Crypto property traders can do a lot with their crypto holdings at this time. Past hodling cryptocurrencies, you can also make them give you the results you want and earn passive revenue. Each centralized and decentralized platforms can be found at this time that provide quite a few cryptocurrency-based monetary merchandise, spanning each decentralized finance (like yield farming and staking) and conventional finance (Tradfi), like loans and stuck deposits.

Binance is one such centralized platform. This text evaluations Binance Earn, a end result of economic merchandise constructed on high of crypto property obtainable on the Binance change. This text will cowl the varied funding avenues underneath Binance Earn and the way they fare in opposition to different crypto monetary service suppliers relating to security, income, ease of use, and way more. As our crypto investments sit idle on exchanges after we experience the bear market, Binance Earn might show profitable in extracting extra worth from our static property, so buckle up!

Binance Earn Evaluate: Abstract

Binance Earn is a complete monetary platform throughout the Binance ecosystem that provides a wide range of funding merchandise aimed toward serving to customers earn returns on their cryptocurrency holdings. From fastened and versatile financial savings accounts to staking, liquidity farming, and extra complicated monetary devices, it gives alternatives for each novice and skilled traders. Whereas it affords the potential for top yields, it additionally comes with numerous ranges of danger and complexity, making due diligence important for all customers.

The Key Options of Binance Earn Are:

- Easy Earn: Cryptocurrency-based loans.

- Staking: Take part in DeFi with Binance.

- Farming: Farm liquidity on Binance.

- Twin Funding: Simplified options-like buying and selling technique.

- Vary Certain: Earn curiosity in sideways markets.

Observe: Customers positioned within the US and UK aren’t supported.

Binance Earn Evaluate: Abstract

| Yr Established | 2017 |

| Regulation | Holds laws throughout a number of nations in Europe, Asia-Pacific, the Center East, the Americas and Africa |

| Earn Merchandise Listed | 11 |

| Native Token | BNB |

| Charges | Variable |

| Newbie Pleasant | Superior merchandise might be complicated for brand spanking new customers |

| Earn Charges | 0.1% – 60% |

Evaluate: What’s Binance?

Binance is a world (besides within the US) firm behind the Binance change, BNB chain, and the BUSD stablecoin. 2017, Changpeng Zhao, a software program engineer, based Binance in China. Binance has since moved its operations and headquarters from the nation owing to the regulatory crackdown in opposition to blockchain companies and the ban on cryptocurrency buying and selling in September 2017.

Zhao, higher identified by his initials CZ, resigned as CEO in November 2023 after pleading responsible to a cash laundering cost by US authorities.

Core options of Binance embody –

- The Binance change – The crypto change harbours a number of conventional and DeFi funding merchandise and a whole lot of digital property to commerce, making it the world’s largest centralized cryptocurrency change when it comes to day by day buying and selling quantity and customers. It affords low buying and selling charges and has excessive liquidity, making certain quick settlements and environment friendly buying and selling by decreasing market volatility.

- The BNB Chain – Construct N Construct (BNB) Chain includes two blockchains:

- The BNB Beacon Chain is liable for blockchain governance, staking, and voting.

- The BNB Sensible Chain is the EVM-compatible part used to help Ethereum dapps within the BNB ecosystem.

- The BNB Chain additionally affords many scaling options, together with zk-Rollup impressed zkBNB and opBNB powered by the Optimism bedrock stack.

- BNB token – Because the governance token of the BNB Chain, the BNB token powers the Proof of Staked Authority consensus design of the BNB Chain. It initially launched as an ERC-20 token on Ethereum and later moved to Bianance Sensible Chain because it merged with the Beacon Chain.

- BUSD – Binance USD is a US dollar-backed stablecoin developed by Binance and Paxos. It was the primary stablecoin to obtain regulatory approval from the New York State Division of Monetary Providers.

The Binance platform affords all-inclusive cryptocurrency options throughout centralized/decentralized and TradFi/DeFi settings. The main target of this overview is the Binance Earn part of the change. If you happen to want to delve deeper into the specifics of Binance, take a look at our Binance overview.

Binance Earn Merchandise Out there:

To start utilizing Binance Earn merchandise, crypto traders should first create a Binance account, which entails finishing a KYC verification examine to confirm the consumer's id (it additionally ensures just one account is related to every id). As soon as registered, all Binance merchandise, together with Earn, spot pockets and derivatives buying and selling, leverage, and margin buying and selling, and others just like the Binance NFT market, are accessible. Earn might be accessed both via the Finance part or through property in your spot pockets. If you happen to haven't already signed up for Binance, we have now a useful Step-by-Step Information to Signing up for Binance.

If you’re excited by Man's take, he additionally has a terrific Binance Information, which you’ll view beneath:

Let’s start with a rundown of Binance Earn, traversing via all of the merchandise section-wise:

Easy Earn

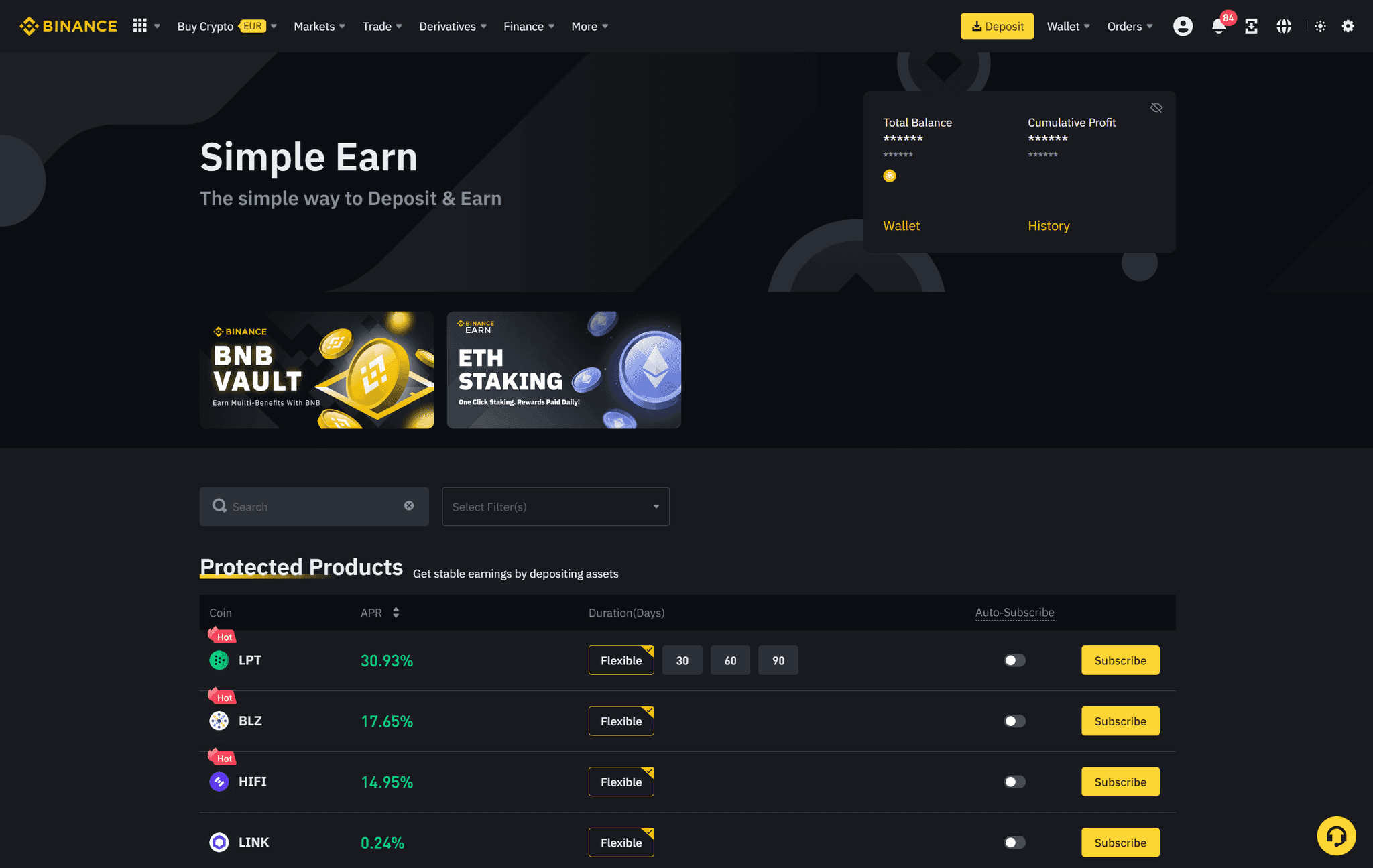

Because the identify suggests, Easy Earn affords traders curiosity of their crypto deposits. There are three merchandise obtainable underneath this part –

Binance Easy Earn

Buyers could make zero-fee crypto deposits underneath versatile financial savings or locked financial savings phrases. These deposits are lent out and earn curiosity over time. Whereas versatile financial savings are redeemable anytime, locked financial savings are locked for a predetermined interval (sometimes 30, 60, or 90 days, with various rates of interest). The precept and the curiosity underneath these phrases are immediately despatched to the consumer’s ‘Spot Wallet.’

Binance additionally affords an ‘Auto-Subscribe’ function for these versatile financial savings and stuck financial savings merchandise. Choosing this function permits Binance to roll again your crypto funding and accrued curiosity into the identical funding plan upon its maturity.

Fastened and locked financial savings in contrast:

| Versatile Financial savings | Locked Financial savings | |

| Redeemability | Redeemable instantly | Redeemable upon maturity |

| Rate of interest | Usually decrease than locked financial savings | Usually increased than versatile financial savings |

| Supported property | 356 | Chosen |

Binance Easy Earn Advantages

- Appropriate for novice and risk-averse merchants.

- Compound curiosity advantages.

- Big selection of supported property.

BNB Vault

Since Binance launched the BNB Coin via an Preliminary Coin Providing (ICO) in July 2017, it has enabled a number of utilities for the coin throughout the ecosystem. Because the native token, it fuels transactions on the BNB Chain, settles transactions on the Binance change, makes in-store funds to affiliated shops and retailers, and affords many extra advantages spanning centralized and decentralized finance settings.

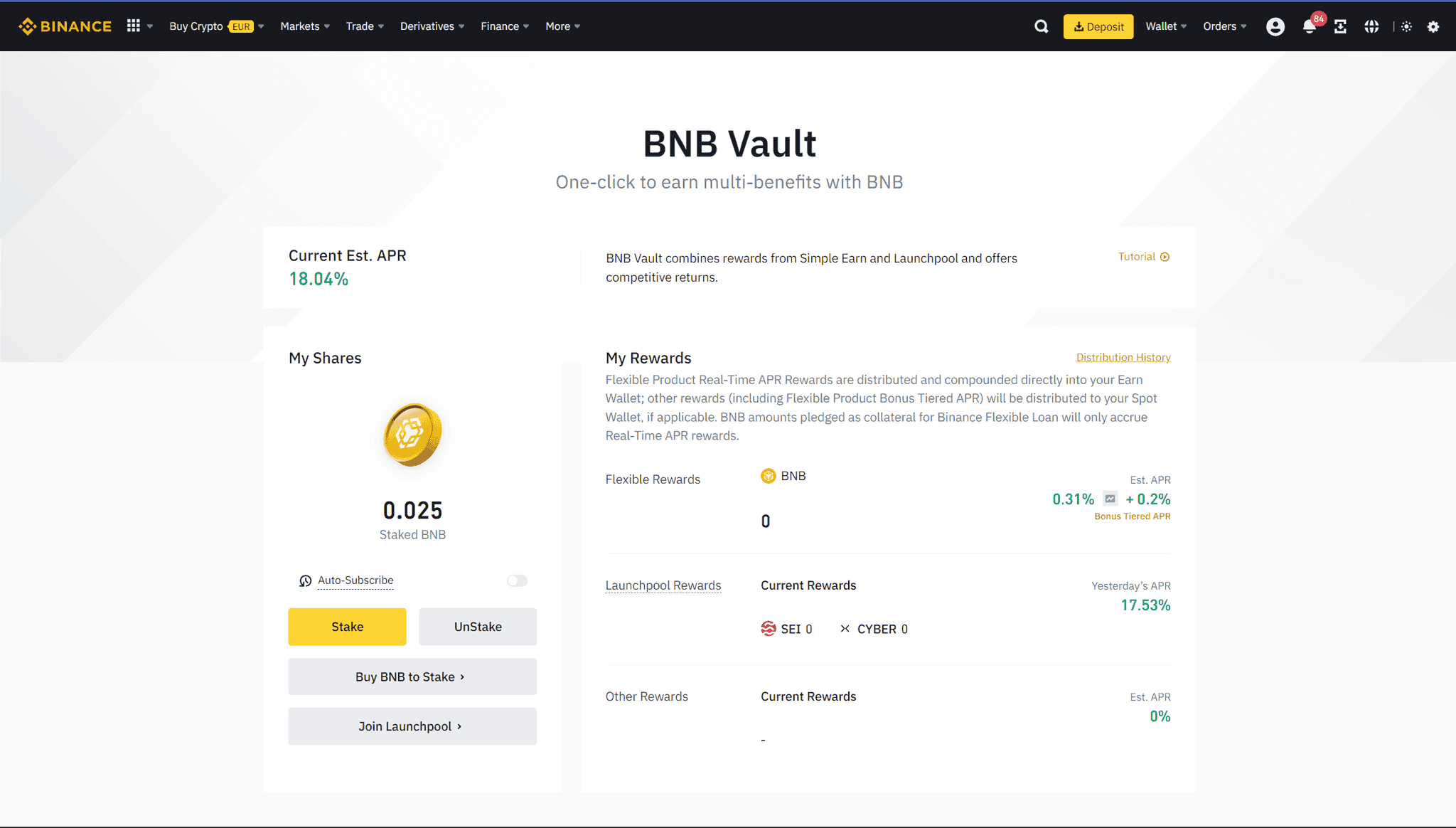

Binance affords the BNB Vault, which may maximize and automate BNB earnings through all these avenues, requiring minimal effort from traders. All they should do is so as to add the specified quantity of BNB to the vault (or allow “Auto-Subscribe,” permitting Binance to entry the BNB within the ‘Spot Wallet’), and the system takes care of the remainder, performing because the BNB yield aggregator to earn crypto for Binance customers. Right here’s what is occurring behind the scenes –

The Vault will sometimes earn crypto by investing the obtainable BNB throughout three main plans:

- Easy Earn Versatile Merchandise: Your BNB will earn curiosity within the ‘Spot Wallet’ over time, with the precept redeemable anytime. The staked BNB is securing the next advantages concurrently;

- Binance Launchpool: Farm new tokens collaborating within the Binance Launchpool.

- Defi Staking: Use your BNB Vault holdings to take part in good contracts-powered Defi staking protocols, much like DeFi yield farming.

(Extra on Launchpool and DeFi Staking later.)

BNB Vault Advantages:

When penning this overview, we are able to make the next observations in regards to the BNB Vault’s worth:

- Automated Asset Allocation and Rebalancing: The Vault dynamically allocates and rebalances the vault BNB asset throughout Launchpool, DeFi Staking, and different advantages to supply the absolute best returns to customers.

- Multi-Publicity Advantages: Because the BNB within the vault earns curiosity underneath the SimpleEarn Versatile Product, Binance additionally affords publicity to the Launchpool and Defi Staking merchandise. The Vault stands at 18.04% APR on the time of writing. The investor can earn the next returns when investing within the merchandise individually:

- Easy Earn: Most return is achieved by locking BNB within the financial savings account for 120 days at 2.1% APR.

- Launchpool: The BNB-CYBER pool affords 15.59% APR, whereas the BNB-SEI pool affords 19.05% APR.

- DeFi Staking: Staking BNB in DeFi earns 0.9% APR.

- Liquidity: The Vault additionally permits Easy Earn versatile deposit of BNB, which isn’t obtainable when you deposit BNB to the Easy Earn product immediately.

The investor’s danger profile might devise methods corresponding to –

- A risk-averse strategy would keep away from publicity to speculative and higher-risk property.

- A risk-friendly investor might deploy their BNB on the Launchpools on extra speculative asset swimming pools, incomes them the next APY.

Danger-reward administration of the BNB Vault:

- If higher-risk tokens lose all their worth, the Vault will earn 0.31% APR or much less from the BNB Versatile financial savings account, which is 0.59% lower than the Binance Staking BNB in DeFi. The chance-averse technique wins on this case.

- If the higher-risk tokens maintain on to their worth, the Vault will make 18.05% APR or extra from its collective investments, which is 1% lower than Launchpool rewards. The chance-friendly technique wins this case.

- The Vault would mitigate the dangers within the above situations by dynamically reallocating BNB and making certain optimum returns. The Vault presently earns over 20x greater than the risk-averse technique and simply 1.05x lower than the risk-friendly technique, providing good upside potential for the additional danger assumed.

Auto-Make investments

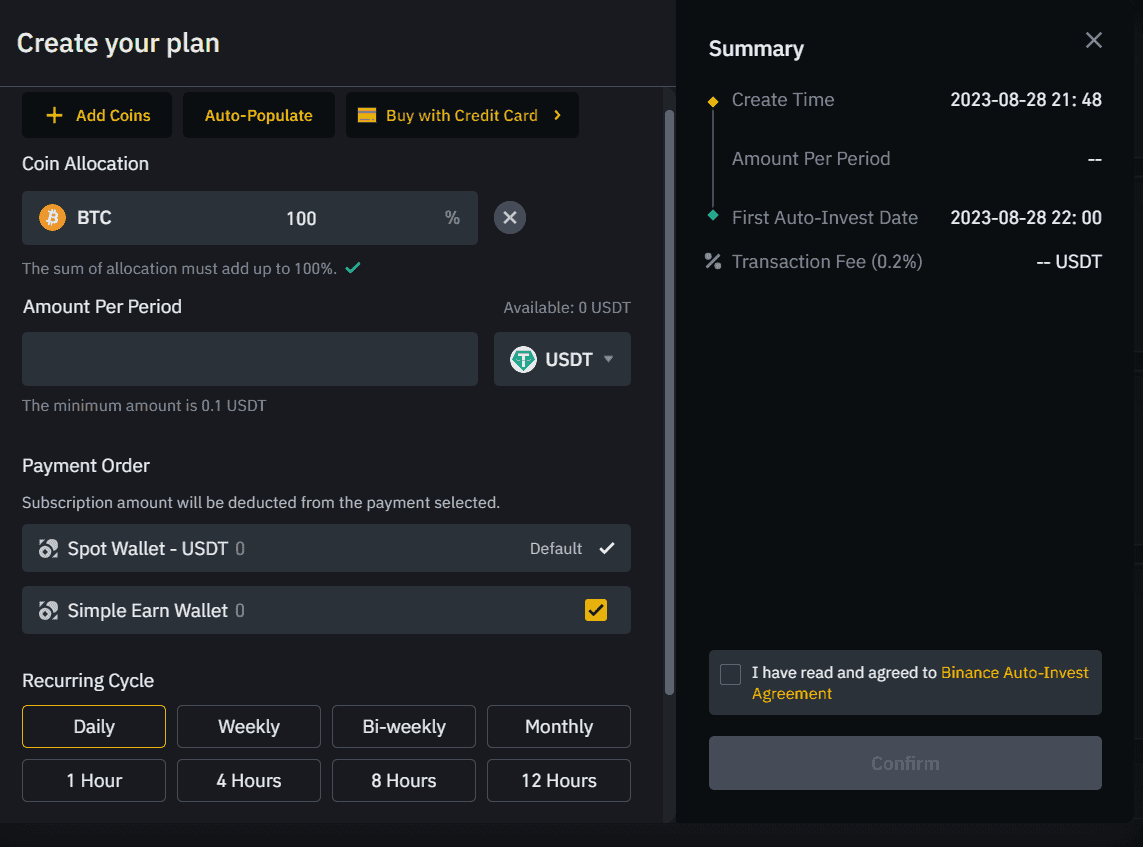

The Auto-Make investments plan underneath Binance Earn is much like SIP (Systematic Funding Plan) merchandise broadly used within the fairness market. The method permits the consumer to automate the acquisition of supporting cryptocurrencies so the required quantity is bought at predetermined intervals. This technique is named Greenback Price Averaging (DCA).

Auto-Make investments is remarkably customizable:

- It permits traders to curate distinctive portfolios that resonate with their danger profile.

- It affords numerous fee choices spanning a number of stablecoins and tokens.

- The supported property are routinely invested into the BNB Vault or Easy Earn Versatile Product, as relevant.

- If the customers run out of the spot funds to pay for the automated purchases, Auto-Make investments may redeem property from the Easy Earn Versatile Merchandise to pay for the transactions if the customers decide in for the function.

Advantages of Binance Earn Auto-Make investments:

- Greenback-cost averaging minimizes the impression of market volatility.

- It saves time by not having to make recurring purchases each time.

- It safeguards traders from making emotional and impulsive choices in occasions of volatility.

Binance Earn Staking

In DeFi, staking includes locking up crypto to take part in numerous community operations. Initially referring to collaborating in blockchain consensus solely, staking has expanded to incorporate liquidity supplier companies, yield farming, governance, and liquid staking.

Binance Earn affords three staking merchandise –

Binance Earn ETH 2.0 Staking

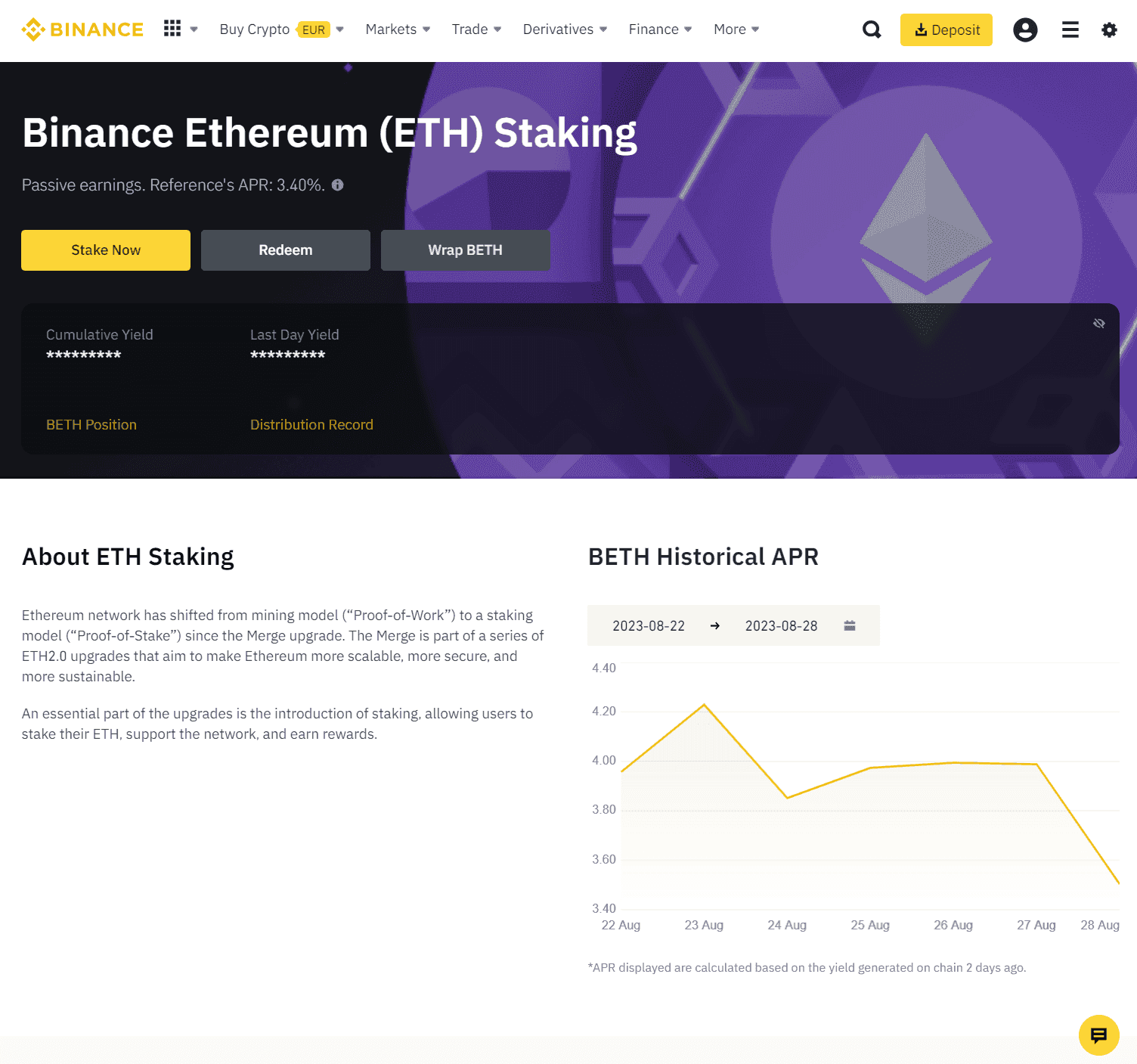

ETH 2.0 refers back to the post-merge Ethereum blockchain that migrated to the Proof of Stake consensus system. Binance affords ETH 2.0 Staking as its Ethereum liquid staking answer for customers' ETH spot positions. Binance levies a 10% curiosity on ETH staking rewards to cowl operational prices, together with {hardware} and community upkeep. Right here’s the way it works –

- Subscribers of ETH2.0 Staking Product obtain an equal BETH to their staked quantity in spot immediately.

- Staking rewards are additionally despatched in BETH, primarily based on its spot quantity. BETH can conduct the identical operations ETH does on Binance.

- A sure quota of ETH is redeemable in opposition to an equal quantity of BETH on daily basis.

Binance ETH 2.0 Staking Advantages –

- Decrease entry barrier – With Binance, earn staking advantages with simply 0.0001 ETH as a substitute of 32 ETH required for on-chain staking.

- Mitigated danger – Binance covers operational bills and protects in opposition to slashing, decreasing the chance of loss.

- Easy course of – Staking as a full node or coping with decentralized protocols is just possible for some.

- Binance Easy Earn – BETH can earn additional rewards from the Easy Earn Versatile Product on Binance.

Binance ETH 2.0 Staking competitors (Cefi and Defi)

| Binance | Coinbase | Kraken | RocketPool | Lido Finance | |

| Fee | 10% | 25% | 15% | Variable | 10% (DAO dependent) |

| Min. Staking Quantity | 0.0001 ETH | No min. quantity | Unspecified | 0.01 ETH | No min. quantity |

| Reward Distribution | Day by day | Each three days | Weekly | 2-3 days | Unspecified |

| DeFi/CeFi | CeFi | CeFi | CeFi | DeFi | DeFi |

| Staking Dangers | Lined | Lined | Not lined | Not lined | Not lined |

| Different | Easy Earn advantages | Retain possession | Extra rewards | rETH token advantages | stETH token advantages |

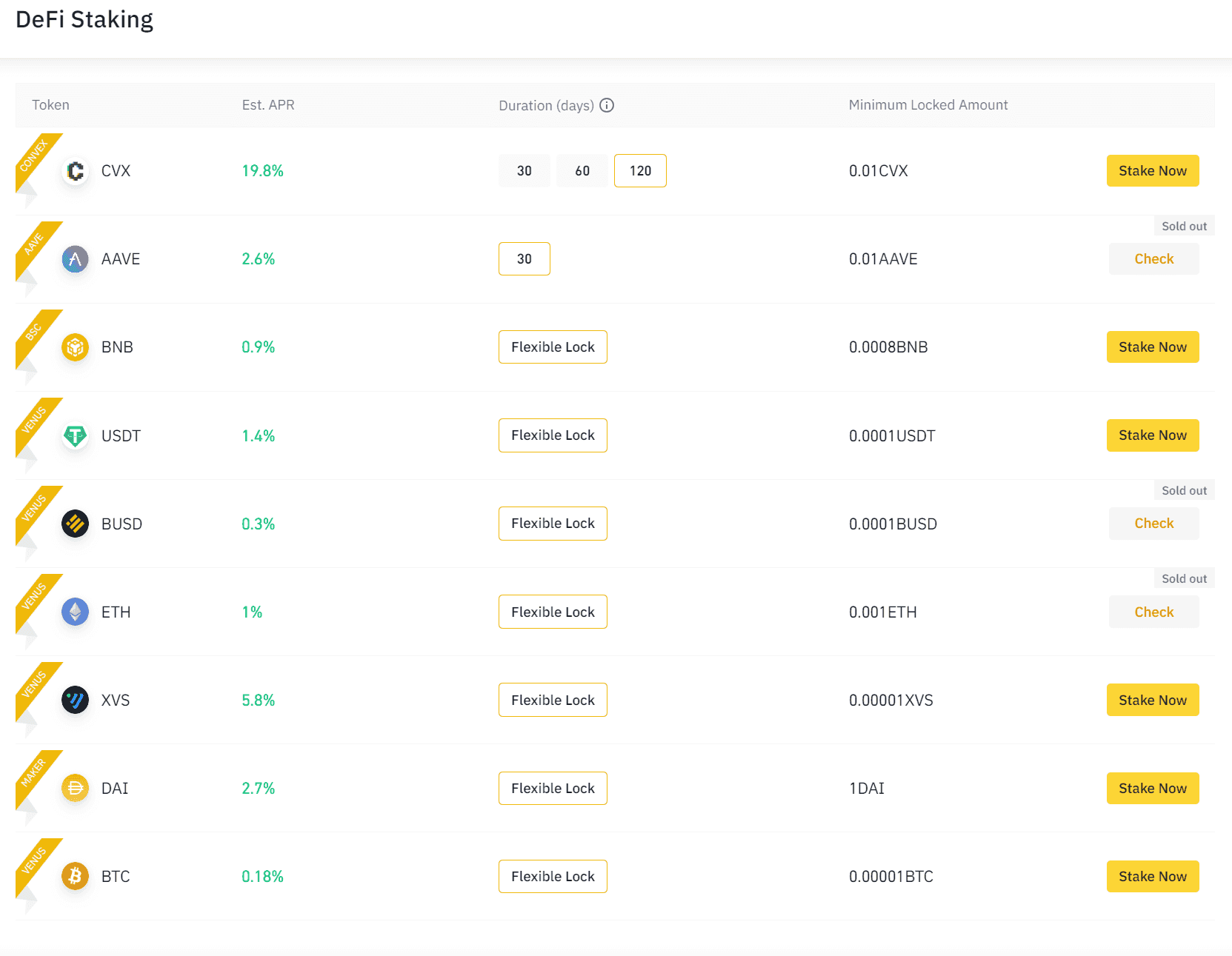

DeFi Staking

The Binance DeFi Staking product permits customers to take part in numerous DeFi protocols and earn passive revenue. Binance affords a user-friendly interface that stakes customers’ crypto on their behalf and covers different overheads corresponding to fuel. The staking product could also be versatile (redeemable anytime) or locked (redeemable after maturity).

Binance solely acts because the facilitator between the consumer and the DeFi protocol, which suggests it doesn’t assure any returns and isn’t liable for reimbursing any loss the customers' stake might incur. Binance may additionally cost an curiosity and margin over the curiosity earned by the consumer.

There are a handful of different centralized DeFi service suppliers. Right here’s how they examine in opposition to Binance (on the time of writing) –

- Staking ETH on Coinbase and Kraken earns 3.26% APY and 4-7% APY, respectively, whereas the identical stake Binance affords 1% APR on ETH deposits.

- A BTC stake on Binance affords 0.18% APR, whereas Kraken affords 0.5%.

- Whereas Kraken affords a 3.75% return on staked USDT, Binance affords 1.4%.

- Depositing AAVE on Binance earns 2.6% APR and the identical asset on Coinbase information 6.23% APY.

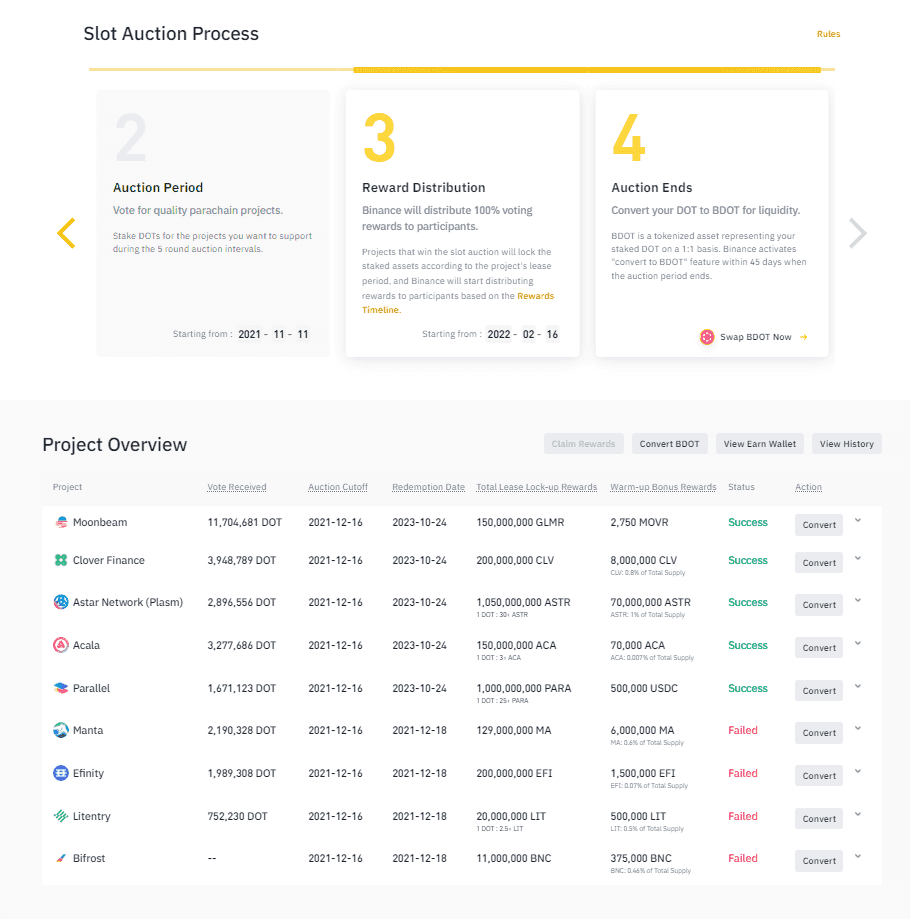

DOT Solt Public sale

DOT Slot Public sale occurs on the Polkadot blockchain. Initiatives bid to hitch the ecosystem as parachains, and their supporters can vote with their DOT holdings. If a undertaking wins the parachain public sale, its corresponding DOT deposit is locked until it stays because the parachain, which rewards the customers with token allocations.

Binance Earn’s DOT Slot Public sale permits customers to make use of Binance spot DOT holdings to take part within the public sale. By eliminating the necessity for the DeFi route, Binance affords ease of use and eliminates the necessity to pay fuel charges. Right here’s the way it works –

- Heat-up interval: Seven days earlier than the official begin of the public sale, Binance and the parachain present a particular warm-up bonus to Binance customers (roughly $30 million USDT).

- Voting: Customers stake their DOT for the specified initiatives. Rewards are cumulative.

- BDOT tokens: Binance points liquid BDOT tokens to customers representing their staked DOT. It prompts the “convert to BDOT” function inside 45 days when the entire public sale interval ends.

- After the lease interval ends, customers can convert their BDOT funds again to DOT.

Farming

Yield farming is the method of deploying crypto to work in DeFi protocols and generate passive revenue. Yield farming companies use good contracts to lock tokens and pay curiosity to depositors. Binance Earn affords three farming merchandise –

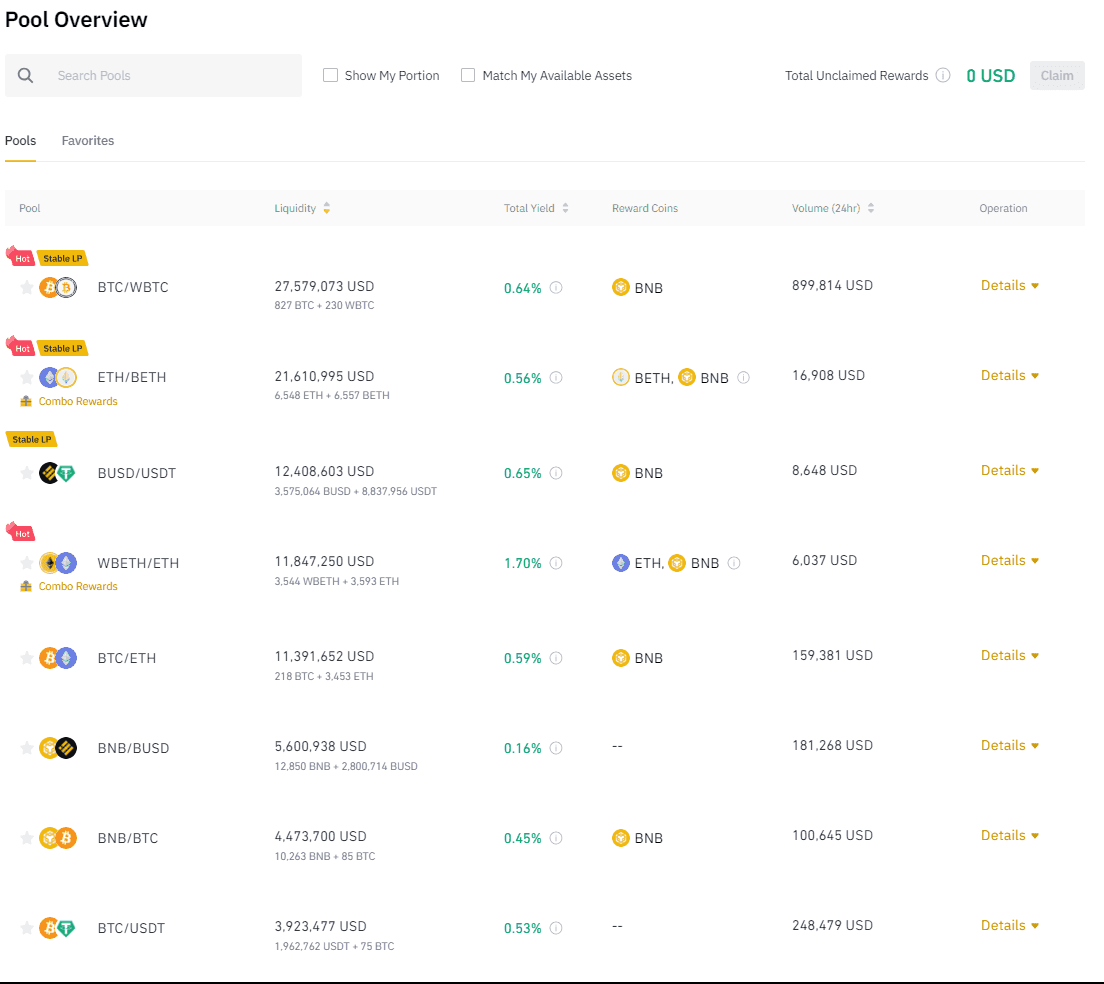

Liquidity Farming

Liquidity farming is a DeFi passive revenue technique the place liquidity is added to swimming pools to earn charges from swaps. Binance may additionally provide further rewards within the type of tokens to incentivize liquidity provision. These could possibly be within the type of BNB or different undertaking tokens Binance companions with.

Let’s examine the highest Binance Liquidity Farming swimming pools with related swimming pools in DeFi protocols (information sourced from DeFi Llama) –

Binance swimming pools –

| Swimming pools | TVL (USD) | APY (%) |

| BTC/WBTC | 27,579,073 | 0.64% |

| ETH/BETH | 21,610,996 | 0.56% |

| BUSD/USDT | 12,408,603 | 0.65% |

| BTC/ETH | 11,391,652 | 0.59% |

| BTC/USDT | 3,923,477 | 0.53% |

DeFi swimming pools constituting related tokens –

| Swimming pools | Undertaking | TVL (USD tens of millions, appx.) | APY (%) |

| WBTC/SBTC | Convex Finance | 11.47 | 1.30% |

| ETH/FRXETH | Convex Finance | 122.73 | 2.70% |

| USDT/CRVUSD | Convex Finance | 44.210 | 5.59% |

| USDT/WBTC/WETH | Convex Finance | 72.04 | 4.80% |

Observations:

Liquidity mining on Binance is hassle-free and doesn’t require difficult personal key and pockets administration. Nonetheless, the info above reveals that the chance for larger returns which might be misplaced by utilizing Binance swimming pools over its DeFi counterparts is kind of substantial.

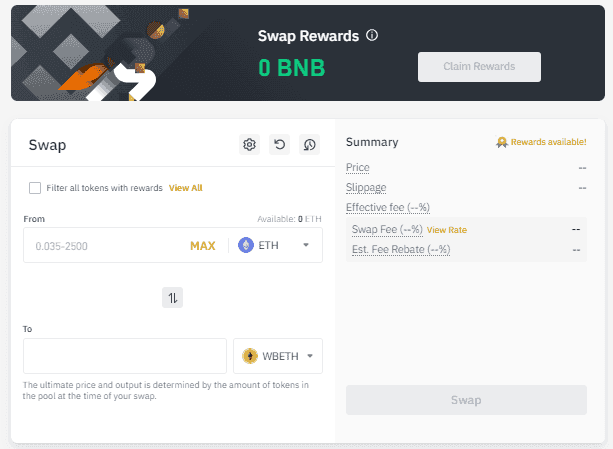

Binance prolonged its Liquidity Farming product with Swap Farming, the place customers can earn further rewards by swapping tokens in liquidity swimming pools on Binance.

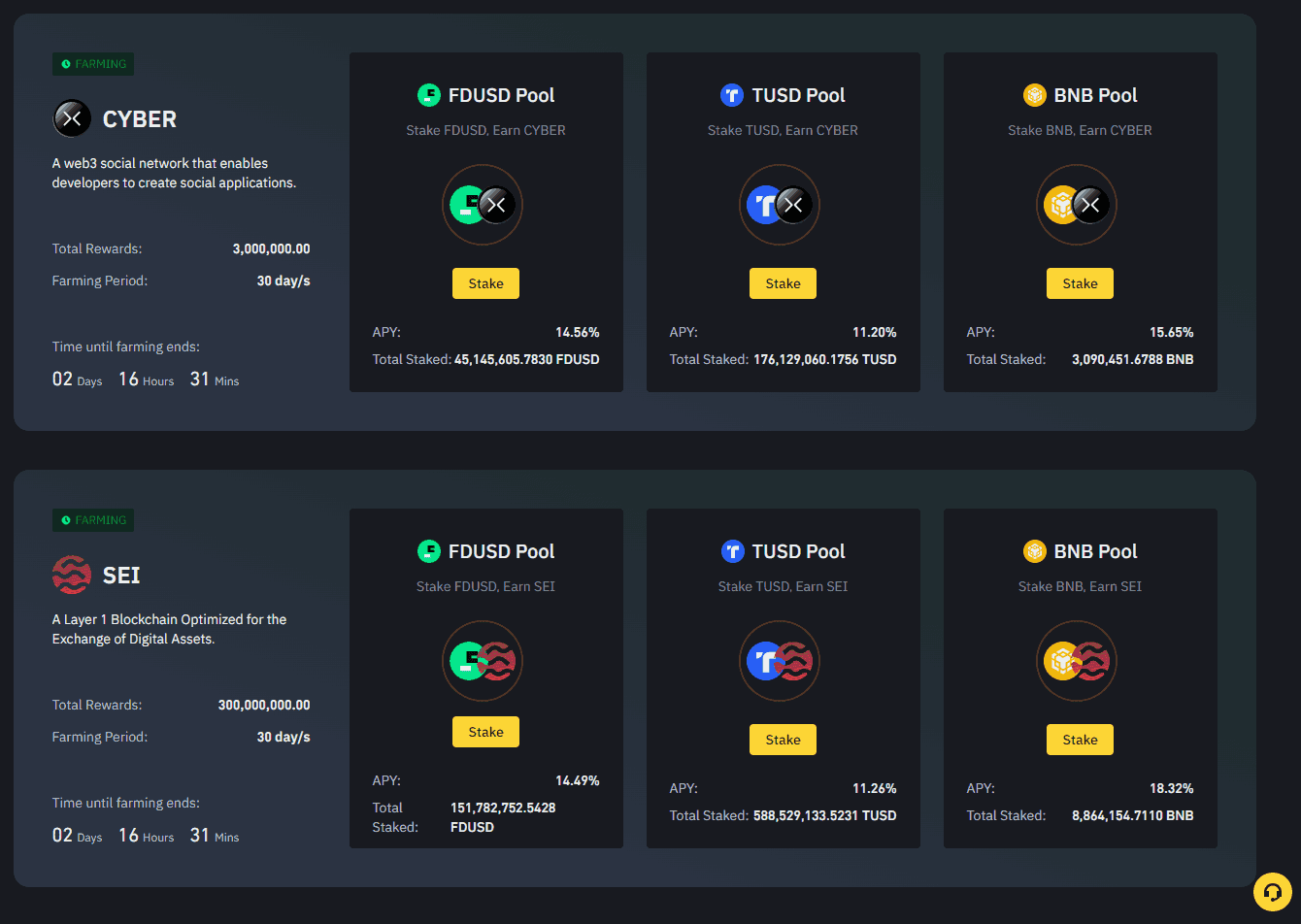

Launchpool

In Binance Launchpool, customers can farm tokens to earn new tokens that launch via this platform, without cost. To farm tokens on Launchpool, stake the specified quantity. The farming interval sometimes lasts 30 days, throughout which customers can farm tokens. The rewards receivable rely upon the variety of different energetic customers throughout the Launchpool and the quantity of crypto deposited to every pool.

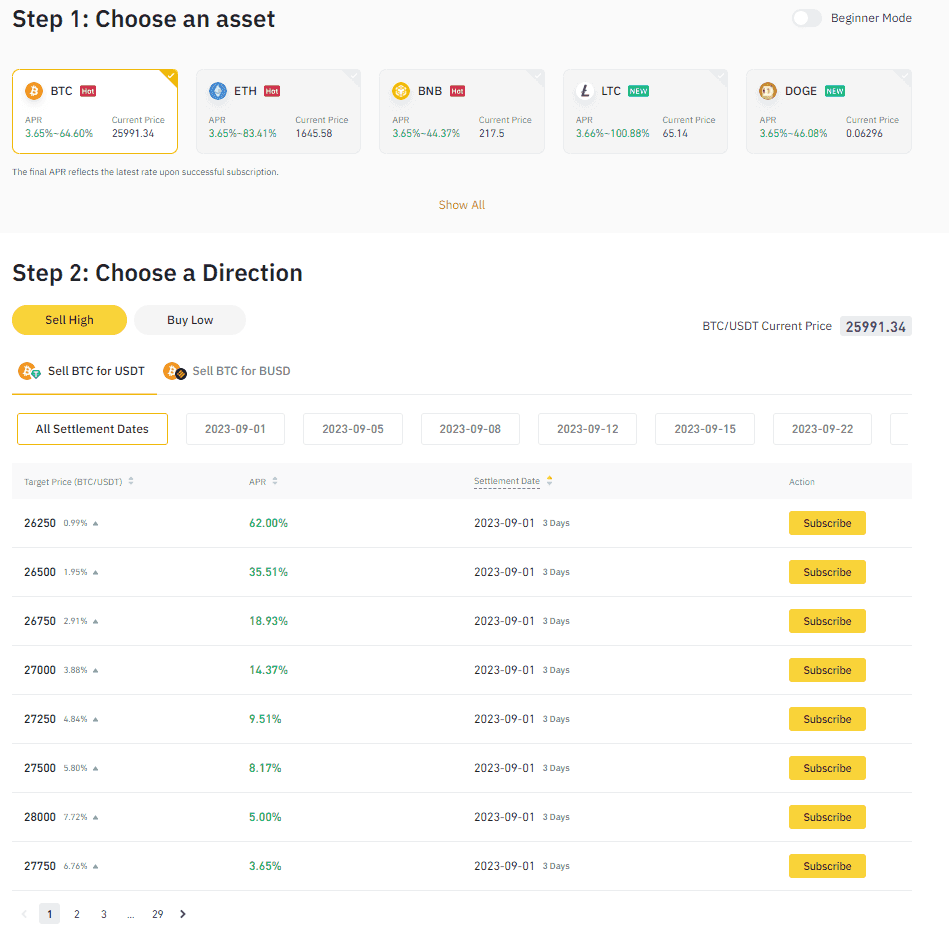

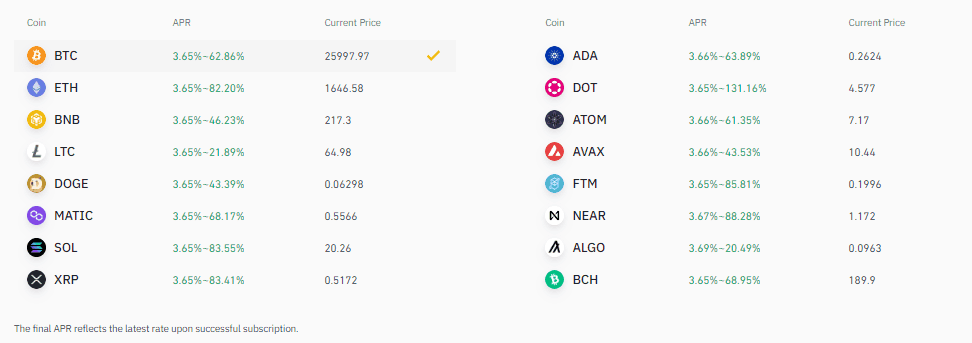

Twin Funding

Binance Twin Funding is a monetary product that enables customers to probably acquire returns from each the cryptocurrency and fiat markets whereas additionally giving them the possibility to take part in potential value good points of the chosen crypto.

Right here’s the essential define –

- Choose the Pair: You select a pair of property you want to put money into, often a cryptocurrency like BTC, ETH, and so on., and a fiat forex like USD, EUR, or a stablecoin like USDT.

- Set the Phrases: You determine the length of the funding and the "target price," which is a predetermined value stage for the cryptocurrency concerned.

- Deposit the Asset: You deposit the cryptocurrency or fiat into the Twin Funding product for the required interval.

- Two Potential Outcomes:

- If the Worth Goes Up: If the value of the cryptocurrency goes above the goal value by the maturity date, you get your preliminary funding again within the fiat or stablecoin forex on the predetermined change charge. This lets you lock in good points with out having to promote your cryptocurrency.

- If the Worth Goes Down or Stays the Similar: If the cryptocurrency's value is beneath the strike value on the maturity date, you get your preliminary funding again within the cryptocurrency, primarily permitting you to purchase extra of the asset at a "discount" in comparison with the goal value.

- Curiosity: Throughout the holding interval, your funding might earn a hard and fast curiosity, additional including to your potential good points.

The Twin funding plan permits potential acquire from rising and falling markets whereas additionally incomes curiosity through the holding interval. Nonetheless, the chance price of this technique might outweigh its good points throughout occasions of elevated volatility. A number of well-known cryptocurrencies can be found for Twin Funding.

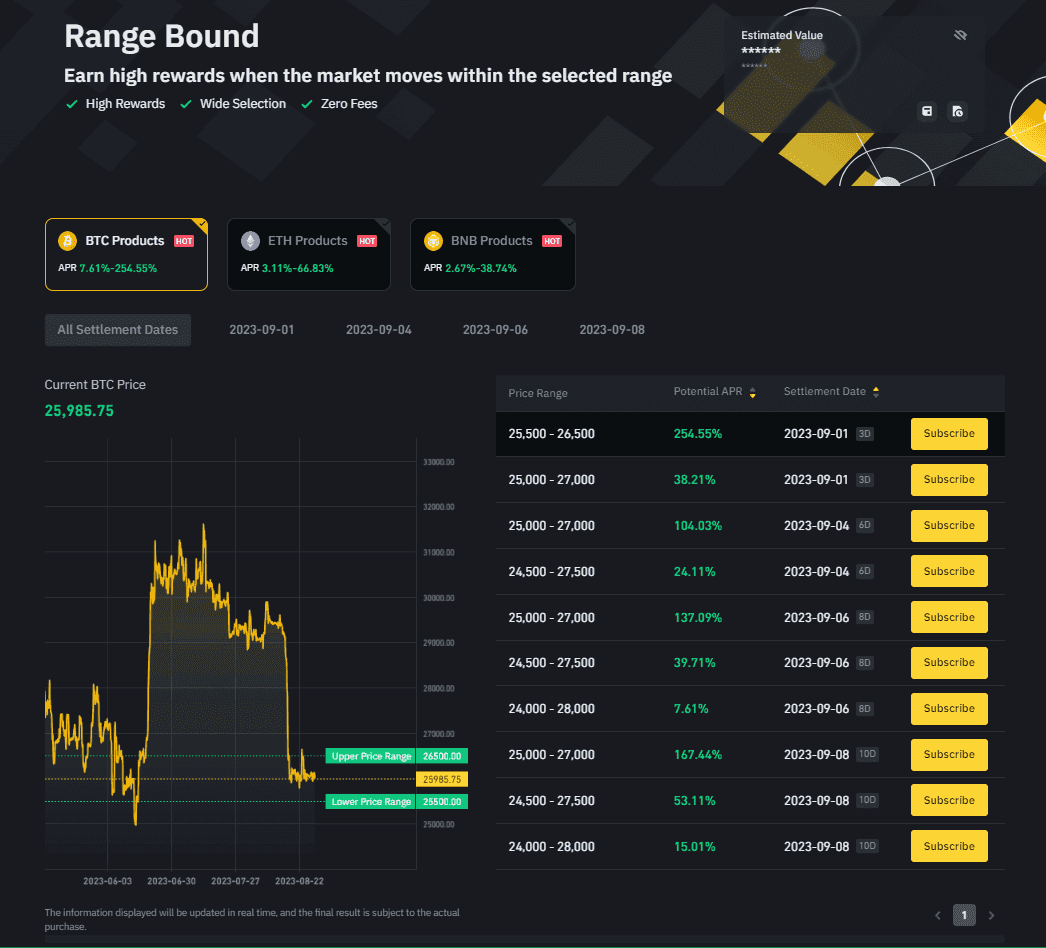

Vary Certain

Cryptocurrency markets are sometimes very risky, however there are occasions of weakened curiosity and low volumes when the value hovers in a variety; that is referred to as a sideways market. By letting customers earn further curiosity, Binance Vary Certain lets customers profit from this sideways motion.

As soon as you choose and deposit the asset, select the popular vary and length. There are two attainable situations:

- Worth stays throughout the vary: If it stays inside vary for the complete length, you obtain rewards equal to the potential APR on the settlement date.

- Worth exits the vary: If the value touches/exceeds the chosen vary at any level through the subscription length, it’s possible you’ll obtain lower than the quantity you initially deposited.

Vary Certain poses a substantial danger and is appropriate for seasoned merchants. Binance affords BTC, ETH, and BNB Vary Certain plans.

Binance Earn: Advantages, Dangers, and Alternatives

Advantages:

- A various portfolio of merchandise throughout DeFi and CeFi for all danger appetites and reward expectations.

- Person-friendly interface.

- Good liquidity and adaptability shield in opposition to volatility.

- Some merchandise provide the best yields available in the market.

Dangers:

- Some merchandise like Twin Funding and Vary Certain could also be laborious for novice merchants to know.

- Some merchandise, just like the Launchpool, are tied to very speculative tokens.

- Unstandardized regulation means merchandise aren’t obtainable uniformly throughout all geographical places.

- Dangers of centralization and restricted direct entry to deposits improve default danger.

Alternatives:

- Binance Earn merchandise can probably assist inexperienced merchants grow to be seasoned at taking dangers, attracting extra worth into the ecosystem.

- All kinds of merchandise with cross-functional purposes retains customers throughout the ecosystem.

- Early adopter benefits.

- Customers already on Binance have a large incentive to proceed their DeFi actions throughout the ecosystem.

Binance Earn Evaluate: Closing Ideas

Binance Earn emerges as a formidable contender within the quickly evolving panorama of crypto finance. With its numerous array of merchandise, user-friendly interface, and the potential for top returns, it affords each novice and skilled traders distinctive alternatives to develop their portfolios.

Nonetheless, as with all funding, it's important to navigate the inherent dangers and complexities fastidiously. Because the crypto ecosystem continues to mature, Binance Earn stands well-poised to capitalize on this progress, providing an all-in-one platform for crypto asset administration that units it other than its opponents.

Continuously Requested Questions

Can You Make Cash on Binance Earn?

Sure, Binance Earn affords numerous funding merchandise designed that will help you earn returns in your cryptocurrency holdings. From financial savings accounts to extra complicated choices like staking and liquidity farming, the platform gives a number of methods to probably generate returns.

Nonetheless, as with all funding, returns aren’t assured and include various ranges of danger. All the time do your due diligence earlier than investing.

Is Binance Earn Value it?

Binance Earn is usually a worthwhile choice for these seeking to earn returns on idle crypto property and do not thoughts not taking self-custody over their property. It affords numerous merchandise catering to completely different danger appetites and return expectations. Nonetheless, the worth of utilizing Binance Earn will depend on your funding targets, understanding of the merchandise, and danger tolerance. All the time conduct thorough analysis and presumably seek the advice of with a monetary advisor to evaluate if it aligns together with your monetary aims.

Is it Secure to Use Binance Earn?

Binance Earn is mostly thought of safe, benefitting from the safety infrastructure of the bigger Binance platform. Nonetheless, like every funding or monetary service, it isn’t totally with out danger. Cryptocurrency markets might be risky, and the varied merchandise include their very own units of dangers.

Centralized platforms like Binance are additionally prone to regulatory or operational points. It is important to learn the phrases and situations, perceive every product’s dangers, and presumably seek the advice of a monetary advisor for personalised recommendation.

How Does Earn Work on Binance?

Binance Earn features as a monetary hub throughout the Binance platform, providing numerous methods to earn returns on cryptocurrency. Customers can select from a variety of merchandise like fastened or versatile financial savings, staking, liquidity farming, and different specialised funding choices.

As soon as you choose a product that aligns together with your danger tolerance and returns expectations, you often deposit the required cryptocurrency into it for a specified time period. Relying on the product, you could possibly earn curiosity, yield, or different sorts of returns. Ensure to learn the phrases and situations for every product earlier than investing.

What’s Crypto Yield?

Crypto yield refers back to the earnings or returns generated on a cryptocurrency funding over a given interval, typically expressed as a share of the preliminary funding. Within the context of decentralized finance (DeFi) or numerous monetary merchandise provided on crypto platforms like Binance Earn, yield can come from numerous sources, together with curiosity from lending protocols, staking rewards, liquidity mining, or yield farming.

The time period “yield” is much like the idea of rate of interest in conventional finance, however the mechanisms for incomes that yield might be fairly completely different, given the progressive and decentralized nature of many crypto-based monetary merchandise.

How Do You Earn Yield in Crypto?

Incomes yield in crypto might be achieved via numerous strategies, every with its personal risk-reward profile. Listed below are some frequent methods:

- Staking: By staking sure sorts of cryptocurrencies in a proof-of-stake (PoS) community, you possibly can earn further tokens as rewards for collaborating in community validation.

- Lending: Platforms like Binance Earn, Compound, and Aave will let you lend your cryptocurrencies to others in change for curiosity over time.

- Liquidity Mining: In decentralized exchanges like Uniswap or Sushiswap, you possibly can present liquidity by depositing pairs of tokens in a pool. In return, you earn buying and selling charges and generally further tokens.

- Yield Farming: This includes extra complicated methods that often embody offering liquidity after which staking the liquidity supplier tokens to earn yield from a number of sources.

- Fastened or Versatile Financial savings: Crypto financial savings accounts, typically offered by centralized exchanges like Binance, provide a hard and fast or variable rate of interest on the crypto you deposit.

- Twin Investments and Structured Merchandise: Extra complicated monetary merchandise can provide yield via a mixture of choices, futures, and different monetary devices.

- Dividends from Token Holding: Some tokens present dividends or different types of yield only for holding them in a selected pockets.

It is essential to know the dangers related to every technique, together with good contract dangers, volatility dangers, and the chance of impermanent loss, particularly in additional complicated methods like yield farming. All the time conduct thorough analysis or seek the advice of a monetary advisor earlier than partaking in these actions.