It’s arduous to think about a time earlier than decentralised exchanges (DEXs) existed, regardless of the comparatively current introduction solely eight years in the past.

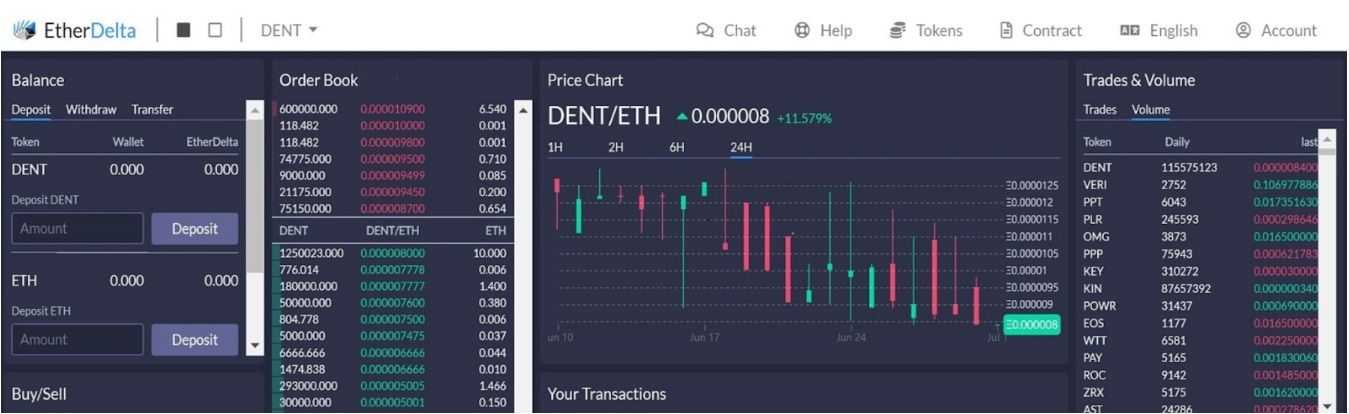

In 2016, the world was launched to the first-ever decentralised change: EtherDelta. Admittedly, the brand new decentralised mannequin was extraordinarily primary however was an absolute game-changer, as you’ll be able to think about. EtherDelta created the primary platform the place crypto merchants might swap tokens anonymously, providing one thing that conventional monetary techniques by no means might.

And although the SEC would shut down the platform simply two years later, it paved the best way for an essential host of platforms we rely on at the moment. Our article explores the standard beginnings of decentralised exchanges, diving into their advantages, challenges, and limitations, in addition to waiting for future tendencies and improvements.

What’s a DEX?

DEXs are primarily platforms that act as a direct intermediary between two contributors desirous to change a cryptocurrency. So simple as that sounds, it immediately challenged the normal method we used to commerce our cryptocurrencies on centralised exchanges (CEXs). CEXs have been already round for a couple of years prior, and are nonetheless round at the moment, some notable ones being Bybit, Binance, Coinbase and Kraken.

With this new possibility, we turned the custodian of our personal funds. DEXs use automated protocols in order that transactions could be despatched immediately between customers in a peer-to-peer buying and selling atmosphere. There have been no meddling fingers getting in the best way anymore.

As well as, the change from the earlier mannequin to this one created extra safety and privateness which is one thing crypto fanatics definitely appreciated. The choice additionally embraces what blockchain tech has all the time preached — openness, inclusivity, and consumer sovereignty. Bitcoin was a daring “middle finger” to centralization, kicking off the march towards decentralised techniques. It solely made sense then to proceed exploring additional down this decentralised path. DEXs assist us accomplish that purpose.

They provide extra privateness than conventional markets whose energy is often centralised in a couple of people. The driving power behind DEXs doesn’t require human interplay in any respect. Algorithms deal with every part. In a lot of these techniques, it’s like an invisible hand runs issues so everybody can commerce with one another at the perfect value potential. Automated market makers (AMMs), as they’re known as, aren’t pushed by individuals haggling over costs however as a substitute by formula-driven protocols. Customers deposit their very own cash right into a liquidity pool which is then used to make trades occur. In contrast to typical order e-book fashions that want consumers and sellers lined up for each transaction, AMMs will all the time get somebody to commerce with you.

This fashion of operating issues makes buying and selling cheaper and simpler whereas including an additional layer of transparency and safety digital techniques desperately want in at the moment’s world the place hacking has grow to be commonplace.

Take a look at our high picks for the perfect decentralized exchanges.

Outstanding DEX Platforms

Listed here are a number of the well-known DEXs at the moment.

Uniswap

Uniswap's DEX is among the most widely known names within the house. It was the primary to implement an AMM system that enabled buying and selling with out conventional order books. As an alternative, liquidity is offered by customers who pool their funds and achieve charges as a reward for doing so. This setup simplifies and hurries up buying and selling whereas providing higher privateness and safety than centralised exchanges.

Many different DEXs, together with PancakeSwap and SushiSwap have since copied this strategy. Nonetheless, Uniswap continues to push boundaries and is at present engaged on v4 to offer much more energy to customers, by permitting them to make trade-off selections by way of "hooks." These hooks are contracts that may be activated at totally different levels and assist the pool motion lifecycle. Because of this not solely will v4 let swimming pools mirror what v3 did, however they’ll additionally enable builders so as to add new issues utterly. For instance: dynamic charges or on-chain restrict orders.

Other than these customization choices, Uniswap v4 has made extra modifications. It additionally goals for higher cost-efficiency with a brand new contract design known as "singleton.” It will put all of its swimming pools into one contract. With this construction and its flexibility of hooks, Uniswap hopes to supply a good sturdier platform. It’s going to enable builders fast customization entry that’s secure for transaction routing throughout a number of swimming pools. Doing it will increase the development of quick, progressive AMM capabilities in a single ecosystem.

All of those improvements underline how targeted Uniswap's builders are on refining its structure in order that it could actually assist extra environment friendly and scalable DeFi interactions.

We’ve an in depth Uniswap evaluate for individuals who wish to study extra concerning the world's main DEX.

Pancakeswap

PancakeSwap is exclusive in that it capabilities like another DeFi change or AMM DEX, however comes with a couple of methods up its sleeve. It operates on the Binance Sensible Chain and has targeted on being deflationary since its inception. The provision of CAKE, PancakeSwap’s native token, is often diminished, which will increase its worth over time (theoretically). The change additionally rewards people who stake their CAKE by way of a revenue-sharing program. The extra customers that assist develop the platform, the extra money they make. Staking additionally offers entry to yield farming, staking, and participation in prediction markets and lotteries.

You’ll be able to learn our full PancakeSwap evaluate right here.

Sushiswap

SushiSwap began off as a clone of Uniswap however rapidly set itself aside with the introduction of the Kashi lending platform, MISO token launchpad, and different tasks that intention to make Sushiswap a fully-fledged DeFi ecosystem.

Nonetheless, you will need to observe that this DEX is within the technique of shifting additional away from decentralisation. After a preliminary vote, greater than 62% of the SushiSwap neighborhood voted for a much less decentralised enterprise construction known as the “Labs model.” It will enable for higher ecosystem administration however has created some friction between members. The proposed Sushi Labs will maintain 25 million tokens price nearly $39 million and have unique rights to future airdrops. Understandably, some members are frightened about cash administration and vote manipulation.

This raises an fascinating query: Will DEXs be pressured into positions the place they have to pivot simply to outlive? Again in March 2023, SushiSwap CEO Jared Gray expressed feeling “uninspired” as a result of regulatory challenges. Now, with the SEC ramping up its regulatory actions in opposition to Uniswap, this may trace at a possible development for the way forward for decentralised exchanges. We'll contact on this later within the article.

We even have a evaluate on SushiSwap.

NEAR Protocol, Solana and Cosmos Ecosystems

On this part, we'll contact on DEXs in these three ecosystems.

Orderly Community on NEAR Protocol

Working on the NEAR Protocol, Orderly Community has made a reputation for itself within the DEX world by specializing in permissionless spot and future order e-book buying and selling. The platform prides itself on its sensible contracts that allow peer-to-peer buying and selling, strong threat administration, and shared asset swimming pools designed to spice up consumer safety and operational effectivity.

In December 2023, Orderly Community unveiled an industry-first Omnichain SDK geared toward builders who wish to create and deploy perpetual DEXs with built-in liquidity. By prioritising effectivity and creativity within the EVM neighborhood, this instrument permits customers to make their ideas a actuality rapidly. Furthermore, it broadens Orderly’s attraction throughout a number of blockchain ecosystems — laying the foundations for a extra interconnected DeFi panorama.

Raydium on Solana

Raydium operates on the Solana blockchain and gives unmatched pace and cost-effectiveness, permitting customers to commerce at low price and in a extremely liquid market. Raydium’s compatibility with Serum DEX makes it much more interesting, growing its liquidity and making a dynamic buying and selling atmosphere throughout the Solana ecosystem. As well as, its cross-chain functionality widens its scope and improves its use case as a multi-purpose decentralised buying and selling platform and liquidity supplier.

Raydium lately launched its beta model for V3, the place the backend infrastructure was utterly rebuilt to maintain the present load and future site visitors. V3 has been optimised for cellular customers due to growing demand, making certain a clean expertise and seamless integration with pockets apps. All forms of swimming pools, together with CLMMs Customary AMMs, have been consolidated beneath their new liquidity web page. Notably, they’ve added a brand new portfolio web page the place customers can handle all their liquidity positions.

Within the new model, token lists are actually editable and have been improved to make searches simpler. This characteristic additionally routinely populates metadata for any searched mint tackle, enabling tokens to be added on to the consumer’s native record to eradicate confusion. The swap now has charts for cellular and desktop with a straightforward toggle on/off possibility for any tradable Raydium token pair. The routing engine has been upgraded to assist baseIn and baseOut swaps in order that within the “Swap To” subject, customers can specify precisely how a lot of a given token they need faraway from their steadiness when swapping therefore enhancing the precision/flexibility of buying and selling.

Jupiter Trade on Solana

Jupiter is fascinating as a result of it’s a DEX aggregator, so it ensures that customers get the perfect value for his or her token swaps. It searches for the perfect commerce paths between any token pair utilizing assets from main DEXs resembling Raydium, Serum, Orca, Saber, Penguin Mercurial, and Supernova, primarily mixing a number of DEXs and AMMs for probably the most intensive liquidity choices. This integration additionally ensures entry to a broad vary of tokens by merchants and probably the most beneficial situations for conducting trades to simplify buying and selling and supply an improved consumer expertise.

Being on Solana, the pace of transactions and low transaction prices make it preferable for individuals prepared to maximise their possibilities with out being overwhelmed by hefty charges or delays. It has been designed to supply a frictionless buying and selling atmosphere that bridges the hole between difficult buying and selling dynamics and easy-to-use operations, particularly for brand new entrants.

Osmosis DEX on Cosmos

Osmosis is a DEX particularly constructed for the Cosmos ecosystem. Launched in 2021, Osmosis is a multi-chain automated market maker (AMM) designed to boost interoperability amongst blockchains. It makes use of the Inter-blockchain Communication Protocol (IBC) and Axelar throughout the Cosmos community, permitting for clean token and information transfers throughout totally different chains.

Moreover, the Gravity DEX, initially a part of Osmosis, has been rebranded to Crescent and transitioned to its personal community. Crescent goals to introduce progressive options resembling an order e-book change mannequin and cross-chain lending capabilities.

By way of competitors and progress, Osmosis, which now contains Crescent, desires to determine itself as a number one DeFi vacation spot throughout the Cosmos ecosystem. Osmosis units itself aside by specializing in interchain communication and scalability. This technique places Osmosis in an ideal place to attach blockchains, present liquidity, and drive DeFi progress throughout the Cosmos community.

Advantages of DEXs

DEXs have been more and more acknowledged for his or her vital benefits in digital asset buying and selling. Essentially the most praised advantages embody their non-custodial nature, which ensures customers' management of personal keys. This characteristic mitigates dangers resembling fund mismanagement, asset freezing, or insolvency points generally confronted on centralised exchanges. Buying and selling could be accomplished anytime with out downtime, which impacts CEXs throughout excessive site visitors or upkeep.

Privateness and accessibility are additionally vital benefits of DEXs. They function on a permissionless foundation, permitting anybody to make use of them with out submitting private info, in contrast to CEXs, which adjust to laws that request these particulars. This high quality makes DEXs particularly enticing in areas with restricted conventional banking entry. Moreover, most new tokens debut on DEXs, permitting early adopters to purchase them at decrease costs earlier than they're listed on CEXs and rise in worth.

Nonetheless, DEXs even have drawbacks.

They typically include larger ranges of threat and complexity — inserting higher duty on the consumer to safe their funds correctly — one easy mistake like a incorrect tackle might trigger irreversible losses. Moreover, transaction charges could be significantly larger than traditional values relying on the community used, resembling Ethereum, the place fuel charges are inclined to fluctuate considerably throughout community congestion.

So, whereas DEXs supply improved safety measures, privateness, and early entry to new tokens, they require the next stage of duty from the consumer and should entail additional prices.

Challenges and Limitations

Though the recognition of DEXs has been growing, they aren’t actually extensively accepted as a result of a number of impediments resembling regulatory challenges, technical points, inadequate buying and selling property, and safety issues.

From a regulatory standpoint, DEXs function in a considerably unregulated house. This freedom permits new concepts to flourish with out fast regulatory interference. Nonetheless, this laissez-faire strategy additionally exposes customers to fraud and cash laundering dangers. As an illustration, the SEC despatched a Wells Discover to Uniswap, underscoring the necessity for DEXs to navigate advanced legalities whereas sustaining their core decentralisation.

Technically, DEXs typically current usability challenges, particularly for newcomers to the crypto house. The interfaces could be advanced and intimidating, pushing much less tech-savvy merchants in the direction of extra user-friendly centralised exchanges. Moreover, applied sciences utilized by many DEXs, resembling automated market maker techniques, face points together with impermanent loss and value slippage, primarily in swimming pools with low liquidity.

Liquidity and slippage points are additionally vital challenges. Usually, DEXs' liquidity is decrease than CEXs, notably for much less popularly traded tokens. This will result in elevated value volatility and slippage, making executing massive orders troublesome. Additional, the reliance on liquidity suppliers, who could withdraw their funds anytime, provides to the instability.

Scalability is one other main concern. A DEX's efficiency is proscribed by its underlying blockchain expertise. Notably, DEXs constructed on Ethereum could endure from gradual transaction instances and excessive fuel charges throughout congestion, leading to a poor consumer expertise and elevated operational prices.

Safety stays a urgent difficulty as properly; though DEXs enable customers to regulate their non-public keys, they’re nonetheless susceptible to dangers resembling sensible contract vulnerabilities. Hackers can exploit these vulnerabilities, and as DEXs develop, the potential influence of safety breaches additionally will increase.

To thrive and develop sustainably, DEXs should overcome these obstacles. Future enhancements will seemingly give attention to enhancing expertise and consumer interfaces whereas making certain compliance with regulatory frameworks crucial for broader acceptance by varied stakeholders.

Case Research and Actual-World Impression

Undoubtedly, DEXs have considerably influenced the broader monetary panorama by introducing DeFi improvements that problem conventional fashions of monetary companies. Listed here are some key case research and examples:

1. Decreasing Transaction Prices and Rising Accessibility: DEXs and DeFi platforms decrease transaction prices by eliminating intermediaries resembling banks and monetary establishments that usually cost charges for transactions, account upkeep, or forex conversion. That is essential for frequent or worldwide transactors because it makes monetary transactions cost-effective. Moreover, DeFi platforms improve monetary inclusion by giving entry to monetary companies to the unbanked populations of people that dwell in areas that lack banking services, thereby bridging accessibility gaps usually seen with conventional finance techniques.

2. Impression on Conventional Monetary Companies: By-passing conventional middlemen like banks, Ethereum-based DeFi protocols present decentralised alternate options for widespread typical monetary companies like lending and borrowing. This transformation offers customers extra management over their funds and introduces automated market-making techniques and decentralised lending that compete with conventional monetary merchandise. Blockchain expertise brings transparency and effectivity in decreasing the prices of accessing monetary companies, making it a beautiful various to conventional finance techniques.

3. Regulatory and Safety Challenges: Integrating conventional finance with DeFi presents challenges. DeFi's largely unregulated standing exposes it to dangers like fraudulence or cash laundering with out shopper protections typical of typical finance frameworks. Moreover, making use of blockchain expertise to common monetary mechanisms requires tackling a fancy regulatory framework and making certain compliance with present legal guidelines and laws.

4. Innovation in Monetary Merchandise: The innovation led to by Defi has led to the creation of latest forms of financial units that might doubtlessly revolutionise the sector. These embody yield farming strategies, which weren’t potential earlier than throughout the conventional ecosystem that impacts funds. Solely smarter merchants would profit from such improvements. Thus, such improvements make monetary markets extra environment friendly whereas offering extra flexibility to customers and enhancing the possibilities of larger returns.

Consequently, integrating DEXs into DeFi has shifted how monetary companies are delivered and skilled by customers globally. It holds the potential for improved effectiveness, decreased costs, and expanded availability; nonetheless, as we will see, some challenges require well-thought-out approaches because the {industry} grows.

Future Tendencies and Improvements

The way forward for DEX expertise could properly depend on developments in layer-2 options, cross-chain interoperability, and the broader evolution of blockchain applied sciences — something to considerably enhance the scalability, effectivity, and value of DEXs. Let’s check out a couple of to get a greater understanding of the place a number of the focus has been aimed:

- Layer-2 Options: That is particularly essential for enhancing the scalability of blockchain networks like Ethereum, which underlies many DEXs. Optimism and Arbitrum are some examples of Layer-2 options that use Optimistic Rollups to fast-track the execution of transactions away from the primary Ethereum chain, thereby resulting in elevated transaction throughput at decrease price. Equally, Zero-Data Rollups batch many transactions right into a single one, thus sustaining community safety whereas enhancing efficiency.

- Cross-Chain Interoperability: The expansion of the blockchain ecosystem has emphasised the necessity for interplay throughout totally different networks. Chainlink developed protocols just like the Cross Chain Interoperability Protocol (CCIP) to permit safe communication and asset switch throughout varied blockchains. This will increase fluidity in asset actions throughout the DeFi ecosystem whereas increasing DEXs' capabilities, like multi-chain buying and selling methods or wider availability of property.

- Continued Blockchain Evolution: Integrating blockchain applied sciences into DEX platforms continues to evolve, with developments specializing in enhancing safety, consumer expertise, and platform efficiency. As an illustration, Chainlink’s innovation has led to the creation of automation instruments for layer 2 networks that allow extra difficult and reliable sensible contract operations, thereby increasing DEXs’ potential use circumstances in areas resembling gaming and finance.

These applied sciences pave the best way towards a extra dynamic DeFi world the place totally different DEXs can function higher with excessive effectivity, ease of attain, and elevated performance. This improvement is essential if we wish the adoption of decentralised exchanges not solely amongst cryptocurrency fanatics but in addition amongst typical monetary establishments searching for decentralised and environment friendly options in opposition to outdated techniques. With time, these transitions might redefine how monetary companies are accomplished, resulting in a fairer, extra clear, and extra environment friendly market.

Conclusion

As we dive deeper into the digital age, DEXs will seemingly proceed reshaping conventional finance. Constructed on the pillars of blockchain expertise — safety and transparency — they facilitate direct peer-to-peer transactions with out counting on conventional monetary intermediaries. This shift challenges the long-established dominance of CEXs and aligns carefully with the foundational rules of blockchain: decentralisation, anonymity, and consumer empowerment. Such transformations are steering us in the direction of extra open monetary markets, the place customers have higher management over managing their property and might work together extra freely.

As we proceed to transition, DEXs will grow to be more and more essential, given the event of the DeFi ecosystem. Along with facilitating easy swaps, these platforms have already gone past that time by venturing into difficult areas resembling yield farming and on-chain asset administration, thus pushing ahead improvement. Additional, as we progress in these facets, tasks will proceed to push by way of regulatory scrutiny, scalability issues, and safety enhancements.

The longer term path of DEX expertise signifies much more integration with layer two options, cross-chain interoperability for a wider asset vary, and additional developments in blockchain infrastructure to assist subtle monetary merchandise. These groundbreaking developments are laying the groundwork for a globally interconnected and environment friendly monetary system.

So, whereas shifting by way of this altering digital panorama, we should acknowledge that DEXs kind a foundation for a broader shift in the direction of a decentralised democratised world finance sector. They reveal how highly effective blockchain could be in altering our serious about financial operations and even energy relations globally.

Steadily Requested Questions

What’s a DEX?

A DEX, or decentralized change, is a platform that facilitates direct peer-to-peer transactions between cryptocurrency merchants with out the necessity for a central middleman. It operates on blockchain expertise and permits customers to swap tokens securely and anonymously.

What are the advantages of utilizing DEXs?

DEXs supply a number of benefits, together with non-custodial buying and selling, which implies customers retain management of their non-public keys, enhanced privateness, decrease transaction prices in comparison with conventional exchanges, and early entry to new tokens. Moreover, they function 24/7 with out downtime and supply accessibility to areas with restricted banking infrastructure.

What are some challenges related to DEXs?

Regardless of their advantages, DEXs face challenges resembling regulatory uncertainty, technical complexities, liquidity points, and safety issues. Regulatory compliance, consumer interface usability, and scalability are areas the place DEXs want enchancment to realize broader acceptance and value.

How do DEXs differ from centralized exchanges (CEXs)?

DEXs function with out a government, permitting customers to commerce immediately with one another. In distinction, CEXs depend on a central middleman to facilitate transactions and infrequently require customers to relinquish management of their funds by depositing them onto the change.

What are some outstanding DEX platforms?

A number of the most well-known DEX platforms embody Uniswap, PancakeSwap, SushiSwap, Raydium, Jupiter Trade, and Osmosis. Every of those platforms operates on totally different blockchain ecosystems and gives distinctive options to customers.