Ladies and Gentlemen, please! Children of all ages.

Welcome to the biggest show on Earth! The world of scams, exploits grifts hacks compromised wallets. This is none other than the Wonderous and Whimsical World of Web3

We have tricks and scams that you’ve not seen before. There’s a trick for everyone, from cascading liquidations to vanishing funds.

Let me introduce to you the first performance of the evening. RUG PULLING!

It’s an act of fame (read as The newest version of the scam(that’s always left the participants speechless and shocked. I personally call it the ‘Houdini of Crypto’. Your money can be worth anything one moment and nothing the next.

Enjoy the show. You might learn some secrets about the trick, and even some of the greatest performers in history.

Enjoyed the theatrical introduction? Dramatics aside, we’re going to talk about ‘Rug Pulls’ one of the most common scams in the crypto space. The scam is notorious for blinding investors. Don’t worry. We will share with you some tips that can help protect you from being blindsided.

Continue reading to learn more.

What is a Rug Pull Scam?

A ‘Rug Pull’ scam is a type of exit scam in the cryptocurrency space. Although the details vary depending on the case, you can describe it as a scam where investors or token holders are suddenly left with worthless investments.

Rug pull scams are often perpetrated by founders of projects who have stopped the development and removed or sold all the liquidity, making the tokens worthless.

The projects that are most likely to succeed are new projects, which trade primarily through DEXs. This is due to the fact that it is easier for projects to obtain liquidity and start trading on DEXs because they are mostly permissionless.

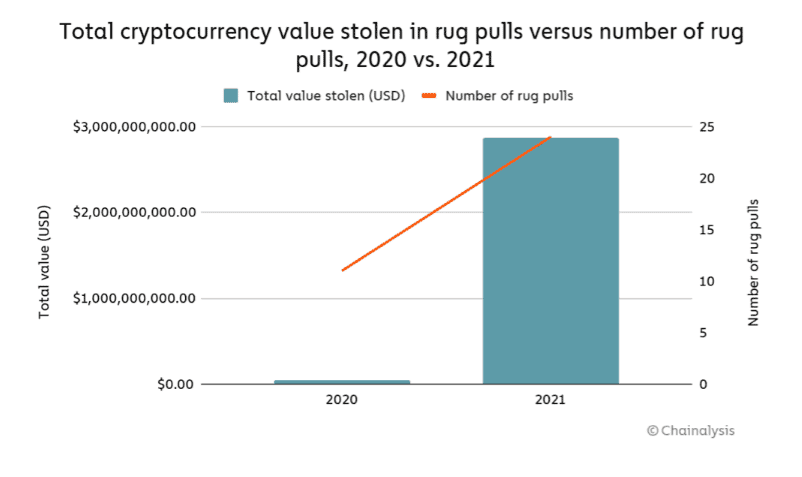

The ‘Rug Pull’ scam seems to have picked up steam last year, a report by Chainalysis found that nearly 37% of all cryptocurrency scam revenue in 2021 was from Rug Pulls. This is an impressive leap compared to the 1% scam revenue contribution rug pulls made in 2020. This may be due to a greater inflow of retail investor and projects into the market as a result of the 2021 bullrun.

Three major Rug Pull Scams

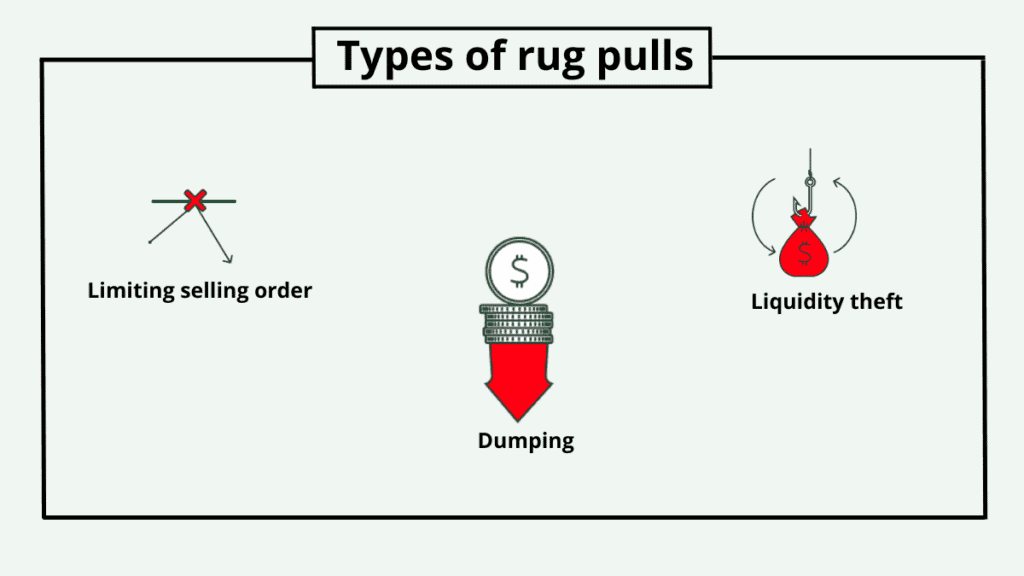

Rug Pull Scams are classified into three types. The method of executing the scam is what makes each one different. Three main types of fraud are used.

Liquidity stealing

The development team will create a liquidity pool at a DEX when launching a new token. If you’re not sure what a ‘liquidity pool’ is, here’s a simple explanation- a liquidity pool is a combined pot of two assets that traders can trade from by depositing one of the two tokens in the pair and withdrawing an equal weight of the other.

Developers are usually the largest contributors to liquidity pools. This means they can withdraw a significant portion of assets from the pool. When developers launch liquidity pools they create one of two tokens, which means there is no cost to fund this side of the pool. The team will only pay for one token – typically ETH, BNB or a combination of both – when launching a liquid pool.

As the project gains attention and investors begin to purchase the token, however, the size of the pool that is funded by ETH or BNB increases, while the size of the project tokens decreases. The liquidity provider’s ETH/BNB stack is higher than when they joined or created the pool.

This is where the first method of rug pulling called ‘liquidity stealing’ comes in. Once the token has reached a certain price, the project developer can leave the scam by withdrawing their share of liquidity. Most development teams are either the largest or the only liquidity providers in a pool. This means that token holders won’t be able to sell their positions once the liquidity is withdrawn. The tokens will be worthless and investors are left with worthless tokens. This method of rug pulling is usually classified as a ‘hard pull’, which means that the intention to rug the project was clear from inception.

Limiting sales orders

The second commonly used method in Rug Pulls is ‘limiting sell order’. A malicious team will create the smart contract for the token so that only certain wallet addresses can execute sell orders. This is also commonly called a ‘honey pot’ scam.

The token price can continue to rise at a rapid rate as long as there are only buy orders. Retail investors are attracted by the green-only charts and begin buying tokens in hopes of a quick gain without performing any diligence on the projects. As soon as the news that the investors were unable sell the token began to gain traction, founders had usually left the project.

One of the popular examples of this type of rug pull is the ‘Squid Game’ token rug pull (which we’ll read more on later). Squid Game rug pulls are also famous because they were caught on live Twitch streams. Limiting sell orders is also another method that comes under ‘hard pull’.

Dumping

The third method is most commonly used in rug pulls. It’s a simple method. In the ‘dumping’ method, the team usually just sells off a massive chunk of the project tokens on the open market which dumps the price all the way down.

This method is usually used by projects who run massive social media campaigns in order to create hype and pressure for the token. The team will dump their tokens once the token has reached a certain price.

The same method is used by projects who start with good intentions but then backtrack when the future looks bleak. Once some teams realize the project has no future, they either sell off their share of the tokens slowly under the guise of ‘development costs’ or they sell it off in one go.

Depending on whether the token was dumped at one go or slowly over time, this method of rug pulling can be classified as a ‘hard’ or ‘soft’ rug pull respectively. A ‘soft pull’ is one whose intentions to rug aren’t as clear, it could be interpreted as either a mismanaged project or a scam that was slowly executed over time.

Rug Pulling – How to avoid it

Let’s talk about how to protect yourself against rug pulling now that you’ve learned the different types of rug pullers.

- Fixed Liquidity Positions within a Pool

Be sure to lock the liquidity that is provided by the developer into a pool of liquidity. This information can be easily found by entering the contract addresses of the tokens on websites such as Token Sniffer, or Crypto Watchtower. If the liquidity position is not locked, it means that the funds are susceptible to being withdrawn at any time, resulting in a rug pull through the ‘liquidity stealing’ method.

- Do not fall for price-action or hype

Do your due diligence before you invest in tokens. Don’t automatically believe that a project is legitimate just because it has been featured on social media. Remember what we said about Honey Pots and limiting rug pulls on sell orders?

- Avoid projects with anonymous developers

When it comes to anonymous developers, it’s best to be cautious. Although there are many famous projects with anonymous devs, the risk is much higher for a project that has anonymous devs due to the lower risk of damaging the reputation.

- If it seems too good, it’s probably true.

That’s right. It’s likely that a project’s yield rate is absurdly high. This is a scam to collect money and then pull the rug out. Whitepapers, and projects with ambitious roadmaps without a clear plan of how to reach their goals are also at risk. While ambitious roadmaps can be commendable they should also include a clear outline of what steps are needed to achieve them, rather than vague promises.

- Audits

You should ensure that the project in which you plan to invest has been externally audited by a reputable firm. This will uncover any vulnerabilities within the smart contract.

- Keep an eye out for a project that is slowly deteriorating

Check the progress of the project on a regular basis. You should reconsider your investment if you notice a drop in activity or the founders are becoming more distant. This could indicate a waning of interest.

Case Studies: Some Of The Biggest Rug Pulls

Thodex

Thodex was a Turkish crypto-exchange that pulled one of the largest rug pulls of 2021. Thodex is a crypto exchange that was centralized and had user deposits of over $2.6 Billion. This profile differs from the usual rug-pulling schemes.

The platform initiated the rug pull by ‘temporarily’ closing the platform to address an “abnormal fluctuation in the company accounts.” Users’ access to funds on the platform was frozen. Faruk Fatih Ozer, the founder and CEO of the platform, fled to Albania while he still had over $2 billion in user deposits. He is still at large, and a warrant for his arrest has been issued internationally.

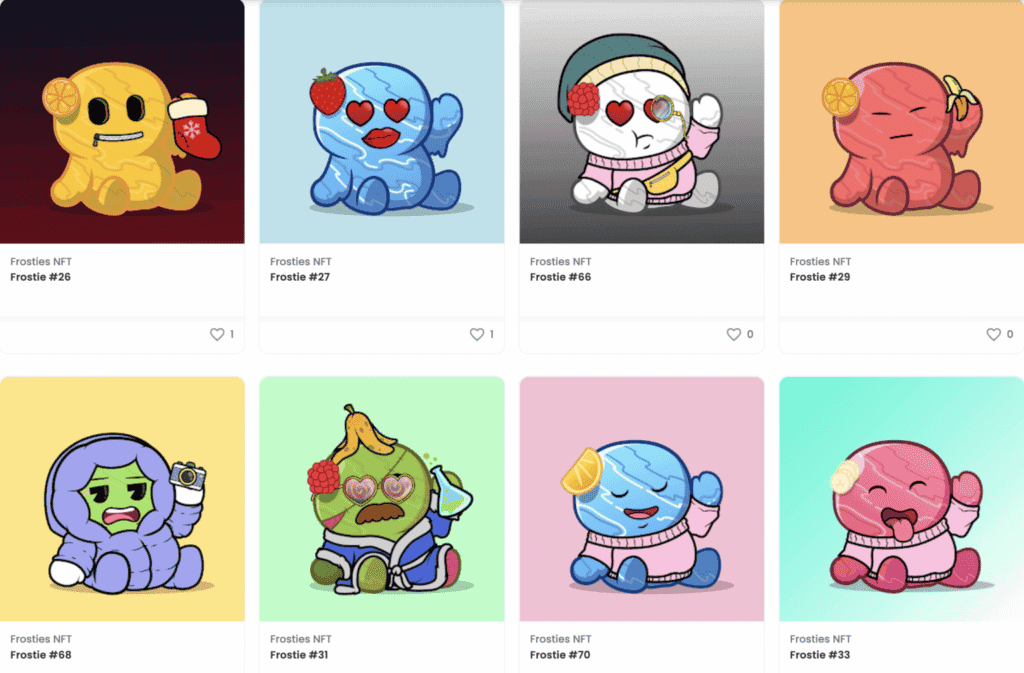

Frosties

Frosties, an 8888 NFT Project that was launched at the beginning of 2022. It generated $1.3m in primary sales. The team behind Frosties Rug pulled the project hours after primary sales. They deleted all of their social media channels and transferred the funds into other wallets. It tweeted a statement “I’m sorry.”

What’s most interesting about this rug-pull is that the Department of Justice was able to track down Ethan Nguyen, and Andre Llacuna. They were then charged with money laundering charges and fraud related to the rug-pull. It's one of the first times someone has been charged for an NFT rug pull and if convicted, the creators face up to 20 years in prison.

In order to find the founders of the project, the investigators issued subpoenas Discord – the platform that was used by the project. Discord revealed the IP address where the usernames of the founders were active. The team discovered a Coinbase transfer that occurred at the same IP address. Another subpoena later disclosed the identity of discord user ‘Frostie’ to be Ethan Nguyen.

Interestingly, at the time the authorities charged them, both Ethan and Andre were already making a move for the next NFT project called ‘Embers’. This project would also have been a sham if they hadn’t been charged.

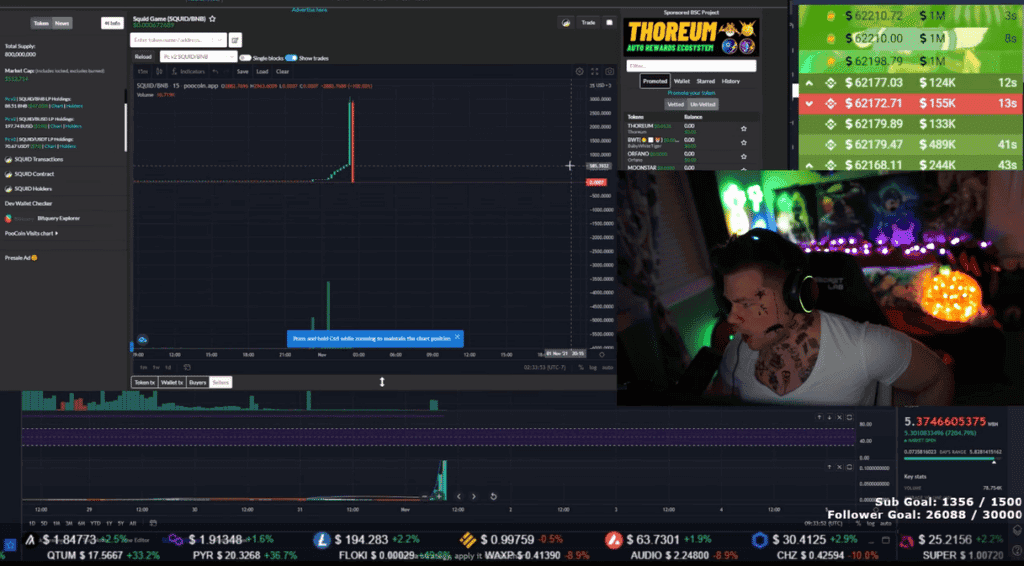

Squid Game

The Squid Game Token was one of many projects that rode on the hype train of the hugely successful Korean TV show with the same title. The plot of the show featured a game show in which participants competed for a massive prize pot by taking part in ‘death games’ to be the last man standing.

A whitepaper was also released by the Squid Game token that promised a play to earn modelled on the concept of show. It detailed a token economy involving another ‘Marble’ token. Investors rushed to pour money into the token hoping to get a piece of the action.

Unfortunately, this project was a honeypot which restricted the sell orders only to certain wallets owned and controlled by the team. The project was a honeypot, which limited the sell orders to only specific wallets owned by the team.

This caused a price increase that made headlines across the globe. In one week, the token rose from $0.01 when it was launched to almost $3000. When the token reached $2861, the team began dumping tokens to drain the liquidity. The exact moment, as mentioned above, was captured on Twitch live by a Twitch creator.

Investors realized, in retrospect, that the project had several red flags. The project whitepaper had several spelling mistakes, poor language, and was lacking in details about the game’s economy. (not to say the ridiculous market capital)

The conclusion of the article is:

You now know how to spot red flags when you are considering investing in a new project. As long as we remain vigilant, we can minimize the risks of investing in such projects.

You can find answers to your questions in the FAQ section listed below.

FAQs

How can I stop a crypto rug-pull?

There is nothing that you can do if you are ever caught up in a rug pulling. If you can, leave the situation as soon as possible. You can also reach out to the community to find out if they are taking any action. It’s unlikely that you would recoup all of your investment but advanced tools for blockchain forensics allow us to identify bad players more easily.

Can you rug-pull Bitcoin?

Bitcoin has existed since almost 14 years. Under current conditions, Bitcoin holders are unlikely to be pulled under the rug. Satoshi Nakamoto, creator of Bitcoin network Satoshi is the largest BTC owner. Over 1 million BTC tokens were mined before his disappearance.

The BTC is distributed across 22,000 wallets that are inactive since Satoshi’s disappearance in 2010. If Satoshi were to return and dump all his BTC (over 22,000 wallets), the price would be impacted by a massive amount. But do keep in mind that this is highly unlikely and that the BTC in those wallets is most likely ‘lost’ forever.

How can you tell if it is a scam or not?

Monitoring the team’s social media accounts and on-chain wallets is a simple way to find out if they are likely to rug pull. If the team seems to have a lot going on but there’s no real goal or utility, it is highly likely that they will rug pull.

Token Sniffer, a free risk analysis tool, can also be used. Remember to also look out for the red-flags that we listed earlier.

Are crypto rug pulls illegal?

This depends on a number of factors, including the type of rug-pull executed, the promises made, and the laws governing digital assets in jurisdictions where lawsuits are filed.

If it’s a ‘hard’ rug pull where the liquidity is drained overnight, then more often than not, it might give investors a cause of action to file a case. If it’s a ‘soft’ rug pull, then it’s often hard to establish the exact intention of the team in slowly draining the funds; whether it is for the development of the project or a planned exit strategy.

As demonstrated in the Frosties NFT Case Study, legislators have taken proactive measures.