Some days I really feel like I’ve the very best job on the planet, writing for the Coin Bureau. I get to cowl some inspiring tasks like mind-blowing metaverses. I get to indicate our readers the very best locations to earn excessive APYs on their crypto holdings, carry out an in-depth evaluation on why Bitcoin is an effective inflation hedge and extra.

If I might help deliver only one individual into crypto, and do my half in serving to of us combat inflation, earn more cash, or uncover cool tasks, then I think about it a mission success.

Although crypto isn’t all about swelling our moon baggage and enjoying video games, typically there’s adulting that must be carried out. So every now and then, I placed on my old-man pants, tighten my suspenders, begin referring to my canine as a younger whippersnapper, and write articles about taxes and crypto charges.

However hey, these issues are essential too! The world of crypto charges could be a harmful place, full of costly classes to be realized if one doesn’t do their homework beforehand.

As you’re studying this text, I’m assuming you’re right here for one of many following causes:

- You’re doing the good factor and making an attempt to be taught as a lot as you may earlier than diving into crypto.

- You’ve FOMO’d in like a real crypto degenerate and bought your socks knocked off by insane charges and at the moment are questioning what the heck occurred! (That was me after I first found Ethereum)

- You’re already in crypto and simply right here to proceed your unending quest on the trail to crypto academic mastery.

No matter what brings you right here right this moment, I hope that by the top of this text, you’ll stroll away with a greater understanding of community charges and how one can hopefully keep away from nasty surprises.

Disclaimer: I maintain lots of the crypto property talked about on this article as a part of my private crypto portfolio.

What are Crypto Networks?

The crypto neighborhood appear to like synonyms. You could hear phrases just like the Bitcoin blockchain, the Bitcoin community, and the Bitcoin protocol; these primarily discuss with the identical factor: the blockchain community that the Bitcoin protocol runs on.

The identical goes for different networks/protocols/blockchains like Ethereum, Binance Good Chain, Cardano, Avalanche, Algorand, Solana and so on. So there are dozens of completely different networks and tens of 1000’s of various tokens operating on all these networks.

What on Earth am I speaking about with all these networks? Isn’t all of it simply crypto?

To be blunt, no. That is the place issues can get complicated. If in case you have solely ever held and traded crypto on a centralized change corresponding to Binance, then crypto could seem easy.

However, in actuality, there are base layer protocols, cost protocols, privateness cash, good contract networks, scaling networks, oracles, interoperability tasks, DAGs, DAOs, stablecoins, lending tokens, tokens for content material monetization, file storage tasks, mesh networking, power tasks, video streaming tasks, and significantly numerous different tasks and protocols which are usually completely completely different. It’s sufficient to make one’s head spin!

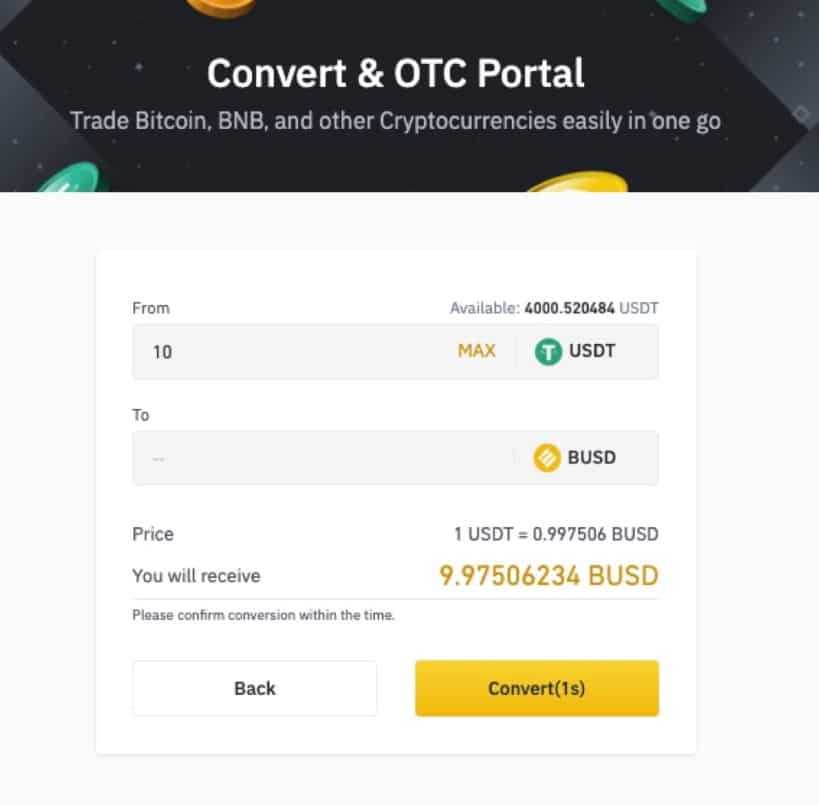

Customers can swap and commerce utterly completely different property from completely different protocols/networks like Bitcoin for Ethereum with no drawback on centralised exchanges. That is actually handy as customers can shuffle crypto property round like a pack of playing cards and never take into consideration what is going on on the underlying networks.

When exchanging crypto on an change, you aren’t magically turning your Bitcoin into Ethereum; that isn’t attainable. What is definitely taking place behind the scenes is that the Bitcoin is being offered, and the funds are getting used to purchase Ethereum.

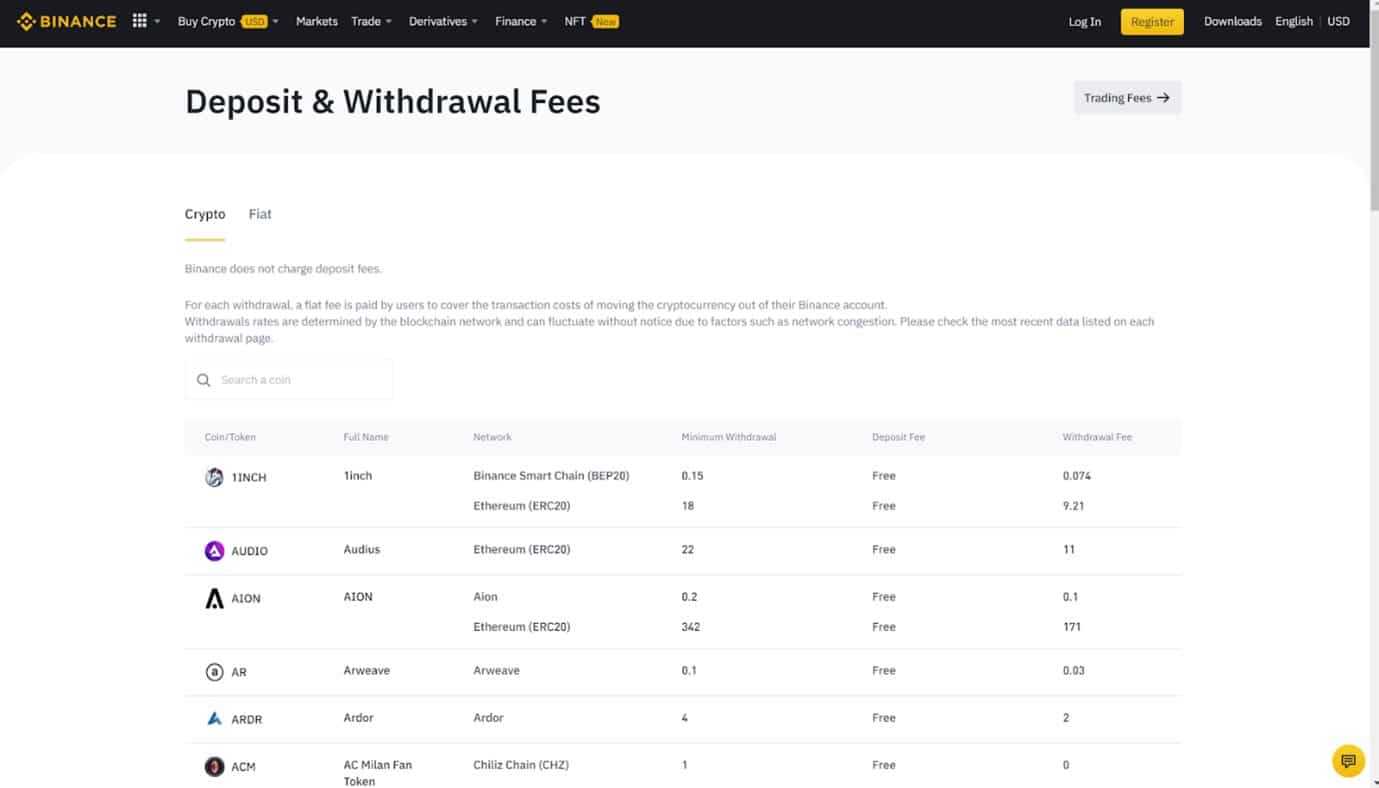

The shopping for and promoting of those property will incur community charges that the change takes care of behind the scenes. The consumer is solely being charged a transaction charge by the change firm. Transaction charges and community charges are completely different. Whereas the terminology could change barely relying on the change or platform and is typically used interchangeably, sometimes, transaction charges go to the change or platform. Community charges go to the underlying community and are paid to the community miners and validators. Extra on them later.

Customers could not at all times see a community charge on a centralized change, however these will grow to be essential when shifting crypto off of an change when trying to self-custody, getting concerned with Decentralized exchanges like Uniswap or different DeFi platforms, mint NFTs and so on.

After I stated that it was unattainable to swap and switch Bitcoin into Ethereum, enable me to elucidate what I imply.

Every native cryptocurrency can solely run and exist solely by itself community, and every cryptocurrency protocol is completely different. Bitcoin runs on the Bitcoin community, Ethereum runs on the Ethereum community, Solana runs on the Solana community, and so on.

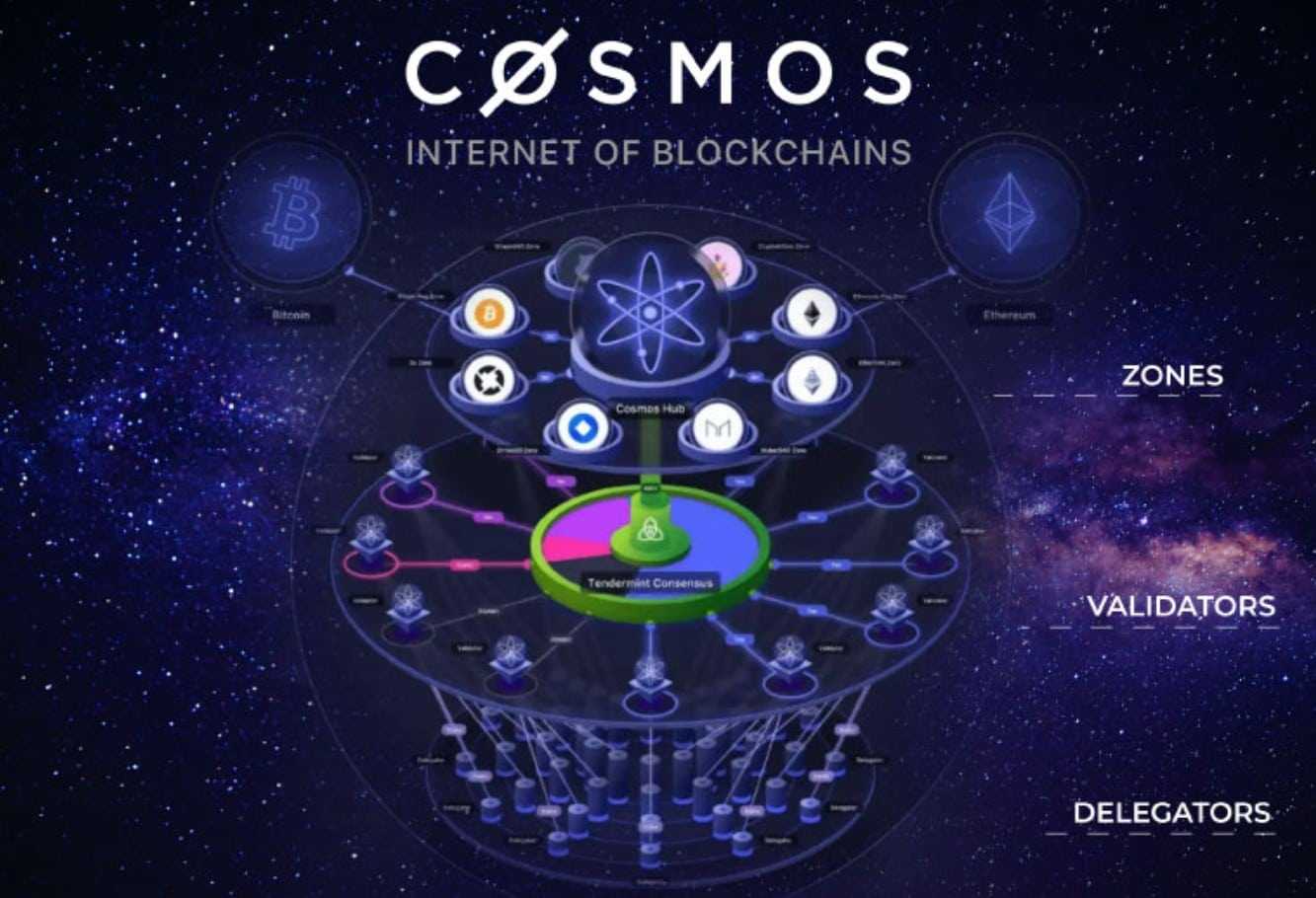

There are issues like cross-chain bridges, wrapped tokens, wormholes, and tasks like ThorChain, Cosmos, and Polkadot that present cross-chain capabilities, however for the simplicity of this text, let’s take it again to fundamentals. I take advantage of Bitcoin and Ethereum for instance, however these similar ideas apply to any crypto-asset that runs on completely different networks.

Cryptocurrency networks don’t play effectively with one another. Belongings like Bitcoin and Ethereum are like trains operating on their very own tracks. Simply as a prepare can not hop off its monitor and onto one other monitor, neither can cryptocurrencies. Every crypto community is basically its personal monitor and doesn’t cross with different community tracks, so Bitcoin by no means leaves the Bitcoin community, Ethereum by no means leaves the Ethereum community, and neither Bitcoin nor Ethereum can run on different networks except it’s a “wrapped” model of the asset.

I discover it helps to visualise this. The Bitcoin community is barely residence to Bitcoin like this:

The Ethereum community is barely residence to Ethereum and Ethereum based mostly ERC20 tokens like this:

Cryptocurrency networks don’t work like this:

The picture above makes it appear like crypto tokens are interchangeable and interoperable, all flowing seamlessly on the identical community, which isn’t the case. Nevertheless, that is the eventual purpose that tasks like Polkadot and Cosmos are attempting to attain, as that is the interoperable crypto future all of us dream of, and it could be nice if all crypto networks had been sometime linked however we’re seemingly a few years away from that.

In case you by no means plan to ship your funds off of the change the place you acquire them, you don’t really want to fret about these things. However for those who ever determine that you simply need to self-custody your crypto, ship it to different exchanges, wallets, platforms, or become involved within the fantastic world of DeFi, then you’re going to need to concentrate and ensure you don’t ship a token on the incorrect community, as that might end in a everlasting lack of funds in some instances.

Community Charges

As talked about, typically the change or platform will cowl the community charge, however anytime you’re sending crypto from a pockets, DeFi protocol/change, or anytime when there is no such thing as a centralized authority concerned, you’ll seemingly encounter a community charge, additionally typically referred to as a transaction charge simply to confuse everybody.

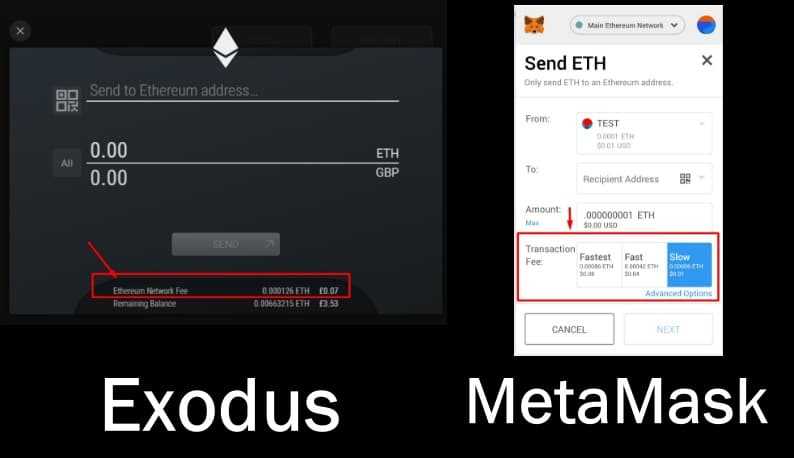

Right here’s what I imply, two very talked-about self-custodial wallets are the MetaMask pockets and the Exodus pockets. One refers back to the Ethereum charge as a community charge. The opposite is a transaction charge (come on, Metamask!). I discussed how the crypto neighborhood loves synonyms, which can also be usually referred to as a Gasoline charge. I can be explaining gasoline charges afterward.

The community charges you have to to pay will range relying on the community. For instance, when somebody desires to ship Bitcoin, the community charge is paid in Bitcoin. When somebody desires to ship Ethereum, the charge will get paid in Ethereum. Solana is paid in Solana, Cardano is paid in Cardano, and so forth, which is sensible. You may consider a blockchain’s native asset as just like gas, aka gasoline, as it’s referred to as for Ethereum. It’s that gasoline/gas wanted to energy transactions for any token that runs on that community.

The place it may well get complicated is that there are tens of 1000’s of tokens constructed on some networks that use the identical metaphorical railway. Ethereum is the most important and most advanced ecosystem, and instance of this. Tokens corresponding to Chainlink (LINK), Decentraland (MANA), The Sandbox (SAND), Uniswap(UNI), stablecoins like USDT and USDC and 1000’s of others additionally run on the Ethereum community, so ERC20 tokens (AKA Ethereum based mostly tokens) do not need their very own community, they run on the Ethereum community. Due to that, customers must pay community charges in Ethereum, as Ethereum is the “fuel/gas” wanted to ship any one of many 1000’s of Ethereum based mostly property.

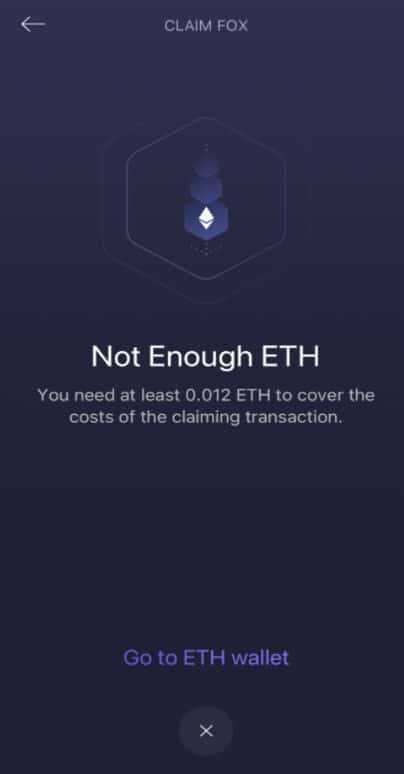

Chainlink was one of many first crypto property I ever bought. Nevertheless, the primary time I attempted to ship it to a pockets, I used to be hit with an error message saying, “You don’t have enough Ethereum!” which I discovered complicated as I used to be making an attempt to ship Chainlink, not Ethereum? I didn’t perceive why I wanted ETH, so I used to be met with a message similar to the one under:

I keep in mind the loopy quantity of shock that existed through the 2021 bull run from many new customers to the crypto business who didn’t perceive Ethereum gasoline charges.

Individuals had been writing scathingly destructive evaluations about crypto pockets corporations everywhere in the web because the Ethereum gasoline charges had been skyrocketing to tons of of {dollars}, and other people had been mistakenly considering that the pockets corporations and crypto platforms had been charging these charges. There have been threats of lawsuits; it was chaos. Individuals didn’t perceive that these charges had nothing to do with the crypto pockets firm or decentralized platform; these charges had been despatched completely to the Ethereum community miners who had been coping with file ranges of visitors on the Eth community.

Now, in fact, I do know, and so do you, that you should maintain Ethereum for gasoline to pay the community charges for any Ethereum based mostly ERC20 token.

The identical goes for the Solana community, BSC, Cardano and so on. At any time when a community has a local token, the native token must be held as gas to cowl the community charges. So subsequent time you go to ship an asset like PancakeSwap (CAKE), you’ll know that the charge must be paid in BNB token, or any Polygon tokens must be fuelled by holding the MATIC token and so on. These community charges are paid routinely, so you should ensure you are holding a few of the native tokens in your pockets, and you’re good to go.

There are a number of exceptions to this rule. Some crypto ecosystems run a two token sort system the place one token is used to cowl charges on the community. The outstanding examples of this are VeChain which has charges that must be paid in VeThor. Theta, which has charges that must be paid in Theta Gasoline. Neo, which has charges that must be paid in Gasoline. And Ontology has charges that must be paid in Ontology Gasoline.

Why are There Community Charges?

I do know charges could be a royal ache and no one likes paying them, however no one desires to work totally free. Charges are how we pay for handy providers to be supplied that make our lives higher. We pay charges to take pleasure in Netflix, charges to take pleasure in Spotify, charges for meals and shelter and so on., and we pay charges to make use of Cryptocurrency as effectively.

Practically each transaction recorded on the blockchain will incur a community charge. It doesn’t matter if you’re utilizing the Ethereum community, Bitcoin community, Ripple, Cardano, Solana, Polkadot, or one of many different networks.

A few blockchain networks enable fee-free transactions that can be lined afterward, however for essentially the most half, simply anticipate that community/gasoline charges can be a part of life within the crypto world. However, hey, I’d moderately pay crypto charges than financial institution charges any day!

Crypto charges aren’t at all times a foul factor as somebody must pay for the work being carried out by the community miners and validators who run the machines, nodes, and protocols that validate and make sure transactions and safe the community.

Miners and Validators are the unsung heroes, the workhorses that assist the blockchain infrastructure, and I don't thoughts paying them for his or her work. If it weren't for them, crypto couldn't be used!

The place do the Charges go?

While you ship a crypto asset to a pockets or an change, for Proof-of-Work-based property like Bitcoin, the transactions must undergo a community/blockchain/Bitcoin miner.

I'll skip the technical jargon to keep away from boring you. I wouldn't even perceive the technical stuff myself. Miners are mainly computer systems devoted to the community that clear up advanced algorithms to validate all transactions and prohibit fraudulent transactions or double-spend assaults.

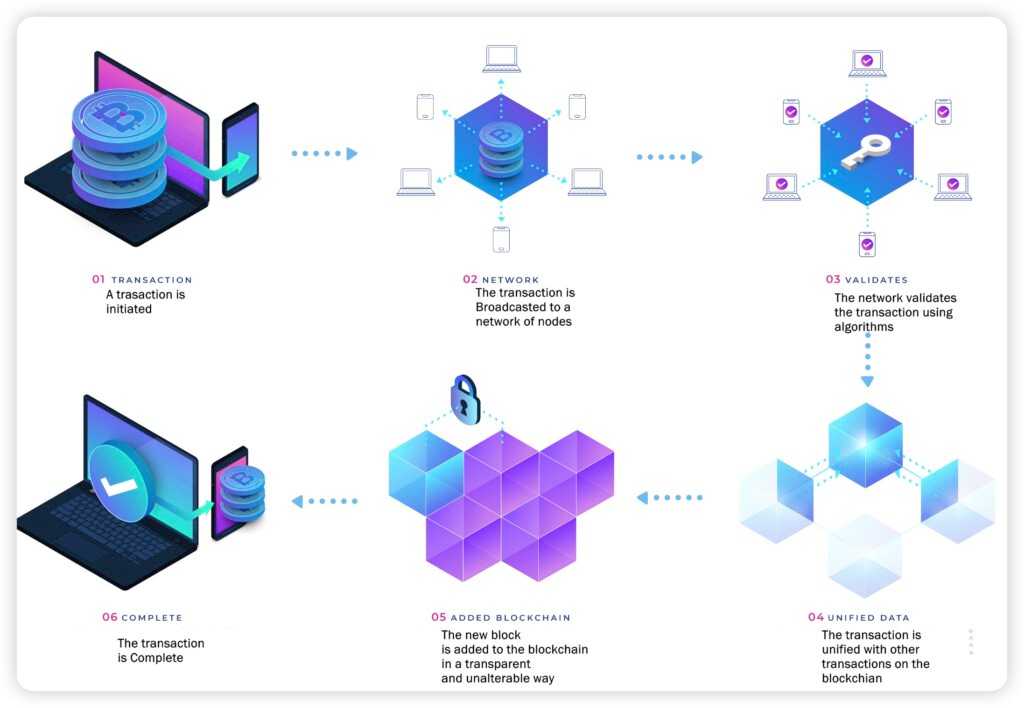

When somebody sends Bitcoin, they create a cryptographically safe transaction broadcasted by way of the web on the Bitcoin community, which is picked up by the community of Bitcoin miners. The miners accumulate as many transactions as can match right into a block. Then their computer systems go to work, going by way of a mathematical course of to confirm the block and add it to the chain of previous blocks, therefore the "blockchain." Right here is how that appears:

Miners get rewarded by way of freshly minted tokens for contributing their computing sources to the community. There’s a variety of computing energy wanted to course of crypto transactions. The sources to take action may be fairly expensive, so the community charge for crypto transactions goes to the oldsters who run these computer systems so we will ship our beloved Proof-of-Work cryptocurrencies.

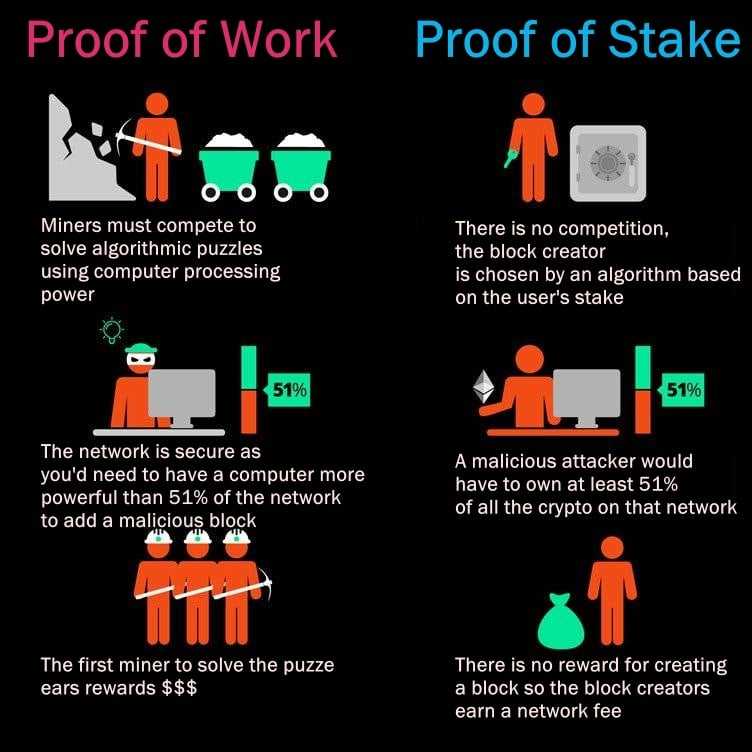

This course of varies quite a bit relying on whether or not the token makes use of a Proof-of-Work, Proof-of-Stake, or one of many different consensus mechanisms. Sadly, I can not cowl all of them, however as Proof-of-Stake may be very widespread, and Ethereum will quickly be merging to Proof-of-Stake, we should always cowl that one as effectively. Some cryptocurrencies that use Proof-of-Stake or a variation are Cardano, Solana, Tezos, Avalanche, Algorand, and lots of others.

Proof-of-Stake cryptocurrencies enable homeowners of a crypto asset to stake cash and create their very own validator nodes. Staking is the method of pledging your cash for use to confirm transactions. When somebody stakes their crypto, these funds are locked up at some point of the staking course of, which varies relying on the asset.

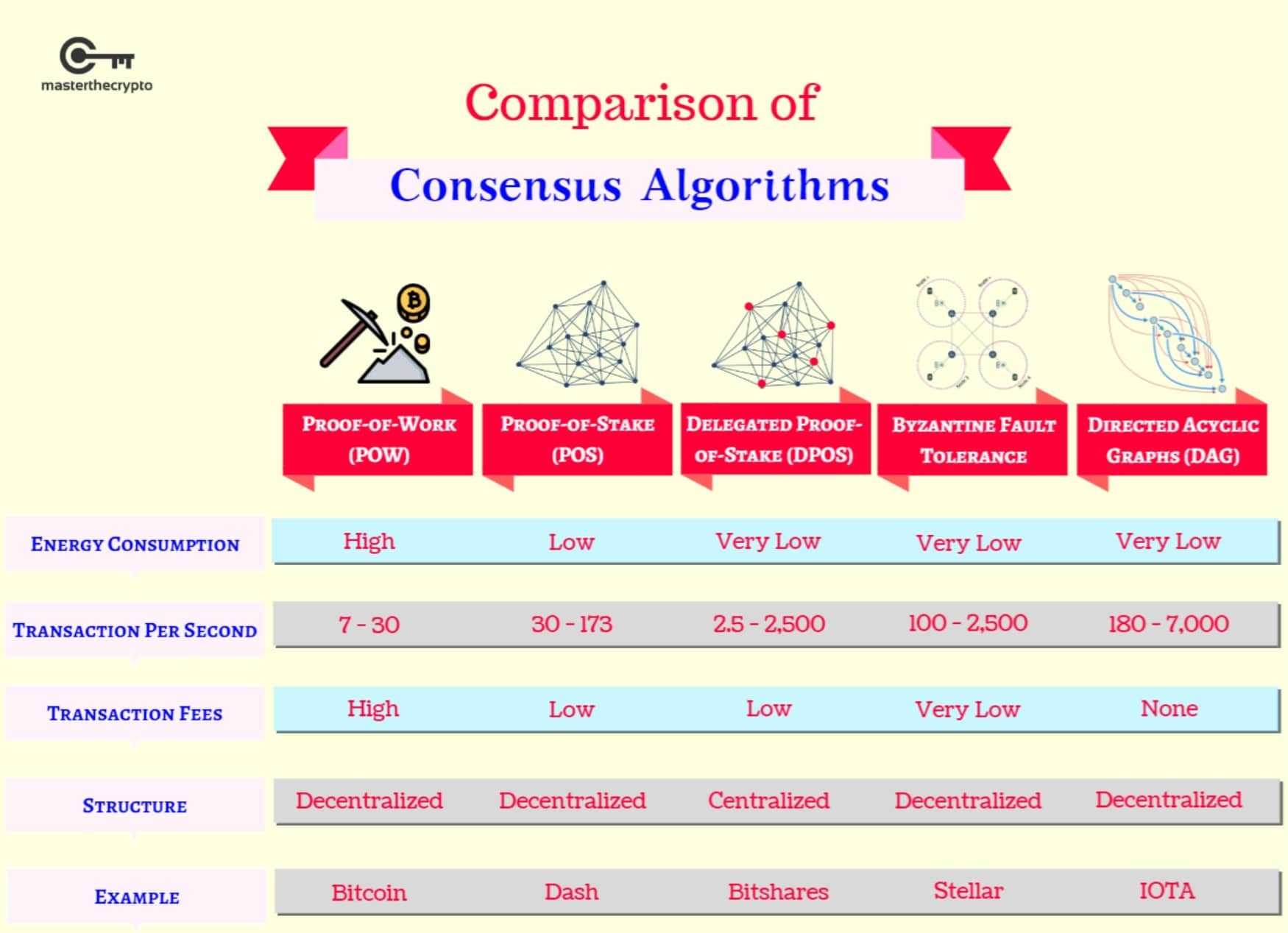

When a block of transactions is able to be processed, the Proof-of-Stake protocol will select a validator node to evaluate the block. The validator checks if the transactions are correct, and if they’re, that block will get added to the blockchain and the validator node that validated and processed the transaction receives rewards for its contribution. These rewards are made up by the community charges that associate with transactions. Proof-of-Stake transactions require a lot much less computational energy, so due to this fact the transaction charges are usually considerably decrease. Here’s a have a look at how a few of the completely different consensus mechanisms evaluate:

Solana, Algorand, and Avalanche easy transactions may be despatched for fractions of a cent when community exercise is low, making these among the many least expensive PoS crypto networks. Nevertheless, advanced transactions on Avalanche have been reported as creeping above $10.

What Influences Transaction Charges?

Simply as not all blockchains are created equal, neither are community charges. Charges largely rely on community congestion, consensus mechanism, block sizes and so on. You may be taught extra concerning the completely different consensus mechanisms mostly utilized in Man's video on Crypto Consensus Strategies.

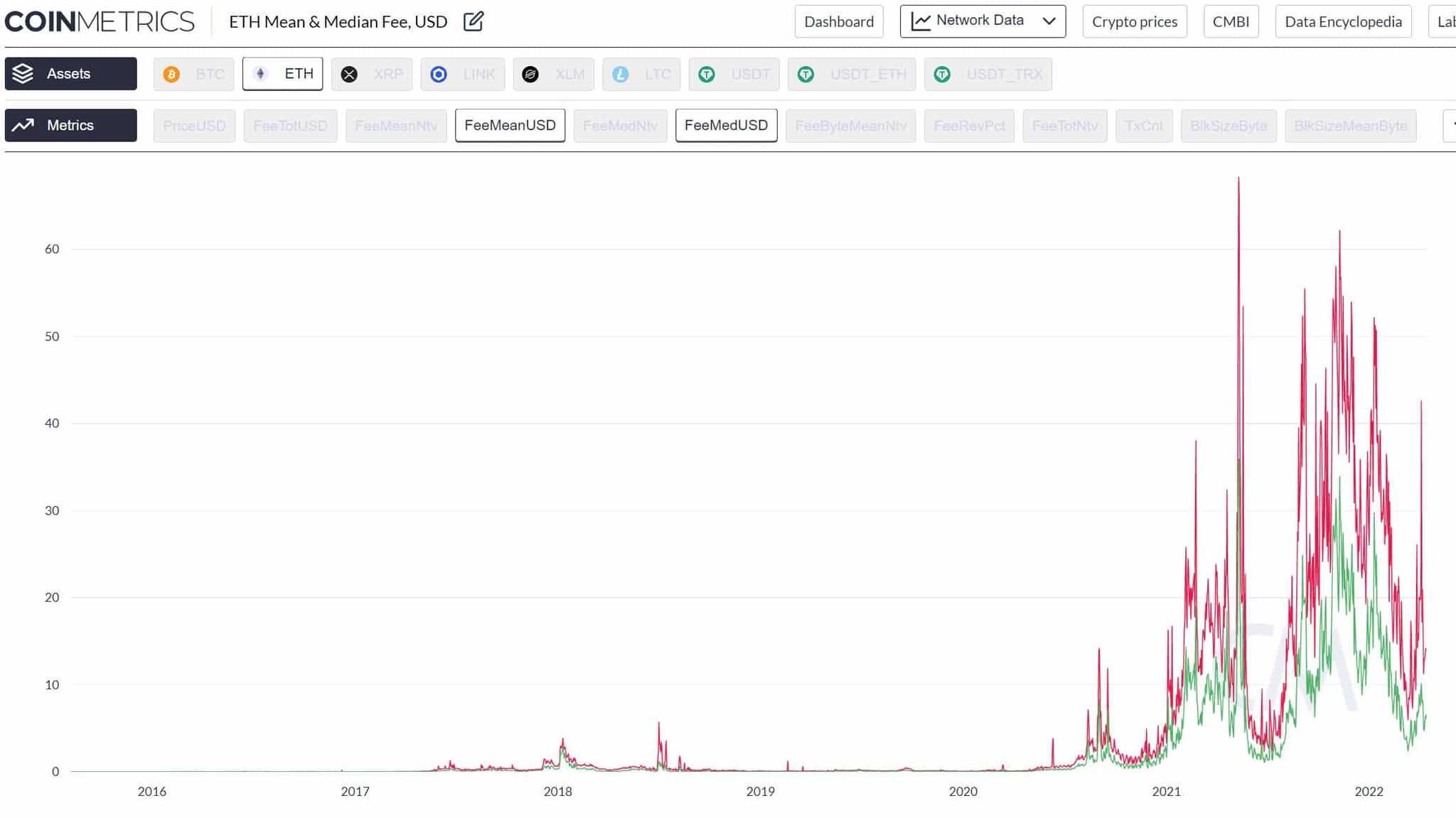

Charges can range massively for tokens like Bitcoin and Ethereum. I'm speaking tons of of {dollars} for Ethereum particularly. I've paid for transactions as little as a number of cents and have seen transactions go for $300 or extra!

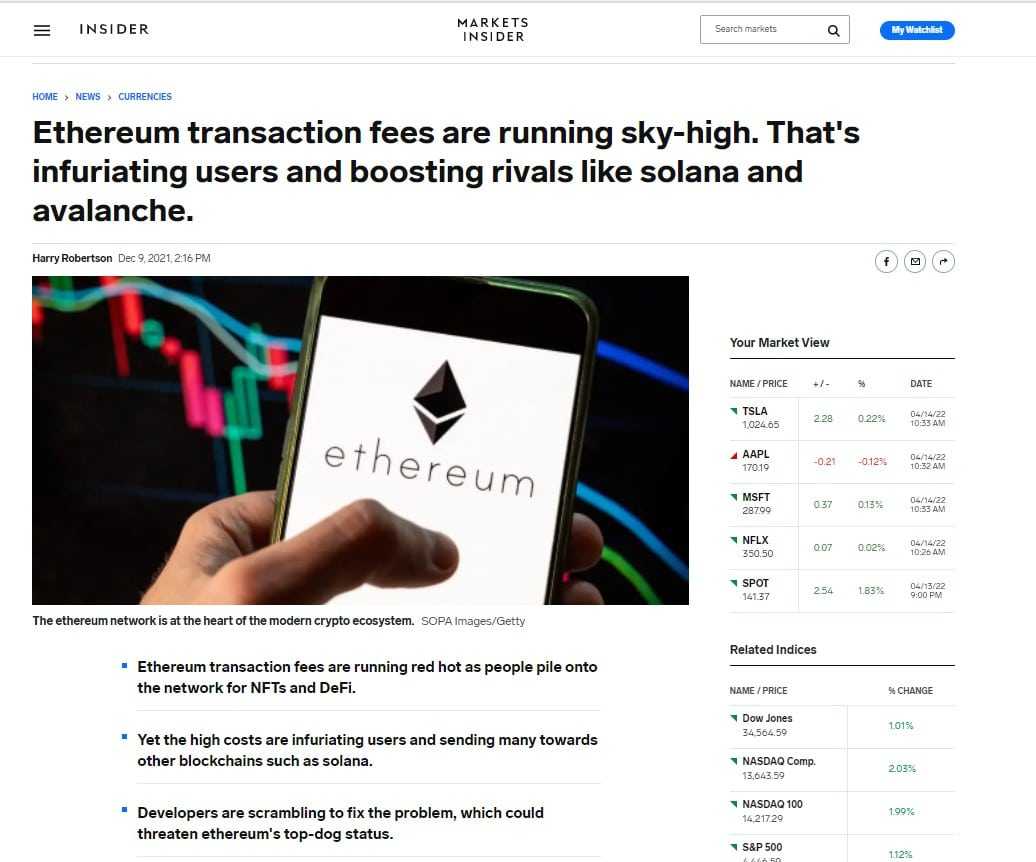

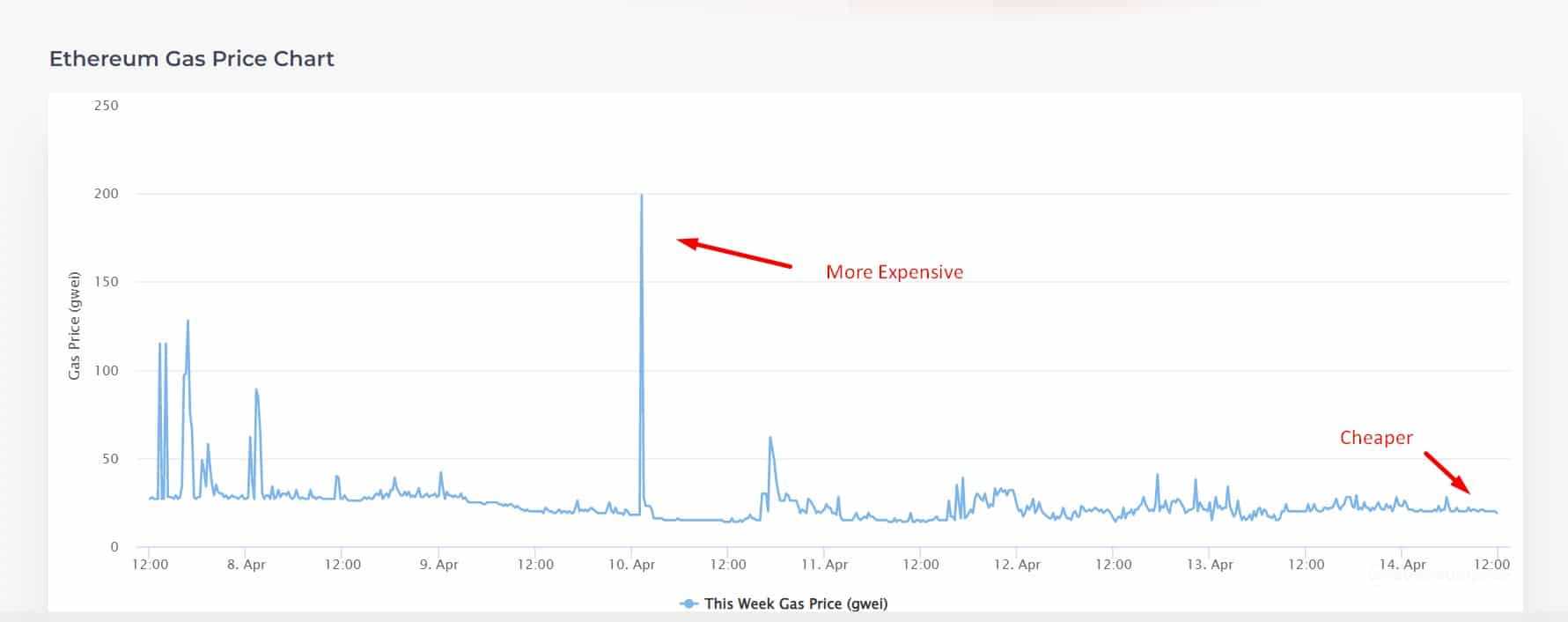

The principle issue contributing to excessive charges for Bitcoin and Ethereum is community congestion when you’re making an attempt to ship a transaction. The extra individuals attempt to use the community without delay, the upper the charge can be. Check out how the Ethereum community spiked through the earlier bull run, forcing Ethereum customers to pay fortunes in the event that they needed to play within the Ethereum playground.

Ethereum gasoline charges have been a large ache level and a major barrier to entry, plaguing all the crypto business for a lot of months throughout bull markets, with charges usually costing greater than the individual is making an attempt to ship.

Due to this, many customers have been altogether avoiding Ethereum, which is without doubt one of the causes for the explosion in reputation of other networks like Cardano, Solana, Avalanche, Algorand and different layer-1s. I need to level out that scaling points are widespread amongst practically all blockchains in these early days.

Now we have already seen Cardano and Solana exhibiting early indicators of community congestion issues, with the Cardano community slowing down after the launch of SundaeSwap and the Solana community experiencing a number of outages! Not good. Now we have additionally seen a substantial spike in community charges on Avalanche throughout peak instances.

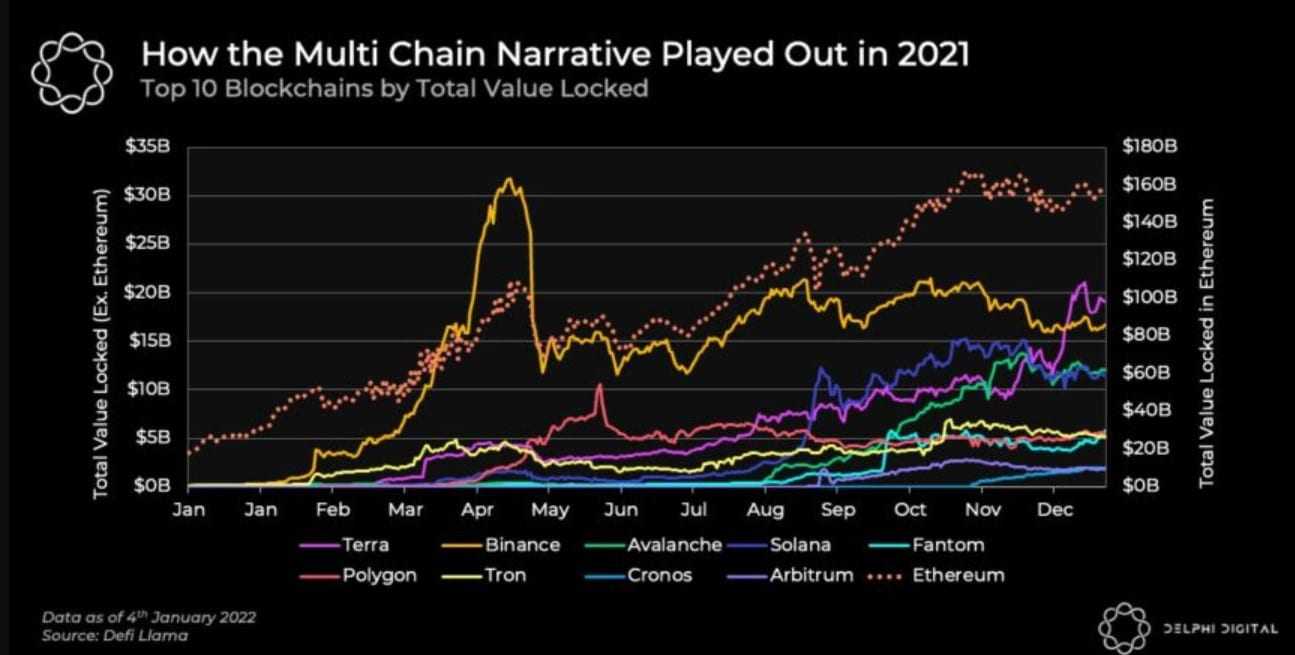

Although, none of those networks come near experiencing the kind of charges hurting Ethereum customers. It’s also essential to state that Ethereum has a considerably larger quantity of customers; the opposite layer-1s solely see a fraction of the visitors that Ethereum handles. No person is aware of what would occur to the opposite layer-1s in the event that they noticed the identical quantity degree or if they may even deal with it! Here’s a have a look at the TVL of many ETH opponents, exhibiting Ethereum continues to be king by fairly a big margin:

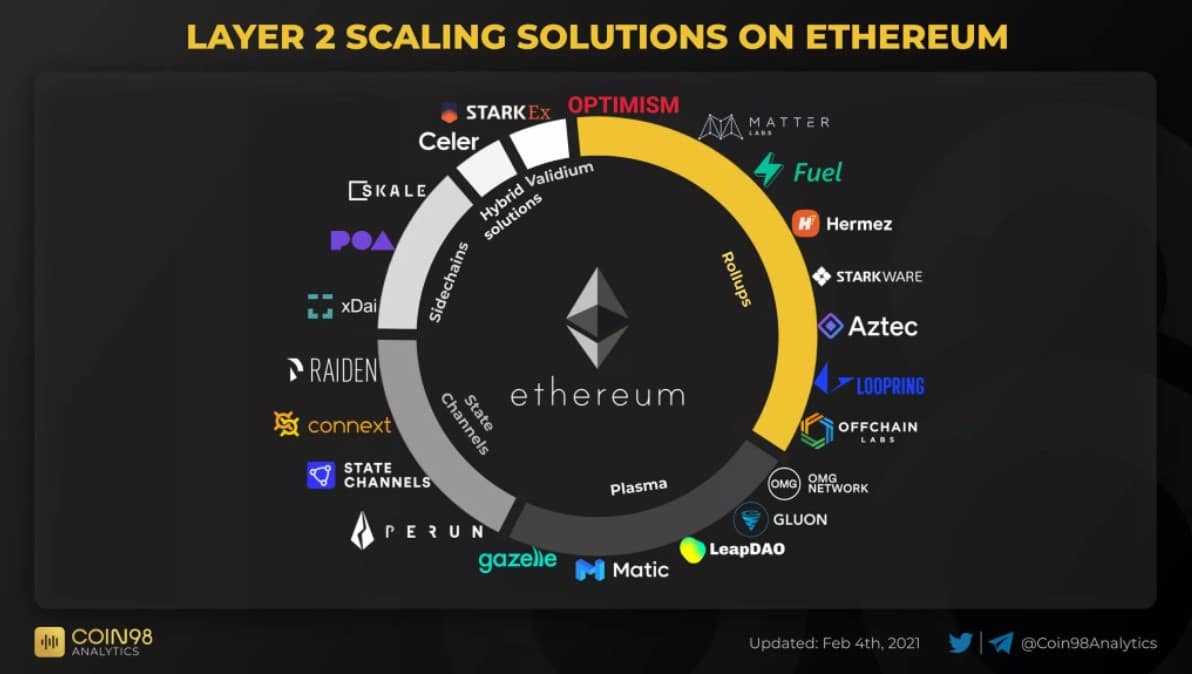

Builders on these networks are conscious of those ache factors and are engaged on scaling options as we communicate. Ethereum already has many layer-2 scaling options, corresponding to Polygon, which purpose to assist, however no community is ideal on this regard, although they’re getting higher on a regular basis. Cardano particularly feels like they’ve some sturdy and superior scaling options within the pipeline that will show to be massively useful. You may study that in our Cardano Overview.

One other issue contributing to charges on Proof-of-Work blockchains are block measurement, hashing algorithms, block house provide and what number of megabytes of information are being crammed into every transaction. That’s the reason cryptocurrencies like Litecoin and Dogecoin have decrease community charges than Bitcoin. Effectively, that, and since extra individuals use Bitcoin.

It’s useful to know that the quantity of crypto you are attempting to ship doesn’t have an effect on the community charge. It doesn’t matter if you’re sending one greenback or a thousand {dollars} value of crypto; the community charge would be the similar, so think about that when deciding how usually you should transfer your stash.

So we all know that crypto charges are usually variable, however some have a set charge construction or no charges relying on the protocol and platform you are attempting to ship from, which we are going to cowl subsequent.

Networks With the Lowest, or No Charges.

Now we have talked quite a bit about what impacts the charges for Proof-of-Work and Proof-of-Stake cryptos and mentioned some Bitcoin and Ethereum alternate options with decrease charges, however for the actually die-hard charge haters, there are even cheaper networks that can enable customers to ship crypto totally free, or with charges so low they’re virtually negligible!

These cryptocurrencies are essential as they’re extra helpful as precise forex. For instance, I don’t thoughts paying 3 {dollars} for a Bitcoin community charge if I plan on solely sending it as soon as and holding it for a 12 months, however I don’t need to pay 3 {dollars} in charges for every day purchases and each time I am going to the store to purchase sweet (Haribo for the win!)

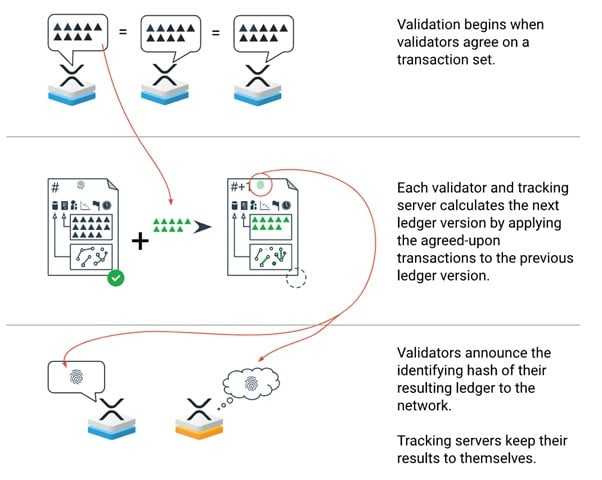

Enable me to introduce Ripple (XRP) and Stellar (XLM) tokens. Whereas Ripple and Stellar each run on their very own networks, these networks are neither Proof-of-Work nor Proof-of-Stake; they each use a distinct technique of validating and verifying transactions. These cryptocurrencies had been developed particularly to be used as cost and cross-border cost networks, and so they fulfil these roles very effectively.

Ripple makes use of Ripple Protocol Consensus Algorithms (RPCA), whereas Stellar makes use of the Stellar Consensus Protocol (SCP). These networks are very related, and I received’t get into the small print of how they work, however mainly, customers can ship Ripple and Stellar, or any crypto that makes use of that type of consensus algorithm for fractions of cents, charges so low they might as effectively be free which is why there are such a lot of XRP lovers. Who doesn’t love primarily free transactions?

“Hey! You said No Fees!?”

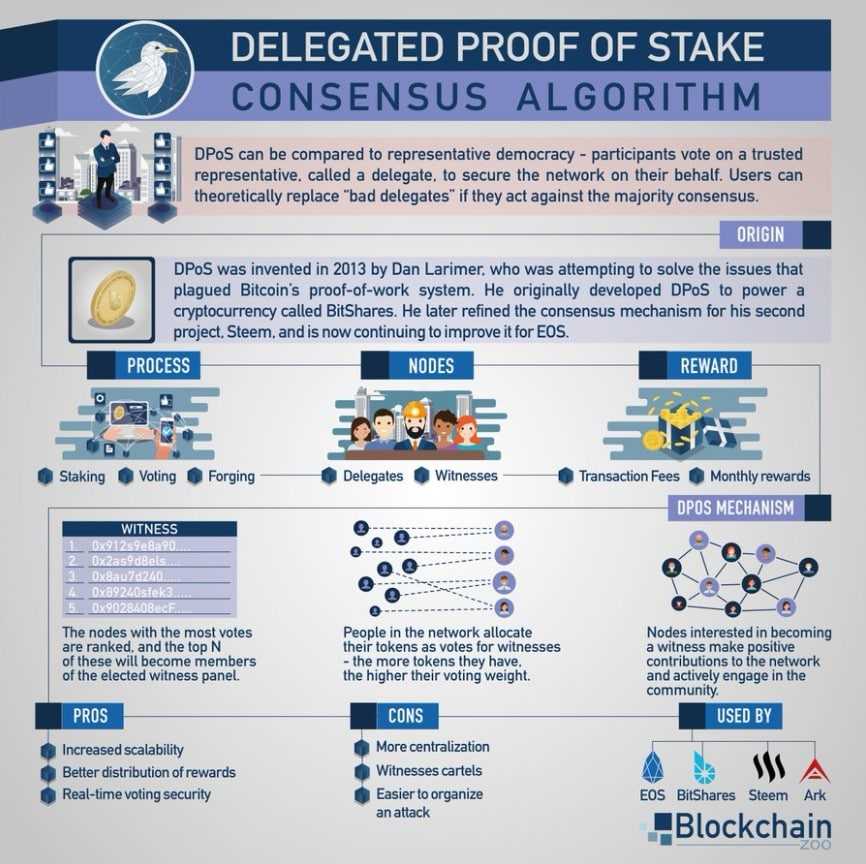

I do know, I do know, I’m attending to these. I promise there are a few distinctive networks on the market the place customers can ship crypto utterly free. The 2 hottest are the EOS community with the native token EOS and the Tron community, with the native token being Tron (TRX).

These networks don’t use Proof-of-Work or Proof-of-Stake both; they use what is named a Delegated Proof-of-Stake (DPoS) consensus mechanism. That is how customers can ship their Tron or EOS tokens utterly freed from cost if they’re sending from a pockets or decentralized platform that helps these community’s distinctive capabilities. Be aware that almost all exchanges should cost a transaction charge as they at all times need their reduce. Right here is a superb diagram from Blockchain Zoo breaking down the Delegated Proof-of-Stake consensus algorithm:

Transactions on these networks aren’t paid in charges however in computational energy in bandwidth and CPU. These networks aren’t as widespread or as widespread right this moment as the usual Proof-of-Stake networks. Nevertheless, in earlier years each Tron and EOS had been prime ten cryptocurrency tasks.

Each networks are nonetheless fairly massive and in use, however they’ve fallen out of favour in current months attributable to an absence of selling efforts and partnerships and an absence of latest developer attraction. However don’t write these networks off! They’ve been round for a very long time, and a few bullish tasks are constructing out on each, such because the Bullish EOS-powered change backed by Peter Thiel and Block.one.

The best way customers can transact totally free is to freeze or lend out their tokens to the community and receives a commission in return with the computational energy wanted to ship these transactions totally free. So as an alternative of Proof-of-Stake, the place validators are paid in tokens, Tron and EOS pay for "staking" in computational energy for some candy fee-free transaction motion.

That’s, in fact, a really simplistic overview of how these networks perform that doesn’t do the ingenuity of the community creators justice for his or her work, however that covers the gist of it for laypeople corresponding to myself. As these networks are barely much less "beginner-friendly," I’d extremely encourage you to do your homework on understanding how these DPOS networks perform earlier than diving in.

Easy methods to Save on Charges

Okay, now, for the great half, let's prevent some digital money!

I have a look at crypto by way of fairly a simplistic view. Too simplistic, in all probability.

After I have a look at making purchases with crypto, I by no means even trouble making an attempt to make use of Bitcoin or Ethereum. The charges are too excessive, and people tokens are too useful, for my part, to waste on my gummy bear purchases. To make use of crypto as money, see in the event that they settle for funds within the least expensive cryptos like Ripple or Stellar. If you wish to use Bitcoin, see if there’s assist for the Bitcoin Lightning community, as that may be a severe game-changer that drastically reduces charges.

Sprint and Litecoin are additionally incredible alternate options, and Litecoin is sort of as extensively accepted as Bitcoin. Dogecoin can also be turning into extra extensively accepted and has cheaper transactions than Bitcoin. Lastly, have a look at Cardano's ADA, Solana's SOL, Avalanches' AVAX or Algorand's ALGO for transactions, as they’ll usually be under a cent, something to keep away from BTC or ETH, actually.

Watch out with Bitcoin charges as effectively. Throughout low congestion instances, a Bitcoin transaction could solely price a number of cents, however charges have spiked to above 50 {dollars} prior to now throughout bull run mania. Additionally, ensure you perceive your Satoshi's and don't let all these 0's idiot you into considering it's low-cost. For instance, many centralized exchanges will "only" cost 0.0006 BTC for a withdrawal, however that’s over 25 {dollars} at present Bitcoin costs!

Anyway, that’s my go-to strategy for crypto purchases. After all, EOS and TRON would additionally enable free transactions although I don’t know of many locations that settle for these. On-line retailers have significantly upped their crypto sport, although, with Shopify retailers having the ability to select to just accept over 300+ cryptocurrencies.

I do know it might sound like I’m hating on Bitcoin and Ethereum, however that might not be farther from the reality! I’d like to have a bunch of gold bars in my basement, however that doesn’t imply I’ll love hauling them to the cafe to try to purchase a espresso. I deal with Bitcoin as a retailer of worth and inflation hedge. I additionally use Ethereum as a retailer of worth and as a technique to become involved within the wonderful world of DeFi. I deal with neither one as a “currency.” Typically you must swallow the charges for his or her advantages, however worry not, there are methods to scale back these charges!

For Bitcoin:

- Use the lightning community when attainable.

- Try to scale back the frequency of Bitcoin transactions. For instance, for those who observe dollar-cost averaging (DCA) and continuously buy Bitcoin on an change, restrict the variety of withdrawals to your pockets to each few months or no matter you’re snug with. In case you purchase 0.0006 BTC each two weeks and the withdrawal charge is 0.0003, you lose half your buy each time you withdraw. Save up a number of purchases and transfer the funds in bigger chunks because the charge just isn’t depending on the quantity. You’ll want to test the withdrawal charges for the platform you utilize to purchase crypto.

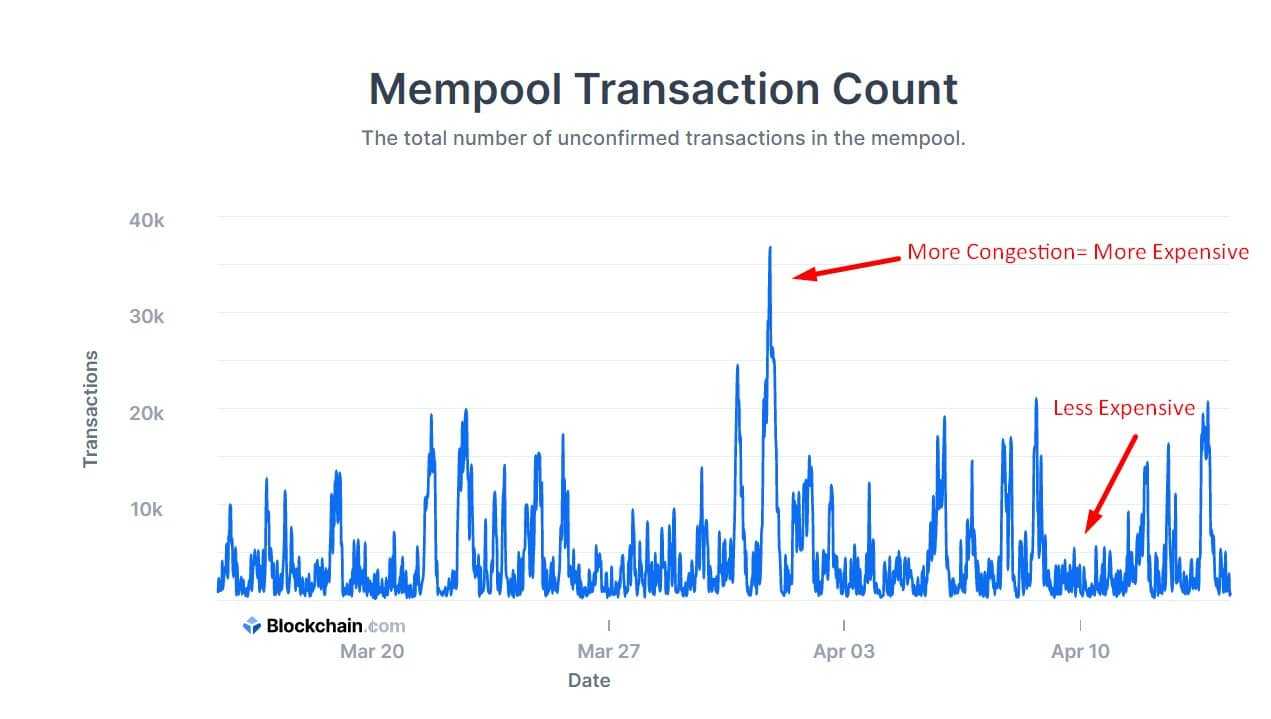

- Anticipate instances of decrease community congestion. These instances are sometimes on weekends, late at evening, or early morning UTC. Use a web site like blockchain.com and have a look at the mempool chart to see what number of transactions are ready to be confirmed. The upper the chart, the costlier.

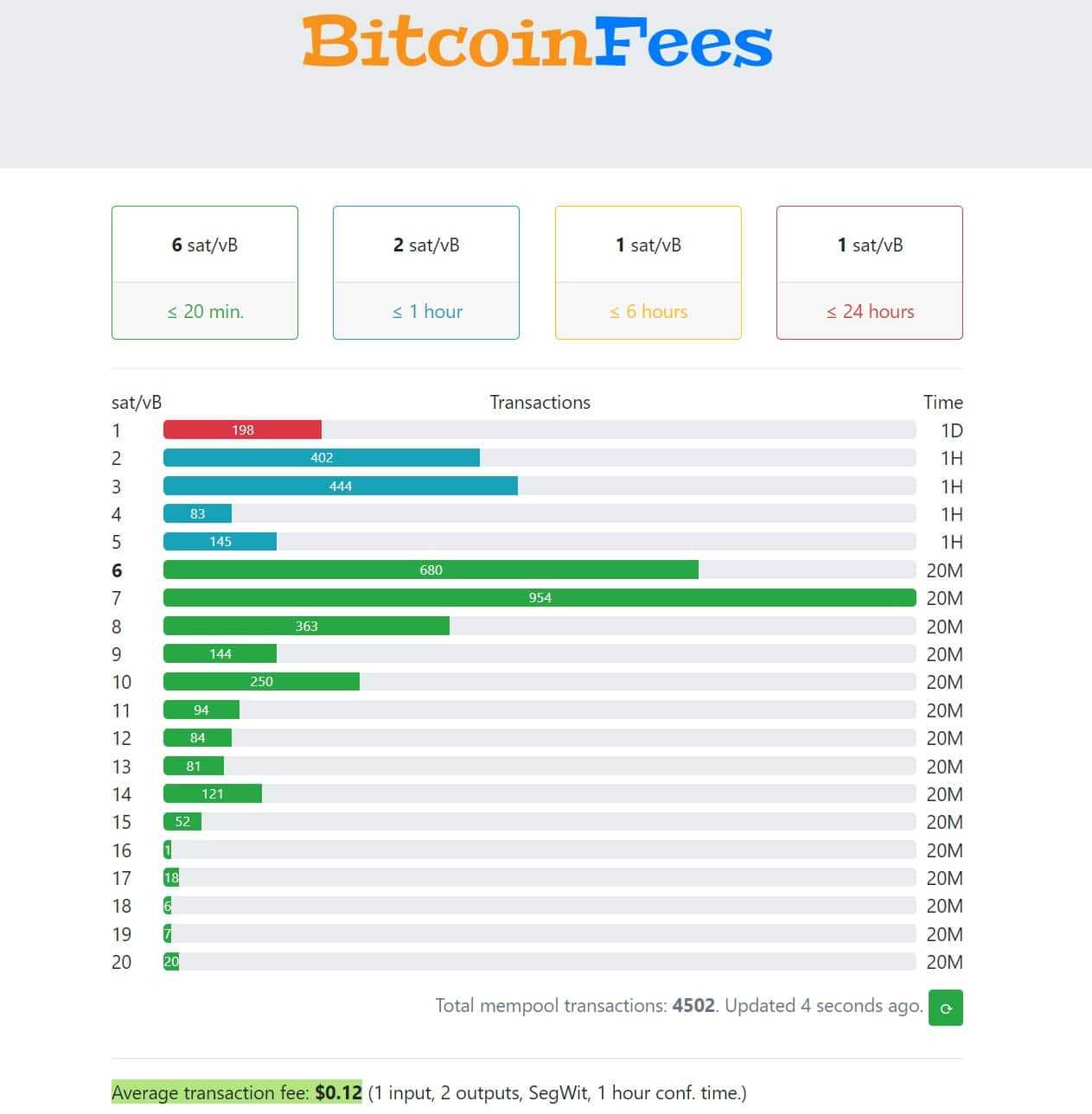

- Regulate the fee- Most Bitcoin wallets assist you to set a customized community charge; nonetheless, if this charge is about too low, there’s a probability the transaction received’t get picked up or can severely decelerate the transaction time. You should utilize a web site like bitcoinfees.internet that may give you beneficial charges to set based mostly on present community congestion.

- Use a pockets or platform that helps SegWit transactions. Utilizing SegWit can scale back Bitcoin charges by as much as 30%.

- Know your Bitcoin pockets deal with codecs. Keep away from utilizing previous Bitcoin legacy addresses (P2PKH) that begin with the number one. Bitcoin addresses have developed, as have many crypto wallets. Try to use wallets/addresses that start with the quantity 3, that are Pay to Script Hash (P2SH), and even higher if you should utilize an deal with that begins with bc1, which is Native SegWit (P2WPKH), as this could scale back charges as much as a further 38%.

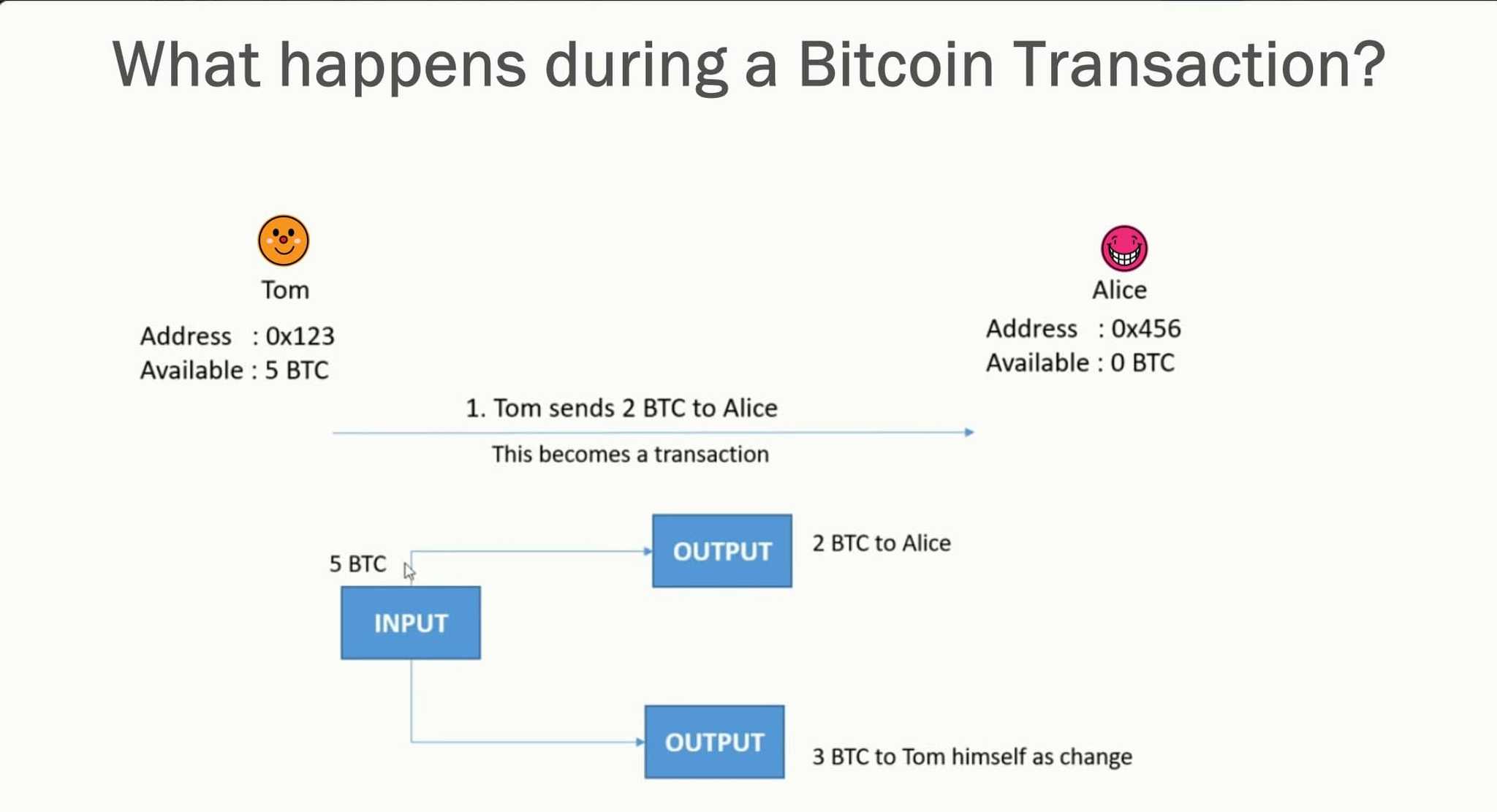

- Thoughts the inputs and outputs! Bitcoin transactions may be costlier to ship if the quantity is made up of smaller inputs. Bitcoin community charges are proportional to the dimensions of bytes in your transaction. Bitcoin makes use of an Unspent Transaction Output (UTXO) mannequin, which implies you obtain BTC again like “change” again for transactions. So, for those who personal 5 BTC and need to ship 2, your pockets sends the whole quantity, so 5, then 3 (minus community charges) would get returned to your pockets in what is named a change deal with like so:

The UTXO that will get returned to the change deal with nonetheless seems in your pockets the identical because it did earlier than, this course of can get extra in-depth, and you may export your change addresses to seek out the bits of Bitcoin that reside in every change deal with if you wish to, however that may be a subject for an additional article. All this occurs behind the scenes and is invisible to the consumer; all you should know is that your pockets stability will replicate the right, complete stability of every change deal with and your Bitcoin deal with.

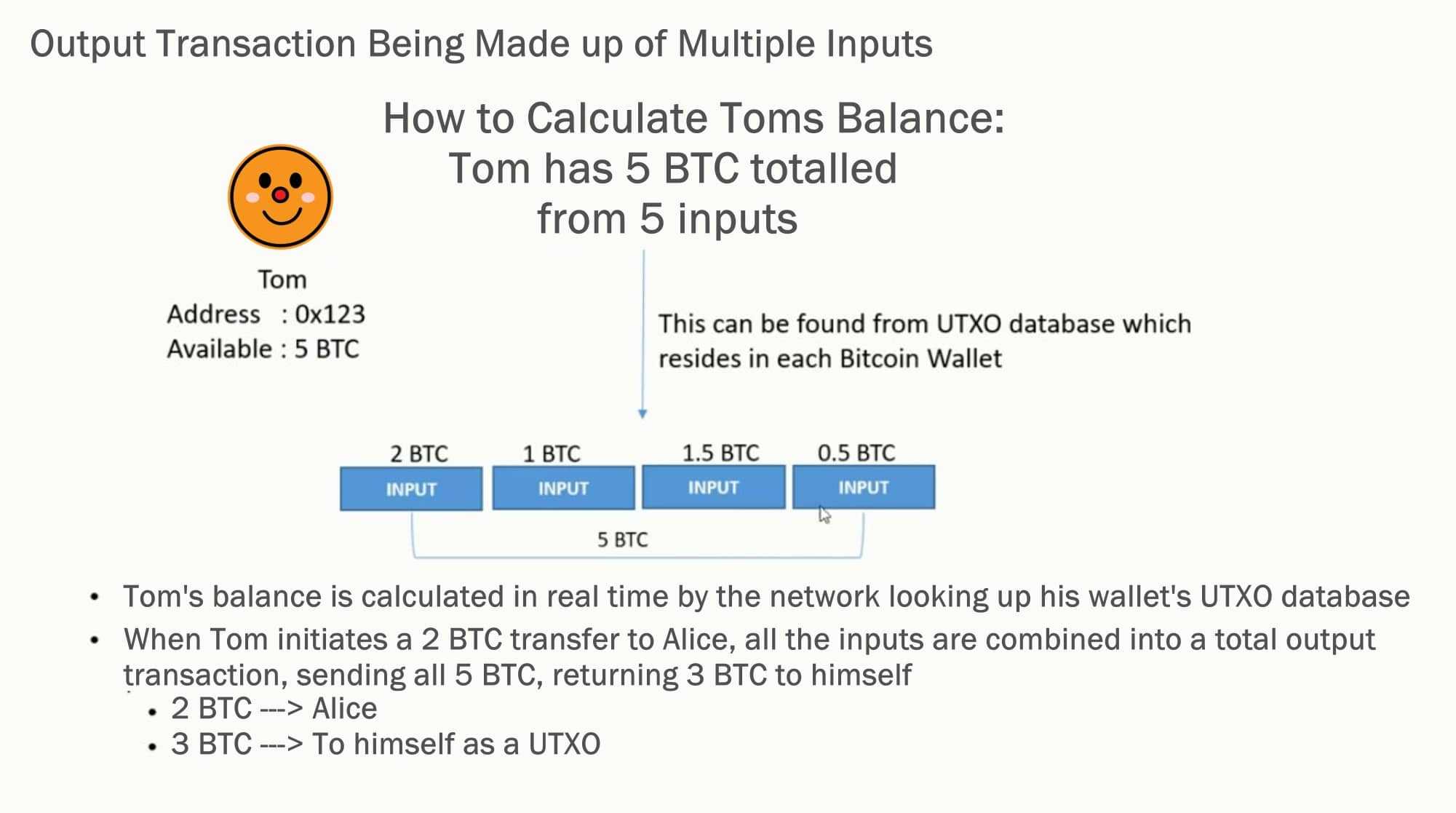

One more reason why all that is essential is that for those who obtain a number of small Bitcoin transactions, then must ship one massive transaction, the community will mix all of the smaller enter quantities you may have acquired to make up the massive output quantity like this:

So what this all means is for those who ship your self one full Bitcoin as one transaction, then you should ship out one full Bitcoin in a single transaction; that one is straightforward as there’s one enter and one output, fewer bytes of information.

The place Bitcoin charges can get costly is that if you should ship one complete Bitcoin out, however that one Bitcoin stability is made up of a bunch of smaller incoming quantities, tossed in with a number of small outgoing transactions with UTXO returns, and that’s now a variety of work your pockets must do to pile collectively one complete Bitcoin, leading to a costlier transaction.

That is analogous to say if you should purchase one thing for 1 greenback and also you hand the cashier 1 greenback. Straightforward. Now say you should purchase one thing for 1 greenback, however you should pay in 100 pennies, digging all of them out from completely different pockets. Some are in your pockets, and a few are in your footwear for good luck; that may be a cumbersome technique to pay. Bitcoin can work the identical means. To keep away from this, you may think about decreasing the variety of Bitcoin transactions you make and sending bigger quantities when attainable.

For Ethereum:

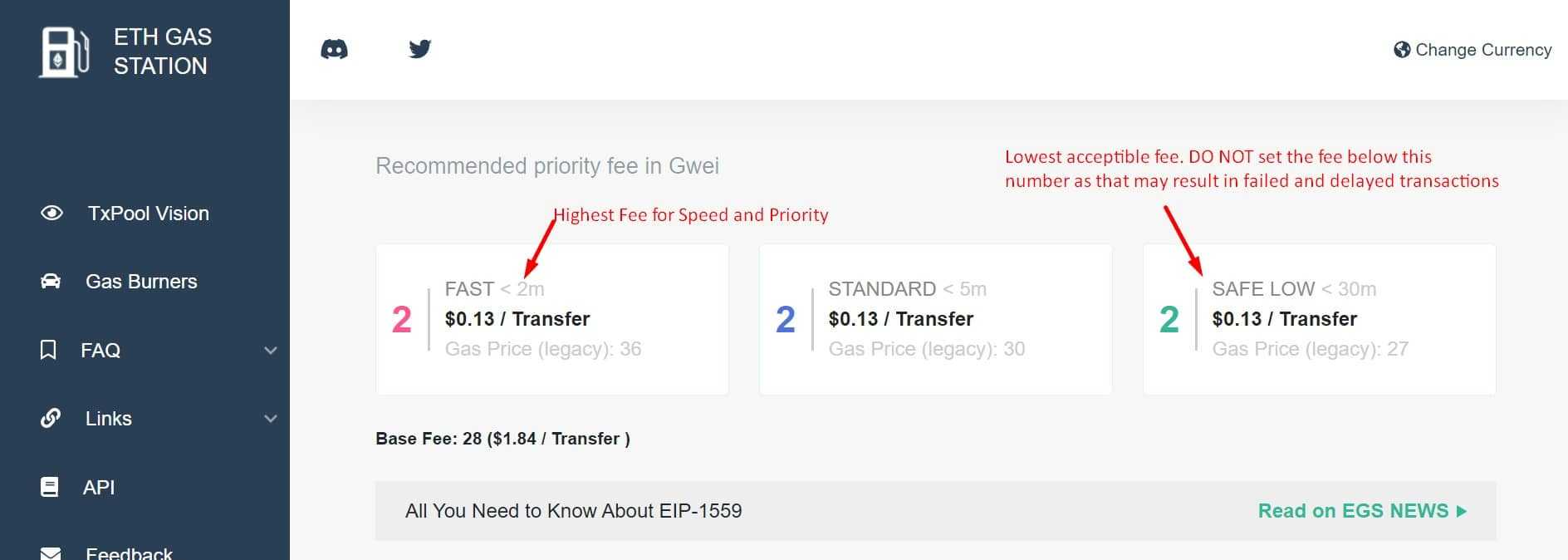

- Before everything, timing is every little thing, just like Bitcoin, besides that prime community visitors impacts Ethereum extra severely. Check out a web site like ethgasstation.information and have a look at the Gwei numbers. Gwei is brief for giga-Wei and is a denomination worth for Ethereum, akin to Satoshis for Bitcoin and cents for {dollars}. When this web site is exhibiting excessive numbers, the community is seeing a variety of visitors/congestion. The positioning offers three numbers that can assist you understand how excessive or low to set your Ethereum gasoline charges. Quick on the left, which is the most costly however will get the transaction carried out the quickest, commonplace, and gradual for the penny pinchers, which would be the least expensive but additionally the slowest transaction time.

Most self-custody wallets like Exodus, Metamask and Trustwallet will routinely choose a gasoline charge for you if you do not need to fret about it, however the gasoline charge that’s routinely chosen received’t be the most affordable possibility. Most wallets will assist you to set your gasoline charges as an “advanced” possibility. As proven within the picture above, keep away from setting too low of a charge, don’t try to set the charge under the gradual quantity proven, as that may significantly wreck your transaction. I’m speaking failed transactions and transactions that may get caught for days.

Try to ship your Ethereum transactions, which embody each one of many tens of 1000’s of ERC20 tokens throughout off-peak instances. Additionally, test websites like ethereumprice.org/gasoline to make sure you aren’t transacting throughout peak instances.

Ethereumprice.org additionally has a useful warmth map that may assist present you the most affordable instances of day to transact in Ethereum, which appears to be like like this:

- Manage Transaction varieties. As with Bitcoin, try to transfer property as little as attainable and mix transactions to lump sums for those who can, because the charge just isn’t depending on the quantity. Gasoline additionally varies relying on the kind of transaction. For instance, interacting with good contracts is commonly quite a bit pricier so keep away from interacting with good contracts if attainable.

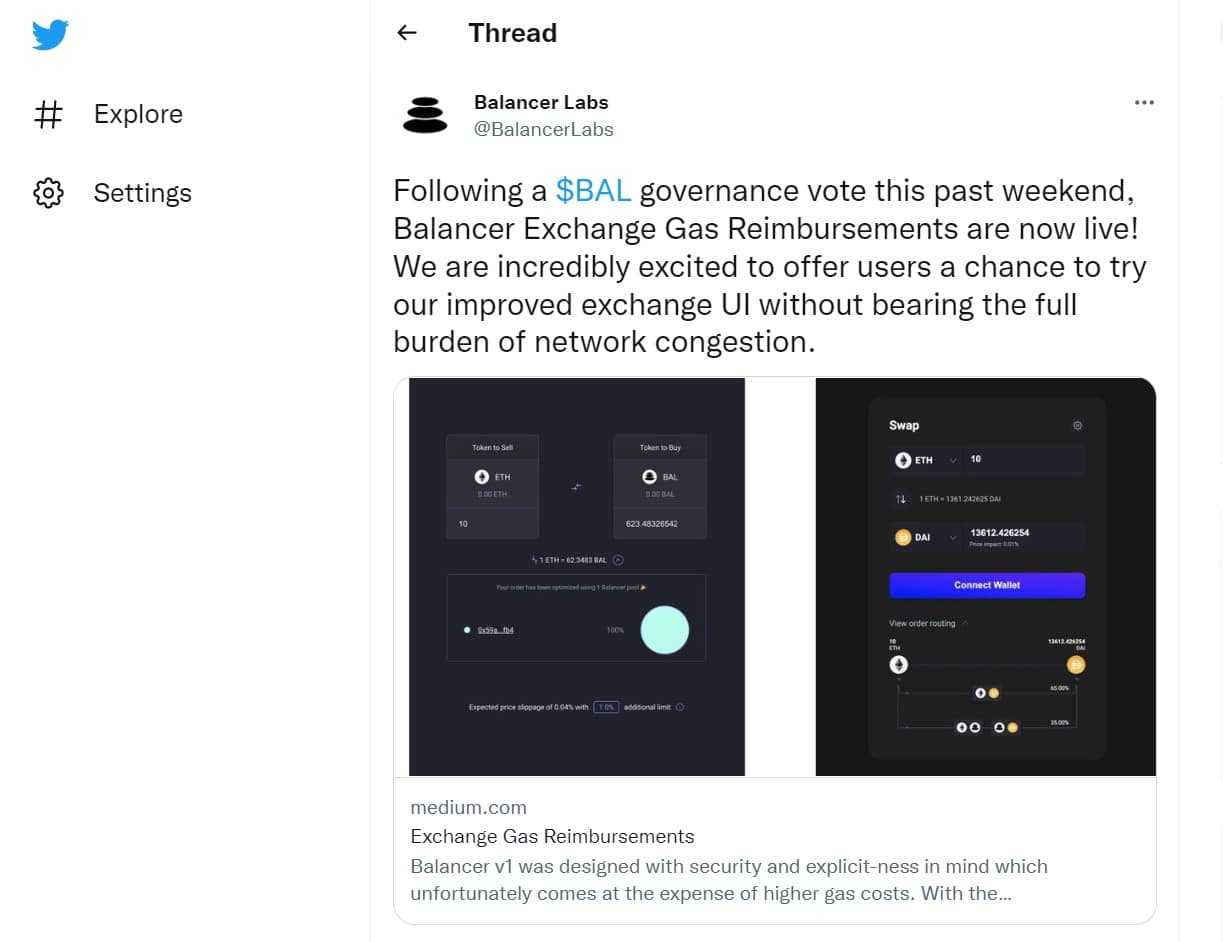

- Discover Decentralized purposes (DAPPS) that supply reductions and scale back gasoline charges. Some Ethereum tasks provide gasoline charge subsidies or minimal gasoline charges. Nice examples of this are Balancer, KeeperDAO and Yearn’s V2 vaults. They will do that by batching particular person consumer transactions collectively. Aave has additionally made spectacular strides on this space with the improve to Aave V2.

- Make the most of Gasoline Tokens. Customers can delete their storage variables on the Ethereum community and earn ETH as refunds for doing so. You may mint the gasoline tokens when the gasoline charges are low and redeem the gasoline tokens for ETH, which can be utilized to pay gasoline charges. You may study that course of on gastoken.io

- Discover layer-two options. Layer two options had been created out of necessity to battle the painfully excessive Ethereum gasoline charges. Most of those options contain shifting transactions to aspect chains. You may be taught extra about this in Man's video on Ethereum Scaling, so I received't go into element on how they work right here. Tasks like Polygon, Loopring, OMG Community, Skale, ZK Swap, Cartesi, Optimism and Arbitrum are the first Ethereum scaling options.

Search for crypto platforms that make the most of these scaling options for cheaper Ethereum alternate options.

- Chill and await Ethereum 2.0 to roll out together with all the finished scaling options. Ethereum 2.0 is about to roll out this 12 months, however a typical false impression is that this can scale back gasoline charges. In actuality, that is simply step one that migrates Ethereum to Proof-of-Stake. The builders are nonetheless going to must deploy extra scaling options, however as soon as that occurs, we’re all gonna be rockin’ out in Eth paradise. Although that could be a 12 months or two away but.

- I hate to say it, however you possibly can scale back Ethereum charges by merely abandoning the community till the builders do one thing concerning the charge concern. Many crypto customers have utterly ditched ETH and now primarily use different networks like Binance Good Chain, Cardano, Solana or Avalanche although every community has its professionals and cons. Binance Good Chain is extremely low-cost and environment friendly, however the trade-off is that it’s about as centralized as a community may be, which is the antithesis of what crypto is all about within the first place.

Different Crypto:

If you’re utilizing Ripple XRP, Stellar XLM, or locking away for computing energy with EOS or Tron, then you definately don’t have to fret about something. Ship XRP and XLM everytime you need with no fuss. Ship Tron and EOS every time you may have sufficient CPU sources collected. For cheaper Proof-of-Stake protocols like Solana, Cardano, Avalanche, and so on., and cheaper Proof-of-Work networks like Litecoin or Doge and so on., the very best factor you are able to do to verify your charges are at their least expensive is to make use of the community throughout off-peak instances. Nevertheless, this isn’t as essential with different cryptos as it’s with Ethereum, as worth fluctuations aren’t as important.

Conclusion

I hope that I used to be in a position to offer you all a little bit of readability and perception right here on understanding the various kinds of community charges which are related to crypto transactions and completely different networks, and that you simply had been in a position to be taught one thing right here right this moment. In the case of crypto, excessive charges can put a severe cramp in your crypto get together, however following the steps on this article, it can save you your self doubtlessly tons of of {dollars} in charges for only a few further steps. I take advantage of the Eth gasoline station each time I ship an Ethereum transaction and at all times set it to the bottom protected charge proven and that transfer alone has saved me tons of and solely takes a minute!

To summarize and evaluate this to real-world makes use of, many individuals within the crypto neighborhood deal with Bitcoin like gold. Stash it, horde it, and conceal it away making an attempt to maneuver it as little as attainable as that is like the final word financial savings account, cash goes in and doesn’t come out till you want it. Ethereum, Solana, and Cardano are extra akin to the gas that you simply put in your automobile’s gasoline tank to get to work and run errands. It’s common to maintain ETH, SOL, and ADA readily available to gas DeFi adventures, whereas additionally stashing as a lot as you may the identical as with Bitcoin for those who consider in the long run appreciation of those property.

Then you may have cryptocurrencies readily available to make use of for funds that you should utilize like a checking account, cash in, cash out. For me, essentially the most environment friendly ones are XRP, Litecoin and Sprint, however actually, any cryptocurrency that’s extensively accepted with low community charges can fill this position.

Anyway, that about wraps up this text. I hope you may have discovered it entertaining, informative, and useful alongside your crypto journey.