With so many exchanges providing futures buying and selling, choosing the right platform could make or break your buying and selling expertise. One of the best platforms present deep liquidity, low charges, superior danger administration instruments, and seamless execution. A foul platform? That may imply excessive charges, sluggish execution, and even liquidation dangers as a consequence of poor infrastructure.

An important futures buying and selling platform isn’t nearly leverage; it’s about safety, liquidity, and having the suitable instruments to handle danger. Some platforms cater to newbies with easy interfaces and academic sources, whereas others supply professional-grade instruments for knowledgeable merchants. Selecting the improper one might depart you combating surprising charges, sluggish commerce execution, and even poor buyer assist.

On this information, we’ll break down the most effective crypto futures buying and selling platforms, their charges, leverage choices, and danger administration instruments, so you possibly can commerce smarter and safer.

What Is Crypto Futures Buying and selling?

Cryptocurrency futures buying and selling is a type of derivatives buying and selling that permits merchants to invest on the long run value of digital property with out proudly owning the precise cryptocurrency. As a substitute of shopping for or promoting crypto immediately, merchants enter contracts that agree to purchase or promote an asset at a predetermined value on a future date.

Such a buying and selling is often utilized by buyers to hedge in opposition to value fluctuations or to amplify their potential income via leverage. Many main exchanges supply futures buying and selling with various levels of leverage, permitting merchants to open bigger positions with a smaller preliminary funding. Nevertheless, larger leverage additionally will increase danger, making it important for merchants to make use of correct danger administration methods.

Futures Buying and selling vs. Spot Buying and selling

A serious distinction between futures buying and selling and spot buying and selling lies in possession and execution:

- Spot Buying and selling: Includes shopping for and promoting cryptocurrencies immediately. Whenever you purchase Bitcoin on a spot market, you personal the BTC and might switch it to your private pockets.

- Futures Buying and selling: Includes buying and selling contracts primarily based on the worth motion of crypto property with out possession. Merchants can go lengthy (betting on value will increase) or quick (betting on value declines), making it attainable to revenue in each bullish and bearish markets.

- Leverage Utilization: Spot buying and selling requires full capital funding, which means if Bitcoin prices $40,000, a dealer should have $40,000 to purchase one BTC. In distinction, futures buying and selling permits leverage, which means a dealer can management a big place with a fraction of the fee, considerably rising each potential income and dangers.

Advantages of Crypto Futures Buying and selling

Futures buying and selling presents a number of benefits over conventional spot buying and selling, making it enticing to energetic merchants:

- Revenue in Any Market Situation – Not like spot buying and selling, the place income rely on value appreciation, futures buying and selling permits short-selling, enabling merchants to revenue in each rising and falling markets.

- Leverage & Capital Effectivity – Futures platforms supply leverage starting from 5x to 100x, permitting merchants to manage bigger positions with much less capital. This could maximize income but additionally exposes merchants to larger danger.

- Liquidity & Excessive Buying and selling Quantity – Main futures exchanges present deep liquidity, making certain fast commerce execution and minimal value slippage.

- Threat Administration & Hedging – Institutional buyers and retail merchants use futures contracts as a hedging software in opposition to value volatility, defending portfolios from sharp market swings.

- No Want for Crypto Possession – Since futures buying and selling doesn’t require holding precise crypto, merchants can keep away from issues like pockets safety, storage, and hacking dangers.

Key Options of the Greatest Crypto Futures Buying and selling Platforms

Choosing the proper crypto futures buying and selling platform can considerably affect a dealer’s success. One of the best platforms supply a mixture of liquidity, leverage, safety, aggressive charges, and superior buying and selling instruments to reinforce the buying and selling expertise.

Buying and selling Pairs & Liquidity

Liquidity is important in futures buying and selling. A extremely liquid platform ensures that merchants can enter and exit positions easily, minimizing slippage and execution delays. The provision of a number of buying and selling pairs additionally permits for diversification and strategic buying and selling, enabling merchants to hedge dangers and discover completely different markets.

Leverage & Margin Buying and selling Choices

One of many greatest benefits of futures buying and selling is leverage, which permits merchants to manage giant positions with a fraction of the capital. This will increase potential income but additionally amplifies dangers, making correct danger administration important. Utilizing stop-loss orders and sustaining a balanced place measurement may help stop liquidation.

Safety & Regulation

Safety is a significant concern in crypto buying and selling. One of the best platforms implement multi-factor authentication, chilly storage for funds, and encryption protocols to safeguard customers from cyber threats.

Regulatory compliance additionally performs a vital function. Whereas some platforms function in absolutely regulated environments, others supply minimal KYC necessities for anonymity. Merchants should resolve whether or not they favor added transparency and investor safety or larger privateness.

Charges & Commissions

Understanding a platform’s charge construction is significant for profitability. Most futures exchanges cost maker and taker charges, the place makers (who present liquidity) pay decrease charges than takers (who take away liquidity).

Extra prices embody:

- Funding charges on perpetual futures contracts.

- Withdrawal charges for shifting funds off the platform.

- Slippage prices as a consequence of poor market liquidity.

Consumer Expertise & Buying and selling Instruments

A clean and intuitive interface can considerably improve a dealer’s effectivity. One of the best platforms supply customizable dashboards, one-click order execution, and real-time charting instruments.

For superior merchants, options like algorithmic buying and selling, API assist, and a number of order varieties are essential. These instruments enable for automation and larger management over commerce execution.

Our High Picks

| Platform | Leverage | Maker Charge | Taker Charge | Key Options |

|---|---|---|---|---|

| Binance | As much as 125x | 0.02% | 0.05% | Deep liquidity, superior buying and selling instruments, TradingView charting, API assist |

| Bybit | As much as 100x | 0.02% | 0.055% | Excessive-speed execution, insurance coverage fund, a number of order varieties |

| OKX | As much as 125x | 0.02% | 0.05% | Skilled-grade charting, API assist, margin name alerts |

| KuCoin | As much as 100x | 0.02% | 0.06% | Leveraged tokens, sturdy danger administration, API integration |

| Bitget | As much as 125x | 0.02% | 0.06% | Demo buying and selling, cross-margin mode, customizable buying and selling expertise |

| Coinbase | As much as 20x | 0.4% | 0.6% | Newbie-friendly, regulated, sturdy safety |

| Toobit | As much as 175x | 0.02% | 0.06% | Extremely-high leverage, grid buying and selling bots, automated buying and selling instruments |

Binance

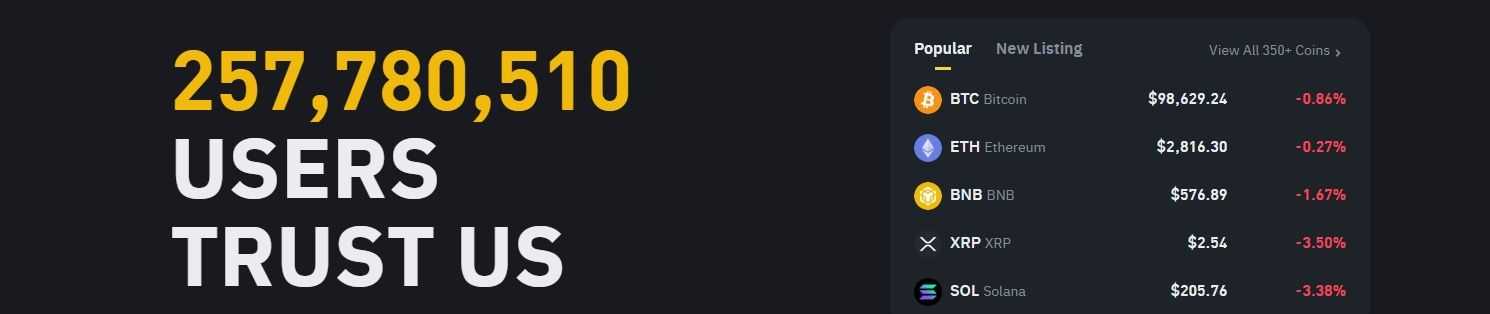

Binance, based in 2017, is the world’s largest cryptocurrency trade by buying and selling quantity. Its Binance Futures platform presents merchants entry to a various vary of crypto derivatives, excessive leverage choices, deep liquidity, and superior buying and selling instruments. Designed for each newbies {and professional} merchants, Binance Futures supplies one of the crucial complete futures buying and selling experiences within the trade.

👉 Signal Up For Binance – Unique 20% Buying and selling Charge Low cost For Life + $600 Bonus

Key Options and Advantages

• Leverage & Threat Administration

Binance Futures permits merchants to leverage as much as 125x on choose contracts, enabling larger market publicity with a smaller preliminary funding. Nevertheless, larger leverage will increase danger, and Binance supplies superior danger administration instruments, together with stop-loss orders and margin upkeep options.

• Various Contract Varieties

Binance presents a number of futures contract choices, together with:

- USDT-M Futures (settled in USDT)

- Coin-M Futures (settled within the underlying cryptocurrency)

- Perpetual Contracts (no expiration date)

• Superior Buying and selling Instruments

Binance Futures integrates TradingView-powered charting, a number of order varieties (restrict, market, stop-limit), and API assist for automated buying and selling.

Charges

- Maker charge: 0.02%

- Taker charge: 0.05%

Merchants holding Binance Coin (BNB) can obtain extra reductions on charges.

Leverage

The platform presents as much as 125x leverage, permitting merchants to amplify their positions.

Supported Belongings

Binance Futures helps a wide array of buying and selling pairs, together with Bitcoin (BTC), Ethereum (ETH), BNB, Solana (SOL), and varied altcoins, making it one of the crucial various crypto derivatives platforms.

We have now an in depth Binance overview proper right here!

Bybit

Bybit, launched in 2018, has positioned itself as one of many main cryptocurrency derivatives exchanges, providing merchants a sturdy and user-friendly futures buying and selling platform. With a concentrate on high-speed execution, superior buying and selling instruments, and aggressive charges, Bybit caters to each newbies {and professional} merchants on the lookout for environment friendly crypto futures buying and selling.

👉 Signal Up For Bybit – Up $60K In Rewards

Key Options and Advantages

• Leverage & Threat Administration

Bybit presents leverage as much as 100x, permitting merchants to take bigger positions with comparatively small capital. To handle the dangers related to excessive leverage, Bybit has an insurance coverage fund designed to guard merchants from excessive market volatility.

• Superior Buying and selling Interface

The platform integrates TradingView-powered charting instruments, a number of order varieties, and an intuitive UI that enhances the buying and selling expertise. Merchants have entry to market orders, restrict orders, conditional orders, and extra, making it simpler to execute advanced buying and selling methods.

• Seamless Efficiency & Safety

Bybit is understood for its high-speed commerce execution, making certain minimal slippage and downtime. It additionally implements multi-factor authentication (MFA), chilly pockets storage, and danger management measures to reinforce safety.

Charges

- Maker charge: 0.02%

- Taker charge: 0.055%

Leverage

Bybit presents leverage as much as 100x on perpetual and futures contracts, permitting merchants to amplify their market publicity.

Supported Belongings

The platform helps a variety of buying and selling pairs, together with main cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and extra.

Try our detailed Bybit overview right here!

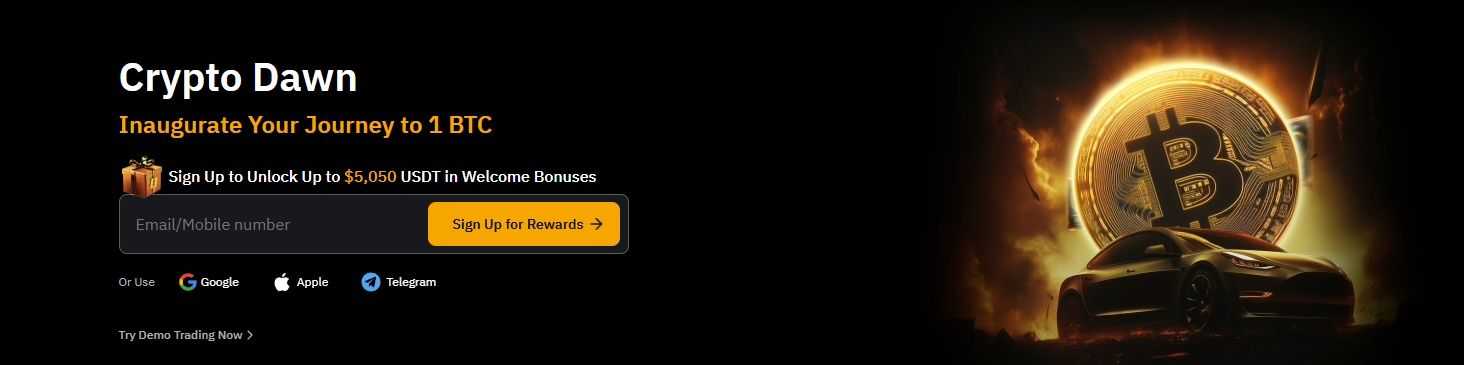

OKX

OKX, based in 2017, is without doubt one of the largest world cryptocurrency exchanges, providing a feature-rich futures buying and selling platform. With its deep liquidity, high-leverage choices, and superior buying and selling instruments, OKX caters to each retail {and professional} merchants seeking to have interaction in crypto derivatives buying and selling.

👉 Signal Up For OKX – Unique 40% Spot Buying and selling Charge Low cost + Get Up To $20K In Bonuses

Key Options and Advantages

• Leverage & Threat Administration

OKX Futures supplies merchants with leverage as much as 125x, permitting them to take bigger positions with a comparatively small capital funding. The platform consists of margin name alerts, stop-loss orders, and an insurance coverage fund to assist mitigate liquidation dangers.

• Various Contract Choices

Merchants can entry a spread of futures contracts, together with:

- USDT-Margined Futures (settled in USDT)

- Coin-Margined Futures (settled within the underlying cryptocurrency)

- Perpetual Contracts (with no expiry date)

This flexibility permits merchants to customise their methods primarily based on market situations and danger tolerance.

• Superior Buying and selling Instruments

The platform presents professional-grade charting instruments, a number of order varieties, and API assist for algorithmic merchants. OKX additionally integrates TradingView-powered charting to reinforce technical evaluation capabilities.

Charges

- Maker charge: 0.02%

- Taker charge: 0.05%

Leverage

OKX presents as much as 125x leverage on sure futures contracts, permitting merchants to amplify their market publicity whereas managing danger via built-in safety options.

Supported Belongings

The platform helps all kinds of buying and selling pairs, together with main cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and extra, giving merchants various choices for his or her futures positions.

Learn our full OKX overview right here!

KuCoin

KuCoin, based in 2017, has grown into one of the crucial widespread world cryptocurrency exchanges, providing a well-developed futures buying and selling platform. With its various contract choices, aggressive charges, and excessive leverage choices, KuCoin Futures appeals to each newbie {and professional} merchants.

👉 Signal Up For Kucoin – Buying and selling Charge Low cost of Up To 60% + FREE Buying and selling Bot!

Key Options and Advantages

• Leverage & Threat Administration

KuCoin Futures supplies merchants with leverage as much as 100x, permitting them to take bigger positions with a smaller capital requirement. The platform consists of margin name alerts, stop-loss orders, and an insurance coverage fund to assist cut back liquidation dangers.

• Various Contract Choices

Merchants can entry quite a lot of futures contracts, together with:

- USDT-Margined Futures (settled in USDT)

- Coin-Margined Futures (settled within the underlying cryptocurrency)

- Perpetual Contracts (with no expiration date)

These completely different contract varieties present flexibility for merchants to develop their methods primarily based on market situations.

• Superior Buying and selling Instruments

The platform integrates TradingView-powered charting, a number of order varieties, and API assist for algorithmic merchants. KuCoin additionally presents leveraged tokens, which permit merchants to achieve leveraged publicity to cryptocurrencies with out the chance of liquidation.

Charges

- Maker charge: 0.02%

- Taker charge: 0.06%

Merchants can obtain extra charge reductions by rising their 30-day buying and selling quantity or holding KuCoin Token (KCS).

Leverage

The platform presents as much as 100x leverage on choose futures contracts, permitting merchants to amplify their market publicity whereas managing danger via accessible safety options.

Supported Belongings

KuCoin Futures helps a variety of cryptocurrencies, together with Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and plenty of altcoins, giving merchants quite a lot of choices for futures buying and selling.

We have now an in depth overview of KuCoin proper right here!

Bitget

Bitget, based in 2018, has positioned itself as a top-tier cryptocurrency trade with a powerful concentrate on futures buying and selling. With its high-leverage choices, aggressive charges, and progressive buying and selling instruments, Bitget appeals to each retail {and professional} merchants.

Key Options and Advantages

• Leverage & Threat Administration

Bitget Futures supplies leverage as much as 125x, enabling merchants to amplify their positions whereas implementing correct danger administration methods. To assist reduce liquidation dangers, the platform presents stop-loss orders, take-profit orders, and cross-margin options.

• Various Contract Choices

Merchants can entry a number of kinds of futures contracts, together with:

- USDT-Margined Futures (settled in USDT for stability).

- Coin-Margined Futures (settled within the underlying cryptocurrency).

- Perpetual Contracts (no expiry date).

This selection permits merchants to undertake completely different methods primarily based on market situations.

• Superior Buying and selling Instruments

The platform integrates professional-grade charting instruments, a number of order varieties, and API assist for automated buying and selling. Bitget additionally presents a demo buying and selling characteristic, permitting customers to check methods with out utilizing actual capital.

Charges

- Maker charge: 0.02%

- Taker charge: 0.06%

Merchants can cut back charges by rising buying and selling quantity or holding Bitget’s native token (BGB).

Leverage

The platform presents as much as 125x leverage, permitting merchants to maximise market publicity whereas managing danger via accessible safety options.

Supported Belongings

Bitget Futures helps a variety of cryptocurrencies, together with Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and plenty of altcoins, offering merchants with varied choices for futures buying and selling.

You’ll find our detailed Bitget overview proper right here!

Coinbase

Coinbase, based in 2012, is without doubt one of the most well-known cryptocurrency exchanges, acknowledged for its sturdy regulatory compliance and beginner-friendly interface. Whereas primarily identified for its spot buying and selling companies, Coinbase has expanded into the futures buying and selling market, providing crypto futures contracts with leverage.

Key Options and Advantages

• Leverage & Threat Administration

Coinbase presents crypto futures contracts with leverage, enabling merchants to manage bigger positions with a smaller upfront capital funding. The platform additionally emphasizes danger administration training, serving to merchants perceive leverage dangers and implement accountable buying and selling methods.

• Various Contract Choices

Coinbase supplies entry to futures contracts for main cryptocurrencies, designed for each retail and institutional merchants. Contract choices embody:

- Bitcoin (BTC) Futures

- Ethereum (ETH) Futures

- Nano Bitcoin Futures (1/one hundredth of a BTC contract measurement)

- Nano Ether Futures (1/tenth of an ETH contract measurement)

These smaller contract sizes make futures buying and selling extra accessible to merchants with decrease capital.

• Superior Buying and selling Instruments

The platform integrates TradingView-powered charting instruments, a number of order varieties, and an intuitive person interface. Coinbase additionally supplies academic sources to assist merchants higher perceive futures buying and selling methods, hedging, and danger administration.

Charges

- Maker Charge: 0.6%

- Taker Charge: 1.2%

Leverage

The platform presents leverage on choose futures contracts, permitting merchants to extend their market publicity whereas using built-in danger administration instruments. Eligible merchants can entry leverage of as much as 20x.

Supported Belongings

Coinbase helps Bitcoin (BTC), Ethereum (ETH), and extra futures contracts, with plans to increase its choices because the platform grows.

Try our detailed Coinbase overview right here!

Toobit

Toobit, launched in 2022, is a comparatively new cryptocurrency trade that has gained consideration for its high-leverage futures buying and selling and progressive buying and selling instruments. The platform goals to offer a safe and environment friendly buying and selling atmosphere for each newbies and skilled merchants.

👉 Signal Up For Toobit – Up To 100,000 USDT Welcome Bonus + Up To 50% Charge Low cost For Life

Key Options and Advantages

• Leverage & Threat Administration

Toobit Futures presents leverage as much as 175x, one of many highest within the trade, permitting merchants to take giant positions with a small capital requirement. Toobit additionally supplies important danger administration instruments resembling stop-loss orders and take-profit options to assist merchants mitigate dangers in unstable markets.

• Various Contract Choices

Toobit presents a number of kinds of futures contracts, together with:

- USDT-Margined Perpetual Futures (settled in USDT).

- Coin-Margined Futures (settled within the underlying cryptocurrency).

- Perpetual Contracts (no expiry date).

These contract choices present merchants with flexibility in executing completely different buying and selling methods.

• Superior Buying and selling Instruments

The platform integrates professional-grade charting instruments, a number of order varieties, and API assist for algorithmic merchants. Toobit additionally presents automated buying and selling bots that enable customers to execute grid buying and selling methods, optimizing commerce execution.

Charges

- Maker charge: 0.02%

- Taker charge: 0.06%

Merchants may also cut back charges via buying and selling quantity incentives and promotional campaigns.

Leverage

Toobit supplies as much as 175x leverage, making it one of the crucial aggressive futures buying and selling platforms by way of place amplification.

Supported Belongings

The platform helps main cryptocurrencies resembling Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and varied altcoins, making certain merchants have a various vary of buying and selling choices.

Learn our full Toobit overview right here!

Find out how to Select the Proper Futures Buying and selling Platform

Selecting the most effective crypto futures buying and selling platform relies on components like safety, charges, buying and selling pairs, and person expertise. A dealer’s objectives, danger urge for food, and buying and selling type additionally affect which platform is best suited.

Safety & Regulation

A safe platform ought to supply multi-factor authentication (MFA), chilly storage, and regulatory compliance to guard person funds. Coinbase is a best choice for merchants who prioritize a regulated and safe buying and selling atmosphere.

Buying and selling Charges

Most platforms comply with a maker-taker charge mannequin, the place makers (who present liquidity) pay decrease charges than takers (who take away liquidity).

- Lowest charges: Binance, Bybit, OKX, KuCoin, and Bitget (maker: 0.02%, taker: 0.05%-0.06%).

- Quantity-based reductions: Coinbase presents considerably decreased charges for high-volume merchants.

Buying and selling Pairs & Liquidity

A various vary of property and excessive liquidity ensures higher order execution and decreased slippage.

- Greatest for altcoins: Binance, OKX, and KuCoin as a consequence of their giant collection of buying and selling pairs.

Consumer Expertise & Buying and selling Instruments – Platforms ought to present intuitive interfaces, TradingView charts, a number of order varieties, and automation instruments. - Greatest for automation: Toobit and Bitget, with buying and selling bots and API assist for automated methods.

Matching Buying and selling Objectives with the Proper Platform

- Excessive-leverage buying and selling: Toobit (175x), Binance & OKX (125x) for merchants seeking to maximize publicity.

- Low-fee buying and selling: Binance, Bybit, OKX, KuCoin, and Bitget supply essentially the most aggressive charges.

- Newbie-friendly: Coinbase, which supplies academic sources and an easy-to-use interface.

The Function of Demo Accounts

Platforms like Bitget and Bybit supply demo buying and selling, permitting customers to check methods, leverage settings, and market situations earlier than risking actual funds. It is a wonderful means for newbies to study with out monetary danger.

Dangers & Greatest Practices in Crypto Futures Buying and selling

Crypto futures buying and selling will be extremely worthwhile, but it surely additionally comes with important dangers, particularly as a consequence of excessive leverage and market volatility. To commerce efficiently, merchants should concentrate on danger administration methods to guard their capital.

Managing Leverage & Avoiding Liquidation

Leverage permits merchants to manage giant positions with a small quantity of capital, but it surely additionally magnifies losses simply as a lot because it amplifies features. A small value motion within the improper path can set off liquidation, wiping out a whole place.

To keep away from liquidation, merchants ought to:

- Use decrease leverage (e.g., 5x–10x as an alternative of 100x+) to reduce danger.

- Implement stop-loss orders to routinely exit dropping trades earlier than losses escalate.

- Keep ample margin steadiness to keep away from compelled liquidation.

Understanding Market Volatility

Cryptocurrency markets are notoriously unstable, with costs ceaselessly swinging 10% or extra inside hours. Whereas volatility creates buying and selling alternatives, it additionally will increase danger, significantly for extremely leveraged positions.

To navigate market fluctuations, merchants can:

- Use hedging methods, resembling opening lengthy and quick positions on completely different property to offset potential losses.

- Keep away from overtrading throughout excessive volatility, as sudden value actions can result in surprising liquidations.

- Sustain with information and market sentiment, as exterior occasions (e.g., regulatory selections, financial studies) can set off speedy value swings.

Threat Administration Strategies

Profitable futures merchants concentrate on defending capital first and income second. Important danger administration strategies embody:

- Place Sizing: By no means danger greater than 1-2% of complete capital on a single commerce.

- Portfolio Diversification: Spreading investments throughout a number of property and methods reduces general danger.

- Gradual Scaling: As a substitute of coming into a full place without delay, merchants can scale out and in to handle danger successfully.

Closing Ideas

Crypto futures buying and selling is an thrilling, high-stakes recreation the place merchants can revenue in each bull and bear markets. However success isn’t nearly catching the suitable trades—it’s about selecting the best platform.

There’s no one-size-fits-all resolution. Your preferrred platform relies on your danger tolerance, expertise stage, and buying and selling technique. Are you a risk-averse dealer who wants sturdy danger administration options? Or an aggressive dealer on the lookout for the best leverage attainable? The precise platform is the one which aligns together with your objectives.

Futures buying and selling comes with enormous alternatives but additionally important dangers. Ensure to analysis, check with demo accounts, and begin with manageable leverage earlier than diving in. Wish to study extra? Try our detailed guides on danger administration and buying and selling methods to sharpen your abilities earlier than your subsequent large commerce!

Often Requested Questions

How do crypto futures differ from spot buying and selling?

Spot buying and selling includes shopping for and promoting precise crypto property, whereas futures buying and selling makes use of contracts to invest on value actions. Futures enable leverage, which means merchants can open bigger positions with much less capital—however at larger danger.

Can newbies commerce crypto futures?

Sure, however with warning. Rookies ought to begin with low leverage (5x or much less), use stop-loss orders, and apply with demo accounts earlier than buying and selling actual cash. Futures buying and selling is riskier than spot buying and selling.

What’s a funding fee in crypto futures buying and selling?

A funding fee is a charge exchanged between lengthy and quick merchants in perpetual contracts to maintain futures costs aligned with the spot market. It fluctuates each 8 hours on most exchanges.

How do crypto futures platforms generate income?

They earn via buying and selling charges, funding charges, and liquidation charges. Some, like Binance and OKX, additionally revenue from margin lending curiosity.

Are crypto futures buying and selling platforms regulated?

Some are, however not all. Coinbase is a totally regulated trade, whereas others function in offshore jurisdictions with fewer compliance necessities. At all times verify native laws earlier than buying and selling.