Bitcoin balances at crypto exchanges are now near historic lows. On-chain data indicates that inventory is rapidly depleting.

10X Research published a note on Sunday that highlighted this trend. It was accompanied by the sharp decline in Bitcoins available for purchase.

This contrasts starkly with the trends that were observed at the end of summer, when a sudden influx temporarily replenished foreign exchange reserves.

However, this time no such increase in inventory has taken place, which is exacerbating supply constraints.

Analysts claim that Bitcoin and the crypto-market as a whole have been supported by positive catalysts, which indicate a continued rise in the year to come.

Donald Trump is the president-elect. He has promised to set up a Bitcoin reserves in the U.S., while also protecting crypto mining and creating favorable policies for this industry.

That has helped drive Bitcoin's price to record highs just below $100,000 and has revamped the asset's image as a store of value in the eyes of investors.

On-chain analytics suggest that long-term holders—often viewed as a stabilizing force in the market—are firmly holding their positions, limiting the flow of Bitcoin into exchanges and reducing liquidity.

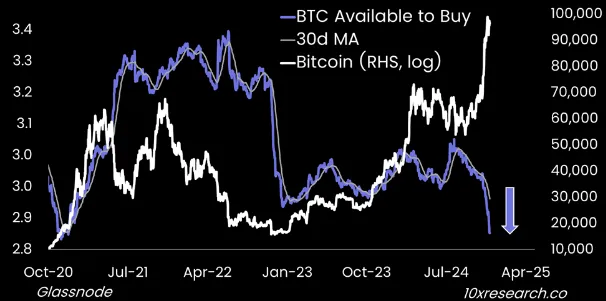

The attached chart from 10X Research, leveraging Glassnode data, reveals a clear divergence between Bitcoin's available supply on exchanges and its price.

The 30-day moving-average of Bitcoins available for purchase has dropped precipitously.

Meanwhile, Bitcoin's price, plotted on a logarithmic scale, surged sharply in the latter half of 2024, recently nearing the $100,000 threshold.

Currently, only three major exchanges—Bitfinex, Binance, and Coinbase—report sufficient Bitcoin reserves to meet buyer demand, 10X notes.

The smaller exchanges are facing increasing difficulties in maintaining liquidity. This could result in a rise of price volatility.

This tightening coincides with macroeconomic developments, which include institutional interest in Bitcoin financial products like spot ETFs.

The shrinking inventory of exchange items may increase the price as retail players and institutions demand grows. Decrypt Before, I told you.