Staking and mining are the cornerstones of the cryptocurrency ecosystem, taking part in a pivotal function in community safety and investor engagement. By taking part in staking, people contribute to the robustness of blockchain networks and unlock alternatives for passive earnings. Staking has a number of advantages:

Fueling Crypto Financial Safety

At its core, staking entails locking up a specific amount of cryptocurrency to help the operations of a blockchain community. This course of is integral to Proof-of-Stake (PoS) blockchains, the place validators are chosen to verify transactions primarily based on the quantity of cryptocurrency they stake. This mechanism secures the community and aligns individuals' pursuits with the blockchain's well being and stability.

Incomes Passive Earnings

Past enhancing community safety, staking affords a compelling monetary incentive: the chance to earn passive earnings. By staking their belongings, buyers obtain rewards, usually within the type of further cryptocurrency tokens. This earnings technology appeals to novice and seasoned buyers looking for to maximise returns with out partaking in lively buying and selling.

Bootstrapping New Initiatives by way of Restaking

A latest innovation within the staking panorama is "restaking," which allows staked belongings to be utilized throughout a number of protocols. This strategy permits new initiatives to leverage the safety and capital of established networks, successfully bootstrapping their growth. As an illustration, platforms like EigenLayer facilitate restaking by permitting customers to stake their ETH or liquid staking tokens and lengthen crypto-economic safety to different purposes on the community, incomes additional advantages.

Whereas restaking presents alternatives for enhanced yields and community help, it additionally introduces complexities and dangers that buyers ought to rigorously think about.

As we strategy 2025, staking in decentralized finance continues to evolve, providing many choices for buyers. This text goals to information readers via the highest DeFi staking platforms.

What’s DeFi Staking?

DeFi staking entails locking cryptocurrency belongings into a wise contract to help a blockchain community's operations, notably these using a Proof-of-Stake (PoS) consensus mechanism. In PoS networks, validators are chosen to verify transactions and create new blocks primarily based on the quantity of cryptocurrency they stake. Conventional staking sometimes requires organising a full node and assembly the community's minimal staking necessities, enabling individuals to validate transactions and take part in community consensus to earn rewards.

Key Ideas in DeFi Staking

- Sensible Contracts and Staking Contracts: Sensible contracts are self-executing agreements coded on the blockchain, making certain that staking processes are automated, clear, and safe. Once you stake your tokens, you basically develop into a validator (or delegator) for the community, serving to to take care of its safety and stability. In return on your contribution, you obtain rewards within the type of new tokens or a share of transaction charges.

- Staking Rewards: Staking rewards sometimes embrace newly minted tokens and a share of transaction charges, incentivizing individuals to contribute to community safety and operations.

- Slashing: To keep up community integrity, PoS networks implement slashing, a penalty mechanism that reduces a validator's staked funds in the event that they interact in malicious actions or fail to carry out their duties. This mechanism discourages misconduct.

DeFi Staking vs. Centralized Staking

When evaluating decentralized staking to centralized staking companies, a number of key elements emerge:

- Possession: DeFi staking permits customers to retain precise possession of their belongings as they preserve management over their personal keys. In distinction, centralized staking requires customers to entrust their belongings to a 3rd social gathering, successfully relinquishing direct management.

- Transparency: DeFi platforms function on open-source good contracts, providing clear staking processes and reward distributions. Centralized platforms might lack this transparency, making it tough for customers to confirm how rewards are calculated and distributed.

- Safety and Management: DeFi staking provides customers better management over their belongings, decreasing reliance on intermediaries and mitigating counterparty threat. Centralized staking entails entrusting belongings to a platform, which can pose safety dangers if compromised.

- Mechanism: In DeFi staking, customers delegate their stake to a community of permissionless validators, taking part immediately within the community's consensus mechanism. Centralized staking platforms pool person funds and stake them utilizing the platform's chosen validators, usually with out disclosing the specifics of the method.

- Studying Curve: DeFi staking might be advanced, requiring customers to navigate varied platforms and handle personal keys, which can be daunting for novices. Centralized platforms provide a extra user-friendly, web2-like expertise, simplifying the staking course of on the expense of decentralization.

Conclusion

Selecting between DeFi and centralized staking platforms depends upon particular person preferences, notably relating to management, transparency, and ease of use. Within the following part, we’ll discover rising DeFi staking platforms poised to make an affect in 2025, offering insights that can assist you make knowledgeable choices on this evolving panorama.

Our High Picks

Right here's a complete overview of the DeFi staking protocols we’re about to debate, highlighting their key options, related tokens, and present annual proportion charges (APRs) or annual proportion yields (APYs):

| Protocol | Class | Token | APR/APY | Further Data |

|---|---|---|---|---|

| Lido | Liquid Staking | stETH | 3.0% APR | Lido permits customers to stake Ethereum (ETH) and obtain stETH, a liquid staking token that accrues staking rewards over time. |

| Pendle | Yield Tokenization | USDe | 28.03% APY | Pendle allows customers to tokenize and commerce future yield, providing alternatives to optimize returns on varied DeFi belongings. |

| EigenLayer | Restaking | LST tokens | Varies | EigenLayer permits ETH stakers to "restake" their belongings, offering safety to a number of companies and incomes further rewards; precise APR varies primarily based on companies and participation. |

| EtherFi | Liquid Restaking | ETH | 4.3% | EtherFi affords non-custodial liquid staking for ETH, permitting customers to take care of management over their keys whereas incomes staking rewards.

|

| Ethena | Stablecoin | sUSDe | 27% APY | Ethena supplies a crypto-native artificial greenback (USDe) and affords staking alternatives with aggressive yields. |

| Jito | Liquid Staking | JitoSOL | 9% APY | Jito affords liquid staking for Solana (SOL), offering customers with JitoSOL tokens that accrue staking rewards and might be utilized inside the Solana ecosystem. |

| Babylon | Bitcoin Staking | BTC | 3-5% | Babylon allows Bitcoin holders to stake their BTC immediately, incomes rewards by contributing to the safety of Proof-of-Stake blockchains. |

Notice: APR (Annual Share Price) represents the yearly curiosity earned with out accounting for compounding, whereas APY (Annual Share Yield) consists of the results of compounding. Charges are topic to alter primarily based on market situations and protocol specifics.

Lido Finance

Lido Finance is a number one DeFi protocol specializing in liquid staking companies. It allows customers to stake their digital belongings throughout a number of blockchain networks whereas sustaining liquidity, successfully addressing the normal staking limitations, similar to asset lock-up and excessive entry boundaries. By issuing liquid staking tokens (LSTs) like stETH for Ethereum, Lido permits customers to earn staking rewards and concurrently make the most of their belongings inside the broader DeFi ecosystem.

Main Options of Lido Finance

- Liquid Staking: Lido's core service permits customers to stake belongings with out locking them up. It supplies staked token derivatives (e.g., stETH) that may be freely transferred, traded, or utilized in different DeFi protocols.

- Decentralized Governance: Managed by the Lido Decentralized Autonomous Group (DAO), Lido ensures that choices relating to protocol parameters, node operator choice, and charge buildings are made collectively by LDO token holders.

- Safety Measures: Lido employs skilled node operators and conducts common audits to take care of the integrity and safety of the staking course of and reduce dangers, similar to slashing penalties.

- DeFi Integration: Lido's liquid staking tokens are broadly accepted throughout varied DeFi platforms, enabling customers to interact in actions like lending, borrowing, and yield farming whereas nonetheless incomes staking rewards.

Supported Cash for Staking

Lido helps staking for a number of cryptocurrencies throughout totally different networks, together with:

- Ethereum (ETH): Stake ETH and obtain stETH.

- Polygon (MATIC): Stake MATIC and obtain stMATIC.

- Solana (SOL): Stake SOL and obtain stSOL.

- Polkadot (DOT): Stake DOT and obtain stDOT.

- Kusama (KSM): Stake KSM and obtain stKSM.

LDO Token and Its Utility

Lido's native token, LDO, serves a number of key features inside the ecosystem:

- Governance: LDO holders take part within the Lido DAO, voting on important choices similar to protocol upgrades, charge buildings, and the choice of node operators.

- Incentives: LDO tokens could also be used to incentivize liquidity suppliers and customers who contribute to the expansion and stability of the Lido protocol.

Abstract and Latest Milestones

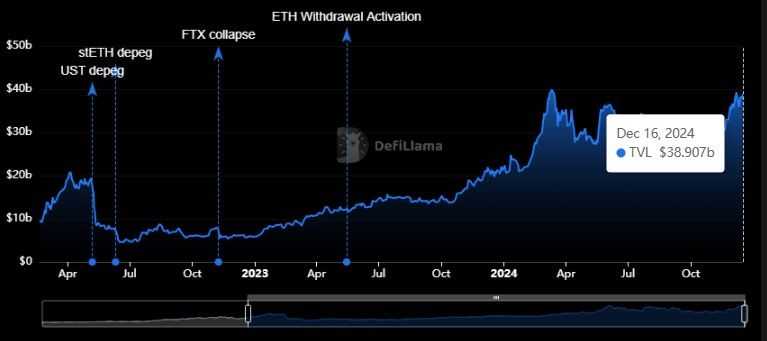

Lido Finance has solidified its place as a dominant participant within the DeFi area. As of December 2024, its Whole Worth Locked (TVL) was nearing an all-time excessive of $40 billion.

This development displays elevated confidence in Lido's liquid staking options and their integration inside the DeFi ecosystem. Moreover, the latest launch of a group staking module has enhanced decentralization by permitting permissionless node operator participation, additional strengthening the community's safety and resilience.

Lido's flagship staking technique entails offering customers with liquid staking tokens that may be utilized throughout varied DeFi platforms. This technique affords flexibility and the potential for compounded returns. Because the DeFi panorama continues to evolve, Lido stays on the forefront, providing revolutionary options that cater to the various wants of cryptocurrency buyers.

For deeper insights into Lido, examine Coin Bureau’s Lido Assessment.

Pendle Finance

Pendle Finance is a decentralized finance (DeFi) protocol that allows customers to tokenize and commerce future yields of yield-bearing belongings. By separating an asset's principal and yield parts, Pendle permits superior yield administration methods, together with fixing yields, speculating on future yield actions, and unlocking liquidity from staked belongings. This revolutionary strategy brings conventional finance ideas, similar to rate of interest derivatives, into the DeFi area, providing customers better management and suppleness over their investments.

Main Options of Pendle Finance

- Yield Tokenization: Pendle permits customers to wrap yield-bearing tokens into Standardized Yield (SY) tokens, that are then cut up into Principal Tokens (PT) and Yield Tokens (YT). This separation allows impartial buying and selling of the principal and future yield parts, facilitating methods like locking in fastened yields or speculating on yield fluctuations. Discuss with our Information on Utilizing Pendle Finance for the fundamentals of Yield Tokenization.

- Pendle Automated Market Maker (AMM): Designed particularly for time-decaying belongings like YT, Pendle's AMM affords optimized pricing and minimal slippage. It helps concentrated liquidity and a dynamic charge construction, enhancing capital effectivity and decreasing impermanent loss for liquidity suppliers.

- vePENDLE Governance: Pendle employs a vote-escrowed token mannequin the place customers can lock PENDLE tokens to obtain vePENDLE. This mechanism grants governance rights, permitting holders to take part in protocol choices, direct incentives to particular liquidity swimming pools, and earn a share of protocol income.

Supported Belongings for Staking

Pendle helps a wide range of yield-bearing belongings throughout a number of blockchain networks, together with:

- Ethereum (ETH): Pendle permits the tokenization and buying and selling of belongings like stETH (Lido's Liquid Staking Token).

- Stablecoins: Tokens similar to USDC and DAI from lending protocols like Aave or Compound might be utilized inside Pendle's ecosystem.

- Different Yield-Bearing Tokens: Belongings generated by varied DeFi protocols can be built-in into Pendle's platform.

PENDLE Token and Its Utility

The PENDLE token is the native utility and governance token inside the Pendle ecosystem. Its major features embrace:

- Governance: PENDLE holders can lock their tokens to obtain vePENDLE, granting them voting rights to take part in protocol governance choices, similar to proposing and voting on upgrades, charge buildings, and different key parameters.

- Incentives: PENDLE tokens incentivize liquidity suppliers and customers, contributing to the platform's development and stability. Moreover, vePENDLE holders can direct incentives to particular liquidity swimming pools, boosting their rewards.

- Income Sharing: vePENDLE holders are entitled to a share of the protocol's income, aligning the group's pursuits with the platform's success.

Abstract and Latest Milestones

Pendle Finance has established itself as a pioneering power within the DeFi area by introducing yield tokenization and a devoted AMM for yield buying and selling. As of December 2024, Pendle's Whole Worth Locked (TVL) has surpassed $5 billion (knowledge by DefiLlama), reflecting rising adoption and confidence in its revolutionary options.

The platform's flagship technique permits customers to lock in fastened yields or speculate on future yield actions by buying and selling Yield Tokens. This flexibility allows buyers to tailor their yield publicity in line with market situations and private threat preferences.

Pendle's integration with a number of DeFi protocols and its enlargement throughout varied blockchain networks, together with Ethereum and Arbitrum, additional solidified its place as a flexible and beneficial device for yield administration within the decentralized finance ecosystem.

Take a look at Pendle Finance Assessment on the Coin Bureau.

EigenLayer

EigenLayer is an revolutionary Ethereum-based protocol that introduces the idea of "restaking," permitting customers to reallocate their staked Ether (ETH) or Liquid Staking Tokens (LSTs) to reinforce the safety and performance of further companies constructed on the Ethereum community. By enabling the reuse of staked belongings, EigenLayer facilitates a shared safety mannequin, selling the event of appchains and rollups with out the necessity for impartial validator units.

Main Options of EigenLayer

- Restaking Mechanism: EigenLayer permits ETH stakers and LST holders to choose into validating new software program modules, often called Actively Validated Companies (AVSs), by restaking their belongings. This course of extends Ethereum's safety to a broader vary of purposes, together with knowledge availability layers, oracle networks, and consensus protocols.

- Permissionless Token Help: EigenLayer has launched permissionless token help, enabling any ERC-20 token to be added as a restakable asset. This enlargement permits a various array of tokens to contribute to the safety of decentralized networks, fostering cross-ecosystem partnerships and enhancing the utility of assorted tokens.

- EigenDA (Information Availability Layer): EigenLayer affords EigenDA, a low-cost knowledge availability resolution for rollups and different layer-2 options. By making certain knowledge is instantly accessible and safe, EigenDA enhances scalability and effectivity for Ethereum-based purposes.

- Governance and Flexibility: EigenLayer's structure permits AVSs to customise their safety parameters, together with choosing particular tokens for restaking and defining slashing situations. This flexibility allows companies to tailor safety measures to their distinctive necessities, selling a extra resilient and adaptable ecosystem.

Supported Belongings for Restaking

EigenLayer helps a wide range of belongings for restaking, together with:

- Ether (ETH): Customers can restake their natively staked ETH to take part in securing further companies.

- Liquid Staking Tokens (LSTs): Tokens similar to stETH, rETH, and others might be restaked via EigenLayer, permitting holders to earn further rewards.

- ERC-20 Tokens: With permissionless token help, any ERC-20 token can now be added as a restakable asset, broadening the scope of participation and safety inside the ecosystem.

EIGEN Token and Its Utility

EigenLayer has launched the EIGEN token, which is described as a common intersubjective work token. It’s designed to assist protocols that use EigenLayer’s AVS fork in excessive instances of liveness assaults or safety breaches with out disrupting the blockchain’s modular stack. EIGEN and restaked ETH improve the crypto financial safety ensures that may be secured via EigenLayer.

Abstract and Latest Milestones

EigenLayer has quickly gained traction inside the DeFi area, with its Whole Worth Locked (TVL) reaching roughly $20.10 billion as of December 2024 (by way of DefiLlama). This development underscores the protocol's attraction in enabling customers to maximise the utility of their staked belongings via restaking.

As EigenLayer continues to evolve, it stays on the forefront of enhancing Ethereum's safety and scalability via its pioneering restaking protocol, providing customers and builders new alternatives to interact with and construct upon the Ethereum community.

Take a look at the EigenLayer Assessment on the Coin Bureau.

Ether.fi

Ether.fi is a decentralized, non-custodial liquid staking protocol designed to empower Ethereum (ETH) holders by permitting them to stake their belongings whereas retaining management over their personal keys. By issuing liquid staking tokens (LSTs) often called eETH, Ether.fi allows customers to earn staking rewards and take part within the broader DeFi ecosystem with out the normal constraints related to staking. This strategy enhances the Ethereum community's safety, decentralization, and person autonomy.

Main Options of Ether.fi

- Non-Custodial Staking: In contrast to many staking companies, Ether.fi ensures that customers preserve management over their personal keys all through the staking course of, considerably decreasing custodial dangers.

- Liquid Staking with eETH: When customers stake ETH, they obtain eETH, a liquid token representing their staked belongings. This token can be utilized throughout varied DeFi platforms for lending, borrowing, and yield farming whereas accruing staking rewards.

- Integration with EigenLayer: Ether.fi collaborates with EigenLayer to supply restaking capabilities, permitting customers to earn further rewards by securing a number of decentralized purposes (DApp) concurrently. This integration enhances yield potential and contributes to the general safety of the Ethereum ecosystem.

- Operation Solo Staker: Ether.fi promotes decentralization by enabling people to function their very own validator nodes via the Operation Solo Staker initiative. This program reduces entry boundaries and encourages a extra distributed community of validators, strengthening Ethereum's resilience.

ETHFI Token and Its Utility

Ether.fi's native token, ETHFI, serves a number of features inside the platform:

- Governance: ETHFI holders have the fitting to take part within the protocol's governance, influencing choices associated to treasury administration, token utility, and ecosystem growth.

- Income Sharing: A portion of the protocol's month-to-month income is allotted for repurchasing ETHFI tokens, probably enhancing their worth and benefiting token holders.

- Staking Incentives: Customers can stake their ETHFI tokens to earn further rewards, additional incentivizing participation and alignment with the platform's development.

Abstract and Latest Milestones

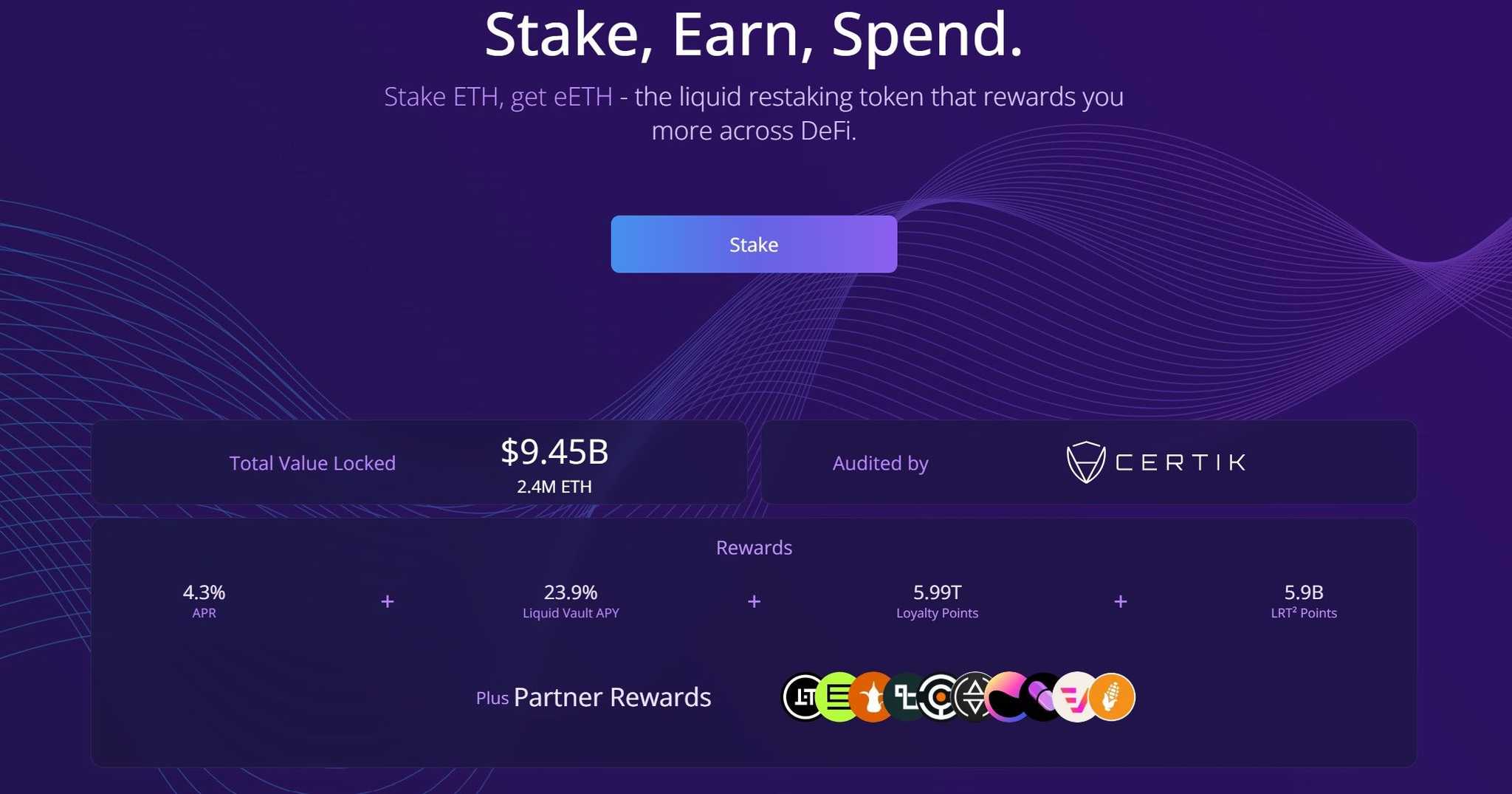

Ether.fi has quickly emerged as a major participant within the DeFi area, with its Whole Worth Locked (TVL) exceeding $9.54 billion in December 2024 (by way of DefiLlama), positioning it as one the main restaking protocols within the Ethereum ecosystem.

Ethena Finance

Ethena Finance is a decentralized finance (DeFi) protocol constructed on Ethereum, providing a crypto-native artificial greenback often called USDe. In contrast to conventional stablecoins counting on fiat reserves, USDe maintains its peg via delta-hedging methods and crypto collateral, primarily Ethereum (ETH). This design supplies a censorship-resistant and scalable resolution for digital greenback illustration, aiming to reinforce stability and accessibility inside the DeFi ecosystem.

Main Options of Ethena Finance

- Artificial Greenback (USDe): USDe is a totally backed artificial greenback collateralized by crypto belongings and managed via delta hedging. This strategy ensures stability with out dependence on conventional banking methods, providing a resilient different within the DeFi area.

- Web Bond (sUSDe): By staking USDe, customers obtain sUSDe, a yield-bearing asset accumulating protocol-generated income over time. This mechanism permits customers to earn passive earnings whereas sustaining publicity to a secure asset.

- Delta-Hedging Mechanism: Ethena employs delta-hedging, using quick positions in derivatives markets to offset worth fluctuations in collateral belongings. This technique maintains USDe's peg to the greenback, making certain stability regardless of market volatility.

- Non-Custodial and Decentralized: Ethena operates with out counting on conventional monetary infrastructure, offering customers full management over their belongings and selling a decentralized monetary ecosystem.

Supported Belongings for Staking

Ethena primarily helps Ethereum (ETH) as collateral for minting USDe. Customers can deposit ETH into the protocol to generate USDe, which might then be staked to obtain sUSDe, enabling participation within the protocol's yield-generating mechanisms.

ENA Token and Its Utility

Ethena's native governance token, ENA, serves a number of key features inside the ecosystem:

- Governance: ENA holders can take part in protocol governance, influencing choices associated to system upgrades, parameter changes, and general strategic course.

- Staking Rewards: By staking ENA, customers can obtain sENA, which can accrue further rewards and affords increased reward multipliers inside the protocol's incentive buildings.

Abstract and Latest Milestones

Ethena Finance has quickly gained traction inside the DeFi panorama. As of December 2024, its Whole Worth Locked (TVL) exceeded $5.9 billion (by way of DefiLlama). This development displays growing confidence in Ethena's artificial greenback resolution and revolutionary decentralized finance strategy.

A flagship function of Ethena is its Web Bond (sUSDe), which permits customers to earn yield by staking USDe. This instrument combines returns from liquid-staked Ethereum and derivatives funding arbitrage, offering a secure and rewarding asset for DeFi individuals.

Ethena's distinctive strategy to creating an artificial greenback, free from conventional monetary dependencies, positions it as a major participant within the evolving DeFi ecosystem, providing customers revolutionary instruments for stability and yield technology.

Take a look at the Ethena Finance Assessment on the Coin Bureau.

Jito

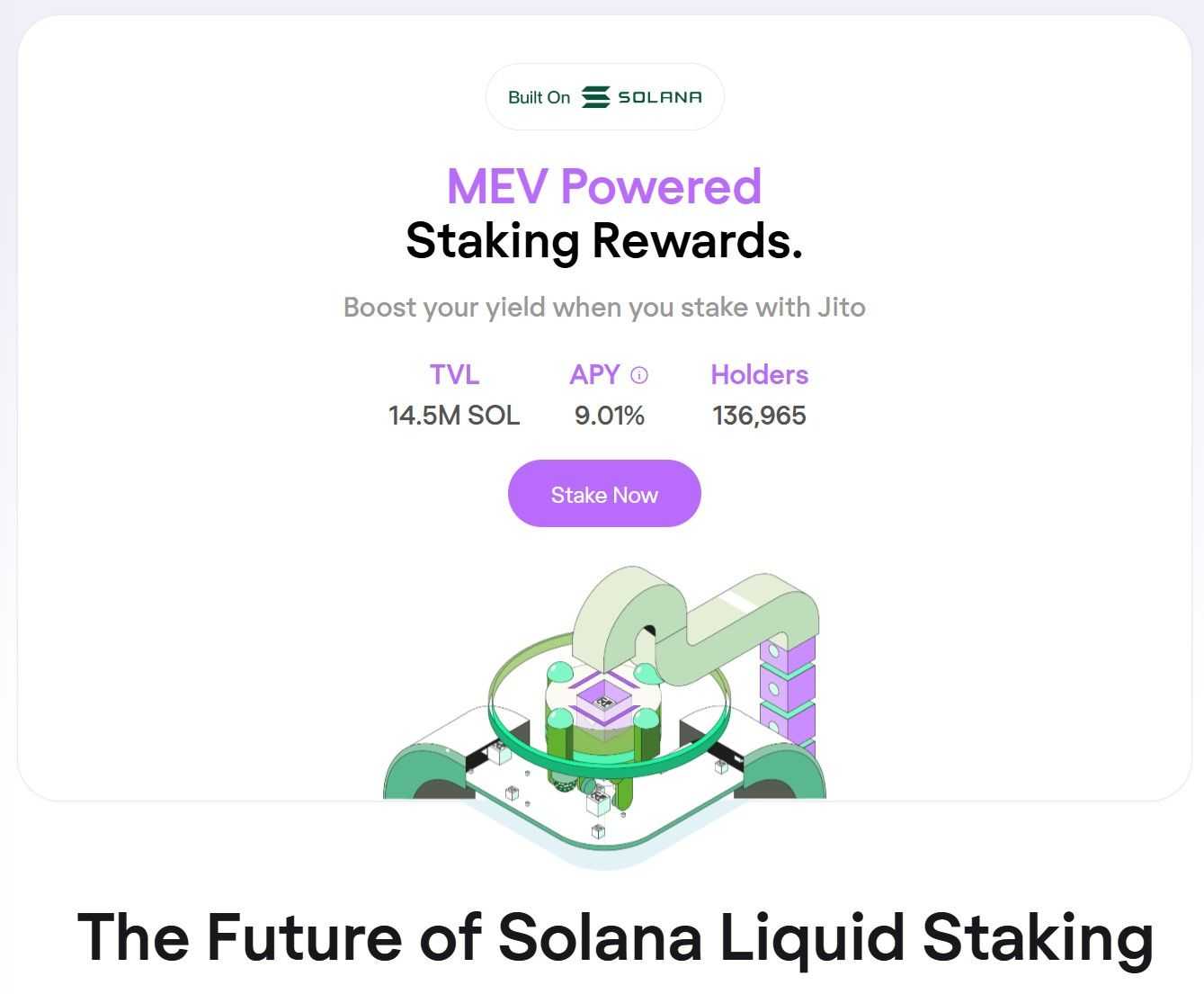

Jito is a liquid staking protocol working on the Solana blockchain, specializing in Maximal Extractable Worth (MEV) methods. By permitting customers to stake their Solana (SOL) tokens in trade for JitoSOL—a liquid staking token, —Jito allows individuals to earn staking rewards augmented by MEV income. This strategy not solely maximizes returns but additionally contributes to the safety and effectivity of the Solana community.

Main Options of Jito

- MEV-Powered Staking Rewards: Jito integrates MEV methods to reinforce staking rewards. By capturing and redistributing MEV earnings, JitoSOL holders profit from increased yields than conventional staking strategies.

- Liquid Staking with JitoSOL: Upon staking SOL, customers obtain JitoSOL tokens representing their staked belongings. These tokens preserve liquidity, permitting customers to interact in varied DeFi actions whereas nonetheless incomes staking rewards.

- Non-Custodial Platform: Jito operates as a non-custodial platform, making certain customers retain management over their belongings. This design enhances safety and aligns with the decentralized ethos of blockchain know-how.

- Enhanced Community Efficiency: Jito contributes to improved community efficiency and lowered spam on the Solana blockchain by solely staking with validators operating optimized software program.

Supported Belongings for Staking

Jito primarily helps the staking of Solana (SOL) tokens. Customers can stake any quantity of SOL and obtain JitoSOL in return, enabling them to earn rewards whereas sustaining liquidity.

JTO Token and Its Utility

Jito has launched its native token, JTO, which serves a number of features inside the ecosystem:

- Governance: JTO holders can take part in protocol governance, influencing choices associated to system upgrades, parameter changes, and general strategic course.

- Staking Rewards: By staking JTO, customers can obtain further rewards, additional incentivizing participation and alignment with the platform's development.

Abstract and Latest Milestones

Jito has skilled important development inside the Solana ecosystem. In accordance with their web site, over 14.5 million SOL tokens have been staked via Jito in December 2024, with roughly 204 Solana validators taking part. The platform affords a staking Annual Share Yield (APY) exceeding 8%, reflecting its aggressive benefit within the liquid staking market.

A flagship function of Jito is its integration of MEV methods to spice up staking rewards. By capturing and redistributing MEV earnings, Jito enhances yields for its customers whereas contributing to the general well being and effectivity of the Solana community.

Jito's dedication to open-source growth is clear via the discharge of Jito-Solana, the primary third-party, MEV-boosted validator consumer for Solana. This initiative underscores Jito's dedication to transparency and group collaboration in enhancing blockchain efficiency.

Babylon

Babylon is a pioneering protocol introducing Bitcoin staking to the decentralized finance (DeFi) ecosystem. By enabling Bitcoin (BTC) holders to stake their belongings immediately, Babylon permits customers to earn yields whereas contributing to the safety of Proof-of-Stake (PoS) blockchains. This revolutionary strategy eliminates the necessity for bridging, wrapping, or transferring BTC to third-party custodians, sustaining the inherent safety and decentralization of Bitcoin.

Main Options of Babylon

- Self-Custodial Staking: Babylon's protocol permits BTC holders to stake their belongings with out relinquishing management to exterior events. Customers lock their Bitcoin in a self-custodial method, making certain full possession and safety all through the staking course of.

- Integration with PoS Chains: By staking BTC, customers can take part in securing varied PoS blockchains, together with app chains and decentralized purposes (DApp). This integration enhances these networks' safety and rewards stakers in return.

- Quick Unbonding: Babylon employs superior Bitcoin timestamping protocols to allow speedy unbonding of staked BTC. This function ensures that customers can withdraw their belongings promptly with out counting on social consensus, sustaining liquidity and suppleness.

- Scalable Restaking: The protocol's modular design helps scalable restaking, permitting a single BTC stake to safe a number of PoS chains concurrently. This functionality maximizes yield potential and contributes to the broader safety of the DeFi ecosystem.

Supported Belongings for Staking

Babylon focuses solely on Bitcoin (BTC) for staking functions. By leveraging BTC's substantial market capitalization, the protocol enhances the safety of PoS networks with out requiring the switch or conversion of belongings into different kinds.

Abstract and Latest Milestones

Babylon has achieved important milestones, together with the profitable launch of its mainnet and the initiation of a number of staking caps. Notably, the protocol's Whole Worth Locked (TVL) surpassed $5.7 billion in December 2024 (by way of DefiLlama), reflecting robust adoption and confidence inside the group.

A flagship function of Babylon is its self-custodial Bitcoin staking mechanism, which permits customers to earn yields with out compromising asset safety. This strategy represents a major development in integrating Bitcoin into the DeFi panorama, offering BTC holders with new alternatives to take part in and profit from the expansion of decentralized finance.

In abstract, Babylon's revolutionary protocol unlocks the potential of Bitcoin inside the DeFi ecosystem, enabling safe, self-custodial staking that enhances the safety of PoS blockchains whereas providing engaging yields to BTC holders.

Advantages and Dangers of DeFi Staking

Listed here are the advantages of DeFi staking:

- Potential for Excessive Rewards By way of Yield Farming: DeFi staking usually supplies profitable rewards, particularly when mixed with yield farming methods.

- Enhanced Management Over Funds: Customers retain full possession of their funds via decentralized wallets, eliminating reliance on third-party custodians.

- Participation in Governance: Staking governance tokens enable customers to vote on protocol choices and affect the platform's future growth.

- Contribution to Community Safety and Operations: By staking, customers assist safe blockchain networks and preserve decentralized operations.

- Liquidity Choices with Liquid Staking: Liquid staking tokens allow customers to entry staked capital whereas persevering with to earn rewards.

- Flexibility in Yield Methods: DeFi staking supplies alternatives for inventive methods like compounding returns via restaking or leveraging staking tokens in different DeFi actions.

- Entry to Rising Ecosystems: Staking helps innovation by serving to bootstrap new protocols and ecosystems.

Dangers of DeFi Staking:

- Sensible Contract Vulnerabilities: Malicious exploits or bugs in good contracts can result in the lack of staked belongings.

- Impermanent Loss in Liquidity Swimming pools: Modifications in token costs might scale back the worth of belongings in liquidity swimming pools, affecting general returns.

- Fluctuations in Token Costs: The unstable nature of cryptocurrencies can affect the worth of staked rewards.

- Slashing Penalties: In some networks, improper validator habits can result in penalties that scale back the quantity of staked funds.

- Protocol-Particular Dangers: Rising platforms might lack ample audits or expertise, growing the danger of operational failures.

- Lack of Liquidity: Staked belongings could also be locked for a particular length, limiting instant entry to funds.

Methods to Mitigate the Dangers of DeFi Staking

- Diversify Staking Throughout A number of Platforms: Unfold your staked belongings throughout totally different protocols to cut back the affect of a single platform's failure.

- Analysis Platform Audits and Safety Historical past: Select platforms with a confirmed safety monitor document and common third-party audits to make sure your funds are protected.

- Keep Up to date on Tokenomics and Protocol Modifications: Monitor token provide adjustments, reward mechanisms, and governance choices that would have an effect on your staking technique.

- Leverage Liquid Staking Choices: Use protocols providing liquid staking tokens to take care of liquidity and suppleness whereas incomes rewards.

- Set Threat Limits: To handle publicity, outline the utmost proportion of your portfolio allotted to staking and cling to it.

- Use Respected Wallets and {Hardware} Safety: Retailer your staked belongings in safe wallets to guard in opposition to potential hacks or phishing assaults.

How one can Begin DeFi Staking: A Step-by-Step Information

DeFi staking means that you can earn rewards by supporting blockchain networks, and whereas particular steps might differ relying on the protocol, the next supplies a generalized information:

Step 1: Select a Staking Protocol

- Analysis totally different staking platforms to determine one which aligns together with your objectives, similar to liquid staking (e.g., Lido Finance or Jito) or yield tokenization (e.g., Pendle Finance).

- Take into account elements like supported belongings, safety measures, and potential rewards.

Step 2: Set Up a Pockets

- Select a non-custodial pockets suitable with the protocol you propose to make use of, similar to MetaMask for Ethereum-based platforms or Phantom for Solana.

- Safe your pockets by backing up your seed phrase and enabling two-factor authentication.

- Discuss with Coin Bureau’s choice of Finest DeFi Wallets for assist.

Step 3: Purchase Tokens

- By way of a cryptocurrency trade, you should buy the tokens required for staking (e.g., ETH for Lido, SOL for Jito).

- Switch the tokens to your pockets.

- Use our Finest Crypto Staking Cash choice that can assist you discover the best coin.

Step 4: Hook up with the Staking Protocol

- Go to the protocol's official web site (e.g., lido.fi, jito.community).

- Join your pockets to the platform by authorizing the connection when prompted.

Step 5: Stake Your Belongings

- Choose the token you wish to stake and specify the quantity.

- Verify the staking transaction, making certain you’ve got sufficient funds to cowl transaction charges.

- In liquid staking protocols, you’ll obtain a by-product token (e.g., stETH or JitoSOL), which you should utilize inside the DeFi ecosystem.

Step 6: Monitor and Handle Your Stake

- Monitor your staking rewards and portfolio efficiency frequently via dashboards or the protocol’s interface.

- Take into account leveraging options like yield tokenization for added methods for protocols like Pendle.

Tricks to Maximize Returns in DeFi Staking

- Diversify Your Staking Portfolio: Unfold your investments throughout a number of protocols (e.g., Lido for ETH, Jito for SOL) to attenuate dangers and optimize rewards.

- Reinvest Rewards: Use earned rewards to compound returns by restaking or taking part in yield farming alternatives.

- Keep Knowledgeable: Comply with updates on protocol governance, tokenomics, and community upgrades that will have an effect on staking rewards or safety.

- Optimize Fuel Charges: Time your transactions throughout low community exercise to cut back transaction prices.

- Discover Superior Methods: Take into account protocols like Pendle Finance to lock in fastened yields or speculate on future yields utilizing tokenized belongings.

- Use Liquid Staking Tokens in DeFi: To stack further returns on high of staking rewards, deploy by-product tokens (e.g., stETH, JitoSOL) in lending, borrowing, or yield farming.

These steps and suggestions will assist you begin your journey in DeFi staking successfully and unlock the potential for producing passive earnings within the decentralized finance ecosystem. We’ve a devoted Information to Staking Crypto in DeFi for readers searching for deeper insights.

Closing Ideas

DeFi staking has advanced right into a cornerstone of the cryptocurrency ecosystem, providing alternatives to earn rewards whereas contributing to community safety and decentralization. This information explored among the high platforms for 2025, together with Lido Finance, Pendle Finance, EigenLayer, and Ether.fi, Ethena, Jito, and Babylon. Every protocol supplies primary staking companies however distinguishes itself with distinctive options like liquid staking, yield tokenization, restaking, or Bitcoin staking.

The important thing to unlocking actual revenue is knowing and successfully leveraging these standout options. Whether or not maximizing rewards via MEV-powered staking with Jito, partaking in restaking on EigenLayer, or exploring revolutionary methods with Pendle, success in DeFi staking requires knowledgeable choices and strategic planning.

Because the crypto market enters one other bullish part, 2025 holds immense promise for decentralized finance. With continued innovation and rising adoption, DeFi staking is poised to supply profitable alternatives for these able to navigate its dynamic panorama.

Regularly Requested Questions

What’s the Distinction Between Staking and Yield Farming?

Staking entails locking cryptocurrency to help a blockchain community and earn rewards, usually via Proof-of-Stake mechanisms. Yield farming, alternatively, focuses on offering liquidity to decentralized exchanges or lending protocols to earn rewards, sometimes within the type of further tokens. Whereas staking prioritizes community safety, yield farming emphasizes maximizing returns via strategic allocation throughout a number of swimming pools.

Can I Unstake My Belongings Anytime?

Unstaking insurance policies differ by platform. Some protocols enable instant unstaking (particularly with liquid staking), whereas others impose lock-up intervals, requiring you to attend earlier than accessing your funds. At all times examine the particular unstaking phrases of the platform, together with any charges or penalties, to keep away from surprises.

How Do Staking Rewards Fluctuate Between Platforms?

Staking rewards rely on elements just like the community’s reward construction, inflation charge, and staking participation. Protocols providing further options, similar to MEV optimization or yield tokenization, might present increased rewards. Rewards additionally differ primarily based on market situations and the platform’s degree of decentralization.

Is DeFi Staking Secure for Rookies?

DeFi staking might be protected for novices in the event that they select respected platforms and observe greatest practices, similar to utilizing safe wallets and beginning with small investments. Nonetheless, dangers like good contract vulnerabilities, slashing penalties, and market volatility require warning and ongoing analysis.

Is DeFi Staking Wroth It?

DeFi staking might be value it for customers looking for passive earnings whereas contributing to blockchain safety. Nonetheless, its worth depends upon elements like reward charges, token volatility, and the person’s threat tolerance. Correct analysis and diversification are key to maximizing its advantages.

Which is The Finest Crypto to Stake?

The perfect crypto to stake depends upon your objectives. Ethereum (ETH) is well-liked for its community safety and utility, whereas Solana (SOL) affords aggressive yields. Stablecoins like USDe present predictable returns. Take into account the platform’s reliability, potential rewards, and tokenomics when selecting.