Cryptocurrency exchanges are like digital highways connecting merchants to their crypto aspirations. However identical to toll roads, they arrive at a price—charges! Whether or not you’re an investor shopping for Bitcoin for the primary time or a dealer flipping by way of altcoins, these seemingly small charges can stack up and eat into your income quicker than a bear market dip.

That’s why selecting an alternate with low charges isn’t simply good; it’s a necessary technique for staying forward within the crypto recreation. From buying and selling charges to withdrawal fees, figuring out the place your cash goes could make all of the distinction.

On this article, we’re diving into the perfect low-fee crypto exchanges, exploring platforms that supply cost-effective buying and selling with out reducing corners on safety, liquidity, or options. We’ll additionally make clear zero-fee exchanges—sure, buying and selling free of charge is feasible, however with some strings hooked up!

Prepared to avoid wasting your hard-earned Satoshis and stage up your crypto buying and selling journey? Let’s get began with the highest platforms which can be paving the way in which for budget-conscious merchants.

Earlier than we start, you'd do effectively to take a look at the next articles:

- Finest No KYC Crypto Exchanges

- Prime Fiat-to-Crypto Trade Platforms

- Most secure Crypto Exchanges

- Finest Crypto Exchanges

Prime Picks

Choosing the proper alternate can really feel overwhelming, however a concise comparability desk can simplify the decision-making course of. Under is a fast reference information to the highest low-fee cryptocurrency exchanges, highlighting their price constructions, options, and supported cryptocurrencies.

| Trade | Spot Price Construction | Key Options | Supported Crypto |

|---|---|---|---|

| Binance | Maker: 0.1%, Taker: 0.1% (0.075% with BNB) | Excessive liquidity, strong safety, superior buying and selling instruments | 600+ together with BTC, ETH, BNB, USDT |

| Kraken | Maker: 0.25%, Taker: 0.40% | Consumer-friendly interface, robust regulatory compliance, fiat on-ramp choices | 1,000+ together with BTC, ETH, DOT, SOL |

| KuCoin | Maker: 0.1%, Taker: 0.1% (0.08% with KCS) | Altcoin variety, crypto lending, copy buying and selling options | 800+ together with BTC, ETH, ADA, DOGE |

| Bybit | Maker: 0.1%, Taker: 0.1% | Robust derivatives buying and selling choices | 500+ together with BTC, ETH, XRP, LTC |

| Bitget | Maker: 0.1%, Taker: 0.1% (0.08% with BGB) | Maker: 0.1%, Taker: 0.1% (0.08% with BGB) | 800+ together with BTC, ETH, SHIB, MATIC |

Finest Lowest Price Cryptocurrency Exchanges

Selecting an alternate with the bottom charges could make a world of distinction, whether or not you’re a seasoned dealer executing high-volume trades or a newbie dipping your toes into the crypto market. On this part, we’ll discover the highest platforms that ship aggressive charges with out compromising on important options like safety, liquidity and person expertise.

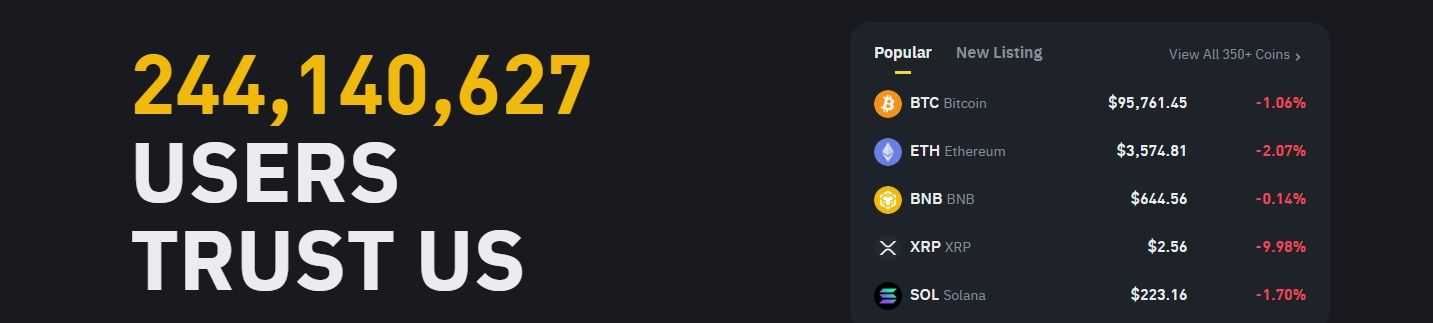

Binance

Binance isn’t simply the most important cryptocurrency alternate by buying and selling quantity—it’s a titan within the crypto house. Beloved for its versatility, user-friendly instruments, and low-cost buying and selling choices, it caters to everybody from first-time merchants to seasoned professionals.

👉 Signal Up For Binance – Unique 20% Buying and selling Price Low cost For Life + $600 Bonus*!

Price Construction

Binance’s aggressive price mannequin is a standout characteristic:

- Spot buying and selling charges: Maker and taker charges each begin at 0.1%. With Binance Coin (BNB) funds, charges drop to 0.075% (25% low cost).

- Futures buying and selling charges: Maker charges are 0.02%, and taker charges are 0.05%, with a ten% low cost for BNB funds.

Options

Binance gives a wealth of options for all sorts of merchants:

- Safety: Trade-leading safety measures, together with chilly storage, two-factor authentication (2FA), and withdrawal tackle whitelisting.

- Supported cash: Over 600 cryptocurrencies, together with Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB).

- Liquidity: As the most important alternate by quantity, Binance ensures quick trades and tight spreads throughout its huge vary of buying and selling pairs.

- Extra instruments: Superior buying and selling for futures and margin, staking and financial savings choices for passive revenue, and academic assets by way of Binance Academy.

Professionals and Cons

Professionals:

• Low charges, with additional reductions for BNB customers.

• Distinctive liquidity and buying and selling quantity.

• An enormous number of cryptocurrencies.

• Robust give attention to person safety.

Cons:

• The interface can really feel overwhelming for freshmen.

• Regulatory restrictions in some areas might restrict sure options.

Try our full overview of Binance for particulars.

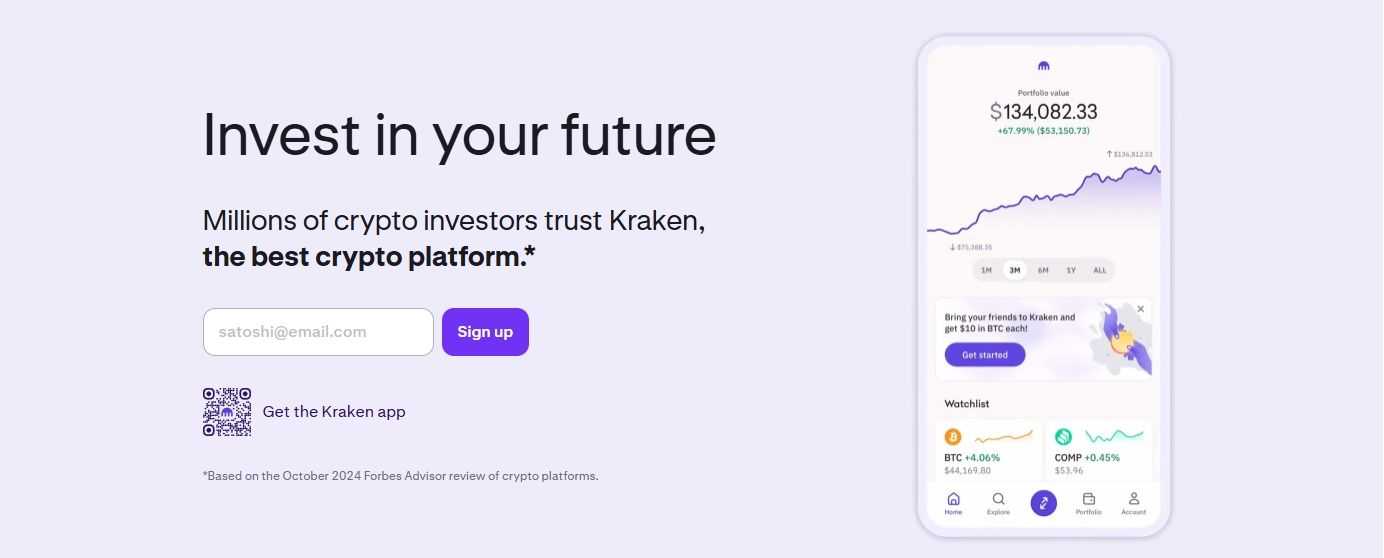

Kraken

Kraken is a well-established cryptocurrency alternate famend for its emphasis on safety, regulatory compliance, and a seamless buying and selling expertise. Catering to each freshmen {and professional} merchants, Kraken is a reliable platform for purchasing, promoting, and staking cryptocurrencies.

👉 Signal Up For Kraken

Price Construction

Kraken gives a clear and aggressive price mannequin:

- Spot buying and selling charges (Kraken Professional): Maker charges begin at 0.25%, lowering to 0.00% for high-volume merchants. Taker charges begin at 0.40%, dropping to 0.10% with elevated buying and selling exercise.

Options

Kraken stands out with a set of options designed to boost the buying and selling expertise:

- Safety: Trade-leading safeguards like two-factor authentication (2FA), chilly storage for almost all of funds, and common audits to make sure compliance and person belief.

- Supported cash: Kraken helps 1000’s of tokens, together with mainstream currencies like Bitcoin (BTC), Ethereum (ETH), Polkadot (DOT), and Solana (SOL).

- Liquidity: Deep liquidity swimming pools present quick order execution and minimal slippage, even for high-volume trades.

- Extra instruments: Superior buying and selling choices like margin and futures, aggressive staking providers for passive revenue, and fiat on-ramps for seamless transitions between conventional currencies and crypto.

Professionals and Cons

Professionals:

• Robust give attention to safety and regulatory compliance.

• Clear price construction with volume-based reductions.

• Big selection of cryptocurrencies and fiat currencies supported.

• Dependable and intuitive interface appropriate for all dealer ranges.

Cons:

• Buying and selling charges may be barely larger than rivals like Binance at decrease quantity tiers.

• Some fiat deposit strategies might incur charges.

Try our detailed overview of Kraken right here.

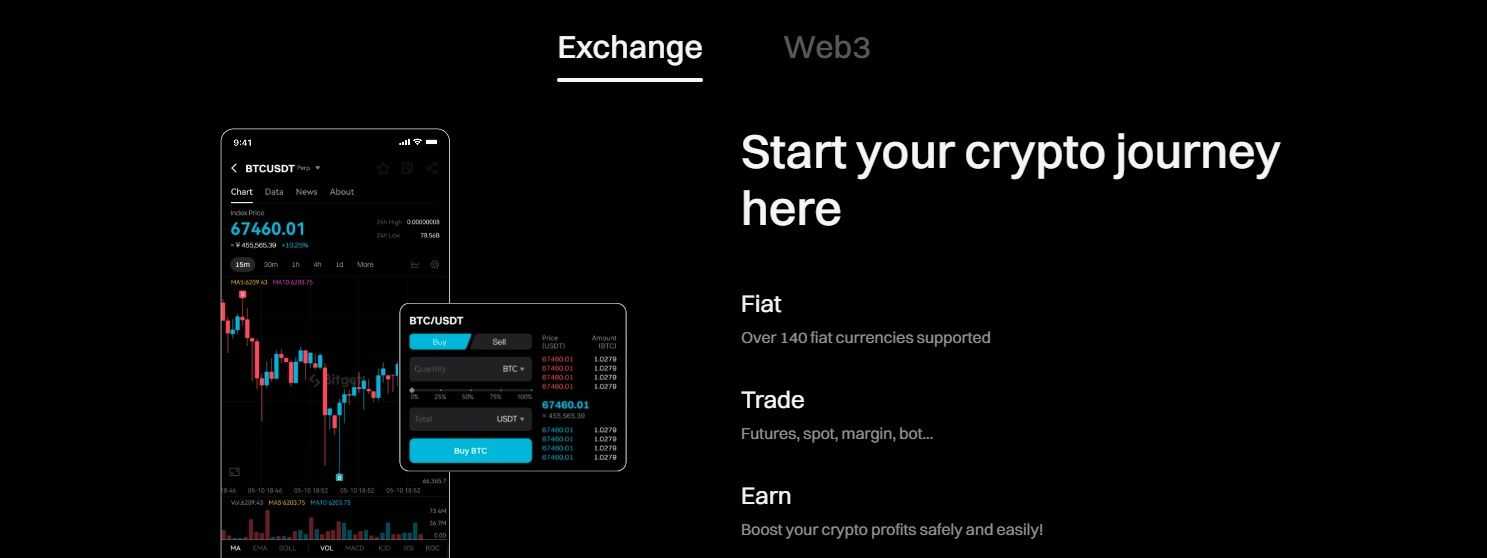

KuCoin

KuCoin, usually referred to as the "People's Exchange," has gained recognition for its broad number of altcoins and progressive options like copy buying and selling and crypto lending. This versatile platform is right for merchants trying to diversify their portfolios and revel in cost-effective buying and selling.

👉 Signal Up For KuCoin – Buying and selling Price Low cost of Up To 60% + FREE Buying and selling Bot!

Price Construction

KuCoin’s price mannequin is aggressive and versatile:

- Spot buying and selling charges: Each maker and taker charges begin at 0.1%, with reductions lowering them to 0.08% for funds made utilizing KuCoin Token (KCS).

- VIP tiers: Excessive-volume merchants get pleasure from additional reductions, with maker/taker charges as little as -0.005%/0.025% or -0.005%/0,020% with KCS reductions.

Options

KuCoin stands out for its versatility and innovation:

- Safety: Multi-layered measures corresponding to chilly pockets storage, two-factor authentication (2FA), and an insurance coverage fund to safeguard towards sudden losses.

- Supported cash: Entry to over 800 cryptocurrencies, together with main tokens like Bitcoin (BTC) and Ethereum (ETH), in addition to a variety of altcoins.

- Liquidity: Whereas not as deep as Binance’s, KuCoin ensures adequate liquidity throughout most buying and selling pairs for clean transactions.

Extra instruments

- Copy buying and selling: Permits customers to duplicate the methods of top-performing merchants.

- Staking and lending: Presents passive revenue alternatives for cryptocurrency holders.

- NFT market: Facilitates buying and selling within the booming NFT sector.

Professionals and Cons

Professionals:

• Aggressive buying and selling charges with additional reductions for KCS holders.

• An in depth number of altcoins, together with area of interest tokens.

• Progressive options like copy buying and selling and lending providers.

• Robust emphasis on safety and person safety.

Cons:

• Restricted fiat-to-crypto choices in comparison with some rivals.

• Buyer help response instances may be slower throughout peak durations.

Try KuCoin's detailed overview right here.

Bybit

Bybit has carved out a distinct segment as a number one alternate for merchants in search of aggressive charges and strong instruments for each derivatives and spot buying and selling. With its beginner-friendly design and progressive options like copy buying and selling, ByBit caters to a variety of customers, from novices to seasoned execs.

👉 Signal Up For Bybit – Up $60K In Rewards

Price Construction

Bybit’s price construction is designed for cost-effective buying and selling:

- Spot buying and selling charges: Maker and taker charges begin at 0.1%, with reductions for VIP customers lowering charges to as little as 0.005/0.015%

- Derivatives buying and selling charges: Maker charges are 0.02%, and taker charges are 0.055%, with additional reductions for high-volume merchants.

Options

Bybit gives a powerful mixture of options designed to boost buying and selling effectivity and person expertise:

- Safety: Utilizing chilly storage for almost all of funds ensures asset safety; and two-factor authentication (2FA) and withdrawal tackle whitelisting present further account security.

- Supported cash: ByBit helps over 500 cryptocurrencies, together with Bitcoin (BTC), Ethereum (ETH), XRP, and Litecoin (LTC).

- Liquidity: Excessive liquidity, notably in derivatives markets, permits seamless commerce execution with minimal slippage, even throughout risky circumstances.

Extra instruments

- Copy buying and selling: Learners can replicate trades made by knowledgeable merchants.

- Leverage choices: Presents as much as 100x leverage on particular derivatives pairs, interesting to superior merchants.

- Consumer-friendly interface: Simplifies navigation for freshmen with out compromising on superior instruments for professionals.

Professionals and Cons

Professionals:

• Aggressive charges for each spot and derivatives buying and selling.

• Progressive options like copy buying and selling and leverage choices.

• Excessive liquidity ensures quick order execution.

• Intuitive platform design, very best for freshmen.

Cons:

• Restricted fiat-to-crypto choices in comparison with bigger exchanges.

• Larger Ethereum withdrawal charges than common.

You would possibly wish to take a look at our detailed overview on Bybit too.

Bitget

Bitget has rapidly risen to prominence within the cryptocurrency alternate house, gaining a popularity as a best choice for derivatives merchants. With aggressive charges, superior instruments, and a user-friendly interface, Bitget appeals to each professionals and freshmen in search of environment friendly and dependable buying and selling choices.

Price Construction

Bitget’s charges are extremely aggressive:

- Spot buying and selling charges: Maker and taker charges are 0.1%, with reductions bringing them right down to 0.08% when paying with Bitget Token (BGB).

- Futures buying and selling charges: Maker charges are 0.02%, and taker charges are 0.06% with additional reductions when paid with BGB.

Options

Bitget’s options are tailor-made to fulfill the wants of various merchants:

- Safety: Makes use of chilly storage for almost all of person funds; two-factor authentication (2FA), and IP whitelisting to boost account security. Moreover, an insurance coverage fund gives safety towards sudden losses.

- Supported cash: Bitget helps over 800 cryptocurrencies, together with Bitcoin (BTC), Ethereum (ETH), SHIB, and MATIC.

- Liquidity: Wonderful liquidity in derivatives markets ensures clean execution and minimal slippage, even throughout risky buying and selling durations.

Extra instruments

- Copy buying and selling: Customers can replicate the methods of skilled merchants, making it very best for freshmen.

- Derivatives focus: The platform excels in futures buying and selling, providing leverage choices and superior charting instruments.

- Consumer-friendly interface: Simplifies buying and selling for freshmen with out sacrificing highly effective instruments for superior customers.

Professionals and Cons

Professionals:

• Aggressive charges with reductions for BGB holders.

• Superior options tailor-made for derivatives merchants.

• Excessive liquidity ensures environment friendly commerce execution.

• Insurance coverage fund provides an additional layer of safety.

Cons:

• Smaller number of cryptocurrencies in comparison with bigger exchanges.

• Restricted fiat deposit choices for customers who have to convert from conventional currencies.

Now we have Bitget coated in an in depth overview for you right here.

Finest Zero-Price Crypto Exchanges

Who doesn’t love the thought of buying and selling with out charges? Nonetheless, as with most issues in life, there’s usually greater than meets the attention. Let’s dive into what these platforms provide and the trade-offs they may deliver.

What Are Zero-Price Exchanges?

Zero-fee crypto exchanges are platforms that permit customers to commerce cryptocurrencies with out paying customary maker or taker charges. These platforms sometimes fall into two classes:

- Fully Price-Free Buying and selling: Platforms like Robinhood provide zero charges for particular varieties of buying and selling, corresponding to spot buying and selling.

- Promotional Price Waivers: Some exchanges briefly waive charges for sure buying and selling pairs or new customers as a part of promotional campaigns.

Whereas these exchanges take away the burden of buying and selling charges, it’s important to grasp their enterprise mannequin. Zero-fee platforms usually monetize in different methods, corresponding to:

- Wider spreads between purchase and promote costs.

- Restricted performance in comparison with conventional exchanges.

- Potential hidden charges for deposits, withdrawals, or premium providers.

By lowering prices upfront, zero-fee platforms entice freshmen and cost-conscious merchants, however customers ought to stay vigilant concerning the general prices of their transactions.

Prime Zero-Price Platforms

Right here's a take a look at just a few zero-fee crypto platforms!

Robinhood

Robinhood is a well-liked zero-fee platform, providing crypto buying and selling alongside shares and ETFs. Its beginner-friendly interface and seamless fiat integration make it an excellent selection for brand new merchants.

Key Options

- Zero buying and selling charges: Commerce cryptocurrencies, shares, and ETFs with no charges.

- Newbie-friendly design: Intuitive interface simplifies buying and selling.

- Fiat integration: Permits straightforward deposits and withdrawals in conventional currencies.

Limitations

- Restricted cryptocurrency choice: Helps fewer cash than devoted crypto exchanges.

- Custodial platform: Customers lack entry to non-public pockets keys, proscribing fund management.

Lykke

Lykke is a zero-commission buying and selling platform that prides itself on transparency and ease. Supporting each crypto and fiat pairs, it’s an excellent selection for merchants in search of a simple, fee-free buying and selling expertise.

Key Options

- Zero commissions: Commerce with no charges or hidden prices.

- Clear pricing: Clear and honest pricing construction.

- Fiat integration: Helps buying and selling between crypto and fiat pairs.

Limitations

- Restricted cryptocurrency choice: Presents fewer cash in comparison with bigger platforms.

- Decrease liquidity: Could lead to slower commerce execution throughout excessive demand.

It's vital to notice that Lykke on June 4, 2024, halted withdrawals after an assault drained $19.5 million from its wallets. In an October 2024 submit, the alternate mentioned:

The techniques are prepared for full operation. As well as, we are going to resolve within the coming days whether or not all different circumstances for continuation of operations are additionally met.

We urge readers to do their very own analysis earlier than selecting Lykke.

Why Are Low Charges Vital in Crypto Buying and selling?

Charges might look like a minor inconvenience at first look, however they will accumulate rapidly, consuming away at your hard-earned income. Whether or not you’re an informal investor or a high-frequency dealer, understanding and minimizing these charges is essential for maximizing returns.

Totally different Kinds of Charges

Cryptocurrency exchanges sometimes cost a number of varieties of charges that customers should navigate:

- Buying and selling Charges: These are incurred while you purchase or promote cryptocurrencies. Most exchanges apply a maker-taker price mannequin, the place "makers" present liquidity by putting restrict orders and "takers" devour liquidity by filling these orders.

- Withdrawal Charges: These are charged when transferring funds from the alternate to an exterior pockets. These charges range primarily based on the cryptocurrency and might change into important in the event you regularly transfer property off-platform.

- Deposit Charges: Whereas many exchanges provide free deposits, some might cost charges, notably for fiat foreign money deposits by way of financial institution switch or bank card.

- Hidden Charges: Be cautious of hidden prices like unfold markups (the distinction between the purchase and promote value) or foreign money conversion fees.

The Affect of Charges on Profitability

For informal merchants making rare transactions, charges won’t look like a giant deal. Nonetheless, energetic merchants can stack up alarmingly quick. Let’s break this down:

Suppose you commerce $10,000 price of crypto month-to-month, and the alternate fees a 0.3% price per commerce. That’s $30 per transaction, or $60 for a full buy-and-sell cycle. Over a 12 months, you’re $720 in charges!

For traders making small transactions, withdrawal charges can erode a major chunk of their capital, notably when withdrawing lower-value altcoins with larger charges.

Low charges straight improve profitability by permitting merchants to retain a bigger portion of their returns. That is particularly crucial in extremely risky markets the place even small margins could make a giant distinction.

Advantages for Excessive-Frequency and Giant-Quantity Merchants

Low-fee exchanges are a game-changer for high-frequency merchants (HFTs) and people executing large-volume trades. Right here's why:

- Excessive-Frequency Merchants: Engaged in tons of of trades each day, these customers depend on slim margins. Even a fractional price discount can considerably increase their profitability.

- Giant-Quantity Merchants: For those who’re buying and selling hundreds of thousands, a seemingly small price can translate into 1000’s of {dollars} in prices. Many low-fee platforms provide tiered pricing fashions or VIP memberships that reward high-volume merchants with decrease charges, additional enhancing their price effectivity.

The right way to Scale back Charges When Utilizing Crypto Exchanges

Decreasing charges on cryptocurrency exchanges could make a major distinction to your backside line. Whether or not you’re an informal investor or an energetic dealer, adopting efficient methods can assist you keep extra of your earnings.

Methods to Reduce Buying and selling Charges

- Selecting the Proper Buying and selling Pairs: Choosing standard and extremely liquid buying and selling pairs—corresponding to BTC/USDT or ETH/USDT—can assist cut back prices. Low-liquidity pairs usually have wider spreads, which may result in larger charges.

- Utilizing Native Tokens for Price Reductions: Many exchanges reward customers who pay charges with their native tokens. For example, holding and utilizing native cash can unlock reductions, generally as much as 25%, providing a direct approach to cut back buying and selling bills.

Avoiding Excessive Withdrawal Charges

- Choosing Much less Costly Cryptocurrencies for Withdrawals: Withdrawal charges range considerably relying on the cryptocurrency. Selecting property with decrease charges, corresponding to Litecoin or TRON, generally is a cost-effective technique.

- Leveraging Layer 2 Options: Layer 2 networks, like Arbitrum or Optimism, present an answer for prime withdrawal charges on Ethereum-based property. These networks are supported by a number of main exchanges and might save merchants substantial prices, particularly throughout peak durations.

Ideas for Energetic Merchants

Excessive-frequency merchants ought to think about exchanges providing tiered VIP applications or membership plans that present price reductions primarily based on buying and selling quantity or loyalty. These plans are notably useful for merchants executing massive volumes or frequent transactions.

Elements to Contemplate Past Charges

Whereas low charges are a major issue when selecting a cryptocurrency alternate, they’re not the one standards that matter. The next issues are simply as vital to make sure a safe, environment friendly, and seamless buying and selling expertise.

Safety Options

The protection of your property ought to at all times be a precedence. Search for exchanges that implement strong safety measures, corresponding to:

• Chilly Storage: Most prime exchanges retailer the vast majority of their customers’ funds offline, lowering the chance of hacking.

• Two-Issue Authentication (2FA): Provides an additional layer of safety by requiring a second verification step when logging in or withdrawing funds.

• Regulatory Compliance: Select platforms that adhere to related rules in your area, guaranteeing authorized safeguards.

For added peace of thoughts, think about platforms providing insurance coverage towards losses from safety breaches.

Ease of Use and Consumer Interface

A user-friendly platform could make an enormous distinction, particularly for freshmen. Options to guage embrace:

• Intuitive Layouts: Clear interfaces assist customers navigate buying and selling instruments with out pointless confusion.

• Instructional Sources: Tutorials, FAQs, and demos may be invaluable for brand new merchants.

• Cellular Accessibility: A well-designed cellular app ensures comfort for buying and selling on the go.

Even superior merchants profit from easy instruments that permit environment friendly execution of trades with out technical hiccups.

Liquidity and Buying and selling Quantity

Liquidity impacts the velocity and value at which trades are executed. Excessive buying and selling quantity usually signifies:

• Tighter Spreads: Extra aggressive pricing for each patrons and sellers.

• Quicker Transactions: Orders are crammed extra rapidly, which is crucial throughout risky market circumstances.

All the time select an alternate with robust liquidity to keep away from points like slippage or delays in processing trades.

Vary of Supported Cryptocurrencies

The quantity and number of cash obtainable on an alternate decide how versatile your buying and selling technique may be. Contemplate:

• In style Cash: Most exchanges provide main cash like Bitcoin (BTC) and Ethereum (ETH).

• Altcoin Variety: Platforms with a broad number of altcoins allow exploration of area of interest tasks or investments.

• Fiat On-Ramps: Exchanges supporting fiat-to-crypto buying and selling permit seamless entry into the marketplace for new customers.

A various portfolio of supported property provides merchants extra alternatives to diversify and capitalize on rising developments.

All in all, buying and selling charges are just one piece of the puzzle when evaluating crypto exchanges. By prioritizing elements like safety, usability, liquidity, and asset selection, you possibly can select a platform that meets your buying and selling wants holistically. In spite of everything, an excellent alternate is greater than only a low-cost one—it’s one which works seamlessly for you.

The right way to Select the Finest Trade for Your Wants

With numerous platforms obtainable, right here’s a step-by-step information that will help you consider and choose the perfect one in your buying and selling journey.

Step 1: Figuring out Your Buying and selling Objectives

Begin by clarifying what you hope to attain with crypto buying and selling. Are you:

- A Informal Investor? Search for user-friendly platforms with easy interfaces and minimal charges.

- A Excessive-Frequency Dealer? Concentrate on exchanges with low buying and selling charges, excessive liquidity, and superior buying and selling instruments.

- An Altcoin Fanatic? Select platforms providing all kinds of cryptocurrencies to discover various funding alternatives.

Figuring out your personal targets will information you towards exchanges tailor-made to your particular wants.

Step 2: Assessing the Price Construction and Hidden Prices

Dig deep into the alternate’s price construction to make sure transparency and keep away from surprises. Key prices to guage embrace:

- Buying and selling Charges: Search for platforms with aggressive maker-taker charges. Reductions for utilizing native tokens generally is a bonus.

- Withdrawal Charges: For those who plan to withdraw funds usually, test the charges in your most popular cryptocurrencies.

- • Deposit Charges: Many exchanges provide free deposits, however some might cost for particular fiat strategies like bank card transactions.

- • Spreads and Conversion Charges: Be conscious of hidden fees like unfold markups or foreign money conversion prices which will have an effect on your profitability.

A transparent understanding of those prices can assist you select probably the most cost-effective choice.

Step 3: Checking Platform Opinions and Consumer Suggestions

What do different merchants need to say concerning the platform? Researching evaluations can present precious insights into the alternate’s popularity. Concentrate on:

- Reliability: Examine if the platform has a historical past of downtime, safety points, or controversies.

- Ease of Use: Consumer suggestions usually highlights whether or not the platform is beginner-friendly or suited to superior merchants.

- Buyer Assist: See if customers reward the responsiveness and helpfulness of the alternate’s help workforce.

Unbiased overview websites, boards like Reddit, and different social media teams are wonderful assets for genuine person experiences.

Discovering the perfect alternate in your wants is all about alignment—between what the platform gives and what you require. By figuring out your targets, understanding price constructions, and consulting person suggestions, you can also make an knowledgeable choice that units you up for a profitable buying and selling journey.

Finest Crypto Exchanges With Lowest Charges: Closing Ideas

With cryptocurrency buying and selling, each Satoshi saved on charges can imply better income in your pocket. Choosing the proper alternate isn’t nearly discovering the bottom charges; it’s about placing the proper steadiness between affordability, safety, liquidity, and performance.

Every alternate gives distinctive options tailor-made to totally different buying and selling kinds, whether or not you’re a high-frequency dealer, an altcoin fanatic, or somebody new to the crypto scene. And if zero charges catch your eye, platforms like Robinhood deliver thrilling alternatives with trade-offs price contemplating.

In the end, your selection ought to align along with your targets—whether or not it’s saving on charges, exploring area of interest tokens, or diving into superior buying and selling instruments. One of the best alternate is the one which empowers your technique whereas holding prices low.

Incessantly Requested Questions

What are buying and selling charges, and the way do they work?

Buying and selling charges are fees utilized by exchanges while you purchase or promote cryptocurrencies. They usually observe a maker-taker mannequin, the place “makers” pay decrease charges for offering liquidity, whereas “takers” pay barely larger charges for consuming liquidity.

How can I cut back charges on crypto exchanges?

You’ll be able to decrease charges by utilizing native tokens (like BNB on Binance) for reductions, selecting low-cost buying and selling pairs, or choosing exchanges with fee-saving subscription plans or VIP tiers primarily based on buying and selling quantity.

Are zero-fee exchanges really free?

Zero-fee exchanges take away direct buying and selling charges however might monetize in different methods, corresponding to wider spreads, deposit or withdrawal charges, or limitations in performance. All the time test for hidden prices earlier than buying and selling.

What ought to I think about past charges when selecting an alternate?

Safety, liquidity, ease of use, and the vary of supported cryptocurrencies are essential elements. A low-fee alternate with poor safety or restricted coin choices might not meet your wants.

Are low charges extra vital for informal merchants or high-frequency merchants?

Each profit, however low charges are essential for high-frequency merchants who make a number of each day transactions. For informal merchants, withdrawal charges or deposit fees might have an even bigger affect.