Decentralized finance (DeFi) has seen a exceptional surge over the previous few years, reshaping the way in which people have interaction with monetary companies. With this fast progress, the ecosystem has develop into saturated with a plethora of decentralized exchanges (DEXs) and liquidity swimming pools, every providing distinctive benefits and catering to completely different points of the market.

The sheer variety of DEXs in operation at present highlights the dimensions and complexity of this evolving panorama. Platforms like DeFiLlama, which tracks and categorizes DeFi tasks, at present listing over 1,300 distinctive DEXs, collectively locking in billions of {dollars} in worth. Navigating this huge community of exchanges might be daunting, particularly relating to figuring out which platforms provide probably the most favorable buying and selling situations.

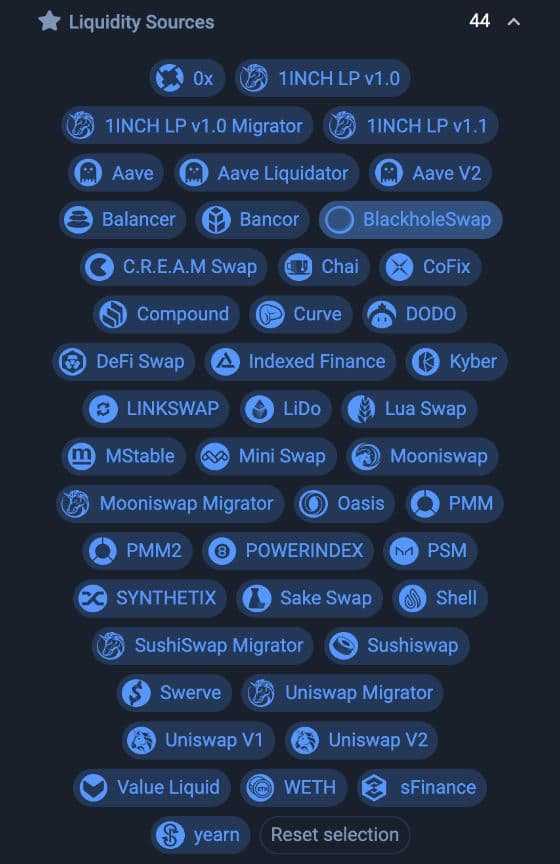

That is the place DEX aggregators like 1inch Trade come into play. By streamlining the buying and selling course of and integrating a number of liquidity sources right into a single platform, 1inch not solely simplifies the person expertise but additionally ensures that merchants can optimize their transactions by accessing the perfect costs out there throughout the DeFi ecosystem.

This 1inch Trade overview will present a complete exploration of the platform's key options, strengths and weaknesses.

1inch Trade Evaluation Abstract

1inch Trade is a DEX aggregator that enhances the DeFi buying and selling expertise by offering customers with the perfect charges throughout a number of decentralized exchanges. With options just like the Pathfinder algorithm, Fusion 2.0 improve, and the 1inch Liquidity Protocol, it provides environment friendly, cost-effective buying and selling and liquidity choices.

The Key Options of 1inch Trade Are:

- DEX Aggregation: 1inch optimizes trades by splitting orders throughout a number of decentralized exchanges, guaranteeing customers get the very best charges.

- Pathfinder Algorithm: This superior routing algorithm finds probably the most environment friendly buying and selling paths, minimizing prices and slippage for customers.

- Fusion 2.0: The newest improve considerably reduces gasoline charges and enhances buying and selling effectivity, making it cheaper for customers.

- 1inch Liquidity Protocol: Customers can present liquidity and earn rewards, with enhanced options like restrict orders and safety measures.

- Cross-Chain Integration: 1inch helps a number of blockchains, extending its attain and usefulness throughout varied networks within the DeFi ecosystem.

What’s 1inch Trade?

The 1inch trade is a decentralized trade, or DEX, aggregator. Slightly than working as an trade itself, it splits orders between different DEXs and personal liquidity suppliers to search out the very best trade charges. In its present state, 1inch helps over 389 liquidity sources from 11 blockchains and 6.7 million customers.

At 1inch Trade, connecting a web3 pockets after which swapping ERC-20 tokens at the very best charges is an easy course of. The trade will even break up orders between a number of exchanges if that’s what it takes to get the perfect charge for a complete order.

It is usually potential to create restrict orders at 1inch, earn by staking 1INCH tokens, and provide liquidity to the 1inch liquidity swimming pools.

Like so many different Ethereum-based tasks, 1inch emerged from an ETH dev convention. This time, it was on the ETHGlobal hackathon in 2019. It was based by Sergej Kunz, the CEO of 1inch, and Anton Bukov, its CTO.

In August 2020, they accomplished a Seed spherical from Binance Labs of about $2.8 million. Then, in early December 2020, they closed a a lot bigger $12 million funding spherical led by Pantera Capital. As of Dec 2, 2021, they managed to boost $175 million led by Amber Group with participation from different recognized crypto VCs equivalent to Fenbushi Capital, Alameda Analysis and different blockchain tasks equivalent to Celsius and Nexo, as reported by CoinDesk.

Initially, the founders of 1inch Trade created a separate portal for yield farming referred to as Mooniswap. It was mainly a Uniswap clone. Since December 2020, that portal has been deprecated because the 1inch Liquidity Protocol was launched. Now, the expertise of utilizing 1inch is much like any typical DEX, like Uniswap, the distinction lies beneath the hood. Not like standalone DEXs, 1-inch finds the perfect swap path by analyzing pathways throughout a number of DEXs.

The next overview will discover the options out there on the 1inch trade and clarify make an trade or present liquidity to the swimming pools. There’s rather a lot to cowl, so let’s dive in.

1inch Order Routing

1inch makes use of a proprietary API they’ve named Pathfinder, which incorporates a discovery and routing algorithm. Pathfinder finds the very best paths for any proposed token swap, splitting a swap throughout a number of exchanges and even throughout completely different market depths of the identical trade if obligatory. Moreover, with the dynamic fill mechanism, quantities within the exchanges with the unfavorable charge will get moved to those with favorable charges even when processing the transaction. Because of this, the trade charge and/or gasoline charges a person receives are higher than what they might have gotten on any single trade.

The addition of Pathfinder was the foremost a part of the improve to 1inch model 2. Pathfinder makes use of completely different' market depths' as bridges between supply and vacation spot tokens. Due to this fact, the algorithm makes use of a extra refined strategy than simply splitting a swap throughout completely different protocols. As well as, it might probably break up a part of the swap for a selected protocol between completely different' market depths' on the identical protocol, getting the person the perfect charges, additionally taking into consideration gasoline consumption.

1inch Aggregation Protocol v5

A key linchpin in 1inch's choices is the Aggregation Protocol. It permits for splitting a single transaction into a number of DEXs in the hunt for the perfect charges. Since its inception, new developments have emerged, giving it extra oomph. Probably the most important enchancment within the newest model is the substantial discount of gasoline charges.

The 1inch Router v5 introduces a number of key enhancements designed to optimize decentralized trade (DEX) transactions on the Ethereum community, considerably enhancing effectivity and lowering prices for customers. Listed here are the primary updates and options of the brand new model:

- Elevated Gasoline Effectivity for Swaps: The brand new router provides considerably extra gas-efficient swaps. Particularly, it achieves roughly 5% larger gasoline effectivity in comparison with its predecessor (Router v4) and is 10% extra environment friendly than the closest competitor within the DEX market. Which means customers can count on to save lots of on transaction charges, which is essential in high-volume buying and selling environments.

- Integration with 1inch Restrict Order Protocol v3: Router v5 has been merged with the 1inch Restrict Order Protocol v3, enhancing the general swapping effectivity and additional lowering gasoline prices. The Restrict Order Protocol has develop into a major factor of the DEX market, at present holding about 40% of the market share.

- Improved Interplay Logic: The brand new model encompasses a revamped interplay logic with the addition of pre- and post-interactions. This replace permits for extra complicated and versatile transaction buildings, doubtlessly opening up new methods for customers.

- Enhanced Good Contract Error Dealing with: An improved error processing system has been applied, together with the introduction of customized error messages. This offers customers with clearer, extra particular suggestions on why an operation could have failed, enhancing the person expertise and aiding in troubleshooting.

- Safety Audits: Prioritizing safety, the brand new router has undergone intensive audits by virtually a dozen respected entities within the trade, equivalent to Consensys, OpenZeppelin, and ABDK Consulting. This thorough auditing course of ensures that the router is strong and safe towards potential vulnerabilities.

- Vulnerability Rewards Program: Persevering with its dedication to safety, 1inch provides rewards for reporting vulnerabilities in Router v5. This incentivizes the neighborhood to assist preserve and enhance the router's safety.

Total, the 1inch Router v5 represents a big improve, specializing in cost-efficiency, safety, and person flexibility. It solidifies 1inch's place as a frontrunner within the DEX market by enhancing the buying and selling expertise and providing potential value financial savings by improved gasoline effectivity.

Restrict Order Protocol V3

The 1inch Restrict Order Protocol v3 introduces a number of important enhancements and adjustments that enhance its effectivity and suppleness:

- Unified Order Construction: The brand new model integrates conventional restrict orders with high-performance RFQ (Request for Quote) orders right into a single, extra environment friendly protocol. This replace makes the orders as much as 14% extra gas-efficient for upgraded restrict orders and three% extra gas-efficient for RFQ-like orders.

- Enhanced Interplay Logic: The protocol now helps complicated interactions throughout the order construction, together with concatenated sequences of maker and taker asset information, and pre- and post-interactions. This permits for extra refined order configurations and might deal with a number of interactions effectively.

- Superior Error Dealing with and Safety Options: The replace introduces a extra strong error dealing with mechanism, enhancing the safety and person expertise by offering clearer suggestions on transaction failures. The system now contains higher assist for permit2, permitting trades with out token approval if the identical token was beforehand permitted in different DeFi tasks, thus streamlining the buying and selling course of and enhancing safety.

- Versatile and Dynamic Order Administration: Adjustments to the order construction embrace modifications to how orders are stuffed, equivalent to changing a number of particular parameters with extra versatile ones that may adapt to completely different buying and selling situations. This makes it simpler for builders to implement and customise options in response to particular wants.

- Enchancment in Order Execution: The protocol now permits for extra granular management over order execution, accommodating complicated situations like executing a number of orders with the identical nonce with out requiring repeated approvals. That is particularly useful for customers who have interaction in high-frequency buying and selling or must handle numerous orders concurrently.

These updates are geared toward making the 1inch Restrict Order Protocol v3 not solely extra environment friendly but additionally extra adaptable to the wants of numerous buying and selling methods within the DeFi ecosystem. For builders and merchants on the lookout for a extremely versatile and environment friendly buying and selling protocol, these enhancements present substantial enhancements over earlier variations.

1inch Trade Charges

One of many positives of utilizing 1inch aggregator is its full absence of charges. There are not any trade charges, no deposit charges, and no withdrawal charges. The one prices for customers are solely depending on the decentralized exchanges used to supply liquidity for trades, and 1inch even does its finest to restrict these as a lot as potential by the usage of "Infinite Unlock" and the CHI Gasoline Tokens.

For instance, the Uniswap trade has a flat charge of 0.3% for its orders, and Balancer fees a variable charge relying on which pool you're getting into. Normally, practically no DEXs are providing fee-free trades. The native 1INCH token is not only a utility token but additionally offers governance for the platform, and rewards on 1inch are actually wholly reliant on DAO proposals and voting.

One of many biggest advantages of utilizing the 1inch Trade is the way it can decrease the gasoline charges paid for transactions. When gasoline charges exit of hand throughout demand, it’s more and more vital to reduce gasoline charges.

The 1inch Token

The 1INCH token is rather more than an ERC-20 utility token for the 1inch Trade. It’s an instantaneous governance token used to offer governance to the DEX aggregator and liquidity protocol.

Holders of the 1INCH token, irrespective of the quantity, can use their voting energy to determine on varied parameters of the 1inch protocol. These embrace the governance reward, the swap charge for the liquidity protocol, the value impression charge, and the decay time for the trade. These parameters are discovered beneath the DAO tab of the 1inch Trade web site. Customers also can go right here to vote on present proposals.

The overall provide of 1INCH tokens has been set to 1.5 billion, with 30% of that allotted to the 1inch neighborhood. The 1inch group has chosen to distribute these neighborhood tokens through airdrops, and the entire provide is deliberate to be distributed over 4 years.

The remaining token provide shall be used for growth (14.5%), of which 8% of that was given to buyers throughout its newest funding spherical. The remaining will regularly be distributed to the early buyers and group members (55.5%).

The token is issued by the 1inch Basis, a non-profit organisation established to foster the 1inch Community and its burgeoning neighborhood. A few of its actions embrace:

- Have interaction early adopters

- Encourage customers to stake 1inch in governance proposals

- Situation growth grants for tasks benefiting the 1inch protocol, which additionally contains yield-farming initiatives.

1inch Tokenomics

The 1inch token at present has a circulating provide of 1,158,304,896 out of 1.5 billion tokens. Its market cap sits at $422,210,226 with a TVL of $5,243,661 in Might 2024. It hit an all-time excessive of $7.45 in Might 2021.

Whereas it appears to be a gradual downward dip for the reason that excessive in October, with the vary of improvements coming from the group, all it might take is one other notable partnership or two to drive its value up.

1inch DAO

Not like different protocols with DAOs, there is no such thing as a minimal requirement for holdings at 1inch. Customers with any 1INCH tokens are free to vote and have a say within the potential adjustments to the protocol parameters and governance proposals. They achieve this by staking their 1inch tokens, mainly placing their cash the place their mouth is.

There are two phases to the DAO's implementation. The primary section kicked off in December 2020. On this section, the 1inch tokens had been distributed to neighborhood members in response to a lockup launch schedule. The core neighborhood members play an important function in guaranteeing the governance is finished effectively as the method stabilizes and matures.

Within the second section, the group moved in direction of enabling full governance management and the treasury to the DAO. Two varieties of voting tokens emerged with completely different voting powers.

- st1INCH tokens, artificial non-transferable variations of the staked 1inch tokens in proposals, have full voting energy.

- v1INCH tokens, representing the 1inch tokens locked in vesting contracts, have 1/fifth the voting energy of st1inch.

The place to Purchase 1inch Tokens

Within the early days of the protocol's launch, the one solution to get your palms on the 1inch token was to have some crypto available to swap them inside DEXs or on the 1inch Trade. Because the protocol is the biggest DEX aggregator within the trade, the token is now supported on many of the main exchanges. We suggest Bybit, OKX, Binance, Bitget or Kraken.

1inch Airdrops

One of many issues that created the preliminary pleasure and buzz across the 1inch Trade was its option to airdrop tokens as a part of the token launch.

As a part of that airdrop, all wallets that interacted with 1inch till December 24, 2020, at midnight (UTC), obtained 1INCH tokens so long as they met one of many following situations:

- at the least one commerce earlier than September 15, 2020;

- at the least 4 trades in complete;

- trades for a complete of at the least $20.

Because of this, 90 million tokens had been airdropped on Christmas Day 2020. A short time later, on February 12, 2021, the second airdrop of 6 million tokens was made to Uniswap customers. The advertising ploy delivered tokens to Uniswap customers who met the next standards:

- Traded at the least 20 days on Uniswap;

- Positioned at the least 3 trades in 2021;

- No bots allowed.

Early adopters of 1inch had been fairly happy by the shock airdrop. Picture through 1inch weblog.

Early adopters of 1inch had been fairly happy by the shock airdrop. Picture through 1inch weblog.

There was additionally a second airdrop of 9 million 1INCH tokens to members of the 1inch neighborhood who had been ignored throughout the first airdrop. The distribution scheme utilized to Mooniswap (revamped to 1inch Liquidity Protocol in December 2020), some wallets with transaction relayers and restrict order customers, and a few liquidity suppliers to 1inch swimming pools who didn’t obtain it tokens they had been entitled to within the preliminary Christmas distribution.

The latest 1inch airdrop occurred on September 6, 2022, when 1inch distributed 300,000 OP tokens to its customers on the Optimism community This specific airdrop was geared toward encouraging exercise and boosting person engagement on the Optimism layer-2 scaling answer, which helps to reinforce transaction speeds and scale back prices on the Ethereum community. To seek out out about new airdrops and liquidity mining packages, regulate the 1inch Trade weblog or different social channels.

1inch on Different Chains

On February 25, 2021, the 1inch Basis deployed the 1INCH token on the Binance Good Chain, making the 1inch Aggregation Protocol and the 1inch Liquidity Protocol out there to BSC customers.

Including a bridge to the Binance Good Chain was a sensible transfer. Picture through 1inch weblog.

Including a bridge to the Binance Good Chain was a sensible transfer. Picture through 1inch weblog.

The 1INCH token on Binance Good Chain shall be used for a bridge between the Binance and Ethereum networks. When a person sends 1INCH tokens to the BSC, they are going to be locked in Binance Bridge, and a corresponding worth in 1INCH tokens on Binance shall be consequently unlocked. Thus 1inch customers will get entry to PancakeSwap and different BSC primarily based decentralized exchanges and lending protocols.

There have been 10 million 1INCH tokens initially issued on BSC, and they are going to be used as liquidity in Binance Bridge for transactions between Ethereum and the Binance Good Chain.

1inch is designed to work on any EVM-capable blockchain. The networks it’s at present dwell embrace Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Gnosis Chain, Avalanche, Klaytn, Aurora, zkSync Period and Fantom.

Different Bridges on 1inch

1inch has additionally launched bridges to completely different networks, permitting customers to freely transfer their tokens to different networks at a low charge. The bridges at present supported are Gnosis, Polygon, Arbitrum, Optimism, BNB Chain, Fantom, Klaytn, Aurora, zkSync Period, Base and Avalanche, along with the BNB bridge talked about above.

After choosing a bridge, you may be delivered to the respective community and be requested to attach your Web3 pockets to the location. As soon as there, choose which tokens you wish to bridge over, then hit the "Transfer" button.

Staking the 1INCH Token

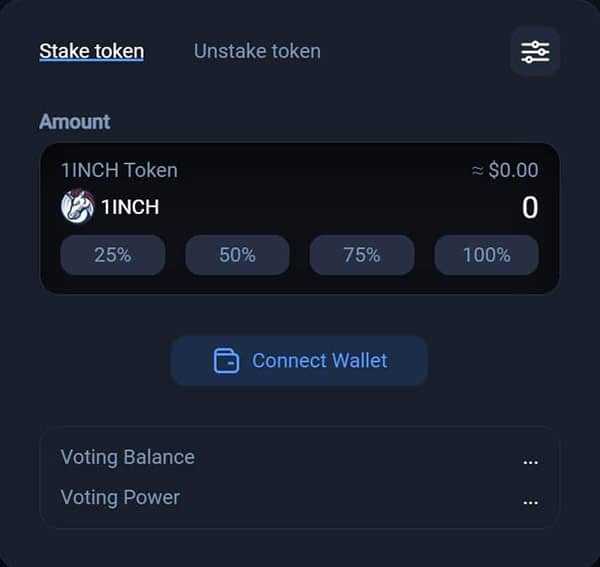

Whereas probably the most important operate of the 1INCH token is its governance function, it additionally has a staking function that lets any 1INCH holder stake the cash and make extra 1INCH tokens. Tokens can simply be staked by going to the DAO tab on the web site after which navigating to the Governance part.

Those that select to stake their 1INCH tokens obtain rewards from the swap charge and the value impression charge. Plus, those that maintain the 1INCH token have the proper to vote on each these parameters, and when voting, holders additionally obtain governance rewards.

Staking 1INCH tokens is sort of easy. First, you should purchase some 1INCH tokens in the event you don’t have already got some. Then navigate to the 1inch Trade and click on on the DAO tab. As soon as on the DAO web page, go to the Governance tab if not already there. Subsequent, discover the token staking field within the higher proper part of the web page and click on on the button to Join Pockets.

Staking is simple at 1inch Trade. Picture through 1inch.trade

Staking is simple at 1inch Trade. Picture through 1inch.trade

As soon as the pockets is linked, you enter the quantity of 1INCH tokens you’d prefer to stake after which unlock them. You should utilize the common “Unlock” or select to make use of the “Infinity Unlock” function. The Infinity Unlock will prevent from paying gasoline for this transaction once more, but it surely might current a safety threat whether it is ever exploited.

It’s also possible to click on the settings icon within the higher proper nook of the staking field to vary the gasoline value between Normal, Quick, and Prompt. In fact, as soon as staking is unlocked, you’ll be able to all the time stake extra by making a final transaction.

1inch Fusion 2.0 Improve

1inch Fusion 2.0 is a big improve to the decentralized trade platform, enhancing the effectivity and velocity of cryptocurrency swaps. Launched in December 2022, Fusion 2.0 permits customers to execute token swaps throughout varied networks with out incurring gasoline charges. This method leverages a community of resolvers—skilled and verified merchants who compete to offer probably the most favorable swap charges, thus guaranteeing customers profit from the perfect out there costs.

The platform makes use of an intent-based strategy the place customers specify their swap intentions, and resolvers use optimized methods to execute these swaps effectively. This mannequin additionally features a partial fill performance, enabling giant swaps to be accomplished in segments by completely different resolvers, usually leading to higher charges than these out there by customary market swaps.

Vital to Fusion 2.0 is the elimination of the settlement contract layer, changed by a extra streamlined interplay instantly with resolvers, which reduces prices and improves token swap costs. Moreover, 1inch has built-in a value curve adjustment function that responds in real-time to fluctuations in market gasoline costs, lowering the probability of order expiration and dashing up transaction instances.

With these improvements, 1inch Fusion 2.0 not solely cuts swap prices by 10%-35% in comparison with its earlier model but additionally outperforms different market choices by about 10%. This makes it a pretty selection for each small-scale merchants and large-volume customers looking for to maximise their buying and selling effectivity and cost-effectiveness. Fusion 2.0 is available within the 1inch dApp, together with an API for builders seeking to combine these capabilities into their very own tasks.

1inch Pockets

The 1inch Pockets is a non-custodial cryptocurrency pockets facilitating seamless interplay with the decentralized finance (DeFi) ecosystem. It integrates a decentralized trade (DEX) aggregator to make sure customers obtain optimum buying and selling charges from over 250 liquidity sources. This pockets helps a number of blockchains, together with Ethereum, BNB Chain, and Polygon, offering flexibility in managing varied digital belongings and executing transactions throughout completely different networks.

Key options of the 1inch Pockets embrace a fiat-on-ramp service, permitting customers to purchase cryptocurrencies instantly with fiat currencies throughout the pockets. This enhances comfort for each inexperienced persons and seasoned merchants. The pockets additionally helps textual content recognition to simply import current wallets utilizing non-public keys or seed phrases, streamlining the setup course of.

Safety is a paramount facet of the 1inch Pockets, which options applied sciences equivalent to Safe Enclave for iOS customers and complete audits by Blue Frost Safety to make sure strong safety towards potential vulnerabilities. Moreover, the pockets employs Flashbot transactions to mitigate front-running dangers which can be frequent in DEX transactions.

Customers profit from options like gasoline customization, which permits them to manage transaction prices and speeds, and slippage tolerance settings to handle the value variance in trades. The partial fill function reduces the chance of transaction failures resulting from value adjustments throughout a swap. Furthermore, lively customers can obtain refunds on gasoline charges by a staking program, additional lowering the price of operations.

The 1inch Pockets additionally features a built-in Web3 browser, offering direct entry to a variety of dApps and a information digest for the newest crypto updates. This makes the 1inch Pockets a complete instrument for partaking with the broader DeFi panorama, providing each safety and effectivity in managing digital belongings. The pockets can also be built-in with Apple Watch and different non-DeFi websites like Coingecko, CoinMarketCap and Dune Analytics, along with blockchain networks equivalent to Polygon, Ethereum and the Courageous Browser.

Different Supported Wallets

As 1inch is a decentralized trade aggregator and liquidity supplier, there is no such thing as a requirement to create an account to commerce by them. All that's wanted is to attach a supported pockets to the trade and fund it with supported ERC-20 tokens. There are by no means any third events between your pockets and the trade.

The 1inch Trade does assist a number of wallets for swapping tokens. The wallets supported embrace MetaMask, TrustWallet, MEW, WalletConnect, and the Ledger {hardware} pockets.

The 1inch Trade can be utilized with a number of web-based, cell, and {hardware} wallets, relying in your choice. Beneath we present you use the 1inch Trade with the MetaMask pockets.

1inch RabbitHole Safety Characteristic

1inch RabbitHole is a safety function built-in throughout the 1inch platform. It's designed to guard customers, significantly these utilizing MetaMask, from potential sandwich assaults throughout their transactions. Sandwich assaults happen when a malicious actor observes a pending transaction and locations their very own transaction each earlier than and after it within the block, benefiting from the value motion brought on by the unique transaction. The RabbitHole function helps mitigate this threat through the use of superior algorithms to stop such predatory practices, guaranteeing a safer buying and selling setting on decentralized exchanges. This function displays 1inch's dedication to enhancing person safety and sustaining integrity throughout the buying and selling course of on its platform.

Find out how to Swap on 1inch Trade

Beneath are the three steps to finishing a swap on the 1inch Trade:

Step 1: Join your ETH Pockets

You’ll have the choice to attach your pockets proper from the homepage. Discover the “Connect Wallet” button within the higher proper nook of the web site and click on it. You’ll want to simply accept the phrases and situations, select between the Ethereum or Binance Good Chain networks, and select the pockets you’re making an attempt to attach.

Step 2: Choose the Token

As soon as your pockets is linked, you’ll be able to select which tokens you’d prefer to trade. As well as, the 1inch Trade will show a comparability chart exhibiting the trade charges from varied linked DEXs.

Not solely is it potential to see the person charges, however it’s also possible to examine these with the perfect charge out there.

In some instances, you may not be capable of discover the asset you’d prefer to swap within the menu. This will happen if the asset hasn’t been whitelisted but by 1inch. On this case, you’ll be able to apply for the token to be whitelisted, or you’ll be able to merely add it as a customized token by clicking the small circled plus icon within the higher proper nook of the order entry field.

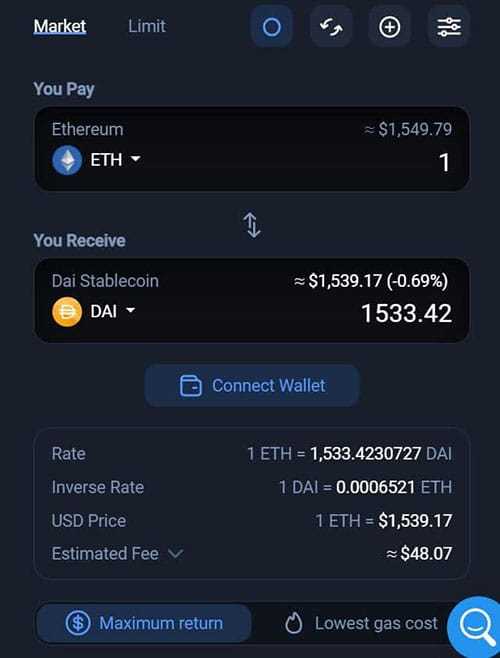

Step 3: Swap Tokens

The token swap has a number of parameters you’ll be able to select from. It would enable for a market order or a restrict order, and you’ll select to execute the order for the utmost return or for the bottom gasoline value. In both case, it would present you your trade charge, the USD worth, and the anticipated charges for the trade.

Select from restrict or market orders, finest trade or lowest gasoline, and swap your tokens transparently. Picture through 1inch.trade

Select from restrict or market orders, finest trade or lowest gasoline, and swap your tokens transparently. Picture through 1inch.trade

You’ll subsequent must unlock the token, and you’ll both unlock only for this trade or select the Infinity Unlock possibility. The previous is dearer in the long term, however it’s also doubtlessly safer.

As soon as the tokens are unlocked, you’ll be able to verify the swap by clicking the “Swap Now” button. Subsequent, you’ll be introduced with all of the swap particulars and requested to confirm them as soon as once more. After which lastly, you’ll must approve the transaction in your pockets, and will probably be despatched to the blockchain.

DeFi Racer Sport

Probably the most revolutionary facet of the 1inch pockets is the DeFi Racer Sport, a car-racing recreation discovered contained in the pockets. The primary goal of the sport is to go so far as potential with out hitting obstacles whereas accumulating in-game cash. These cash will enable the person to unlock in-game options and belongings equivalent to new automobiles.

Customers are inspired to take part in on-line tournaments to vie for the grand prize: 1,500 1inch tokens. Whoopee! Match begin days and instances are posted on 1inch's social media channels along with the principles.

The sport was launched in December 2021 and constructed by Nord Beaver studio from a growth grant by the 1inch growth fund. That is the primary foray for 1inch into GameFi and Web3.0. There may be additionally point out of NFTs coming quickly.

That is fairly a superb concept as a result of it makes use of the pockets app as a recreation app as play just isn’t restricted to utilizing the DEX. A brand-new pockets with zero transaction historical past can nonetheless play it. It's a good way to hook in gamers and even non-crypto noobs. I'm trying ahead to how they’ll proceed exploring methods to get extra entrants into the 1inch world.

Relying on the sport's reputation, we’d see extra of such options within the 1inch pockets within the close to future. I can completely see different pockets builders leaping on the bandwagon for this one, and it gained't be lengthy when we’ve every kind of racing or some such video games showing in wallets.

1inch Infinity Unlock

I've talked about the Infinity Unlock function a number of instances, so now is likely to be a superb time to take a look at it in additional element. Principally, it provides the platform permission to spend a selected token without end, that means you gained't must spend gasoline to unlock the token once more sooner or later. Whereas it’s a saving on transaction charges, it might doubtlessly be harmful if a hacker finds a solution to exploit it sooner or later. The fundamental Unlock function is dearer within the long-run but additionally safer.

1inch Liquidity Swimming pools

The unique liquidity swimming pools for 1inch had been on the Mooniswap portal, which was primarily based on the Uniswap mannequin. Extra not too long ago, the Mooniswap portal has been deprecated and rebranded 1inch Liquidity Protocol and moved to 1inch Trade.

Yow will discover the 1inch Liquidity Protocol swimming pools by navigating to the DAO tab on the trade web site after which going to the Swimming pools tab within the left sidebar. Those that could have had liquidity remaining on Mooniswap might take away that liquidity and transfer it to the 1inch Liquidity Protocol.

As you’ll be able to see, there are a selection of swimming pools out there with good liquidity and really beneficiant APYs.

Not all swimming pools are included within the 1inch farming, so in case you are enthusiastic about staking your LP tokens to earn 1INCH tokens, it’s best to select liquidity swimming pools equivalent to 1INCH-ETH, 1INCH-USDC and 1INCH-DAI.

Including Liquidity to Swimming pools

You realize all about including liquidity in the event you’ve labored with any AMMs earlier than, and the 1inch swimming pools aren’t completely different. You begin by connecting your pockets if it isn’t already linked. After that, you’ll navigate to the Swimming pools part of the portal beneath the DAO tab. There you’ll see the entire out there liquidity swimming pools, together with how a lot liquidity is in them and the APY they’re at present yielding.

Discover the pool you’re enthusiastic about offering liquidity to and click on on it. Then discover the “Provide Liquidity” button and click on it.

If you're offering liquidity, you should deposit an equal worth of every token into the pool. 1inch makes this simple sufficient, and you’ll merely add the quantity for the LP token you need to mint after which regulate it primarily based on the quantity of crypto you need to add to the pool.

You'll once more use both "Unlock" or "Infinite Unlock" to permit the platform to make use of your cash. After unlocking the pair of tokens, you’ll be able to add liquidity sooner or later by making a last transaction.

Digital Charges

A function of 1inch relating to liquidity is Digital Charges. It’s designed to guard towards 'front-running" attacks. The term itself comes from the old days in stock exchanges where the ones posting the trades on behalf of others will put their own trades to benefit from the knowledge gained. In this case, the rate shown is a "pretend" rate matching the previous swap, or it remains the same for future swaps in the same direction instead of the real rate. Therefore, any bots seeing the rates would not be able to react accordingly. After a successful swap, there is a "decay interval" for the pretend charge. This may be anyplace between 1 – 5 minutes. The time period is voted on by the DAO neighborhood.

Staking 1inch LP Tokens

When you've offered liquidity to one of many pairs included within the liquidity farming portal, it is possible for you to to stake these LP tokens and earn 1INCH tokens.

Get began by clicking the Farming hyperlink within the left sidebar of the DAO web page. Now you'll see all of the 1INCH farming swimming pools which can be out there, and also you'll be capable of stake your LP tokens.

If you click on the Deposit button for any of the swimming pools, it would carry up a kind to enter how a lot you need to stake in that pool. When you enter an quantity, it would estimate your each day, month-to-month, and yearly 1INCH earnings.

1inch Trade Safety

As is the case for something crypto-related, safety is essential and a main concern for all customers.

A method 1inch is safe is that it’s a non-custodial DEX aggregator platform. Meaning they by no means have possession of your cash or the non-public keys. So, in contrast to centralized exchanges that require you to deposit your cryptocurrencies to commerce, at 1inch, your cash all the time stay in your pockets and in your possession.

One additional nod in direction of the safety at 1inch is that the platform has by no means suffered from any hacks or safety threats. And because you by no means present them with any private info, not even an e-mail handle, there's no want to fret about information breaches.

1inch Buyer Assist

Whilst you may not count on a lot in the way in which of assist from a decentralized trade with no account registration course of and no charges for buying and selling, the 1inch group has truly made positive that buyer assist is accessible by a number of channels.

- E-mail assist – [email protected]

- 1inch Trade Assist Middle

- Reside Chat

- 1inch Trade assist group

- Telegram group

Moreover, the 1inch group can also be lively on social media channels equivalent to Twitter and YouTube.

1inch and Skynet

Of all of the partnerships that 1inch has aligned itself with, the one with SkyNet appears to be probably the most intriguing. Right here's a fast primer on what’s Skynet:

Skynet is an infrastructure mission that helps a decentralized model of the Web by internet hosting it. Builders use the toolkit offered to construct open-sourced purposes that carry censorship-resistant content material for customers with a common log-in id and the flexibility to personal their information.

Now that we’ve an concept of what Skynet is let's have a look at how the mixing with 1inch matches in.

When interacting with the 1inch dApp by a browser, the person could also be vulnerable to being hacked. It is because there's no solution to know if the programming code has been tampered with by the browser. There may be additionally no idea of an older model of a webpage that one can return to, like a time machine for internet pages. With the Skynet integration, 1inch customers who’re additionally Skynet members can add the saved model of the online app to their Skynet storage, a decentralized storage space. These variations might be accessed even when the web site itself goes offline or is compromised. All that is finished through the SkyNet Homescreen web page accessible to all SkyNet customers.

The important thing takeaway for this collaboration is about safeguarding the person's safety in ways in which the person may not even concentrate on. It might be a bit troublesome to wrap one's head round this. Nevertheless, it might be the start of one thing that we might see extra of within the coming days, particularly if there’s a common dApp concerned.

1inch Card

The 1inch Card is a debit card powered by Crypto Life, designed to combine your cryptocurrency holdings with on a regular basis spending. Whether or not you're procuring on-line, making in-store purchases, or withdrawing money from an ATM, the 1inch Card means that you can use your crypto identical to a conventional debit card.

Supported by the Mastercard community, you’ll be able to pay along with your crypto anyplace Mastercard is accepted, bringing digital belongings into your each day life with ease.

Key Options of the 1inch Card

- Prompt Crypto-to-Fiat Conversion: The 1inch Card provides quick and safe conversion of your cryptocurrency into fiat forex at aggressive charges, permitting you to high up your card and spend with confidence.

- Seamless On-line and In-Retailer Funds: With the 1inch Card, you’ll be able to benefit from the comfort of paying for items and companies on-line or in-store, identical to an everyday debit card. The cardboard comes with each digital and bodily choices, every outfitted with a card quantity, validity date, and CVC.

- Assist for Apple Pay and Google Pay: The 1inch Card is suitable with Apple Pay and Google Pay, enabling you to make one-tap funds along with your crypto for each day necessities at any offline retailer that helps these fee strategies.

- Money on the Go: Want money? The 1inch Card means that you can withdraw money from ATMs worldwide, offering liquidity once you want it.

- Restricted-Version Design: As an early adopter of the 1inch Card, you'll obtain a limited-edition card design, making your card stand out and including a contact of exclusivity to your pockets.

Find out how to Get the 1inch Card

To order your 1inch Card, you could first full a KYC (Know Your Buyer) verification course of. The cardboard is at present out there to residents of the EU, EEA, and the UK. As soon as your account is verified, you’ll be able to select between a digital or bodily card and begin having fun with the advantages of paying with crypto anyplace Mastercard is accepted.

1inch Card Charges and Supported Networks

The 1inch Card comes with aggressive charges, together with a 2% platform charge for card spending, and crypto-to-fiat conversions at 1.75%.

Supported networks at present embrace Bitcoin, Litecoin, XRP, and Ethereum, with plans to increase assist to extra networks sooner or later.

1inch and TradFi

The 1inch Card represents an April 2024 strategic partnership between 1inch, Crypto Life, and Mastercard, aiming to bridge the hole between decentralized finance (DeFi) and conventional finance. This collaboration introduces a Web3 debit card that facilitates the moment conversion of cryptocurrencies to fiat, permitting customers to make on-line and in-person purchases worldwide wherever Mastercard is accepted. Moreover, the cardboard helps money withdrawals at ATMs.

1inch’s collaboration with Mastercard and Crypto Life enhances the utility of cryptocurrencies by enabling on a regular basis transactions by the 1inch Card. It combines the flexibleness of DeFi with the widespread acceptance of conventional monetary methods, sustaining customers' custody of their funds till the second of transaction. The cardboard shall be out there in each bodily and digital codecs, outfitted with customary safety features like a card quantity, validity date, and CVC, guaranteeing secure transactions.

This initiative not solely extends the performance of cryptocurrencies into each day commerce but additionally positions 1inch as a pioneer in integrating DeFi companies with established monetary networks. The cardboard is initially set to be out there to customers within the UK and the EEA, reflecting a big step in direction of mainstream adoption of DeFi options.

1inch Trade Evaluation: Conclusion

The options and instruments offered by 1inch Trade clearly outweigh any potential points, making it a powerful participant within the DeFi ecosystem. By aggregating liquidity throughout a number of DEXs, 1inch successfully tackles the frequent downside of fragmented liquidity, minimizing slippage and optimizing buying and selling prices. Lively merchants profit from evaluating charges and gasoline charges throughout exchanges, saving money and time.

Key options like Fusion 2.0, the 1inch Liquidity Protocol, and restrict orders improve the platform's usability. 1inch’s integration with different networks and revolutionary concepts like DeFi Racer and SkyNet additional prolong its relevance within the crypto world. The potential for future improvements, equivalent to cross-chain swaps and staking, means that 1inch is dedicated to steady progress and person engagement.

The group’s efforts to simplify the UI make the platform accessible to each inexperienced persons and skilled merchants, guaranteeing broader adoption and sustained progress.

Incessantly Requested Questions

What’s 1inch Trade?

1inch Trade is a decentralized trade (DEX) aggregator that optimizes buying and selling by splitting orders throughout a number of DEXs and personal liquidity suppliers to search out the very best trade charges.

Slightly than working as a standalone trade, 1inch connects customers to over 389 liquidity sources throughout 11 blockchains, providing a seamless and environment friendly buying and selling expertise. The platform helps varied options, together with restrict orders, staking, and liquidity provision, all whereas minimizing prices and maximizing buying and selling effectivity throughout the DeFi ecosystem.

Why is 1inch blocked within the USA?

The 1inch Community has expanded geo-restrictions resulting from regulatory considerations, stopping customers in the US and sanctioned nations from taking part in actions like swapping, offering liquidity, staking, or farming.

Though the community has persistently communicated this coverage, it now enforces it with extra technical measures. Often, customers exterior the sanctioned nations may additionally encounter these restrictions resulting from technical errors.

Is 1inch higher than Uniswap?

At first look, I might virtually say it is a non-comparison. One is an aggregator that scrapes tons of Dexes for the perfect value. The opposite is a single DeX. Apples and oranges, proper? Properly, not fairly. Issues aren’t as easy as a result of all of it is dependent upon what you are making an attempt to realize. It might sound like a cop-out however hear me out. Let’s strive it from the next angles:

Quantity of tokens swapped

The important thing benefit of 1inch is that it scours Dexes for the perfect value. The place obligatory, a single swap may need just a few DeXes behind it as a result of it is about securing the perfect value. When you have a sizeable quantity to swap, you’ll seemingly pay fewer charges than in the event you use a single DEX like Uniswap. In the event you use the Chi token, you may be capable of save much more.

For very small quantities that won’t require the participation of a couple of DEX, you possibly can reap the advantages of 1inch’s scouring by trying out which DEX holds the most affordable and going to that DEX instantly.

Liquidity and buying and selling

With regards to making trades and liquidity, TVL is a vital metric to contemplate. Uniswap is the OG of DEXs. Many individuals obtained began in DeFi from utilizing it, and like most issues, it is habit-forming. Until there’s a critical difficulty with it, most individuals are comfortable to stay with what they know. Nevertheless, these new to DeFi and seeking to dip their toes in would do nicely to make some primary comparisons between each platforms. The primary query is: which liquidity pool can assist me take advantage of cash?

How does 1inch earn money?

Talking of earning profits, nicely, how does that work for 1inch? Though no charges are being charged by the trade, it might probably nonetheless generate income. For instance, it receives a portion of the swap charges that go to the liquidity sources it’s partnered with. It might probably additionally make some income from optimistic slippage of orders. These earnings go into swimming pools to pay referrers and for the fee of the governance rewards.

Is it secure to make use of 1inch?

It’s a very reasonable query to ask, and right here is an trustworthy reply. The brief reply is: as secure as a DEX might be. I say this as a result of they have been audited to the gills by varied recognized entities equivalent to Coinfabrik, ConsenSys, Certik and so forth. This offers a sure degree of safety towards sensible contract dangers. As for the potential of rug pull or different such shenanigans associated to founders, elevating $175 million from enterprise capital companies kinda places that to relaxation.

What are some alternate options to 1inch?

The closest one which involves thoughts is Matcha. Similar to 1inch, it’s also a DEX aggregator that hunts for the perfect costs for trades. It is also constructed on the Ethereum community and works with Uniswap, Kyber Community, Balancer and Curve. In addition they function gasless buying and selling (with out slippage) and restrict orders. Nevertheless, it isn’t listed in both DeFiPulse or Defi Llama.

One other one is OpenOcean. Proclaiming itself because the competitor for 1inch, OpenOcean can also be an aggregator for CEX and DEX. The CEX, on this case, is Binance. They utilise the D-star algorithm (versus Pathfinder) to seek for the perfect costs and work with DEXs on networks like Solana, Polygon, Fantom and Avalanche, to call just a few.

In addition they practise “slippage subsidies” whereby the upper trade worth will get refunded to the person whereas the decrease worth will get mitigated by subsidies from the protocol. In addition they have their very own OOE governance token for VIP members. The TVL at present stands at $3.32 million, in response to DeFi Llama.

Competitors on this house entails getting information from the identical DEXs and dApps throughout various chains. For the reason that charges are the identical, it is extra about how they’ll distinguish themselves from their opponents and in addition provide the bottom charges and most liquidity. How rapidly they’ll innovate, execute and increase would be the keys to success.