If you've even briefly followed the NFT ecosystem in recent years, you're likely familiar with the Blur NFT Marketplace. Blur is known for its airdrops, incentive programs and catering to NFT professionals.

The mastermind behind Blur is the enigmatic and anonymous figure known as Pacman. In November 2023, Pacman took a bold step forward by unveiling a new project, Blast, a Layer 2 chain on Ethereum which aims to tackle the high transaction costs and scalability issues that have plagued the NFT space. This endeavor attracted $20 million in funding from prominent venture capital firms like Paradigm, underscoring the market's confidence in Pacman's vision.

The Blast Chain is more than a scaling solution. It offers a native yield for Ethereum (ETH) as well as stablecoins in the network. Blast offers enhanced value propositions as the NFT ecosystem develops. This is for both NFT traders and blockchain users.

This Blast Review will examine the features and benefits of Blast as well as its potential impact on the Layer 2 landscape.

What is Blast Network?

Blast, an Ethereum compatible Layer 2 network, uses optimistic rollup to increase scalability and reduce transaction costs. Optimistic Rollups are based on the assumption that all transactions will be valid unless challenged in a dispute period. "optimistic." This allows for faster and cheaper transactions than those processed directly on the Ethereum mainnet.

Blast distinguishes itself from other Layer 2 networks by offering native yield on assets bridged to its network, including Ethereum (ETH) and real-world assets (RWA) like yield-bearing stablecoins. Blast offers yield to users that simply hold their assets on the Blast Network. This is different from other networks, where users are required to deposit their assets in specific yield-generating protocol. This yield is sourced by ETH staking protocol and RWA loaning protocols.

Blast’s auto-rebasing system is a key feature of its network. Rebasing, in simple terms, is the automatic adjustment of token supply so that its value remains relative to a set target, like a price or yield. Blast’s yield on assets such as ETH and stablecoins are auto-rebasing. This means that the value is adjusted periodically to reflect the accrued return. The users can watch their holdings rise without any need to manually act, which makes the earning and compounding of yield seamless and efficient.

Users can participate by bridging assets like ETH, WETH or stETH as well as stablecoins such DAI, USDT, and USDC, to the Blast Network through the Blast Bridge Contract. Once bridged, these assets start accruing yield, which is credited directly to the users' accounts. This feature is noteworthy, as it simplifies the earning of yield on Layer 2, making it more available to a larger range users.

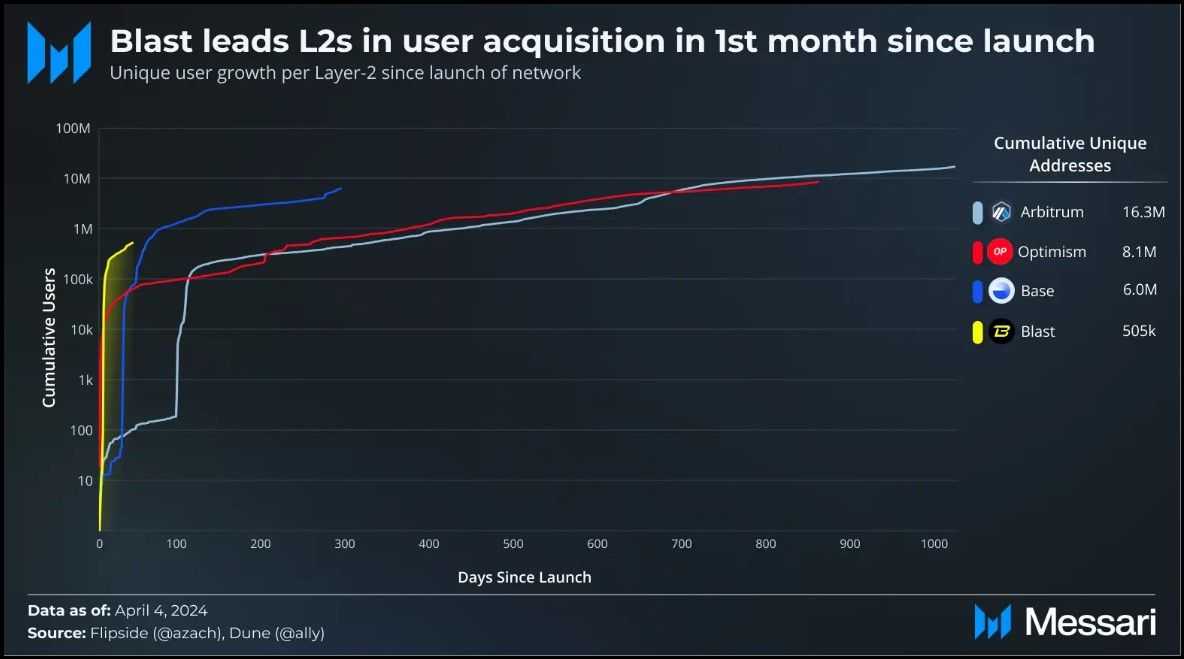

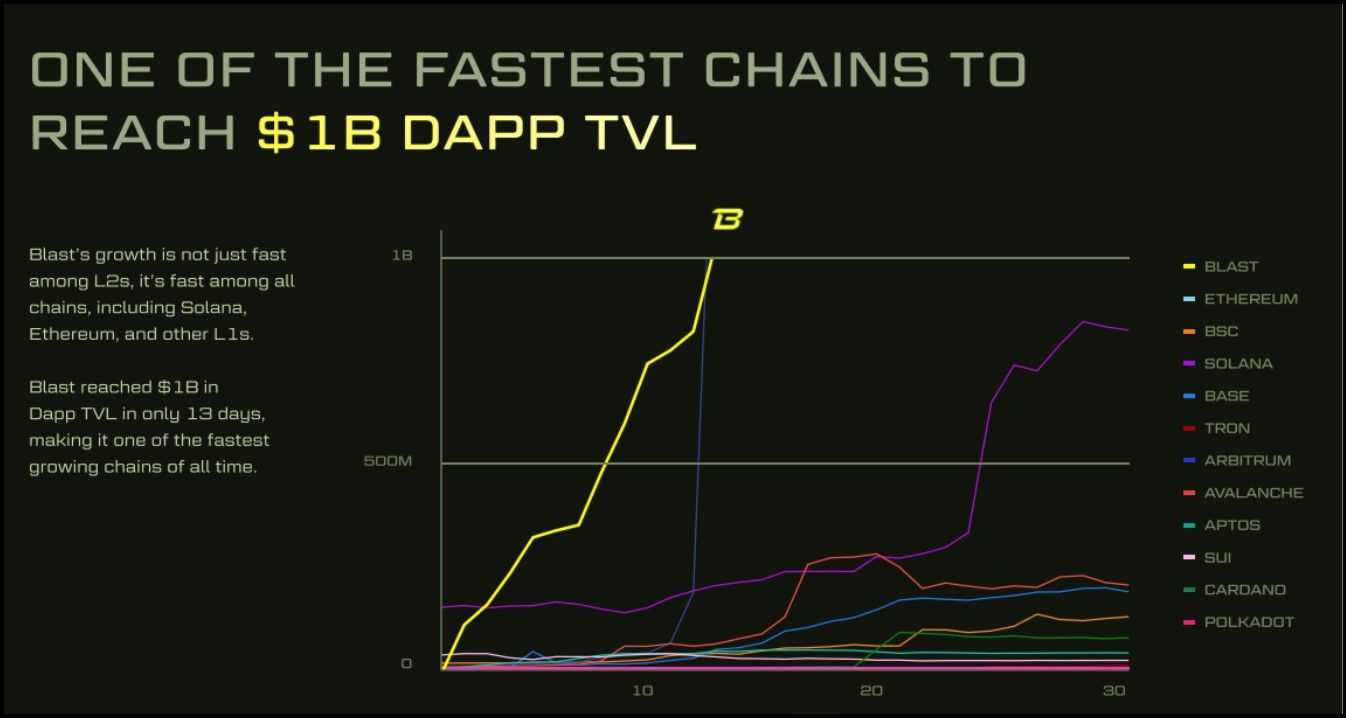

Blast has quickly gained traction within the Ethereum Layer 2, securing its position as one of fastest-growing TVL (total value-locked network). CoinGecko ranks it 12th out of the largest Layer 2, reflecting its importance and adoption in the DeFi and NFT community.

BLAST Tokenomics

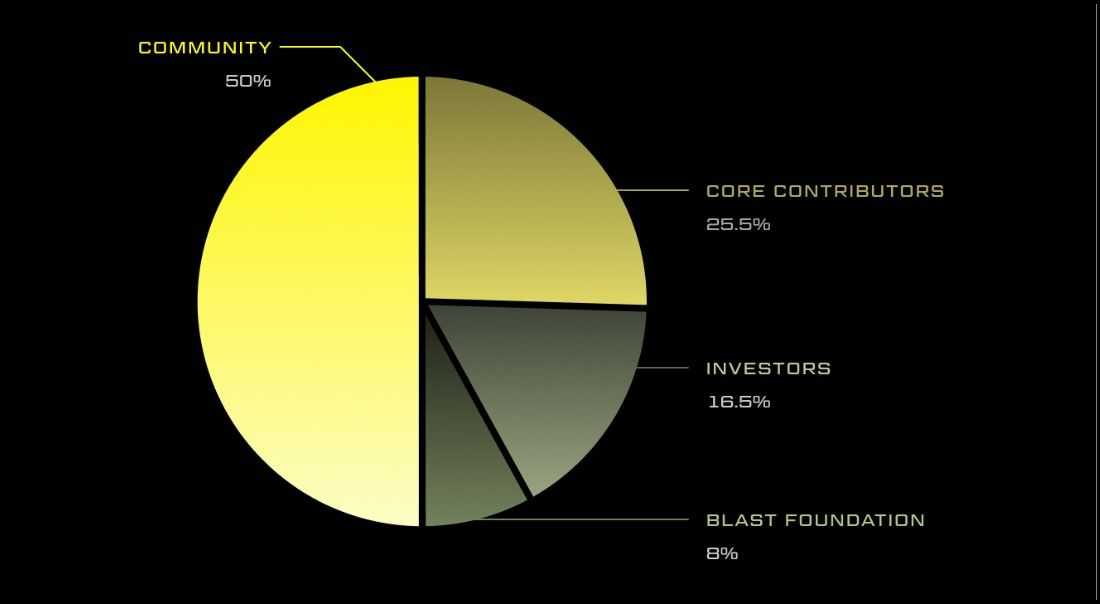

The BLAST is an ERC-20 token that plays a crucial role in Blast Layer 2. With a total supply of 100 billion tokens, BLAST is designed to foster a robust and engaged community while supporting the network's ongoing development. The tokenomics for BLAST place an emphasis on community participation, with 50 percent of the supply being allocated to community-based initiatives. This allocation will be distributed through various incentive campaigns over three years, ensuring that the community continues to play a pivotal role in the ecosystem's growth.

The BLAST Token is based on the idea of creating a network that rewards and recognizes contributions made by both users and developers. Blast wants to create a community where users are more than just participants. The remaining token allocations are:

- 25% for core contributors

- Investors receive 16.5%

- 8% is reserved for Blast.

These allocations will be subject to lock-up and vesting periods designed to ensure stability and long-term commitment in the network.

Where can I buy BLAST?

You can purchase BLAST from, among others:

- Coinbase

- Bybit

- KuCoin

- Bitget

Also, be sure to check out our picks for best crypto exchanges.

USDB: Blast's Auto-Rebasing Stablecoin

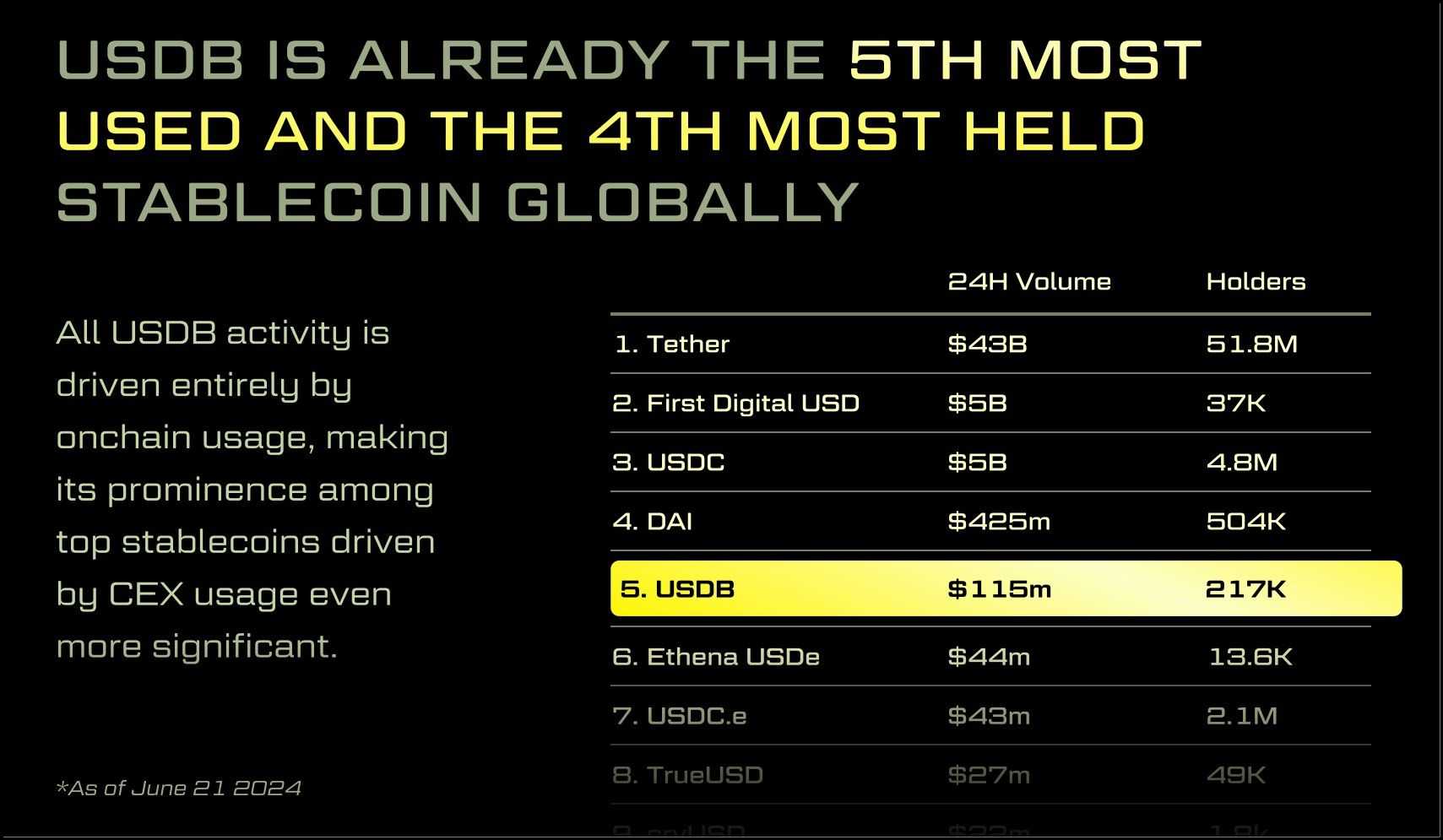

USDB is a native stablecoin for the Blast layer 2 network. It was designed to offer users an asset that earns returns while maintaining stability. USDB has a unique auto-rebasing system that automatically adjusts its value over time to reflect the yield.

Yield Generation USDB earns yield by integrating MakerDAO's on-chain T-Bill protocol. This integration allows USDB owners to passively accrue returns. It’s a good option for anyone looking to earn yield on stablecoins without the need to manage them.

Bridge and Availability USDB can be acquired by bridging stablecoins such as DAI or USDC from the Ethereum network to the Blast. On the Blast Testnet, users are able to bridge mock USDs from Sepolia into USDB. They can then test the stablecoin and interact in a safe environment.

Rebasing Mechanism USDB automatically rebases, which means its supply is adjusted regularly to reflect yield. The rebasing is applicable to externally-owned accounts (EOAs), as well as smart contracts. However, smart contracts have the option of opting out if a fixed value is needed. Blast’s nrUSDB is a non-rebasing option that wraps USDB with its current value. Later, the value can be redeemed by unwrapping it.

Yield Modes USDB has three different yield options to suit the various needs of its users:

- AUTOMATIC: The standard mode is where the yield value is automatically rebased to the token’s current value.

- VOID: This mode prevents rebasing by voiding the yield.

- CLAIMABLE: The user can manually claim the yield in this mode.

Contract Interactions & Redemption Developers are able to interact with USDB via the IERC20Rebasing Interface, which offers functions for configuring and claiming yield. USDB can also be exchanged for DAI if you bridge back to Ethereum. This gives users the flexibility they need when managing their stablecoins both within and outside of Blast.

Blast's Incentive Driven Ecosystem

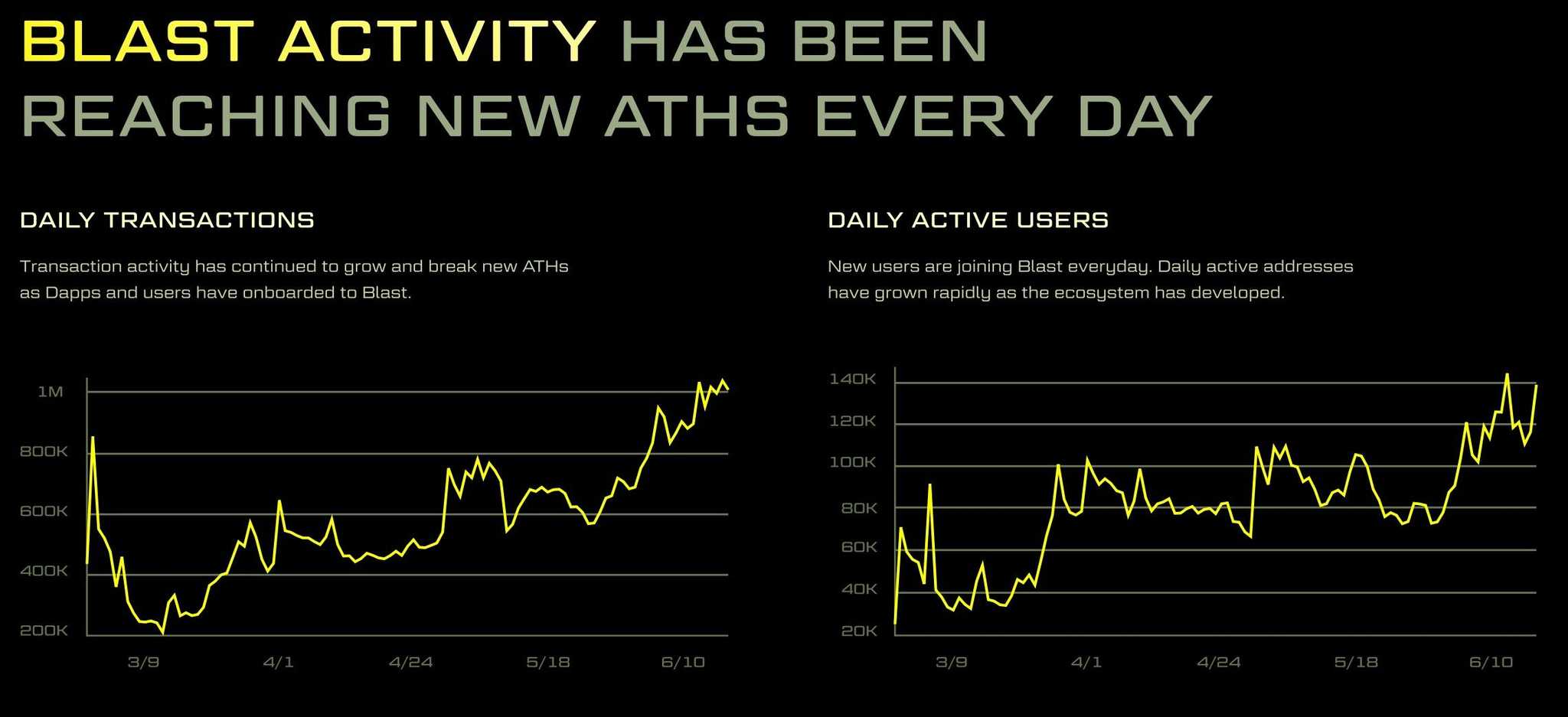

Blast Network has developed an elaborate incentive-driven eco system to accelerate its growth. It also aims to establish itself as one of the top Layer 2 solutions in Web3. This strategy has been highly effective, as evidenced by the network's rapid expansion since its launch in November 2023.

Blast, with its $3 billion of bridged total locked value (TVL), 1,5 million users, over 200 decentralized apps (DApps), and 1.5 million active users, is currently ranked 9th in the world by TVL according to DefiLlama. The network only launched in November of 2023. Blast's native stablecoin, USDB has a market cap of about $411M and about 217k holders within its ecosystem.

Blast Incentive Strategy

The Blast Team has developed a comprehensive and multi-dimensional incentives program to attract users into the Blast Ecosystem and to encourage current users to add liquidity to Layer 2 of its network.

Incentive Programs

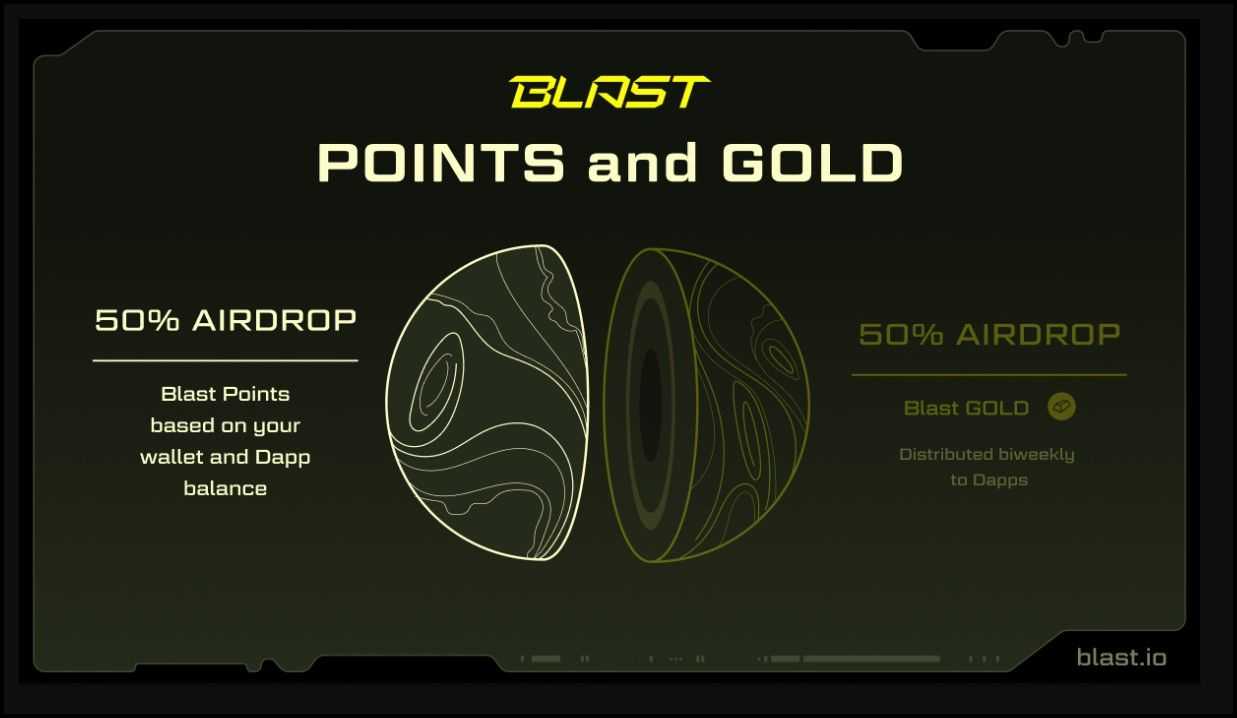

Blast Points Blast Points form a key part of the incentive program, which encourages users to inject more liquidity into the blockchain. Users receive Blast Points for holding ETH (or WETH) or USDB (or both) in their wallets. The points are accumulated at each block. This system rewards users for maintaining and increasing their liquidity within the Blast Network, increasing the TVL as well as overall activity in the ecosystem.

Blast gold: Blast gold is an additional incentive, aimed at DApps that are built on the Blast platform. Blast encourages a dynamic and active ecosystem by rewarding users for engaging with DApps. This dual-incentive scheme ensures that both Dapp engagement and liquidity provision are appropriately rewarded. It promotes a balanced growth on the network.

Application-Specific Incentives: Apart from the Blast Points or Blast Gold incentives, each application within the Blast ecosystem offers its own unique incentive mechanism. Examples include Thruster Finance, Crypto Valley and Crypto Valley. DApps are able to customize their rewards in order to retain and attract users. This further enhances the Blast ecosystem’s overall appeal.

Referral Program Blast offers a referral program that rewards users for inviting other people to join the network. Direct invites earn an extra 16% in bonus points. Further invites will yield an additional bonus of 8%. This referral system creates a viral growth effect, encouraging users to actively expand the network's user base.

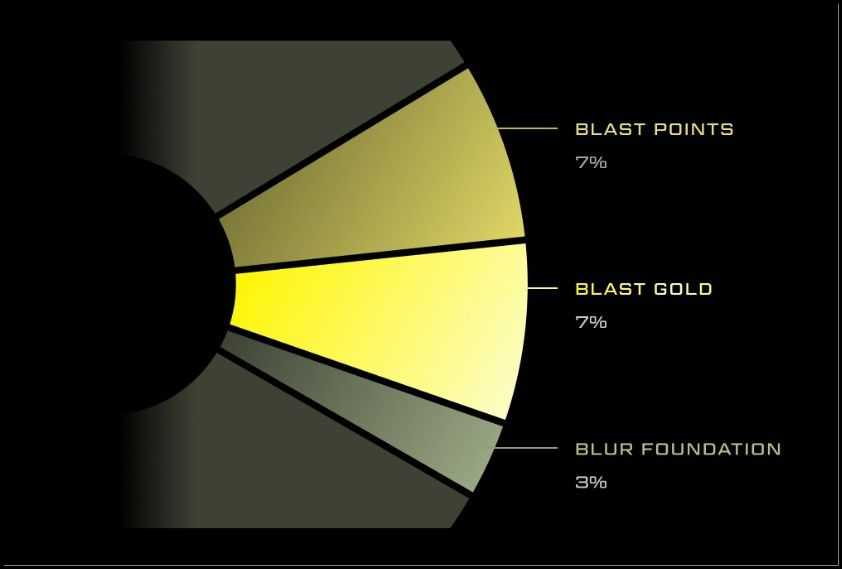

Phase 1 Airdrop Distribution

This airdrop phase saw 17% of total token supply distributed, which amounted to 17 billion tokens. This distribution divided rewards strategically between early adopters, and contributors to ecosystem:

- Blast Points earned by users who bridged assets such as ETH and uSDB with the Blast network received 7% of total supply.

- Blast Gold is awarded to users who contribute to the success DApps in the network. They also get an additional 7% supply.

- 3% of the total supply was allocated to the Blur Foundation, which supports the NFT marketplace and will be used for retroactive and future airdrops.

These distribution mechanisms incentivize early participation and align the community's interests with the Blast ecosystem's long-term success, ensuring that those who contribute to the network's growth are duly rewarded.

Phase 2 Incentive program

The Phase 2 reward program continues the incentive strategy, allocating 10 billion BLAST to tokens over a period of 12 months in order to continue building the eco-system. Blast Gold is distributed equally between Blast Points, which are used to reward Dapps for providing liquidity. Users can enhance their Points earnings by increasing their wallet balances, which are automatically adjusted to reflect the native yield rates—around 4% for ETH/WETH and 5% for USDB. Furthermore, BLAST tokens earn points at twice the rate of ETH/WETH/USDB, providing an additional incentive for holding the network's native token.

This comprehensive and multi-dimensional incentive strategy has successfully rapidly scaled the Blast ecosystem, attracting significant liquidity and users.

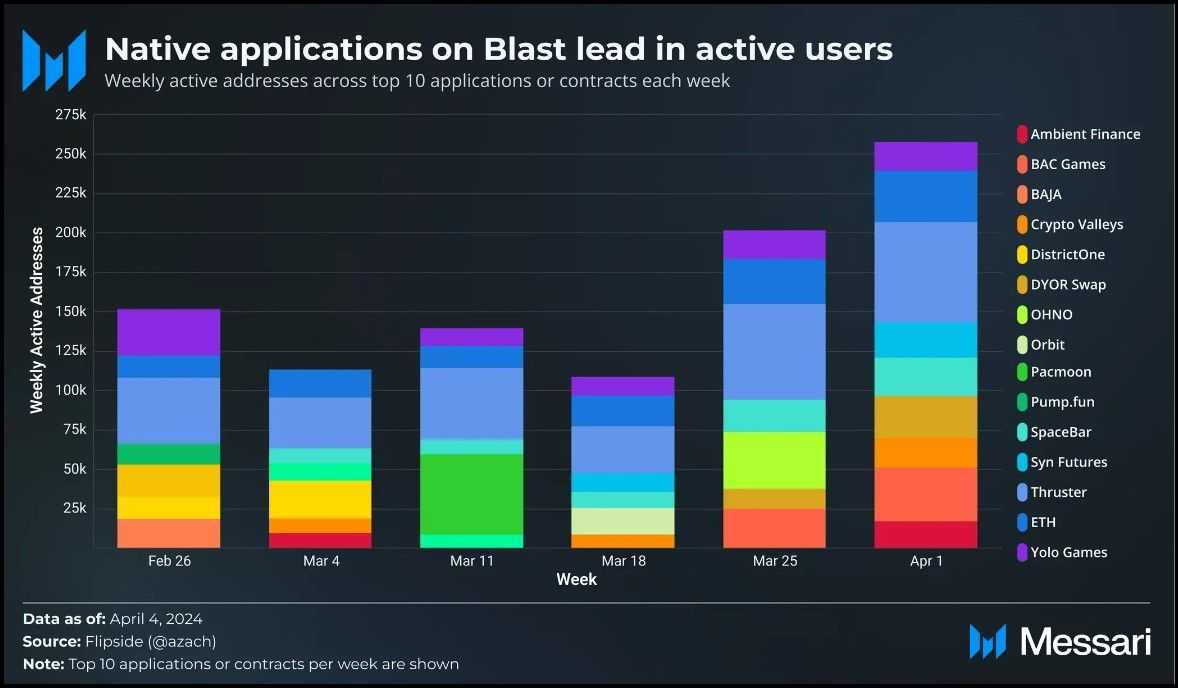

Blast DApp Ecosystem

The DApp landscape is changing rapidly on the Blast network, largely because of its incentive-driven ecosystem. This environment attracted a huge user base but also led to users being conservative and focusing on rewards instead of exploring new applications. There are over 200 DApps that are currently live on Blast. However, only a handful have had a significant impact. It presents a unique opportunity for innovative consumer applications to capture users' attention, especially as Blast transitions toward a more permissionless network structure.

The Blast network, despite the conservative nature of its users, hosts several unique applications that have a solid growth potential.

Fantasy Top

Fantasy Top is a unique twist on the SocialFi platform, combining fantasy sports elements with the Twitter speculative dynamics. Users can collect and exchange cards that represent influencers. Their real-world performance will directly impact game outcomes. Fantasy Top’s integration of rare card, a trading platform, and weekly contests adds layers to engagement. It is therefore a good candidate for long-term growth within the Blast eco-system.

Baseline Protocol

Baseline Protocol is revolutionizing liquidity management in the Blast network with its algorithmic mechanisms for market-making. Baseline’s automated liquidity placement and rebalancing is done through smart contracts, which ensure price stability and token value growth. This approach draws inspiration from the Protocol Owned Liquidity (POL) concept and positions Baseline as a critical tool for maintaining the health of the Blast ecosystem's financial products, making it a standout application for developers and users alike.

Crypto Valleys

Crypto Valleys brings back the nostalgic feel of DeFi Kingdoms with pixel art and strategic gameplay. The game's utility token, YIELD, powers the in-game economy, allowing players to purchase seeds, items, and upgrades. The game is centered around farming and adventure, where players manage NFTs and cultivate crops to advance through the game. Crypto Valleys’ engaging mechanics and initial traction could make it a mainstay in the Blast gaming community.

Blast Ecosystem Critique

The Blast network's incentive-driven ecosystem has garnered significant attention, but it also faces scrutiny regarding the long-term sustainability of its incentive model. Blast, which has over 1.5 million active users and $3 billion worth of bridged TVL, has experienced rapid growth. Critics, however, are worried that the aggressive incentives programs may lead to inflated, short-term activity, rather than organic, sustainable growth. There's a worry that as the rewards diminish in value over time, user retention could suffer, especially if the incentives that initially attracted users are reduced or phased out.

Security concerns have also been raised by the use of a multi-signature wallet with 3/5 signatures to control funds. The critics claim that the setup makes it vulnerable to collusion or security breaches. These concerns are further intensified by the centralization in this system. Several signers have been reported to be connected with the same entity.

Additionally, some have compared Blast's incentive structure to a pyramid scheme, particularly due to the heavy reliance on referral and reward mechanisms to drive user recruitment. This remark has led to skepticism, especially given the lack of transparency around the network's future roadmap. Blast’s ecosystem is in trouble after its June airdrop. By August 2024, 62% of its ATH value has been lost.

Blast has implemented a sustainable plan to reduce rewards over time, despite these concerns. This will maintain economic stability. However, critics remain cautious, suggesting that unless Blast can transition from a rewards-driven model to one that fosters genuine user engagement and innovation, the network's long-term viability may be at risk. Blast will face a major challenge in balancing growth with sustainability within the highly competitive Layer 2-ecosystem.

Blast Network Review – Closing Thoughts

Blast Layer 2 is a network that has rapidly established itself as one of the most formidable players in Web3. This has been achieved by a carefully crafted incentive program, which has brought significant liquidity to the network and increased user participation. Its innovative approaches such as native yield and dynamic incentive programmes set it apart.

But the sustainability of these rewards is still a concern. Many critics are questioning if the network can continue to grow so rapidly without being heavily dependent on rewards. Blast’s success will be determined by its ability to foster organic growth, innovation and growth within its ecosystem. The network's future will depend on its ability to balance immediate user acquisition with long-term viability, making it a fascinating project to watch in the coming years.

Common Questions

What is Blast network?

Blast Network, an Ethereum compatible Layer 2 chain, aims to increase scalability and reduce transaction costs by using optimistic rollup technologies. It offers unique features, such as native yields on assets such as ETH and stablecoins.

What is the difference between Blast Network and other Layer 2 solutions like Layer 3?

Blast is different from other Layer 2 Solutions in that it offers native yields for assets connected to its network. Users can therefore earn returns on their assets without the need to use specific yielding protocols.

What is a BLAST Token?

BLAST, the native ERC-20 Token of the Blast network. It is a key component of the ecosystem. It supports community incentives, network growth, and development.

What is USDB currency?

USDB, Blast Network’s native stablecoin is rebasing automatically. It gains yield through integration with protocols such as MakerDAO’s T-Bill on-chain protocol. This makes it a yield bearing asset that maintains its stability.

Where can I get BLAST tokens from?

The BLAST Token can be bought on Coinbase (Bybit), KuCoin (Bitget), and Bybit.

What are some of the main criticisms made against the Blast network?

The Blast network ecosystem’s incentives-driven critics question its sustainability in the long term, arguing the aggressive incentives could lead to an inflated short-term growth rather than organic development. Some have expressed concern about the devaluation in rewards that could occur as more users sign up, which may impact retention. Additionally, the use of a 3/5 multi-signature wallet for fund control has sparked security concerns, with some viewing the incentive structure as overly reliant on referral mechanisms, akin to a pyramid scheme.

What is Blast Incentive?

Blast offers incentives to developers and Dapps. These include Blast Gold and Blast Points, which are awarded based on the liquidity contribution and participation of users and Dapps. The structure of the ecosystem encourages innovation, allowing dApps their own incentives in addition to the foundational rewards. Blast Phase 2 allocates 10 billion BLAST to tokens in 12 months for the further development of the network. These tokens are split evenly between Blast points and Blast gold. This approach helps attract and retain both developers and users within the ecosystem.