Chainlink has been getting fairly a little bit of consideration these days. A lot in order that LINK has risen to a market cap of greater than $6 billion.

The preliminary catalyst for these positive aspects was the launch of Chainlink on the Ethereum mainnet in Might 2019 and a Coinbase itemizing. Primarily, the undertaking’s aim is to create a extensively used decentralized oracle service. In the event that they’re profitable it might change sensible contract utilization and effectiveness without end.

On this Chainlink evaluation, we are going to take a deep dive on the undertaking together with the know-how, adoption, use instances, & LINK worth prospects.

Want for Oracles

When sensible contracts are talked about almost everybody thinks of Ethereum. And that’s as a result of when Ethereum was launched again in 2015 it contained one thing that took blockchain know-how to the following stage.

The sensible contracts of Ethereum meant that blockchain know-how could possibly be way over only a means for conducting monetary transactions. Ethereum’s sensible contracts expanded the utility of blockchain massively.

There was one drawback with Ethereum sensible contracts nevertheless, and that’s the truth that they solely work with information on their very own blockchain. Whereas that also leaves them as a really useful gizmo, they aren’t almost as helpful as they could possibly be. Making a solution to embody information from outdoors the chain would give sensible contracts an immense increase within the potential use instances.

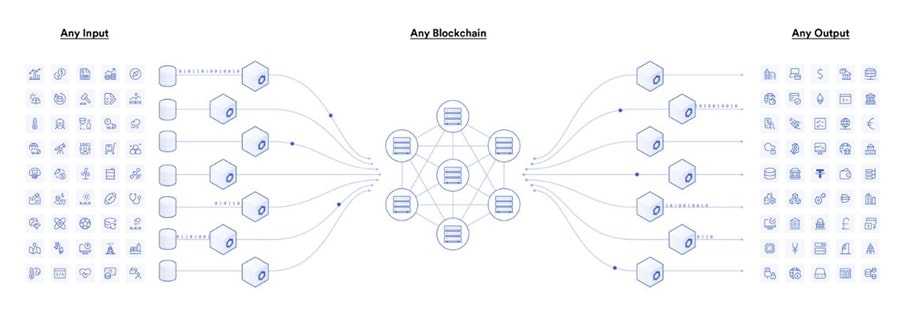

The founders of Chainlink noticed this, and so they moved to fill the hole. Chainlink is being created as a means to make use of oracle’s to tug information from off-chain sources. Chainlink oracles will be capable to use information swimming pools, software program interfaces (APIs) and different actual world sources. It opens up the likelihood for sensible contracts to make use of any information supply in any respect, it doesn’t matter what the supply is.

Chainlink has been extraordinarily useful to tasks that want off-chain information to be actually helpful. By giving blockchains entry to conventional information units, Chainlink seeks to be the bridge between conventional information and the way forward for blockchain know-how.

If blockchains are decentralized computer systems and sensible contracts are decentralized purposes, then Chainlink might be considered like a decentralized Web that lastly permits sensible contracts to work together with the skin world whereas sustaining blockchain know-how’s elementary ensures round safety, transparency, and belief.

With these fundamentals set, let’s have a extra detailed have a look at what Chainlink is being developed for, and the way it can change the blockchain house.

How Chainlink Works

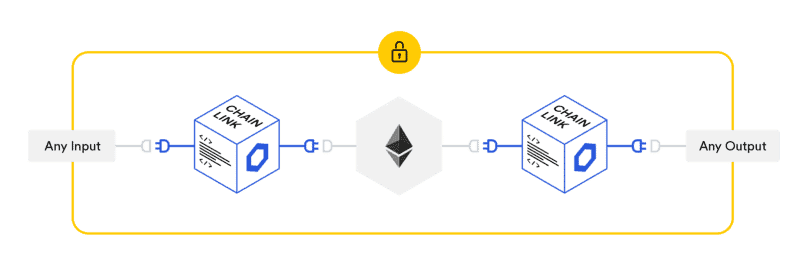

The principle perform of Chainlink is to create a bridge between on-chain assets and off-chain assets. This implies there are two main parts within the Chainlink structure – an on-chain infrastructure and an off-chain infrastructure. Let’s see how each work.

On-Chain Features

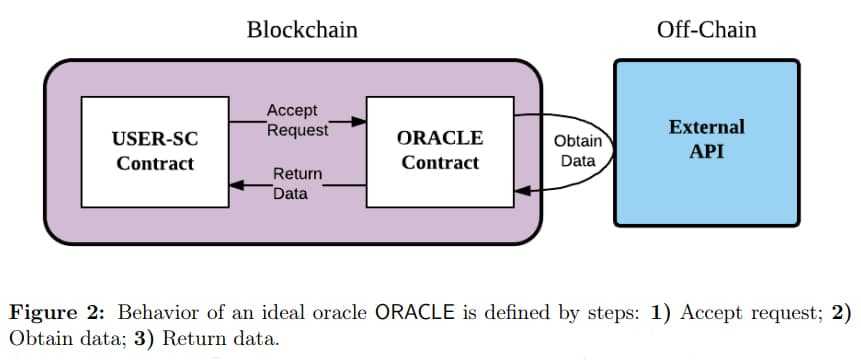

The on-chain sensible contracts are the primary a part of Chainlink’s structure. Included within the sensible contracts are oracles that are created to course of person information requests.

These oracles will take any person requests for off-chain information which are submitted to the community utilizing a requesting contract and course of them, sending them to the suitable sensible contract to be matched with an oracle that may then present the wanted off-chain information. There are three kinds of contracts that may assist with matching: the popularity contract, the order-matching contract, and the aggregating contract.

The popularity contract ensures that the oracle supplier is dependable and reliable. Whether it is, the request is handed to the order matching contract, which works to move the requesting contract to an acceptable oracle based mostly on the service stage being requested, and the bids from the oracles. Lastly, the aggregating oracle collects information from the chosen oracles and delivers the perfect consequence to the requesting contract.

Off-Chain Features

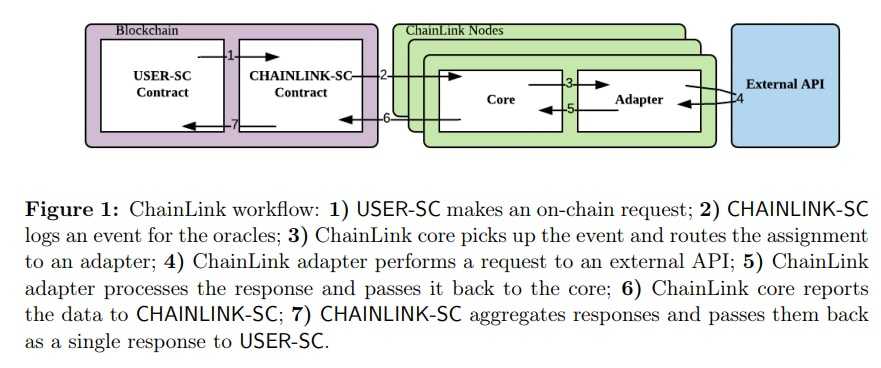

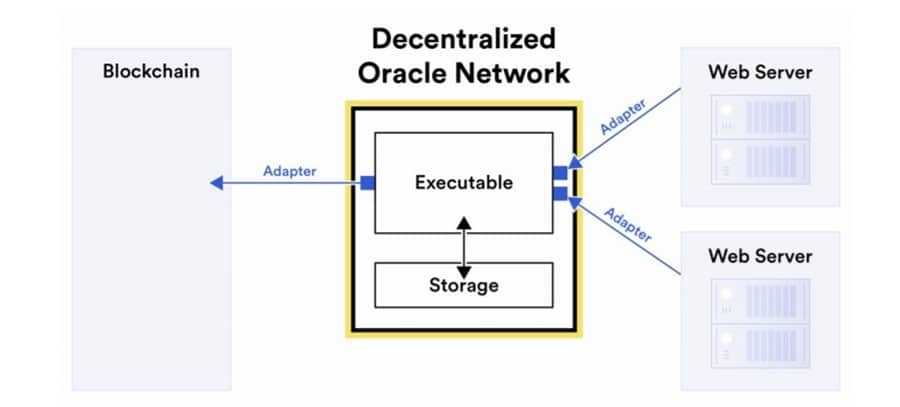

Off-chain parts are the opposite a part of the Chainlink structure. These are oracle nodes that exist off-chain, however are linked to the Ethereum community. I say Ethereum community right here as a result of at present Chainlink is barely able to interfacing with Ethereum sensible contracts, however sooner or later it’s deliberate to work with many various networks and sensible contracts. The majority of the work is finished by these off-chain oracles, as they gather many of the information being requested.

All the information collected is processed via Chainlink Core, which is the software program that connects the Chainlink blockchain with off-chain information sources. Chainlink Core is answerable for processing information and passing it to the on-chain oracle.

All of this work by the off-chain nodes isn’t executed as charity. These nodes count on to obtain fee for the info assortment and transmission. And they’re paid, in LINK tokens.

There’s a secondary perform of off-chain nodes that make them fairly helpful to builders. The off-chain nodes enable for the mixing of exterior adapters, that are like decentralized purposes (dApps) on the Ethereum community. Exterior adapters are written by builders to carry out subtasks inside the exterior nodes. This makes information assortment and processing extra environment friendly.

Cross-chain Interoperability Protocol

The Cross-Chain Interoperability Protocol (CCIP) is a brand new generalized cross-chain communication protocol that permits sensible contract builders to switch information and tokens throughout blockchain networks.

The applying deployment course of throughout a number of blockchains is at present damaged, affected by the fragmentation of property, liquidity, and customers. With CCIP, nevertheless, builders can make the most of token transfers and arbitrary messaging to allow the creation of DApps which are made up of a number of completely different sensible contracts deployed throughout completely different blockchain networks that interoperate to create a single unified software. This Web3 design sample is named the cross-chain sensible contract.

Chainlink CCIP is within the “early access” stage of growth and is at present obtainable on the Ethereum Sepolia, Optimism Goerli, Avalanche Fuji, Arbitrum Goerli, and Polygon Mumbai testnets.

Oracle and Supply Distribution

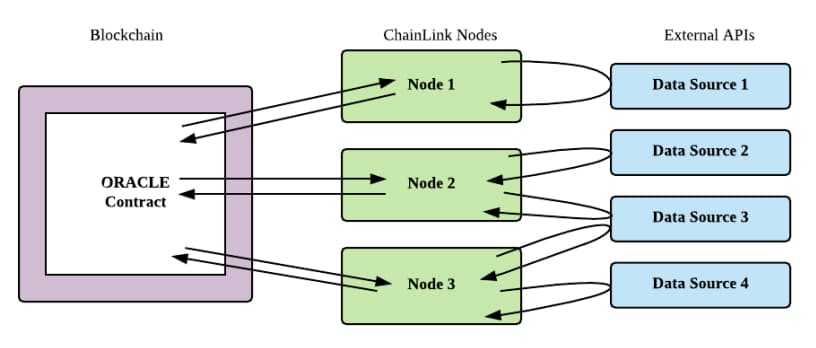

Chainlink’s decentralized nature and distinction from different oracle protocols are proven by the ideas of oracle distribution and supply distribution utilized by Chainlink. This decentralization helps Chainlink keep away from centralization and different safety points.

Supply distribution and oracle distribution are the keys to the safety and decentralization of the oracle community. Supply distribution is the idea that causes oracles to tug their information from quite a lot of sources. This helps them maintain community popularity. And oracle distribution is the idea that has information requests contracted to a number of oracles to take care of decentralization.

The above determine reveals the 2 stage distribution on the Chainlink community. Nonetheless, it helps to try a sensible instance.

Climate Utility

An organization creates a person referred to as the Sunshine Day Climate App. The person requires up-to-the minute climate information, and to get it there’s a request submitted to Chainlink. The matching oracle locates three completely different oracles to search out and transmit the wanted information, following the oracle distribution methodology to take care of a safe community.

As a result of the community additionally requires supply distribution every of the oracles will draw their information from completely different sources. We’ll name the oracles X,Y and Z. Oracle X will get its information from Accuweather and Wunderground.

Oracle Y will get its information from the Nationwide Climatic Knowledge Middle and Open Climate Map, whereas Oracle Z will get its information from the Nationwide Climate Service and the Nationwide Oceanic and Ambiance Administration.

With this oracle and supply distribution the community stays completely decentralized, and Sunshine Day Climate receives aggregated information from three respected oracles who all obtain their information from completely different sources.

One different good thing about this technique is that oracles are incentivized to stay trustworthy, since their reported information can be in contrast with the info from different oracles. If fraudulent information is reported the oracle would see its popularity sink, and will face different community imposed penalties.

Trusted Execution Environments

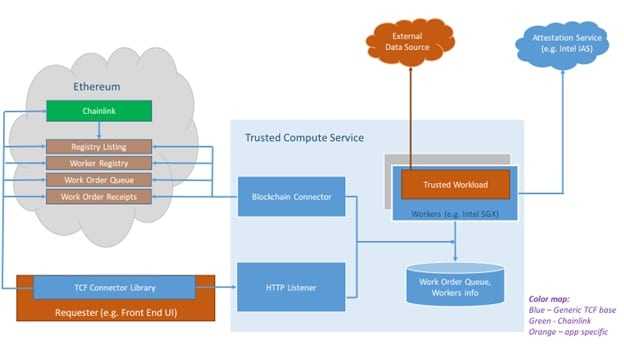

Trusted Execution Environments, or TEEs for oracles, have been added to Chainlink in late 2018 when City Crier was acquired by Chainlink.

Combining TEEs with decentralized computations provides Chainlink an added layer of safety for particular person node operators. TEEs confer the good thing about permitting all computations carried out by a node personal, even from the node operator themselves.

This will increase the general reliability of the oracle community as a result of it prevents any node from tampering with any of the computations carried out by them.

Chainlink Explorer

The Chainlink Explorer is the means to ensure all of this information is out there to customers. It was launched in Might 2019 together with the launch on the Ethereum mainnet and is designed to offer the perception into the perform of Chainlink nodes in two main dimensions:

- Detailed data relating to every node’s success of person requests. This contains each the off-chain exercise and the on-chain outcomes, and it provides the sensible contract builders essential information relating to how properly nodes and oracle networks are performing.

- Reliability and velocity information for each node linked to the explorer are aggregated for each on-chain and off-chain exercise. This permits the Chainlink builders to start to grasp how a popularity system would work inside the Chainlink community, with the speculation being derived from actual transaction information.

The Chainlink group is planning on increasing the capabilities of the explorer to offer deeper ranges of perception relating to the operation of every particular person node. This can embody numerous metrics about node reliability and velocity, which dApps and contracts have used a specific node, and information about every node’s success of commitments.

As actual transactions enhance on the mainnet the group expects to have an elevated quantity of verifiable proof for every oracle’s reliability, giving customers and elevated perception into oracle efficiency.

As soon as the group has been in a position to create a data-driven framework for customers to decide on node operators, they’ll be capable to divide the nodes into oracle networks that obtain decentralization.

To be able to attain this stage, the group is engaged on ranges of aggregation throughout oracle networks, seeking to present the wanted safety and effectivity anticipated from such oracle networks.

Threshold Signatures

One step on this path was a brand new method to the utilization of threshold signatures on Chainlink, which can enable the group to create oracle networks that may include 1000’s of nodes.

The principle good thing about this threshold signature setup is that it permits oracles to have their signatures verified on-chain which offers added safety and it does so in probably the most environment friendly method.

Making massive oracle networks environment friendly is a fascinating aim as a result of will probably be a most well-liked methodology for providing dependable inputs for high-value sensible contracts.

Good Contract Inputs

In addition to creating environment friendly, safe and extremely decentralized oracle networks, Chainlink can be attempting to change into the most important supply of sensible contract inputs and outputs.

One of many targets of reaching this state is to make sensible contract growth as speedy as net software growth is at this time. Just like the best way net builders are ready to attract from a big pool of APIs and information streams, sensible contract builders will even be capable to draw from a group of inputs and outputs, if the Chainlink group is profitable in reaching this aim.

This may make Chainlink the go-to blockchain for builders and sensible contracts to search out pre-made inputs and outputs that may quickly be applied in dApps or that may securely and simply settle for particular enter/output requests.

Since Chainlink is way forward of some other oracle community of its sort, reaching these targets might cement Chainlink’s place inside sensible contract growth and execution.ChainLink Use Instances

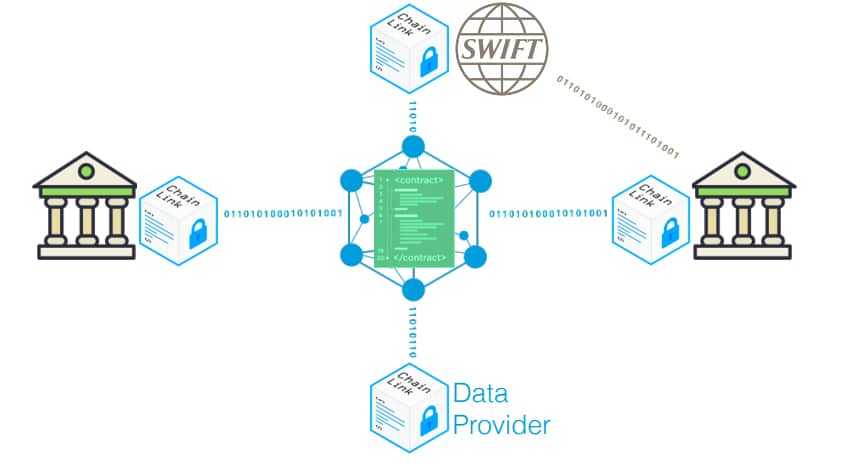

Fairly probably the most important constructive growth to date at ChainLink is its partnership with the SWIFT banking transaction community. Let’s face it, SWIFT is among the largest world monetary networks, and success with them might result in many different partnerships inside the finance trade from banks to fee processors to insurance coverage outfits.

Whereas SWIFT isn’t flat out utilizing Chainlink, it’s growing the SWIFT Good Oracle with the assistance of Chainlink, and that leaves it potential for integrations between the 2.

One other constructive is that Chainlink has little competitors, and even these which are engaged on blockchain oracle growth are far behind Chainlink.

However Chainlink has discovered its means into many different areas. Presently the highest three are decentralized finance, insurance coverage, and gaming. In case you’re eager about all of the completely different ways in which Chainlink is getting used you possibly can try the put up they put collectively “77 Smart Contract Use Cases Enabled by Chainlink”

Decentralized Finance (DeFi)

There are such a lot of conventional monetary merchandise that at the moment are being constructed on blockchains. These embody lending and borrowing, derivatives, interest-bearing instances, and rather more. These monetary merchandise get the good thing about added transparency and safety by being placed on the blockchain, whereas additionally turning into extra accessible to everybody.

DeFi purposes are utilizing Chainlink to entry present costs and rates of interest, to confirm collateralization, and lots of different instances that enable DeFi purposes to hold out features equivalent to settling an choices contract, concern dividends robotically, or concern a mortgage at present truthful market charges.

Gaming

Just lately builders have begun releasing gaming purposes based mostly on sensible contract applied sciences. One of many issues most video games want is a supply of randomness for in-game situations or to find out the winner of a contest. Chainlink’s VRF answer delivers precisely the kind of randomness wanted, and it delivers it to the sensible contract in order that it may be confirmed truthful and unbiased since nobody, not even the builders, can tamper with the randomness.

Insurance coverage

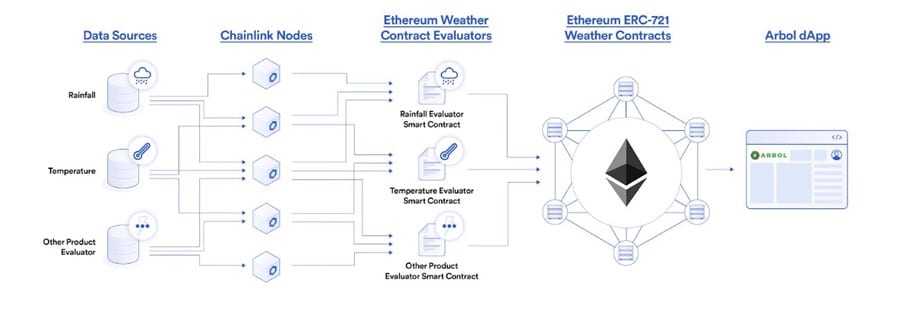

Insurance coverage is one space that can be benefitting from blockchain know-how and Chainlink’s oracles. The place sensible contracts are used to create parametric insurance coverage contracts, Chainlink is used to offer information for these contracts.

For instance, Chainlink is used to offer climate information to the Arbol crop insurance coverage market, and in consequence farmers in every single place on the planet can get hold of parametric crop insurance coverage as long as they’ve an web connection. These insurance policies are then settled in a good and well timed method in response to the quantity of rainfall, temperature, or different evaluators the coverage is ready to (e.g. if it rains greater than x quantity this yr, pay out y settlement).

Conventional Techniques

Among the different main use instances for Chainlink are in offering information to extra conventional retailers equivalent to web sites, IoT networks, and information suppliers. Chainlink permits enterprises a solution to make their information obtainable to blockchain networks as properly. As a result of Chainlink is blockchain agnostic its oracles are the proper integration gateway to attach digital information or infrastructure to any blockchain in any respect. In truth, an trade commonplace framework for utilizing oracle networks to attach conventional methods was lately offered to the World Financial Discussion board. Chainlink could possibly be the proper answer for this commonplace.

These are only a few of the numerous, many use instances that Chainlink offers for permitting sensible contracts to work together with exterior information and methods securely and reliably. Finally oracle networks like Chainlink allow much more use instances for blockchain based mostly sensible contract dApps.

Chainlink has grown into probably the most extensively used decentralized oracle answer all through each rising sensible contract vertical, together with DeFi, insurance coverage, gaming, NFTs, and extra. The increasing suite of decentralized companies obtainable on the Chainlink Community is fueling innovation throughout quite a few main blockchains, offering builders with an array of key oracle features:

- Chainlink Worth Feeds present an in depth assortment of on-chain monetary market information for a broad array of property, which is used to safe billions of {dollars} for main DeFi purposes like Aave, Synthetix, and dYdX.

- Chainlink VRF generates verifiable randomness backed by on-chain cryptographic proofs, enabling tasks like Aavegotchi to mint NFTs with provably uncommon attributes and PoolTogether to pretty choose winners in its no-loss lottery.

- Chainlink Proof of Reserve provides on-chain information feeds that allow sensible contracts to carry out on-demand audits of tokenized asset reserves, equivalent to for stablecoins like TUSD and PAX and cross-chain tokens.

- Chainlink Exterior Adapters give builders the instruments to create connections to any off-chain useful resource or API, leveraged by Arbol’s parametric crop insurance coverage market to fetch climate information and Everpedia’s prediction market customers to get U.S. election outcomes.

The Chainlink Community has achieved an expansive community impact via widespread adoption within the decentralized oracle market and is already securing billions in on-chain worth. Whereas it’s been no small feat to get thus far, we’ve got solely scratched the floor of what’s potential with decentralized oracle networks and the sensible contracts they assist.

Chainlink’s Future

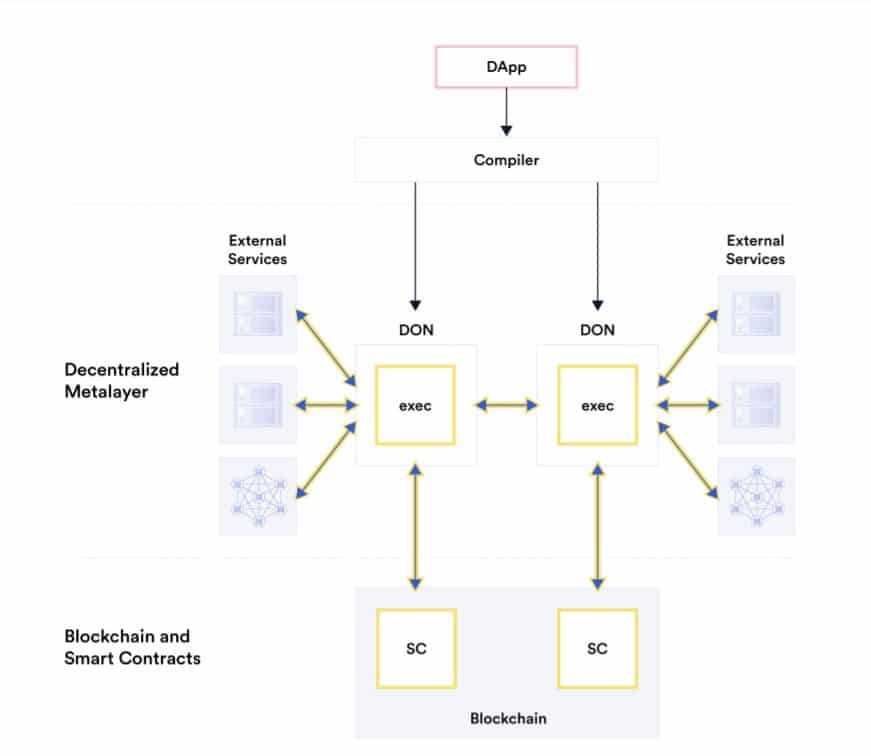

Chainlink has not merely been sitting nonetheless. In April 2021 they launched a brand new whitepaper entitled Chainlink 2.0: Subsequent Steps within the Evolution of Decentralized Oracle Networks. The whitepaper describes how Chainlink plans so as to add a decentralized metalayer that can make sensible contracts even higher by making them extremely scalable and confidential, whereas additionally including safe strategies of off-chain computation.

One of many keys to the whitepaper is the introduction of a brand new structure the place the decentralized oracles of Chainlink can ship key capabilities to sensible contracts that blockchains are unable to offer. This new structure permits for hybrid sensible contracts which function an off-chain computation layer. This layer depends on the blockchain for safety, but additionally operates with the scalability, function richness, and connectedness of an off-chain system.

On account of this new abstraction layer Chainlink can assist a rising variety of decentralized companies, that are able to delivering an ever bigger variety of use instances, whereas serving to an bigger variety of customers.

Redefining the Perform of Decentralized Oracle Networks

The unique Chainlink whitepaper launched the idea of decentralized oracle networks, giving builders a solution to feed exterior information into blockchains in a safe and dependable method. Within the Chainlink 2.0 whitepaper the builders recommend a framework that mixes numerous interoperating Decentralized Oracle Networks (DONs), every consisting of a group of nodes able to bi-directional information switch and decentralized off-chain computation. It’s just like layer-2 know-how, with the Chainlink DONs anchored to an present blockchain which permits for the synching of knowledge outputs and the computation of state adjustments off-chain. It additionally permits for the creation of guardrails to implement the correctness of oracle stories and the arbitration of off-chain oracle disputes.

It is a extra superior sort of off-chain computation which the Chainlink builders imagine will enable DONs to offer a blockchain agnostic gateway for sensible contracts whereby they not solely have the power to entry off-chain information, but additionally achieve an off-chain computing surroundings. This may be extraordinarily worthwhile since it’s going to enable a blockchain to execute code it couldn’t in any other case because of constraints equivalent to price, privateness, velocity, or just technical limitations.

This superior answer will enable DONs in Chainlink to function as a safe full-stack answer, and supply for the creation of hybrid sensible contracts counting on a mixture of on-chain code and off-chain computations. This hybrid development will enable sensible contracts to realize critical upgrades in each confidentiality and scalability, which in flip is predicted to extend the large-scale adoption of blockchain know-how.

How Chainlink DONs Will Energy DeFi and the Wider Good Contract Economic system

As soon as Chainlink is upgraded to DONs will probably be in a position to assist numerous decentralized companies that use its subsequent technology sensible contract development. Plus, the companies that at present run on the Chainlink Community will even be enhanced by the benefits created by the DONs. Under is a short itemizing of the superior decentralized companies that can be made potential by DONs:

- Hybrid Good Contracts which are seamlessly linked to all essential off-chain assets, whereas retaining elevated ranges of privateness and being secured by your most well-liked blockchain or layer 2.

- Enhanced Chainlink Knowledge Feeds that present higher-frequency updates, privacy-preserving queries, and multi-blockchain supply, all of which decrease prices and empower DeFi purposes like derivatives protocols and enterprise options with an much more safe and dependable supply of exterior information. Chainlink Knowledge Feeds are already being made extra scalable via OCR.

- Enhanced Chainlink VRF with enhanced safety, cryptoeconomic safety, and cost-efficiency to assist safer gaming, NFT minting, and some other purposes that require a safe supply of randomness for end-to-end safety.

- Chainlink Keepers that present decentralized and extremely dependable automated upkeep of key sensible contract features like harvesting yield and triggering liquidations, at present being primed for manufacturing and examined by high tasks.

- Chainlink Truthful Sequencing Providers (FSS) that use DONs to order person transactions on a blockchain as a way of mitigating front-running, back-running, and different associated assaults, in addition to different kinds of transactions like oracle report transmission attributable to miner-extractable worth (MEV).

- Chainlink Decentralized Identification wherein privacy-preserving oracle protocols interoperate with present methods in a backwards-compatible method to open up new use instances like on-chain credit-based lending.

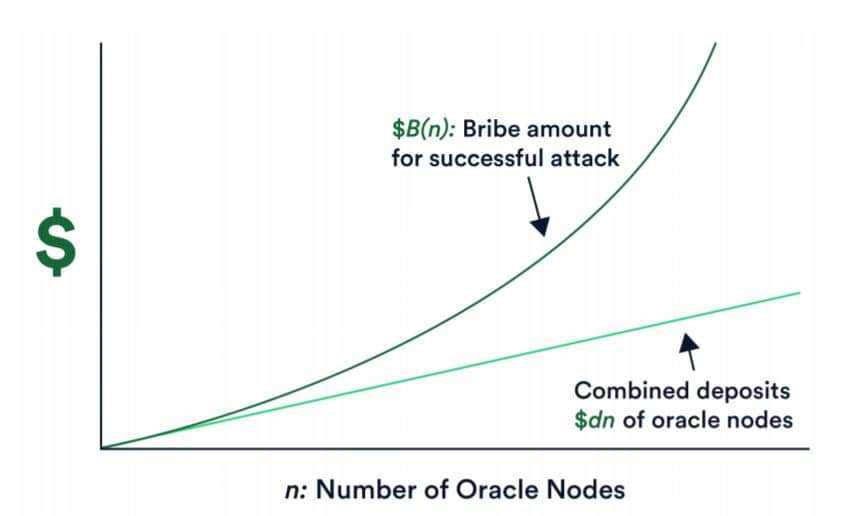

Chainlink Cryptoeconomic Safety (Tremendous-Linear Staking)

One other new idea launched within the Chainlink 2.0 whitepaper is that of super-linear staking. It is a main enhancement to the design of the staking mechanism. In super-linear staking an attacker would wish to have assets that are larger than the mixed safety deposits of all of the DON nodes. Additionally included are a concentrated alerter system and a two-tier adjudication system that present larger cryptoeconomic safety ensures when put next with different methods.

The preliminary beta model of Chainlink staking (v0.1) was launched in December 2022, and it consisted of a 25 million LINK staking pool that supported the cryptoeconomic safety of the ETH/USD information feed on Ethereum. The subsequent iteration (v0.2) is ready to launch within the fourth quarter of 2023, with an preliminary expanded pool measurement of 45 million LINK.

The launch of the v0.2 beta improve will progressively develop entry to a broader scope of members, beginning with a precedence migration interval for present v0.1 stakers earlier than getting into early entry after which common entry.

For extra data on super-linear staking and the opposite types of cryptoeconomic safety being developed, confer with Part 9 of the whitepaper.

ChainLink Partnerships

The partnerships that ChainLink has cast are part of its power as properly. The SWIFT partnership is the most important, however it isn’t the one strong partnership already fashioned by ChainLink.

It’s fascinating as a result of it appears the group behind Chainlink has targeted on constructing partnerships somewhat than on advertising and marketing, and that’s a big a part of the explanation the coin goes unnoticed by many cryptocurrency fanatics. The next are the most important Chainlink partnerships up to now:

- SWIFT: Chainlink and Swift lately concluded blockchain interoperability assessments that revolved round linking conventional monetary property with blockchain networks. SWIFT mentioned in a launch that the assessments demonstrated a “secure and scalable way to connect multiple blockchains for movement of tokenised assets around the world.” World banking giants equivalent to Citi, BNY Mellon, Lloyds and ANZ, amongst others, have been a part of the experiments.

- Zeppelin OS: An working system that was developed particularly for creating sensible contracts;

- Request Community: An trade platform that goals to be the usual for exchanging fiat and cryptocurrencies;

- Sign Capital: A London based mostly personal asset agency.

Chainlink has been extraordinarily energetic in including new companions and node operators for the reason that launch on the Ethereum mainnet. It appears as if hardly a day or two goes by with no new announcement of a companion becoming a member of to run a Chainlink node.

All of this has been extraordinarily constructive for Chainlink, rising the adoption of the blockchain even because the group continues specializing in growth somewhat than advertising and marketing. It seems that Chainlink markets itself, and new companions come on the lookout for Chainlink somewhat than the opposite means round.

That’s signal for any sort of enterprise…

LINK Token

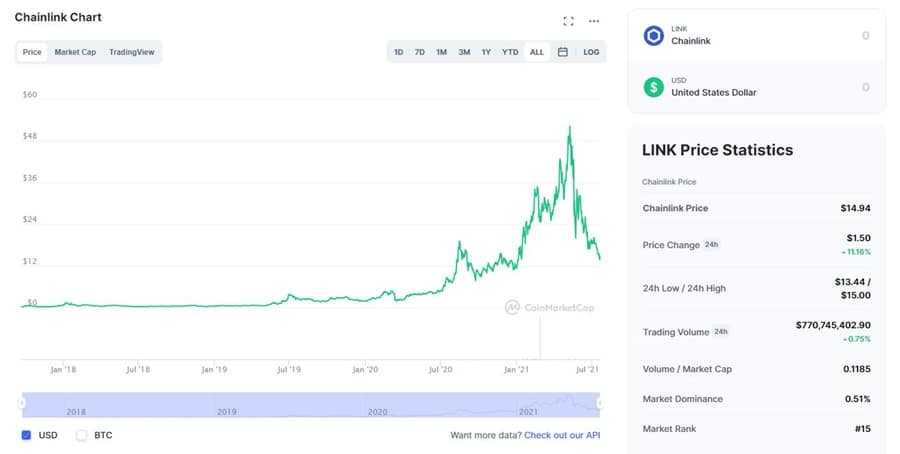

The LINK token rallied strongly proper after its ICO and by October 2017 it reached $0.47. After dropping from that prime it rallied once more in December 2017 and January 2018 together with the remainder of the cryptocurrency markets, hitting a excessive of $1.35 in January 2018.

It dropped in 2018 together with the remainder of the market, hitting a low of $0.1647 on the finish of June, however by September 18, 2018 it recovered and was buying and selling at $0.2872 and was the fiftieth largest coin by market cap, with a market cap of $100,530,182.

From September 2018 via Might 2019 the worth of LINK remained roughly between $0.25 and $0.50 because the crypto markets started a sluggish restoration. Might 2019 is when the worth took off once more as buyers have been inspired by the launch of Chainlink on the Ethereum mainnet. By June 29, 2019 it was buying and selling as much as $4.54, nevertheless it pulled again to the $1.60 space by September 2019.

The positive aspects weren’t completed nevertheless as worth rallied as soon as extra to $18.80 in August 2020. There was a drop to the $10-12 vary for the remainder of 2020 after which the large 2021 rally started, taking LINK to an all-time excessive of $52,88 on Might 10, 2021. After hitting that prime worth retreated dramatically, and as of late July 2021 LINK is buying and selling again at $14.94.

Shopping for & Storing LINK

Previously, if you happen to wished to buy LINK your self you wanted to take action with BTC or ETH as there have been no fiat purchases obtainable for the token. Nonetheless, it was lately added on Coinbase, and may now be bought there utilizing USD.

Binance remains to be the perfect trade to buy LINK from although as the majority of the buying and selling quantity is on that trade. You may also purchase at Huobi, OKEx, and Mercatox in addition to dozens of different small and medium-sized exchanges.

When it comes to LINK liquidity, it’s fairly properly unfold out throughout the entire exchanges the place it’s listed. This implies that you’re not depending on the liquidity from any single trade which additional reduces the danger.

Trying on the particular person orders books on the likes of Binance, they’re fairly deep and there’s a cheap stage of turnover. Which means that you’ll be capable to place massive block orders with out a lot worth slippage.

After getting your LINK tokens you’ll want to maintain them in an offline pockets. Give that these are ERC20 tokens any pockets that helps Ethereum will do. These embody wallets equivalent to MetaMask or MyEtherWallet.

Conclusion

The Chainlink undertaking isn’t the simplest to come back to grips with, however when you do it’s simple to see the way it can profit the blockchain ecosystem massively going ahead. Blockchains by themselves are very restricted, and so they require oracles to unlock their full potential. As a result of Chainlink is among the few tasks engaged on oracle growth they may simply change into an trade chief for years to come back.

The unique whitepaper is a long-term, multi-year view of how Chainlink will evolve. Nonetheless with the discharge of the two.0 model of the whitepaper we’ve got a imaginative and prescient for the undertaking that extends for a decade or extra.

This formidable imaginative and prescient for the Chainlink Community can be applied incrementally with new decentralized companies being launched in parallel, so we will formally analyze the safety impression of this huge array of latest oracle functionalities.

We’re assured that Chainlink will allow sensible contracts to take the following main leap of their evolution, powered by a hybrid on-chain/off-chain structure. Simply as Chainlink’s safe information oracles have unlocked innovation throughout the DeFi ecosystem, Chainlink 2.0’s expanded Decentralized Oracle Networks will empower hybrid sensible contract builders to construct the scalable and privacy-preserving decentralized purposes that mainstream customers have been ready for.