Ever since Bitcoin, born from the ashes of the 2008 monetary disaster, was unveiled to the world, its position, together with that of different cryptocurrencies, has been about disrupting the normal monetary system, tracing again to feudal instances when monarchs dominated the world.

From time immemorial, those that have energy management the wealth distribution, and it has by no means been as apparent as now, when the hole between the haves and have-nots has widened tremendously. Nonetheless, with the beginning of Bitcoin and cryptocurrencies, there may be now one other try at a greater method of wealth distribution the place peculiar folks such as you and I can have a stab at getting a sliver of that pie. How this will probably be performed will probably be via Decentralised Finance.

On this article, we’ll take a look at what decentralised finance is, the dangers concerned, the sorts of actions that may be undertaken, and naturally, the highest DeFi tasks.

What’s Decentralized Finance?

Finance, as we all know it, is the realm the place numerous monetary consultants and professionals eagerly guard their area, oftentimes with nice ferocity. By deliberately preserving finance behind a wall of purple tape, restrictions, jargon and technicalities, it’s designed to incentivise peculiar folks to place belief of their experience and centralized methods. This has not all the time been to their shoppers' profit and loads of intermediaries, each corporations and people, have taken benefit of this case, typically to the acute, as seen with the subprime mortgage disaster that just about toppled Wall Avenue.

Decentralised Finance is just about the other. There are not any gatekeepers, so anybody with an web connection is free to take part. There’s nonetheless loads of jargon, however there are many of us, like us on the Coin Bureau, who intention to teach everybody on the fundamentals.

Most essential of all, there are only a few, if any, intermediaries concerned. Many of the heavy lifting is finished utilizing good contracts, that are a collection of laptop codes crafted with particular circumstances to be fulfilled routinely. Try our Newbie's Information to Sensible Contracts if you wish to be taught extra about this revolutionary know-how.

Not like borrowing with a financial institution, which requires leaping via numerous hoops within the hope of getting a mortgage, none of that’s mandatory when borrowing from a DeFi platform. So long as you’ve the mandatory collateral, you may get a mortgage. Nonetheless, there is no such thing as a grace interval in terms of getting liquidated. As soon as the worth of the collateral goes beneath the borrowed quantity, the collateral is liquidated nearly instantly, no questions requested because the code within the good contract is triggered based mostly on a predetermined set of coded directions.

How Secure is DeFi?

When crypto's potential first began popping its head up, it was cheap to count on that the identical playbook may very well be utilized to this new house. From Mt Gox as the primary Bitcoin change to a plethora of different centralised exchanges that got here up after, folks new to crypto and accustomed to the way in which issues work are extra inclined to belief these centralised finance (CeFi) entities. A few of that belief is warranted however others are misplaced as many people have came upon.

In the meantime, DeFi additionally has its share of unhealthy actors spoiling the pot for everybody. Hacks, rugpulls, scams are what occupy the forefront of individuals's minds. This offers these unfamiliar with the surroundings the impression that every little thing is bonkers in crypto, just like the minute you place one thing down, it's instantly swept away by a gust of scammy wind. Is that the target reality? I'd beg to vary. Everybody is aware of that unhealthy information is all the time extra eye-catching than excellent news. “If it bleeds, it leads” is one thing one would hear in maybe a barely disreputable newsroom. Who desires to listen to about issues working properly? It's what's not working properly that’s newsworthy. So it’s the similar with DeFi. It could be cheap to imagine that DeFi sustains essentially the most losses in comparison with CeFi given all of the airtime every time a hack occurs.

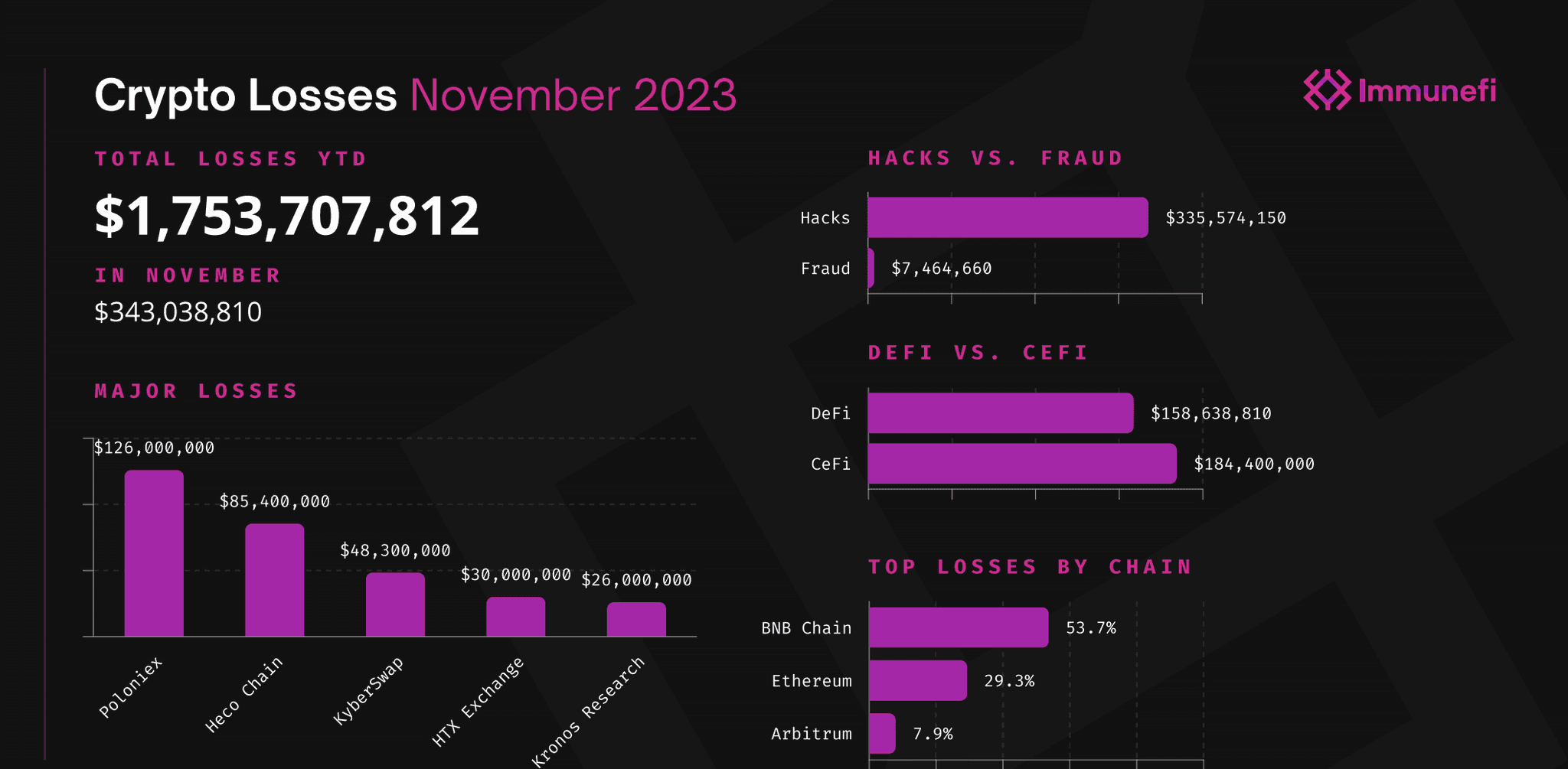

Nonetheless, the precise state of affairs paints a barely totally different image than what’s normally believed. ImmuneFi, a number one bug bounty and safety providers platform for web3 based mostly in Singapore, has given us some stats value protecting:

As startling because the numbers might seem, what’s notable is that of the overall losses in crypto in November 203, nearly all of it’s attributed to CeFi, not DeFi. Frauds additionally play a a lot smaller position than hacks.

What makes CeFi extra prone to hacks is its centralised nature. It's like having 5 folks stand guard over 100 acres of land vs 50 folks stand guard over the identical land dimension. The 5 folks might every be giants, every equal to twenty folks, however there are nonetheless solely 5. If any of them falls the chance of a breach is big. Within the latter situation, though the 50 folks individually will not be as robust as a single large, there are extra to combat towards and when one falls, the loss is minimal. It's simpler to focus sources on a number of factors of failure than to unfold out sources to assault over a bigger house.

The general numbers representing losses are definitely nothing to smell at. The silver lining although is that DeFi isn't as unhealthy because it has been portrayed as a result of it’s much less dangerous than CeFi.

Staying secure in DeFi is a subject we take significantly right here on the Bureau, so to be taught extra, be at liberty to take a look at the next sources:

- Crypto Security Information

- Ransomware and Cybercrime: Staying Secure in Crypto

- Coin Bureau x Hacken Safety: Battling Crypto Crime

What Can You Do in DeFi?

DeFi isn’t just about borrowing and lending cash on decentralised blockchain platforms. Taking a wider perspective, DeFi contains varied finance-related actions. There are exchanges the place one can swap one asset for an additional with out present process KYC or trusting a custodial middleman, purchase insurance coverage for the protocols that you just work together with to hedge towards the chance of failure, wager on predictions based mostly on the result of real-world occasions, or simply pure playing in on-line casinos.

The vast majority of DeFi exercise nonetheless revolves round lending, borrowing, yield farming, offering liquidity, and staking of tokens to earn yield. To that finish, quite a few platforms are providing a wide range of methods, together with automated yield farming ones, to assist customers get essentially the most out of their funds.

Finest DeFi Tasks

At a look, here’s a take a look at among the main DeFi platforms, their supported chains, TVL and class:

| Protocol | Supported Chains | TVL ($) | Class |

| Aave | 10 | 7.434b | Lending |

| Nexus Mutual | 1 | 225.65m | Insurance coverage |

| Yearn Finance | 5 | 308.04m | Staking |

| Stargate Finance | 13 | 307.71m | Lending, staking |

| Venus Finance | 1 | 979.81m | Lending |

| Pinksale | 6 | 224.83m | Launchpad |

| Beefy Finance | 25 | 185.15m | Yield Farming |

| Tangible | 5 | 43.83m | RWA |

| PolyMarket | 1 | 8.84m | Prediction |

| Marinade Finance | 1 | 1.124b | Staking |

| MarginFi | 1 | 483.92m | Lending |

| Step Finance | 1 | NA | Dashboard |

| Alpha Homora V2 | 5 | 71.09m | Yield Farming |

| cBridge by Celer | 20 | 104.45m | Bridging |

| Indigo | 1 | 88.96m | Synthetics |

| Djed | 1 | 20.24m | Stablecoin |

Now we’ll break a few of these down by every main community.

Ethereum

Aave

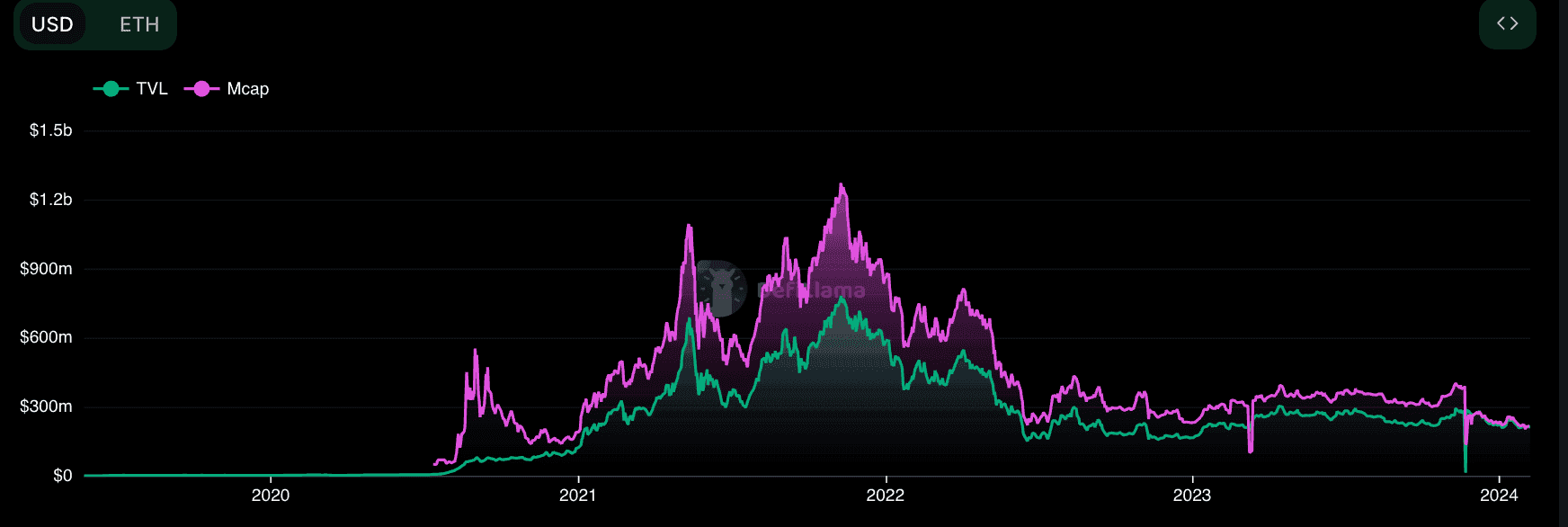

Aave is likely one of the earliest DeFi tasks on Ethereum again in 2020 when DeFi was simply coming into being. The open-source, non-custodial protocol permits lenders to earn curiosity via deposits and debtors to borrow belongings. As one of many first movers within the house, it’s now firmly in place because the third-largest dApp in Ethereum by TVL.

At the moment, at $7 billion in TVL, Aave has branched out to different L2s on Ethereum together with Arbitrum, Optimism, and Polygon. You may also discover Aave in Avalanche, a non-Ethereum blockchain. Greater than $10 billion has made its strategy to Aave throughout 8 networks and 15 markets.

The protocol has a kitty fund of greater than $300 million that acts as a backstop in case of protocol insolvency. This offers lenders peace of thoughts when interacting on their platform. The good contracts have been vetted by 6 top-notch safety corporations for example of their dedication to safety.

Nexus Mutual

Crypto investing is a dangerous enterprise which most conventional insurance coverage corporations wouldn’t dare to cowl. Concern not, for Nexus Mutual is right here.

It is a decentralised insurance coverage protocol that enables customers to insure towards good contract failure. Two sorts of merchandise can be found:

- Protocol cowl: This insurance coverage guards towards dangers confronted by the protocol resembling exploits, liquidation failure, oracle failure, hacks, and governance assaults.

- ETH Slashing cowl: This insurance coverage is for ETH stakers who incur losses because of penalties within the Ethereum consensus course of.

Customers must be members earlier than they will use the providers provided. Protection funds come from staking swimming pools managed by members with danger and pricing experience who earn a price for his or her providers.

Even with a ton of rivals nipping at its heels, Nexus remains to be the premier crypto insurance coverage protocol that different comparable tasks measure towards. Not happy with resting on its laurels, Nexus can be planning to launch two new sorts of merchandise, one associated to real-world dangers and one other is a directors-and-officers cowl.

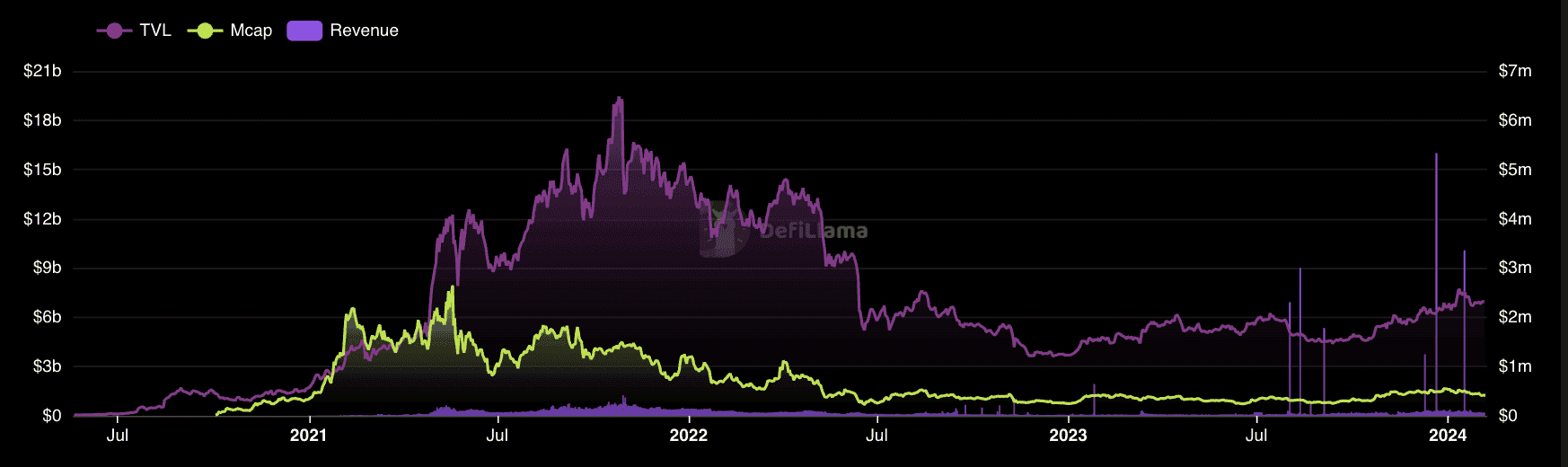

Yearn Finance

Yearn Finance is the place DeFi buyers go to earn yield with out staring on the display each day. The protocol makes use of automation that maximizes income gained from yield farming. It's like robo-investing for crypto.

The vaults in Yearn Finance are sources of capital that routinely generate yield for buyers. A few of them have a particular increase of extra rewards than others.

Every vault utilises a number of investing methods. The general robustness of the vault is represented by a danger rating. Every technique is asses based mostly on 8 components: Group Data, Protocol Security, Audit, Code Evaluation, Complexity, Longevity, TVL Impression, and Testing Rating.

Binance Sensible Chain (BSC)

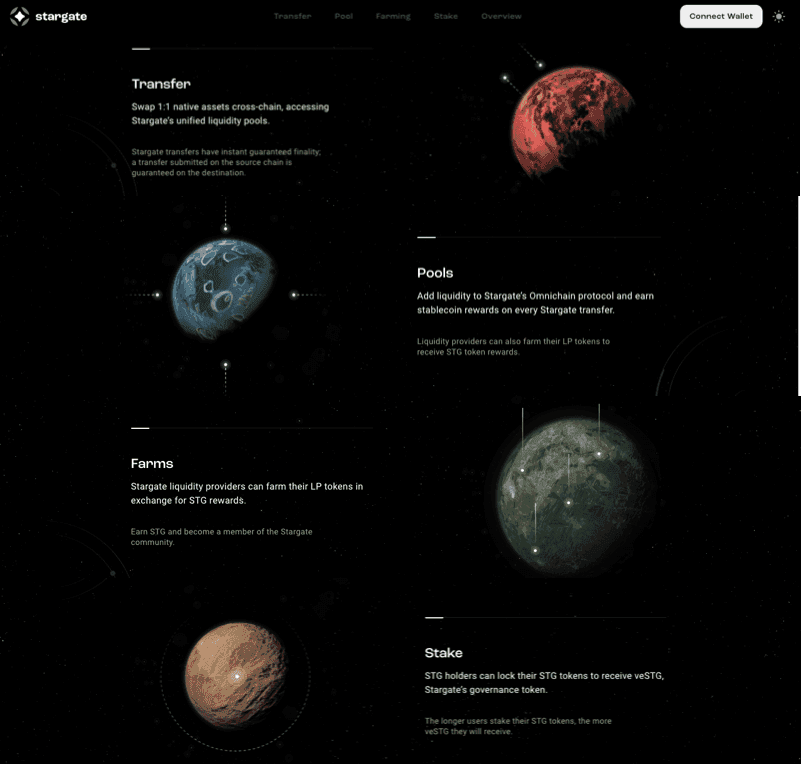

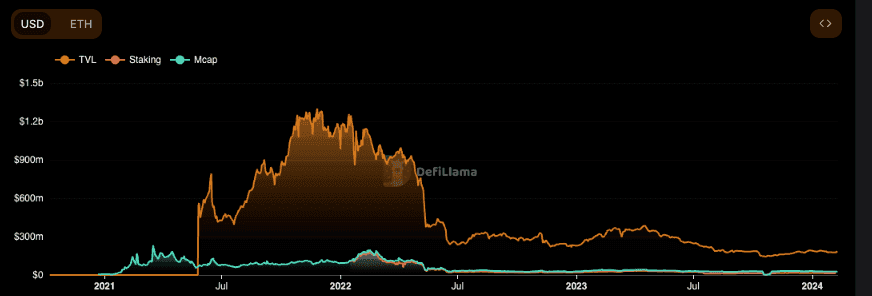

Stargate Finance (STG)

Stargate Finance is a cross-chain liquidity protocol that enables native belongings to simply be swapped amongst all of the chains it helps with instantaneous assured finality. Most bridging options face a typical danger which is an absence of enough liquidity. Too many requests may simply drain a pool as a result of these swimming pools are standalone swimming pools for every token inside every chain. Not solely that, customers may also face excessive charges and lengthy bridging time. Provided that the proportion of hacks happens on bridges, the lengthy settlement time can be an added danger.

Stargate's Delta Algorithm lets all chains supported by Stargate preserve particular person liquidity swimming pools “soft-partitioned” into a number of sub-pools. Then it programmatically controls the unified liquidity swimming pools in order that they don’t seem to be drained earlier than the swaps are carried out. If there isn't sufficient liquidity to assist the transaction, it merely gained't undergo. Stargate additionally utilises rebalancing charges to encourage customers to replenish belongings low in stability and discourage customers from depleting sure belongings. This helps to take care of a sure stage of liquidity in swimming pools.

Out of the $308.48 million of TVL locked in STG, $55.07 million of it’s within the Binance Sensible Chain, which is the second-highest TVL contributor.

Venus Finance

Venus Finance is a decentralised borrowing and lending platform on the Binance Sensible Chain. You possibly can see it’s Binance's model of Compound and MakerDAO because the protocol itself is a fork from these two tasks. The Cash Market Protocol is the place customers do the borrowing and lending, with curiosity accrued each block.

The model 4 improve launched remoted liquidity swimming pools so that every of them has customized danger administration configurations. The worth oracle used additionally acquired an improve as it will probably fetch costs from a number of feeds and validate via decentralised sources. One other key element is stablecoin minting, which is named VAI, the protocol's stablecoin pegged at a 1:1 ratio towards the US greenback. Customers can stake VAI or XVS, the protocol's governance token in Vaults to earn passive revenue whereas serving to to safe the platform's safety.

It's worthwhile to notice that the protocol skilled a nasty debt loss again in Might 2021 of $77 million following a major liquidation occasion. Since then, quite a few proposals have been made and upgrades added to make sure comparable occasions resembling these don't occur sooner or later.

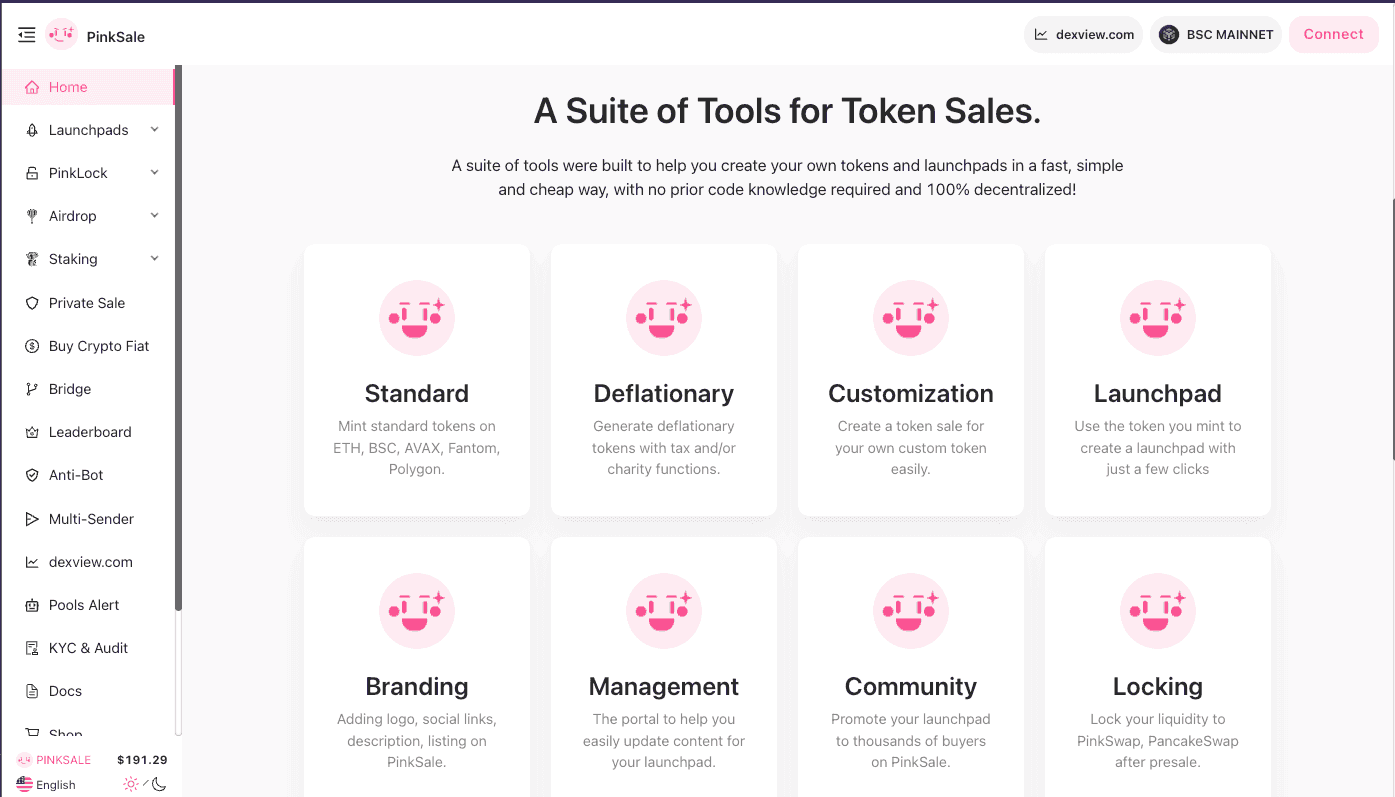

Pinksale

Ever questioned how one can launch a customized token on the blockchain and have it’s accessible to commerce with none technical know-how? If the reply is sure, then Pinksale is value testing. This protocol, which launched on the BSC blockchain, is a one-stop-shop for anybody seeking to launch their token and have it listed on the BSC DEXes resembling PinkSwap and PancakeSwap for buying and selling. As well as, customers also can create their challenge launchpad, airdrops, and staking applications on the platform.

Different providers provided by PinkSale embrace bridging capabilities, anti-bot program related to the token's contract deal with, and multi-sending performance to batch-send your new tokens to a number of addresses without delay. With a slew of different supporting providers accessible, Pinksale has nearly all of the substances you could efficiently launch your token not simply on the BSC chain, but additionally Fantom, AVAX, Polygon, and ETH.

Polygon

Beefy Finance (BIFI)

Beefy Finance is an automatic yield-farming optimizer. What this implies is that Beefy maximizes the consumer's rewards from varied liquidity swimming pools routinely with funding methods enforced by good contracts. This enables customers to earn yield via auto-compounding to maximise incomes potential. Customers have a number of methods of incomes yield: staking their BIFI tokens, staking their crypto belongings, or depositing their Liquidity Pool tokens (LPs) from exterior DEXes into vaults.

The principle product for Beefy is the Vaults, that are non-custodial, thus making certain customers have full management of their belongings throughout the staking course of. Every vault has an funding technique designed to compound all rewards earned by reinvesting them to supercharge your positive factors. There are three sorts of vaults accessible:

- Single asset vaults

- Stablecoin vaults

- Liquidity Swimming pools

Regardless that Beefy acquired began on the Binance Sensible Chain, their share on Polygon and Polygon zkEVM totals $21.72 million, far superseding its TVL on BSC, which is $16.91 million in keeping with DeFi Llama. As well as, the protocol is supported in over 20 blockchain networks for a mixed TVL of $185.2 million.

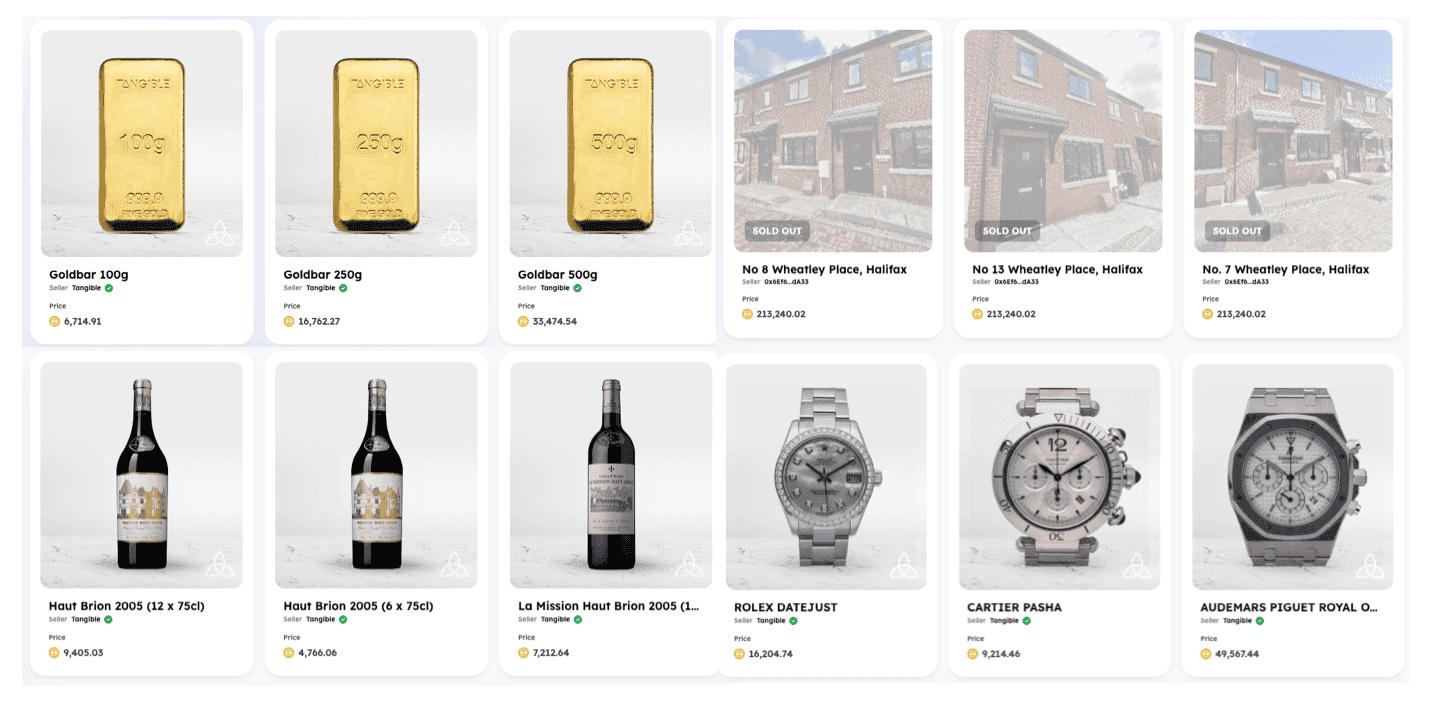

Tangible

Tangible is an thrilling entry into the world of Actual-World Asset (RWAs) tokenisation. A Tangible Non-Fungible Token (TNFT) is created from the tokenized asset that can be utilized as collateral in different DeFi tasks. The NFTs can then be used to redeem the bodily asset at any time. Additionally it is the creator of Actual USD, the primary stablecoin backed by tokenised, yield-producing actual property. With Actual USD, customers can entry tokenised and fractionalised RWAs of their NFT market. At the moment, there are 4 important sorts of belongings accessible for buy: gold bars, wines, actual property, and watches. Pricing is denoted in DAI.

Other than shopping for a complete asset, customers also can purchase a fraction of an asset, normally involving actual property. This enables larger entry to a wider pool of customers who might not have enough money a whole property however can nonetheless get a foot on the property ladder by proudly owning a small piece. The TNFT can be simply transferred via {the marketplace}. It’s as much as the vendor to find out the minimal fraction for the property and in addition the worth of all the accessible share.

PolyMarket

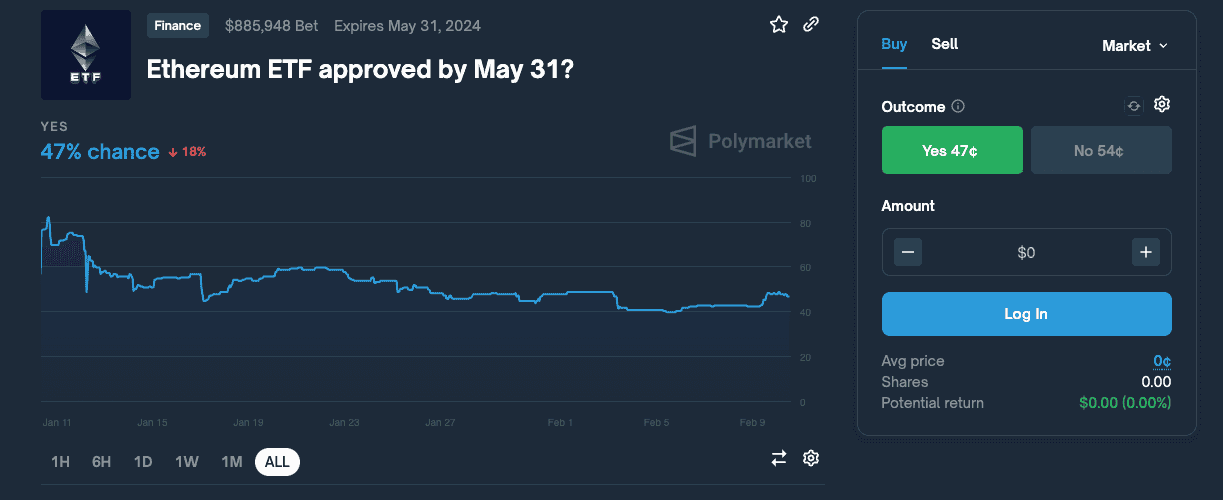

Betting on predictions of real-world outcomes has all the time been one thing that has been round so long as playing has existed in human society. PolyMarket places a DeFi spin to it by permitting betters to purchase “outcome shares” utilizing USDC. The pricing displays the aggregated likelihood of the anticipated final result. If it's a Sure/No consequence, and the shares are solely value a number of cents, the probability of it being a Sure could be very low.

These shares may be traded at any cut-off date earlier than the outcomes are in and Polymarket doesn't cost a price for the trades. As soon as the outcomes are unveiled, they are going to find yourself costing both $1 or $0. Those that picked the correct final result get to money out their shares at $1.00. Fuel charges are calculated in MATIC so contributors ought to carry each USDC and MATIC.

Be aware that because of a CFTC high-quality of $1.4 million, the platform has been closed to US residents.

Solana

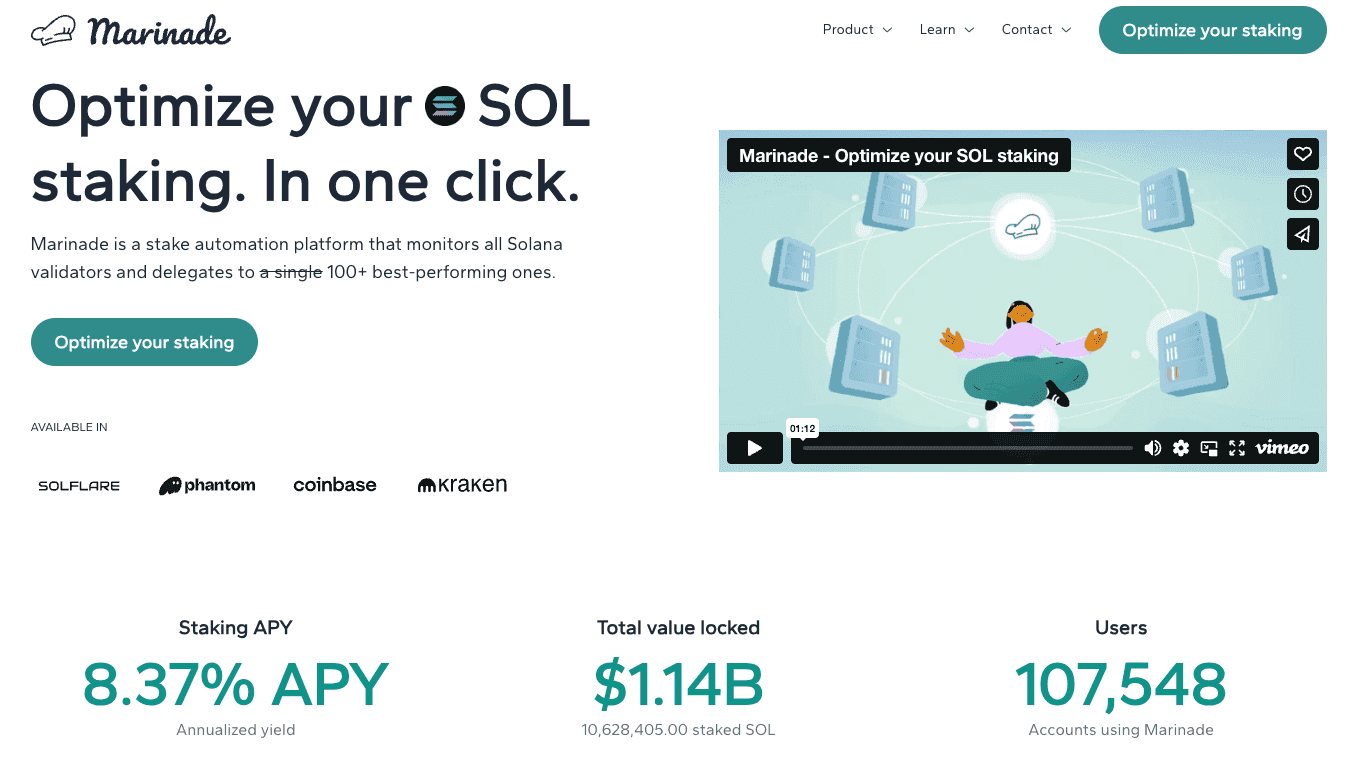

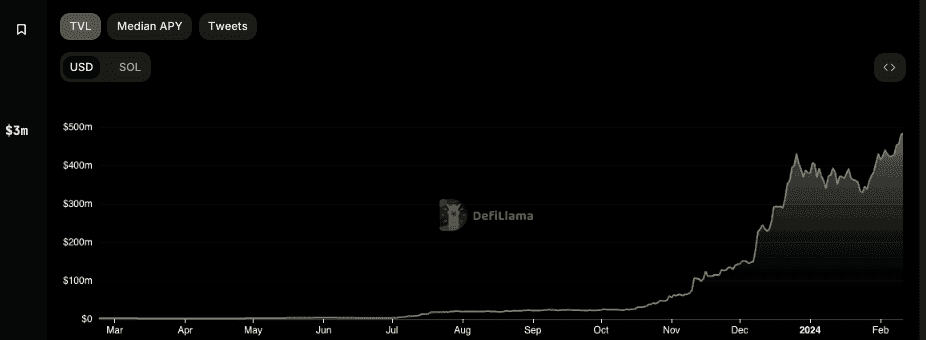

Marinade Finance (MNDE)

Marinade Finance is the highest staking platform for SOL tokens within the Solana ecosystem. The platform affords two sorts of methods for staking: Marinade Native earns customers as much as 8.37% APY for staking SOL tokens through automated staking delegation throughout lots of of validators. Be aware that the SOL tokens are locked into the protocol throughout the staking interval. Liquid Staking lets customers earn as much as 7.89% APY and offers you a liquid staking token (mSOL) that may then be used throughout greater than 20+ DeFi integrations. So long as you’ve entry to the mSOL tokens, you may all the time use them to redeem your staked SOL. Customers also can lookup the validators on the platform to gauge which of them they particularly wish to stake with. Alternatively, they will go away it as much as the platform's algorithm to determine.

The platform is ruled by the Marinade DAO utilizing the MNDE token. This may be earned via staking SOL on the platform. The proposals and precise governing happen on the Realms platform the place claimed MNDE tokens are locked in 30 days.

MarginFi

MarginFi is a lending and borrowing protocol on Solana the place lenders earn yield and debtors get hold of loans via over-collateralization. Curiosity is paid to the mortgage particular to the asset and is of the variable type. One strategy to gauge the borrower's skill to repay loans is thru a metric often called Account Well being, represented by a share. The decrease it’s, the much less probably the borrower can repay the mortgage. As soon as it hits 0% or decrease, the borrower is vulnerable to liquidation, which is each automated and permissionless. MarginFi affords Lite mode and Professional mode for many who wish to get began.

Lenders deposit their tokens into the liquidity swimming pools that are then lent out to debtors. Along with the curiosity earned, lenders additionally obtain margin factors. That is a part of a loyalty level marketing campaign to incentivise utilization. Customers also can earn factors via borrowing belongings or referrals. Lenders earn 1 level per greenback per day however debtors can get 4 factors per day for a similar quantity.

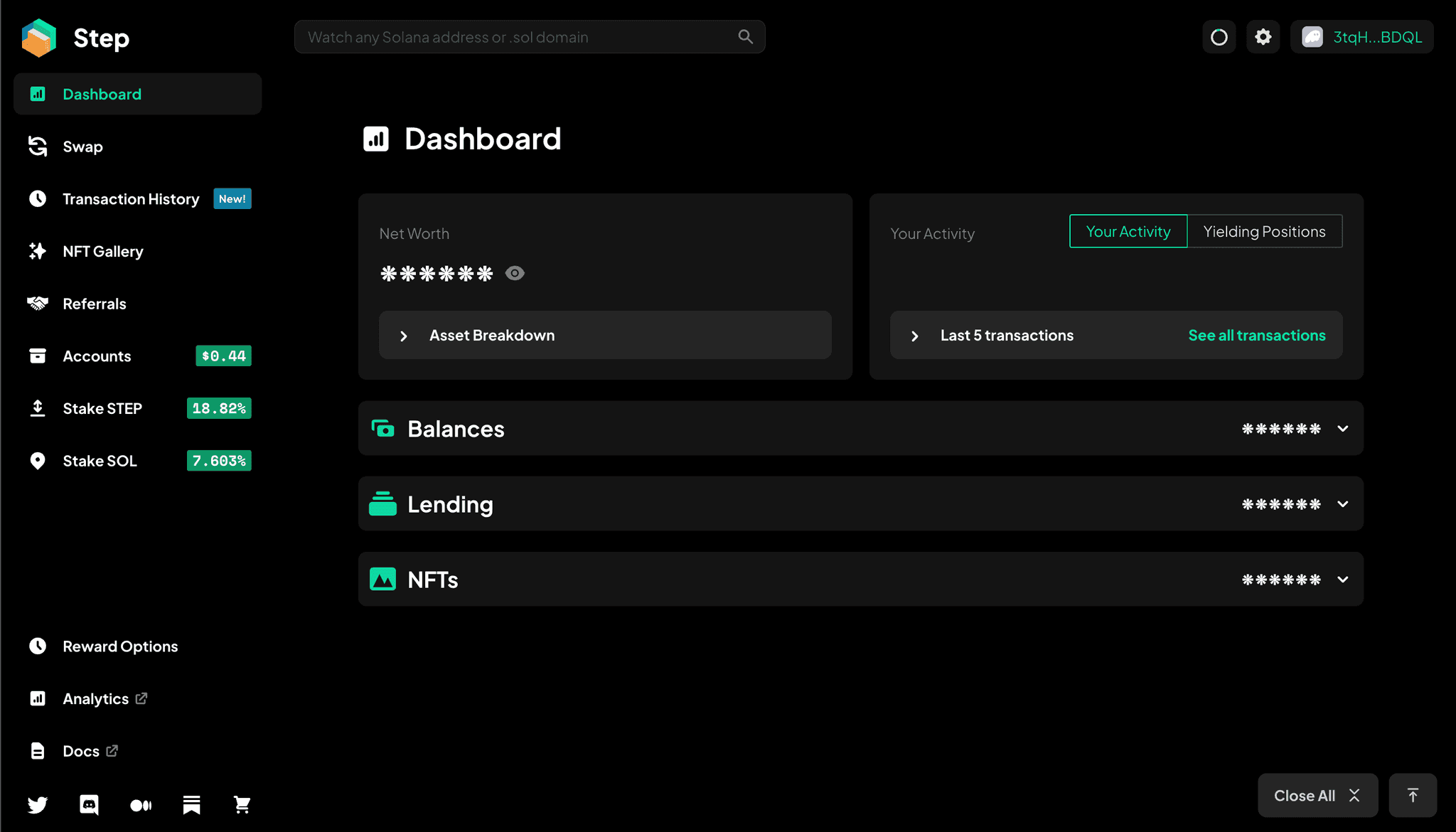

Step Finance

If you happen to've ever had the expertise of interacting with too many DeFi merchandise and wish only one place to see every little thing that's taking place, Step Finance is the reply, a minimum of for the DeFi merchandise within the Solana ecosystem. This platform is a portfolio visualisation that shows all of the liquidity swimming pools, farming positions, tokens, and any DeFi exercise associated to the pockets that’s related with it. The dashboard is simple to grasp mixed with varied helpful metrics and visualizations. Not solely do customers get an general view of their exercise in Solana, however they will additionally execute swaps and enter into varied yield farming positions and automatic vaults inside the Step platform.

As well as, they've added a Transaction Historical past part that gives extra particulars than what the transaction historical past within the pockets affords with the intention to do a extra detailed investigation of every transaction. The dashboard comes with the power to view or cover all balances on the portfolio. You may also view any NFTs within the pockets through their NFT Gallery. Staking choices are additionally accessible for each STEP and SOL tokens.

Avalanche

Alpha Homora V2

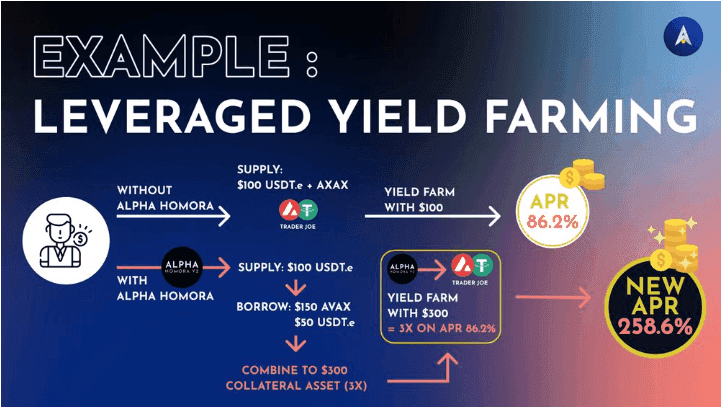

Alpha Homoroa V2 is a multi-chain lending platform and is DeFi's first leveraged yield farming protocol. Let's see what's the distinction. Regular yield farming is the place lenders deposit their funds right into a DEX like Dealer Joe's and earn buying and selling charges. Lenders additionally get LP tokens that are then additional staked to get extra APR. In leveraged yield farming, lenders each lend and borrow funds to acquire 3x APR by yield farming with the mixed worth. This results in a a lot greater APR.

Celer Community

Celer Community is a Layer 2 scaling platform that enables for off-chain transactions. The platform gives builders with a way to construct quick, low cost, and easy-to-use blockchain functions. As well as, it affords merchandise to unravel challenges inside the crypto world. One of many merchandise is cBridge, a bridging resolution for asset transference for 40+ blockchains and layer-2 rollups. The bridge has facilitated greater than $14 billion cross-chain asset switch quantity for over 540k distinctive customers. It is a non-custodial bridge, that means customers have full management of their funds.

The opposite product is Layer2.Finance that enables for fast transactions with out having to attend for confirmations on the primary blockchain.

Cardano

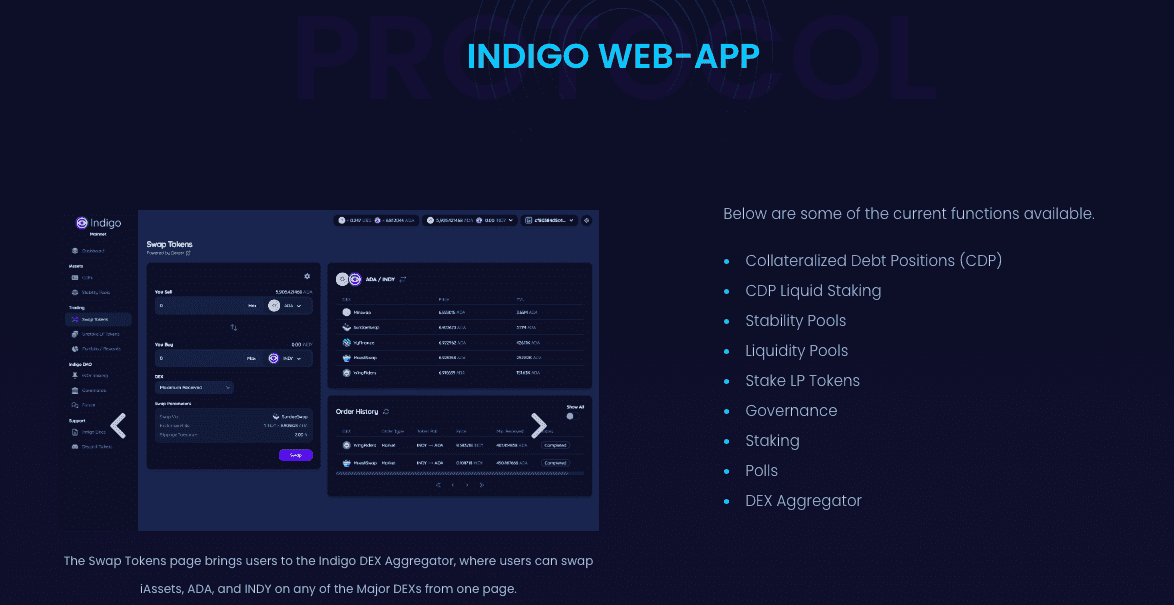

Indigo (INDY)

Indigo is a platform that provides artificial belongings often called iAssets in a decentralized method. Artificial belongings imply a digital model of an asset. Examples is usually a digital model of an Apple share or Bitcoin. You don't must possess the precise share or Bitcoin with you however you may nonetheless profit from the worth motion of the asset. iAssets are minted with good contracts and are used to create new markets on varied Automated Market Makers (AMM) and be the liquidity for yield farming. The artificial belongings can be used to take part in different DeFi protocols, resembling SundaeSwap, COTI, and Minswap, as collateral or liquidity.

The protocol has an Autonomous Oracle with the important thing performance of updating the costs of the real-world belongings in order that the artificial ones are at par with their real-life counterparts. With the assorted partnerships in place, Indigo goals to be the primary platform for these coming into the DeFi world of Cardano.

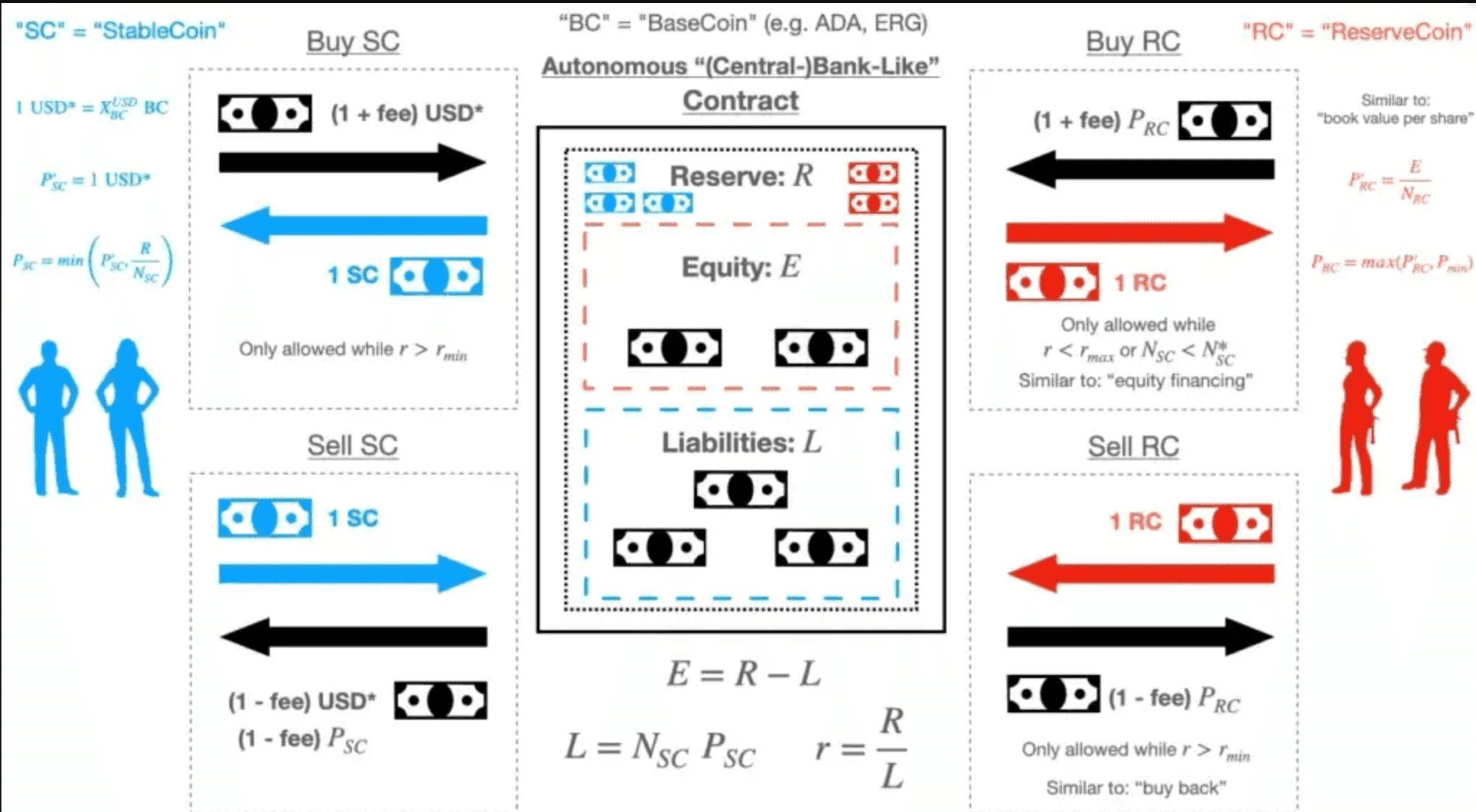

Djed (DJED)

Djed is an algorithmic stablecoin provided on the Cardano blockchain. Not like how UST works on Terra, Djed additionally has a collateral element with ADA and a reserve coin known as SHEN behind it. The algorithm is to watch the distinction between DJED and the USD it’s pegged towards. How Djed prevents what occurs with UST is with SHEN. This token's operate is to safeguard Djed from falling decrease than 1USD by having a minimal variety of tokens in place. If it appears like Djed goes to exceed its peg, then there may be additionally a most quantity of SHEN in circulation to stop this from taking place.

The whitepaper states that Djed “behaves like an autonomous bank that buys and sells stablecoins for a price in a range that is pegged to a target price”. Additionally it is “the first stablecoin protocol where stability claims are precisely and mathematically stated and proven.”

There’s extra to Djed than we are able to cowl right here, which is why we’ve a devoted Djed article that dives into the nuances.

Djed can be utilized on different protocols as collateral or to offer liquidity. Empowa, one other challenge on Cardano that enables native African housing builders to offer lease-to-own choices for eco properties, accepts the stablecoin.

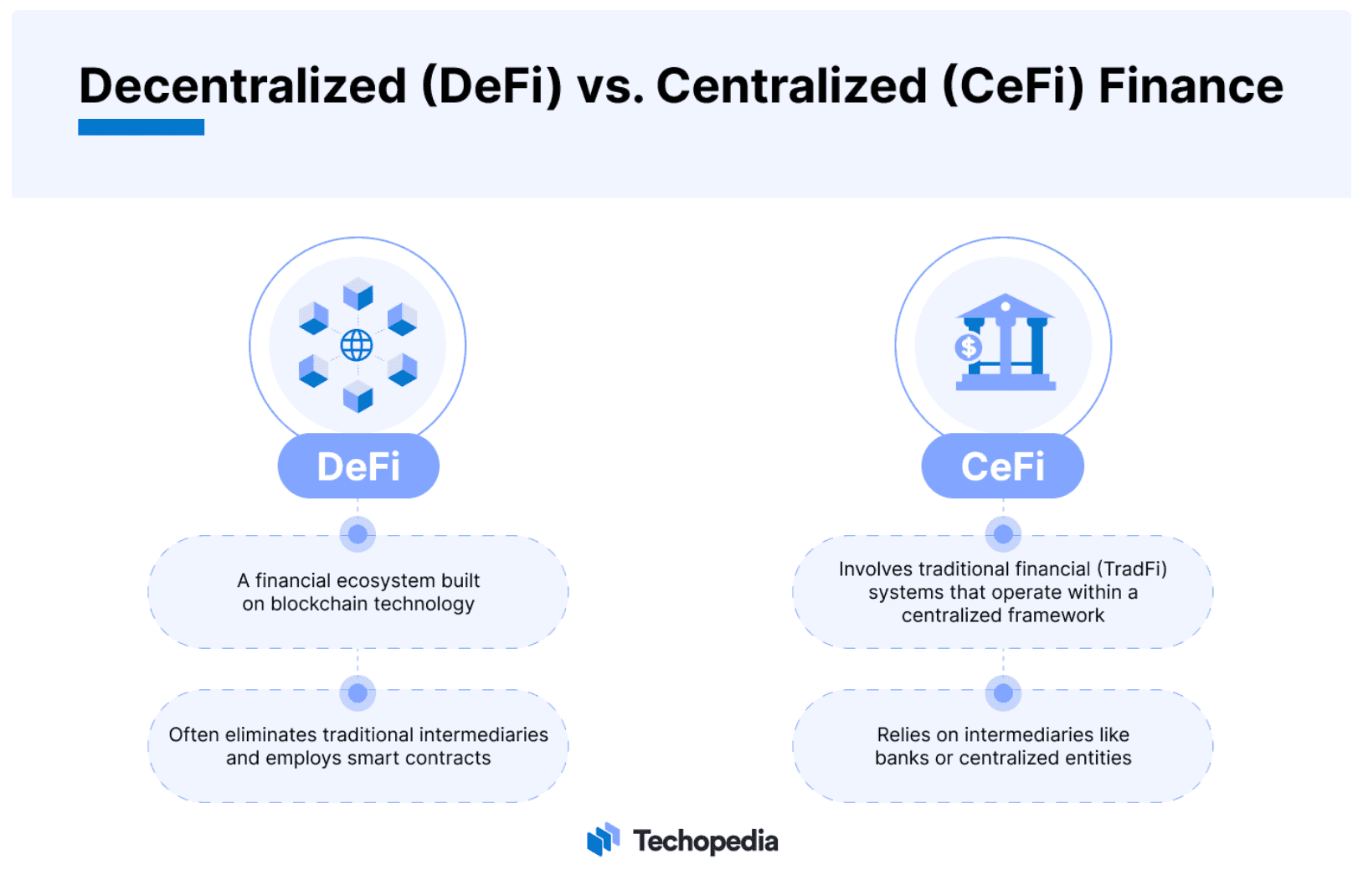

DeFi vs CeFi

DeFi and CeFi are two distinct approaches to crypto, with vocal proponents in each camps. Let's take a quick look to grasp them higher.

One can take into account CeFi as an extension of TradFi within the crypto house. Lots of the fashions that make up TradFi may be present in CeFi. This features a single firm with opaque record-keeping that’s solely accessible to permissioned events, resembling regulators, buyers and inner workers. As an organization, income and the underside line are very a lot a key element of the enterprise. Identical to standard corporations, they’ve a payroll and workers prices related to working the enterprise.

Belief in CeFi is commonly attained via regulation, compliance, popularity, observe file, and multi-layer safety. Centralised exchanges, which fall below CeFi, enable for fiat-to-crypto conversions and digital asset banking-style merchandise, thus offering a beneficial service in getting folks onboard the crypto prepare. Due to this fact, it additionally offers with banks and different intermediaries in order that they will supply providers to the general public.

One other service that CeFi affords is custodial providers, which sits properly with those that are extra snug with somebody holding their funds for them. Not like banks which can be normally insured in some type by the federal government for a specific amount, CeFi corporations aren’t on the identical stage of accountability so the chance of them going rogue is a double-whammy. It’s because not solely are funds absconded, it's the severance of belief between the consumer and the entity that’s deadly. Nonetheless, in some instances, like Celsius, FTX and Mt Gox, there are authorized avenues for patrons to hunt some type of compensation, lengthy although it might take.

DeFi protocols rely closely on good contracts to execute all performance on the platform. These good contracts are automated, immutable, clear and auditable by safety corporations specialising in good contract creation. This removes all of the intermediaries normally concerned in CeFi, thus decreasing the price of offering comparable sorts of providers to the consumer. All of the transactions happen on-chain, that means they’re accessible for consumption in a public ledger that may be accessed by anybody.

For individuals who need the duty of holding their very own funds, DeFi is their most well-liked selection as a result of these are non-custodial platforms. Customers additionally don’t want to offer any sort of private identification or fill in any utility type to entry the providers provided on DeFi. All one wants is a pockets to work together with the platform. These wallets are normally free or can simply be obtained with out revealing any private data.

DeFi sometimes has no administration staff to talk of. What they’ve is a governance mannequin often called a DAO. It is a community-led initiative the place those who’re incentivised for the challenge to develop are normally the very customers of the platform. Customers holding governance tokens can suggest proposals which can be voted on by different token holders. Profitable proposals are then carried out by the staff, which is a extra democratic course of than centralised entities.

Because of the decentralised nature of DeFi protocols, there is no such thing as a single governing company that may maintain the protocol accountable for any malicious behaviour occurring on its platform. A very good instance is Twister Money, a mixing service that enables the origins of funds to be obfuscated in order that the funds can’t be traced again to a single supply. Regardless that among the customers utilizing the blending service are as much as no good, the operations are dealt with by good contracts, that are traces of laptop code. There’s some debate as as to whether the creators of the protocol must be held accountable, because the creators of Twister Money have been the targets of authorized motion. I’m of the private opinion that it's like asking the one who invented cash to be accountable for cash laundering actions.

Why Take into account DeFi?

If you happen to dwell in a rustic the place the monetary infrastructure is properly arrange, you may not have any specific incentive to include DeFi into your realm of monetary exercise, just because you don’t have any want for it. You could have creditworthiness that you just've established with a single financial institution the place you get your mortgage from.

In case you have no drawback acquiring loans via common money-lending entities, you don’t have any want to make use of DeFi to get a mortgage. If you happen to're completely happy incomes a small curiosity out of your financial institution though the mortgage curiosity you pay far outweighs the curiosity you're getting, you don't must lend your cash on DeFi protocols to earn a much bigger curiosity however shoulder some danger on the similar time.

Nonetheless, if you’re somebody who has issue getting a mortgage after getting turned down for one purpose or one other though you do have some collateral you should utilize to ensure the mortgage, you may wish to give DeFi borrowing a strive. In case you are involved in getting the next charge of curiosity, you is perhaps incentivised to do a little analysis on which DeFi protocols can supply return that outperforms banking returns.

If you wish to get on the property ladder however don't have sufficient for a down fee, you is perhaps tempted to provide fractional NFTs of real-world belongings a strive as a result of a minimum of, you may inform your mates that you’re gathering hire from 1/sixteenth of a property in New York. This may go in direction of rising your capital with the intention to finally purchase a spot of your individual someday.

Closing Ideas

On this capitalistic society that we dwell in, having a sure stage of wealth is the one strategy to make all of it the way in which to the end line often called the tip of life. Probably the most fundamental method of acquiring wealth is thru exchanging our labour for funds, which might function the seeds of capital. Solely capital is able to attracting extra capital, thus the wealth-building course of begins.

With conventional finance, the limitations to accumulating wealth have gotten greater and better as time goes by. We are able to attribute that to inflation in items however not in precise wage will increase. That’s how we arrive at the place we’re as we speak with the ever-widening hole between the haves and have-nots.

With the appearance of DeFi, the doorway for accumulating capital has been flung extensive open. The entry barrier to get began in wealth-building has been drastically lowered. The varied manners provided to take part in DeFi enable an important many individuals to have an opportunity at constructing wealth at their very own tempo. Opposite to well-liked perception, DeFi isn’t a get-rich-quick scheme. It bears asking when interacting with a DeFi protocol, “where is the yield coming from?” If the reply is “from other users”, then it pays to proceed with warning. The road between crowdsourcing and a Ponzi scheme is a really high-quality one certainly.

Regardless of the dangers presently concerned in interacting with DeFi protocols, it’s value remembering that the house remains to be evolving, and at a really speedy tempo too. Because the sector continues to mature, it’s potential that DeFi might someday be accepted as a mainstream different to what conventional finance affords.

Continuously Requested Questions

What are DeFi Tasks?

DeFi tasks are platforms the place one may be concerned in monetary exercise with out the necessity to reveal private identification of any type. The operations are carried out utilizing good contracts, thus largely eliminating human intervention. Sorts of DeFi tasks embrace lending and borrowing, staking, yield farming and many others.

Why is DeFi essential?

DeFi is essential as a result of it lowers the entry barrier for anybody to get began on the wealth-building course of.

Why is DeFi higher than CeFi?

DeFi is healthier than CeFi as a result of anybody can take part beginning with any quantity. There isn’t any restriction of any type resembling age, gender, race and many others. By utilizing good contracts to execute the operations, the price of charges is drastically diminished. The provision and demand of capital is way more clear to everybody.

How is DeFi totally different from crypto?

DeFi is a sector inside the crypto house. Crypto usually refers back to the tokens and cash utilized by protocols as a type of fee or reward for securing the blockchain networks.

What one does with the crypto tokens and cash acquired is to speculate them in DeFi tasks that may earn them yield or use as collateral for loans.