Few subjects within the annals of cryptocurrency historical past have ignited as a lot ardour and debate because the Bitcoin block house controversy. This seminal argument not solely divided communities but additionally challenged Bitcoin's very ethos, prompting introspection on its core ideas. It stirred profound questions: What does Bitcoin basically characterize? How would Satoshi Nakamoto, the enigmatic creator of Bitcoin, have navigated these turbulent waters?

This text delves deep into the center of this debate by evaluating Bitcoin with Bitcoin Money, a spinoff born out of the will for a distinct path ahead. By exploring the intricacies of each networks, we intention to make clear the mindset of Bitcoin Money advocates and reveal the ideological rifts that led to this important divergence. Whether or not you're an investor, a technologist, or just a curious observer of blockchain know-how, understanding the nuances of this break up can present invaluable insights into which community aligns greatest together with your private or monetary goals. Be a part of us as we unravel the layers of this advanced narrative, providing readability on a selection that continues to resonate inside the crypto group.

The Bitcoin Block Area Debate

One should delve into the pivotal Bitcoin block house debate to completely grasp the distinctions between Bitcoin and Bitcoin Money. This dialogue is not only a technical dissection however a story that encapsulates the evolution of Bitcoin from a distinct segment experiment to a world monetary community.

Understanding the Block Dimension Difficulty

The Unique Bitcoin Block Dimension: Bitcoin's blocks are capped at roughly 1 MB, a design that originally aimed to stop spam assaults. This dimension restrict implies that, on common, solely about 7 transactions may be processed per block each 10 minutes. Whereas this was enough in Bitcoin's infancy, it grew to become a bottleneck because the community expanded.

Rising Transaction Charges: By 2017, the Bitcoin community surged in adoption, turning it into a world community with thousands and thousands of customers. This spike in exercise led to a major improve in transaction charges as customers vied to get their Bitcoin transactions included within the subsequent block.

The Divergence of Options

The escalating debate on scale the Bitcoin blockchain gave rise to 2 major factions, every with its personal imaginative and prescient for Bitcoin's future:

Faction 1: Enhance the Block Dimension

This group advocated an easy resolution: increase the block dimension from 1 to eight MB. This modification would immediately improve the variety of transactions every block might accommodate, ostensibly easing the community congestion and decreasing charges.

Faction 2: Segregated Witness (SegWit)

The second faction proposed a extra intricate resolution often called Segregated Witness (SegWit). This method optimized transaction storage, successfully permitting extra transactions in a 1 MB block with out altering the preliminary block dimension.

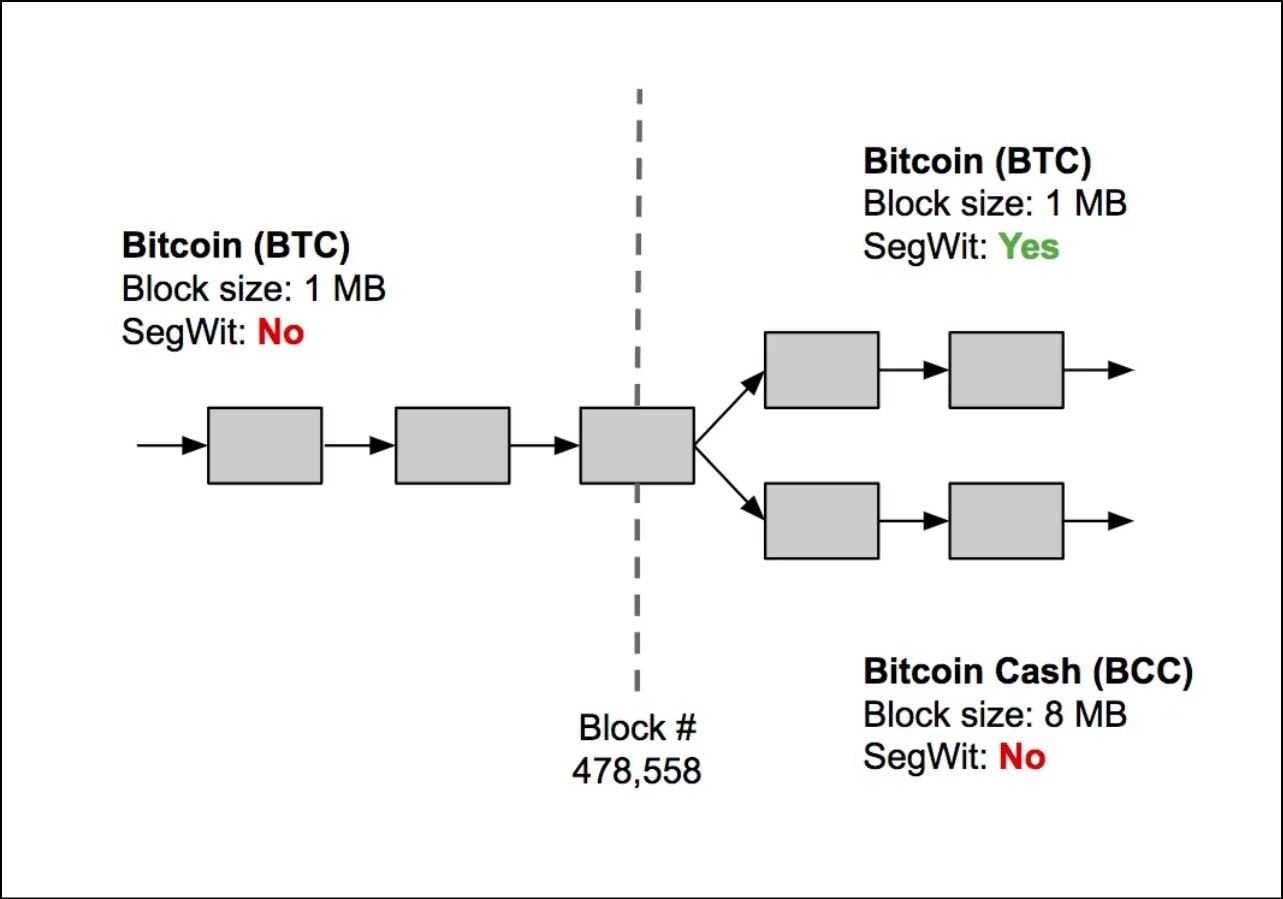

The Fork and Beginning of Bitcoin Money

After in depth debates and no consensus in sight, the group reached a essential juncture. At block peak #478559, proponents of the bigger block dimension initiated a tough fork, creating a brand new department of the blockchain. This marked the inception of Bitcoin Money, embodying the imaginative and prescient of a cryptocurrency with an 8 MB block dimension to accommodate extra transactions and scale successfully.

In the meantime, the remaining Bitcoin group moved ahead with the implementation of SegWit, an improve that may later pave the way in which for additional improvements and optimizations within the community.

By way of this break up, two distinct philosophies emerged, every addressing the scalability problem in its personal distinctive means. Understanding this schism is essential for anybody seeking to comprehend the underlying ideas and sensible variations between Bitcoin and Bitcoin Money.

Bitcoin Money Overview

Right here's a desk that gives a side-by-side comparability of technical data for Bitcoin and Bitcoin Money:

| Function | Bitcoin (BTC) | Bitcoin Money (BCH) |

|---|---|---|

| Yr Based | 2009 | 2017 |

| Creator | Satoshi Nakamoto | Fork of Bitcoin |

| Consensus | Proof of Work (PoW) | Proof of Work (PoW) |

| Ticker | BTC | BCH |

| Block Dimension | 1 MB (as much as 4 MB with SegWit) | 32 MB (initially elevated to eight MB) |

| Transactions Per Second (TPS) | ~7 (varies with SegWit) | ~116 (is determined by block dimension utilization) |

| Market Capitalization (March 2024) | Over $1 Trillion | $11 Billion |

| Circulating Provide (March 2024) | 19,682,224 | 19,667,250 |

| Max Provide | 21 million | 21 million |

What’s Bitcoin Money?

The inception of Bitcoin Money (BCH) is intricately tied to a core assertion from its whitepaper: "A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution." This line, mirroring the introduction in Bitcoin's unique whitepaper, underscores that Bitcoin Money is not only a brand new entity however a hard-forked continuation of Bitcoin's unique promise, albeit with particular, pivotal modifications.

Core Tenets of Bitcoin Money

- Bigger Block Dimension: On the coronary heart of Bitcoin Money is its elevated block dimension of 8 MB, additional elevated to 32 MB in Could 2018. This modification was carried out to reinforce transaction throughput, diminish charges, and align Bitcoin extra carefully with its supposed operate: facilitating environment friendly peer-to-peer transactions. The bigger block dimension immediately responds to the congestion and excessive charges skilled on the Bitcoin community, particularly throughout important utilization.

- Dedication to On-Chain Scaling: Bitcoin Money champions the idea that true scalability and effectivity ought to stay on one chain, preserving the ledger's integrity and decentralization. Not like Bitcoin's Segregated Witness (SegWit) improve, whereas bettering Bitcoin's scalability to a point, it closely depends on off-chain options just like the Lightning Community. Bitcoin Money maintains that each one transaction knowledge needs to be processed inside the blockchain to make sure most safety and decentralization.

- Upholding Bitcoin's Foundational Imaginative and prescient: Proponents of Bitcoin Money typically level to Satoshi Nakamoto's unique imaginative and prescient of Bitcoin as a digital retailer of worth and a medium of trade. For Bitcoin to serve successfully as a medium of trade, it should facilitate transactions that aren’t solely safe but additionally quick and inexpensive sufficient for day by day use.

- A Pragmatic Strategy to Scalability: Bitcoin Money emerged as an instantaneous, sensible resolution to the scalability problem when the community confronted excessive congestion. Whereas SegWit introduced a forward-looking method, it required additional time for improvement and refinement. In distinction, rising the block dimension provided an instantaneous treatment to the community's urgent points, aiming to revive Bitcoin's utility as an efficient, decentralized peer-to-peer digital money system.

By way of these core tenets, Bitcoin Money strives to realign the cryptocurrency with what its supporters consider to be Satoshi Nakamoto's unique aspirations, emphasizing usability, low charges, and dependable, on-chain transaction processing.

Bitcoin vs Bitcoin Money: Key Variations

Bitcoin and Bitcoin Money characterize two distinct paths inside the cryptocurrency panorama, every with distinctive technical traits and philosophical underpinnings. Listed here are the important thing variations between them:

- Block Dimension Restrict:

- Bitcoin: Maintains a 1 MB block dimension restrict, though Segregated Witness (SegWit) successfully permits extra knowledge to be processed by separating transaction signatures.

- Bitcoin Money: Upon its creation, Bitcoin Money initially elevated the block dimension restrict to eight MB, with subsequent updates permitting for even bigger blocks. That is supposed to course of extra transactions per block, decreasing charges and transaction occasions.

- Scalability Options:

- Bitcoin: Focuses on off-chain scalability options just like the Lightning Community and SegWit to enhance scalability with out immediately rising the block dimension. SegWit additionally optimizes block house utilization, permitting extra transactions to suit right into a block.

- Bitcoin Money: Advocates for on-chain scalability by way of bigger block sizes, aiming to deal with congestion and excessive charges immediately on the blockchain with out relying closely on multi-layer options.

- Philosophical Strategy:

- Bitcoin: Typically considered as digital gold, it's thought-about extra of a retailer of worth than a medium of trade as a consequence of its restricted transaction throughput and better charges throughout peak occasions.

- Bitcoin Money: Positions itself as a peer-to-peer digital money system, emphasizing its utility for on a regular basis transactions with decrease charges and sooner affirmation occasions.

- Transaction Charges:

- Bitcoin: Because of the restricted house in every block, Bitcoin can expertise increased transaction charges, particularly during times of community congestion.

- Bitcoin Money: Typically gives cheaper transactions as a consequence of its bigger block dimension, which might accommodate extra transactions.

- Consensus and Community Results:

- Bitcoin: It has a bigger consumer base, extra recognition, and a extra in depth community impact, which contributes to its worth and safety.

- Bitcoin Money: Whereas it has a major consumer base, it’s smaller than Bitcoin, which impacts its liquidity, adoption, and notion within the crypto ecosystem.

- Growth and Innovation:

- Bitcoin: Has a extra conservative method to adjustments, specializing in safety and stability, with improvements like Schnorr signatures and Taproot.

- Bitcoin Money: Extra open to bigger protocol adjustments to enhance scalability and transaction effectivity, as demonstrated by its block dimension will increase and different protocol enhancements.

- Market Place:

- Bitcoin: Stays probably the most acknowledged and valued cryptocurrency, typically serving as a benchmark for all the crypto market.

- Bitcoin Money: Whereas important in its personal proper, it holds a smaller market capitalization and is much less influential within the broader cryptocurrency panorama.

Understanding these variations is essential for anybody seeking to interact with or put money into these cryptocurrencies, as every gives distinct benefits, challenges, and use instances.

Sensible Contract Capabilities of Bitcoin vs Bitcoin Money

The Taproot improve considerably enhanced Bitcoin's (BTC) functionality to help extra advanced transactions, together with those who could possibly be thought-about rudimentary sensible contracts, whereas sustaining its emphasis on privateness and effectivity. Evaluating this to Bitcoin Money's (BCH) method to sensible contracts gives an fascinating distinction, as every community has totally different priorities and design philosophies.

Bitcoin's Enhancements with Taproot

- Schnorr Signatures: Taproot introduces Schnorr signatures, which permit for extra privateness and effectivity in transactions. They permit the aggregation of a number of signatures into one, a characteristic useful for multi-signature transactions and sensible contract execution.

- MAST (Merkelized Summary Syntax Timber): MAST permits for creating situations beneath which a transaction may be spent. It improves privateness and effectivity by solely revealing the situations met when the transaction is spent moderately than all doable situations.

- Tapscript: That is the scripting language launched with Taproot. It enhances Bitcoin's scripting capabilities and makes it simpler to implement advanced situations for transaction spending.

- Privateness and Effectivity: Taproot enhances privateness by making advanced transactions indistinguishable from easy ones once they're spent. It additionally reduces the info dimension of advanced transactions, resulting in effectivity good points.

Bitcoin Money Sensible Contract Capabilities

- Scripting Language: Bitcoin Money makes use of an enhanced model of Bitcoin Script, a stack-based language. It's not Turing-complete, that means its capabilities are restricted in comparison with fully-fledged sensible contract platforms.

- CashScript and Spedn: These high-level languages facilitate writing sensible contracts on BCH. They compile right down to Bitcoin Script, making sensible contract improvement extra accessible.

- OP_CODES: BCH has re-enabled and added new OP_CODES to increase its scripting capabilities and permit for extra advanced transaction varieties.

- Covenants: Bitcoin Money helps covenants, which supply a option to specify guidelines about how BCH may be spent, enabling extra advanced transaction buildings.

The Taproot improve considerably enhanced Bitcoin's (BTC) functionality to help extra advanced transactions, together with those who could possibly be thought-about rudimentary sensible contracts, whereas sustaining its emphasis on privateness and effectivity. Evaluating this to Bitcoin Money's (BCH) method to sensible contracts gives an fascinating distinction, as every community has totally different priorities and design philosophies. Whereas Bitcoin's scripting language emphasizes privateness and safety, Bitcoin Money leans towards transaction effectivity.

Comparability

- Complexity and Functionality: Whereas BCH's sensible contract capabilities are extra express and accessible, they’re nonetheless basically restricted by the constraints of Bitcoin Script. Conversely, Taproot doesn't drastically increase Bitcoin's sensible contract capabilities however considerably enhances the effectivity and privateness of advanced transactions, which might embody contract-like situations.

- Developer Accessibility: With CashScript and Spedn, Bitcoin Money could be extra accessible to builders seeking to create easy sensible contracts with out the complexity of Ethereum's Solidity. Taproot’s Tapscript improves developer choices on Bitcoin however stays advanced in comparison with devoted sensible contract platforms.

- Use Instances: Bitcoin Money's sensible contract capabilities are geared in the direction of monetary transactions with some degree of programmability. Bitcoin's Taproot improve focuses on enhancing privateness and effectivity, significantly for advanced transactions like these involving multi-signature necessities or conditional spending, which may be considered as fundamental sensible contracts.

In abstract, Bitcoin Money has extra express instruments and languages for creating sensible contracts than Bitcoin, which boosts its capabilities for advanced and personal transactions utilizing Taproot. Nevertheless, neither Bitcoin nor Bitcoin Money are designed to compete immediately with platforms like Ethereum when it comes to sensible contract complexity and breadth of doable purposes.

Bitcoin's Decentralization vs. Bitcoin Money's Transaction Effectivity

When evaluating Bitcoin's decentralization to Bitcoin Money's transaction effectivity and scalability, it's essential to evaluate how these traits affect their utility in the actual world. Let's delve into these features to find out if one can construct a case for utilizing Bitcoin Money over Bitcoin in real-world purposes.

Bitcoin's Decentralization and Ecosystem Improvements

Bitcoin's dedication to a smaller block dimension is usually considered as a measure to protect decentralization. This dedication results in an costly and congested community. Bitcoin mitigates these bottlenecks with scalability options just like the Lightning Community, which permits for quick and low-cost off-chain transactions, and Rootstock, which permits sensible contracts. These improvements improve Bitcoin's scalability and performance with out altering its core block dimension.

Bitcoin Money's Transaction Effectivity and Scalability

Bitcoin Money elevated the block dimension restrict to make the community extra sensible for on a regular basis transactions. Bitcoin Money's method may be interesting for customers prioritizing quick and cheap transactions, particularly for smaller, on a regular basis funds. Its dedication to on-chain scaling is designed to supply an easy consumer expertise with out the necessity for extra layers or secondary protocols.

Evaluating the trade-offs:

- Normal Person Expertise: Off-chain scaling can introduce extra steps than direct transactions on the Bitcoin Money community for a basic consumer.

- Financial Safety and Recognition: Bitcoin's broader recognition and adoption give it better financial safety than BCH. This widespread acceptance, coupled with its in depth ecosystem, can provide customers extra alternatives and use instances.

- Lengthy-term Viability: Bitcoin Money could (or could not) protect Nakamoto's unique imaginative and prescient, however Bitcoin's off-chain options provide a stability between effectivity, asset acceptance, and decentralization.

In conclusion, whether or not one chooses Bitcoin Money for its transaction effectivity or Bitcoin for its decentralized nature and progressive off-chain options is determined by particular person priorities and use instances. Bitcoin Money presents a compelling case for these valuing fast, on a regular basis transactions. Nevertheless, Bitcoin's off-chain scalability options could provide a viable and engaging trade-off for customers who prioritize a well-established community with a broad vary of functionalities and a extra strong safety mannequin.

The place to Purchase and Retailer Bitcoin and Bitcoin Money

The Coin Bureau extensively covers cryptocurrency buy and storage. Relatively than repeating the identical data repeatedly, here’s a curation of Coin Bureau articles masking all the things associated to cryptocurrency buy and storage.

Normal Cryptocurrency Data

- Finest cryptocurrency exchanges

- Finest Bitcoin Lightning Wallets

- 5 Finest {Hardware} Wallets

All About Bitcoin

- Methods to Purchase Bitcoin on eToro

- Methods to Purchase Bitcoin within the US

- Methods to Purchase Bitcoin in Canada

- Methods to Purchase Bitcoin in Europe

- Methods to Purchase Bitcoin UK

- Methods to Purchase Bitcoin on OKX

- Methods to Purchase Bitcoin on Binance

- Methods to Purchase Bitcoin on Bitget

All About Bitcoin Money

- Step-by-Step Information to Shopping for BCH on Native Bitcoin Money

- Bitcoin Money Wallets: High 10 Most secure Locations to Retailer BCH

Closing Ideas

In concluding our comparability between Bitcoin and Bitcoin Money, it's evident that every gives distinct benefits primarily based on differing priorities and philosophies inside the cryptocurrency house. Bitcoin Money focuses on transaction effectivity and scalability by way of bigger block sizes, aligning with its imaginative and prescient of being a peer-to-peer digital money system appropriate for on a regular basis transactions. Alternatively, Bitcoin emphasizes decentralization, safety, and a broader ecosystem of progressive options, together with off-chain scalability choices just like the Lightning Community, which cater to a wide range of consumer wants past easy transactions.

The selection between Bitcoin and Bitcoin Money finally hinges on particular person preferences for transaction pace and price versus the broader utility and robustness of the community. Because the cryptocurrency panorama continues to evolve, each Bitcoin and Bitcoin Money will stay pivotal gamers, every catering to totally different segments of the digital financial system.

Ceaselessly Requested Questions

What’s Bitcoin Money? Do Pre-Fork BTC Holders Additionally Personal BCH?

Bitcoin Money (BCH) is a cryptocurrency that was created as a fork of Bitcoin in 2017, primarily to extend the block dimension to enhance transaction effectivity and cut back charges. It goals to be a peer-to-peer digital money system, in distinction to Bitcoin’s evolving function as ‘digital gold’. Sure, pre-fork BTC holders additionally personal an equal quantity of BCH. In the event that they held Bitcoin in a pockets the place they management the personal keys or on an trade that supported the fork, they obtained an equal quantity of Bitcoin Money.

How Does SegWit Enhance the Efficient Block Dimension to 4 MB?

Segregated Witness (SegWit) is a protocol improve carried out on Bitcoin that will increase the block’s efficient capability with out altering its dimension restrict. It achieves this by separating the transaction signatures (witness knowledge) from the transaction knowledge. This segregation implies that extra transaction knowledge can match into the 1 MB block, whereas the witness knowledge is counted individually, permitting for a theoretical improve in block dimension as much as 4 MB. This modification improves the community’s capability and effectivity and not using a direct improve within the block dimension restrict.

Is Bitcoin Money as Safe as Bitcoin?

Whereas Bitcoin Money incorporates the core safety features of Bitcoin, its safety is mostly thought-about barely much less strong than Bitcoin’s, primarily as a consequence of its smaller community dimension and hash price. In blockchain know-how, a better hash price signifies better community safety, because it requires extra computational energy to aim a 51% assault. Since Bitcoin has a bigger community and a better hash price, it’s usually considered as safer in comparison with Bitcoin Money.

How A lot Sooner and Cheaper is Bitcoin Money than Bitcoin?

Bitcoin Money transactions are typically sooner and cheaper than Bitcoin transactions as a consequence of its bigger block dimension. Whereas Bitcoin transactions can change into sluggish and costly throughout occasions of congestion as a result of 1 MB block restrict, Bitcoin Money’s elevated block dimension permits for extra transactions per block, decreasing wait occasions and charges. Nevertheless, the precise distinction in pace and price can fluctuate primarily based on community congestion and utilization ranges at any given time.

Is BCH a Good Retailer of Worth?

Bitcoin Money (BCH) was primarily designed to be an environment friendly medium of trade with its elevated block dimension permitting for faster and cheaper transactions. As a retailer of worth, BCH’s efficiency is topic to debate. In comparison with Bitcoin (BTC), which has gained widespread recognition as a digital retailer of worth akin to gold, BCH has not achieved the identical degree of market adoption or notion as a price reserve. Whereas some traders might even see potential in BCH’s utility and undertake it as a part of a diversified cryptocurrency portfolio, its worth as a retailer of worth is mostly thought-about much less confirmed than Bitcoin’s, particularly given its shorter historical past and better worth volatility. Buyers usually assess a retailer of worth primarily based on its long-term stability and acceptance, areas the place Bitcoin presently has a stronger observe document.