Staying forward of market traits is essential to creating knowledgeable buying and selling choices. That is the place crypto charting apps are available. These platforms present real-time value knowledge, technical evaluation instruments, and portfolio monitoring, serving to merchants and traders navigate the usually unstable crypto market with confidence.

Choosing the proper charting app is crucial for market evaluation. Whether or not you’re a newbie monitoring Bitcoin’s value or a seasoned dealer executing complicated methods, the correct instrument could make all of the distinction. Superior charting options, customizable alerts, and cross-platform accessibility might help merchants spot traits, set value alerts, and execute trades with precision.

This text explores the highest crypto charting apps, highlighting their options, execs and cons, and pricing choices. Whether or not you want an all-in-one buying and selling platform, a free market knowledge aggregator, or a sophisticated technical evaluation instrument, we’ve acquired you coated.

What Are Crypto Chart Apps?

In the event you’ve ever tried buying and selling crypto with out a charting app, you in all probability felt like a pilot flying blind. Crypto chart apps are important instruments that give merchants a visible illustration of value actions, serving to them analyze market traits and make knowledgeable choices.

At their core, these apps present real-time value monitoring, permitting customers to see how totally different cryptocurrencies are acting at any given second. However they’re extra than simply fancy value tickers. They arrive filled with technical indicators, overlays, and analytical instruments that assist merchants predict market actions. Whether or not you're easy line charts or deep-diving into complicated candlestick patterns, these apps present the required insights to strategize trades successfully.

Why Are They So Essential?

Crypto markets are wildly unstable—costs can swing dramatically inside minutes. A superb charting app helps merchants keep forward by providing:

- Sample Recognition – Figuring out bullish or bearish traits early.

- Quantity Monitoring – Understanding market sentiment and liquidity.

- Customized Alerts – Notifying customers of important value ranges or development adjustments.

- Historic Information Evaluation – Studying from previous value actions to foretell future traits.

For day merchants, swing merchants, and even long-term traders, a crypto charting app isn't simply helpful—it’s a necessity. With out it, you're basically guessing in a market the place data-driven choices make all of the distinction.

Key Options to Search for in a Crypto Chart App

Some are filled with options that make buying and selling a breeze, whereas others barely transcend exhibiting value actions. Whether or not you’re a newbie simply dipping your toes into the crypto market or a seasoned dealer on the lookout for an edge, choosing the proper charting app boils down to some key options. Let’s break them down.

1. Actual-Time Value Monitoring and Information Updates

Crypto strikes quick—like, blink-and-you-miss-it quick. A strong charting app ought to present real-time value updates so that you’re by no means caught off guard by a sudden value surge (or crash). Stale knowledge is a dealer’s worst enemy, particularly in a market that operates 24/7. The very best apps pull stay knowledge from a number of exchanges, guaranteeing accuracy and retaining you forward of the sport.

2. Superior Charting Instruments: Candlesticks, Indicators, and Overlays

Charts aren’t only for wanting fairly—they’re the inspiration of technical evaluation. A robust app ought to supply:

- Candlestick charts – The gold customary for merchants, providing insights into market sentiment, momentum, and value route.

- Indicators – Instruments like Shifting Averages (MA), Relative Energy Index (RSI), and Bollinger Bands assist predict potential value actions.

- Overlays – Enable merchants to superimpose a number of technical indicators on a single chart for deeper evaluation.

The extra instruments you’ve at your disposal, the higher your possibilities of making worthwhile trades.

3. Customizable Alerts for Value Actions and Buying and selling Alerts

Think about waking as much as discover Bitcoin simply hit the worth you had been ready for—however you missed the commerce. That’s the place customized alerts are available. The very best charting apps allow you to set:

- Value alerts – Get notified when an asset hits a sure stage.

- Quantity alerts – Preserve observe of sudden spikes or drops in buying and selling exercise.

- Indicator-based alerts – Get real-time updates when an asset crosses key technical ranges.

Customized alerts take the guesswork out of buying and selling and maintain you knowledgeable even while you're away from the display screen.

4. Integration with Exchanges and Portfolio Administration Instruments

A terrific charting app isn’t nearly charts—it also needs to make it straightforward to commerce and observe your portfolio. Search for:

- Trade integration – The power to commerce instantly from the charting app with out consistently switching platforms.

- Portfolio monitoring – Retaining tabs in your holdings, good points, and losses in actual time.

- API connectivity – Seamless linking to a number of exchanges for unified knowledge monitoring.

In a market the place timing is every little thing, an app that mixes charting, alerts, and buying and selling in a single place offers you a severe benefit.

Our High Picks for 2025

To make your life simpler, we've curated an inventory of top-notch apps that stand out in 2025. Right here's a fast overview:

| Platform Identify | Accessible on | Free Model | Beginning Value |

|---|---|---|---|

| TradingView | Internet, iOS, Android | Sure | $14.95/month |

| CoinGecko | Internet, iOS, Android | Sure | $103.2/month |

| Delta | Internet, iOS, Android | Sure | $13.99/month |

| CoinMarketCap | Internet, iOS, Android | Sure | $29/month |

| CryptoView | Internet, iOS, Android | Sure | $19/month |

| Coinigy | Internet, iOS, Android | Sure | $18.66/month |

TradingView

TradingView has earned its popularity as a premier charting platform, catering to each novices and seasoned merchants. Its user-friendly interface mixed with highly effective analytical instruments makes it a favourite within the crypto group.

Options:

- Complete Charting Instruments: Entry over 400 built-in indicators and techniques, together with 110+ sensible drawing instruments, facilitating in-depth market evaluation.

- Group-Pushed Insights: Have interaction with an enormous group the place merchants share concepts, scripts, and techniques, fostering collaborative studying.

- Multi-Machine Accessibility: Seamlessly swap between units with apps accessible for net, iOS, and Android, guaranteeing you're at all times related to the markets.

Professionals:

- Person-Pleasant Interface: Designed to be intuitive, making it accessible for merchants in any respect ranges.

- In depth Customization: Tailor your charts with a plethora of indicators and drawing instruments to fit your buying and selling model.

- Lively Group: Profit from shared insights, customized scripts, and real-time concepts from merchants worldwide.

Cons:

- Subscription Prices: Whereas a free model is accessible, superior options require a subscription, which may be a consideration for budget-conscious customers.

- Studying Curve: The abundance of instruments and options might be overwhelming for newcomers, necessitating time to completely harness its potential.

Pricing:

TradingView affords a number of subscription tiers, with Non-Skilled and Skilled Plans.

The Non-Skilled plan stands at:

- Important: $14.95/month or $12.95/month if annual.

- Plus: $29.95/month or $24.95/month if annual.

- Premium: $59.95/month or $49.95/month if annual

The Skilled plan stands at:

- Knowledgeable: $119.95/month or $99.95/month if annual.

- Final: $239.95/month or $199.95/month if annual.

Every plan caters to totally different wants, with the Important plan offering ample options for many merchants.

Do try our detailed information on methods to use TradingView.

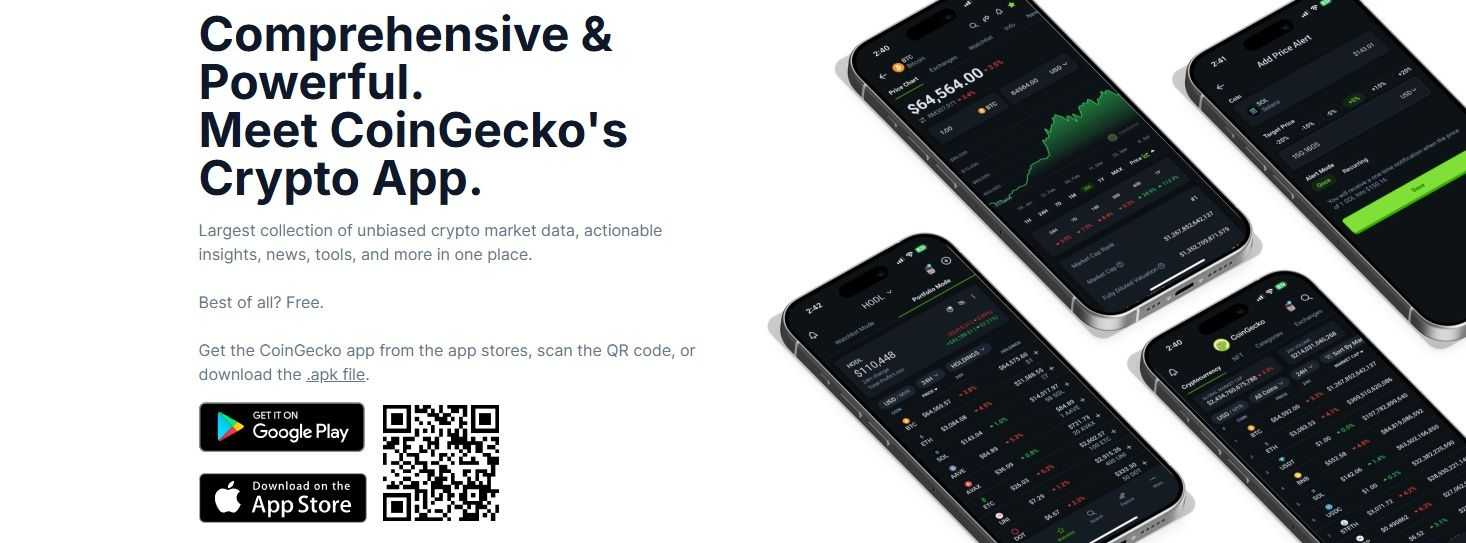

CoinGecko

Established in 2014, CoinGecko has grow to be a cornerstone within the cryptocurrency ecosystem, providing complete knowledge and insights that cater to each newcomers and seasoned merchants. Its dedication to transparency and accuracy has solidified its place as a trusted useful resource within the crypto group.

Options:

- In depth Cryptocurrency Information: CoinGecko tracks over 15,000 cryptocurrencies throughout greater than 1,000 exchanges, offering real-time data on costs, buying and selling quantity, and market capitalization.

- Portfolio Monitoring: Customers can monitor their crypto holdings and assess efficiency via CoinGecko's intuitive portfolio tracker, accessible on each net and cell platforms.

- Instructional Assets: Past knowledge aggregation, CoinGecko affords a wealth of academic content material, together with guides and articles, to assist customers navigate the complexities of the crypto world.

Professionals:

- Person-Pleasant Interface: Designed with accessibility in thoughts, CoinGecko's platform is straightforward to navigate, making it appropriate for customers in any respect expertise ranges.

- Complete Market Protection: With knowledge spanning an enormous array of cryptocurrencies and exchanges, customers acquire a holistic view of the market.

- Free Entry: A lot of CoinGecko's options can be found without charge, offering beneficial instruments with out monetary dedication.

Cons:

- Superior Options Require Subscription: Whereas the free model is strong, accessing premium options necessitates a subscription.

- Information Overload for Newbies: The sheer quantity of data might be overwhelming for newcomers, doubtlessly resulting in evaluation paralysis.

Pricing:

CoinGecko affords the next plans for its API:

- Analyst: $103.2 monthly if billed yearly.

- Lite: $399.2 month-to-month should you pay for the total yr.

- Professional: $799.2 monthly should you select yearly billing.

- Enterprise: Pricing for this tier is assessed on a case by case foundation.

To see what's included in every plan, you possibly can head to the CoinGecko pricing web page. Additionally, we have now an in depth overview proper right here!

Delta

Delta is a flexible funding monitoring app that gives a complete overview of assorted asset lessons, together with cryptocurrencies, shares, ETFs, indices, commodities, foreign exchange, and NFTs. Designed for each novice and seasoned traders, Delta supplies real-time knowledge and insights to assist customers make knowledgeable funding choices.

Options:

- Multi-Asset Monitoring: Monitor a variety of belongings, from conventional shares to digital currencies and NFTs, all inside a single platform.

- Auto-Syncing: Join your portfolios seamlessly with numerous wallets, exchanges, and brokers to routinely synchronize transactions and balances.

- Superior Analytics: Acquire deeper insights into your investments with options like portfolio analytics, asset element screens, and efficiency metrics.

- Customizable Alerts: Set personalised notifications for value actions, information updates, and important adjustments in your portfolio's worth.

- Cross-Machine Syncing: Entry your portfolio throughout a number of units, guaranteeing you keep up to date whether or not you're in your telephone or desktop.

Professionals:

- Person-Pleasant Interface: Delta's intuitive design makes it accessible for traders in any respect ranges, offering a seamless consumer expertise.

- Complete Asset Protection: The app helps an enormous array of belongings, permitting customers to handle numerous portfolios effectively.

- Actual-Time Information: Keep knowledgeable with stay value updates and market charts, enabling well timed funding choices.

- Free Model Accessible: Delta affords a sturdy free model with important options appropriate for a lot of customers.

Cons:

- Restricted Connections on Free Plan: The free model restricts customers to 2 connections with wallets or exchanges, which can be inadequate for energetic merchants.

- Premium Options Require Subscription: Superior functionalities, equivalent to limitless connections and deeper analytics, are accessible solely via a paid subscription.

Pricing:

Delta operates on a freemium mannequin. Free Model consists of primary options with a restrict of two connections and two-device syncing. Then there may be additionally Delta PRO.

- Delta PRO: Priced at $13.99 monthly, or $99.99 yearly, and is even accessible for $299 as a lifetime buy.

PRO affords advantages like limitless connections, superior metrics, stay value updates, and multi-device syncing throughout as much as 5 units. The lifetime buy choice isn't unhealthy in any respect if you’re a severe investor.

CoinMarketCap

Launched in 2013, CoinMarketCap has established itself as a number one authority in cryptocurrency knowledge aggregation, providing a complete suite of instruments and options to help each novice and skilled traders in navigating the complexity of crypto happenings.

Options:

- In depth Cryptocurrency Information: CoinMarketCap supplies real-time monitoring of 1000’s of cryptocurrencies, providing insights into costs, market capitalization, buying and selling volumes, and historic knowledge.

- Portfolio Tracker: Customers can monitor their crypto holdings throughout a number of exchanges and wallets via a unified dashboard, enabling environment friendly monitoring of income, losses, and total portfolio valuation.

- Watchlist Performance: The platform permits for the creation of a number of watchlists, enabling customers to watch chosen cryptocurrencies and obtain updates on market actions.

- Instructional Assets: By means of CoinMarketCap Academy, customers have entry to a wealth of articles, guides, and tutorials.

- API Entry: Builders and analysts can make the most of CoinMarketCap's API to entry stay costs, market caps, and historic knowledge, facilitating the mixing of complete crypto knowledge into numerous functions and providers.

Professionals:

- Complete Information Protection: With an enormous array of tracked belongings, CoinMarketCap affords customers a holistic view of the cryptocurrency market.

- Person-Pleasant Interface: The platform is designed to be intuitive, making it accessible for customers with various ranges of experience.

- Free Entry to Core Options: A lot of CoinMarketCap's important instruments and knowledge can be found without charge, offering beneficial assets with out monetary dedication.

Cons:

- Superior Options Require Subscription: Whereas the platform affords a sturdy free model, entry to premium options, significantly throughout the API providers, necessitates a paid subscription.

- Information Overload for Newbies: The in depth quantity of data accessible might be overwhelming for newcomers, doubtlessly resulting in evaluation paralysis.

Pricing/Price:

CoinMarketCap affords tiered plans to cater to totally different consumer wants:

- Fundamental Plan: Free entry with restricted endpoints and name frequency.

- Hobbyist Plan: Priced at $29 monthly (billed yearly) or $35 month-to-month, providing elevated knowledge entry and name limits.

- Startup Plan: At $79 monthly (billed yearly) or $95 month-to-month, this plan supplies extra complete knowledge and better name limits.

- Customary Plan: For $299 monthly (billed yearly) or $375 month-to-month, customers obtain in depth knowledge protection appropriate for skilled use.

- Skilled Plan: For $699 monthly (billed yearly) or $875 month-to-month, with extra upgrades, significantly suiting industrial use or for tremendous high-end merchants.

- Enterprise Plans: Tailor-made options with customized pricing can be found for organizations requiring superior customized options and help.

CryptoView

Launched in 2019, CryptoView is an all-in-one cryptocurrency portfolio administration and buying and selling platform designed to streamline the buying and selling expertise for each novice and seasoned traders. By integrating a number of trade accounts and wallets right into a single, safe interface, CryptoView affords a complete answer for managing and analyzing cryptocurrency belongings.

Options:

- Multi-Trade Buying and selling: CryptoView permits customers to attach and commerce throughout numerous main cryptocurrency exchanges from a unified platform.

- Superior Charting Instruments: The platform incorporates TradingView charts, and customers can monitor a number of buying and selling pairs concurrently via a completely customizable multi-charting interface.

- Portfolio Administration: Customers can observe their crypto belongings throughout totally different trade accounts and wallets, monitoring numerous efficiency indicators to make knowledgeable funding choices.

- Market Scanner: CryptoView's market scanner covers over 1000’s of buying and selling pairs, outfitted with sensible filters and analytics to assist customers uncover buying and selling alternatives throughout supported exchanges.

- Safety Measures: The platform emphasizes safety by not storing buyer funds or offering pockets providers. All funds stay securely in customers' trade wallets, and CryptoView applies enterprise-grade safety requirements to guard API keys and private knowledge.

Professionals:

- Person-Pleasant Interface: CryptoView's intuitive design caters to each newcomers and skilled merchants, facilitating environment friendly navigation and evaluation.

- Complete Toolset: The mixing of superior charting instruments, portfolio administration, and market scanning options supplies a holistic buying and selling expertise.

- No Further Buying and selling Charges: Other than the subscription charge, CryptoView doesn’t impose further transaction charges or commissions, permitting customers to commerce with out incurring extra prices.

Cons:

- Subscription-Primarily based Mannequin: Whereas CryptoView affords a 30-day free trial, continued entry to premium options requires a subscription, which can be a consideration for budget-conscious customers.

- Studying Curve for Superior Options: The in depth vary of instruments and functionalities may require time for brand new customers to completely discover and make the most of successfully.

Pricing/Price:

CryptoView operates on a subscription-based mannequin with totally different plans. The Free Plan supplies primary entry with restricted options. There’s additionally the premium plan which affords full entry to all options, together with multi-exchange buying and selling, superior order sorts, order historical past synchronization, and the market scanner.

The Premium subscription is accessible at:

- Month-to-month Subscription: $19 monthly.

- 3-month Subscriptions: $17 monthly.

- 6-Month Subscription: $15 monthly.

- Annual Subscription: $13 monthly (billed yearly), offering a 30% low cost in comparison with the month-to-month plan.

Coinigy

Based in 2014, Coinigy is a multi-exchange cryptocurrency buying and selling and portfolio administration platform. By integrating over 45 exchanges right into a single interface, it streamlines the buying and selling expertise for each newcomers and superior customers.

Options:

- Multi-Trade Integration – Commerce and monitor belongings throughout Binance, Coinbase Professional, Kraken, and extra from one dashboard.

- Superior Charting Instruments – TradingView-powered charts with 75+ technical indicators and customizable layouts.

- Actual-Time Information & Alerts – Stay value feeds through CryptoFeed, plus SMS, electronic mail, and browser alerts for value actions.

- Portfolio Administration – 24/7 computerized steadiness monitoring throughout all related trade accounts.

- Cellular & API Entry – iOS and Android apps, together with developer-friendly API providers for automation.

Professionals:

- Complete Trade Help – The most effective multi-exchange buying and selling options.

- No Further Buying and selling Charges – No fee past trade charges.

- Safety-Targeted – API-based buying and selling means funds keep on exchanges.

Cons:

- Paid Subscription Required – No free plan past the trial interval.

- Studying Curve – Some superior options might take time to grasp.

Pricing:

- Professional Dealer – $18.66/month, consists of limitless buying and selling, portfolio monitoring, and charting.

- API Developer Professional – $99.99/month, provides enterprise API entry and precedence help.

Desktop vs. Cellular: Which Platform Ought to You Select?

On the subject of crypto charting apps, one of many greatest choices merchants face is whether or not to make use of desktop or cell. Each platforms have their benefits, however the correct alternative is determined by your buying and selling model and desires.

Desktop: Energy and Precision

For severe merchants, desktop platforms supply superior charting capabilities and higher efficiency. Giant screens enable for in-depth technical evaluation with a number of indicators, overlays, and buying and selling pairs displayed without delay. Plus, desktop apps usually combine with {hardware} wallets and supply sooner execution speeds, making them ideally suited for skilled merchants.

Limitations: Desktop platforms lack mobility, that means merchants may miss alternatives when away from their setups.

Cellular: Comfort and Accessibility

Cellular apps present on-the-go buying and selling, real-time value alerts, and fast order execution. They’re nice for informal merchants or those that must react to market actions anytime, wherever. Most apps supply cross-device syncing, guaranteeing a seamless expertise between desktop and cell.

Limitations: Cellular apps usually have fewer charting instruments and restricted display screen house, making detailed evaluation tougher.

Better of Each Worlds: Cross-Platform Syncing

Customers can sync their settings and charts throughout units, combining desktop energy with cell comfort. This ensures you possibly can analyze charts in your PC and execute trades out of your telephone with out lacking a beat.

Finally, the only option is determined by your buying and selling habits—however gaining access to each platforms affords essentially the most flexibility.

Free vs. Paid Crypto Charting Instruments

When selecting a crypto charting app, one of many greatest choices merchants face is whether or not to stay with a free plan or spend money on a premium model. Whereas free plans present primary options, paid subscriptions unlock highly effective instruments that may elevate your buying and selling sport.

What Do Free Plans Provide?

Most free crypto charting instruments present real-time value monitoring, primary charting, and restricted technical indicators. Apps like CoinGecko, CoinMarketCap, and Delta supply free entry to market knowledge, value alerts, and portfolio monitoring. TradingView’s free tier even consists of interactive charts and a handful of indicators.

Nonetheless, free variations usually include advertisements, restricted historic knowledge, fewer alerts, and restrictions on simultaneous chart layouts. For informal merchants, this may be sufficient, however energetic merchants will possible discover these limitations restrictive.

When Ought to You Improve?

In the event you're severe about buying and selling, premium plans generally is a game-changer. Paid subscriptions—like TradingView ($14.95/month), CryptoView ($19/month), and Coinigy ($18.66/month)—supply:

- Superior technical indicators (e.g., Bollinger Bands, RSI, MACD)

- A number of chart layouts for side-by-side comparisons

- Sooner knowledge updates and precedence entry to new options

- Customized alerts through electronic mail, SMS, or push notifications

- API entry for automated buying and selling and customized evaluation

If you end up annoyed by free-tier limitations—particularly lack of superior indicators, real-time knowledge, or cross-platform syncing—upgrading is a brilliant transfer. Severe merchants will shortly discover that the additional value pays for itself in higher insights and extra environment friendly decision-making.

Methods to Use Crypto Chart Apps Successfully

Crypto charting apps are highly effective instruments, however to get essentially the most out of them, it is advisable know methods to use them successfully. Whether or not you're analyzing value traits, setting alerts, or studying candlestick patterns, mastering these options might help you make higher buying and selling choices.

Setting Up Your First Crypto Chart

Earlier than diving into technical evaluation, it is advisable configure your chart accurately:

- Selecting the Proper Time Body – Brief-term merchants (scalpers and day merchants) usually use 1-minute to 1-hour charts, whereas swing merchants favor 4-hour to every day charts. Lengthy-term traders profit most from weekly or month-to-month charts to seize macro traits.

- Deciding on a Chart Kind – Candlestick charts are essentially the most broadly used as a result of they supply detailed insights into value motion. Line charts are easier however lack depth, whereas bar charts supply comparable knowledge to candlesticks however in a unique visible format.

- Including Technical Indicators – Fashionable indicators embody Shifting Averages (MA), Relative Energy Index (RSI), and Bollinger Bands. These instruments assist merchants establish traits, overbought/oversold circumstances, and potential breakouts.

Utilizing Candlestick Patterns for Higher Market Insights

Candlestick charts are filled with data. Understanding key patterns can enhance your market timing:

- Bullish patterns: Hammer, Engulfing, Morning Star → Point out potential value will increase.

- Bearish patterns: Taking pictures Star, Darkish Cloud Cowl, Night Star → Recommend attainable downturns.

- Reversal alerts: Doji, Head and Shoulders → Warn of development adjustments.

Setting Value Alerts and Notifications

Most charting apps allow you to set customized alerts to watch market actions:

- Value Alerts: Get notified when an asset hits a predefined value goal.

- Quantity Alerts: Determine sudden spikes in shopping for or promoting stress.

- Momentum Alerts: Observe RSI or MACD crossovers for potential development shifts.

By successfully utilizing these options, merchants can keep forward of the market with out consistently gazing their screens.

Remaining Ideas

Choosing the proper crypto charting app is crucial for higher market evaluation, smarter trades, and total portfolio administration. In 2025, platforms like TradingView, CoinGecko, Delta, CoinMarketCap, CryptoView, and Coinigy stand out, providing a mixture of free and premium options tailor-made to totally different buying and selling types.

For newcomers, free plans present primary charting, value monitoring, and portfolio instruments. Skilled merchants, nevertheless, profit from premium variations that unlock superior indicators, a number of chart layouts, real-time alerts, and API entry.

One of the best ways to seek out the correct platform? Take a look at totally different apps and see what suits your wants. Whether or not you like cell comfort or desktop precision, utilizing the correct charting instrument might help you keep forward of the market and commerce with confidence.

Incessantly Requested Questions

What are the primary variations between centralized and decentralized crypto charting apps?

Centralized apps pull knowledge from main exchanges and infrequently require API entry, whereas decentralized apps combination on-chain knowledge instantly from blockchain networks, providing extra transparency however doubtlessly fewer buying and selling options.

How do crypto chart apps deal with excessive market volatility and flash crashes?

Many apps supply real-time alerts, volatility indicators (like Bollinger Bands), and circuit breakers to assist merchants react shortly and decrease losses throughout sudden market swings.

Are there crypto charting apps that combine with chilly storage wallets for added safety?

Sure, some apps like CryptoView enable portfolio monitoring for {hardware} wallets (Ledger, Trezor) with out exposing non-public keys, guaranteeing safe administration of holdings.

What position do social sentiment evaluation instruments play in trendy crypto charting apps?

Social sentiment instruments analyze crypto-related discussions on Twitter, Reddit, and information websites to gauge market temper, serving to merchants predict potential value swings based mostly on sentiment traits.

Can crypto chart apps assist detect insider buying and selling or whale exercise available in the market?

Sure, apps with on-chain analytics observe giant transactions and trade inflows/outflows, which may trace at whale actions or potential market manipulation.

What are the dangers of relying solely on free crypto charting apps for buying and selling choices?

Free apps usually lack superior indicators, have delayed knowledge, and restricted charting capabilities. Relying solely on them might result in missed alternatives and poor decision-making.

How do totally different charting timeframes affect technical evaluation in crypto buying and selling?

Shorter timeframes (1m–1h) are used for scalping and day buying and selling, whereas longer timeframes (4h–1W) assist swing merchants and long-term traders spot macro traits.

Are there AI-powered crypto charting apps that present automated buying and selling methods?

Sure, platforms like TradingView and Coinigy supply AI-driven indicators and bot integrations, permitting merchants to automate methods based mostly on real-time market circumstances.

How do crypto chart apps incorporate macroeconomic knowledge like rates of interest and inflation?

Some apps combine macroeconomic indicators (like CPI, Fed fee choices, and international inventory market knowledge) to assist merchants correlate crypto traits with broader monetary occasions.

What are some lesser-known however highly effective indicators merchants ought to use in crypto charting apps?

Indicators like VWAP (Quantity Weighted Common Value), Keltner Channels, and the Chaikin Cash Stream (CMF) can present distinctive insights into liquidity, development power, and market momentum.