The LIBRA meme coin, initially framed as a funding mechanism for Argentina, has left a path of empty wallets and shattered belief following its launch and subsequent collapse.

The fallout revealed an $11 million crater of unrealized losses nonetheless hanging over 1,001 remaining holders, in response to new analysis from blockchain analytics agency Nansen.

Reaching a peak of $4.5 billion in valuation earlier than its decline, the LIBRA token's on-chain aftermath confirmed {that a} small group of wallets profited whereas most merchants skilled losses.

"Unrealized losses exceed unrealized gains by $4.57 million, highlighting a significantly larger imbalance," Nansen analyst Nicolai Søndergaard wrote on Wednesday.

Nansen's evaluation tracked 15,431 wallets buying and selling LIBRA, discovering that 86% of addresses recorded realized losses totaling $251 million, whereas 2,101 worthwhile wallets netted roughly $180 million collectively.

A crypto “Wild West”

However the injury is extra than simply numbers.

Arjun Arora, chief working officer at decentralized orderbook protocol Orderly Community, sees the LIBRA token's collapse as having broader results on the crypto business.

"The scandal reinforces a consensus macro narrative of crypto as a "Wild West"—a space where political influence, insider trading, and lack of transparency can fleece unsuspecting retail investors," Arora informed Decrypt.

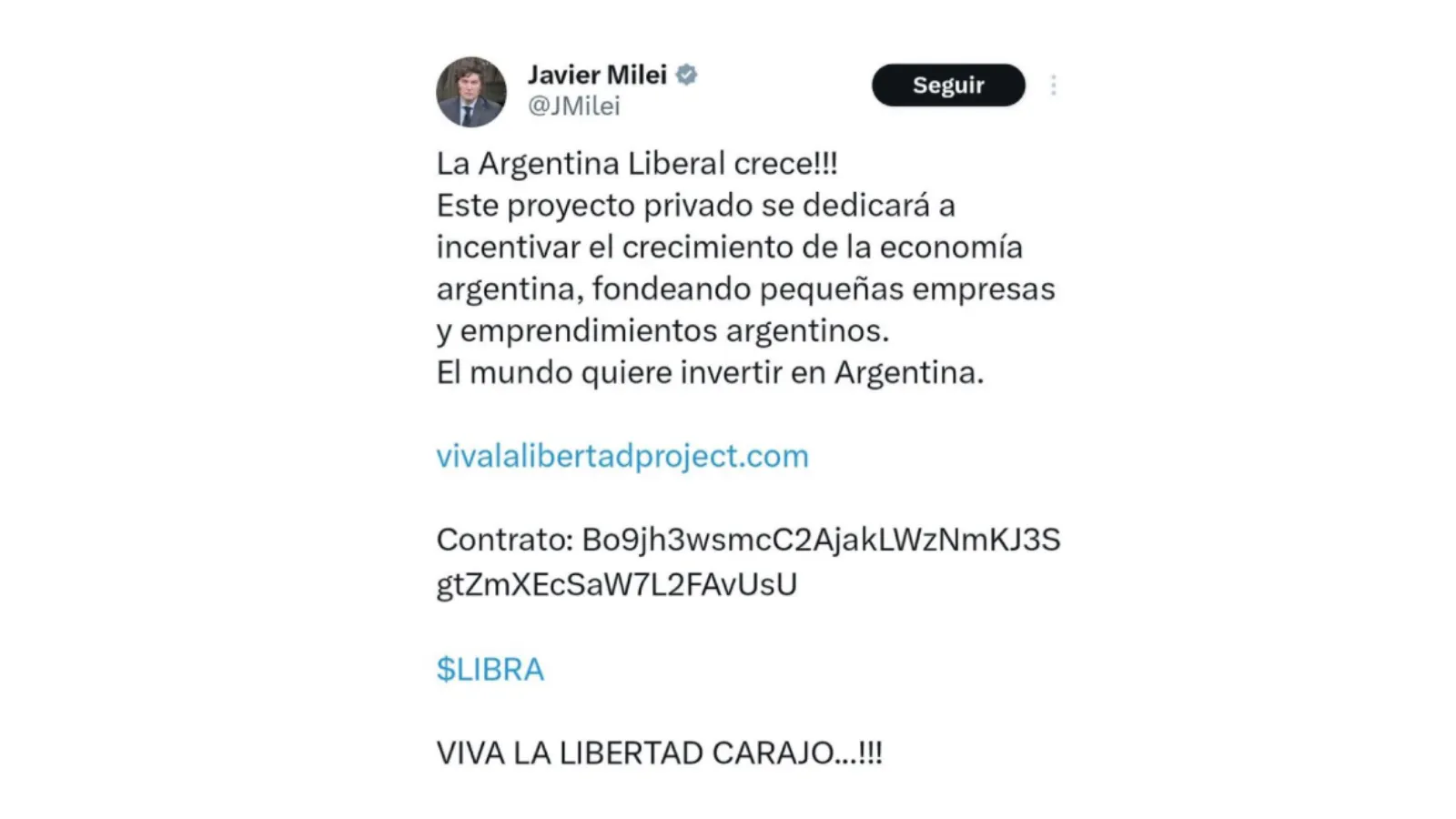

LIBRA gained widespread consideration after Argentine President Javier Milei's now-deleted tweet about it. Initially described as a software to fund small companies in Argentina, it was subsequently tagged as "just a meme coin" by Hayden Davis, who claimed to be its "launch strategist."

Days later, fraud costs had been leveled towards Milei, as Argentina's inventory market dipped following LIBRA's collapse. On-chain proof later revealed hyperlinks between the LIBRA token and the issuers of U.S. First Woman Melania Trump’s MELANIA meme coin.

Because the controversy unfolded, Solana skilled liquidity outflows and dropped 8.8%, going through "repercussions" regardless of, as Nansen’s analysis identified, it not being a direct participant within the launch.

The unfavourable notion following LIBRA's collapse is "particularly damaging" because the business "seeks mainstream adoption and legitimacy" from retail pockets and institutional vaults, a lot in order that it "pushes against all the hardworking builders" within the crypto area, Arora opined.

Early Thursday, Milei arrived in Washington to fulfill with IMF chief Kristalina Georgieva in a bid to seal a $44 billion deal that might assist increase Argentina's financial system.