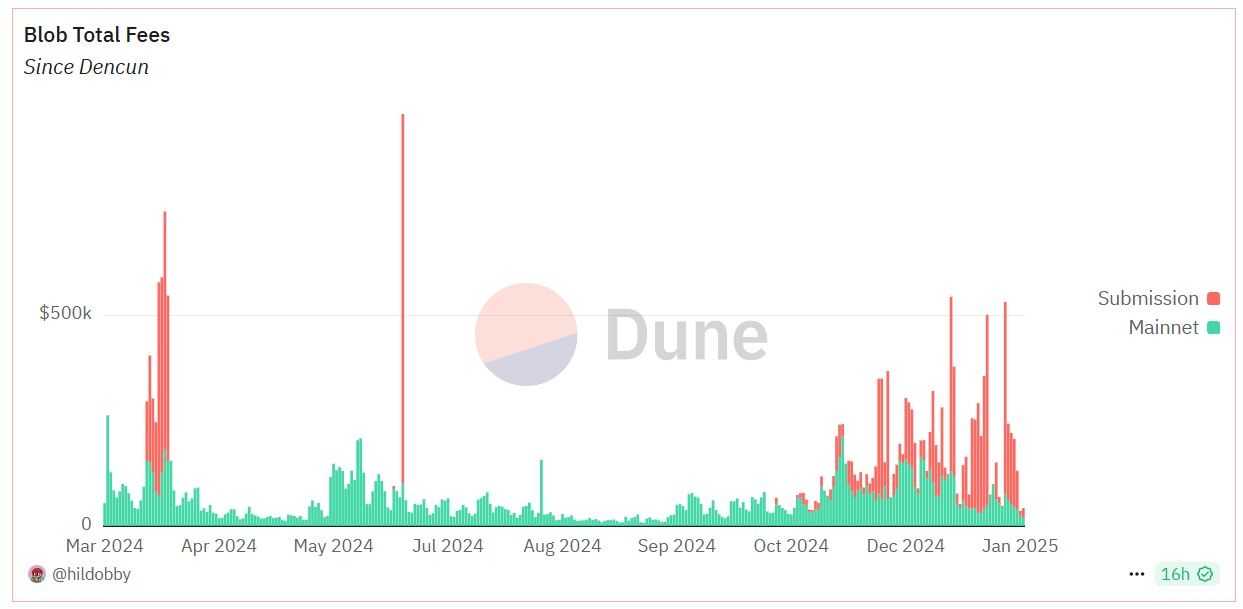

Ethereum Blob Price Market Might Cross $1 Billion Mark

EIP-4844, often called Proto-Danksharding, has considerably enhanced Ethereum's scalability, which introduces "blob-carrying transactions" to optimize information storage for Layer 2 (L2) networks. This growth additionally launched a separate price marketplace for these transactions, the "blob gas market."

Understanding EIP-4844 and Blob-Carrying Transactions

EIP-4844, or Proto-Danksharding, was launched to enhance Ethereum's scalability by enabling a brand new transaction kind that carries massive quantities of knowledge, often called "blobs." These blobs are briefly saved in Ethereum's beacon nodes, permitting L2 options to publish information with out competing with Layer 1 (L1) transactions for gasoline charges. This separation facilitates decrease prices and elevated effectivity for L2 operations.

Twin Price Markets and Base Price Burn Mechanism

With the introduction of blob-carrying transactions, Ethereum now operates two parallel price markets:

- Layer 1 Price Market: Handles conventional transactions and good contract executions.

- Blob Fuel Market: Devoted to L2 transactions using blob information.

Each markets incorporate the bottom price burn mechanism established by EIP-1559. On this mechanism, a portion of transaction charges is burned, lowering the general provide of ETH and probably growing its worth.

Present Utilization and ETH Burn Projections

Since November 2024, validators have posted greater than 20,000 blobs on Ethereum each day. If this development continues or accelerates, projections point out that blob charges may burn over $1 billion value of ETH in 2025, marking a major milestone in Ethereum's evolving safety and financial mannequin.

Components Driving Blob House Enlargement in 2025

A number of key components are anticipated to drive the growth of blob area utilization in 2025:

- Explosive L2 Adoption: Transaction volumes on Ethereum L2s are rising at an annualized charge exceeding 300% as customers migrate to lower-cost, high-throughput environments for DeFi, gaming, and social purposes. The proliferation of consumer-facing decentralized purposes (DApps) on L2s will considerably improve the demand for blob area as extra transactions move again to Ethereum for ultimate settlement.

- Rollup Optimizations: Advances in rollup expertise, comparable to improved information compression and lowered prices for posting information to blob area, will encourage L2s to retailer extra transaction information on Ethereum, unlocking increased throughput with out sacrificing decentralization.

- Introduction of Excessive-Price Use Instances: The rise of enterprise-grade purposes, zk-rollup-powered monetary options, and tokenized real-world belongings will drive high-value transactions, prioritizing safety and immutability, and growing the willingness to pay blob area charges.

Implications for Ethereum's Ecosystem

The expansion of the blob gasoline market has a number of implications:

- Enhanced Scalability: By offloading L2 information storage from the principle Ethereum chain, the community can deal with extra transactions with out congestion, bettering person expertise.

- Financial Impression: Burning ETH via blob charges reduces provide, probably exerting upward strain on its worth, benefiting holders and community members.

- Safety Concerns: The elevated use of blob area underscores the necessity for ongoing monitoring to make sure the community's consensus safety stays strong amid increased information throughput.

In conclusion, the implementation of EIP-4844 and the next growth of the blob gasoline market signify vital developments in Ethereum's scalability and financial mannequin. As Layer 2 adoption accelerates and new use circumstances emerge, the utilization of blob area is poised for substantial progress in 2025, reinforcing Ethereum's place as a number one platform for decentralized purposes.

Closing Ideas

Reflecting on the transformative tendencies shaping the cryptocurrency panorama, it's evident that 2025 holds vital promise. Nonetheless, it's essential to method this evolving market with a balanced perspective, combining optimism with warning.

Key Takeaways:

- Innovation and Progress: The speedy developments in AI brokers, the growth of Ethereum's Layer 2 options, and the growing tokenization of real-world belongings underscore the dynamic nature of the crypto ecosystem.

- Mainstream Adoption: The combination of crypto into conventional monetary methods, exemplified by institutional investments and the rise of stablecoins, signifies a broader acceptance and legitimization of digital belongings.

- Regulatory Developments: Anticipated regulatory modifications, significantly underneath the present U.S. administration, are poised to affect the trajectory of the crypto market, probably introducing each alternatives and challenges. This sentiment echoes the necessity for prudence within the face of speedy market developments.

Tips for Buyers:

- Conduct Thorough Analysis: Earlier than making any funding choices, make sure you comprehensively perceive the belongings and applied sciences concerned.

- Keep away from Overleveraging: Leveraged positions can amplify positive factors and losses. To mitigate potential dangers, it's advisable to keep up conservative leverage.

- Diversify Investments: Keep away from concentrating your portfolio on a single asset or sector. Diversification might help unfold threat and improve potential returns.

- Keep Knowledgeable: The crypto market is very dynamic. Often replace your self with the newest developments, regulatory modifications, and market tendencies.

In conclusion, whereas the cryptocurrency market presents unprecedented alternatives, it's important to method it with a disciplined and knowledgeable mindset. By balancing optimism with warning, traders can navigate this evolving panorama extra successfully, capitalizing on its potential whereas safeguarding in opposition to inherent dangers.

Incessantly Requested Questions

What are the Most Vital Narratives of 2025?

These are the most well liked narratives for 2025:

- Bitcoin ETFs and Institutional Shopping for

- Stablecoins and U.S. Greenback Supremacy

- AI Brokers in Crypto

- Ethereum’s Layer 2 Progress and Blob House Enlargement

- Tokenized Actual-World Belongings (RWAs)

Why is Trump's Presidential Win Optimistic for Crypto?

Trump’s administration has signaled sturdy pro-crypto insurance policies, together with a possible government order including Bitcoin to the U.S. strategic reserve. This might result in elevated authorities adoption, world legitimacy, and a positive regulatory setting for the cryptocurrency business.

Is AI an Vital Narrative in Crypto in 2025?

Completely. AI brokers are revolutionizing crypto by enabling specialised bots for on-chain duties, DeFi, social media, and enterprise use circumstances. Platforms like Virtuals have democratized AI agent creation, driving adoption. With tens of millions of customers already engaged, AI brokers are set to dominate a number of purposes in 2025.

What to Anticipate From Ethereum in 2025?

Ethereum will see progress in Layer 2 adoption, blob gasoline market utilization, and developments in rollup applied sciences. Protodanksharding (EIP-4844) will optimize scalability, and ETH burn from blob transactions may exceed $1 billion. Enterprise and DeFi use circumstances will additional solidify Ethereum’s dominance.