The Ethereum Merge represents probably the most important upgrades to the Ethereum community since its inception. This transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism marked a revolutionary shift for Ethereum and the broader blockchain panorama. The Merge successfully eradicated Ethereum's reliance on energy-intensive mining. The Merge has additionally catalyzed the event of assorted area of interest industries and utilities inside the Ethereum ecosystem. Within the transient interval since its implementation, many of those use circumstances have turn out to be defining traits of Ethereum.

One notable end result of the Merge is the rise of Staking-as-a-Service (SaaS), an idea that differs from the normal Software program-as-a-Service mannequin. Staking-as-a-Service permits customers to stake their Ethereum with out having to handle the technical complexities concerned in working a validator node. This service has shortly gained recognition because it lowers the obstacles to entry for taking part in Ethereum staking, enabling extra customers to contribute to community safety and earn staking rewards.

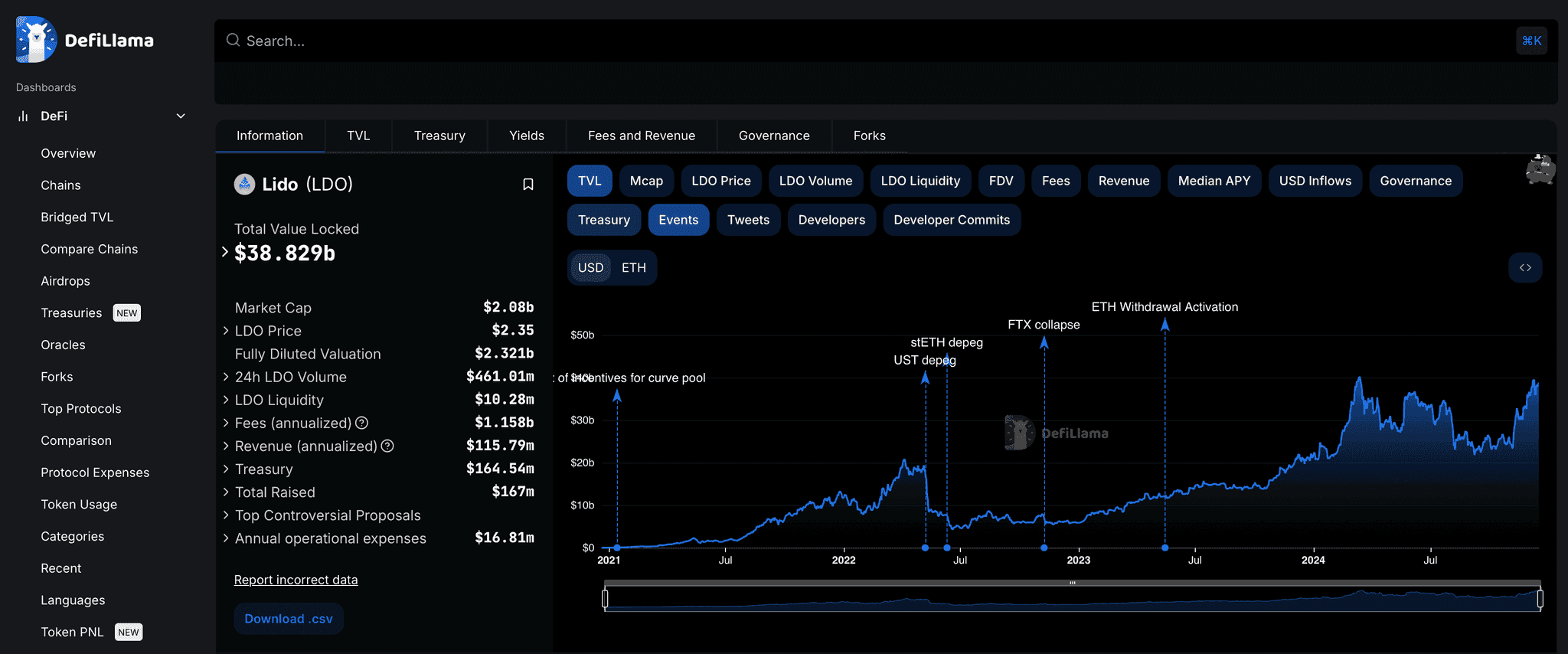

This evaluate focuses on Lido Protocol, a number one challenge within the Staking-as-a-Service area. Lido has quickly ascended to turn out to be the most important protocol by Complete Worth Locked (TVL) in Ethereum, boasting over $25 billion in TVL as of September 2024, in response to DefiLlama. Lido's success will be attributed to its user-friendly strategy to staking, permitting customers to take part in staking while not having the technical information or the total quantity of 32 ETH required to run a private validator.

On this Lido Finance evaluate, we are going to discover each facet of the Lido Protocol, together with its distinctive options, its influence on the Ethereum ecosystem, and its potential future developments. We'll additionally assess the professionals and cons of utilizing Lido for staking, offering readers with a complete understanding of its position inside the quickly evolving Ethereum panorama.

What’s Liquid Staking?

Liquid staking is an modern strategy to staking on proof-of-stake (PoS) blockchains. In contrast to conventional staking, the place tokens are locked up and inaccessible for a set interval, liquid staking permits customers to stake their belongings whereas nonetheless retaining liquidity. Customers obtain a by-product token representing their staked belongings, which can be utilized in decentralized finance (DeFi) functions, enabling them to earn further yields or commerce their positions with out ready for the staking interval to finish.

Liquid Staking Derivatives (LSDs)

Liquid staking derivatives (LSDs) are tokens issued to customers after they stake their belongings by means of liquid staking platforms. These tokens, reminiscent of stETH for Ethereum or stMATIC for Polygon, signify the staked asset and accrue staking rewards over time. They permit customers to keep up flexibility and liquidity, using their staked belongings throughout numerous DeFi protocols whereas nonetheless taking part in staking. They’re extra generally often called Liquid Staking Tokens (LSTs).

For extra, you possibly can learn our full information to liquid staking.

What’s Lido Finance?

Lido Protocol was launched in December 2020 as a liquid staking resolution for proof-of-stake (PoS) cryptocurrencies. The protocol was co-founded by a gaggle of buyers and builders, together with Semantic Ventures, ParaFi Capital, Terra, MakerDAO creator Rune Christensen, Aave CEO Stani Kulechov, and Synthetix founder Kain Warwick. Early assist additionally got here from node operators like Stakefish and Staking Amenities.

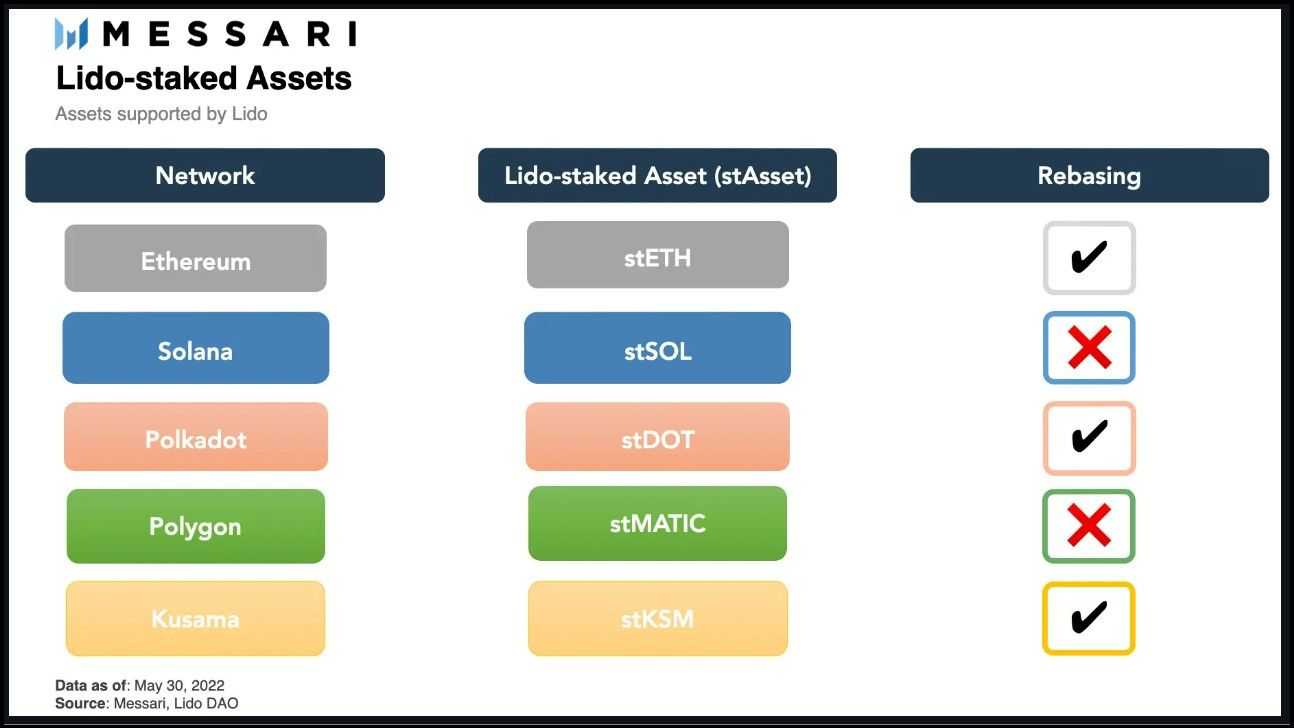

Lido initially launched its staking service on Ethereum and shortly expanded to incorporate assist for different networks, reminiscent of Solana, Polkadot, Kusama, and Polygon, every providing the same liquid staking mannequin.

The Lido Decentralized Autonomous Group (DAO) was established to supervise the protocol's governance and guarantee its decentralized operation. The DAO is chargeable for key selections, reminiscent of protocol upgrades and the allocation of staking rewards. The governance of Lido is performed utilizing the LDO token, which permits holders to take part within the decision-making processes of the protocol).

Lido Protocol Economics

The ethos of liquid staking revolves round maximizing the utility of staked tokens whereas enhancing accessibility for customers excited about Ethereum staking. Conventional staking requires customers to lock up their tokens, making them inaccessible for a selected interval, which limits their utility. Liquid staking, nevertheless, permits customers to stake any quantity of tokens and retain liquidity, offering them with flexibility and the potential for extra yield from DeFi functions.

How Does Lido Work?

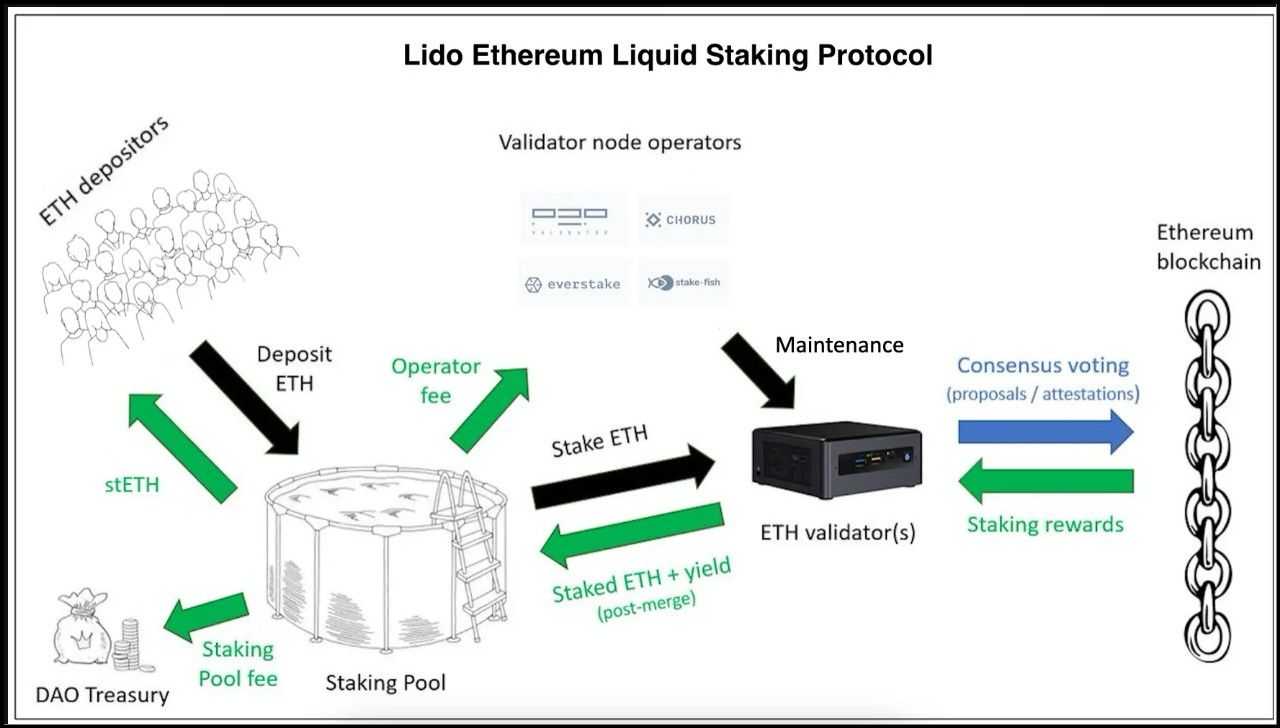

Lido is a liquid staking protocol designed to allow customers to take part in Ethereum staking with out coping with the technical complexities or monetary burdens historically related to it. Customers can deposit any quantity of ETH into the Lido protocol, no matter measurement, which Lido then stakes by means of a community of trusted validators.

- Staking and Minting stETH: When customers stake their ETH with Lido, the protocol mints stETH tokens equal to the quantity staked. These stETH tokens signify the person's staked ETH within the Lido contract and accrue staking rewards proportionally.

- Utility of stETH: stETH tokens are liquid and are helpful in numerous Web3 use circumstances, together with DeFi protocols, buying and selling, and even restaking to generate further yields. This versatility makes stETH beneficial inside the broader Ethereum ecosystem.

Governance

Lido's governance is managed by the Lido DAO, which oversees the protocol's core ideas, together with setting charges, assigning node operators, and managing oracles. The DAO operates on the LDO token, permitting token holders to take part in decision-making processes.

Lido Charges

Lido prices a ten% price on all staking rewards earned by means of the protocol. This price is split equally, with 5% allotted to the DAO treasury and 5% rewarded to node operators for his or her providers. The remaining 90% of the staking rewards are distributed amongst Lido stakers in proportion to the quantity of stETH held of their wallets.

Strategic Implications

Combining DeFi methods with liquid staking tokens (LSTs) like stETH can considerably improve returns, as customers can leverage their staked belongings throughout a number of monetary merchandise and protocols. Nevertheless, this additionally comes with elevated threat, significantly the potential of dropping the initially deposited ETH if the stETH tokens are misplaced or mismanaged.

The following part will discover the nuances of the Lido protocol's parts in better element, shedding gentle on the mechanics and intricacies that underlie this staking resolution.

Lido Structural Elements

The Lido protocol contains the next important parts:

Node Operators

Node operators are an important element of the Lido Protocol. They’re chargeable for staking customers' ETH and guaranteeing the safety and effectivity of the staking course of. Right here's an outline of how node operators perform inside the Lido ecosystem:

- Position and Whitelisting: Lido at the moment has a gaggle of 36 whitelisted Ethereum validator nodes. These nodes are chosen and managed by the Lido Node Operator Sub-Governance Group (LNOSG), which oversees the whitelisting course of to make sure that solely dependable and reliable validators take part within the community.

- Significance of Sincere and Environment friendly Operations: The position of node operators is important for sustaining the safety and integrity of the funds staked inside the Lido Protocol. Sincere and environment friendly node operators assist decrease slashing penalties, which might happen if validators behave maliciously or fail to keep up correct node operations.

In response to Lido's documentation, their node operators have maintained a strong observe document with no slashing penalties to this point, demonstrating their reliability and effectivity. - Non-Custodial Construction: Lido operates on a non-custodial foundation, which means that node operators don’t have direct management over the customers' funds. As an alternative, they use a public validation key to validate transactions utilizing the staked belongings. This construction enhances the safety of the protocol by guaranteeing that node operators can’t entry or mismanage the staked funds instantly.

By leveraging a community of trusted and diversified node operators, Lido ensures that the staking course of is safe and environment friendly, aligning with the broader targets of decentralization and person fund safety.

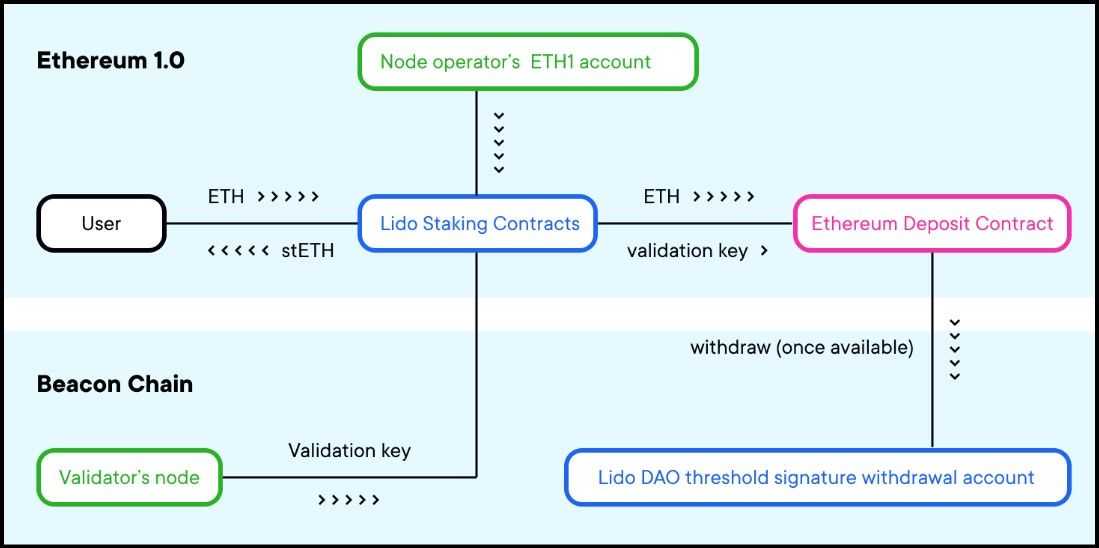

Lido Sensible Contracts

The Lido Protocol depends on a number of good contracts to handle its operations and keep the integrity of its liquid staking providers. Two main good contracts kind the core of Lido's structure: the Lido Staking Pool Contract and the Lido Oracle Contracts. Right here's an outline of their features and significance inside the protocol.

Lido Staking Pool Contract

The Lido Staking Pool Contract is the central good contract chargeable for dealing with the core functionalities of the Lido Protocol. Its main tasks embrace:

- Managing Person ETH Deposits and Withdrawals: The contract accepts ETH deposits from customers and processes their withdrawal requests. This ensures customers can take part in staking with out the necessity to run their very own validator nodes.

- Minting and Burning stETH Tokens: Upon receiving ETH deposits, the staking pool contract mints stETH tokens equal to the quantity of ETH deposited. These tokens signify the staked ETH and accrue staking rewards over time. Conversely, when customers withdraw their staked ETH, the corresponding stETH tokens are burned.

- Managing the Node Operators Registry: The contract maintains a registry of node operators by means of the NodeOperatorsRegistry contract. It distributes ETH to node operators in a round-robin trend, guaranteeing a good and balanced allocation of staking duties.

- Delegating Funds to Node Operators for Staking: The staking pool contract delegates the pooled ETH to a community of trusted node operators who carry out the precise staking operations on the Ethereum community. This delegation course of is essential for sustaining the protocol's non-custodial nature.

- Making use of Charges and Distributing Rewards: Lido prices a ten% price on staking rewards, which is split equally between the DAO treasury and node operators. The remaining 90% of the rewards are distributed to stETH holders in proportion to their holdings. This price construction ensures sustainability whereas rewarding each the DAO and the operators.

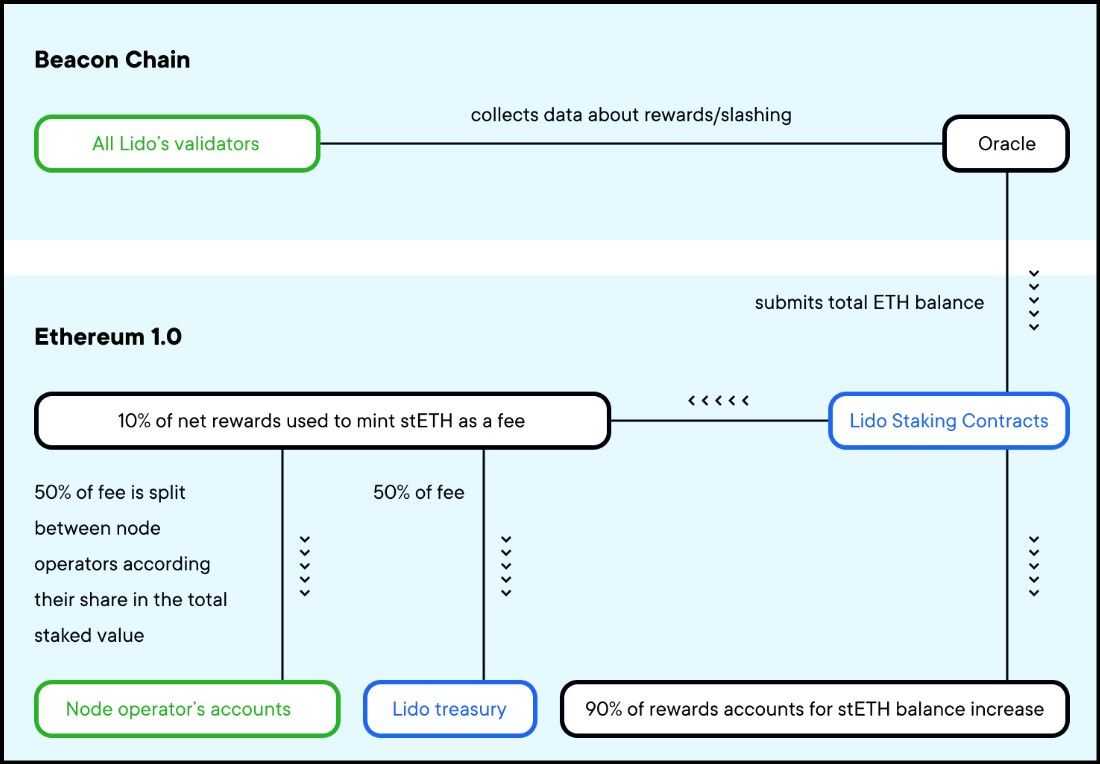

Lido Oracle Contracts

The Lido Oracle Contracts play a significant position in sustaining the accuracy and safety of the protocol by offering up-to-date knowledge on the state of the community and validators. Key features of the Oracle contracts embrace:

- Monitoring Validator Balances: The oracles monitor the staked ETH stability of every validator, reporting any modifications attributable to block rewards or slashing penalties. This ensures the staking pool contract is at all times conscious of the correct staking state.

- Updating the Staking Pool with Rewards and Penalties: On days when validators generate internet optimistic rewards, the oracles report the extra ETH to the staking pool, which mints equal stETH tokens. These tokens are then distributed: 90% to stETH holders, 5% to the DAO treasury, and 5% to the node operators. This course of retains the rewards distribution clear and truthful.

- Guaranteeing Correct stETH Rebase: The oracles additionally play a important position within the rebase mechanism of stETH. They make sure the stETH token provide displays the present worth of the underlying staked ETH, sustaining a 1:1 peg with ETH.

By combining the functionalities of the staking pool contract and the oracle contracts, Lido ensures a safe, environment friendly, and decentralized staking resolution that provides liquidity to staked belongings, enhancing their utility throughout numerous DeFi functions.

Lido LSTs: stETH and wstETH

Lido's liquid staking ecosystem depends on two most important tokens, stETH and wstETH, which serve distinct roles to reinforce flexibility and compatibility within the staking and DeFi panorama.

stETH: The Core Liquid Staking Token

- stETH is an ERC-20 token on the Ethereum community that represents ETH staked by means of the Lido protocol. It serves as a receipt for customers who stake their ETH, permitting them to keep up liquidity whereas incomes staking rewards.

- Illustration of Staked ETH: When customers deposit ETH into Lido, the protocol stakes this ETH by means of its community of validators. In return, customers obtain stETH tokens in an equal quantity, representing their staked ETH. This tokenization permits customers to retain publicity to ETH and take part in staking rewards.

- Distribution of Staking Rewards: stETH holders earn rewards derived from two sources:

- Consensus Layer Rewards: These are rewards from Ethereum's Proof-of-Stake (PoS) mechanism, reflecting the inflationary issuance of ETH.

- Execution Layer Rewards: These embrace transaction charges and Maximal Extractable Worth (MEV) rewards earned by validators.

As these rewards accumulate, they’re transformed into further stETH tokens, that are proportionately distributed to all stETH holders, permitting them to learn from the staking returns.

- Rebasable Token Sustaining a 1:1 Ratio with ETH: stETH is a rebasable token that adjusts its provide to mirror the rewards earned, sustaining a 1:1 ratio with the ETH staked within the Lido pool. This rebasing ensures that the worth of stETH stays aligned with the underlying ETH, making it a gorgeous possibility for customers in search of liquidity alongside staking rewards.

- Every day Balances Calculated by Oracles: Lido employs a system of oracles to calculate and replace stETH balances each day. These oracles observe validator efficiency, together with earned rewards and slashing penalties, guaranteeing that the stETH provide precisely displays the overall staked ETH and accrued rewards. After deducting a ten% price (5% for the DAO treasury and 5% for node operators), the remaining rewards are distributed to stETH holders.

wstETH: The Wrapped Model of stETH

- wstETH is a wrapped model of stETH designed to offer compatibility with DeFi protocols that don’t assist the rebasing characteristic of stETH.

- Token Wrapper Mechanism: In contrast to stETH, which rebases periodically to distribute staking rewards on to token holders, wstETH maintains a set stability. This characteristic makes it appropriate with DeFi protocols that can’t deal with rebasing tokens. For instance, if MakerDAO doesn’t assist stETH's rebasing mechanism, a person with stETH locked in MakerDAO may miss out on the rebasing rewards. To unravel this difficulty, Lido provides wstETH, which doesn’t rebase however as a substitute accumulates staking rewards.

- Accumulating Token: wstETH acts as an accumulating token. When customers convert stETH to wstETH, they lock within the worth of their stETH on the present fee. The wstETH contract accumulates rewards by growing the intrinsic worth of every wstETH token over time. Thus, whereas stETH adjusts its provide to distribute rewards, wstETH grows in worth, reflecting the accrued staking rewards. This accumulation permits wstETH to be value greater than 1 ETH because the staking rewards improve, whereas stETH maintains an in depth 1:1 peg with ETH.

- Conversion and Redemption: The conversion course of between stETH and wstETH is simple. Customers can mint wstETH by depositing their stETH, and conversely, they will burn wstETH to redeem stETH. This flexibility permits customers to decide on the token that most closely fits their technique, whether or not they want compatibility with non-rebasing-friendly DeFi platforms or choose the liquidity of stETH.

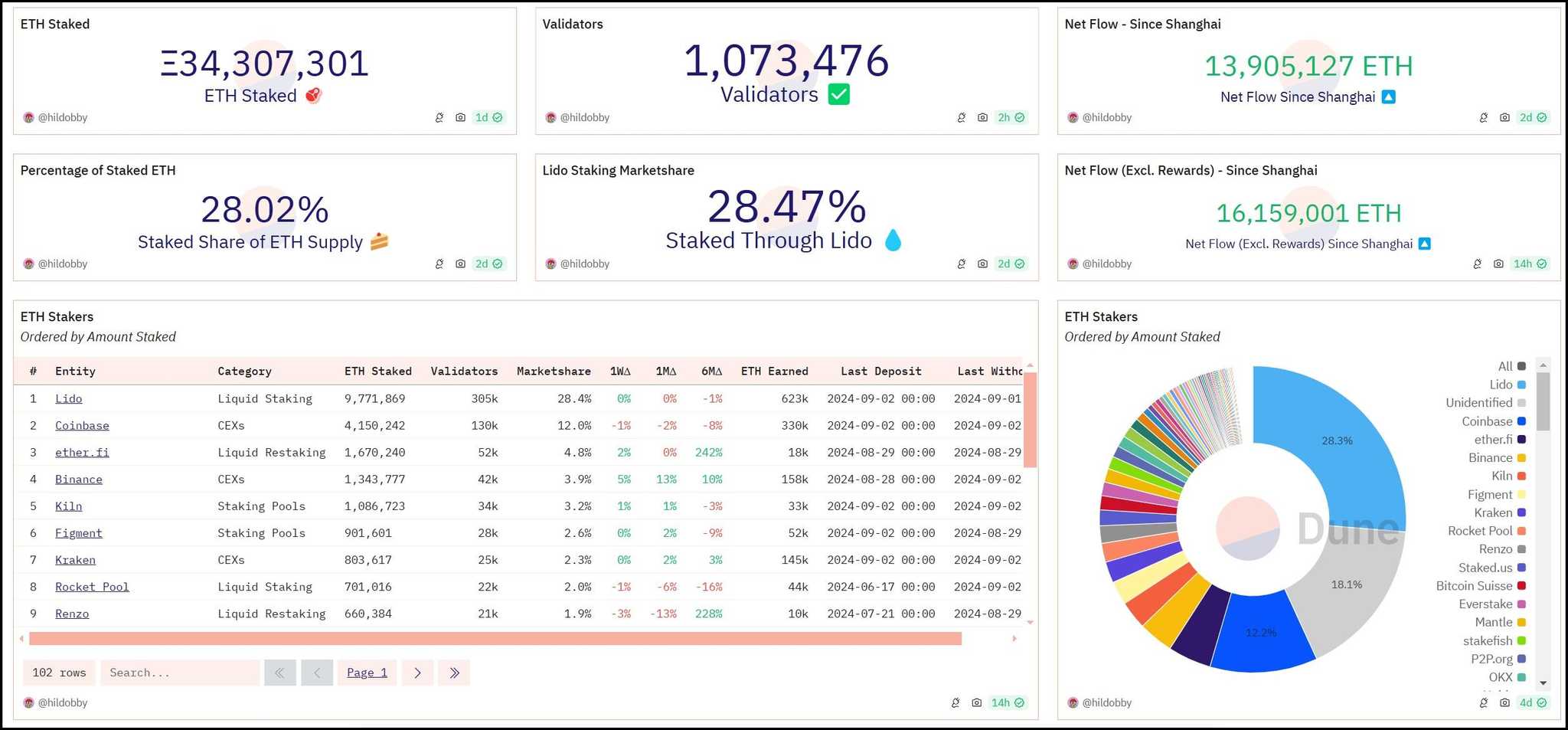

The Position of stETH and wstETH in Lido's Ecosystem

Collectively, stETH and wstETH underpin Lido's liquid staking mannequin, offering customers with choices that cater to numerous DeFi methods and threat appetites. As of September 2024, Lido holds a big place within the Ethereum staking ecosystem, controlling 28.3% of the overall staked ETH, making it the most important staker on Ethereum, in response to Dune Analytics. This dominant place highlights the protocol's skill to supply scalable and versatile staking options that meet the varied wants of the Ethereum neighborhood.

Lido expanded its liquid staking ecosystem to many chains after Ethereum. Right here's a whole record of networks Lido helps:

- Ethereum (stETH)

- Polygon (stMATIC)

- Solana (stSOL)

- Polkadot (stDOT)

- Kusama (stKSM)

Furthermore, at the moment, wstETH token is current on the next networks:

- Arbitrum

- Optimism

- Scroll

- Base

- Linea

- ZKSync

- Mantle

- Polygon PoS

- Mode

- Binance Sensible Chain (BSC)

LDO Token and the Lido DAO

The Lido DAO manages the liquid staking protocol and votes to determine key system parameters. The first features of the DAO are:

- Determine key parameters of the liquid staking protocol, like charges, oracles and node operators.

- Scouting, assessing and qualifying node operators to make sure environment friendly protocol operations.

- Approve grants to assist analysis initiatives.

- Bug bounty program.

- Conducting different operational duties.

The LDO token facilitates the DAO's governance selections. LDO is the Lido protocol's ERC-20 token. The tokenomics of the LDO token are designed to assist the Lido ecosystem's development and sustainability by strategically distributing tokens amongst numerous stakeholders and sustaining a set provide. Listed below are the important thing features:

- Circulating and Complete Provide:

LDO has a complete provide of 1,000,000,000 tokens, with a circulating provide of 892,898,290 tokens. This capped provide construction helps keep the token's worth by stopping inflation from a vast provide. - Token Distribution:

The allocation of LDO tokens is deliberate to make sure long-term sustainability and incentivize participation within the Lido ecosystem:- DAO Treasury: A good portion of the LDO tokens is reserved for the DAO treasury, which funds improvement, neighborhood initiatives, and different actions authorized by LDO holders.

- Founders and Workforce: Tokens are allotted to the founders, crew members, and early contributors as an incentive for his or her ongoing assist and improvement efforts.

- Validators and Advisors: A portion of the LDO tokens is allotted to validators working staking nodes and advisors contributing to the platform's strategic route.

- Traders: Early buyers who offered capital for Lido's preliminary improvement are allotted a share of the tokens, aligning their pursuits with the platform's development.

The place to Purchase LDO?

LDO tokens will be bought on each centralized and decentralized exchanges.

- Centralized Exchanges: Main centralized exchanges like Binance, Coinbase, and Kraken supply LDO buying and selling pairs, permitting customers to purchase LDO utilizing fiat currencies or different cryptocurrencies. These platforms present a user-friendly interface and extra options like fiat on-ramps, making it simpler for brand new customers to accumulate LDO.

- Decentralized Exchanges: LDO will also be bought on decentralized exchanges (DEXs) like Uniswap and SushiSwap. These platforms enable customers to commerce instantly from their wallets, offering better privateness and management over their funds. Customers can swap ETH or different ERC-20 tokens for LDO while not having to create an account or endure KYC verification.

Lido DeFi Integrations

stETH, Lido's liquid staking token, has turn out to be a significant asset within the Ethereum DeFi ecosystem, offering numerous utilities throughout totally different classes. These utilities improve the yield potential of ETH holders and contribute to Ethereum's safety and resilience. Here’s a categorized overview of stETH's integrations and their roles:

1. Decentralized Exchanges (DEX)

- Curve Finance (stETH/ETH Liquidity Pool): Curve provides a stETH/ETH liquidity pool that enables customers to earn buying and selling charges and liquidity mining rewards with low slippage. This pool is designed to keep up a steady peg between stETH and ETH, minimizing impermanent loss for liquidity suppliers. The APR for offering liquidity right here is roughly 3-5%.

- Uniswap V3 (wstETH/ETH Pool): Uniswap helps a wstETH/ETH liquidity pool. This pool is especially appropriate for wstETH attributable to its non-rebasing nature, which avoids the complexities related to rebasing tokens like stETH. The estimated APR for this pool ranges from 2-5%, relying on market circumstances.

- Balancer v2 (wstETH/ETH Composable Secure Pool): Balancer v2 offers a customizable and dynamic steady pool for wstETH/ETH. This pool provides dynamic swap charges and the flexibleness of Balancer's distinctive liquidity administration options, offering an APR of 2-5%. This pool permits customers to earn buying and selling charges whereas benefiting from Balancer's options like dynamic asset weights.

2. Lending Protocols

- Aave v2 Ethereum Mainnet Market: stETH is listed as an accepted collateral asset on Aave, permitting customers to borrow different belongings whereas retaining their publicity to staking rewards. The APR for stETH on Aave ranges from 3-8%, making it a gorgeous possibility for customers seeking to leverage their stETH with out unstaking it.

- Different Lending Platforms (Cream Finance, Compound): Much like Aave, platforms like Cream Finance and Compound settle for stETH as collateral, enabling customers to borrow different belongings whereas nonetheless incomes staking rewards. The yield on these platforms aligns with the charges on Aave, typically starting from 3-8%.

3. Restaking Platforms

- EigenLayer: EigenLayer permits customers to restake stETH, enhancing their yields whereas contributing to Ethereum's prolonged safety framework. With a large $2.19 billion in stETH restaked (898,555.15 stETH tokens), EigenLayer represents roughly 75% of the Ether staked within the protocol. This substantial determine highlights the rising significance of liquid staking tokens (LSTs) in securing Ethereum and its prolonged ecosystem.

- Blast Layer 2 Chain: Blast provides a local yield mechanism using LST tokens, with roughly $946.72 million in stETH (388,634.68 tokens) locked in its contracts to earn yield for the layer 2 protocol. This integration showcases how LSTs usually are not only for yield farming but additionally for offering safety to different blockchain layers.

4. Yield Aggregators and Different DeFi Alternatives

- Offering Liquidity on DEX Protocols: Past Curve and Uniswap, different DEXs reminiscent of SushiSwap additionally supply stETH liquidity swimming pools. These swimming pools allow customers to earn buying and selling charges, liquidity mining rewards, and the underlying staking rewards from stETH. The mixed APR for offering stETH liquidity can vary from 3% to eight%, relying on the precise DEX and market circumstances.

- Yield Optimization Platforms (Yearn Finance, Convex, Idle Finance): Platforms like Yearn Finance and Convex supply superior yield optimization methods involving stETH. These methods can embrace auto-compounding and leveraged positions, doubtlessly growing yields as much as 5-10% APR. Idle Finance provides risk-adjusted tranches that present yields between 1.5% and eight.5% APR, relying on the person's threat urge for food.

Affect of stETH within the Ethereum Ecosystem

- The widespread integration of stETH throughout a number of DeFi platforms demonstrates its important position within the Ethereum ecosystem. These integrations enable ETH holders to earn further yields by means of numerous DeFi methods whereas sustaining liquidity. Furthermore, by staking ETH by means of Lido, customers contribute to Ethereum's safety and resilience, incentivizing extra ETH to be staked within the protocol. This elevated staking exercise helps to safe the Ethereum community and its related layers, enhancing the general robustness of the blockchain.

Enhanced Yield on ETH By way of Liquid Staking

- Combining the bottom staking rewards from Lido with the extra yields earned by means of DeFi integrations considerably enhances the potential returns on ETH. For instance, staking ETH through Lido offers a base reward of roughly 4.8% yearly. By additional integrating stETH into DeFi platforms—whether or not by means of liquidity swimming pools, lending, or yield optimization methods—customers can doubtlessly obtain mixed yields starting from 8% to 10% or larger. This multi-layered yield technique leverages the flexibleness of liquid staking whereas optimizing returns throughout numerous DeFi protocols, albeit with the added dangers related to good contracts, market volatility, and impermanent loss.

- By utilizing Lido's stETH, ETH holders can maximize their returns, contributing to the broader DeFi ecosystem and reinforcing the safety of Ethereum and its prolonged networks.

Lido Finance Evaluate: Closing Ideas

Lido's liquid staking protocol has established itself as a pivotal element within the Ethereum ecosystem, providing ETH holders a versatile and rewarding strategy to take part in staking. The varied integration of stETH throughout numerous DeFi platforms underscores its utility, enabling customers to maximise their returns whereas contributing to the safety and stability of the Ethereum community. With alternatives starting from liquidity provision on DEXs to lending and restaking on modern platforms like EigenLayer and Blast, Lido offers a number of avenues for ETH holders to reinforce their yields.

Nevertheless, the panorama of liquid staking is aggressive, and Lido faces important competitors, most notably from RocketPool. RocketPool, like Lido, is a outstanding liquid staking resolution on Ethereum however differs essentially in its design and strategy:

- Validator Set Design: One of many main variations between Lido and RocketPool lies of their strategy to validator set participation. Lido emphasizes an environment friendly and skilled validator set, which includes deciding on a curated group of validators to make sure excessive efficiency and minimal threat. Whereas this strategy offers a dependable and safe staking atmosphere, it introduces a level of centralization, as solely whitelisted validators can take part. In distinction, RocketPool adopts a permissionless mannequin, permitting any person with the required technical abilities and capital to turn out to be a validator. This open strategy promotes decentralization however might include elevated dangers related to much less skilled validators.

- Liquidity Incentives: One other notable distinction is the way in which these protocols deal with liquidity incentives. Lido allocates a big quantity of funds to LDO-induced rewards, encouraging liquidity provision and participation by means of numerous incentive applications. This technique helps keep excessive liquidity ranges for stETH and enhances its utility within the DeFi ecosystem. RocketPool, however, doesn’t have a built-in incentive mechanism like Lido's in depth LDO rewards. Whereas this may restrict RocketPool's rapid liquidity, it aligns with its ethos of fostering natural development and lowering reliance on exterior incentives.

These variations mirror broader philosophical divergences between the 2 protocols: Lido prioritizes environment friendly, centralized management for safety and excessive liquidity, whereas RocketPool leans in the direction of a extra decentralized and permissionless strategy. As each protocols proceed to evolve, these distinctions will form their roles and affect inside the Ethereum ecosystem.

In conclusion, liquid staking is turning into more and more integral to Ethereum's future, offering new alternatives for yield and enhancing community safety. As protocols like Lido and RocketPool advance and adapt to altering market dynamics, they are going to proceed to play essential roles in shaping the panorama of Ethereum staking and DeFi. For ETH holders, understanding these nuances is vital to creating knowledgeable selections on find out how to maximize their participation and returns within the quickly increasing world of liquid staking.

Steadily Requested Questions

What’s Lido?

Lido is a decentralized liquid staking protocol on the Ethereum community that enables customers to stake their ETH with out locking up their belongings or sustaining a validator node. In return for staking ETH, customers obtain stETH, a tokenized model of their staked belongings that accrues staking rewards and can be utilized throughout numerous DeFi platforms. Lido goals to offer liquidity to staked ETH, enhancing its utility within the Ethereum ecosystem whereas selling decentralization and bettering community safety by means of broad participation in staking.

The best way to Liquid Stake on Lido?

To liquid stake on Lido, go to the Lido staking platform and join your pockets (e.g., MetaMask). As soon as related, select the quantity of ETH you need to stake and make sure the transaction. After staking, you’ll obtain an equal quantity of stETH, representing your staked ETH and accruing staking rewards. stETH can be utilized in numerous DeFi protocols for extra yield alternatives whereas sustaining the liquidity of your staked belongings. Lido’s interface offers a straightforward and accessible approach for customers to take part in staking with out managing a validator node.

The best way to Purchase the LDO Token?

LDO tokens will be bought on each centralized and decentralized exchanges. On centralized exchanges like Binance, Coinbase, and Kraken, you should buy LDO utilizing fiat currencies or different cryptocurrencies by organising an account and finishing the required KYC verification. For decentralized exchanges like Uniswap or SushiSwap, join your pockets, choose the LDO buying and selling pair, and swap ETH or one other ERC-20 token for LDO. This course of permits customers to accumulate LDO instantly from their wallets with out the necessity for intermediaries or centralized controls.

What are the charges for staking with Lido?

Lido prices a ten% price on staking rewards, which is break up between the Lido DAO treasury (5%) and the node operators (5%). The remaining 90% of rewards are distributed to stakers primarily based on the quantity of stETH they maintain.

What’s the influence of stETH within the Ethereum ecosystem?

stETH has turn out to be an important asset within the Ethereum DeFi ecosystem, permitting ETH holders to earn further yields whereas contributing to Ethereum’s safety. By staking ETH by means of Lido, customers assist safe the Ethereum community whereas benefiting from liquid staking and enhanced returns by means of DeFi integrations.