Margin buying and selling is a technique that permits merchants to amplify their publicity out there by borrowing funds to extend the dimensions of their place. In easy phrases, it enables you to commerce with more cash than you even have, multiplying each your potential income and your dangers.

This type of buying and selling is a double-edged sword. On one facet, it unlocks the power to seize outsized beneficial properties from small worth actions. Alternatively, it might shortly wipe out your capital if you happen to misjudge the market. That’s why margin buying and selling is commonly seen as a check of talent—it rewards these with a robust directional view, technical self-discipline, and sharp danger administration.

The panorama for margin buying and selling in crypto can be shifting. Regulatory strain that after restricted entry to leveraged buying and selling in a number of areas is now easing, opening the door for extra platforms to supply margin options globally. Whether or not you’re an skilled dealer in search of decrease charges or simply beginning to discover leverage, you now have extra decisions than ever.

On this article, we’ll break down what margin buying and selling is, the way it works, key ideas to grasp, and the chance administration methods each dealer ought to know. We’ll additionally evaluate among the prime crypto margin buying and selling platform in 2025.

What Is Margin Buying and selling?

Think about Alice hears a few shopping center being inbuilt her neighborhood. She predicts it will usher in individuals, enhance foot visitors, and most significantly, push up the encompassing land values. She needs in. So, she units her sights on shopping for a main piece of land throughout the road to construct a restaurant.

However the challenge prices $10 million, and she or he solely has $5 million.

She approaches a financial institution, which agrees to lend her the remaining $5 million to fund the entire challenge. In return, Alice should pay curiosity and use her $5 million as collateral. With this association, she now controls a $10 million asset utilizing simply half the capital—she’s utilizing leverage.

However issues go south. The mall's development will get delayed, and its future begins wanting unsure. As investor pleasure fizzles, property values drop. Alice’s restaurant challenge is now solely price $6 million. The financial institution panics—it needs to guard its $5 million mortgage. They name Alice and demand that she both add extra funds to cowl the falling worth or they’ll seize the challenge totally. This can be a margin name.

If Alice fails to deposit more cash, the financial institution liquidates the asset, taking full management to get better its mortgage. Alice loses her $5 million, all as a result of the market moved in opposition to her. Had she used solely her personal funds, she’d nonetheless maintain the property at a 40–50% paper loss. However with leverage, that loss turns into absolute.

Let’s break this down in crypto buying and selling phrases:

Key Ideas in Margin Buying and selling (Defined By Alice’s Analogy)

- Directional View of the Market: Alice believes the mall will increase property values—that is her wager that the market will transfer in a positive course. Equally, margin merchants will need to have a robust directional view on crypto costs.

- Collateral: Alice makes use of her $5 million because the down fee. That is the capital you stake in buying and selling to open a leveraged place.

- Margin: Alice's remaining $5 million is the margin mortgage. In buying and selling, this borrowed quantity boosts your shopping for energy.

- Leverage: Alice now controls a $10 million challenge with $5 million of her personal cash—a 2x leverage. Relying on the alternate, merchants use leverage to multiply their publicity, e.g., 5x or 10x.

- Curiosity: Alice should pay the financial institution curiosity on the borrowed $5 million. Merchants on margin pay borrowing charges to the alternate or liquidity supplier.

- Margin Name: When the property drops in worth, the financial institution fears its mortgage is dangerous and calls for extra funds from Alice. Likewise, in case your crypto place nears liquidation, the alternate points a margin name requiring you to prime up your collateral.

- Liquidation: If Alice can’t give you more cash, the financial institution seizes the challenge to get better its mortgage. The alternate mechanically closes your place in crypto buying and selling when losses exceed your margin buffer.

On this analogy:

- The financial institution = the crypto alternate

- The land/restaurant challenge = your crypto place

If you happen to'd like a deep-dive, take a look at our article on the ins and outs of margin buying and selling.

Widespread Misunderstandings About Margin Buying and selling

1. Margin Buying and selling ≠ Derivatives Buying and selling

Many new merchants assume that every one leveraged buying and selling occurs in derivatives (like perpetuals or futures). However margin buying and selling normally happens within the spot market—you’re nonetheless shopping for and promoting precise property, simply with borrowed funds. Derivatives, then again, are contracts primarily based on the asset's worth and comply with a special liquidation and funding logic.

2. You Commerce With Your Collateral

In conventional finance, when you publish collateral for a mortgage, you may’t contact it—it simply sits locked till you repay the debt. However in crypto margin buying and selling, your collateral is lively. It’s added to the borrowed quantity to find out the complete worth of your place. For instance, a dealer placing up $1,000 and borrowing one other $1,000 has a $2,000 place. Income and losses are calculated on the complete $2,000, not simply the $1,000 you set in.

Why Margin Buying and selling is Standard

Margin buying and selling appeals to a variety of merchants for one easy cause: it boosts potential returns with out requiring further capital. If an asset rises 10%, a spot dealer who purchased with their very own cash earns a ten% return. Nonetheless, a margin dealer utilizing 2x leverage earns 20%—twice the upside with the identical preliminary funding.

That magnifying impact is the core draw of margin buying and selling. For merchants with robust conviction and timing, it permits them to capitalize extra effectively on market strikes. However with that amplification comes danger, and volatility is the important thing variable that makes or breaks leveraged positions.

Buyers who purchase property outright can afford to sit down by means of market swings as a result of they personal the asset. However margin merchants don’t technically personal what they’re buying and selling—at the least not till the borrowed quantity is paid again. If the market crashes and the place loses 50% of its worth below 2x leverage, it’s sport over. The alternate will liquidate the place, taking the complete quantity to cowl the mortgage. That’s why a exact directional view of the market is non-negotiable in margin buying and selling—it’s the muse of each commerce.

One more reason margin buying and selling is fashionable is its simplicity in comparison with different leveraged methods. Whereas futures and choices additionally provide leverage, they’re extra advanced and sometimes too superior for newbie merchants. Margin buying and selling, against this, is extra intuitive—you’re simply borrowing capital to purchase extra of an asset. Merchants can begin with conservative leverage like 1.1x or 1.5x to construct confidence earlier than going larger.

It’s this mix of amplified returns, accessibility, and comparatively simple mechanics that makes margin buying and selling a popular instrument within the crypto dealer’s arsenal.

Predominant Standards for Selecting a Margin Buying and selling Change

Not all margin buying and selling platforms are created equal. Whereas the core mechanics could also be comparable—borrowed funds, leveraged publicity, danger of liquidation—every alternate brings its personal mix of options, restrictions, and prices.

Listed below are the principle elements to guage earlier than choosing the right alternate to your margin buying and selling wants:

Regional Availability

Earlier than anything, guarantee margin buying and selling is legally obtainable in your nation—and supported by the alternate to your area. Some platforms, like Kraken and Coinbase, prohibit margin entry in particular jurisdictions as a result of regulatory constraints. Others, like Binance and KuCoin, provide margin companies globally however could restrict options relying on the place you’re primarily based.

Buying and selling Charges

Margin buying and selling includes two sorts of prices: buying and selling charges and borrowing curiosity. Buying and selling charges (maker/taker) apply to each executed order, and even small share variations add up over time. Exchanges like Binance and KuCoin provide extremely aggressive charges, particularly for customers holding their native tokens (BNB, KCS). Alternatively, Kraken costs barely larger base charges, which can have an effect on frequent merchants.

Supported Cryptocurrencies

The extra buying and selling pairs you may entry with margin, the extra versatile your technique will be. Exchanges like KuCoin and OKX help a whole lot of margin-enabled tokens, together with lesser-known altcoins. Platforms like Kraken and Coinbase are typically extra conservative, providing fewer however extra vetted pairs. Make certain your most popular property are literally obtainable for leveraged buying and selling on the platform.

Leverage Limits

Leverage caps differ considerably. Whereas OKX and KuCoin help as much as 10x on spot margin for some pairs, Kraken is capped at 5x and Coinbase doesn’t at the moment help margin buying and selling for people in any respect. Excessive leverage can maximize beneficial properties, nevertheless it additionally will increase liquidation danger—so select a platform that aligns along with your danger urge for food and buying and selling type.

Prime Margin Buying and selling Exchanges

We'll checklist our picks for the perfect centralized exchanges for margin buying and selling. Here’s a desk summarizing our findings:

| Change | Leverage (Spot) | Maker Payment | Taker Payment | Curiosity Charges | Margin-Tradable Cryptos | Funding Choices | Notes |

|---|---|---|---|---|---|---|---|

| Binance | As much as 10x (remoted), as much as 3x (cross) | 0.012% | 0.030% | Varies by cryptocurrency; < 5% yearly | 450+ | Change pockets | Reductions obtainable for top buying and selling volumes and BNB holders. |

| Kraken | As much as 5x | 0.16% | 0.26% | Dynamic charges primarily based on asset and period | 100+ | Change pockets | Charges will be diminished by means of larger buying and selling volumes. |

| KuCoin | As much as 10x (spot), as much as 125x (futures) | 0.02% | 0.06% | Not specified | 700+ | Property alternate, direct deposit | Reductions obtainable for KCS holders and high-volume merchants. |

| OKX | As much as 10x | 0.08% | 0.10% | Not specified | 400+ | Change pockets | Payment reductions for OKB holders and high-volume merchants. |

| Bybit | As much as 5x (spot) | < 0.1% | < 1.0% | 1.62%–8.70% yearly | 100+ | Base property, crypto funds | Gives leveraged tokens and a demo account for follow. |

Please observe that charges and rates of interest are topic to vary and should differ primarily based on elements similar to buying and selling quantity, account tier, and promotions. For essentially the most correct and up-to-date data, discuss with the official charge schedules and phrases of service on every alternate's web site.

Binance

Binance, based in 2017 by Changpeng Zhao, has quickly ascended to change into the world's largest cryptocurrency alternate by buying and selling quantity. Famend for its intensive vary of supported cryptocurrencies, aggressive charge construction, and international attain, Binance caters to novice and skilled merchants. The platform affords a set of buying and selling choices, together with spot, futures, and margin buying and selling, complemented by superior instruments and sturdy safety measures.

Margin Buying and selling Particulars

- Margin-Tradable Listings: Binance boasts an expansive choice of over 600 margin buying and selling pairs, offering merchants with various property to interact.

- Leverage Choices: Merchants can entry leverage of as much as 10x on choose spot pairs by means of Binance's margin buying and selling platform. The platform affords each cross and remoted margin modes, permitting for flexibility in danger administration methods.

- Curiosity Charge Calculation: Binance employs a tiered rate of interest system for margin borrowing. Rates of interest are calculated primarily based on the quantity borrowed and the mortgage period, with charges various throughout totally different cryptocurrencies. Detailed and up-to-date rates of interest for every asset will be discovered on Binance's official charge schedule.

- Buying and selling Charges: Margin buying and selling on Binance incurs customary buying and selling charges following a maker-taker mannequin. The bottom charge is 0.1% for each makers and takers. Customers can profit from reductions by holding Binance Coin (BNB) of their accounts or by attaining larger buying and selling volumes, which can qualify them for VIP tiers with diminished charges.

- Margin Buying and selling Options: Cross and Remoted Margin Help: Binance affords cross margin and remoted margin accounts. Cross margin permits merchants to share their obtainable steadiness throughout all trades inside the account, offering a security internet the place different property can cowl potential losses.

In distinction, remoted margin allows merchants to allocate a particular margin to every place, that means losses are confined to the funds allotted to that commerce, providing extra management and minimizing danger on a per-trade foundation. - Superior Buying and selling Instruments: The platform offers a complete suite of buying and selling instruments, together with real-time charts, technical evaluation indicators, and varied order sorts, catering to the wants of each novice and seasoned merchants.

- Danger Administration Options: Binance incorporates danger administration mechanisms similar to margin degree monitoring, margin calls, and liquidation protocols to assist merchants handle and mitigate potential losses.

Professionals:

- In depth Asset Choice: With over 600 margin buying and selling pairs, Binance affords one of the various picks out there.

- Aggressive Charges: The platform's charge construction is favorable, particularly for high-volume merchants and people using BNB for charge funds.

- Superior Options: Binance offers sturdy buying and selling instruments and danger administration options, enhancing the buying and selling expertise.

Cons:

- Regulatory Restrictions: Binance faces regulatory challenges in sure jurisdictions, which can restrict entry to a few of its companies.

- Complexity for Learners: The big range of options and instruments will be overwhelming for brand new merchants, necessitating a studying curve to navigate the platform successfully.

KuCoin

KuCoin, established in 2017, has quickly grown right into a outstanding cryptocurrency alternate, acknowledged for its intensive vary of supported cryptocurrencies and progressive buying and selling options. Catering to a worldwide consumer base, KuCoin affords varied companies, together with spot buying and selling, futures, staking, and margin buying and selling. Its dedication to offering a flexible buying and selling surroundings has made it a most popular platform for knowledgeable merchants.

Margin Buying and selling Particulars

- Margin-Tradable Listings: KuCoin helps many margin-tradable pairs, permitting customers to interact with quite a few cryptocurrencies past the standard choices. This intensive choice allows merchants to diversify their methods and discover alternatives throughout varied digital property.

- Leverage Choices: KuCoin affords two main margin modes:

- Cross Margin: Gives as much as 5x leverage, that means merchants can borrow as much as 4 instances their principal funding. On this mode, all property within the margin account are used as collateral, sharing the chance throughout all positions.

- Remoted Margin: Gives as much as 10x leverage, although the utmost varies by buying and selling pair. Every buying and selling pair has its remoted margin account, with dangers confined to that place. This mode permits for extra exact danger administration on a per-trade foundation.

- Curiosity Charge Calculation: Rates of interest on borrowed funds are calculated primarily based on the quantity borrowed and the mortgage period. KuCoin employs a dynamic rate of interest mannequin, which can differ relying on market circumstances and the particular cryptocurrency borrowed. Merchants are suggested to assessment the present rates of interest instantly on the KuCoin platform earlier than initiating margin trades.

- Buying and selling Charges: KuCoin makes use of a tiered maker-taker charge construction, with customary charges beginning at 0.1% for each makers and takers. Customers can profit from reductions by holding KuCoin Shares (KCS), the platform's native token, or by attaining larger buying and selling volumes, which can qualify them for diminished charges.

- Margin Buying and selling Options

- Cross and Remoted Margin Help: KuCoin offers cross and remoted margin choices, permitting merchants to decide on their most popular danger administration technique. Cross margin shares the collateral throughout a number of positions, whereas remoted margin confines the collateral to particular person trades.

- Auto-Borrow and Auto-Repay Features: KuCoin affords auto-borrow and auto-repay options to streamline the buying and selling course of. When enabled, these capabilities mechanically borrow the required funds when putting an order and repay the liabilities upon order execution, lowering handbook intervention and enhancing buying and selling effectivity.

- Superior Buying and selling Instruments: The platform offers a complete suite of instruments, together with real-time charts, technical evaluation indicators, and varied order sorts (e.g., restrict, market, stop-limit), catering to the wants of each novice and seasoned merchants.

Professionals:

- In depth Asset Choice: KuCoin's broad vary of margin-tradable pairs affords merchants various alternatives throughout the cryptocurrency market.

- Versatile Leverage Choices: With as much as 10x leverage obtainable, merchants can tailor their methods to align with their danger tolerance and market outlook.

- Revolutionary Options: Features like auto-borrow and auto-repay improve the buying and selling expertise by automating routine processes

Cons:

- Restricted fiat on-ramp: The alternate doesn’t provide intensive fiat deposit choices; customers should deposit crypto if no regional on-ramp choices can be found.

- Unregulated Change: KuCoin is unregulated, which is perhaps a deal-breaker for merchants preferring the safety assurances of licensed exchanges.

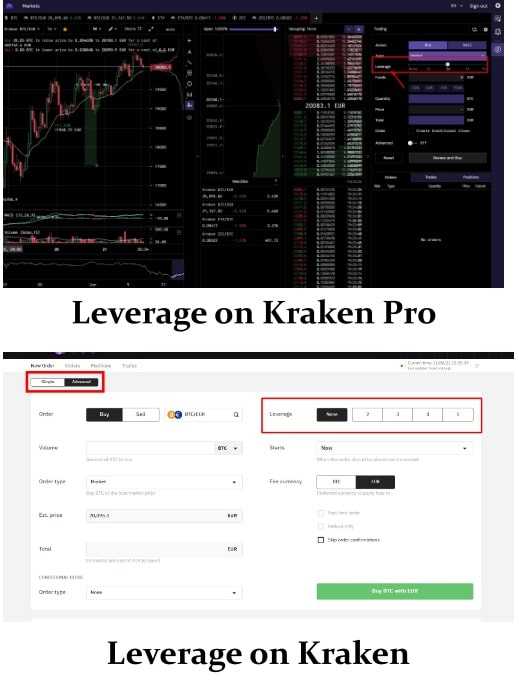

Kraken

Kraken, based in 2011, is a well-established cryptocurrency alternate acknowledged for its robust safety measures, regulatory compliance, and complete buying and selling companies. Amongst its choices, Kraken offers a sturdy margin buying and selling platform that allows customers to amplify their buying and selling positions by means of leverage.

Margin Buying and selling Particulars

- Margin-Tradable Listings: Kraken affords over 100 margin-enabled markets, permitting customers to interact in crypto-to-crypto and fiat-to-crypto buying and selling pairs. This intensive choice permits merchants to implement various buying and selling methods throughout varied asset courses.

- Leverage Choices: Kraken offers leverage starting from 2x to 5x relying on the buying and selling pair. Which means merchants can open positions as much as 5 instances their collateral's worth, enabling lengthy and brief positions to capitalize on market actions.

- Curiosity Charge Calculation: Kraken employs a dynamic rate of interest mannequin for margin buying and selling, the place charges are influenced by the borrowed asset, mortgage period, and prevailing market circumstances. Curiosity is accrued hourly, permitting merchants to handle their positions and related prices.

- Buying and selling Charges: The platform makes use of a maker-taker charge construction, with customary charges beginning at 0.16% for makers and 0.26% for takers. These charges will be diminished by means of larger buying and selling volumes or by partaking in particular buying and selling actions, providing incentives for lively merchants.

- Margin Buying and selling Options

- Superior Buying and selling Interface: Kraken affords a professional-grade buying and selling interface geared up with real-time charts, complete technical evaluation instruments, and varied order sorts, catering to the wants of each novice and skilled merchants.

- Danger Administration Instruments: The platform incorporates important danger administration options, together with margin name alerts and automatic liquidation processes, to assist merchants mitigate potential losses and handle leveraged positions successfully.

Professionals:

- Regulatory Compliance: Kraken operates below stringent regulatory frameworks, offering a safe and compliant surroundings for margin buying and selling.

- Sturdy Safety Measures: The alternate is famend for its industry-leading safety protocols, safeguarding consumer funds and private data.

Cons:

- Restricted Leverage In comparison with Some Opponents: With a most leverage of 5x, Kraken's choices could also be much less interesting to merchants searching for larger leverage choices obtainable on different platforms.

- Geographical Restrictions: Sure margin buying and selling options could also be unavailable in particular jurisdictions as a result of regulatory constraints, doubtlessly limiting entry for some customers.

For essentially the most present data on Kraken's margin buying and selling choices, together with supported pairs, leverage choices, and charges, it’s advisable to seek the advice of Kraken's official assets or contact their help workforce instantly.

OKX

OKX, established in 2017, has quickly advanced into a number one cryptocurrency alternate, famend for its complete suite of buying and selling companies and progressive options. OKX affords a various array of economic devices serving a worldwide clientele, together with spot buying and selling, futures, choices, and notably, margin buying and selling. The platform's dedication to offering superior buying and selling instruments and a wide array of cryptocurrencies has made it a most popular selection amongst each retail and institutional merchants.

Margin Buying and selling Particulars

- Margin-Tradable Listings: OKX helps an in depth vary of margin-tradable pairs, encompassing quite a few cryptocurrencies. This broad choice allows merchants to diversify their portfolios and implement varied buying and selling methods throughout a number of digital property.

- Leverage Choices: Merchants on OKX can entry leverage starting from 1x as much as 10x, relying on the particular buying and selling pair. This flexibility permits customers to amplify their positions in line with danger tolerance and market outlook.

- Curiosity Charge Calculation: OKX employs a dynamic rate of interest mannequin for margin buying and selling, the place charges are influenced by the borrowed asset, mortgage period, and prevailing market circumstances. Curiosity is accrued hourly, permitting merchants to handle their positions and related prices.

- Buying and selling Charges: The platform makes use of a maker-taker charge construction, with charges various primarily based on the consumer's buying and selling quantity and whether or not they add liquidity (maker) or take away liquidity (taker) from the market. Detailed data on the present charge schedule will be discovered on OKX's official web site.

- Margin Buying and selling Options:

- Cross and Remoted Margin Modes: OKX affords cross margin and remoted margin choices. Cross margin permits merchants to share their obtainable steadiness throughout all positions, offering a security internet the place different property can cowl potential losses. In distinction, remoted margin allows merchants to allocate a particular margin to every place, that means losses are confined to the funds allotted to that commerce, providing extra exact danger administration.

- Portfolio Margin Mode: OKX offers a portfolio margin mode for superior merchants that permits for cross-asset margining. This function allows offsetting income and losses throughout totally different positions, doubtlessly lowering general margin necessities and enhancing capital effectivity.

- Fast Margin Mode: OKX introduces a Fast Margin mode designed to simplify the margin buying and selling course of. This function automates borrowing and compensation, streamlining the buying and selling expertise and lowering the handbook steps in managing leveraged positions.

Professionals:

- In depth Asset Choice: With a big selection of margin-tradable pairs, OKX affords merchants various alternatives throughout the cryptocurrency market.

- Versatile Leverage Choices: Providing leverage as much as 10x, OKX caters to numerous buying and selling methods and danger appetites.

- Superior Buying and selling Options: Revolutionary instruments like Portfolio Margin and Fast Margin modes improve the buying and selling expertise and supply subtle danger administration choices.

Cons:

- Regulatory Uncertainty: OKX operates in a quickly evolving regulatory surroundings, and its companies could also be topic to modifications primarily based on jurisdictional rules. Merchants ought to keep knowledgeable concerning the authorized standing of margin buying and selling of their respective areas.

- Complexity of Superior Options: Whereas providing highly effective instruments, the superior options (like portfolio margin mode) could require a studying curve for merchants unfamiliar with subtle margin methods.

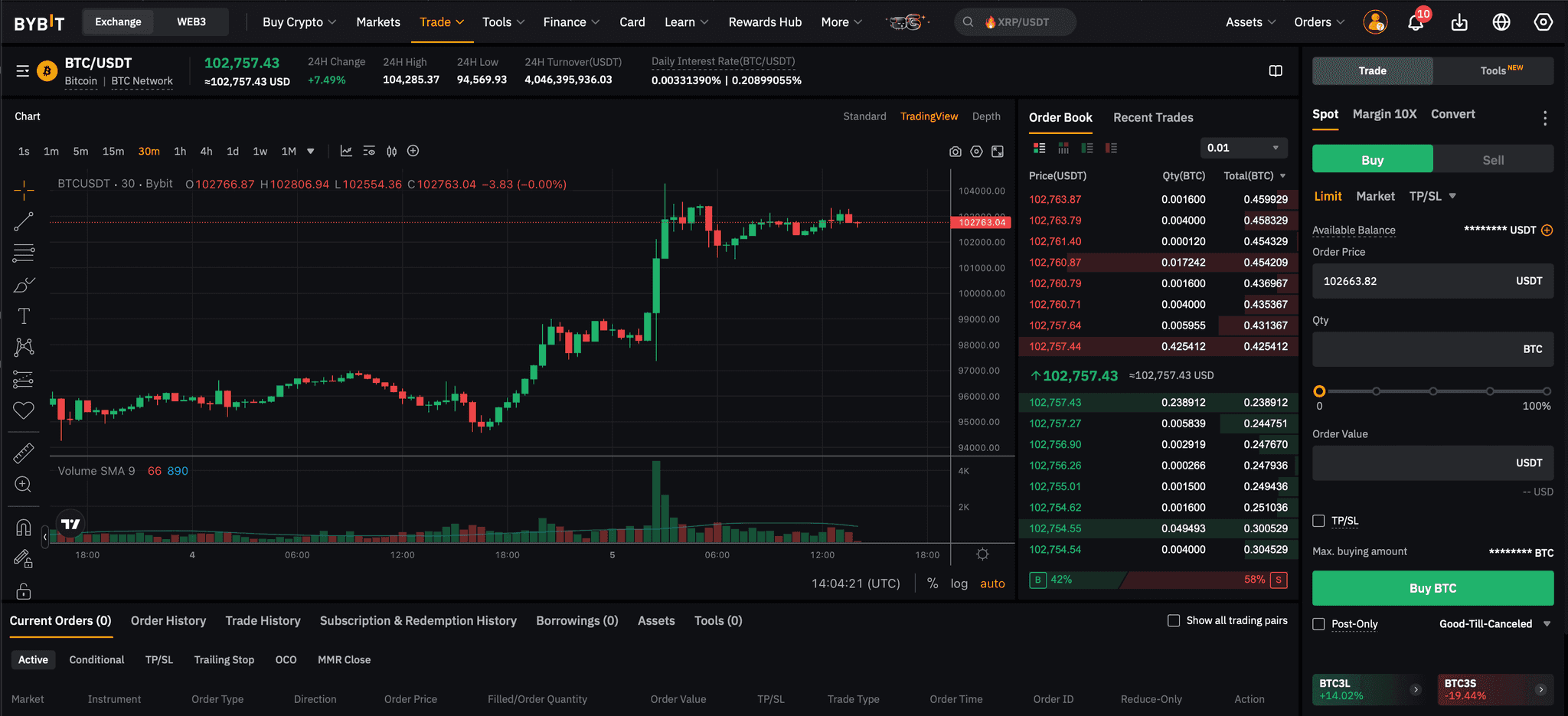

ByBit

Bybit, established in 2018, has quickly gained prominence within the cryptocurrency alternate panorama, notably for its derivatives buying and selling companies. The platform is acknowledged for its user-friendly interface, sturdy safety measures, and superior buying and selling options tailor-made for all merchants. Along with derivatives, Bybit affords spot and spot margin buying and selling, enabling customers to leverage their positions within the cryptocurrency market.

Margin Buying and selling Particulars

- Margin-Tradable Listings: Bybit helps quite a lot of margin-tradable pairs, together with main cryptocurrencies like BTC/USDT and ETH/USDT. This choice permits merchants to interact in leveraged buying and selling throughout among the most liquid and widely known digital property.

- Leverage Choices: Bybit affords leverage of as much as 10x for spot margin buying and selling. This implies merchants can amplify their positions by borrowing funds, permitting for doubtlessly larger returns on funding. It's necessary to notice that whereas leverage can enhance potential income, it additionally magnifies potential losses.

- Curiosity Charge Calculation: Curiosity on borrowed funds is calculated hourly. The charges are dynamic and depend upon market circumstances, the particular asset borrowed, and the mortgage period. Merchants can view the present rates of interest instantly on the Bybit platform earlier than initiating a margin commerce.

- Buying and selling Charges: Bybit employs a maker-taker charge mannequin for spot margin buying and selling. The usual charge is 0.1% for each makers and takers. Customers can profit from charge reductions by holding Bybit's native token or by attaining larger buying and selling volumes, which can qualify them for VIP tiers with diminished charges.

- Margin Buying and selling Options

- Margin Modes: Bybit's Unified Buying and selling Account helps three margin modes: Remoted Margin (IM), Cross Margin (CM), and Portfolio Margin (PM). By default, the account is about to Cross Margin, however customers can choose the margin mode that most closely fits their buying and selling technique.

- Danger Administration Instruments: The platform affords stop-loss orders, configurable leverage settings, and trailing cease orders to assist merchants handle danger successfully. These instruments allow merchants to outline danger tolerance ranges and shield their capital whereas pursuing revenue alternatives.

- Superior Buying and selling Interface: Bybit offers a professional-grade buying and selling interface geared up with real-time charts, complete technical evaluation instruments, and varied order sorts, catering to the wants of each novice and skilled merchants.

Professionals:

- Person-Pleasant Interface: Bybit's platform is designed for ease of use, making it accessible for merchants in any respect expertise ranges.

- Superior Danger Administration Instruments: Options like stop-loss orders and trailing stops help merchants in managing their publicity successfully.

- Sturdy Safety Measures: Bybit employs industry-leading safety protocols to safeguard consumer funds and private data.

Cons:

- Regulatory Issues: Bybit operates in a fancy regulatory surroundings, and customers ought to know the authorized implications of margin buying and selling of their respective jurisdictions.

- Restricted Fiat On-Ramp Choices: The platform affords restricted choices for direct fiat foreign money deposits, which can require customers to make the most of third-party companies to fund their accounts.

For essentially the most present data on Bybit's margin buying and selling choices, together with supported pairs, leverage choices, charges, and regional availability, it’s advisable to seek the advice of Bybit's official assets or contact their help workforce instantly.

Danger Administration For Margin Buying and selling

Margin buying and selling will be worthwhile, nevertheless it's not forgiving. The very instrument that amplifies your income—leverage—can even erase your capital if used recklessly. Good danger administration separates sustainable merchants from those that get worn out. Listed below are just a few essential rules to bear in mind:

1. Don’t Over-Leverage

Simply because an alternate affords 10x leverage doesn’t imply you need to use all of it. Greater leverage means thinner margins for error—smaller market strikes can set off liquidations. Many skilled merchants keep on with low leverage (1.5x–3x) to protect flexibility and keep away from being compelled out of positions throughout routine market swings.

2. Use Margin Accounts Successfully

Understanding cross vs remoted margin is important.

- In cross margin, all of your obtainable property within the margin account are pooled collectively. Positive factors in a single place can offset losses in one other—however the reverse can be true. If one place tanks, your whole account will be in danger.

- In remoted margin, solely the funds assigned to a specific commerce are in danger. It’s safer for managing high-volatility trades, because it limits harm to a single place.

Realizing when to make use of which may dramatically scale back portfolio-wide danger.

3. Monitor Your Collateral Property

Your margin account’s well being relies upon not simply on the place but additionally on the worth of your collateral. If you happen to’re utilizing unstable property as collateral, sharp worth drops can shrink your buffer and set off surprising margin calls. Many merchants choose depositing stablecoins like USDT or USDC as margin to maintain issues steady—eradicating another variable from the equation.

4. Use Cease Loss and Take Revenue Orders

Protecting orders are your first line of protection. A cease loss prevents devastating drawdowns by mechanically exiting a commerce if the worth hits a sure degree. A take revenue locks in beneficial properties when your goal is met. Utilizing each removes emotion from the equation and ensures you're not counting on display screen time to make quick choices.

5. Be Cautious with In a single day Actions

Crypto markets don’t sleep. Massive strikes typically occur throughout in a single day hours if you’re not watching the charts. If you happen to're holding a leveraged place whilst you’re offline or asleep, use protecting orders or preserve a good danger profile. With out lively monitoring, even just a few hours of inactivity can result in surprising liquidations.

For extra insights into danger administration, take into account studying our Margin Buying and selling Information.

Superior Methods for Margin Merchants

When you’ve mastered the fundamentals of margin buying and selling, the subsequent step is knowing methods to use leverage as a part of a broader technique. Superior merchants transcend easy lengthy/brief setups to include hedging, portfolio balancing, and sensible capital allocation.

Listed below are some methods to degree up your margin buying and selling sport:

1. Utilizing Derivatives to Construct a Delta-Impartial Portfolio

A delta-neutral technique includes balancing lengthy and brief positions in order that your portfolio's internet publicity to cost actions is minimized. As an illustration, if you happen to’re lengthy a margin place in ETH, you may hedge that publicity by opening a brief ETH perpetual futures contract. This manner, you may preserve publicity to funding charges or volatility whereas minimizing directional danger. Merchants use this to earn yield from foundation spreads or funding charge arbitrage with out betting on worth course.

2. Portfolio Margin Mode

Some exchanges (like OKX and Bybit) provide portfolio margin mode, which assesses your margin necessities primarily based on the complete portfolio’s internet danger moderately than particular person positions. This permits for extra capital-efficient buying and selling by recognizing pure hedges. For instance, if you happen to’re lengthy BTC and brief BTC choices, the system understands the chance is decrease than if every place had been standalone, and reduces margin necessities accordingly. It’s a strong instrument, nevertheless it requires a strong grasp of place correlation and volatility.

3. Cross-Market Arbitrage

In unstable markets, worth discrepancies between exchanges or buying and selling pairs can come up. Margin accounts assist you to deploy borrowed funds shortly to take advantage of these gaps. For instance, if BTC trades at $30,200 on one alternate and $30,000 on one other, you may brief on the higher-priced alternate whereas shopping for on the decrease, netting the distinction as soon as the costs converge. Velocity, low charges, and adequate capital are key right here.

4. Margin Scalping with Tight Danger Controls

Scalping on margin includes putting frequent, small trades that capitalize on micro-movements. When accomplished with excessive leverage and strict stop-loss guidelines, it might amplify returns—however requires near-perfect execution and self-discipline. This technique is greatest reserved for extremely liquid pairs with tight spreads and minimal slippage.

5. Utilizing Stablecoins for Steady Leverage

Superior merchants typically construction their accounts utilizing stablecoins as collateral, which helps them preserve leverage with out introducing additional volatility. That is particularly helpful in multi-asset methods the place the place worth fluctuates however the collateral doesn’t. It simplifies liquidation calculations and margin administration.

These methods demand a deeper understanding of market mechanics and danger publicity. Whereas they provide higher capital effectivity and hedging potential, additionally they enhance operational complexity—so don’t use them except you’re assured in your danger administration and place sizing. Coin Bureau's Information on Professional Buying and selling Methods will assist you brainstorm totally different margin buying and selling methods.

Last Ideas

Margin buying and selling could be a highly effective instrument for a disciplined dealer. It permits you to amplify beneficial properties, unlock capital effectivity, and discover extra subtle methods—nevertheless it additionally introduces critical danger if used carelessly.

This text mentioned how margin buying and selling works, what ideas that you must perceive earlier than getting began, and why it stays fashionable amongst crypto merchants. We additionally in contrast prime exchanges like Binance, Kraken, KuCoin, OKX, and Coinbase primarily based on actual margin options—leverage limits, charges, asset help, and regional availability. Lastly, we coated key danger administration ways and superior methods like delta-neutral hedging and portfolio margining that skilled merchants use to remain forward.

If you happen to’re contemplating margin buying and selling, perceive the mechanics, decide an alternate that fits your wants, and by no means cease refining your danger technique. Margin buying and selling magnifies not simply income—however each resolution you make.

Steadily Requested Questions

How Do Margin Necessities Differ Amongst Decentralized (DeFi) And Centralized Exchanges?

Margin necessities on centralized exchanges (CEXs) are usually extra standardized and tiered primarily based on the asset, leverage used, and account sort. These platforms additionally implement liquidation protocols and provide remoted/cross margin modes with real-time margin monitoring.

On decentralized exchanges (DeFi), margin necessities are coded into sensible contracts. They typically depend on overcollateralization (particularly in lending protocols) and will be stricter as a result of lack of centralized danger oversight. Liquidations on DeFi platforms could typically be extra sudden as a result of automated triggers and fewer predictable oracle feeds.

Is There A Beneficial Ratio Of Spot To Margin Buying and selling In A Balanced Crypto Portfolio?

There’s no mounted ratio, however most risk-conscious merchants allocate lower than 20% of their capital to margin positions at any given time. The remaining stays in spot holdings or steady property to protect flexibility and act as emergency collateral. A balanced strategy would possibly appear like 80/20 or 70/30 (spot/margin), relying in your danger tolerance and technique.

Can I Use Margin Buying and selling To Hedge Current Positions Throughout A number of Exchanges?

Sure. Many merchants use margin accounts to hedge publicity on different platforms. For instance, if you happen to maintain an extended spot place on Change A, you would open a brief margin place on Change B to offset draw back danger. This requires cautious place sizing, charge consciousness, and real-time monitoring to keep away from mismatches as a result of liquidity or unfold variations.

Are There Particular Stablecoins Higher Suited For Margin Positions And Why?

Sure—USDT and USDC are essentially the most broadly accepted stablecoins for margin buying and selling as a result of their deep liquidity and broad integration. USDC is mostly most popular for transparency and regulatory compliance, whereas USDT tends to be extra liquid throughout international exchanges. Each assist preserve steady collateral worth, lowering the chance of margin calls attributable to fluctuating collateral.

How Do Flash Crashes Have an effect on Margin Merchants And What Precautions Can Be Taken?

Flash crashes can set off speedy, compelled liquidations—particularly in cross-margin accounts the place a number of positions are affected. Precautions embody:

- Utilizing remoted margin to include danger

- Setting tight stop-loss orders

- Avoiding excessive leverage throughout unsure or illiquid intervals

- Monitoring slippage and order e book depth to keep away from being caught in illiquid worth zones

Does Margin Buying and selling All the time Contain Paying Curiosity, And How Do I Calculate These Charges?

Sure, margin buying and selling all the time includes curiosity on borrowed funds. The speed will depend on:

- The asset you borrow

- The period of the mortgage (normally charged hourly)

- The alternate’s base charge and your VIP degree

Calculation instance:

Borrow $5,000 USDT at 0.02% every day → Day by day curiosity = $1

What’s The Finest Manner To Analyze Order Ebook Depth Earlier than Opening A Important Leveraged Place?

Use the order e book heatmap and depth charts to evaluate liquidity at totally different worth ranges. Key metrics to verify:

- Bid-ask unfold

- Slippage estimates

- Quantity focus close to your entry/exit factors

You wish to keep away from markets with skinny books the place giant orders can transfer the worth considerably—particularly when utilizing leverage.

Do Referral Or VIP Applications Cut back Margin Charges Sufficient To Influence General Profitability?

Sure, they’ll. Excessive-volume merchants or VIP tier customers typically get:

- Decrease rates of interest

- Decreased maker/taker charges

- Higher liquidation thresholds

Referral packages generally provide charge rebates, which may enhance long-term profitability if you happen to’re buying and selling continuously or with dimension.

Which Technical Indicators Are Most Generally Used In Margin Buying and selling Methods?

Margin merchants typically depend on:

- RSI (Relative Power Index) for recognizing overbought/oversold circumstances

- EMA/SMA crossovers for momentum shifts

- MACD for pattern reversals

- Quantity profiles to verify commerce setups

- Bollinger Bands for volatility squeezes and breakouts

These instruments are sometimes mixed to filter false indicators and determine high-probability entries and exits.