In the crypto-world, innovation is accelerating at a breakneck pace. Each new development promises to close the gap left by its predecessors. The crypto world hasn’t been free of flaws.

Bitcoin and Ethereum's scalability issues have been well-documented and often serve as a topic of interest in crypto circles. Along with the high transaction costs and slow confirmation times that come along with this scalability problem, mainstream adoption is affected. These issues created the need for a solution that addresses these problems while preserving crypto's decentralization ethos.

Enter Arbitrum. It aims to show a way towards a crypto-future that is more scalable.

This Arbitrum review will tell you everything you need to know about the L2.

Arbitrum

Arbitrum is one of the projects that uses Optimistic Rollups. The Layer-2 Blockchain, also known as L2, is a Layer-2 network built over the Ethereum (Layer 1 ) network. By adopting optimistic rollups, Ethereum can solve its scalability problem, allowing it to increase the speed of transactions. This in turn reduces transaction fees as the number of transactions added per block increases.

While transactions on Arbitrum are done via ArbOS (the operating system which handles all transactions and charges fees), the Ethereum network is responsible for processing the security of the transactions. So it's essentially combining the best of both worlds.

Arbitrum’s consensus algorithm for processing transactions is called the AnyTrust Garantie. The way this works is all validators must agree before a new block can be added. As long as there is one validator who disagrees, the block won't be added to the blockchain.

The project's primary target audience is developers, as it offers an ETH-friendly environment for them to build DApps without costly fees. In the sections that follow, we’ll also highlight some of the key features and benefits offered by the project.

Arbitrum Rollup

The number of dispute rounds required to settle challenges is one way to differentiate between different types of rollups. Arbitrum's version uses the Multi-Round Interactive Optimistic Rollup. A contract on the chain referees back and forth between the challengers and asserters. The amount of data available on the chain is also low.

The EVM is compatible with the Ease-of-Use and ease of use

Arbitrum’s high compatibility is also a highlight. The EVM can be described as the "computer" The Ethereum Smart Contract execution network is run by Arbitrum. Arbitrum is its own platform."supercomputer"Arbitrum is based on the Arbitrum virtual machine, also known as AVM. ArbOS sits on top of AVM. AVM uses the EVM architecture. The AVM supports the EVM architecture.

Arbitrum positions itself in this way as the "home-away-from-home" Option for ETH developers. This is because it supports not just EVM but all Ethereum tools natively without any additional add-on. It supports all smart contracts languages such as Solidity. dApps developed originally in Ethereum will easily migrate to Arbitrum by making minimal changes to the code. It's never been easier to move dApps over, making it a most attractive option as the transaction costs are drastically lower than working on the Ethereum network itself.

Short History

In May 2021, the project was soft launched. Two months after the soft launch, in early July about 300 DApps had been launched. On August 31, 2021, the mainnet, also known as Arbitrum 1, was launched.

Arbitrum Ecosystem

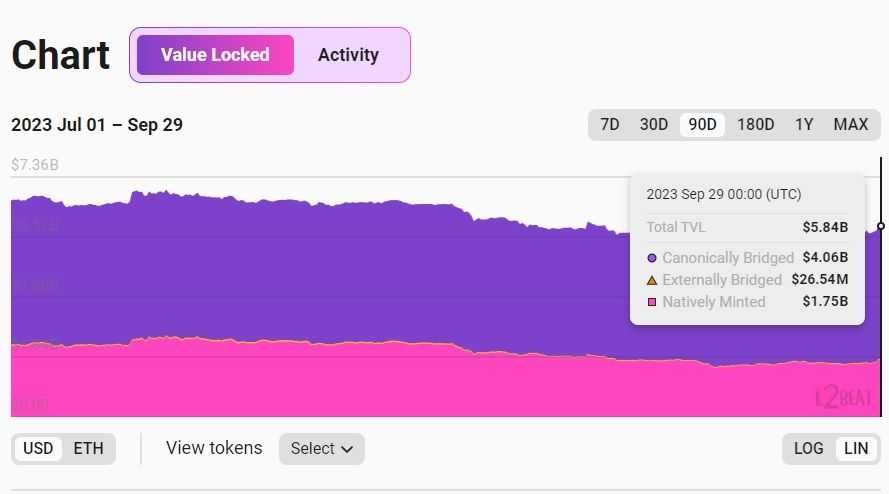

Ethereum accounts for more than half of all L2s’ Total Value Locked.

TVL, or TVL Arbitrum One, was 5.84 billion dollars. That's more than half the market share! The Ethereum community is very popular and believes in it.

Now, let's see what kind of DApps are on Arbitrum.

"Your portal to discover the Arbitrum ecosystem" When you visit the Arbitrum Portal, the first thing you’ll see is Projects and Bridge. You can choose between two different categories: Projects or Bridge.

Projects

It allows you to explore the Arbitrum ecosystem and its 600+ DApps. According to DefiLlama the top 10 DApps in Arbitrum are all related to DeFi. DAppRadar has also identified a number of other interesting DApps.

- You can also find out more about the following: Play Web3 Gaming, there's HunnyPlay, SpartaDEX and MODragon.

- ZKasino and BetSwirl, as well as JustBet are all listed. category.

- Post.Tech Galxe QuestN is amongst the best. Social DApps Arbitrum.

Bridge

The Arbitrum bridge facilitates asset transfers between Arbitrum One (an AnyTrust-based chain), Arbitrum Nova and Ethereum’s mainnet.

Offchain Labs

The team building Arbitrum carries an impressive resumé. From New York, previous experiences have ranged from Deputy US Chief Technology Officer at the White House (Ed Felten), to Senior Advisor for the President, to Co-Author of the Leading Textbook in Cryptocurrency, Bitcoin and Cryptocurrency Technologies by Steve Goldfeder, to Technical Consulting on Cryptocurrency Projects. In addition to this, many of the rank and file staff are crypto enthusiasts with their own areas of interest.

Major investors in the blockchain sector include Lightspeed, Pantera and Polychain Capital. Lightspeed, Pantera, and Polychain Capital are major investors. With the help of other VCs like Coinbase Ventures Blockchain, Fenbushi Capital and Mark Cuban Companies to name a couple, a total $120 Million in Series B funding has been raised.

With this amount of institutional support, it's safe to say that Arbitrum is no fly-by-night operation, and the calibre of its team is proof of its staying power in the crypto world. They're also looking to expand their team to cater for their dramatic growth.

Arbitrum Reddit Project

Offchain Labs was part of a project with Reddit that was very exciting. Reddit’s decision to introduce its ERC-20 Token, Community Points to its users was a big deal. "Scaling Bake Off" Pick the best blockchain to collaborate on. Arbitrum won the competition by beating 21 competitors. Reddit contributors can also earn tokens through quality comments. These tokens can then be used to purchase items from the Reddit community.

Arbitrum Token Airdrop

Arbritum’s governance token, ARB was released in March 2023. It was an enormous success, with over 1 billion tokens distributed. Daily transactions increased before the launch from 300k up to over 2.7 millions on the day the airdrop. Active users also increased from 100,000 to more than 600,000.

Arbitrum TVL was contributed by:

- GMX: A decentralized perpetual exchange

- Uniswap v3 : a liquidity provider

- Arbritum Exchange

- The DAO: Sushi

In January 2023, Arbitrum’s total value lock (TVL), was $1.62 Billion. However, by March 31, TVL was over $2 billion and, according to Arbitrum website's, TVL stood at $5.5 billion as of Aug. 31.

Arbritum’s market capitalization is over $1 billion, and its fully diluted valuation exceeds 9 billion dollars

ARB is the 41st most valuable coin according to CoinGecko.

ARB reached an all-time peak of $8.67 per share in March 2023. However, it lost these gains by September 2023 when the stock plummeted to its lowest level.

It will be fascinating to watch how ARB does as we emerge from the bear market.

The Arbitrum Technology Upgrade

Nitro

Arbitrum introduced the Nitro Upgrade in August 2022. Arbitrum Nitro has the following improvements over original Arbitrum:

- Transaction costs reduced: The average cost to send Ethereum on Arbitrum (ETH) is $0.25.

- The Nitro Upgrade increases performance of layer 1 nodes.

- Compatible with Ethereum Virtual Machine (EVM).

- Additional layer 1 interoperability

- Geth Trading to improve debugging and compatibility of Ethereum. “compiling in the core code of Geth (go-Ethereum).”

"Geth (go-ethereum) is a Go implementation of Ethereum – a gateway into the decentralized web. Geth has been a core part of Ethereum since the very beginning. Geth was one of the original Ethereum implementations making it the most battle-hardened and tested client." Geth Ethereum

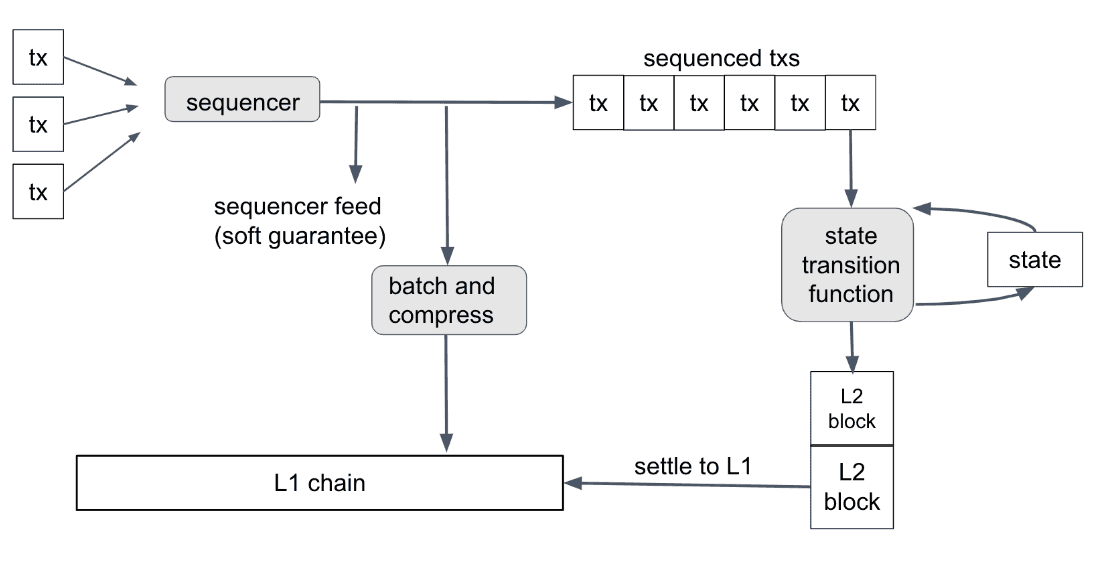

Nitro’s two-phase transaction processing strategy begins with an order sequence, and is then processed by a function that determines the state of each element in this sequence.

Arbitrum wanted to also separate execution and proving. Nitro compiles the source code two times:

- Executed in Nitro to Native code for speed.

- WASM is a security-portability tool that can be used to optimise and prove the effectiveness of WASM.

Nitro utilizes an optimistic rollup protocol for settling transactions on the Ethereum layer 1 chain.

Nitro is the proprietary Blockchain network technology stack behind Arbitrum One, and Nova. Nitro’s rollup architecture is 7x faster than Ethereum, and has lower fees. (Source: Arbitrum)

Layer 2 solutions, Rollups bundle transaction data to transfer it away from a main blockchain. The transactions are performed off-chain and the assets are stored in smart contracts on-chain.

One of the main benefits that Arbitrum offers is super-fast transaction speed (TPS).

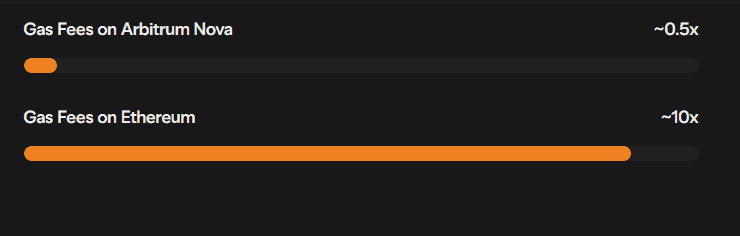

Ethereum has an average transaction speed of 30 TPS. This is compared to an astonishing 40,000 transactions per second for Arbitrum. Fees are lower when transactions happen faster. Ethereum transactions cost up to several dollars, while Arbitrum costs only two cents.

AnyTrust Chain by Arbitrum Nova

Arbitrum introduced Nova, a new product in July 2022 that uses AnyTrust Technology.

AnyTrust Protocol accepts mild assumptions of trust by using an external committee. AnyTrust is based on the assumption that two honest people make up the Committee. To ensure that data is used correctly, one party must have access to the data.

Arbitrum Nova is a DApp that offers low-cost transactions with high security.

Nova's use cases include the following:

- Game developers: to increase functionality for the users.

- Nova was used to build the Reddit Community Point System.

- Blockchain DApps. Multiple use cases such as NFT systems.

Nova has "strong security guarantees using a DAC (Data Availability Committee) model). Committee members include the following list of well-known companies: –

- Consensys

- Quicknode

- Offchain Labs

- Google Cloud

"Nova is powered the most trustworthy organizations on web2 and web3." (Source: Arbitrum)

To learn more about AnyTrust technology, visit Arbritum's Developer AnyTrust page.

Arbitrum Stylus

Arbitrum announced the launch of Stylus in February 2023 as a next-generation "Programming environment upgrade for arbitrum One and arbitration Nova"

Stylus technology is interoperable with Ethereum Virtual Machine (EVM). It enables the deployment of smart contracts in programming languages like C++, C and Rust to Arbitrum One and Nova, alongside Solidarity DApps on existing EVM programs.

"You won't have to know Solidity to build on Arbitrum. The tooling that engineers are familiar with can be used, no matter their preferences." (Source: Arbitrum Medium).

Stylus enables lower fees and faster DApps. Stylus technology means that a contract does not need to know what language others use. It has multiple use cases, such as DeFi, gaming, DAOs, and many more can benefit from the data saving costs and increased performance.

Users compile their programs into WASM, transforming on-chain into an enforced, secure execution.

WASM is an abbreviation of WebAssembly.

"WASM is a software standard that defines an executable binary-code and text interface for such programs, as well as a way to facilitate interaction between them and the host environment. WebAssembly. Paradigm. Structured; stack machine." (Source: Wikipedia)

Stylus enables the termination of malicious programs without evoking the EVM and can be proven on-chain.

"Stylus doesn't replace the EVM; it augments it. We call EVM+ because we do everything additively." (Source: Arbitrum Medium).

Top Projects On Arbitrum

Hundreds of projects have partnered with Arbitrum, from DeFi lending, crypto wallets, NFT platforms, stablecoins, infrastructure and much more.

- Superfluid: DeFi Primitive

- ToFu NFT: NFT Marketplace

- Aave: DeFi Lending Platform

- Curve: Decentralised exchange

- Coinbase Wallet: Crypto Wallet

- Huobi Wallet: Multi-chain wallet

- Dev Protocol: Middleware Protocol

- Synapse: Cross-Chain Layer Protocol

- Farmland: Decentralised Farming Game

- FluidFi: Tokensised Equity in Fluid Finance

- Abracadabra: Interest Bearing Crypto Assets for Collateral

To view all projects, visit the Arbiproject website.

Risk & Pain Points

As much of a powerhouse as Arbitrum has been with its success, it is not without some weaknesses. Here are two key areas to pay attention to:

Optimistic vs zkRollups

The design of optimistic rollups involves a challenge period, which can be up to 2 weeks, as it gives people ample opportunity to check that all blocks are actual transactions. For those who want to withdraw their tokens, this can be a long wait time before getting their tokens back. Here is where zkRollups shine.

Unlike Optimistic rollups with the challenge period, zkRollups, also known as zero-knowledge Rollups, generate a validity proof known as SNARK to validate the authenticity of the transactions. SNARK contains only key details of the transaction, not the complete data. This rollup method does not require a challenge period, which makes moving funds around a lot faster.

If you want to dive deeper into the Layer 2 scaling race, check out our in-depth analysis of Arbitrum vs. Optimism and ZkSync.

Fund Security

According to L2Beat, a website that compares L2 projects together with analysis, there are a few ways that the security of funds can be compromised on Arbitrum, including, but not limited to:

- Mistakes in the AVM implementation could lead to lost funds.

- The centralised validator going down, which means users cannot create new blocks. However, exiting the system requires a new block to be produced. In this case, funds can be frozen. This recently happened due to the current centralised structure.

- No delays in code upgrades might mean that a malicious code can slip in without knowing. This kind of incident could result in stolen funds.

Conclusion

In 2021, we saw the rise of L1 alternatives like Solana, Avalanche and Fantom chomping away at Ethereum's market share. These L1s honed in on Ethereum's weaknesses and jumpstarted their ecosystems of DApps to provide an alternative to Ethereum's offerings. These alternative L1s may have gotten a headstart with faster transaction speed and low-cost fees, but is it as secure as Ethereum? They also have their growing pains to contend with, as can be seen with Solana's on-off outages in the past few months

In the space of L2s, Arbitrum is the top dog and the one to beat. How long it can retain its winning crown depends on its development pace to secure the blockchain. News of a bug causing a 7-hour outage within five months of another bug is not something it wants to be known for.

There is talk that L1s will mainly be for the bots in the future as humans will likely be interacting with DApps built on L2s. When you think of it, internet users don't need to know about IP addresses or website domain hosting to shop online or check their email.

It is highly plausible in the not-so-distant future that things like gas fees and which blockchain is hosting the DApps will be of no interest to the general public as these friction/touchpoints will already have been ironed out or "rolled up" under a slick UI and compelling service/ product. Arbitrum won’t be well-known to most people until that moment.

Arbitrum is a company we look forward to following over the coming years.

FAQs

Does Arbitrum Crypto Make a Good Investment?

Do your research before investing. You can benefit from talking to a financial adviser who is familiar with the crypto industry.

It is impossible to predict where the token prices will go on the cryptocurrency market. Arbitrum’s ARB token saw a lot of adoption, but it is interesting to watch what happens when the cryptocurrency market goes on a bullish run.

Where Can I Purchase Arbitrum ARB

It is always a good idea to choose a reliable cryptocurrency exchange. The following well-established platforms include Arbitrum ARC.

- Binance

- Coinbase Exchange

- Kraken

- Gate.io

- OKX

What is the security of arbitrum?

Arbitrum offers good security because it relies on zk rollups, which are known as zero knowledge. This reduces the risk of an attack. ZK rolls combine several transactions to create a single transaction. This reduces how much information is stored in the blockchain.

What is Arbitrum and how do I invest?

Choose Binance as your crypto exchange of choice if you decide to invest in Arbitrum.

- Join Binance for free via website or mobile app

- Verify that your account is valid by submitting government proof like a driver’s license

- Verify your account by clicking the button. “Buy Crypto”

- You can use a debit or credit card or a stablecoin like USDC. (You will need a cryptocurrency wallet).

- Your new ARB tokens will be transferred to your crypto wallet.

It is always recommended by financial experts to only spend what you can afford.