The world of cryptocurrency can really feel like a maze, particularly with over 1,600 exchanges out there immediately, in line with Blockspot.io. For newcomers, the choices may be overwhelming.

Every alternate affords its personal mix of options, buying and selling pairs, and payment constructions, so it’s vital you’re taking the time to guage your decisions earlier than diving in. Key elements like safety, consumer expertise, liquidity, and the number of belongings on supply are essential for making a secure and environment friendly buying and selling atmosphere.

With safety breaches and regulatory hurdles popping up incessantly, assessing an alternate's reliability is paramount. It's not nearly security, both — having a various vary of buying and selling choices, a user-friendly interface, and responsive buyer help can vastly improve your buying and selling expertise.

Bybit is one alternate that checks all of those bins. Nevertheless, can Bybit actually be trusted?

On this overview, we will provide you with the whole lot you’ll want to know concerning the alternate.

Assessment Abstract:

Bybit is a well-liked cryptocurrency alternate identified for its high-leverage buying and selling choices, providing as much as 100x on derivatives and a user-friendly platform with superior options like copy buying and selling, buying and selling bots, and Bybit Earn. It boasts robust safety measures, together with chilly storage and multi-signature wallets, making certain a safe buying and selling atmosphere.

Bybit Key Options:

- Nice Collection of Tradeable Belongings- Bybit affords a variety of buying and selling devices together with derivatives, spot, and instantaneous purchase crypto options.

- Skilled Grade Buying and selling & Matching Engine- Bybit is understood for its ultra-fast matching engine and instantaneous commerce execution.

- Multilingual Help– Bybit affords good buyer help, out there in a number of languages.

- Leverage buying and selling out there

- NFT Market

- Fiat Withdrawals

- Crypto Loans

- Bybit Copy Buying and selling

- Bybit crypto debit card

Notice: Customers positioned within the US and UK aren’t supported.

👉Signal as much as Bybit Change!

The Bybit 2025 Hack

In February 2025, Bybit fell sufferer to a staggering $1.5 billion hack that was tied to North Korean hackers. Right here's how the exploit unfolded, in line with Chainalysis.

- Hackers focused chilly pockets signers with phishing assaults, tricking them into approving malicious transactions. This allowed attackers to exchange Bybit’s multi-signature pockets contract with a compromised model.

- Posing as a routine switch, the attackers rerouted roughly 401,000 ETH to their very own wallets.

- The stolen funds have been funneled by means of a number of wallets, making monitoring tough. The hackers then transformed giant parts of ETH into BTC and DAI, utilizing decentralized exchanges (DEXs), cross-chain bridges, and no-KYC swap providers to obscure their path.

- A good portion of the stolen belongings stays untouched, a trademark tactic of North Korea-linked cybercriminals. By ready out preliminary scrutiny, they goal to maneuver funds undetected over time.

Inside 72 hours after the hack, the alternate replenished its reserves.

Bybit Overview

| HEADQUARTERS: | Dubai |

| YEAR ESTABLISHED: | 2018 |

| REGULATION: | Granted an in principal license as a Digital Asset Service Supplier in Dubai. Regulated by the authorities in Cyprus |

| SPOT CRYPTOCURRENCIES LISTED: | 500+ |

| NATIVE TOKEN: | The Bybit alternate doesn’t have a local token. Nevertheless, it has launched the BIT token for BitDAO. |

| MAKER/TAKER FEES: | Spot Buying and selling – From 0.1% maker/0.1% taker Perpetual and Futures Contract- 0.02% maker/ 0.055% taker charges Choices- 0.03% Maker/ 0.03% Taker Customers with VIP standing unlock payment reductions |

| SECURITY: | 2FA, Chilly Storage of Belongings, Multi-Sig wallets, Insurance coverage Fund |

| BEGINNER-FRIENDLY: | Sure |

| KYC/AML VERIFICATION: | Required |

| FIAT CURRENCY SUPPORT: | 60+ Fiat currencies supported by way of P2P alternate Deposit 65+ fiat Currencies, and withdraw 16, together with USD, EUR, GBP, and extra. |

| DEPOSIT/WITHDRAW METHODS: | Financial institution switch, credit score/debit card, crypto switch, third-party fiat on and off-ramps |

Bybit is a cryptocurrency alternate specializing in derivatives and futures buying and selling, with a spot buying and selling market.

Initially primarily based in Singapore, it moved its headquarters to Dubai in 2022 and operates below Bybit Fintech Restricted, which is registered within the British Virgin Islands. The platform is understood for providing high-leverage buying and selling choices, as much as 100x on perpetual contracts, which has attracted each retail and institutional merchants.

Bybit has rapidly risen to grow to be one of many prime cryptocurrency exchanges, rating second in derivatives buying and selling behind Binance in line with CoinGecko. The alternate's foremost merchandise embrace perpetual futures, but it surely additionally helps spot buying and selling with leverage as much as 10x.

Notice: Whereas the leverage characteristic on Bybit is common, the usage of excessive leverage is extremely dangerous and is beneficial for knowledgeable merchants solely. Remember to perceive the dangers of leverage earlier than using it.

To make sure safety, Bybit makes use of chilly storage options, multi-signature addresses, SSL encryption, and extra consumer safety measures equivalent to two-factor authentication (2FA) and anti-phishing codes. It has a high-security ranking from exterior audits.

Bybit additionally affords a number of distinctive options, together with an insurance coverage fund to guard merchants from shortfalls in liquidation occasions, superior order varieties, a sturdy matching engine, and customizable buying and selling interfaces. Along with buying and selling, Bybit gives merchandise like Bybit Earn, copy buying and selling, choices buying and selling, and an NFT market. It helps fiat deposits and withdrawals for numerous currencies and affords a cellular app for buying and selling on the go.

Bybit has grow to be a preferred alternate globally however is restricted in sure jurisdictions, equivalent to america, Syria, and Quebec.

If you’re desirous about Man's take, be at liberty to take a look at the information he put collectively beneath:

Getting Began with Bybit

Getting began with Bybit is a breeze. You’ve got two choices for signing up:

- Via your e-mail tackle

- Through your cell phone quantity

To kick issues off, simply head over to the Bybit homepage and click on the “Sign Up” button within the top-right nook. You’ll see prompts for each sign-up strategies — choose the one which fits you greatest. In case you have a referral code, go forward and enter it; if not, no worries — you may skip that step.

Right here’s the place it will get slightly totally different: in the event you determine to enroll along with your e-mail, you’ll obtain a reCAPTCHA verification code in your inbox. Simply verify your e-mail, seize that code, and enter it on the Bybit website. In case you go the cellular route, the verification code will come as a textual content message as an alternative. When you enter that code, you’ll be all set to discover the platform!

Don’t neglect: In case you use our particular sign-up hyperlink, you would snag as much as a $60,000 bonus.

Bybit KYC

Bybit is a centralized alternate that follows regulatory measures to stop cash laundering, requiring customers to endure Know Your Buyer (KYC) verification to entry its services and products. The KYC course of has two ranges:

- Stage 1: Obligatory for all customers, providing advantages like a each day withdrawal restrict of as much as 1 million USDT. Nevertheless, it doesn’t present entry to the Bybit Card.

- Stage 2: This stage permits customers to entry the Bybit Card and raises the each day withdrawal restrict to as much as 2 million USDT.

KYC is vital for a number of causes on Bybit:

- Regulatory Compliance: It helps Bybit meet authorized necessities.

- Fraud Prevention: KYC aids in detecting and stopping unlawful actions and suspicious habits.

- Enhanced Providers: Customers who full KYC can entry fiat providers, earn merchandise, and revel in greater each day withdrawal limits.

- Unique Gives: KYC verification unlocks entry to particular promotions and occasions, equivalent to Launchpads.

- Account Restoration: A KYC-verified account simplifies the method of recovering entry in case of misplaced credentials.

Funding Your Account

Bybit helps a wide range of deposit strategies:

- Crypto deposit: Includes transferring cryptocurrency from an exterior pockets or one other alternate to your Bybit account

- Purchase crypto utilizing fiat foreign money: You should buy the crypto of your alternative on Bybit utilizing fiat currencies such because the US greenback and the euro.

- Credit score/debit card fee: Linking your credit score/debit card lets you fund your account with out counting on third-party channels.

- Third-Social gathering Cost: To facilitate third-party funds, Bybit has partnered with over various service suppliers.

- P2P Buying and selling: This gives a simple peer-to-peer platform designed for the shopping for and promoting of cash between two customers.

Bybit Order Varieties

Listed below are the principle varieties of orders you should use on Bybit

- Market Order: Executes instantly on the present market worth for fast entry or exit.

- Restrict Order: Means that you can set a selected worth at which you need to purchase or promote an asset. For instance, you may place a restrict order to purchase Bitcoin at $65,000, which is able to execute robotically as soon as the value reaches that stage.

- Conditional Order: Prompts when sure situations are met, equivalent to reaching a set off worth, and may use numerous reference costs for activation.

- Cease-Entry Order: Triggers a market or restrict order when a predetermined worth is reached, with purchase cease orders set above and promote cease orders set beneath the final traded worth.

- Take Revenue and Cease Loss Orders: Mechanically shut a place at a specified revenue (take revenue) or loss (cease loss) stage.

- Iceberg Order: Splits bigger orders into smaller ones to scale back market affect and slippage, hiding the full order measurement.

- One-Cancels-the-Different Order: Pairs two conditional orders in order that if one is executed, the opposite is robotically canceled.

- Put up-Solely Order: Ensures {that a} restrict or conditional restrict order is positioned within the order e book until there’s an instantaneous match, stopping market execution.

- Scale back-Solely Order: Means that you can lower your place measurement with out growing it.

- Shut on Set off: Mechanically closes a place when a specified situation is met.

- Trailing Cease Order: Follows the market worth at a set distance, adjusting the cease worth because the market strikes.

- Time-Weighted Common Worth (TWAP) Order: Executes a big order step by step over a specified time to attenuate market affect.

- Scaled Order: An algorithmic strategy to executing giant orders with out inflicting important worth fluctuations.

- Chase Restrict Order: Constantly adjusts its entry worth to remain at one of the best bid or ask till stuffed, canceled, or reaching a set most chase distance.

For a step-by-step information funding your account and putting your first order, take a look at our Bybit buying and selling information article. We even have an in depth Bybit sign-up information, which additionally touches on how full Bybit KYC.

Merchandise and Options

Bybit affords a wide selection of merchandise and options that cater to each novice and seasoned merchants alike. Let's take a better take a look at what makes Bybit an interesting alternative for cryptocurrency lovers.

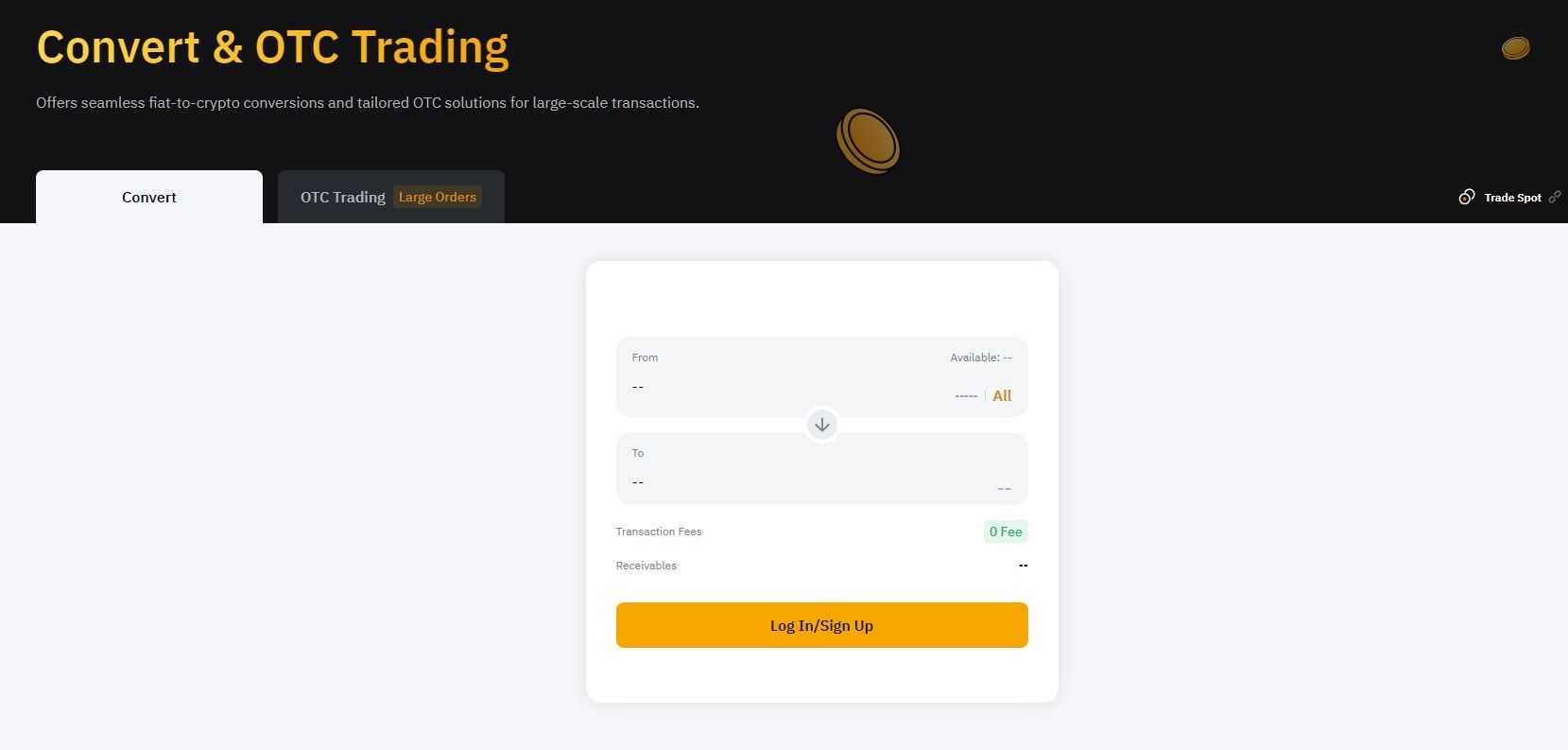

Bybit Convert

Bybit Convert is all about simplicity and comfort. It permits customers to swap between fiat currencies and numerous cryptocurrencies with only a click on, making it extremely user-friendly — particularly for individuals who are put by complicated charts or market evaluation.

The characteristic helps a broad vary of buying and selling pairs, permitting you to simply convert your belongings as wanted. Most conversions occur immediately, permitting you to reap the benefits of market fluctuations in actual time. This characteristic spans throughout totally different account varieties, together with spot, funding, and derivatives, which implies you should use it flexibly.

Remember: Bonus balances can’t be transformed, so it's a good suggestion to familiarize your self with the foundations surrounding your funds.

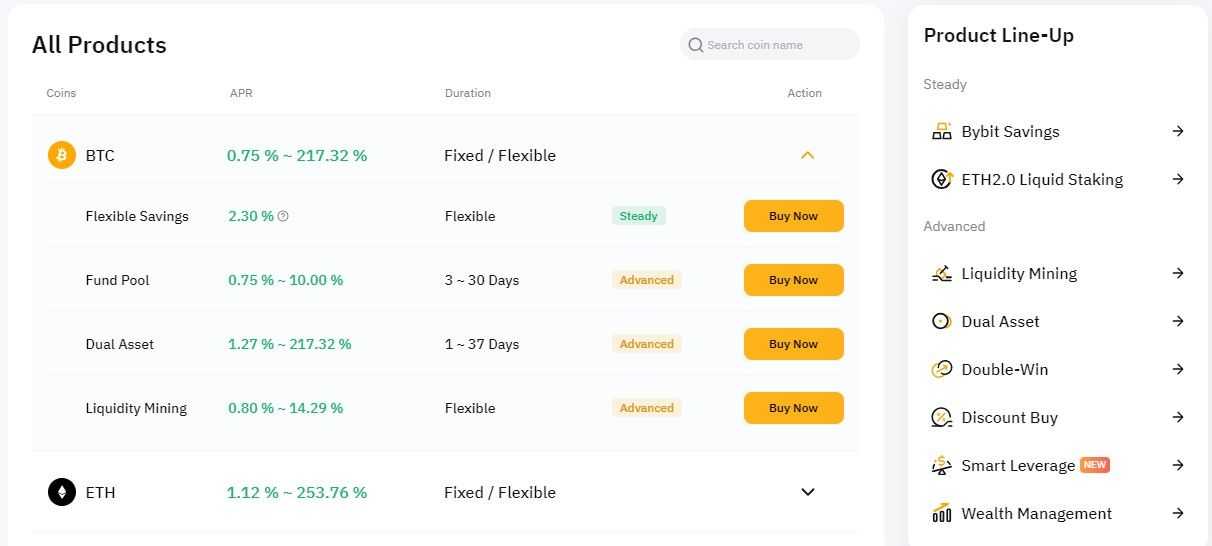

Bybit Earn

Bybit Earn isn't only a single product; it’s a set of seven totally different monetary instruments.

- Bybit Financial savings permits you to park your cryptocurrencies and earn curiosity over time.

- ETH2.0 Liquid Staking lets you stake your Ethereum whereas protecting your belongings accessible.

- Liquidity Mining encourages you to contribute to liquidity swimming pools in alternate for rewards.

- Twin Asset lets you profit from worth actions in two totally different belongings without delay.

- Double-Win affords a strategy to probably revenue no matter market course, making it a fantastic hedge towards volatility.

- Wealth Administration gives customized funding methods tailor-made to your monetary targets.

- Launchpool provides you early entry to new token initiatives, permitting you to take a position earlier than they go mainstream.

Take a look at our full overview of Bybit Earn.

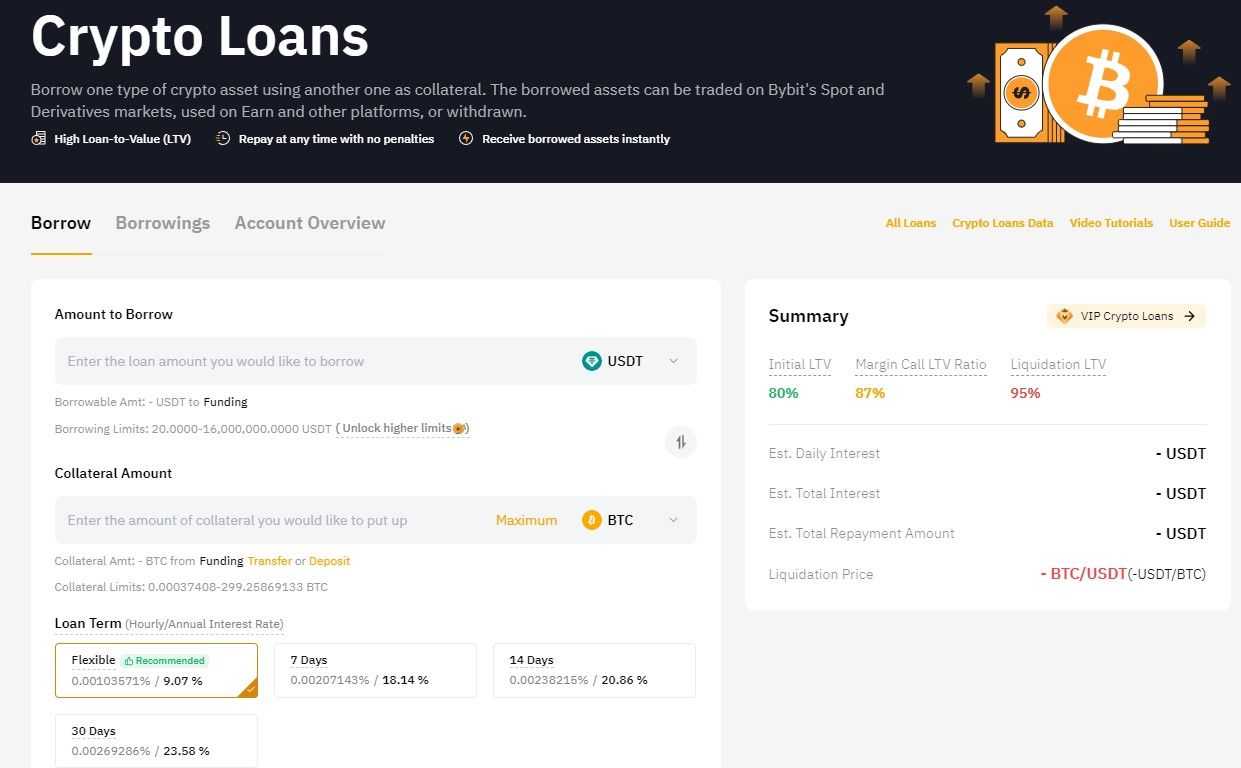

Bybit Lending and Crypto Loans

In case you have idle cryptocurrencies simply sitting in your pockets, Bybit Lending is a good way to place them to work.

This product permits you to lend your belongings to different customers, incomes hourly curiosity in your contributions. Bybit matches lenders with debtors, whether or not they’re in search of funds for margin buying and selling or different wants. They take asset security severely, using a number of danger administration methods to guard your investments.

On the flip aspect, in the event you want fast entry to liquidity, Bybit Crypto Loans let you borrow funds with out promoting your crypto. You should utilize your belongings as collateral for short-term loans with phrases starting from 7 to 180 days. Nevertheless, regulate the liquidation danger; if the worth of your collateral drops beneath a sure stage, Bybit could liquidate it to cowl your mortgage.

It’s important to remain knowledgeable concerning the phrases, particularly concerning overdue curiosity, which might escalate rapidly in the event you miss compensation deadlines.

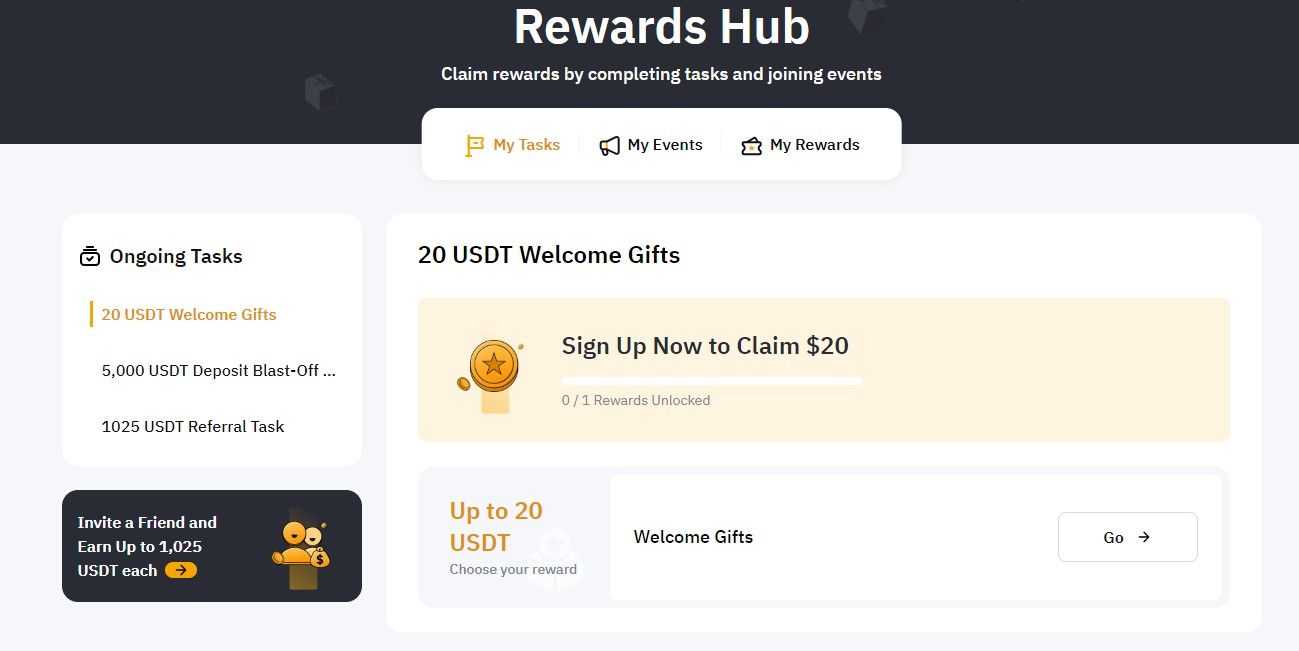

Bybit Rewards Hub

The Bybit Rewards Hub is sort of a treasure chest full of alternatives to earn rewards just by participating with the platform. Customers can full numerous duties, equivalent to signing up or inviting pals, to earn thrilling bonuses.

These rewards can come in several kinds:

- Bonuses that assist offset buying and selling losses

- Coupons that cut back buying and selling charges

- Airdrops of tokens you should use as you would like

- Price reductions that lighten the load in your buying and selling prices

- APY boosters that improve your yield in Bybit Earn merchandise

- Loss cowl vouchers to cushion potential losses throughout buying and selling

Every reward comes with its personal set of situations and timeframes.

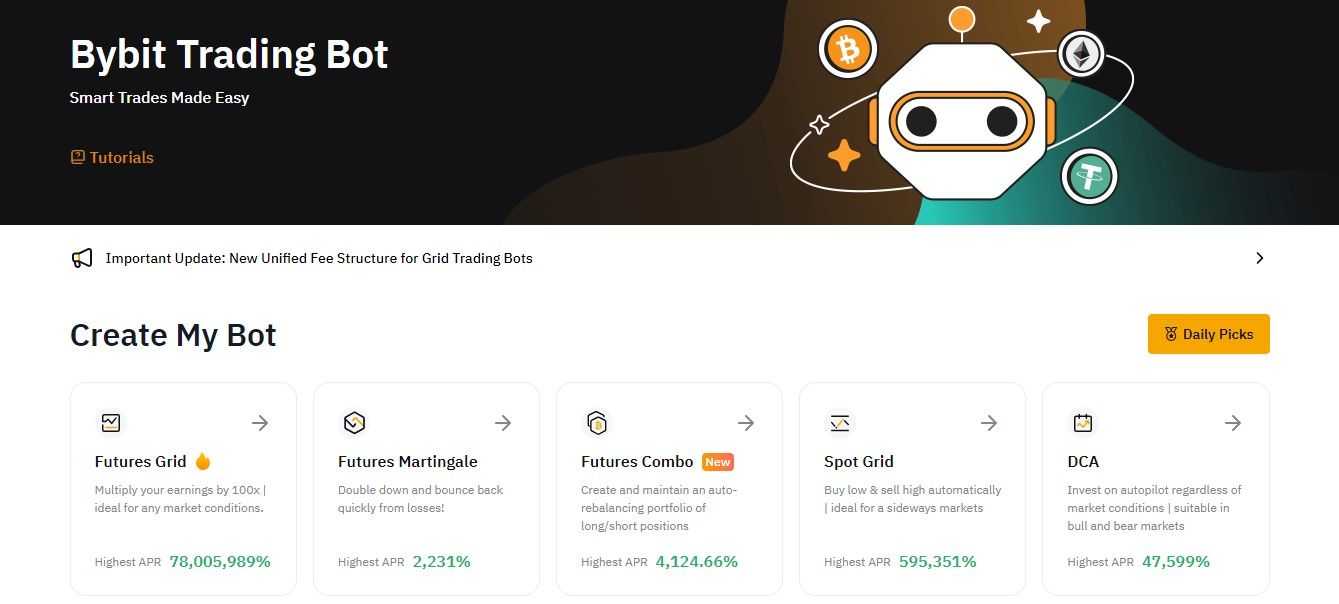

Bybit Buying and selling Bots

For many who favor a hands-off strategy, Bybit’s Buying and selling Bots are right here!

These automated instruments execute trades in your behalf, permitting you to take a break from fixed market monitoring. Bybit affords a number of varieties of bots, every designed to cater to totally different buying and selling methods:

- Spot Grid Bot is ideal for making the most of worth volatility. It locations purchase orders beneath and promote orders above a selected reference worth, repeatedly adjusting to market modifications.

- Futures Grid Bot operates within the perpetual contract market, using leverage to maximise potential income. You’ll be able to select from three modes—lengthy, brief, or impartial—relying on market situations.

- DCA Bot (Greenback-Price Averaging) helps you make investments frequently with out worrying about market timing, which is particularly useful for long-term traders.

Whereas these bots can improve your buying and selling expertise and allow you to capitalize on alternatives, additionally they include dangers, notably in unstable markets, so it’s sensible to strategy them with a superb understanding of how they work.

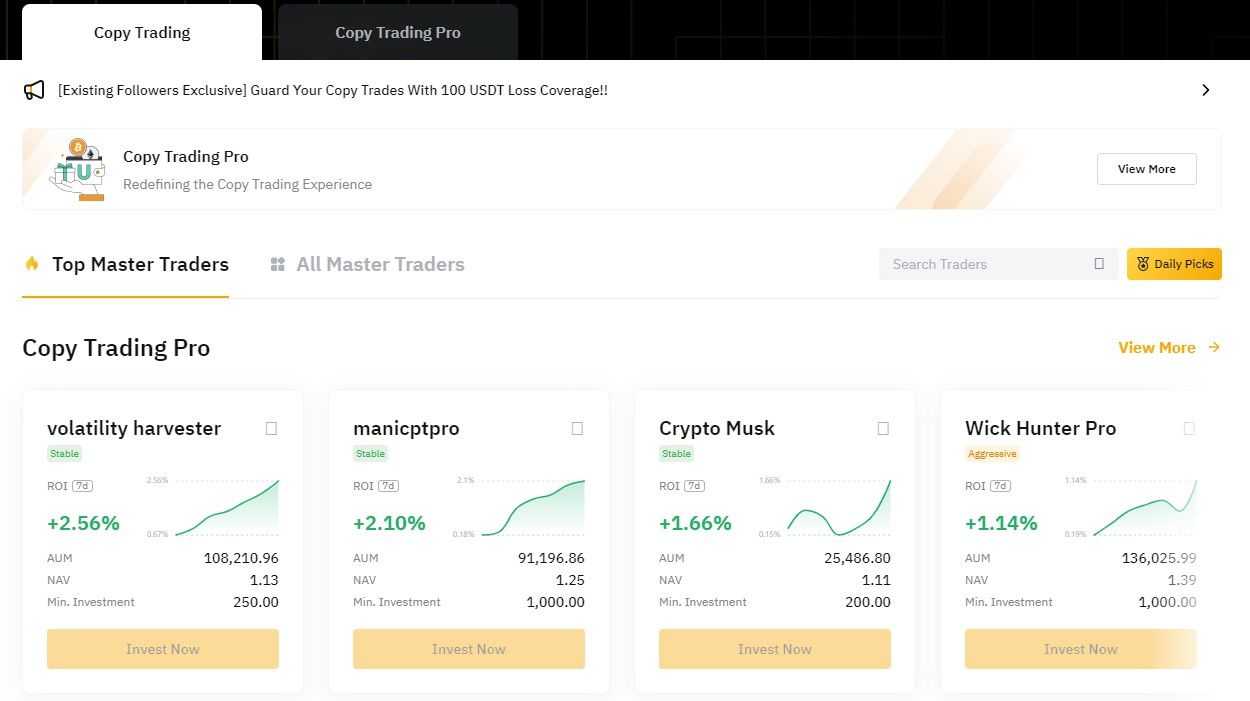

Bybit Copy Buying and selling

In case you’re new to buying and selling or just need to profit from the experience of skilled traders, Bybit Copy Buying and selling is a wonderful possibility. This characteristic lets you replicate the trades of profitable merchants on the platform.

There are two foremost modes:

- Good Copy Mode permits you to comply with grasp merchants with a set danger ratio primarily based in your steadiness, offering a stage of security.

- Superior Copy Mode provides you the pliability to customise your order settings, preferrred for these with a bit extra expertise.

This characteristic has grow to be fairly common, because it permits customers to diversify their portfolios whereas leveraging the talents of others, making it a win-win scenario for a lot of merchants.

You’ll be able to learn our Bybit Copy Buying and selling overview to be taught extra.

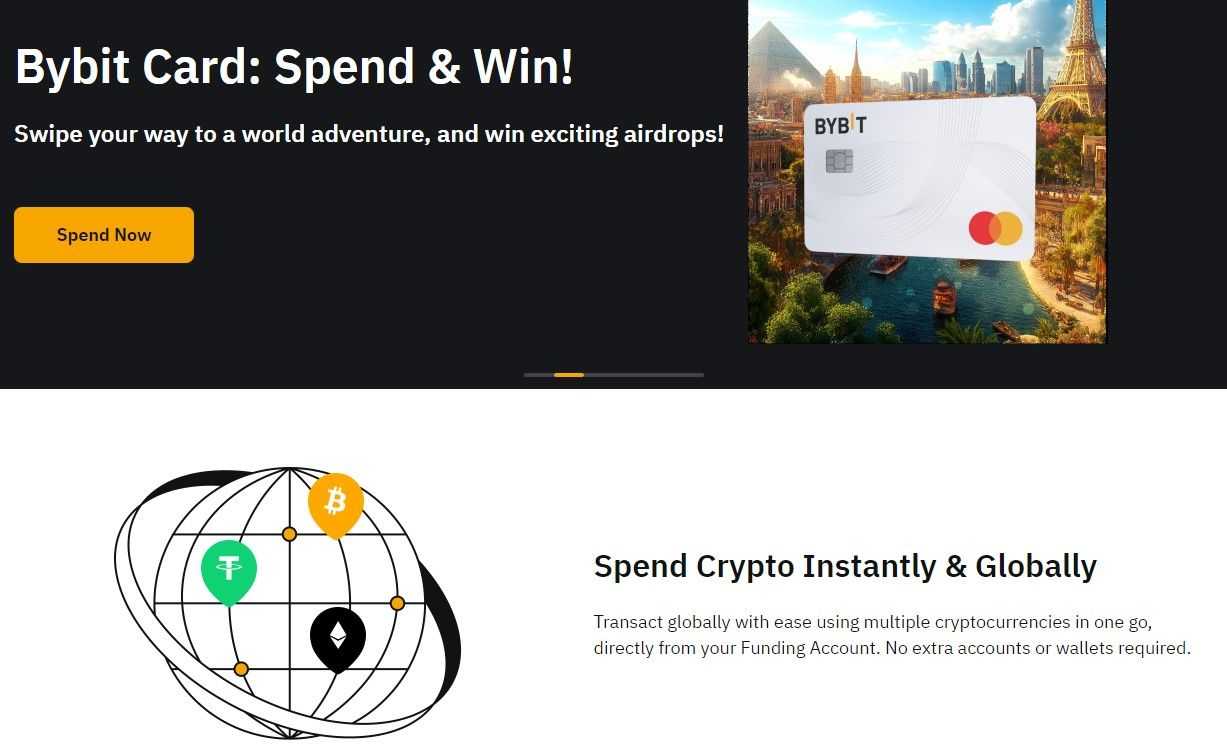

Bybit Crypto Card

The Bybit Card is a digital Mastercard that simplifies the method of spending your cryptocurrencies in on a regular basis transactions.

Customers can select one fiat foreign money (EUR or GBP) and one cryptocurrency (like BTC, ETH, XRP, USDT, or USDC) to fund their card. Whereas the digital model is free to make use of, there’s a payment for the bodily card, which takes as much as 30 days to reach. One limitation is that the Bybit Card can’t be added to digital wallets like Apple Pay or Google Pay, which can make it much less handy for some customers.

Whereas there are not any annual charges, customers ought to concentrate on a 0.5% international alternate payment and a 0.9% crypto conversion payment, which applies in the event you don’t have sufficient fiat to cowl a transaction.

Bybit Pockets

The Bybit Pockets is a custodial pockets, that means that the alternate holds your belongings and manages the personal keys. This setup lets you simply entry a variety of decentralized functions in DeFi, GameFi, and NFT marketplaces. The pockets additionally options cross-chain compatibility, making it easy to handle a number of belongings throughout totally different platforms.

Key functionalities embrace personal key administration, automated assortment of airdrops, and entry to DeFi merchandise, which broadens your funding horizons and enhances your engagement with the crypto ecosystem.

Bybit NFTs

Bybit’s NFT market is an thrilling area for purchasing, promoting, and buying and selling non-fungible tokens.

Supporting each Ethereum and Solana blockchains, customers can transact utilizing ETH, XTZ, and USDT. Nevertheless, it’s value noting that NFTs can solely be priced with one token at a time. {The marketplace} fees a 1% buying and selling payment for sellers, together with a royalty payment for creators, which helps help the inventive group.

At the moment, NFT deposits are solely supported on Ethereum, whereas withdrawals may be made on each Ethereum and Solana.

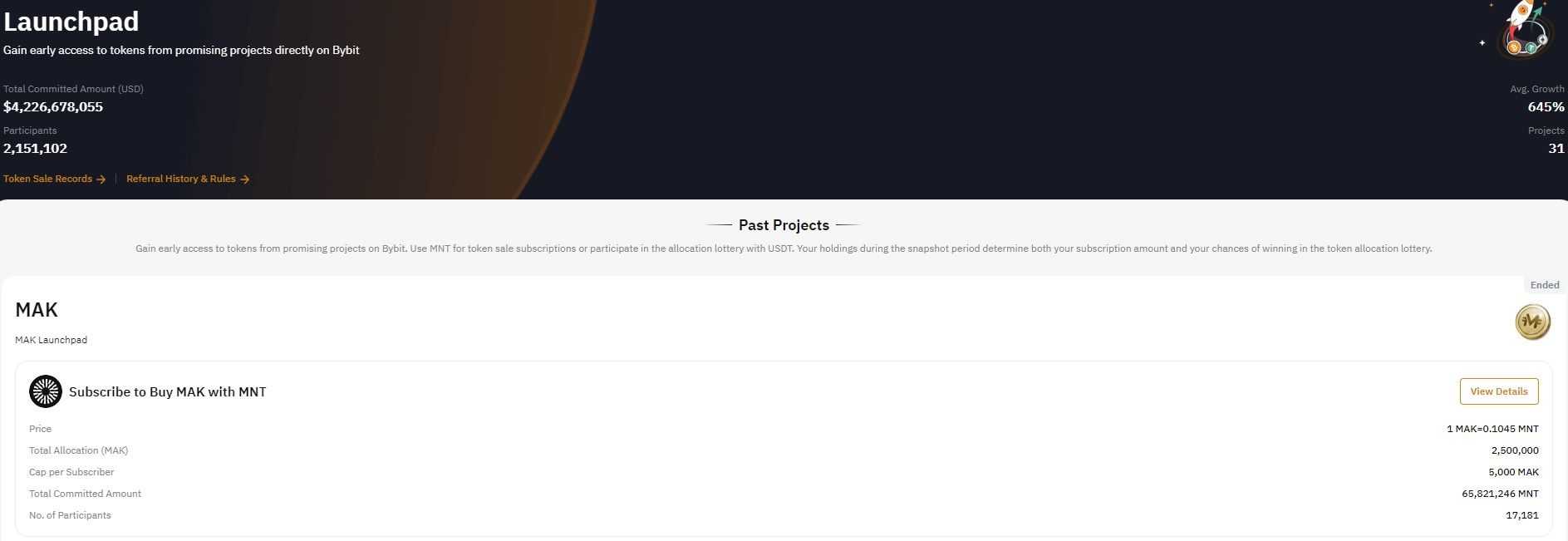

Bybit Launchpad

The Bybit Launchpad is designed for these wanting to get in on the bottom ground of recent blockchain initiatives.

It gives entry to token gross sales earlier than they go public, permitting you to take a position early in probably promising initiatives. Customers can take part by committing Mantle (MNT) or utilizing lottery tickets to achieve allocations for brand spanking new tokens. The method options a number of phases that embrace a warmup interval, subscription, allocation choice and the announcement of outcomes.

TradeGPT

Bybit TradeGPT leverages real-time market information to supply insights and ideas tailor-made to your buying and selling methods.

In contrast to conventional chatbots, TradeGPT gives up-to-date data on market traits, potential funding alternatives, and technical evaluation.

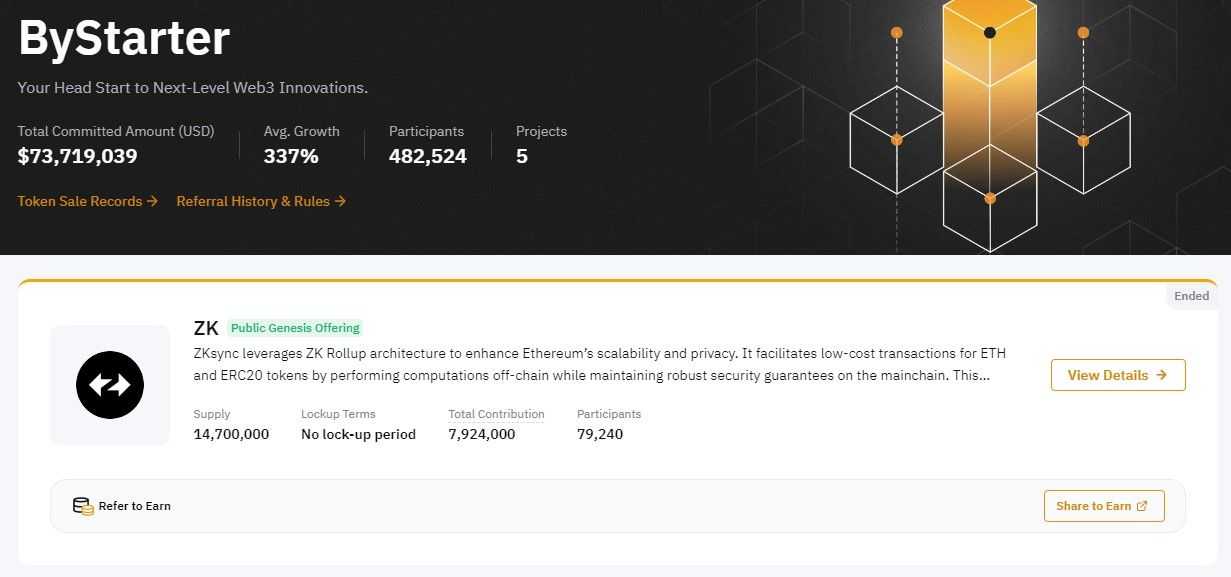

ByStarter

ByStarter serves as a platform for token gross sales, the place customers can spend money on early-stage digital belongings.

The method unfolds in a number of phases, beginning with a warmup interval for KYC verification, adopted by a subscription section the place you commit funds. Then comes the allocation section, the place winners are randomly chosen to obtain tokens. A lock-up interval follows, throughout which token holders are prohibited from promoting their belongings.

VIP Program

Bybit's VIP program is designed to reward loyal merchants primarily based on their buying and selling exercise and asset holdings.

It options a number of tiers, every providing distinctive advantages equivalent to decrease buying and selling charges, entry to unique campaigns, and precedence buyer help.

Institutional Providers

For institutional purchasers, Bybit gives a complete vary of specialised providers. These embrace over-the-counter (OTC) buying and selling options, liquidity packages, and customised buying and selling methods designed to fulfill the distinctive wants of bigger buying and selling operations. These purchasers additionally get entry to a devoted help crew making certain real-time safety alerts and sturdy danger administration.

Affiliate and Referral Program

The Bybit affiliate and referral program permits you to earn rewards by bringing pals onto the platform.

Each referrers and new customers can take pleasure in advantages by finishing particular duties — equivalent to making a minimal deposit or attaining sure buying and selling volumes. The associates program encompasses a fee construction that rewards you primarily based on the buying and selling quantity generated by your referrals.

Is Bybit Secure?

Since its launch in 2018, Bybit boasted a clear safety file. That modified in 2025 when hackers obtained away with $1.5 billion. Nevertheless, it's vital to notice that the breach wasn't a results of lax safety protocols, however slightly the results of social engineering. On prime of that, withdrawals weren't paused and Bybit had resorted its reserve 1:1 inside 72 hours of the assault.

With that out of the best way, right here's an summary of how Bybit retains customers' cash safe.

Platform Safety

Bybit employs a sturdy triple-layer safety strategy. Person funds are saved offline in chilly wallets, complemented by superior applied sciences like multi-signature, Trusted Execution Atmosphere (TEE), and Threshold Signature Schemes (TSS) to stop unauthorized entry.

The platform conducts common Proof of Reserves audits, with outcomes made publicly out there. Bybit adopts a privacy-first philosophy, making certain transparency about information assortment and utilization, using robust encryption, and sustaining strict entry controls. Actual-time monitoring programs detect suspicious actions, resulting in enhanced withdrawal safety measures.

Bybit has achieved a AA safety ranking from CER.

Safety and Compliance

Bybit works intently with international regulatory our bodies to fight cash laundering and employs Know Your Buyer (KYC) procedures centered on buyer due diligence by means of partnerships with main resolution suppliers.

The platform collaborates with legislation enforcement to deal with cybercrime and is dedicated to selling accountable buying and selling practices, providing sources on danger administration and safety.

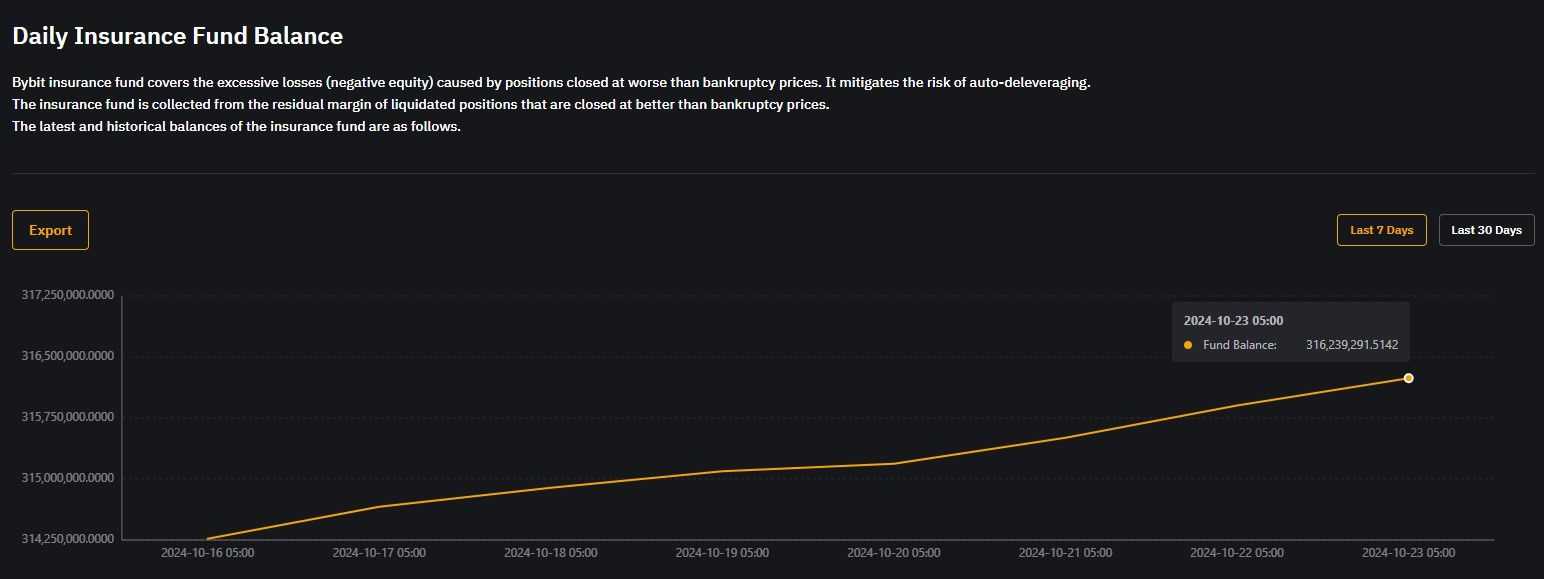

Insurance coverage Fund

Bybit’s insurance coverage fund serves as a security internet for merchants participating in derivatives buying and selling, serving to to defend them from extreme losses.

Right here’s the way it works:

When a dealer’s place is liquidated, it’s settled on the chapter worth — the edge the place there’s no remaining preliminary margin. This settlement happens whatever the present market worth. If the closing worth of the place is best than this chapter worth, any remaining margin will likely be transferred to the insurance coverage fund. Which means merchants can nonetheless contribute positively to the fund even when dealing with a liquidation.

Alternatively, if the closing worth falls beneath the chapter worth, leading to a loss that exceeds the dealer’s preliminary margin, the insurance coverage fund steps in to cowl the distinction. This mechanism is particularly vital because it reduces the chance of Auto-Deleveraging (ADL), which might occur when the market is unstable and positions are quickly liquidated to take care of system stability.

Basically, the steadiness of the insurance coverage fund fluctuates primarily based on the end result of liquidations. When liquidations happen at costs higher than the chapter worth, the fund receives further contributions. Conversely, when losses are lined resulting from unfavorable closing costs, the fund’s steadiness decreases.

Leverage on Bybit

Provided that Bybit is a leveraged alternate, it signifies that they permit crypto margin trades. Merchants will solely need to put up a small proportion of the preliminary place as collateral for his or her trades.

Which means when you have the leverage of 100x, you may be required to place up a margin of 1% of the preliminary notional quantity of the commerce. So, if the notional on a 10BTC contract is $36,000, you’ll have to put up $360 in preliminary margin.

Main Professional 💯: With Bybit, leverage is freely adjustable, that means that it may be modified even after opening a place, which is one thing that can not be performed on different exchanges.

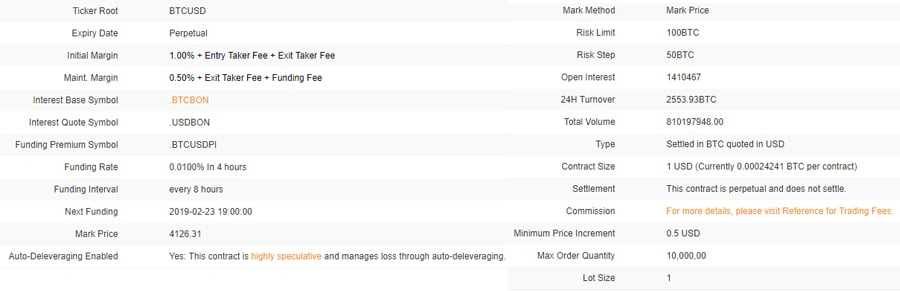

What’s shocking concerning the perpetual contracts on Bybit is their measurement. Every contract is simply value 1 USD, which is way smaller than the contracts on different exchanges. Under is all the opposite specifics of their BTCUSD contract.

They’ve just about the identical phrases on their ETH/USD contracts. Yow will discover extra details about the totally different contracts on the Bybit Market Overview Web page.

Whereas Bybit does supply as much as 100x leverage on their contracts, this isn’t fixed. If you’re a big dealer and are coming into sizable positions then they are going to carry down the leverage which you could obtain in your contract.

This protects the alternate from the danger posed by giant positions. Under is the desk of the BTCUSD danger limits. Yow will discover the ETHUSD, EOSUSD and XRPUSD danger limits on their Danger Restrict Ranges web page.

| Place Worth | MM* | Preliminary Margin | Max Leverage |

|---|---|---|---|

| 150 BTC | 0.5% | 1.00% | 100 |

| 450 BTC | 0.5% | 2.00% | 50 |

| 750 BTC | 2.5% | 3.00% | 33 |

| 1,050 BTC | 3.5% | 4.00% | 25 |

| 1,350 BTC | 4.5% | 5.00% | 20 |

| 1,500 BTC | 5.0% | 5.50% | 18 |

MM* stands for Upkeep Margin

As you may see, the upkeep margin is fixed at 0.5% for all contract sizes. Nevertheless, for bigger positions, they are going to enhance the minimal preliminary margin requirement such that there’s a a lot larger shortfall between the liquidation stage and the chapter stage.

Liquidation

Liquidation is what occurs when you could have practically depleted your preliminary margin and the mark worth hits the “liquidation price”. On this occasion, the dealer will likely be liquidated with the remainder of their margin, if any, being despatched to the Bybit insurance coverage fund.

ADL ⚙️: Bybit operates an Auto Deleveraging system. Basically, this occurs when a place can't be liquidated at a worth that’s higher than the chapter worth and the insurance coverage fund can’t cowl it. The ADL system will robotically deleverage a place of an opposing dealer that’s chosen in line with their outlined standards. You’ll be able to learn extra concerning the ADL in Bybit's Auto Deleveraging article.

Whereas there are lots of merchants who could also be upset by a liquidation, it is a vital danger administration software in a futures alternate and is part of margin buying and selling. Nevertheless, Bybit has various instruments that may assist merchants keep away from the danger of liquidation. These embrace the next:

- Twin Worth Mechanism: With a view to forestall the danger of market manipulation on the alternate, Bybit makes use of a twin worth mechanism because the contract reference worth. That is composed of the "Mark Price" which triggers liquidation and the “Last Traded Price” which is used to calculate the value at which the place is closed. The previous is a world Bitcoin worth whereas the latter is the present Bybit market worth. Utilizing exterior pricing inputs reduces singular alternate manipulation.

- Auto Margin Replenishment: If you wish to be sure that your place will all the time have satisfactory ranges of margin then you may set it to auto-replenish. Which means at any time when your margin is near being depleted, it would draw in your funds to maintain your place open

- Cease Loss: This kinds a part of the order choices that we speak about beneath. Having efficient cease losses in your positions will be sure that it by no means will get all the way down to the liquidation stage.

Mark / Spot Worth 📈: For these , the Mark worth is derived from the Spot worth. The spot worth is a Bitcoin worth index that represents the worldwide worth. It’s comprised of costs on Bitstamp, Coinbase Professional and Kraken. The Mark worth is the spot worth index plus a decaying funding foundation charge

Bybit Charges

Bybit's buying and selling charges fluctuate for non-VIP and VIP customers, with VIP customers eligible for enhanced payment reductions primarily based on their ranges.

VIP ranges are decided by both asset steadiness or the final 30-day buying and selling quantity. Merchants want to fulfill considered one of these standards to unlock the payment low cost comparable to their VIP Stage.

As the main focus of this text is on new merchants, we'll persist with non-VIP.

Bybit at the moment affords two zero-fee campaigns: one for derivatives buying and selling utilizing Bybit Arbitradge and one other for EUR Spot buying and selling. Throughout these promotional durations, merchants can interact in particular pairs with out incurring charges. Moreover, new customers making a minimal deposit of 100 EUR may take pleasure in zero charges, and staking on Bybit is fee-free as effectively.

Exchanges categorize orders as both "makers" or "takers" to find out the relevant buying and selling charges:

- Makers: These are merchants who add liquidity to the market by putting restrict orders that aren’t instantly stuffed. They typically contribute to the order e book's depth. Makers usually pay decrease charges and will even obtain rebates; as an illustration, Bybit has a Market Maker Incentive Program that provides rebates of as much as 0.015%.

- Takers: In distinction, takers take away liquidity from the market by putting market orders which might be stuffed instantly. Takers normally incur greater charges resulting from their position in taking liquidity from the order e book.

For particular charges on Bybit:

- Makers in derivatives buying and selling are charged 0.01%

- Takers in derivatives buying and selling pay 0.06%

- Each makers and takers in spot buying and selling are charged 0.10%

Bybit Buying and selling Platform

Some of the vital issues for a dealer is to have an efficient buying and selling platform with superior know-how.

So, how does Bybit stack up?

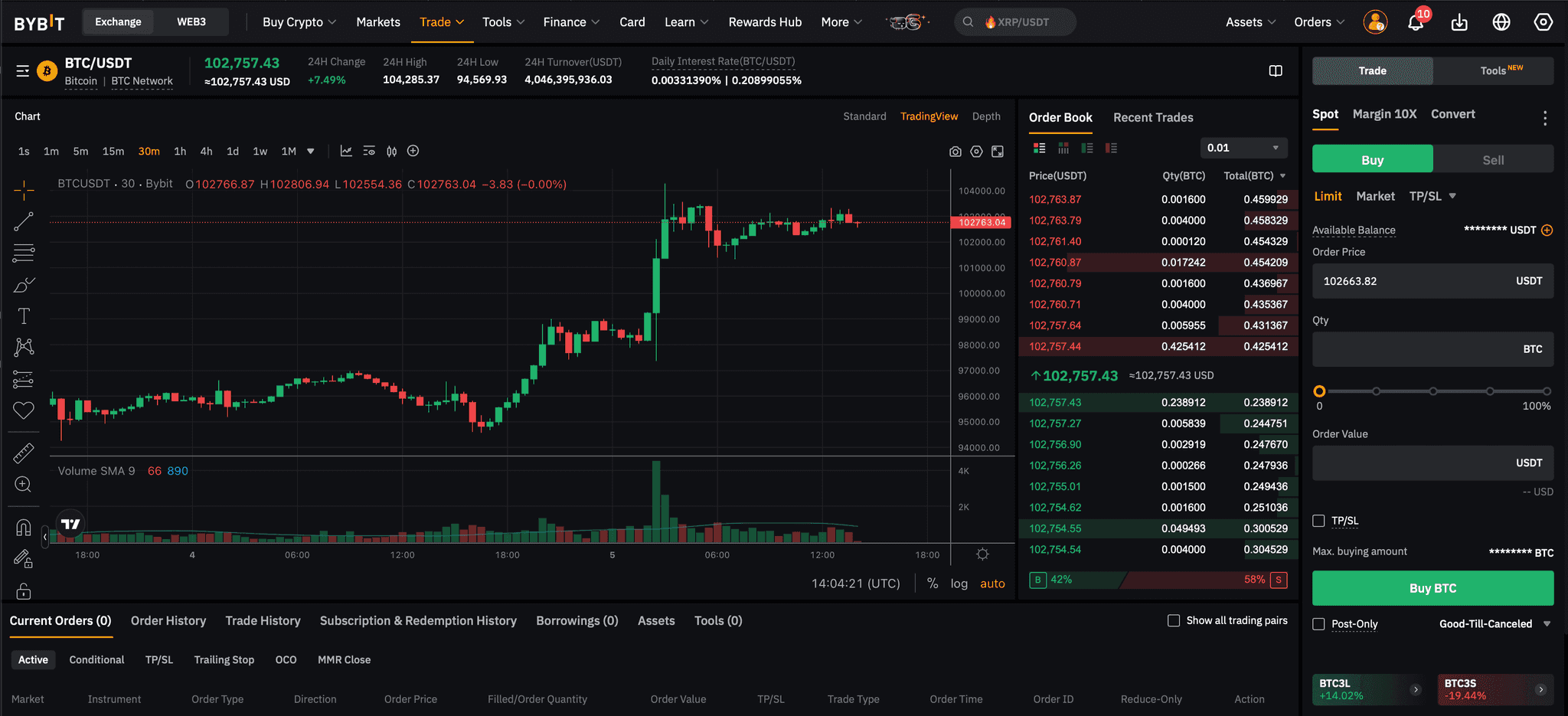

Very effectively right here, in keeping with the highest exchanges within the trade. The buying and selling platform is effectively laid out and intuitive. On the prime, you may toggle between your wallets and account administration. It’s also possible to swap between the BTC and ETH futures markets.

Right here's a take a look at the Bybit's buying and selling interface:

For these seasoned merchants amongst you, you should have seen that Bybit makes use of TradingView charting know-how. This third-party charting package deal is well-known within the trade for having probably the most performance and options. TradingView has a number of indicators and has a clear, user-friendly interface appropriate for crypto buying and selling novices.

Much like many shares and foreign exchange platforms, TradingView has grow to be adopted by many crypto platforms, so it’s comparatively simple so that you can adapt in the event you do open an account elsewhere.

High Tip 💯: You’ll be able to swap out the TradingView worth charts for the market liquidity charts. These are useful for the dealer to find out market sentiment (bullish/bearish)

Additionally, you will discover that in your present place/order bar, you could have the "ADL ranking" indicator. This can present you the place you at the moment are positioned for potential deleveraging within the case that the ADL is triggered. As talked about above, that is performed to handle danger.

One thing that Bybit seems to be fairly happy with is their order-matching engine. They declare that this buying and selling engine is ready to execute a complete of 100,000 transactions per second per contract. So for each new asset they are going to add, their matching engine could have a devoted 100,000 transactions per second for that asset solely.

Why does this matter?

Properly, sooner order execution signifies that the danger of slippage and buying and selling errors is vastly diminished. Furthermore, with an asset that strikes as rapidly as Bitcoin, it’s actually vital to have the ability to match either side of the order e book virtually instantaneously.

We’ve got had members from the Coin Bureau crew take a look at out the buying and selling execution and have heard from different high-level merchants and may attest to the claims that Bybit has knowledgeable grade matching and commerce execution engine which might be second to none within the trade. Take a look at our Bybit Buying and selling Information for a take a look at the buying and selling performance provided.

Market Analytics Knowledge

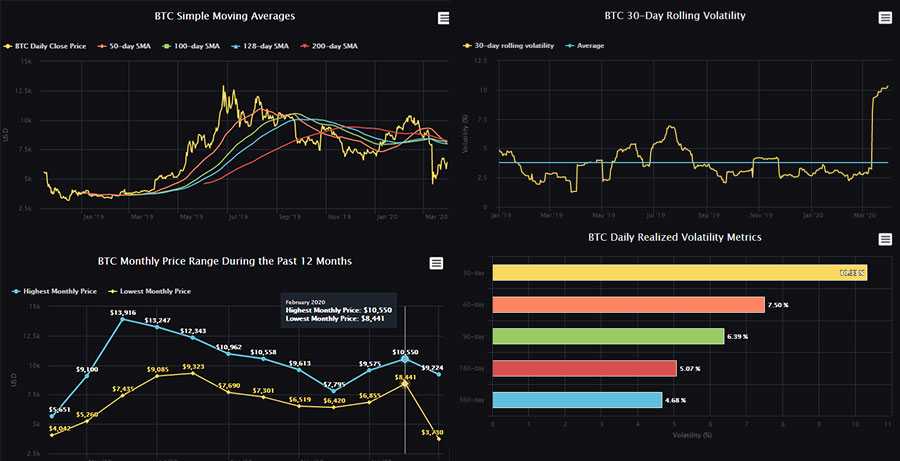

One thing else we discovered fairly neat was their market information part and notably their superior information part. This contained some actually helpful graphs and charts that might assist inform your buying and selling.

It’s also possible to pull up a few of these charts and obtain the info. This might both be as a picture, vector file or as a csv. Right here you may see an instance of us doing that with the rolling volatility chart.

Here’s a checklist of the info that you’ll be able to obtain in addition to what it means:

- BTC Each day Realised Volatility what the realised volatility was like over a sure time frame

- Month-to-month Worth Vary Takes a take a look at month-to-month highs and lows within the worth. It lets you observe the vary the asset traded in.

- Worth Shifting Averages: This has the value of Bitcoin together with the variety of transferring common indicators of various time frames.

- Rolling Volatility The realised volatility over the previous 30 days in comparison with the common for the interval. Provides you a way of how a lot the value swung in a given interval.

There may be additionally a number of different information which you could study in these tabs. That features data on the particular index worth, funding information and the insurance coverage fund. You also needs to observe the weights which might be used to calculate the spot worth.

Bybit High Advantages Reviewed

Bybit is a wonderful platform for non-US prospects in search of a derivatives alternate or these desirous to commerce the spot market. It affords probably the greatest buying and selling experiences within the trade. A few of the prime advantages Bybit affords are:

Broad Vary of Belongings and Providers – Since 2018, Bybit has grown into one of many prime exchanges that gives customers with entry to a variety of belongings in addition to providers. Bybit has over 500 belongings within the spot market and 450+ contracts within the derivatives market. It additionally affords customers providers equivalent to buying and selling bots, lending, institutional providers, referral and affiliate packages, the Bybit debit card, P2P market, copy buying and selling, and extra. Bybit has performed a fantastic job competing with the likes of Binance as a “one-stop-shop” crypto alternate that provides the whole lot a crypto consumer wants below one roof.

Bybit Copy Buying and selling– As a result of Bybit has grow to be a extremely revered alternate, due to its professional-grade buying and selling and matching engine and incredible choice of merchandise, the platform has attracted a number of the most proficient crypto merchants within the trade. This has led to their copy buying and selling platform turning into probably the greatest within the trade as merchants can copy the trades of a number of the greatest merchants in crypto.

Excessive Leverage and Danger Administration – The alternate permits customers to commerce with as much as 100x leverage on choose belongings, but it surely additionally has a wide range of instruments that guarantee danger is correctly contained. A few of the instruments embrace Bybit’s insurance coverage fund, auto deleveraging, cross and remoted margin accounts, a variety of order choices, and many others.

Good Buyer Help – Bybit has 24/7 customer support out there for customers to get any points addressed.

Bybit Change Assessment: Conclusion

We discovered Bybit to be a user-friendly alternate with robust know-how, affordable charges and a comparatively intuitive consumer interface. We’re additionally glad to see Bybit has developed an insurance coverage fund to handle market danger.

Bybit is well-positioned to supply a substitute for the established order within the crypto derivatives buying and selling market and has loved astronomical development within the trade.

The alternate is likely one of the quickest rising platforms round, with new merchandise and options being added on a regular basis, which has solely been fuelling its development.

So, do you have to use Bybit?

You’ll be in good firm in the event you selected to take action. Lots of the greatest merchants in crypto and even some institutional merchants belief Bybit they usually have a sturdy safety framework in place. We encourage you to do your individual analysis however on the face of it, Bybit seems to be a incredible alternate that ticks most of our bins.

You’ll be able to be taught extra about Bybit and the way it stacks up towards different exchanges:

- Bybit vs KuCoin

- Bybit vs Binance

- Bybit vs PrimeXBT

- Bybit vs Bitget

- Bybit vs OKX

Warning ⚡️: Buying and selling leveraged futures merchandise is extremely dangerous. Just remember to apply satisfactory danger administration

Incessantly Requested Questions

What’s Bybit?

Bybit is a cryptocurrency and derivatives buying and selling alternate established in 2018. It affords a professional-grade, high-performance matching engine, making it a preferred buying and selling platform with over 2 million customers. The alternate is understood and revered within the crypto group for superior buying and selling choices, good buyer help, and its dedication to crypto schooling.

Is Bybit Legit?

Bybit is about as reliable as an unregulated “off-shore” crypto alternate may be. Due to the sturdy safety measures in place, and the truth that this alternate has been working since 2018, Bybit is likely one of the most extremely trusted exchanges outdoors the highest 5.

Is Bybit Obtainable within the US?

Sadly not. Residents from america and Sanctioned international locations aren’t permitted to make use of Bybit.

The place is Bybit Positioned?

Bybit is headquartered in Dubai, United Arab Emirates

Why is Bybit banned within the US?

Bybit is an unregulated crypto platform and doesn’t adhere to lots of the USA authorities’s guidelines and laws.

How reliable is Bybit?

Bybit is usually thought-about reliable, particularly given its dedication to safety and transparency. The alternate makes use of sturdy safety measures equivalent to chilly storage for almost all of consumer funds, multi-signature wallets, SSL encryption, and two-factor authentication (2FA).

Moreover, it has a AA safety ranking from Licensed. Bybit has rapidly gained a constructive fame within the crypto trade for its user-friendly platform, clear payment construction, and buyer help, in addition to its common safety audits.

Nevertheless, as with all platform, customers ought to train warning by enabling all out there security measures and making certain they’re on the reliable web site.

What are the disadvantages of Bybit?

A few of the key disadvantages of Bybit embrace:

- Restricted in Sure Jurisdictions: Bybit is unavailable in key markets just like the U.S., Canada (Quebec), and another areas.

- Excessive Leverage Danger: Bybit affords as much as 100x leverage, which may be engaging to superior merchants however is dangerous for novices and will result in fast liquidation.

- Not Appropriate for Newbies: Given its give attention to derivatives buying and selling, the platform may be complicated for novices who’re unfamiliar with margin buying and selling, liquidation dangers, and different superior options.

- No In-App Pockets Management: Bybit’s custodial pockets mannequin means customers don’t management the personal keys to their funds, which can be a priority for these prioritizing self-custody.