Again within the early 2000s after I obtained my first e mail deal with from Rocketmail and browsed the Web utilizing Netscape, there was no manner I, and hundreds of thousands all over the world, may have foreseen the extent of our reliance on the Internet. The dot-com growth bookmarked an essential chapter within the historical past of Web improvement. Within the run-up resulting in the crash, it appeared that something with ".com" related to it was a possible money-making machine, though it didn't a lot matter how the cash was going to be made to a lot of these investing in it.

After the bust, the place fortunes had been misplaced and made, the Web went via a low-profile interval. Those that managed to catch a glimpse of the potential advantages it may deliver continued constructing. Out of these ruins, progressively just a few corporations began to take form. Quick ahead to as we speak, greater than 20 years later, and the world has by no means appeared as vibrant and thrilling as it’s now.

Trying on the inventory market as we speak, tech shares have been among the largest drivers within the S&P 500. If you happen to had a penny for each time you heard somebody say, "Gosh, if only I'd invested in Apple/Amazon/Microsoft/Oracle/[insert big tech company here]," you'd already be capable to afford a thousand shares of any of these corporations. For each success, the best way can be paved with the corpses of people who didn't make it. It's not nearly having the chance, but additionally a smidgen of luck concerned. Even when you grabbed the possibility to do one thing and misplaced, it's higher than not having acted. In spite of everything, if issues had labored out in another way, who is aware of?

This brings me to as we speak when I’m confronted with the delivery of a brand new asset class often known as digital belongings. From computer systems to the Web to smartphones and now to cryptocurrency, it's a continuation of the place we got here from and the place we're heading to. I missed my likelihood to put money into the Web again within the day as a result of I didn't have a lot cash and knew jack about investing. As I see what is occurring within the crypto area, I believe that is the closest God ever got here to placing me in a time-machine capsule in order that I may do one thing towards securing my very own future. With the curiosity of sharing information with anybody equally enthusiastic concerning the evolution of Web3, I hope you will see this Cryptocurrency Newbie's Information useful

And now, with out additional ado, I wish to introduce you to the wild and colourful world of cryptocurrency.

What’s Cryptocurrency?

Everyone knows what’s forex, as within the wads of paper and cash that you just use in your every day life. Every nation has its personal forex, which might solely be used inside its personal borders aside from for just a few exceptions. The "crypto" half is a shortened type of the phrase "cryptography," that means "the practice of creating and understanding codes that keep information secret," based on the Cambridge Dictionary.

In different phrases, coded forex. The phrase "currency" itself can be a little bit of a misnomer as a result of it's not nearly cash, despite the fact that that's the way it obtained began, which we’re going to take a look at later. Nevertheless, we're simply going to float and name it cryptocurrency, for now.

Cryptocurrency is, based on Monia Milutinović, “ a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.[2] ”

-Wikipedia

In its early days, "cryptocurrency" often meant issues like cash, tokens, and one other form of asset often known as non-fungible tokens (NFTs). Provided that it's evolving at breakneck velocity, it's gone on to incorporate extra than simply "currency". In case your head is beginning to spin, I get you. I promise it'll get higher and I'll additionally give extra detailed explanations of those as we go alongside. For now, simply consider cryptocurrency, or crypto shortened, as a type of cash that exists with out the backing of weapons or land and is accepted worldwide.

Is Cryptocurrency the Identical as Blockchain?

The brief reply is not any. It's doable for blockchain expertise to work with out cryptocurrency however it could be tough the opposite manner round. Blockchain can, and infrequently does, work utterly independently with none want for cryptocurrencies, however cryptocurrency depends on some type of blockchain expertise for its existence, whether or not that's a vanilla sort of blockchain or rainbow variations of it.

Some examples of the rainbow variations are DAG, brief for Directed Acyclic Graph (utilized by a mission referred to as IOTA) and hashgraph (utilized by Hedera Hashgraph). Nevertheless, we received't get into them at this level because it's past our scope of debate.

Since this text is all about cryptocurrency, we received't dwell an excessive amount of on what’s blockchain expertise. I don't need your head to begin hurting now. If you happen to'd prefer to study extra about it, remember to take a look at our article "What Is Blockchain?" for a complete understanding of this expertise.

What’s Bitcoin? A Newbie's Overview

Whereas blockchain expertise has been round since 1991, it wasn't till Bitcoin got here alongside that gave the expertise its first actual use case. When the Bitcoin white paper first appeared in 2008, it was a few protocol for “a new electronic cash system that’s fully peer-to-peer, with no trusted third party.” The white paper, revealed underneath the identify of Satoshi Nakamoto, listed blockchain expertise because the means to make this protocol a actuality. We'll discover out a bit extra about how that is completed later.

Within the curiosity of maintaining issues transferring, listed below are some salient factors about Bitcoin for a fundamental grasp of what it’s and what makes it so revolutionary:

- It has a finite provide of 21 million. This implies cash printing is just not doable and runaway inflation can not occur.

- It’s the largest cryptocurrency out there with a market capitalization ranging between $800 billion and $1 trillion and above.

- It may be despatched anyplace globally inside seconds to minutes for lower than the worth of the most cost effective road meals you’ll find. Improvements akin to Bitcoin's Lightning Community has made this doable.

- Decentralized- the Bitcoin community can't be managed by any authorities or influenced by lobbyists. It’s resistant to human corruption. Transactions on the community can’t be sanctioned. Since no one owns the community, it’s a way more levelled taking part in area between nations, firms, and folks.

- Bitcoin is clear as its ledgers are as public because the promoting on a billboard, making it straightforward to hint. Good criminals know to not use Bitcoin as transactions are viewable by anybody eternally, and cryptocurrency forensic corporations can simply observe felony exercise.

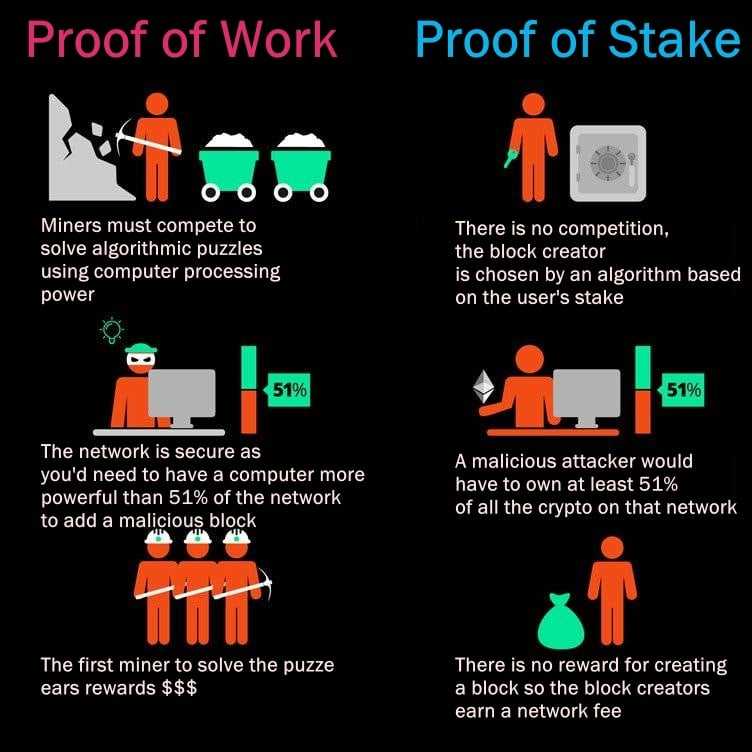

- The Proof-of-Work consensus mechanism is likely one of the most safe methods of defending the community from hacks and assaults. Not solely is it almost inconceivable to assault technologically, but it surely's additionally prohibitively costly to take action.

- Billions of {dollars} price of Bitcoin might be transported on one thing as small as a USB machine, cell phone, and even by an individual merely memorizing their restoration phrase, making it ultra-portable. The identical can’t be mentioned of gold or money.

- The Bitcoin community itself could have began off as a fee community, but it surely's obtained much more potential for use in methods that may result in vital change to the best way society operates.

Picture through medium/coinmonks

Picture through medium/coinmonks

To study extra about bitcoin, we invite you to dive into our "What Is Bitcoin" article for a greater understanding of its makes use of and potential.

Was Bitcoin the First Cryptocurrency?

Not fairly. Nakamoto wasn't the primary particular person to aim some form of digital money system. There have been others earlier than who had a crack at it. All of them confronted "the double spend" downside. That is greatest illustrated as: if I gave you one digital greenback, what stops me from spending once more that greenback I simply gave you? The primary one that had a go was David Chaum along with his eCash system in 1982. The concept was to make use of blind signatures and it allowed customers to retailer digital money on their very own computer systems. Nevertheless, this method relied on banks, which as we all know, aren't at all times probably the most dependable in occasions of disaster.

After him got here Adam Again with HashCash, which makes use of the Proof of Work algorithm in 1997. Mockingly, there was no cash concerned on this. As an alternative, it was supposed as a approach to stop spam emails and DDoS assaults. Customers would wish to resolve a cryptographic puzzle earlier than the e-mail could possibly be despatched, together with a novel stamp that will be generated because of this. If the e-mail was despatched with a used stamp, the e-mail wouldn't be despatched. Adam used a double-spend database to do the checks.

In 1998 Wei Dai got here up with B-Cash and Nick Szabo with Bit Gold. Each are decentralised and nameless methods to ship cash. Hal Finney, in 2004, additionally had an concept referred to as Reusable Proof of Work (RPoW) added to the combo. None of those managed to get off the bottom in any significant manner because of the trade-offs or limitations concerned. Nevertheless, they had been the inspiration for Nakamoto and the Bitcoin protocol.

What made the Bitcoin protocol profitable the place others had stumbled was the introduction of the Unspent Transaction Output (UTXO) idea. It principally retains observe of how a lot of a digital forex is left after a transaction happens, just like the change you get from a merchandising machine.

Why Do Individuals Spend money on Cryptocurrencies?

Everybody has their very own causes for enterprise something. Investing in crypto is not any exception. Whereas the person causes could fluctuate, when you had been to do a survey and ask folks why they put money into crypto, the solutions you get might be grouped into just a few classes.

Hedge Towards Inflation

Most cryptocurrencies have a finite provide. As demand for it rises, there can be extra {dollars} chasing the restricted provide as a substitute of the opposite manner round. An excellent instance of that is Bitcoin. Extreme cash printing and irresponsible financial and financial coverage can result in inflation, or worse, hyperinflation, as we’re at present seeing in many countries all over the world. With Bitcoin, run-away inflation is just not doable as new provide can not flood the system.

I want to take a second to level out that not all crypto has a finite provide. Some have an infinite provide and but handle to be deflationary on the similar time. The instance I'm considering of is Ethereum, one other cryptocurrency, ranked no. 2 within the crypto area after Bitcoin.

What makes it attention-grabbing is its potential to be deflationary. As rewards are generated and given out to community contributors, a portion of the circulating quantity is taken out of circulation via an motion often known as burning. In Ethereum's case, this happens with each transaction occurring on the Ethereum blockchain as a portion of the charges get despatched to a pockets deal with that can not be accessed by anybody, successfully eradicating them from the whole Ethereum provide. To search out out extra about Ethereum, it's potential, use instances, and what separates it from Bitcoin, be at liberty to take a look at our Ethereum Newbie's Information.

Bitcoin has been the best-performing asset in a decade, producing an annualized return of 230%. Some consider it's a good higher hedge in opposition to inflation than gold!

Retailer of Worth

Some folks see crypto as a retailer of worth and select to put money into it for that goal. However wait, some folks may ask: “that's not quite true. The price of the tokens I bought last week with cash, isn't the same as this week or even a year ago. What kind of value does it store?”

On this occasion, I admit, the worth goes up and down fairly drastically at occasions, identical to the shares within the inventory market. So the shop of worth narrative actually isn't concerning the worth, however what it would usher in the long term. Give it some thought: Why do folks put money into property? With the expectation that the worth of it’s going to go up. The explanation for the worth going up has so much much less to do with any renovations you've made to it to extend its worth. Quite, it's as a result of, as soon as once more, there are extra {dollars} chasing a finite provide of homes. Even when you didn't do any form of enchancment to the home, when you've obtained a great location, the worth would almost certainly go up by itself.

Relating to retailer of worth, it's about utilizing your cash to purchase one thing that retains its worth over time as increasingly more {dollars} come into the market and lose buying energy. It's additionally why millionaires these days don't imply the identical as they used to twenty or 30 years in the past. We now consider billionaires the identical manner as a substitute. Not as a result of they made that rather more cash, however as a result of cash obtained low-cost attributable to inflation.

Hypothesis

In a capitalistic society, everybody wants capital. If you happen to don't have it, you'll have to discover a approach to get it. Speculating in crypto is likely one of the quickest methods to develop or lose wealth. For each Dogecoin millionaire you hear about, there are various extra who’ve misplaced so much. There’s potential to achieve a small fortune in a really brief time, but it surely's no straightforward climb to the highest, so beware!

Passive Earnings

Everyone knows about placing cash in a set deposit account to earn curiosity. The curiosity earned is often often known as passive earnings. You didn't need to work for it and the cash simply seems like magic. The aim of each FIRE particular person and retiree is to stay off passive earnings with out having to place in a sure variety of hours a day of labour in change for money. Crypto provides a number of alternatives for anybody to earn passive earnings. The most typical manner to take action is thru staking, a course of the place token holders can park their tokens right into a staking pool or with validators to assist them safe the blockchain community.

Learn up on how staking works and see if you need to provide this a strive.

Decentralised Banking

Other than staking, one other approach to earn passive earnings is by being a lender as you possibly can acquire curiosity from the borrower. You're primarily doing that once you put cash in a financial institution. It's simply that the financial institution is the one who decides how a lot curiosity you earn whereas they lend out your cash to another person for a better fee of curiosity. It's at all times struck me as odd that the curiosity I get from my financial institution deposits is vastly completely different from the mortgage curiosity I pay to the financial institution. Why ought to the financial institution pocket all that distinction?

That is what Decentralised Finance (DeFi) is all about. It provides everybody the chance to be their very own lender and earn curiosity that they’ll decide and select from, relying on how lengthy they wish to lend their cash out. This occurs via crypto protocols that act because the intermediary to assist lenders and debtors discover one another. Since there isn’t a overhead or workers prices or shareholders to appease, the distinction between the speed of curiosity charged to debtors and paid to lenders is so much much less.

It's additionally an important equilibrium as a result of it permits anybody with cash to be a lender and anybody who wants cash generally is a borrower with out having to fill out a number of types or have a good credit score rating or undergo the entire course of and even then, nonetheless not make certain that you may get that mortgage you're hoping for, even with collateral.

Hedge Towards Danger

The banking system as we all know it’s extremely fragile attributable to fractional reserve lending and lots of corporations are vulnerable to financial institution runs. It is because the financial institution at all times has much less in its vaults than the precise deposits it collects as a result of it desires to squeeze each little bit of utility it will possibly by investing the cash into all kinds of monetary devices.

Many really feel that proudly owning Bitcoin helps hedge in opposition to the dangers that exist within the monetary system, much like proudly owning gold, which is why Bitcoin is sometimes called “digital gold.”

How Does Cryptocurrency Work?

On this part, we offer you an summary of how cryptocurrency works, from the way it's created all the best way to the varied use instances. We wish to present you the potential for what it will possibly usher in serving to with the additional improvement of society and civilisation. Let's get began!

How Cryptocurrency is Created

Usually talking, there are two ways in which cryptocurrency comes into being. The primary is thru cryptocurrency mining. The opposite manner is thru pre-mining, which is a barely fancy manner of claiming “we created this out of thin air.”

What’s Cryptocurrency Mining?

There are various technicalities concerned, which I can’t go into element, being a non-technical particular person myself. What I can do is offer you a fundamental understanding of the way it works.

The 2 most well-known cryptocurrency consensus mechanisms are Proof-of-Work and Proof-of-Stake. Of the 2, the latter is extra well-liked as it’s extra extensively adopted by different initiatives than the previous.

Essentially the most high-profile instance of utilizing the Proof-of-Work technique is Bitcoin mining. This mining course of requires an enormous quantity of computing energy to resolve advanced mathematical issues with the intention to add a block to the blockchain. Cash are generated as a reward to the miners who want to take a position a considerable amount of cash to get machines with grunty graphics playing cards to take part on this exercise.

That is what Proof-of-Work seems like:

I purchase ice cream from you utilizing 0.0002 BTC, or 20,000 satoshis (sats). That's about $5. I switch the funds from my pockets to your pockets. Behind the scenes, right here's what's occurring:

- This transaction is broadcasted to all of the miners (computer systems) throughout the community.

- Every node or miner is busy gathering sufficient new transactions to fill a block.

- As soon as completed, additionally they have to crack that downside to incorporate the reply within the block.

- When it manages to take action, it’s going to broadcast the block to all of the nodes within the community.

- The opposite miners verify that each one the transactions in that block is legitimate and nothing has been used.

- When the block is accepted to the blockchain, all of the miners use the reply on this block to create a brand new block. And the method begins once more.

At this level, you will note my 0.0002 BTC seem in your pockets.

The opposite approach to generate rewards is known as the Proof-of-Stake technique, involving a course of referred to as Staking.

To qualify as a validator, which is what miners are referred to as right here, that you must have a minimal quantity of tokens readily available. In Ethereum's case, the magic quantity is 32. The act of staking implies that your node is backed by these tokens. They act as a "guarantor" of your credibility as a validator so that you’re not incentivised to be a nasty actor on the community. If you happen to validate false transactions, your node is just not at all times operating, otherwise you do something to hurt the community, then your tokens will get confiscated or “slashed.”

Validators are randomly chosen to confirm transactions and add to the blockchain. Those that handle so as to add a block will get rewards given by the protocol. The one factor you are able to do to extend your probabilities of being chosen is to carry extra tokens than others. Happily, this may be completed by having others be part of your staking pool. In return, you share no matter rewards you get along with your contributors.

If you happen to'd like to grasp extra about how these two consensus mechanisms examine with one another, I extremely advocate studying our article on Proof-of-Work vs Proof-Of-Stake to get a extra in-depth look. You can too watch Man clarify it when you want a extra visible technique.

The Approach of the ICO

ICO is brief for Preliminary Coin Providing. That is an motion taken by blockchain initiatives to boost funds. Cash or tokens of the mission had been issued in change for money to construct the mission. Again in 2017, there was an ICO growth, much like the dot-com growth within the 2000s. The trajectory for each was additionally related as nearly all of the businesses that obtained began this fashion went bust afterward. It wasn't that ICOs don't work, it's simply that there have been too many half-thought-out initiatives that both didn't have a strong plan or had been an answer in search of an issue.

Those that obtained the cash or tokens, almost certainly considered them like shares in an organization, despite the fact that that's not precisely correct. With an organization's shares, you partake within the income and losses generated by the corporate primarily based on what they're promoting or providing. If you happen to maintain sufficient of them, you even get to have your say on how the corporate operates.

Members of ICOs are often enterprise capitalists (VCs) who see these initiatives as investing in a start-up. They put down giant sums in change for the tokens and even present steering to make sure the mission has a profitable launch. As soon as the mission's token will get listed on an change and buying and selling begins, these VCs can be able to make their a refund by promoting their tokens out there at a worth level that's nearly at all times greater than what they paid for. That is even earlier than the mission begins to show a revenue! Those who’re caught shopping for the tokens at a better worth are retail clients such as you and me.

To stop this from occurring, initiatives began implementing a Vesting Schedule, which implies that VCs received't be capable to promote all their tokens on the similar time. As an alternative, they’ll solely promote them in tranches after a sure time period has handed. To search out out extra about how ICOs work, right here is an article that talks about them intimately.

For main networks like Ethereum, the ETH token is just not solely given out as a type of reward to the validators for his or her efforts as a participant in securing, validating, and maintaining the blockchain operating, however can be used as a type of fee for many who need their transactions recorded on the blockchain. You're principally paying to your transaction to take up area within the blockchain. If you happen to're enthusiastic about how blockchains make cash, take a look at our article on blockchain income to study extra.

The Approach of the Airdrop

The founders of some crypto initiatives determined to not difficulty tokens to boost funds. Perhaps they obtained a grant or seed cash someplace to begin up their mission, therefore determined to not go the ICO route. Because the mission develops and garners customers, the founders could determine to reward customers for partaking with the mission. The reward is often within the type of a coin or token distributed to the customers totally free. This is called an “airdrop.”

Not solely is it to reward customers, however these airdrop bulletins, made prematurely, are additionally used to advertise the mission so extra individuals who hadn't engaged with it earlier than will begin to. Usually, these tokens will enable the holders a say within the governance of the mission, and they are going to be used as a type of fee to additional have interaction with the mission.

There are quite a few examples of token airdrops. One of many extra distinguished ones is the Ethereum Identify Service. This mission provides customers the flexibility to purchase their very own customised ".eth" area, just like the DNS ones for IP addresses, however on the Ethereum community.

Let's say I've purchased one referred to as "eateggs.eth". Now, I may create a subdomain referred to as "helpme.eateggs.eth" and use it for a special goal than the principle area identify.

With this area identify, you need to use it for a brand new web site you is likely to be constructing or extra generally, hyperlink it to a pockets deal with that’s used to retailer your cryptocurrency. That manner, if you wish to obtain a crypto fee from somebody, you possibly can say "just send the money to eateggs.eth". You possibly can study extra about blockchain domains and the way they work in our Unstoppable Domains evaluate.

The ENS token was airdropped to anybody who had purchased a .eth area identify previous to Nov ninth 2021. Customers had till Could 2022 to say their ENS tokens from the official web site. This is called a governance token which permits token holders to get to vote on the course of the place the mission goes.

Instantly after the airdrop occurred, folks had been buying and selling the tokens for as a lot as 120 at one level, earlier than the worth settled down a bit within the 80-dollar zone. Since then, it's gone manner right down to barely lower than $15 on the time of writing, which is lower than the preliminary worth when airdropped.

Forms of Cryptocurrency

What number of cryptocurrencies are there? Not as many stars as there are within the sky however squarely within the 4-digit territory. Most of them fall into one in every of these buckets under:

Cash – that is the reward given out for collaborating within the community and serving to to safe the blockchain. The reward is a local token of a person blockchain. Bitcoin, Ethereum, Cardano, and Solana are nice examples of cash.

Tokens – these are digital currencies which might be issued by an utility but it surely's not used to pay for area on the blockchain. Examples embrace AAVE, UNI (by Uniswap), APECOIN and many others. clarification right here is the Ethereum community. The Ethereum community has just one coin, which is Ethereum (ETH), however there are millions of completely different tokens constructed on high of the Ethereum community.

Non-fungible tokens (NFTs) – not like the cash and tokens beforehand talked about, that are swappable, i.e. one ETH coin is far the identical as the following ETH coin, these NFTs have distinctive traits that make them one-of-a-kind. Think about Beanie Infants in a digital card format. One other promoting level for NFTs is provenance because it's straightforward to see all its previous and current house owners. That is of the utmost significance as a result of nearly all of NFTs haven’t any bodily type. The one approach to safeguard its uniqueness is the flexibility to show that there’s just one present proprietor at any given time.

Throughout the NFT sub-asset class are varied sorts like artworks, digital certificates, identities, digital land deeds and many others which we received't get into intimately. If you happen to'd prefer to study extra, be at liberty to provide this Basic Evaluation on NFTs a learn.

Stablecoins – these are cryptocurrencies pegged to a fiat forex, often on a 1:1 ratio, and backed by some type of asset, though there have been cases the place it's backed by an algorithm. You possibly can see them as a form of avatar for the fiat currencies they signify. Relative to different cryptos, it’s a steady asset as its worth is designed to stay inside the $1 zone roughly. The most typical examples of this are USDC and USDT, two cryptocurrencies which might be pegged $1 to $1 with the USA Greenback, and PAXG, a cryptocurrency pegged to the worth of gold.

Wallets

Assuming you've taken the plunge and gotten your self some cryptocurrencies, the following huge factor to contemplate is the place to retailer them. That is the place the idea of wallets comes into the image.

Not like an everyday pockets that you just put your money in, a crypto pockets doesn't retailer your crypto because it's already saved on the blockchain as info. As an alternative, a crypto pockets comprises keys that grant you entry to the crypto that's on the blockchain that you need to use.

Broadly talking, there are two sorts of wallets: cold and warm wallets. A chilly / {hardware} pockets is just like the protected you put in in your individual dwelling. It's disconnected from the web and nobody can entry it besides you. A sizzling pockets is like renting a storage unit from a storage firm. You’ve got the keys to your stuff within the unit, however you depend on the storage firm to assist maintain issues protected for everybody.

To study extra about wallets and the way they work, please learn our article on {hardware} wallets for additional perception.

How A lot Cash Do I Have to Begin Investing in Cryptocurrency

The great thing about cryptocurrency funding is that you just don't want any sizable amount of cash to begin off with. Identical to shopping for fractional shares, you should purchase a fraction of a cryptocurrency or complete models of them for these which might be at an affordable worth. It's no matter you possibly can afford to lose if issues go pear-shaped.

For a deeper understanding of find out how to put money into cryptocurrencies, discover our detailed information on investing in cryptocurrency.

How Can I Spend money on Bitcoin?

Bitcoin is likely one of the most well-known cryptocurrencies and there are quite a few methods to get your palms on some. The most typical manner is both via apps like Paypal utilizing your bank card, on-line crypto outlets like EasyCrypto, or via a cryptocurrency change like Binance or Coinbase. There’s additionally Swissborg, a crypto funding platform that’s positively price testing.

If you happen to purchase via an change, you’ll be required to open an account with them. A few of them may require that you just endure a KYC course of by asking for ID or different proofs as a part of regulatory processes earlier than they let you deposit money or make crypto purchases. When you’ve gotten the money, simply commerce it for Bitcoin or some other form of crypto, and bingo, you're in!

You can too put money into Bitcoin not directly by shopping for shares of Bitcoin-mining corporations or corporations that present tools to mine Bitcoin akin to Nvidia which provides the graphic playing cards utilized in mining Bitcoin.

Different Methods to Spend money on Cryptocurrency?

Other than shopping for cryptocurrency immediately, there are different methods to put money into cryptocurrencies that’s much less dangerous (however not risk-free). The recognition of NFTs has been surging so shopping for them generally is a good funding, if you know the way to gauge their worth. Relating to artwork NFTs, it's a bit like shopping for art work. Numerous the worth is subjective, and on this case, extremely speculative.

One possibility you possibly can take into account is investing in an Alternate-Traded Fund (ETF) that contains of blockchain corporations. Some examples embrace iShares Blockchain Expertise UCITS ETF, iShares Future Metaverse Tech and Communication ETF, and even ARK Innovation ETF (ARKK) which has Coinbase, one of many high crypto exchanges, as one in every of its high holdings.

Are Cryptocurrencies a Good Funding?

After all, we can not give funding recommendation and "Good" is a subjective time period, with its definition being measured in opposition to quite a lot of standards, however many crypto lovers and monetary thought leaders within the area really feel that it’s one thing price contemplating having as a part of a diversified portfolio. As cryptocurrency is sort of unstable, it is not uncommon for buyers to begin by solely exposing 1-5% of their internet price to crypto belongings, and, as with all funding, solely investing what they’ll afford to lose.

Professionals & Cons of Cryptocurrency

Cryptocurrency Professionals

- Decentralisation: There is no such thing as a central or single entity controlling the blockchain networks the place cryptocurrencies reside, not like fiat currencies that are 100% managed by the federal government and central banks. You possibly can have entry to your funds with out concern of seizure.

- Safety: Superior encryption strategies are used to safe cryptocurrency transactions, which retains the funds protected.

- Anonymity: No private info is important to carry out a crypto transaction. Cryptocurrencies akin to Monero are nice for many who worth privateness.

- Transparency: Public blockchains have ledgers which might be publicly accessible for anybody to entry them. The transactions recorded are pseudonymous, with solely a pockets deal with as a reference for every transaction that occurred.

- Immutability: As soon as a transaction is recorded on the blockchain, it can’t be altered or deleted in any manner. This makes falsifying data an impossibility.

- Environment friendly: No intermediaries of any type are required to switch cash from one celebration to a different. Not solely does this velocity up effectivity, it additionally significantly lowers any charges incurred.

- Complete possession management: Customers might be their very own financial institution by having 100% custody of their very own funds by storing their crypto in chilly wallets.

Cryptocurrency Cons

- Irreversibility: Transactions made in error can’t be reversed. This consists of sending tokens via the incorrect community or utilizing the incorrect pockets deal with. These leads to misplaced funds which might be often irretrievable. On this sense, crypto could be very unforgiving.

- Volatility: Cryptocurrency costs can fluctuate sharply from at some point to the following. Modifications of 10% and above both manner is a frequent prevalence.

- Lack of regulation: Little regulatory oversight within the cryptocurrency area provides room for fraud, scams, and different unlawful actions to thrive.

- Steep studying curve: There's quite a lot of new information to study, and it's not straightforward for many individuals to grasp, thus limiting adoption.

- Sturdy sense of accountability: Customers are extremely inspired to have custody over their very own funds. This generally is a huge stress for many who are used to having others be the custodian of their belongings.

- Safety dangers: Some cryptocurrencies are vulnerable to cyber-attacks and hacks. As well as, poorly-written code or misconfiguration may result in lack of funds.

- Power hungry: Proof-of-work mining has usually been criticised because the least eco-friendly approach to generate mining rewards because of the giant demand for electrical energy to energy the machines. Nevertheless, improvements are being made to harness the power generated by the machines to be the supply for different actions that profit mankind, akin to powering greenhouses to develop meals.

- Lack of buyer help: When one thing goes incorrect, it's not doable to seek out the blockchain's help heart to hunt assist or deal with a problem. This inconvenience is mitigated by the group help for the blockchain, which is usually discovered on social media channels.

Closing Ideas

I hope that by the tip of this text, I’ve laid out sufficient info about cryptocurrencies to fulfill not less than a little bit of your curiosity about cryptocurrencies. For the skeptics, I hope that you just've learn sufficient to place apart a few of that skepticism and conform to delve just a bit bit deeper to grasp extra about this new budding expertise that would probably take the world by storm.

It is likely one of the grandest needs of fervent cryptocurrency believers that 1 Bitcoin = 1 Bitcoin. Which means, if purchases are priced in Bitcoin, Bitcoin's buying energy can be unaffected by the rise and fall of its worth in opposition to any sort of fiat forex. The one manner for this to occur is for sufficient folks to just accept Bitcoin as a type of fee by itself deserves. If that occurs, the world would've undergone a seismic shift not solely in economics, but additionally in "the affairs of humans" as politics is understood. This shift may very properly mark a change and revolution in society.

We’re simply starting to discover the varied methods they are often included into our lives. Whereas a lot of as we speak's winners is probably not round in a decade or so, there are numerous as-yet-unborn entities that would find yourself as tomorrow's champions. No matter how issues will prove within the present state of affairs, the introduction of cryptocurrencies will definitely mark the daybreak of a brand new milestone for human civilisation.

Regularly Requested Questions

What Cryptocurrency Ought to a Newbie Purchase?

Most novices begin with Bitcoin as it’s the least dangerous and most well-established. It’s extremely liquid, holds the most important market cap, and is the one crypto representing all of crypto to these outdoors of the crypto business. Chances are you’ll not see large good points in comparison with among the riskier tokens on the market, however in comparison in opposition to equities, its development has been nothing in need of exceptional.

The way to Study Crypto for Newcomers?

Because of the web, there isn’t a scarcity of knowledge one can look as much as study extra about crypto. Consuming high quality content material, akin to Coin Bureau’s YouTube channel or listening to crypto podcasts aimed toward crypto novices generally is a good begin. If you happen to want to study in a extra systematic trend, you possibly can sign-up for programs on academic platforms akin to Coursera or EdX.org.