Within the early days of Bitcoin, anybody with a pc might mine blocks and earn rewards independently. However as Bitcoin's reputation surged, so did the competitors. Mining turned a race, and the computational energy required to resolve cryptographic puzzles elevated dramatically. Quickly, it turned evident that solo miners—these working alone—confronted slim probabilities of incomes constant rewards. The sport had modified, and with it got here the rise of mining swimming pools.

This pivotal improvement allowed miners to pool their sources, giving them a greater shot at fixing blocks and incomes rewards. At this time, mining swimming pools kind a vital spine of Bitcoin’s ecosystem, enabling contributors to affix forces and share income primarily based on their contributions.

So, why have mining swimming pools turn into such a dominant drive within the cryptocurrency universe? Can you continue to go it alone and mine Bitcoin independently, or is it a misplaced trigger? How do these swimming pools function, and what makes one pool higher than one other? These are simply a few of the questions miners — particularly new ones — face as they appear to navigate the complexities of recent Bitcoin mining.

At this time, we'll dive into Bitcoin mining swimming pools, discover how they work, enable you to perceive what to think about, and spotlight the most effective Bitcoin mining swimming pools.

What’s a Bitcoin Mining Pool?

A Bitcoin mining pool is a collective of particular person miners who mix their computational sources to boost their probabilities of efficiently mining Bitcoin blocks. This collaboration permits miners to share the rewards primarily based on their contributions, measured by way of hash energy, which is the computational effort expended in fixing cryptographic puzzles required to validate transactions and create new blocks on the Bitcoin blockchain.

The idea of mining swimming pools emerged as Bitcoin mining turned more and more aggressive and resource-intensive. As extra miners joined the community, the issue of fixing these puzzles escalated, making it practically unimaginable for particular person miners with restricted sources to earn rewards constantly. By pooling their sources, miners can obtain a extra secure earnings stream, because the chance of discovering a block will increase considerably when many contributors contribute their hash energy collectively.

Advantages of Becoming a member of a Mining Pool:

- Regular Payouts: Miners obtain payouts extra often in comparison with solo mining, the place rewards may be sporadic and unpredictable.

- Decrease Barrier to Entry: Pooling sources permits smaller miners to take part while not having in depth {hardware} or electrical energy sources.

- Shared Experience: Many swimming pools present help and sources that may assist much less skilled miners navigate the complexities of mining.

Mining swimming pools additionally contribute to the general safety of the Bitcoin community. By growing the variety of contributors engaged on fixing blocks, they assist preserve decentralization and scale back the danger of any single entity gaining extreme management over the blockchain. This collective effort ensures that transactions are processed effectively and securely.

Solo Mining vs. Pool Mining

The first distinction between solo mining and pool mining lies in how miners strategy the duty of validating transactions and incomes rewards.

- Solo Mining: On this technique, a person miner works independently to resolve cryptographic puzzles. Whereas this strategy permits for 100% possession of any mined rewards, it comes with vital dangers. The likelihood of efficiently mining a block is low for solo miners, particularly given the present scale of Bitcoin mining operations dominated by giant entities with substantial sources.

- Pool Mining: Conversely, pool mining includes becoming a member of forces with different miners to extend collective hash energy. This technique permits contributors to share the rewards primarily based on their contribution, resulting in extra frequent payouts.

Execs and Cons

In fact, execs and cons are what make or break offers. Let's check out some favorable and unfavorable points for higher perspective on each solo and pool mining.

Solo Mining Execs:

- Full management over mined rewards.

- No charges paid to a pool operator.

Solo Mining Cons:

- Excessive variance in earnings; lengthy durations with out rewards.

- Requires vital funding in {hardware} and electrical energy.

Pool Mining Execs:

- Extra constant earnings attributable to shared efforts.

- Decrease preliminary funding in comparison with solo mining.

Pool Mining Cons:

- Charges deducted by pool operators can scale back general earnings.

- Much less autonomy over the mining course of as choices are sometimes made by pool operators.

At this time, many miners want pool mining attributable to its reliability and decrease threat profile. The aggressive panorama has made it more and more difficult for particular person miners to succeed with out collaboration. By becoming a member of a pool, miners can guarantee they obtain common payouts whereas nonetheless contributing to the safety and decentralization of the Bitcoin community.

By the way in which, we now have in depth protection on totally different mining swimming pools so that you can take a look at. Listed below are some to get you began:

- Litecoin

- Dogecoin

- Bitcoin Gold

- Monero

- ZCash

- Sprint

How Do Bitcoin Mining Swimming pools Work?

Bitcoin mining swimming pools have revolutionized the way in which miners function within the aggressive panorama of cryptocurrency. As we simply realized, by pooling sources, miners enhance their probabilities of incomes constant rewards whereas sharing the workload. We’ll now discover the mechanics behind these swimming pools and the way they distribute rewards amongst contributors, making certain that everybody advantages from their collective efforts.

Pool Mining Mechanics

So, how precisely do Bitcoin mining swimming pools function? At their core, these swimming pools are all about teamwork. When miners be part of a pool, they mix their computational energy to deal with the complicated mathematical puzzles required to validate transactions and add new blocks to the blockchain. This collaboration considerably will increase the probabilities of efficiently mining a block in comparison with going solo.

- Mining Shares Allocation: Every miner in a pool is assigned a sure variety of "shares," which characterize their contribution to the mining effort. These shares are primarily based on the hash charge every miner contributes—primarily how a lot computational energy they bring about to the desk. The extra shares a miner has, the larger their potential reward when the pool efficiently mines a block.

- Function of Hash Price: Hash charge is essential in pool mining. It measures what number of calculations a miner can carry out per second. Larger hash charges result in extra shares and enhance the chance of discovering a block. When a miner's {hardware} solves a puzzle, they submit their resolution again to the pool operator, who verifies it and broadcasts it to the Bitcoin community.

- Understanding Proof of Work (PoW): The underlying mechanism that makes all this attainable is known as Proof of Work (PoW). In easy phrases, PoW requires miners to resolve complicated mathematical issues as proof that they’ve achieved the required work. This course of secures the community and prevents malicious actions like double-spending. When a pool member efficiently mines a block, that block's reward — at present 3.125 BTC — will get distributed amongst all members primarily based on their shares.

Reward Distribution Fashions

Now that we perceive how mining swimming pools perform, let’s dive into how rewards are distributed amongst contributors. There are a number of frequent fashions utilized by mining swimming pools:

- Pay-Per-Share (PPS): On this mannequin, miners obtain a set quantity for every share they submit, no matter whether or not the pool finds a block. This offers a gentle earnings stream however usually comes with larger charges.

- Pay-Per-Final-N-Shares (PPLNS): PPLNS rewards miners primarily based on the final N shares submitted earlier than a block is discovered. This mannequin encourages miners to stick with the pool longer and might result in larger payouts throughout fortunate streaks however might lead to decrease earnings throughout much less profitable durations.

- Full Pay-Per-Share (FPPS): Much like PPS, FPPS consists of transaction charges along with block rewards, providing miners an much more profitable payout construction.

The first distinction between these fashions lies in how rewards are calculated and distributed. PPS provides constant payouts however at larger prices; PPLNS can yield larger returns however is much less predictable; and FPPS combines each parts for doubtlessly larger earnings.

Which Mannequin is Greatest for Which Sorts of Miners?

- New Miners: These simply beginning out would possibly want PPS for its reliability.

- Skilled Miners: Extra seasoned miners would possibly go for PPLNS, as they’ll higher deal with variance and maximize income over time.

- Revenue-Targeted Miners: If transaction charges are excessive, FPPS might be interesting because it maximizes earnings by way of each block rewards and costs.

In brief, Bitcoin mining swimming pools streamline the mining course of by pooling sources and distributing rewards primarily based on contributions. Understanding how these swimming pools work and their varied reward distribution fashions might help miners select the best setup for his or her wants, finally enhancing their probabilities of incomes Bitcoin constantly.

Greatest Bitcoin Mining Swimming pools

Listed below are a few of the finest Bitcoin mining swimming pools on the market!

| Mining Pool | Payout Fashions | Charges |

|---|---|---|

| F2Pool | PPS+, FPPS, PPLNS | 2.5% |

| Foundry USA Pool | FPPS | N/A |

| Braiins Pool | PPLNS | 2% |

| Antpool | FPPS, PPLNS | 0-4% |

| ViaBTC | FPPS, PPLNS | As much as 4% |

| Clover Pool | FPPS | 1% |

F2Pool

F2Pool, also referred to as Discus Fish, is among the largest Bitcoin mining swimming pools globally, controlling roughly 20% of the community's hash charge. Based in 2013, it permits miners to interact in mining a number of cryptocurrencies past Bitcoin.

Payout Strategies

F2Pool provides three payout fashions for Bitcoin mining:

- PPS+ (Pay Per Share Plus): Miners obtain a set quantity for every legitimate share submitted, no matter whether or not the pool finds a block.

- FPPS (Full Pay Per Share): This technique consists of each block rewards and transaction charges, offering constant payouts.

- PPLNS (Pay Per Final N Shares): Rewards are primarily based on the final N shares submitted, which may profit loyal miners over time.

Charges: F2Pool costs a aggressive payment of two.5% on mining rewards. The minimal withdrawal threshold is about at 0.005 BTC, making certain that miners can obtain their earnings promptly.

Multi-Forex Help: Past Bitcoin, F2Pool additionally permits mining for varied cryptocurrencies similar to Ethereum, Litecoin, and Bitcoin Money, offering flexibility for miners.

Execs:

- Constant Earnings: The assorted payout fashions be certain that miners can select an choice that most accurately fits their wants.

- Multi-Forex Help: Past Bitcoin, F2Pool permits mining for varied cryptocurrencies, offering flexibility for miners.

- Clear Operations: The pool often publishes details about its hash charge and mining income, selling transparency inside the group.

Cons:

- Centralization Issues: As one of many largest swimming pools, F2Pool faces criticism for contributing to mining centralization, which may pose dangers to the Bitcoin community.

Foundry USA Pool

Foundry USA Pool is a number one Bitcoin mining pool launched by Digital Forex Group in 2020. It has rapidly established itself as a major participant within the mining area, contributing to the decentralization of Bitcoin's hash charge and specializing in safety and reliability.

Key Options

- Market Share: Foundry USA Pool at present controls roughly 30% of the overall Bitcoin community hash charge, making it one of many largest mining swimming pools globally.

- Payout Mannequin: The pool primarily makes use of the FPPS (Full Pay Per Share) mannequin, which ensures secure and constant payouts that embrace each block rewards and transaction charges.

- Safety & Compliance: Foundry emphasizes safety with options like KYC (Know Your Buyer) compliance and SOC (Service Group Management) certifications. This deal with safety helps construct belief amongst miners.

- Analytics Instruments: The platform offers superior analytics and efficiency monitoring instruments, permitting miners to watch their operations successfully.

Execs

- Dependable Payouts: The FPPS mannequin provides constant earnings, making it a pretty choice for miners looking for stability.

- Robust Safety Measures: With strong safety protocols and compliance requirements, Foundry USA Pool prioritizes the security of its customers' funds.

- Decentralization Focus: By contributing to the general decentralization of Bitcoin's hash charge, Foundry helps the foundational ideas of the cryptocurrency community.

Cons

- Centralization Issues: With Foundry controlling a good portion of the hash charge, there are issues about centralization inside the Bitcoin community, doubtlessly resulting in dangers related to a 51% assault.

- Restricted Cryptocurrency Help: Whereas primarily centered on Bitcoin mining, Foundry might not provide as many choices for miners taken with diversifying into different cryptocurrencies.

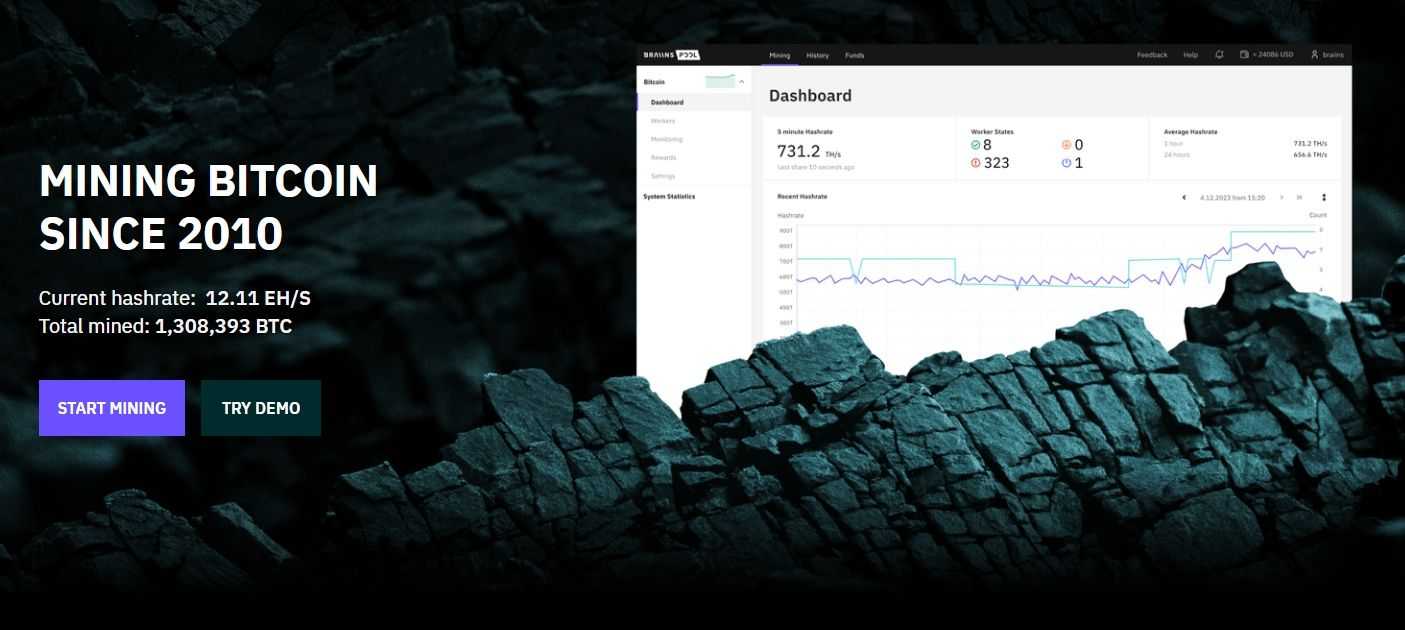

Braiins Pool (previously Slush Pool)

Braiins Pool, acknowledged as the primary Bitcoin mining pool, launched in 2010 and has mined over 1.21 million BTC, showcasing its reliability within the trade.

Key Options

- Payout Mannequin: Makes use of the Pay Per Final N Shares (PPLNS) mannequin to reward miners primarily based on latest contributions.

- Charges: Prices a aggressive payment of two%, with a minimal withdrawal threshold of 0.001 BTC.

- Transparency: Supplies detailed statistics and real-time monitoring instruments.

Execs

• Progressive Payout Construction: As a pioneer of the PPLNS mannequin, Braiins Pool has developed mechanisms to reduce pool hopping dangers, making certain extra secure earnings for miners.

• Detailed Analytics: Complete statistics assist miners monitor efficiency successfully.

Cons

• Variable Payouts: PPLNS can result in fluctuating earnings.

• Larger Charges In comparison with Some Swimming pools: The two% payment might deter smaller miners.

Antpool

Antpool is operated by Bitmain Applied sciences and is among the largest mining swimming pools globally, constantly contributing a good portion of the worldwide hash charge since its launch in 2014.

Key Options

- Payout Fashions: Affords versatile payout choices together with FPPS (Full Pay Per Share) and PPLNS (Pay Per Final N Shares).

- Charges: Variable charges vary from 0% for PPLNS to as much as 4% for FPPS.

- Solo Mining Possibility: Supplies an choice for miners to try incomes whole block rewards independently.

Execs

• Versatile Cost Buildings: Miners can select from a number of payout fashions.

• Multi-Coin Help: Helps varied cryptocurrencies like Litecoin and Ethereum.

Cons

• Clunky Consumer Expertise: Some customers might discover the platform's interface much less intuitive.

• Various Charges Impacting Profitability: Larger charges can have an effect on earnings relying on the chosen payout mannequin.

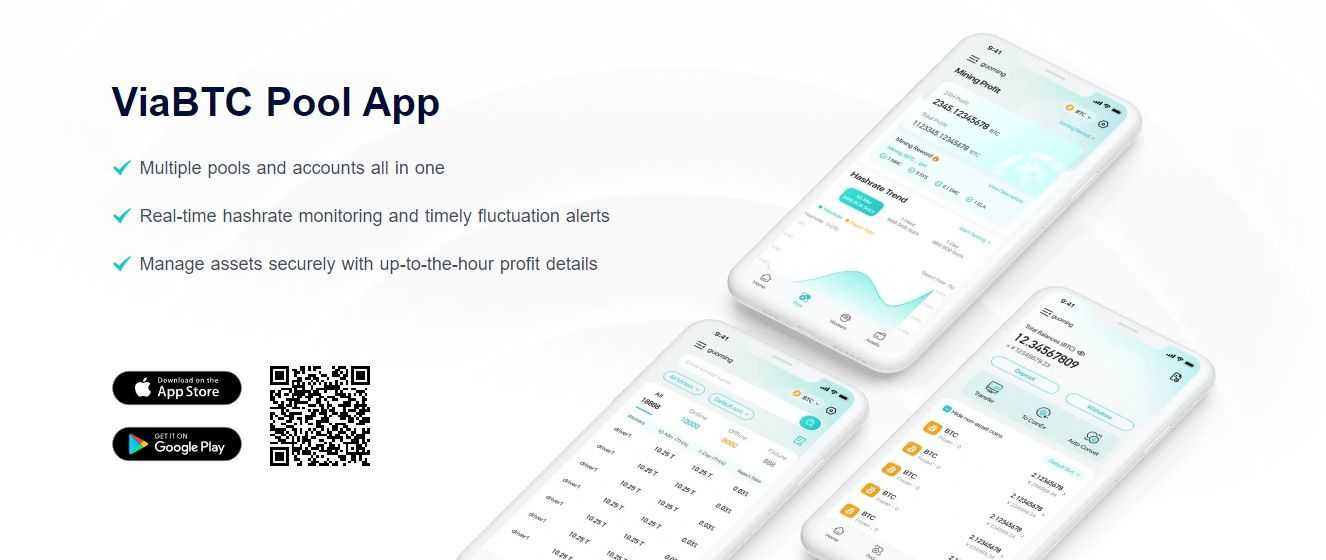

ViaBTC

ViaBTC is a distinguished cryptocurrency mining pool based in 2016, controlling roughly 11% of the overall Bitcoin hash charge. It helps varied cryptocurrencies and provides cloud mining companies.

Key Options

- Payout Fashions: Affords FPPS and PPLNS payout choices; FPPS ensures constant payouts together with transaction charges.

- Multi-Forex Help: ViaBTC helps mining for a number of cryptocurrencies, together with Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Money (BCH), and extra, permitting miners to diversify their operations.

- Cloud Mining Providers: Permits customers to hire hash energy with out sustaining bodily tools.

Execs

• Numerous Mining Choices: Intensive help for quite a few cryptocurrencies.

• Consumer-Pleasant Interface: Intuitive platform with real-time statistics and efficiency monitoring instruments.

Cons

• Cloud Mining Dangers: Comes with dangers associated to scams and market volatility.

• Larger Charges for Sure Fashions: Charges can differ considerably primarily based on payout strategies, with FPPS charges reaching as much as 4%, which can affect general profitability.

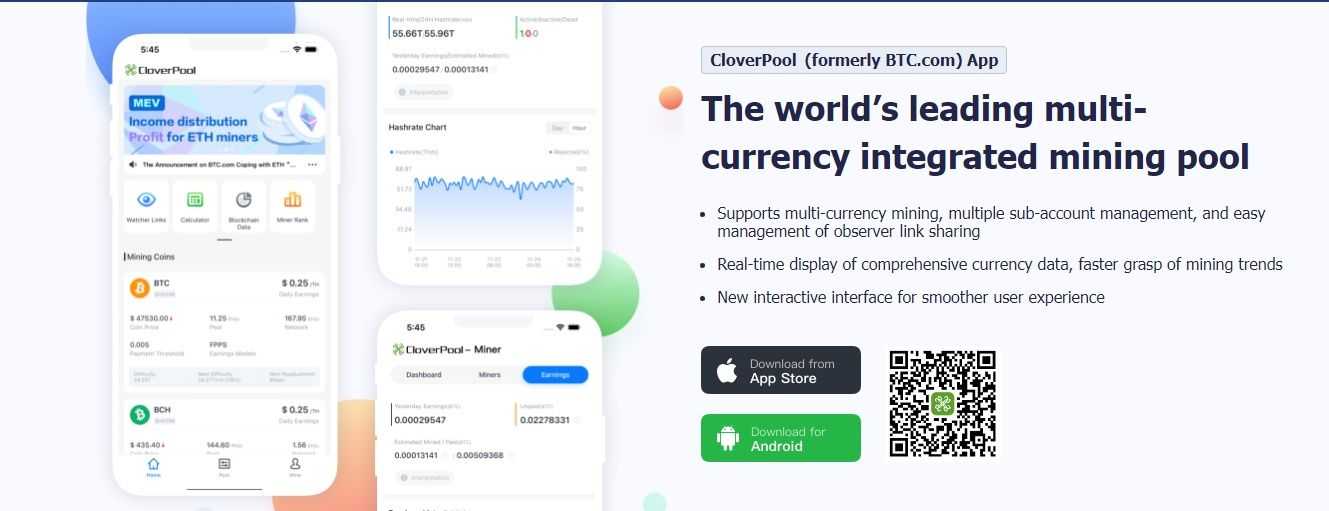

Clover Pool (previously BTC.com)

Clover Pool, beforehand generally known as BTC.com, is a serious participant within the Bitcoin mining pool area, launched by Bitmain in 2016. It’s acknowledged for its user-friendly platform and superior analytics capabilities, making it a preferred alternative amongst miners.

Key Options

- Payout Mannequin: Primarily makes use of FPPS for constant earnings that embrace block rewards and transaction charges.

- Charges: Prices a low payment of simply 1%, making it aggressive amongst main swimming pools.

- Multi-Forex Help: Clover Pool helps mining for varied cryptocurrencies, together with Bitcoin (BTC), Bitcoin Money (BCH), Litecoin (LTC), and Ethereum (ETH), permitting miners to diversify their operations.

- Analytics Instruments: Supplies complete analytics that permit customers to trace efficiency metrics successfully.

Execs

• Low Charges: At simply 1%, Clover Pool’s charges are very aggressive.

• Actual-Time Information Monitoring: Superior analytics assist optimize operations and monitor earnings carefully.

• Numerous Cryptocurrency Help: The flexibility to mine a number of cryptocurrencies enhances flexibility for miners seeking to maximize their profitability.

Cons

• Minimal Withdrawal Thresholds Might Apply: Smaller miners might face challenges accessing their earnings rapidly.

Key Elements to Think about When Selecting a Mining Pool

Selecting the best Bitcoin mining pool can considerably affect your mining success and profitability. With so many choices obtainable, it’s important to think about a number of key components earlier than making a choice.

On this part, we’ll break down the essential parts you need to take into account, together with pool charges, hash charge and measurement, in addition to safety and status.

Pool Charges

On the subject of mining swimming pools, charges are an enormous deal. Completely different swimming pools cost varied varieties of charges that may eat into your income in case you're not cautious.

- Fee Charges: Most swimming pools take a proportion of your earnings as a fee for his or her companies. That is usually round 1% to three%, however particular swimming pools can differ broadly.

- Upkeep Charges: Whereas some swimming pools might cost upkeep charges to cowl operational prices, many primarily deduct charges from earnings as a substitute of imposing flat upkeep costs.

Understanding how these charges have an effect on your general profitability is essential. For instance, if a pool costs a 2% fee however provides larger payouts attributable to its hash charge, it would nonetheless be price becoming a member of.

Typical Charge Buildings

In style swimming pools typically have clear payment constructions. For example:

- F2Pool: 2.5% payment for Full Pay Per Share (FPPS)

- Braiins Pool: 2% payment for Pay Per Final N Shares (PPLNS)

- Antpool: 2.5% for FPPS and 1.5% for PPLNS

All the time learn the nice print to make sure you know what you’re signing up for!

Hash Price and Pool Dimension

The hash charge of a mining pool is one other important issue to think about. The next hash charge means the pool can clear up blocks extra rapidly, resulting in extra frequent payouts. Becoming a member of a pool with a excessive hash charge will increase your probabilities of incomes rewards constantly. The extra energy the pool has, the higher its probabilities of discovering blocks.

Bigger vs. Smaller Swimming pools

- Bigger Swimming pools: They often provide extra stability and constant payouts attributable to their vital hash energy. Nonetheless, the draw back is that the rewards could also be cut up amongst many miners, leading to smaller particular person payouts.

- Smaller Swimming pools: These typically present larger payouts per block discovered since there are fewer miners sharing the rewards. Nonetheless, they could have much less constant earnings attributable to decrease general hash energy.

Present Hash Price Information

Understanding the hash charge is essential as a result of it displays the overall computational energy getting used to mine Bitcoin. Right here’s a breakdown of a few of the high mining swimming pools and their hash charges, introduced in a extra relatable approach:

- Foundry: This pool leads with a powerful hash charge, accounting for about 30% of the overall Bitcoin community's mining energy.

- Antpool: Following carefully, Antpool holds round 20% of the community's hash charge.

- ViaBTC: This pool contributes about 10% to the general hash charge.

- F2Pool: With a share of round 8%, F2Pool can also be a major participant.

Safety and Status

Safety is paramount when selecting a mining pool. You need to be certain that your earnings are protected from potential threats.

- Elements Affecting Pool Safety: Search for swimming pools which have robust defenses in opposition to DDoS assaults and preserve server stability. A secure server means much less downtime and extra alternatives to mine.

- Evaluating a Pool's Status: Examine person evaluations, group suggestions, and any historical past of safety breaches. A good pool may have clear operations and good buyer help.

Excessive-Profile Safety Breaches

Sadly, some mining swimming pools have confronted vital safety points up to now:

- In 2014, Ghash.io quickly managed over 51% of Bitcoin's hash charge, elevating issues about centralization.

- In 2020, Poolin skilled a DDoS assault that triggered momentary disruptions.

- Extra not too long ago, F2Pool was famous for filtering transactions from OFAC-sanctioned addresses, which raised issues about censorship inside mining operations.

Deciding on the best mining pool includes rigorously weighing charges, hash charges, and safety measures. By doing all of your homework and understanding these key components, you possibly can select a pool that aligns along with your mining targets and maximizes your profitability within the aggressive world of Bitcoin mining.

Dangers Concerned in Bitcoin Mining Swimming pools

Whereas Bitcoin mining swimming pools provide quite a few benefits, additionally they include inherent dangers that miners ought to pay attention to. Understanding these dangers might help you make knowledgeable choices about the place to take a position your time and sources.

Centralization Dangers

One of many largest issues with mining swimming pools is centralization. Massive mining swimming pools can dominate the community, resulting in a focus of energy that contradicts Bitcoin's decentralized ethos. When a number of swimming pools management a good portion of the hash charge, they’ll doubtlessly execute a 51% assault, permitting them to control transactions, censor blocks, or double-spend cash. This centralization not solely threatens the integrity of the Bitcoin community but additionally undermines belief amongst customers.

To fight this threat, diversifying mining efforts throughout a number of swimming pools might help preserve decentralization. By spreading hash energy amongst varied swimming pools, miners can scale back the chance of any single entity gaining extreme management over the community.

Pool Operator Dangers

One other important threat includes the pool operators themselves. If a pool operator is mismanaged or dishonest, it will probably result in vital monetary losses for miners. Points similar to poor transparency, lack of communication, and even outright fraud can jeopardize your earnings.

To establish dependable pool operators, search for these with a stable monitor report and constructive group suggestions. Analysis their historical past and examine for any previous incidents of fraud or mismanagement. For example, some swimming pools have confronted scrutiny for failing to distribute rewards pretty or for participating in questionable practices. Now we have already shared some examples above.

So, whereas mining swimming pools present alternatives for constant earnings, additionally they include dangers tied to centralization and operator integrity. By staying knowledgeable and vigilant, miners can navigate these challenges successfully. You should definitely spend a while in growing your information and understanding concerning the choices.

Greatest Bitcoin Mining Swimming pools: Closing Ideas

Bitcoin mining swimming pools have turn into a vital a part of the mining panorama, particularly as the issue of mining continues to rise. Whereas solo mining might enchantment to these looking for full management over their operations, the dangers and inconsistencies typically outweigh the potential rewards for many. Mining swimming pools, alternatively, provide a extra accessible and dependable solution to take part in Bitcoin mining, particularly for these with out entry to large-scale {hardware} or huge monetary sources.

Nonetheless, selecting the best pool requires cautious consideration. Elements similar to charges, payout fashions, hash charges, and safety measures play a pivotal position in figuring out your general profitability. It’s vital to weigh the professionals and cons of various swimming pools primarily based in your particular person wants and sources. Bigger swimming pools might provide stability, whereas smaller ones would possibly present larger payouts at the price of extra variability. The bottom line is to align your targets with the pool that gives the most effective steadiness of safety, rewards, and operational transparency.

In the end, the world of Bitcoin mining swimming pools is numerous and ever-evolving. Staying knowledgeable, often reviewing pool efficiency, and being aware of dangers like centralization or operator mismanagement are essential for long-term success. With the best strategy, mining swimming pools can present a rewarding solution to take part in securing the Bitcoin community whereas incomes returns.

Continuously Requested Questions

What’s the most worthwhile Bitcoin mining pool?

Profitability in a mining pool relies on a number of components, together with the pool’s charges, payout mannequin, and the miner’s {hardware} capabilities. Swimming pools like F2Pool and Antpool are sometimes thought of among the many most worthwhile attributable to their excessive hash charges and versatile payout fashions.

F2Pool, for instance, makes use of the Full Pay Per Share (FPPS) mannequin, which incorporates each block rewards and transaction charges, doubtlessly boosting earnings. Nonetheless, profitability additionally relies on the miner’s prices (e.g., electrical energy, {hardware}) and the general community issue. It’s important to often consider pool efficiency and regulate primarily based in your distinctive scenario.

Which Bitcoin pool is best for mining?

There isn’t a one-size-fits-all reply to this, because the “better” pool relies on your particular wants. F2Pool is superb for miners looking for constant payouts, whereas Braiins Pool is favored for its transparency and revolutionary payout mannequin (PPLNS), which may result in larger rewards throughout fortunate streaks.

Antpool is one other robust contender, providing each Pay Per Share (PPS) and Pay Per Final N Shares (PPLNS) fashions, giving miners flexibility. In the end, components like payment construction, reliability, and payout frequency ought to information your alternative.

Are Bitcoin mining swimming pools price it?

For many miners, becoming a member of a mining pool is unquestionably price it. Solo mining has turn into extraordinarily aggressive, and the probabilities of constantly incomes rewards are slim except you’ve gotten a major quantity of hash energy. Mining swimming pools permit miners to pool sources, growing the chance of incomes rewards extra steadily. Whereas swimming pools do cost charges, the constant payouts, decrease entry limitations, and decreased variance make them a extra secure and enticing choice for many miners.

Which platform is finest for Bitcoin mining?

A few of the high platforms for Bitcoin mining embrace F2Pool, Braiins Pool, Antpool, ViaBTC, and Clover Pool. These platforms provide a wide range of options similar to totally different payout fashions, low charges, and user-friendly interfaces. For miners in search of multi-currency help, F2Pool and ViaBTC present extra flexibility. If transparency and historic reliability are vital to you, Braiins Pool is a best choice. Every platform has its strengths, so it is vital to think about your particular person targets, whether or not that’s maximizing revenue, consistency, or long-term stability.