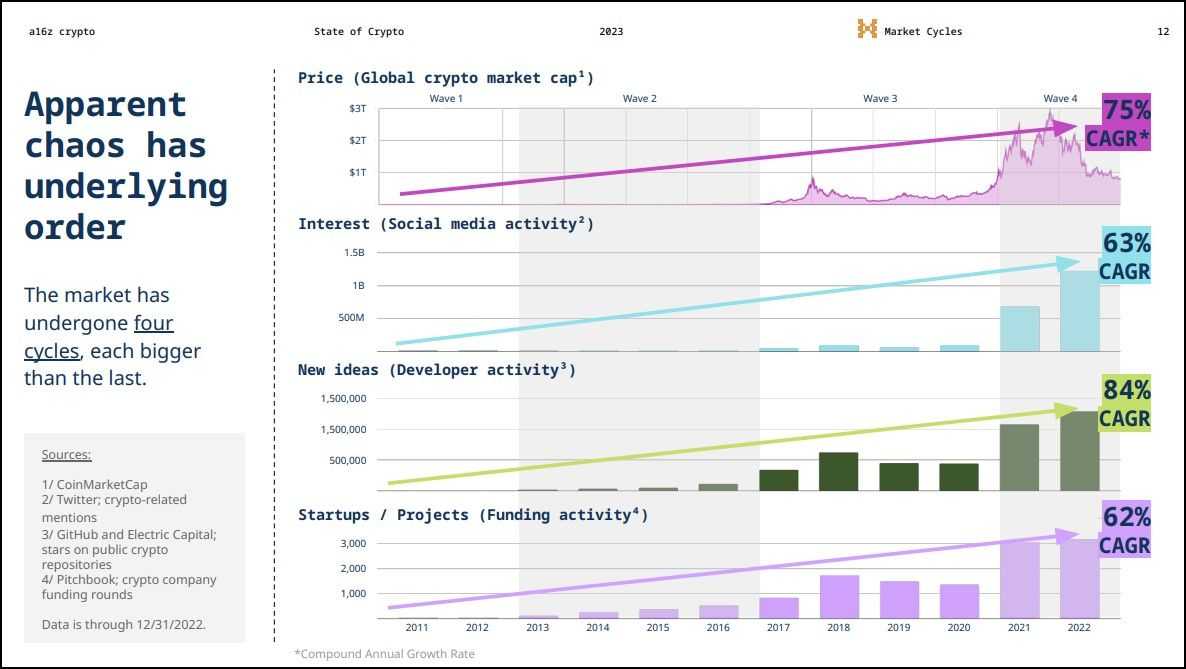

Within the ever-evolving panorama of the crypto economic system, Bitcoin and Ethereum stand out as the 2 most mature property, every commanding a novel place and function. Historically, the roles have been distinct: Bitcoin emerged because the quintessential retailer of worth, whereas Ethereum, with its versatile platform, turned the spine for the burgeoning Decentralized Finance (DeFi) sector. Nevertheless, the previous few market cycles have blurred these strains, ushering in a brand new period the place the functionalities and perceptions of those cryptocurrencies overlap greater than ever earlier than.

Current technological developments and shifts in investor sentiment have considerably altered how we view and use these property. Bitcoin is now not only a digital gold; it's making inroads into DeFi, demonstrating its versatility past a mere retailer of worth. Concurrently, Ethereum is witnessing a metamorphosis, with its native token, Ether, more and more being considered as a possible retailer of worth, a shift pushed by its rising commodification and integral position within the crypto ecosystem.

In gentle of those developments, this evaluation goals to supply an up to date perspective on the Bitcoin vs Ethereum debate. Our goal is to not declare a victor however to supply a nuanced evaluation of how these property evolve, highlighting their rising similarities and protracted variations as they turn out to be extra deeply ingrained within the cloth of digital finance.

Creator's Disclaimer: My funding portfolio contains important holdings in each Bitcoin and Ethereum. I firmly consider within the distinctive worth and significant position every performs within the broader context of Web3, embodying the core ideas of autonomy, decentralization, and self-governance that outline this new digital frontier.

Within the curiosity of preserving this piece concise and never digressing, I’m scripting this evaluation assuming the readers have a good data of blockchain expertise and the intricacies of Bitcoin and Ethereum that make them distinctive. For the uninitiated, I urge you to check with some foundational sources obtainable on The Coin Bureau:

- Bitcoin 101

- Ethereum 101

- Newbie’s Information to Blockchain Expertise

What’s Bitcoin?

Bitcoin, the pioneering cryptocurrency, revolutionized the digital world when it was launched in 2009 by a person or group recognized below the pseudonym Satoshi Nakamoto. This groundbreaking digital asset operates on distributed ledger expertise on a Proof of Work blockchain. It underpins its integrity and safety by requiring miners to unravel complicated computational issues to validate transactions and create new blocks.

Famend for its shortage and decentralized nature, Bitcoin is commonly lauded because the premier retailer of worth within the digital asset realm, drawing parallels to gold. It shares key traits with treasured metals, reminiscent of restricted provide and sturdiness, however in a digital format, providing a contemporary twist on the idea of a “safe-haven” asset. Bitcoin stands out as the one digital asset that has obtained an official classification as a commodity, underscoring its distinctive standing and the widespread recognition of its worth proposition.

In current developments, Bitcoin has seen important technological enhancements that increase its performance. Implementing Segregated Witness (SegWit) and Taproot upgrades has launched a brand new stage of scriptability to Bitcoin, opening the door to sensible contract capabilities and enhancing its effectivity and privateness. The emergence of Ordinals and BRC20s illustrates the evolving panorama of Bitcoin, indicating a shift in direction of extra versatile functions. Moreover, the launch of Bitcoin Trade-Traded Funds (ETFs) within the USA and the cryptocurrency's surge to new all-time excessive value ranges underscore its rising acceptance and maturation as a mainstream monetary asset.

What’s Ethereum?

Ethereum, conceived by Vitalik Buterin and launched in 2015, marked a big evolution in blockchain expertise by introducing a platform designed to execute sensible contracts and construct decentralized functions (DApps). Initially working on a Proof of Work (PoW) consensus mechanism, Ethereum underwent a monumental transition to Proof of Stake (PoS) with "The Merge," aligning with its sustainability targets and enhancing its effectivity and scalability.

As essentially the most extensively adopted sensible contract platform, Ethereum stands on the forefront of the Decentralized Finance (DeFi) motion, offering the foundational infrastructure that powers many functions and layer-2 ecosystems. Ether, Ethereum's native cryptocurrency, serves a crucial perform past a mere retailer of worth; it's the lifeblood of the community, utilized to pay for on-chain computation within the type of fuel charges, enabling the execution of sensible contracts and transactions.

Furthermore, Ethereum underpins dynamic layer-2 ecosystems, the place numerous scaling options flourish, considerably enhancing transaction throughput whereas lowering prices. A notable current development in Ethereum's technological evolution is the introduction of proto-danksharding within the Dencun improve. This growth marks a pivotal step in Ethereum's scalability roadmap, drastically lowering layer-2 charges and additional solidifying Ethereum's place as a number one, modern blockchain platform, frequently adapting to satisfy the rising calls for of its numerous and increasing consumer base.

Bitcoin vs Ethereum: Technical Comparability

This part will cowl the technical options of the networks and distinction them with each other.

Bitcoin

Bitcoin was designed as a distributed ledger (to trace BTC transactions) and a peer-to-peer community (to change BTC with none counter-party), offering a decentralized answer for monetary transactions with out conventional banking techniques. Its underlying expertise facilitates a safe and clear ledger of transactions, selling belief amongst customers.

- Structure: Bitcoin's Proof of Work (PoW) consensus is foundational to its safety, requiring miners to compete in fixing complicated mathematical issues, requiring costly {hardware} and electrical energy. This course of secures the community and introduces new bitcoins into the system, mimicking the method of mining treasured metals.

- Block Measurement and Timing: The roughly 1 MB block dimension restrict in Bitcoin is a design alternative that balances transaction throughput with community decentralization. The ten-minute interval for block creation goals to make sure community stability and safety, although it may possibly result in variability in transaction affirmation instances.

- Provide and Inflation: The fastened provide cap of 21 million BTC is a key function that underpins Bitcoin's worth proposition as "digital gold." The halving occasions half the BTC issuance price each 4 years, simulating a type of digital shortage that influences its market worth.

- Mining: Bitcoin mining has advanced right into a extremely aggressive trade, with contributors investing in specialised {hardware} (ASICs) to enhance their possibilities of success. This competitors contributes to the community's safety, appearing as a deterrent to malicious behaviour.

Ethereum

Past a distributed ledger, Ethereum is a platform for steady general-purpose computation (executing sensible contracts), reminiscent of constructing decentralized functions. This flexibility has established Ethereum as a cornerstone of the DeFi and broader blockchain ecosystem.

- Structure: The transition to Proof of Stake (PoS) with Ethereum's Merge represented a big shift in direction of vitality effectivity and scalability. In PoS, validators' possibilities of making a block and receiving rewards are proportional to their stake (with a minimal requirement of 32 EH), changing Bitcoin's resource-intensive structure of block creation with a capital-intensive construction.

- Block Measurement and Timing: Not like Bitcoin, Ethereum's block dimension adapts based mostly on community utilization, permitting it to deal with fluctuations in demand extra dynamically. An Ethereum block is full when the validators do a threshold amount of transactions. This flexibility helps Ethereum's position as a platform for numerous functions, from easy transactions to complicated sensible contracts. For extra particulars on Ethereum block dynamics, check with the Ethereum Transactions Overview on The Coin Bureau.

- Provide and Inflation: Ethereum's variable provide mechanism is designed to adapt to the community's wants, supporting its utility whereas managing inflation. The shift to a PoS consensus has additional implications for Ethereum's provide dynamics, doubtlessly resulting in internet deflation in periods of excessive community exercise.

- Staking and Liquid Staking: The introduction of staking in Ethereum democratizes community participation, permitting a broader vary of contributors to contribute to community safety. Liquid staking enhances this by offering liquidity to staked property, enabling contributors to have interaction with the community with out locking of their sources.

Bitcoin and Ethereum within the Actual World

In the true world, Bitcoin and Ethereum have transcended their digital origins to affect numerous sectors and industries, showcasing their versatility and rising acceptance.

Bitcoin's Actual-World Use Instances:

- Funding Automobile: Bitcoin has cemented its standing as a sought-after funding asset, with devices like futures and change traded funds (ETFs) permitting traders to take a position on its value with out holding the precise cryptocurrency. These monetary merchandise have launched Bitcoin to conventional funding markets, broadening its investor base.

- Authorized Tender: El Salvador adopted Bitcoin as authorized tender in a groundbreaking transfer, demonstrating its potential to perform as an on a regular basis forex alongside conventional fiat. This adoption signifies a monumental step in Bitcoin's journey, highlighting its capability to facilitate day by day transactions and monetary inclusion.

Ethereum's Actual-World Use Instances:

- Actual-World Belongings (RWAs): Ethereum's sensible contracts allow the tokenization of real-world property, permitting them to be purchased, bought, and traded on the blockchain. This course of enhances liquidity and accessibility, bridging the hole between bodily property and digital finance.

- Blockchain-Based mostly Identification Techniques: Leveraging its decentralized nature, Ethereum supplies options for safe and verifiable identification techniques, lowering fraud and enhancing privateness.

- Decentralized Autonomous Organizations (DAOs): Ethereum helps the creation of DAOs, enabling community-led governance buildings the place choices are made collectively with out a centralized authority, fostering transparency and engagement.

Via these functions, Bitcoin and Ethereum are pioneering new monetary paradigms and offering modern options to longstanding issues throughout numerous industries.

Environmental Impression of Bitcoin and Ethereum

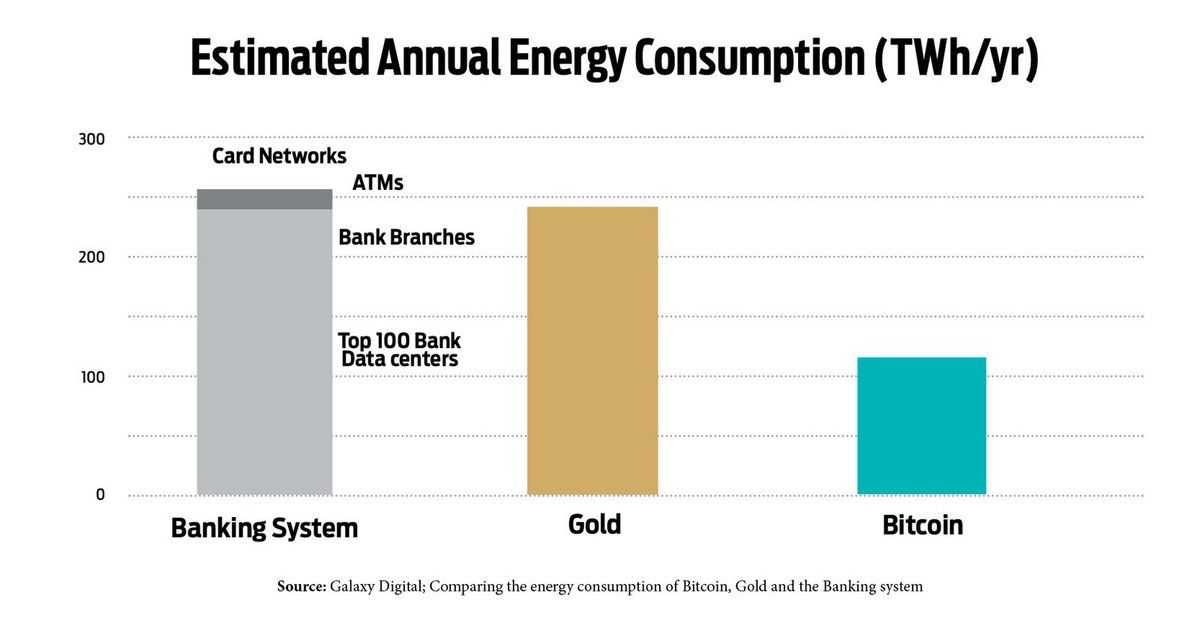

Bitcoin's environmental footprint has been a subject of appreciable debate, largely attributable to its Proof of Work (PoW) consensus mechanism, which requires substantial computational energy and, consequently, a big quantity of electrical energy.

Critics usually spotlight Bitcoin's vitality consumption as a key concern, particularly when contemplating the sustainability of digital property. Nevertheless, it's essential to contextualize this consumption by evaluating it to the vitality necessities of conventional monetary techniques, together with banking networks, interbank funds, and international remittances, the place Bitcoin's utilization seems much less important.

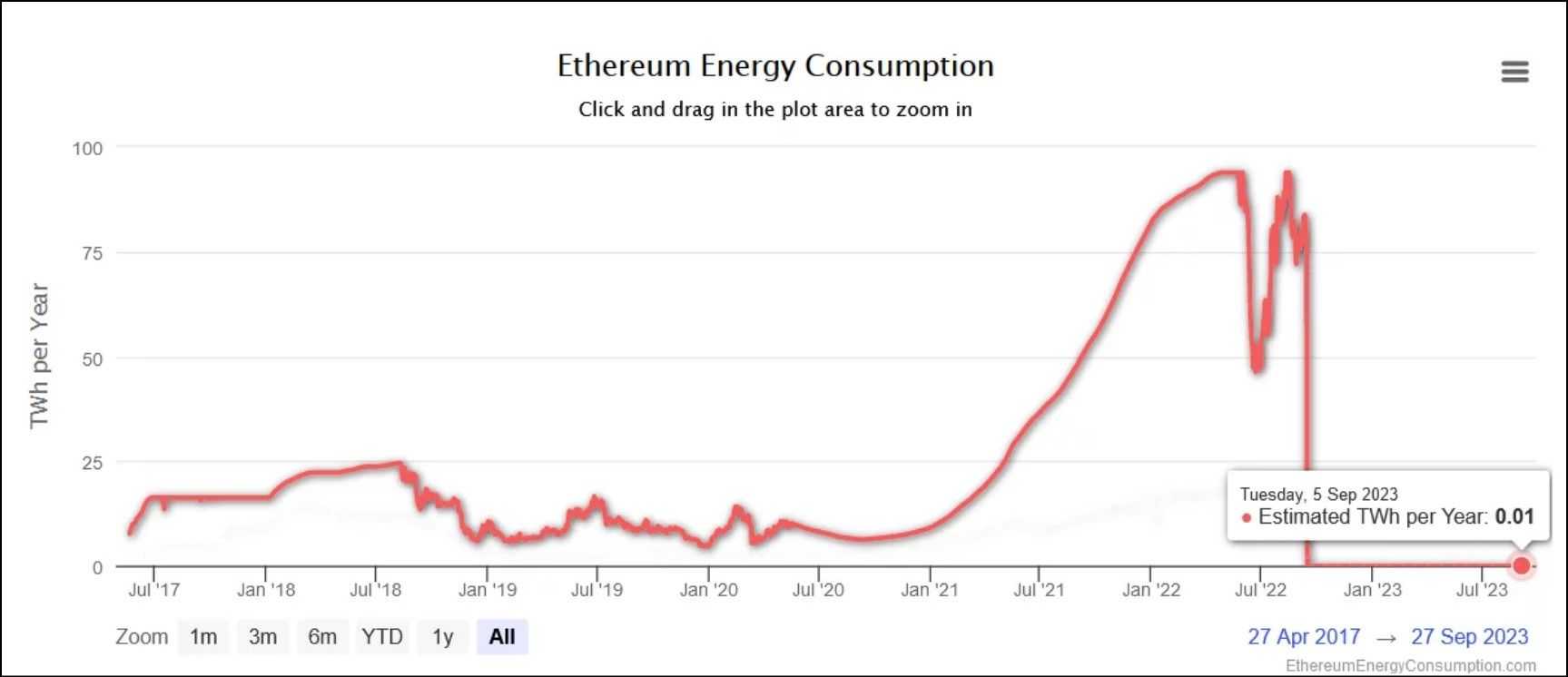

On the opposite facet, Ethereum's transition to a Proof of Stake (PoS) consensus mechanism markedly decreased its vitality consumption. By eliminating the necessity for energy-intensive mining, Ethereum's vitality utilization decreased by an estimated 99%, positioning it as a extra environmentally pleasant blockchain community. This shift not solely addressed the rising considerations across the carbon footprint of cryptocurrency operations but additionally set a precedent for different blockchain networks to think about extra sustainable consensus mechanisms.

Sensible Contracts and Decentralized Functions

Right here's how Bitcoin and Ethereum evaluate throughout sensible contracts and DApps.

Ethereum’s Sensible Contract Capabilities

On the coronary heart of Ethereum's innovation is the Ethereum Digital Machine (EVM). This highly effective execution layer capabilities akin to an working system for decentralized functions. Builders can deploy arbitrary functions written in Solidity, a programming language designed particularly for Ethereum, enabling a permissionless surroundings for innovation.

This flexibility has established Ethereum as the first hub for DeF) developments, the place most new concepts and functions are first launched and examined. The EVM's functionality to assist complicated sensible contracts and composable parts fosters a vibrant ecosystem for builders and customers alike.

Bitcoin’s Sensible Contract Capabilities

Bitcoin's preliminary design centered on its position as a peer-to-peer cost system, with restricted scope for extra functionalities. Nevertheless, introducing the Taproot improve marked a big milestone, introducing enhanced scripting capabilities. Whereas this growth has paved the way in which for a level of sensible contract performance—illustrated by initiatives like Ordinals and the potential for constructing sidechains—Bitcoin's capabilities on this area stay comparatively restricted. Its non-Turing full nature restricts it from supporting complicated logical constructs or growing composable sensible contracts, a stark distinction to the pliability supplied by Ethereum's growth surroundings.

Authorized and Regulatory Atmosphere

Bitcoin and Ethereum, as main figures within the cryptocurrency house, are on the forefront of discussions regarding regulatory readability. Their widespread adoption and important market presence have drawn elevated consideration from regulatory our bodies searching for to ascertain clear frameworks for digital property.

Bitcoin enjoys a comparatively settled place within the regulatory panorama, being the one digital asset with a definitive classification as a commodity in america. This readability largely stems from Bitcoin's easy design and its main perform as a retailer of worth, akin to digital gold, which aligns with the traits of commodities.

Ethereum's regulatory standing, nevertheless, is extra complicated and is at present a topic of debate amongst key regulatory authorities. The Securities and Trade Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) have each asserted jurisdiction over Ethereum, with differing views: the SEC treats it as a safety, whereas the CFTC considers it a commodity. This division displays the multifaceted nature of Ethereum, particularly given its utility in powering sensible contracts and decentralized functions on the EVM.

Regardless of the regulatory uncertainties surrounding Ethereum, a good portion of the cryptocurrency neighborhood advocates Ether as a commodity. They argue that Ether, like oil, is a gas for the EVM, important for executing operations and supporting the community's performance, reinforcing its commodity-like traits. This attitude aligns with the broader view of cryptocurrencies as new asset courses that necessitate nuanced regulatory approaches.

Neighborhood and Developer Ecosystem

The neighborhood and developer ecosystem surrounding Bitcoin and Ethereum are vibrant and frequently evolving, with every blockchain internet hosting a novel set of functions and improvements.

For Bitcoin, the introduction of Ordinals and the BRC-20 token commonplace represents a big shift in its ecosystem. Ordinals have launched a technique to inscribe digital knowledge straight on Bitcoin, creating a brand new class of NFTs on the Bitcoin blockchain. This innovation has spurred curiosity and exercise inside the Bitcoin neighborhood, attracting new builders and initiatives.

Moreover, the BRC-20 token commonplace, akin to Ethereum's ERC-20, permits for the creation and switch of tokens on the Bitcoin community, additional increasing its use circumstances. Furthermore, Layer 2 options and DeFi initiatives constructed on Bitcoin's community, like Stacks and Rootstock, show the rising breadth of Bitcoin's performance, extending past its unique use as a digital forex.

On the Ethereum facet, the community stays essentially the most extensively adopted platform for sensible contracts and DApps, internet hosting a mess of initiatives throughout numerous sectors. Ethereum's versatile and sturdy programming surroundings, supported by the EVM, continues to be a big draw for builders. This has fostered a various ecosystem the place improvements in finance, gaming, id verification, and extra are commonplace.

Ethereum's skill to assist complicated sensible contracts and its pivotal position within the DeFi house underscore its place as a dynamic and influential platform within the blockchain neighborhood.

These developments spotlight the dynamic and ever-evolving nature of the blockchain house, with each Bitcoin and Ethereum taking part in essential roles in shaping the way forward for decentralized expertise and functions.

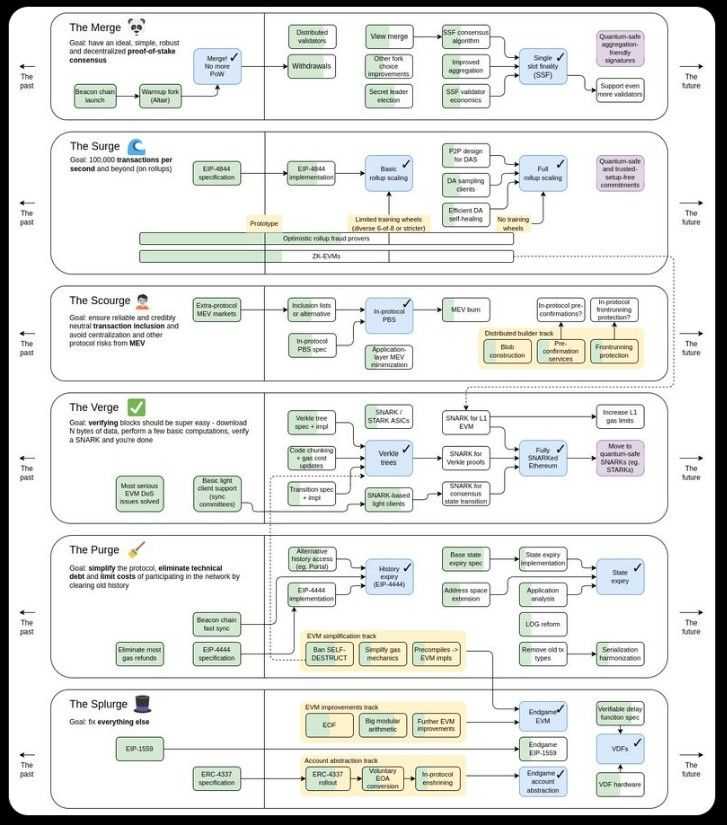

Roadmap

Right here's what the roadmap seems like for 2 main cryptos.

Bitcoin

The evolution of Bitcoin's ecosystem is deliberately gradual, reflecting its foundational design as a primary, safe, and secure community. Main updates or onerous forks are uncommon however impactful, with notable occasions together with the contentious Bitcoin Money cut up and important upgrades like SegWit and Taproot. These developments have formed Bitcoin's trajectory, enhancing its capabilities and safety. Wanting forward, a pivotal occasion on the horizon is the April 2024 halving, set to cut back Bitcoin's block reward from 6.25 to three.125 BTC, a change that traditionally influences the community's economics and miner dynamics.

Ethereum

In distinction, Ethereum's growth panorama is bustling and speedy, underscored by its transition to Proof of Stake. This monumental shift was adopted by the Dencun improve in March 2024, introducing proto-danksharding — a big step ahead in enhancing Layer 2 scalability and throughput.

The following milestone on Ethereum's roadmap is the total implementation of Danksharding, which is predicted to consolidate and amplify the advantages of proto-danksharding, additional boosting the community's capability and effectivity. This trajectory underscores Ethereum's dedication to steady enchancment and innovation, aiming to fortify its place as a number one platform for decentralized functions and finance.

The Monetary Facet: Market Cap and Funding Potential

This part delves into comparative market evaluation and funding traits for these main digital currencies. Please word the insights offered herein are for informational functions solely and shouldn’t be construed as monetary recommendation.

Comparative Market Evaluation

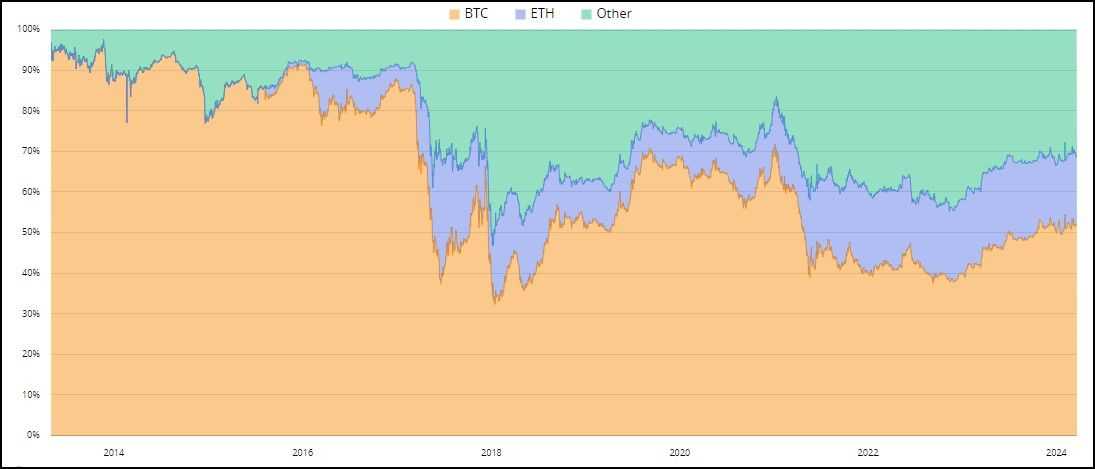

- Market Capitalization: With a mixed market capitalization nearing 70% of the worldwide cryptocurrency market, Bitcoin and Ethereum are the 2 most respected crypto property, standing at $1.27 trillion and $400 billion, respectively.

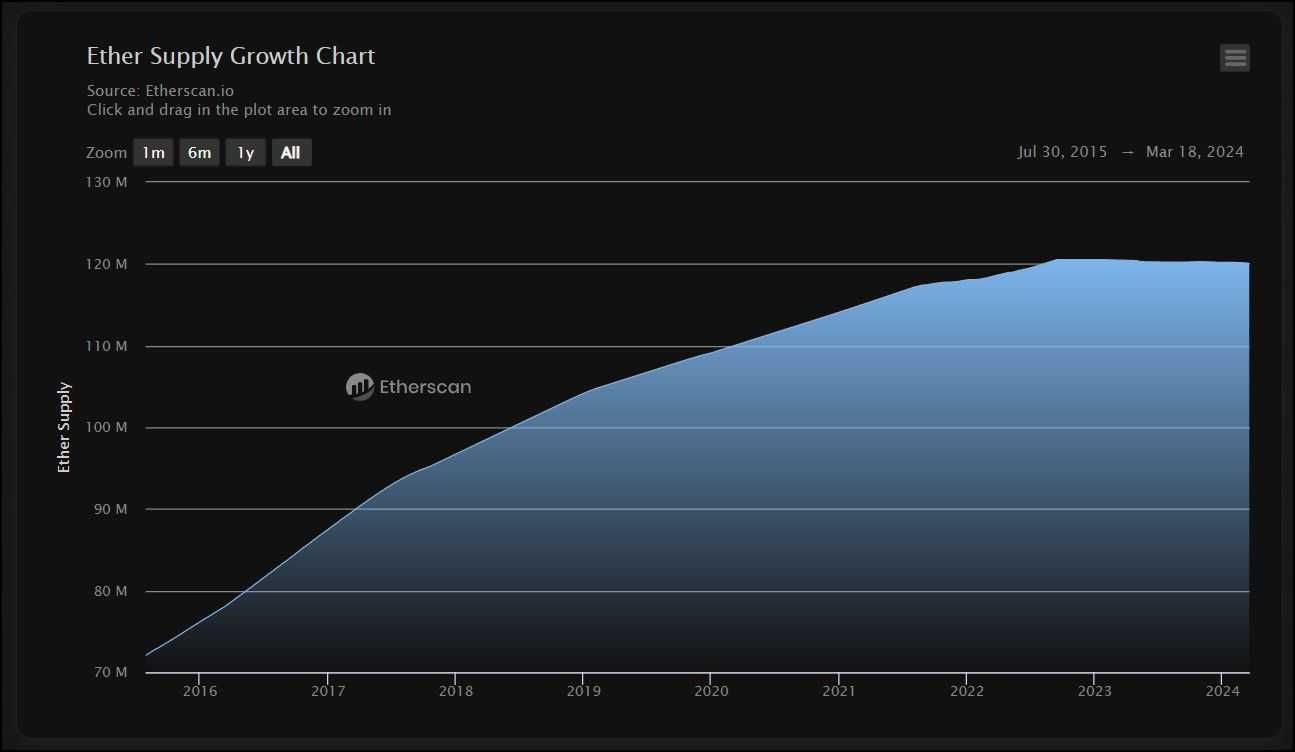

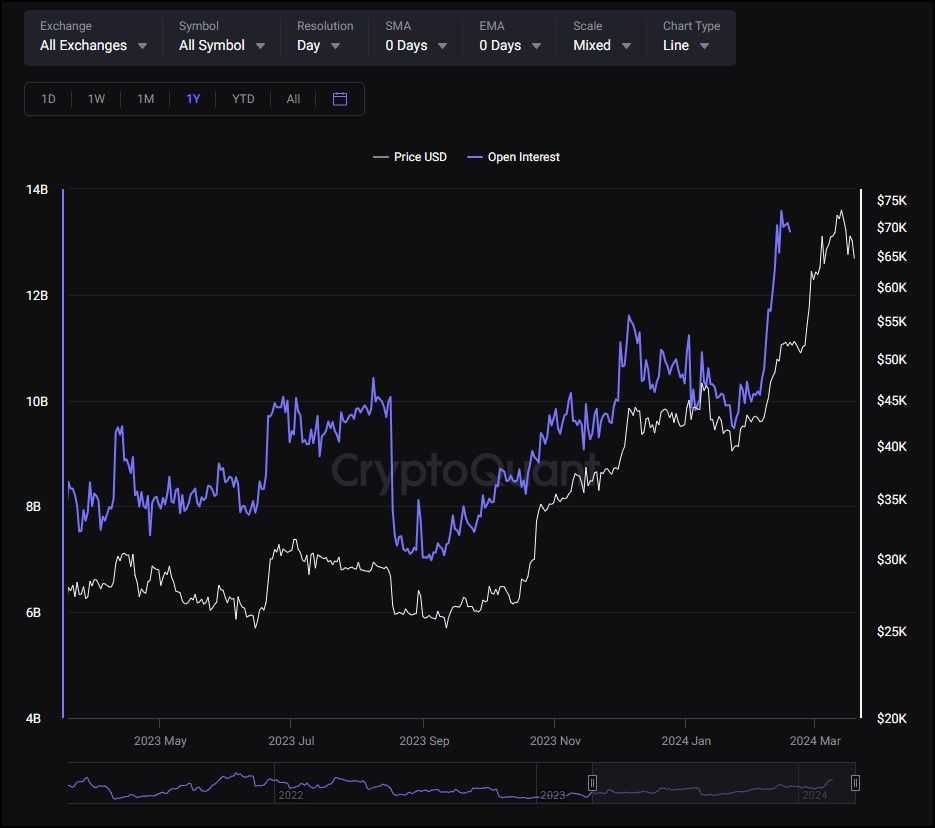

- Market Metrics: As of March 2024, liquidity for each Bitcoin and Ethereum exhibits stagnation or discount. Bitcoin ETFs are drawing important quantities of BTC out of circulation, and with the upcoming halving, BTC's liquidity is predicted to tighten additional. Conversely, Ethereum's provide dynamics have stabilized at round 120 million Ether in circulation, influenced by ongoing token burns post-merge.

- Historic Value Developments: Bitcoin's current surge previous its earlier all-time excessive to round $73,000 signifies a possible new part of value discovery, contrasting with Ethereum's wrestle to revisit its peak.

- Influencing Elements: The near-term outlook for Bitcoin and Ethereum is formed by a number of elements: the anticipated BTC halving, traits in ETF inflows, retail investor curiosity, Ethereum's Danksharding improve, ongoing ETH burns, and the regulatory panorama, notably relating to ETH ETFs within the USA.

Funding Developments

- Open Curiosity: The rise in open curiosity for BTC and ETH from January to March 2024 signifies a bullish sentiment, suggesting that the market might anticipate continued upward value actions.

- Funding Dynamics: Institutional traders have been the first drivers of the current BTC and ETH rallies, reflecting a cautious stance amongst retail traders in comparison with earlier market cycles.

- Public Sentiment: The sentiment in direction of Bitcoin and Ethereum is at present blended, with long-term holders remaining dedicated whereas new traders exhibit hesitancy. Regardless of this, the accessibility and integration of cryptocurrencies into conventional monetary merchandise are at an all-time excessive, signalling rising mainstream acceptance.

In abstract, the monetary panorama of Bitcoin and Ethereum is woven with traits in market capitalization, funding behaviours, and exterior financial elements. As these cryptocurrencies proceed to evolve and intersect with broader monetary markets, their trajectories will probably be influenced by a mixture of technological developments, regulatory choices, and shifts in investor sentiment. Understanding these dynamics is essential for anybody trying to navigate the intricate world of crypto investing.

Funding Methods for Bitcoin and Ethereum

Listed below are just a few methods you may make the most of for those who're trying to put money into Bitcoin or Ethereum.

Bitcoin ETFs and ETH Futures

Investing in Bitcoin ETFs is likely one of the most easy and accessible methods. It presents a sensible technique to acquire publicity to Bitcoin's value actions with out coping with the complexities of direct cryptocurrency possession. ETFs decrease counterparty dangers related to custodial providers. Equally, ETH futures present a passive avenue for traders to take a position on Ethereum's future value with out holding the precise asset.

Greenback-Price Averaging (DCA)

DCA is a perfect technique for semi-passive traders. It entails often shopping for a hard and fast greenback quantity of Bitcoin or Ethereum, whatever the asset's value, lowering the affect of volatility and doubtlessly decreasing the typical price over time. This method is useful for these trying to make investments with out attempting to time the market.

Shopping for On-Chain

Buying Bitcoin or Ethereum straight on the blockchain provides a layer of complexity however eliminates counterparty danger, providing full management over one's digital property. This technique requires a deeper understanding of wallets, transactions, and community charges however supplies a extra hands-on funding expertise.

DeFi Participation

Collaborating within the Ethereum DeFi ecosystem presents numerous methods like yield farming, liquid staking, and extra for these trying to take a extra energetic and risk-inclined method. Investing in DeFi entails participating with sensible contracts to earn curiosity or rewards, usually yielding larger returns than conventional funding avenues. Nevertheless, this method calls for technical data and a excessive tolerance for danger, because the DeFi house is understood for its volatility and potential for loss.

Every of those methods caters to totally different ranges of involvement and danger tolerance, permitting traders to decide on the method that finest aligns with their funding targets and experience within the cryptocurrency area.

Shopping for Bitcoin and Ethereum

Cryptocurrencies have turn out to be extra accessible than ever. The accessibility is particularly improved for Bitcoin, which is now as straightforward as shopping for shares. The Coin Bureau has an intensive assortment of shopping for guides that may information you each step of the way in which:

Refer to those articles for getting Bitcoin:

- The best way to Purchase Bitcoin within the US

- The best way to Purchase Bitcoin in Canada

- The best way to Purchase Bitcoin in Europe

- The best way to Purchase Bitcoin UK

- The best way to Purchase Bitcoin on OKX

- The best way to Purchase Bitcoin on Binance

- The best way to Purchase Bitcoin on Bitget

Refer to those articles for getting Ethereum:

- The place to Purchase Ethereum: Greatest Exchanges to Purchase ETH

- Investing in Cryptocurrency in 2024: Full Information and Ideas

- Information to Investing in Crypto ETFs and Funds

Bitcoin vs Ethereum: Closing Ideas

All through our exploration of Bitcoin and Ethereum, we've delved into numerous sides that outline and differentiate these blockchain titans, every illuminating a novel side of the crypto panorama.

In our technical comparability, we noticed the foundational variations between Bitcoin and Ethereum, from their consensus mechanisms to dam dimension and sensible contract capabilities. Bitcoin stays the epitome of a digital retailer of worth, whereas Ethereum has carved out its area of interest as a platform for decentralized functions and sensible contracts, demonstrating the various potential inside blockchain expertise.

Our journey by way of BTC and ETH in the true world highlighted their rising adoption and integration into on a regular basis transactions and monetary techniques, showcasing their sensible worth past speculative property. The environmental affect dialogue underscored Bitcoin's energy-intensive nature contrasted with Ethereum's important strides in direction of sustainability post-merge, reminding us of the ecological concerns in blockchain expertise.

The exploration of sensible contracts and decentralized functions additional differentiated Ethereum's versatile ecosystem from Bitcoin's centered design, highlighting the modern functions and the colourful communities they assist. The authorized and regulatory surroundings part revealed each property' complicated panorama, emphasizing the significance of readability and compliance of their broader acceptance.

Our examination of the neighborhood and developer ecosystem showcased each networks' sturdy and dynamic nature, with passionate contributors driving innovation and development. The roadmap evaluation supplied a glimpse into the longer term, outlining each blockchains' strategic instructions and anticipated developments.

We dissected market traits and funding potential within the monetary side section, offering a nuanced understanding of their financial standings. Lastly, our dive into funding methods showcased the spectrum of approaches obtainable to traders, from passive to actively engaged, reflecting the various alternatives inside the crypto area.

As we encapsulate these insights, it's clear that Bitcoin and Ethereum usually are not simply rivals however are complementary forces shaping the blockchain area. Their evolution, challenges, and triumphs illuminate the broader narrative of cryptocurrency: a testomony to human ingenuity and a touch on the transformative potential of decentralized expertise. As traders, builders, or just curious observers, our understanding of those pioneering platforms enriches our grasp of the digital future unfolding earlier than us.

Ceaselessly Requested Questions

What are the Key Variations Between Bitcoin and Ethereum?

Bitcoin primarily serves as a digital forex and retailer of worth, using a Proof of Work (PoW) consensus mechanism. Ethereum, alternatively, is designed to facilitate sensible contracts and decentralized functions (DApps) by way of its Proof of Stake (PoS) consensus mechanism. Whereas Bitcoin is concentrated on monetary transactions, Ethereum supplies a platform for builders to construct a variety of functions.

How do Bitcoin and Ethereum Impression the Atmosphere?

Bitcoin’s PoW consensus is energy-intensive. Ethereum has transitioned to a PoS mechanism with the Merge, drastically lowering its vitality consumption by about 99%. This makes Ethereum’s community much more energy-efficient in comparison with Bitcoin’s PoW mannequin.

Can Bitcoin and Ethereum Coexist within the Lengthy Time period?

Sure, Bitcoin and Ethereum can coexist as they serve totally different functions. Bitcoin is seen as a retailer of worth or “digital gold,” whereas Ethereum is a platform for constructing decentralized functions and executing sensible contracts. Their distinct worth propositions permit them to cater to totally different segments of the blockchain and cryptocurrency markets.

What are the Newest Upgrades for Bitcoin and Ethereum?

Bitcoin’s current upgrades embrace SegWit and Taproot, enhancing its scalability and privateness. Ethereum has undergone the Merge, transitioning to PoS, and launched proto-danksharding with the Dencun improve, which is a step in direction of enhancing scalability and lowering transaction prices.

How do Funding Methods Differ for Bitcoin and Ethereum?

Funding methods for Bitcoin usually concentrate on its worth as a digital retailer of wealth, with strategies like shopping for and holding or investing by way of Bitcoin ETFs. Ethereum’s funding methods would possibly embrace taking part within the DeFi ecosystem, leveraging its sensible contract capabilities, or investing in ETH futures. Each property provide alternatives for dollar-cost averaging and on-chain purchases, catering to a variety of funding preferences and danger tolerances.