Cryptocurrencies' journey from a fringe fascination to being too sexy to be ignored has been well chronicled.

The decentralized digital currency has now attracted the attention of major institutions, changing the narrative away from scepticism and towards a more receptive investigation of the sector. Once aloof observers, major institutions are now actively searching for ways to provide investment products tied to digital assets.

The incredible returns on investments offered by crypto are a clear catalyst for the shift in mood. Bitcoin, still the biggest coin, has shown extraordinary returns, which have surpassed traditional investment vehicles. Bitcoin has been called the “best investment vehicle” “the best investment of the decade”.

While retail investors were already on board the crypto hype train since the sector's nascent days, these mouth-watering returns have promoted institutional players to reconsider their initial hesitancy.

This article will explore Wall Street's increasing interest in crypto, which coins are favoured by major institutions and what's next when it comes to institutional adoption.

Significance of Wall Street's Attention to Crypto

Wall Street's interest in crypto brings about major implications for this still-new asset class, particularly in terms of legitimacy and mainstream acceptance. This interest from the traditional financial heavyweights is important in many ways, as it helps to validate digital assets.

Legitimation of the Crypto Market

Cryptocurrencies have long been dismissed as speculative and volatile, but Wall Street's attention brings a level of acknowledgement.

- Due Diligence: Investors, known for their thorough due diligence, are researching and analyzing crypto markets. This leads to two things — a better understanding of the risks and opportunities within the space, and reinforcing the notion that cryptos deserve to be considered within the broader financial landscape.

- Integrating Traditional Investments Wall Street's adoption of crypto comes with integration into traditional investment strategies. Make no mistake — this isn't experimental but reflects a measured approach to diversification and risk management.

- Compliance with Regulatory Standards: Institutions that are traditional navigate the cryptomarket with a focus on regulatory compliance. Due to the involvement of traditional players, existing financial regulations must be adhered to. This pushes the crypto market in a direction towards greater transparency and regulation.

Increased market Credibility

The fact that traditional institutions like banks and financial institutions invest in cryptocurrencies lends credibility to the asset class.

- Validation: It is important to note that the participation of institutions such as BlackRock, with a long history of success, can be a strong validation. Established names like BlackRock (the world's largest asset manager) with a storied history reassure fellow institutional investors.

- Trust: They are known for their thoroughness in due diligence, compliance and risk management. Their endorsement of crypto market inspires confidence, and attracts investors that may have been hesitant.

- Acceptance of the Broader Community: Wall Street's interest in crypto encourages a broad spectrum of investors to consider digital assets as part of their investment portfolios. The approval of institutional players can help lower barriers to entry and make digital tokens more appealing for investors who have traditionally preferred conventional asset classes.

- Market Maturity and Stabilization Wall Street is not going anywhere! The presence of institutional investor, who are known for their stability and long-term outlook, can potentially mitigate some of digital assets’ extreme volatility.

- The creation of financial products: Wall Street’s development of financial products related to crypto contributes to the credibility of the market. As we'll discuss later, products such as crypto ETFs and futures contracts offer investors regulated and familiar investment vehicles.

Inflows of Institutional Capital

Wall Street's foray into the crypto market brings with it a significant inflow of institutional capital.

- Market Liquidity: The increase in liquidity and depth of the market is one of the immediate effects of institutional capital inflow.

- Diversification of institutional portfolios Digital assets are a non-correlated class of assets that can offer diversification benefits beyond traditional stocks and bond.

- Impact on market dynamics: Institutional capital’s sheer size can have a major impact on the market. Institutional capital can have a significant impact on market dynamics.

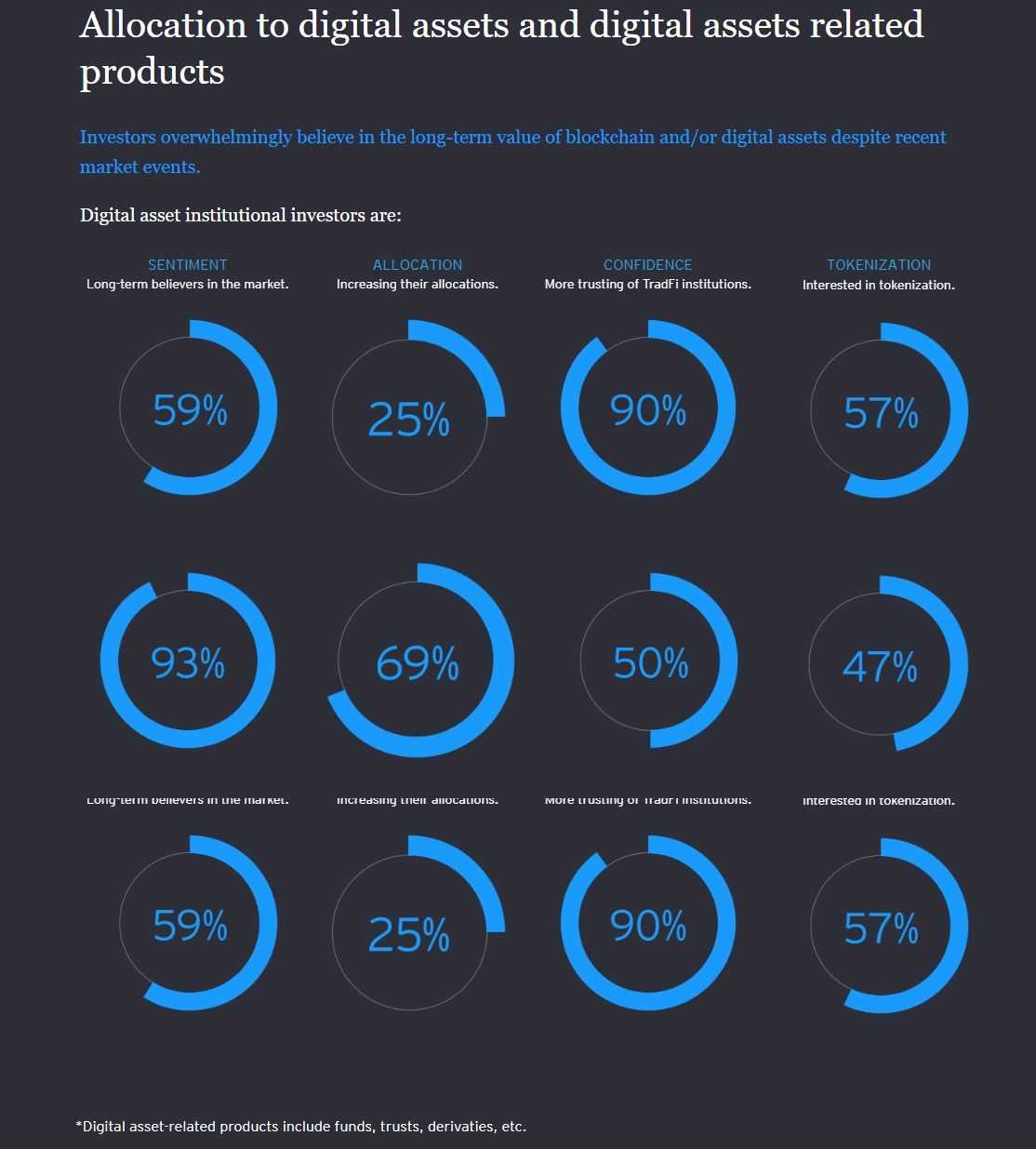

Overall, institutions remain cautious and optimistic. The majority of those who are currently investing in digital assets allocate between 1% and 5% of their total portfolio to digital assets and related products. According to EY, 76% of respondents who have digital assets indicate that they allocate less than 5% of their portfolios. Only 3% of respondents invest more than 20%.

Modern Portfolio Theory (MPT) is a popular investment strategy that aims to offer the best risk to reward ratio. Our article How to Use Modern Asset Theory to Build Crypto Portfolio covers the strategy in great detail.

Evolution of Regulatory Law

Regulators are forced to adapt their frameworks as institutional players invest in digital assets. TradeFi and the decentralized currencies have prompted regulators into developing a strategy that promotes innovation and minimizes risks.

In the last year, regulatory and legal frameworks have played a key role in restoring confidence in digital assets. The resilience of the market, backed by innovation, is a catalyst for regulatory frameworks which balance risk, opportunity, and innovation. PwC

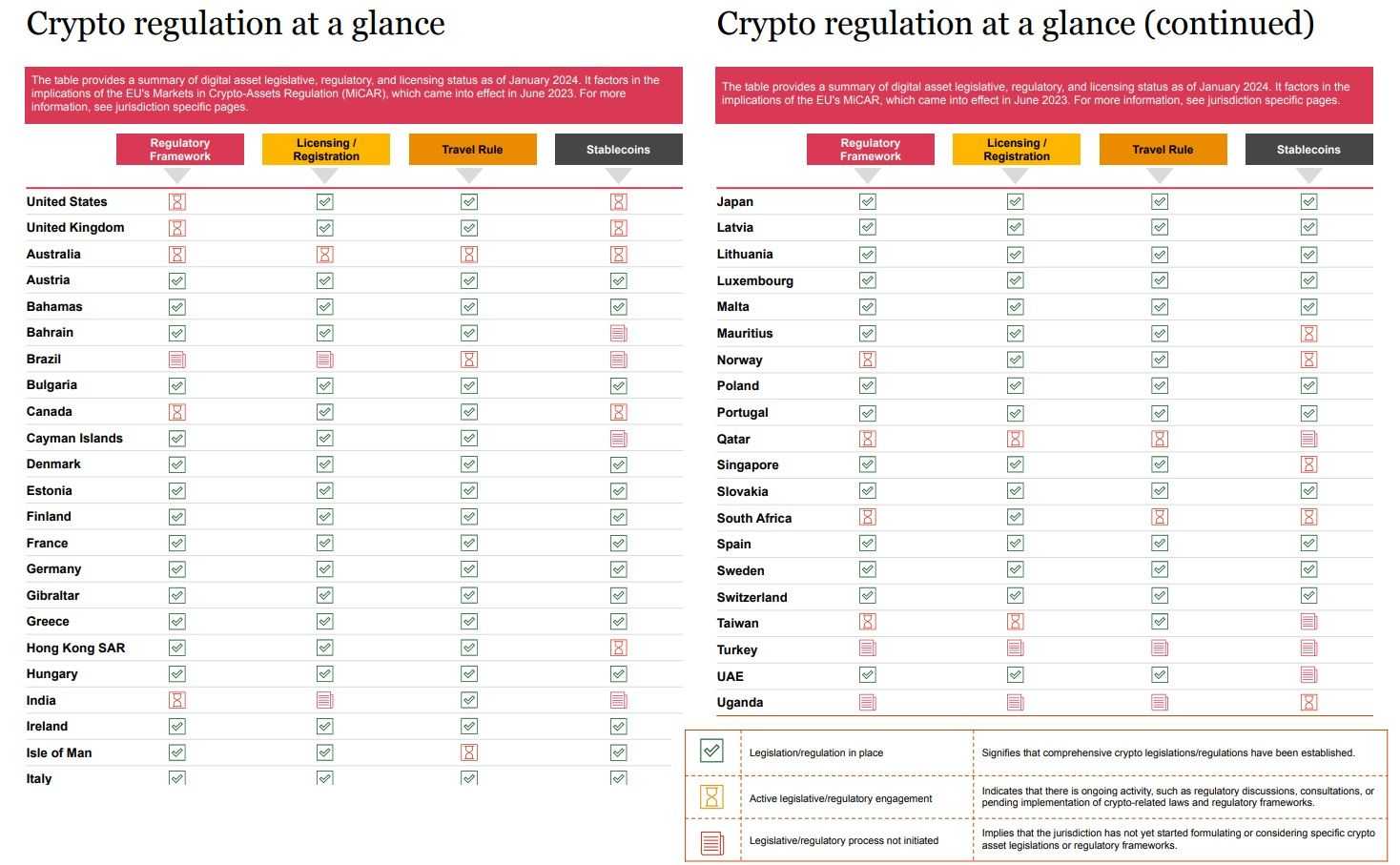

In recent years, there has been a noticeable shift in regulatory scepticism towards a more nuanced and comprehensive approach. Some jurisdictions are actively working to create comprehensive regulatory frameworks. This, of course, doesn't include the US, where four agencies — the SEC, the Commodity Futures Trading Commission, the Department of Justice, and the Treasury Department's Financial Crimes Enforcement Network (FinCen) — work in tandem to police the sector at their whim amid a lack of clear regulatory guidelines specific to cryptocurrencies.

In 2023, CFTC brought 47 cases involving conduct relating digital asset commodities. That’s more than 49% out of all the actions filed that year. The SEC noted that 2023 is a “highly productive and impactful year” Its enforcement of crypto related misconduct.

As regulatory clarity is developed, institutional investors will have a better understanding of their participation. This will boost confidence and pave the way to a more secure, regulated and safe environment where both industry participants and the industry itself can flourish.

For industry players across the globe, 2024 is not just about weathering the storm – it’s about building a foundation for a thriving ecosystem, where clear regulatory guidance acts as the cornerstone of renewed stability. PwC

Bitcoin: The Pioneer's Enduring Appeal

Bitcoin has maintained its position as the world’s largest cryptocurrency and has become increasingly popular among institutions. Institutions that were once wary about digital assets have seen a marked shift in attitude. An increasing number of them are actively integrating Bitcoin into investment strategies.

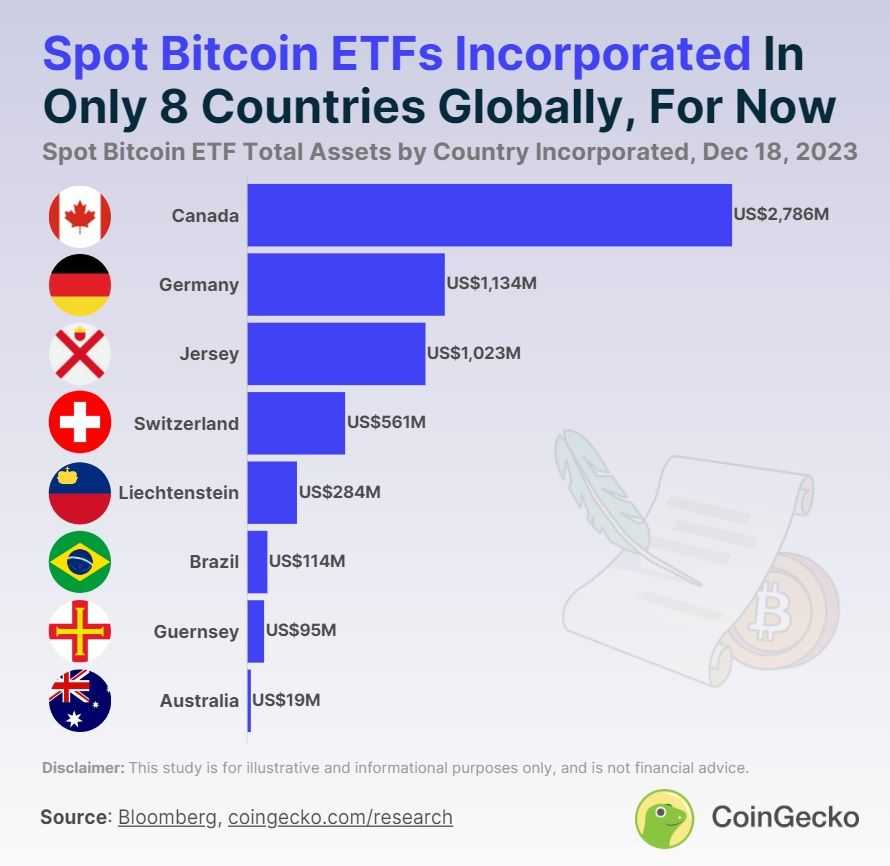

Bitcoin ETFs, for example, are a familiar and regulated way to get exposure to Bitcoin.

The popularity of spot bitcoin ETFs is on the rise. According to Decrypt, more than 15 companies, including BlackRock, WisdomTree and Valkyrie, are awaiting the SEC's approval. If recent headlines are anything to go by, the SEC's blessing is imminent but they've been saying that for years now.

Spot Bitcoin ETFs aren't new by any measure — countries including Canada, Germany, Australia and Switzerland have given their nod to these investment products. According to CoinGecko, if the SEC approves these applications, then the U.S. will become the ninth country in the world where spot Bitcoin ETFs have been incorporated. There are currently 22 spot Bitcoin ETFs active around the globe, with assets totaling $6.01 billion.

Factors Contributing to Bitcoin's Appeal

Bitcoin, with its 21 million coin limit and decentralized nature, has been compared to digital gold" that is considered the currency of the future to some and a store of value to others.

Bitcoin's appeal among institutional investors stems from a combination of attributes unique to the digital currency.

- Institutional Infrastructure: The development of institutional infrastructure, including regulated exchanges, custody solutions, and financial products, has significantly enhanced Bitcoin's appeal. Institutions now have more secure and compliant avenues, reducing the operational and regulatory risks associated with crypto investments.

- Macro-Economic Trends: Bitcoin's decentralized nature and finite supply make it attractive in times of macroeconomic uncertainty. Bitcoin is considered to be a hedge against traditional market fluctuations, especially during periods of economic distress.

- Recognition by Traditional Finance: Bitcoin's increasing recognition by traditional finance players has contributed to its appeal. As established financial entities show interest and integrate Bitcoin into their offerings, it bolsters the perception of Bitcoin as a legitimate and noteworthy investment.

Wall Street is Smitten by Bitcoin's Performance

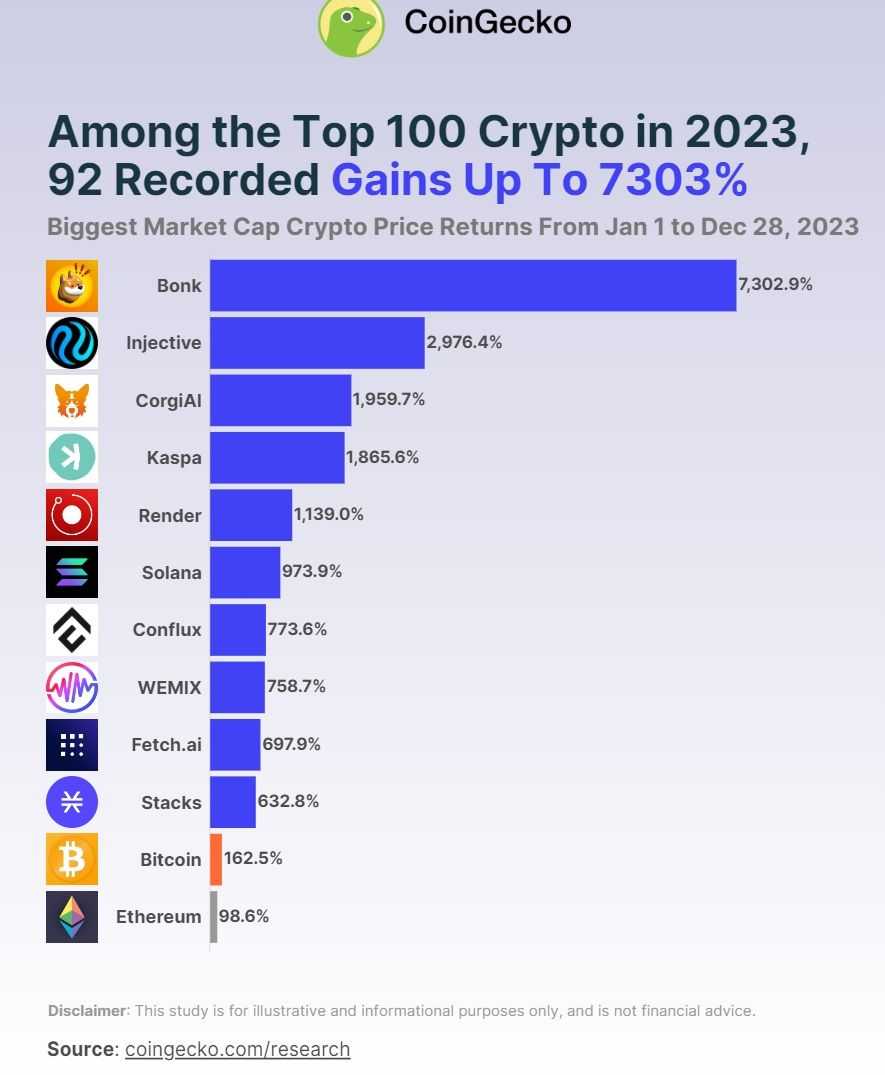

Bitcoin outperformed 65 tokens in the top 100 cryptos in 2023, according to CoinGecko, increasing by 162.5% to $43,418 from $16,540 since the beginning of the year up to Dec. 28, 2023.

Bitcoin's returns over various timeframes have captured the attention of institutional investors seeking alpha in their portfolios. The digital asset's ability to deliver substantial profits has instilled confidence among Wall Street players and turned many naysayers into supporters.

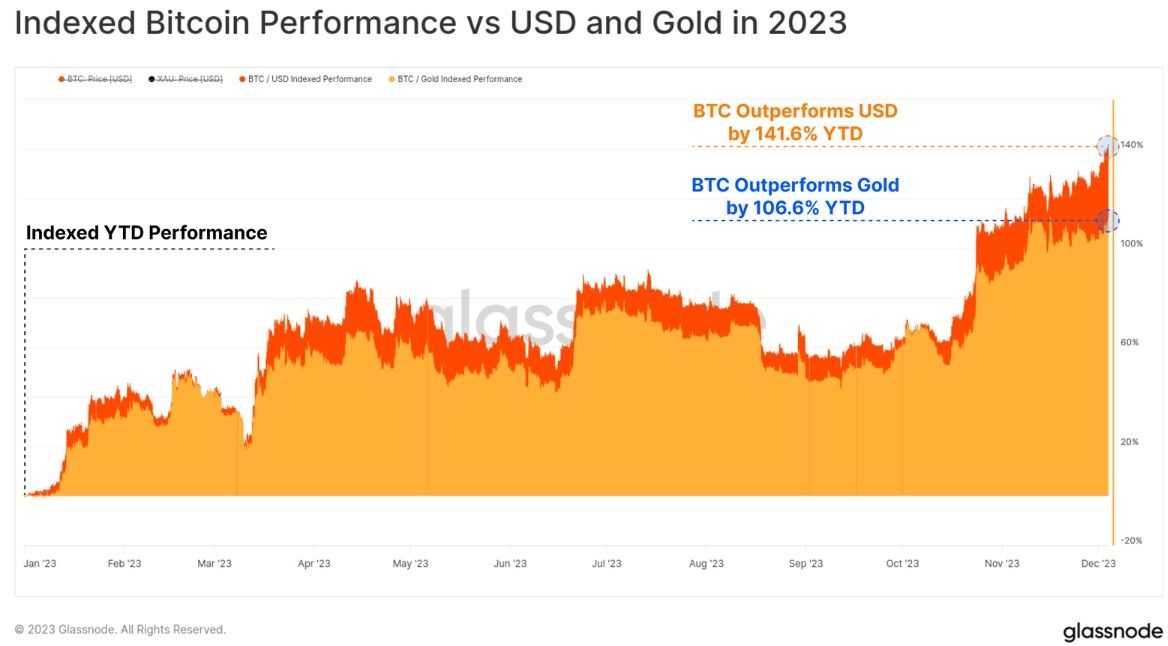

Bitcoin continued to lead as one of the best-performing assets globally in 2023. According to Glassnode, BTC outperformed both USD and gold denominators:

- BTC vs USD: +141.6%

- BTC vs Gold: +106.6%

Positive trends like this foster a more favourable environment for other cryptocurrencies, influencing Wall Street sentiment towards the broader crypto space.

For a deep dive into crypto's returns, head over to our article where we pit Bitcoin and stocks across various verticals such as returns, innovation, volatility and adoption.

Ethereum: Beyond Digital Gold

While Bitcoin may have started it all and currently remains the flagship crypto, Ethereum has emerged as a key player capturing institutional interest due to its unique features and versatility.

Institutional Interest in Ethereum

Institutional adoption of Ethereum is gaining momentum. Today, the second-largest crypto enjoys a dominant position in the crypto world thanks to its pioneering smart contracts functionality, market recognition and network effects.

Institutional investors are drawn to Ethereum as a means of expanding beyond traditional assets. The unique features of Ethereum — smart contracts and burgeoning decentralized applications ecosystem — offer a distinct means for diversification.

ZyCrypto quoted Bloomberg as reporting that seven spot Ether ETF filings have been made by companies including Fidelity, Invesco & Galaxy and Grayscale, among others.

Ethereum is a pioneering force in blockchain innovation, and institutional interest is largely fueled by their desire to be part of blockchain technology's transformative journey as the network continues to shape the landscape with its advancements in decentralized finance.

Applications Driving Institutional Attention

There's no question about Ethereum's technological capabilities, but we must delve a bit deeper to understand why it is on Wall Street's radar.

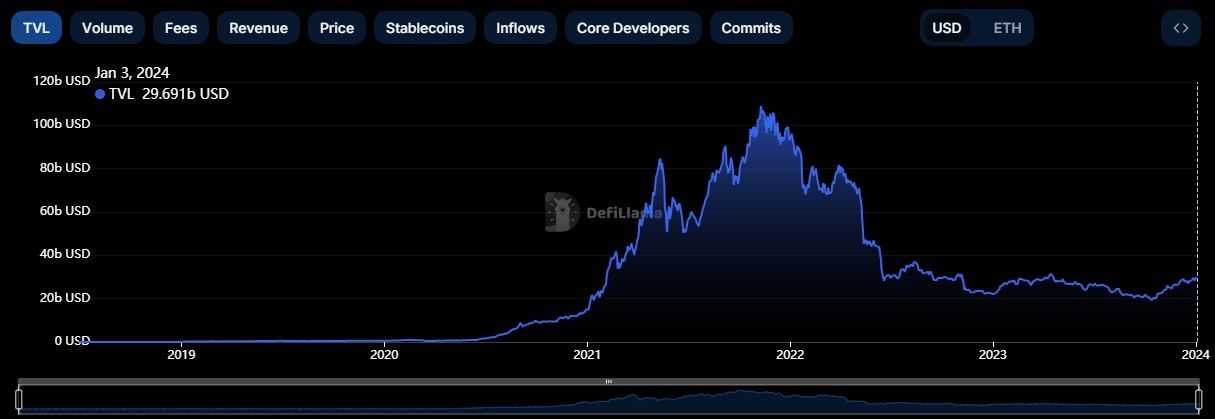

- Decentralized Finance: Ethereum's role as the primary platform for DeFi applications has positioned it as the top dog in the crypto sector. Investors are intrigued by the potential disruption of traditional financial intermediaries and the financial inclusion offered by DeFi protocols.

- Non-Fungible Tokens: Thanks to its smart contract functionality, Ethereum is a tour de force in the NFT market as well. In 2022, the NFT market generated sales of over $24.7 billion, and Ethereum claimed the lion's share. Its market share in the NFT space has surpassed 78%. The blockchain houses many of the most sought-after NFT marketplaces, such as OpenSea, Blur, Magin Eden and Castle

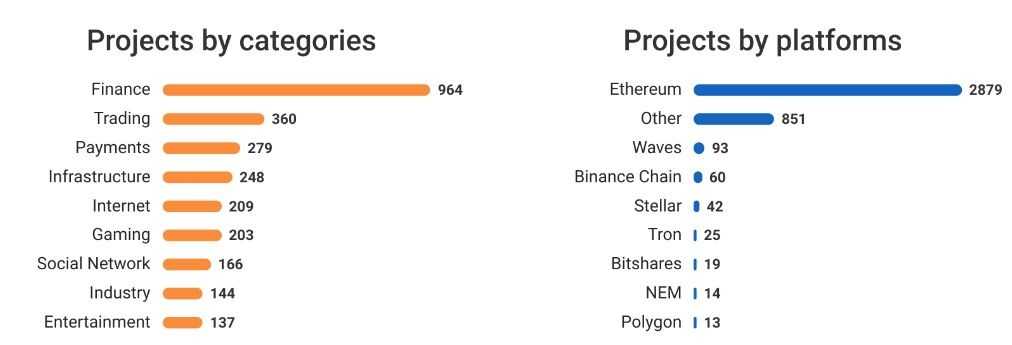

- Initial Coin Offerings: Remember the ICO frenzy of 2017 and 2018? Ethereum played a central role in enabling this crowd-funded boom of raising capital. A total of 2,284 initial coin offerings in 2018 raised about $11.4 billion, 13% more than in 2017, with Ethereum claiming 84.29% of the projects. More recent data from 2023 suggests Ethereum captured 72% of all ICOs.

Altcoins on the Radar

It isn't just Bitcoin and Ethereum that have won Wall Street's seal of approval, many institutional investors have set their sights on altcoins (Ethereum is an altcoin too; any coin not called Bitcoin is, in fact).

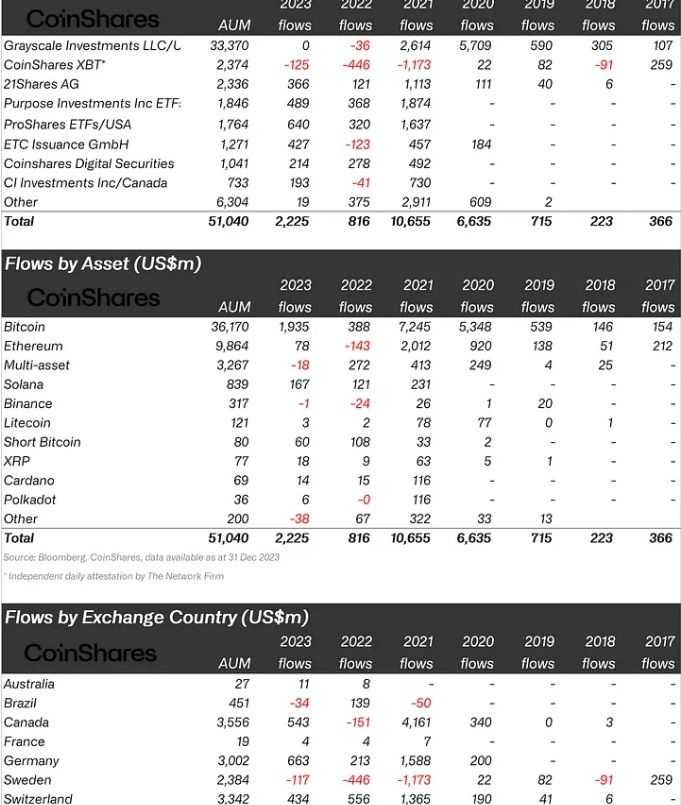

According to CoinShares, the following digital currencies witnessed inflows (money coming in) in 2023:

- Solana ($167 million)

- Litecoin ($3 million)

- XRP ($18 million)

- Cardano ($14 million)

- Polkadot ($6 million)

Unsurprisingly, Bitcoin saw the highest inflows at $1.94 billion followed by Ethereum at $78 million. Money flowing into the altcoin sector from institutions can often act as a canary in the coal mine, highlighting which projects are likely to gather more attention as investors, both retail and institutional look to deploy capital in the digital asset space. As the old clichés go “swimming with the whales” and following the “smart money” is often considered a good approach to investing.

All in all, digital asset investment products attracted $2.25 billion of inflows in 2023, representing a 2.7x increase over the previous year.

Much of the recovery was in the final quarter where it became increasingly clear that the SEC was warming up to the launch of Bitcoin spot-based ETFs in the United States. Total assets under management (AuM) has risen by 129% over the year, ending at US$51bn, the highest since March 2022 – CoinShares

Factors Fueling Interest in Altcoins

There are several factors that play a role in steering institutional interest towards specific altcoins.

- Technological Innovations: Cutting-edge features, scalability solutions, and advancements in blockchain technology often serve as compelling factors. For example, Solana, Cardano and Polkadot are considered by many as “Ethereum killers” as they aim to address Ethereum's scalability bottleneck.

- Use Cases: The real-world applications of altcoins are likely a significant driver of institutional interest. Web3 applications, crypto gaming and DApps are some of the verticals unique to blockchain technology. In the real world, the technology can be seen in action in several sectors including banking and finance, healthcare and supply chain to name a few. If this sounds like music to your ears, you'd find our article on use cases of blockchain technology a great read!

- Market Trends: Altcoins don't exist in isolation; they're part of the broader crypto ecosystem. Liquidity, for example, is probably something on institutional investors' minds before they venture into altcoins, so they'll likely stick to coins with high liquidity. Another consideration is likely volatility and these financial giants employ advanced risk models and analytics to anticipate and mitigate potential price swings.

- Partnerships: Collaborations play an important role for not just crypto companies but every corporation. Institutional investors likely analyze strategic alliances formed by altcoins. Solana, for example, struck a partnership with payment processor Visa, which touted its "The key to success is speed, scalability & low transaction costs." Cardano, on the other hand, has partnerships with the European Investment Bank and the International Finance Corporation, among many others.

Challenges and Concerns

The journey toward widespread institutional involvement is not without its hurdles.

As major financial institutions contemplate integrating digital assets, they must over certain challenges and concerns, ranging from regulatory uncertainties to security apprehensions and the intricacies of altering long-standing perceptions.

Regulatory Uncertainty

Regulatory uncertainty remains a major concern for institutional investors considering entry into the cryptocurrency space. The lack of a standardized regulatory framework introduces a level of ambiguity that may give some institutions pause.

The global regulatory landscape for cryptocurrencies is highly fragmented, with different countries adopting varying approaches. Some nations have embraced cryptocurrencies, providing clear guidelines, while others maintain a restrictive stance. According to PwC, 42 countries either held discussions or passed laws concerning cryptocurrencies in 2023.

The rapid evolution of the crypto market often outpaces regulatory developments. Nevertheless, the lack of clear guidelines complicates compliance efforts for institutions. Addressing regulatory uncertainty requires a concerted effort from all stakeholders.

Crypto companies, financial institutions, and advocacy groups can come together to engage with regulators to advance clear and comprehensive regulatory frameworks.

Security Concerns

The security of digital assets remains a paramount concern for institutions. Instances of hacking and vulnerabilities in the sector have likely forced some institutional investors to stay on the sidelines.

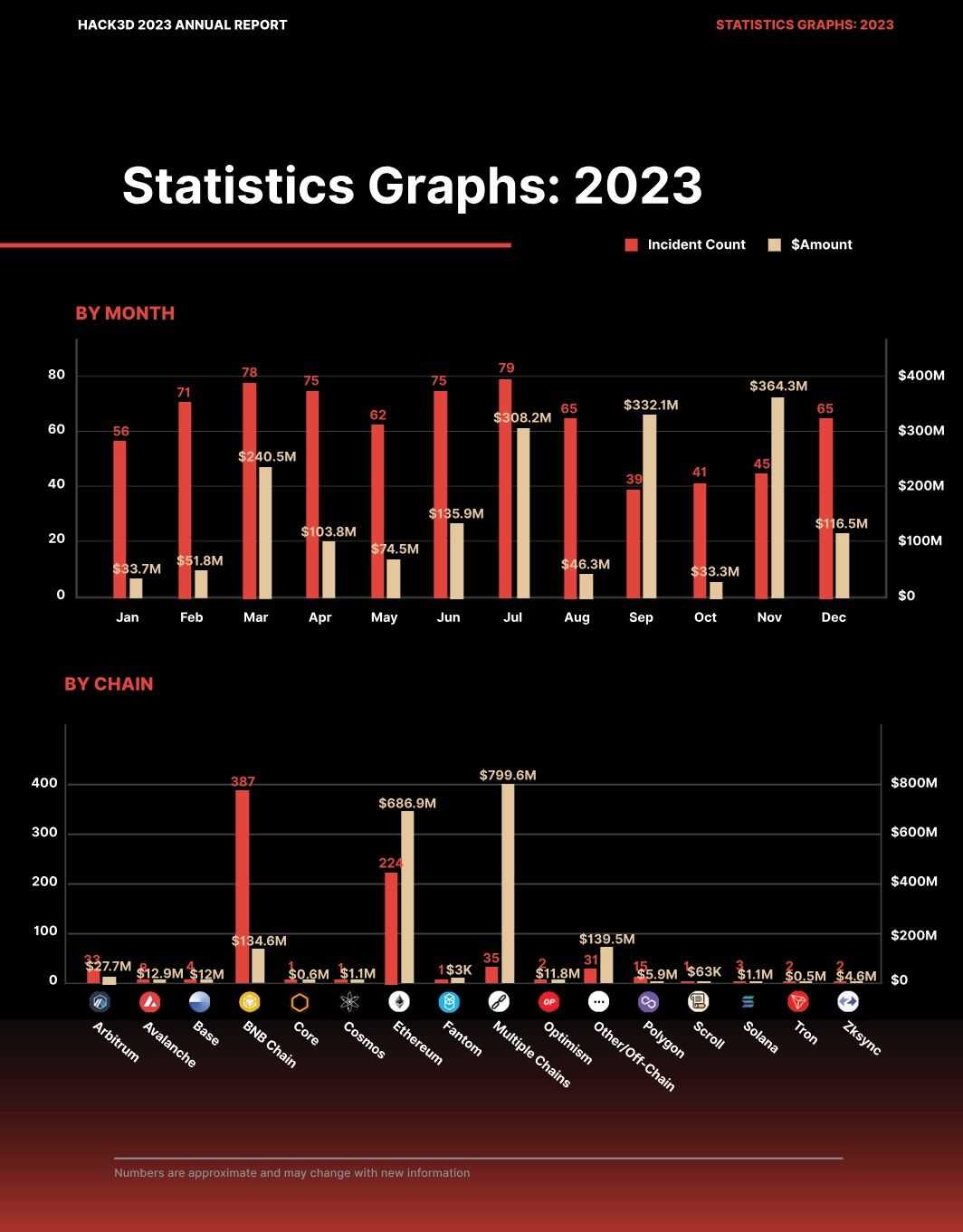

According to CertiK, over $1.8 billion was lost across 751 security incidents in 2023. Interestingly, this represents a decline of 51% from the $3.7 billion lost in 2022. Private key compromises were the most costly attack vector, and BNB Chain experienced the highest number of security incidents. Ethereum saw a total of 224 incidents, totalling $686 million in losses.

The biggest hacks in 2023 included:

- Mixin: $200 million

- Euler Finance: $197 million

- Poloniex: $126 million

- Atomic wallet: $100 million

- Curve: $60 million

Addressing these security concerns involves a multifaceted approach that includes leveraging specialized custodial services, ensuring regulatory compliance and exploring self-custody solutions.

Reputational Risk

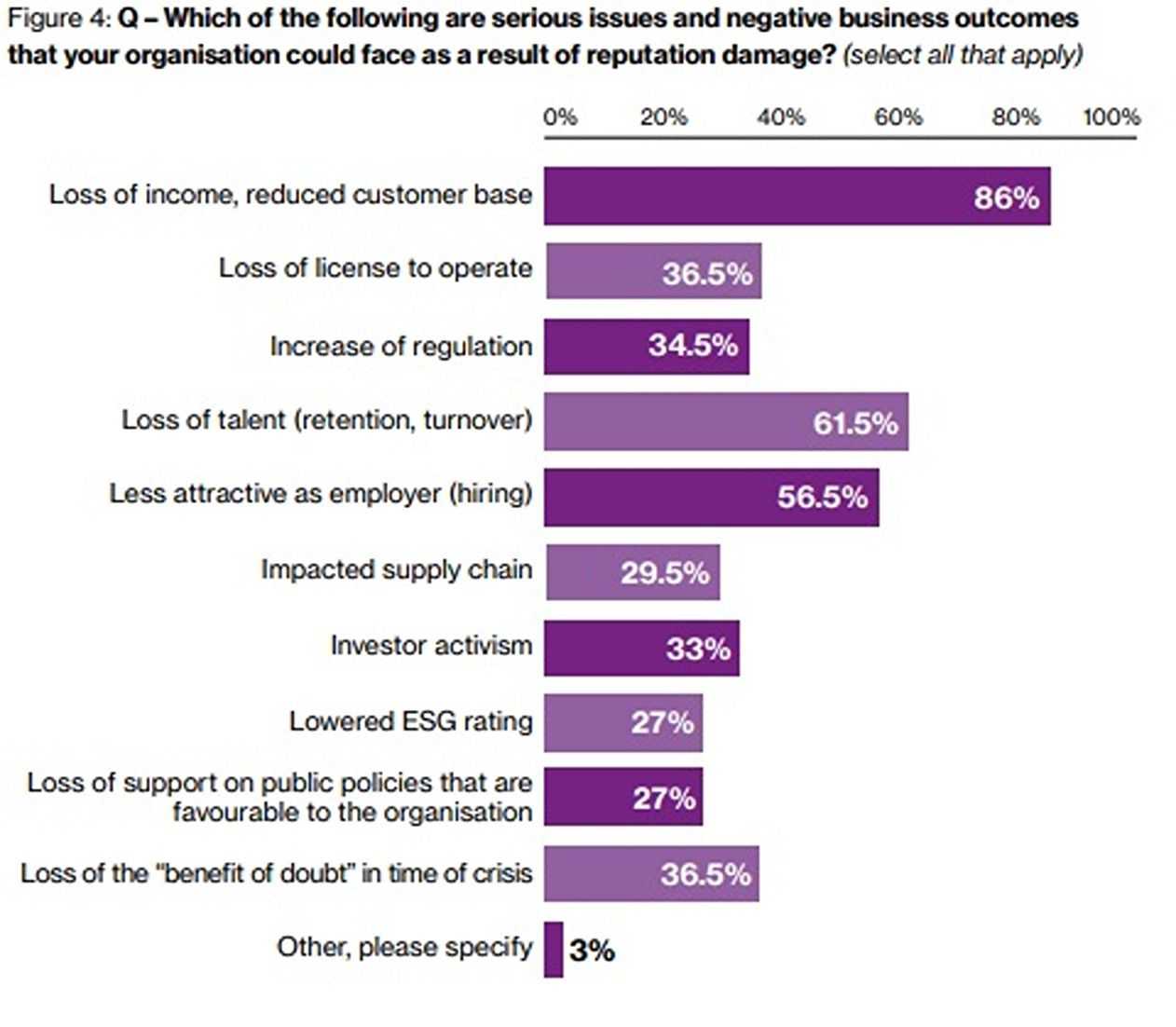

Blockchain technology has come a long way. Still, cryptocurrencies are often associated with volatility and speculative trading, which may pose a reputational risk for institutions.

Reputational risk is a subtle menace that can jeopardize even the most well-managed corporations. This risk leads to repercussions that defy straightforward measurement. Nevertheless, its impact can detrimentally influence a company's bottom line and stock price.

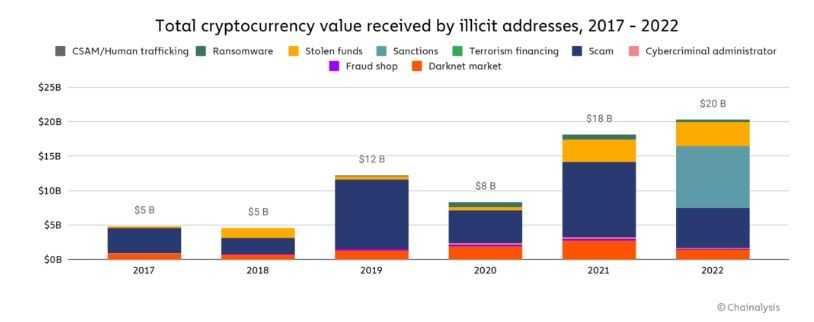

Cryptocurrencies carry a speculative narrative that contrasts with the conservative approach favoured by many institutional investors. Their association with certain illicit activities, facilitated by perceived anonymity and decentralization, has also contributed to negative perceptions.

According to Chainalysis, illicit transaction volume in 2022 rose for the second consecutive year, hitting an all-time high of $20.1 billion. Forty-four per cent of the total came from activity associated with sanctioned entities.

What's Next for Institutional Crypto Interest?

Institutional interest in crypto is set to reshape the future landscape of finance as Wall Street ditches its “praise the sea, on shore remain” mantra and is now increasingly drawn into the cryptoverse.

The surge in institutional adoption is poised to usher in a wave of fresh investments through the introduction of innovative institutional crypto products. The shift gained notable momentum with the launch of the first Bitcoin Futures ETF in the U.S. in 2021. While this ETF was futures-based rather than tied to the bitcoin spot market, its inception marked a significant stride in the right direction. Of course, more than 12 companies have filed applications with the SEC for a spot Bitcoin ETF.

The growing appetite among institutional investors for conventional financial products tied to crypto is driving the creation of new offerings, resulting in an influx of investments.

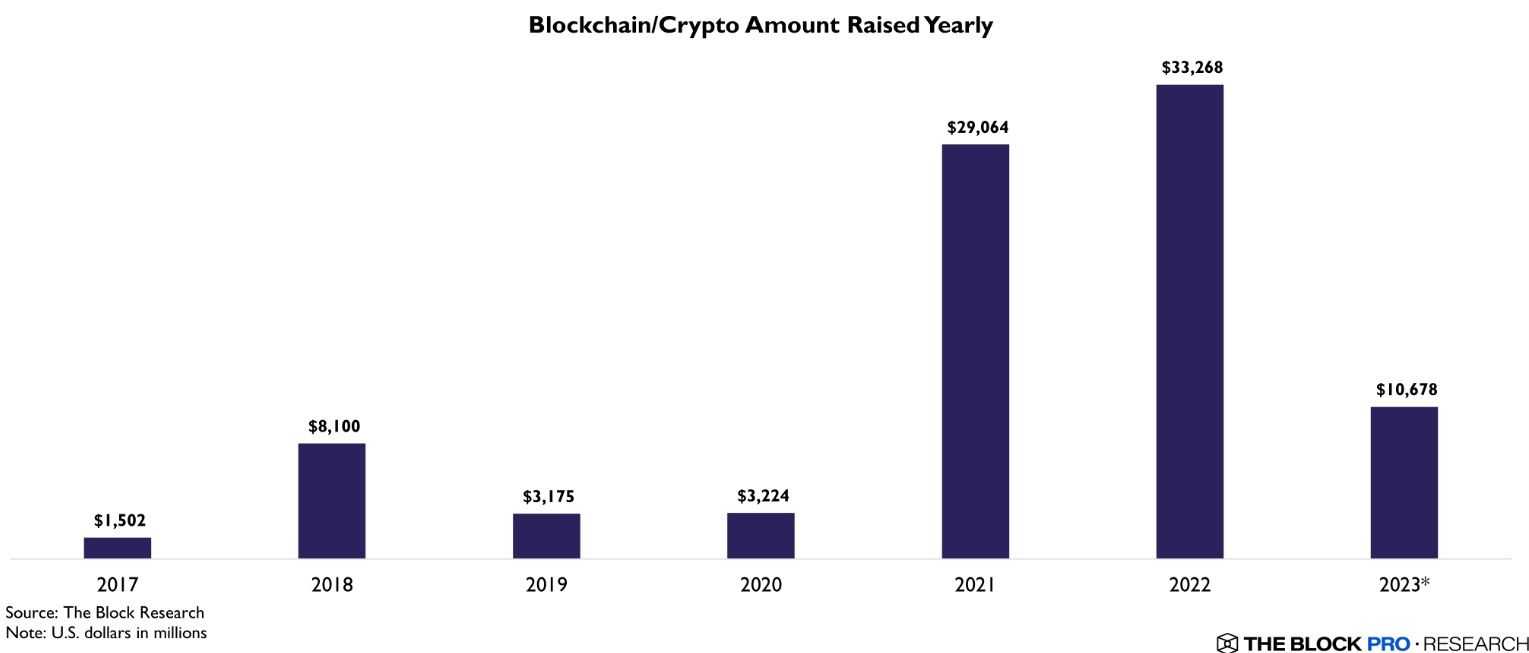

Speaking of, crypto VC funding took a beating in 2023, falling by 68% in 2023 to $10.7 billion, compared to $33.3 billion in 2022, according to The Block. Still, the total outpaces prior bear markets, exceeding the $6.4 billion invested in 2019 and 2020.

As the cryptocurrency market continues to mature, institutional involvement is likely to increase due to factors including:

- The continued development of regulatory frameworks is expected to provide institutions with clearer guidelines.

- The highly anticipated approval and launch of spot Bitcoin and Ether exchange-traded funds in the U.S.

- The evolution of DeFi and the continued advancements in blockchain technology.

Emerging Trends and Potential Catalysts

There are a few emerging trends that should act as catalysts for heightened institutional participation in the crypto market.

Tokenization

One notable trend is the growing interest in tokenization of real-world assets. Tokenization, a process involving the issuance of a digital representation of an asset, has emerged as the new crypto buzzword. The spectrum of tokenized assets spans physical items like real estate or art, financial instruments such as equities or bonds, intangible assets like intellectual property, and even personal identifiers and data.

The potential impact of tokenization is significant. Industry experts project a substantial surge, with forecasts predicting up to $5 trillion in tokenized digital-securities trade volume by 2030.

While the concept of digital-asset tokenization has garnered attention since its introduction in 2017, its widespread adoption has lagged. Despite persistent hype, meaningful traction has been slow to develop.

Regulatory Clarity

Any discussion in the crypto realm is incomplete without some regulatory cherry on top!

Increased regulatory clarity holds the key to unlocking a new chapter in the adoption of cryptocurrencies by major institutions. As the regulatory landscape for digital assets becomes more defined, major players in the financial industry will likely find greater comfort and confidence in navigating the crypto space. Regulatory clarity addresses longstanding concerns surrounding compliance, legal frameworks, and risk mitigation, which have traditionally been deterrents for institutional involvement in the crypto market.

The EU is far ahead of most geographies when it comes to regulating the crypto market. In April 2023, the EU passed the Markets in Crypto-Assets Regulation (MiCA), which was met with great fanfare. French Finance Minister Bruno Le Maire called it a “landmark" Former Binance CEO Changpeng Zhao has welcomed the new law. “clear rules of the game.”

Here's a neat table, courtesy of CoinDesk, that lays out the basics of MiCA.

| The Good | The Bad |

|---|---|

| Legal Certainty | There are strict rules that must be met |

| Cryptography-specific rules | Fines of up to a million euros for mistakes |

| Credibility for wary customers | USD Stablecoins Caps |

| One license for all of the bloc | NFTs fall into a grey zone |

| Attract TradFi investment | It is unclear how the overseas enforcement of laws will work |

The U.S. has reached a crossroads with regards to cryptoregulation. Regulations that are enforced do not provide clarity for consumers, nor do they protect them. They also chill innovation. Gemini

It is important to move from regulatory uncertainty to clarity, as this could lead to a flood of institutional investment in the cryptomarket.

Closing thoughts

Wall Street's crypto narrative has evolved from cautious observation to active participation.

The staggering returns that cryptocurrencies offer have led many institutions to reconsider their initial scepticism. This shift isn't necessarily about fattening their balance sheets but potentially signifies a broader acknowledgement of blockchain technology's potential. This attention is crucial in legitimizing crypto as a market, and dispelling the notion that digital assets are purely speculative.

The future looks promising for institutional interest in crypto. Predictions suggest a deeper integration into institutional portfolios of digital assets, driven by regulatory development, the launch exchange-traded funds and advances in decentralized financing. New trends such as tokenization present new opportunities.

Wall Street is now actively exploring cryptocurrencies after a period of scepticism.

Common Questions

What cryptos is Wall Street interested?

Wall Street’s interest in cryptocurrency is focused on two players: Bitcoin, and Ethereum.

- Bitcoin: Renowned as “digital gold,” Bitcoin is seeing an increased adoption by institutions. Institutions can enter the market with ease and comfort thanks to the emergence of regulated investments such as Bitcoin exchange-traded fund (ETFs) or pending spot ETFs. Bitcoin’s outperforming performance, which has outpaced traditional assets, instilled trust and drawn institutional attention.

- Ethereum: Ethereum, the second largest cryptocurrency, is gaining institutional attention due to its role in Decentralized Finance (DeFi) and smart contracts. Institutional investors are also attracted by the platform’s dominance of non-fungible (NFT) tokens. The filing of ETFs for spot Ether by major companies shows the increasing interest among institutional investors in Ethereum.

Why do institutional investors show interest in cryptocurrency?

A number of factors are attracting institutional investors to cryptocurrency. Major institutions have been attracted by the high returns of assets such as Bitcoin. The legitimization of crypto markets, increased market trust, and potential diversification also contribute to the interest among institutions.

What role does regulatory transparency play in institutional crypto interests?

The regulatory clarity of cryptocurrencies is a major catalyst for institution involvement. As the regulatory frameworks get more defined, institutions feel more confident and comfortable navigating in the cryptospace. Clear guidelines address concerns about compliance, legal frameworks and risk mitigation. This makes it easier for institutions and financial institutions to assess risks and benefits of crypto investments.

What are the challenges that institutional investors face when entering the cryptomarket?

Institutional investors have to overcome many challenges before they can enter the crypto market. These include regulatory uncertainty, concerns about security, and risks related to their reputation. Lack of a standard regulatory framework creates uncertainty, security is a major concern because of hacking incidents and institutions face reputational risks due to the association between cryptocurrencies and volatility.

What are the differences in institutional interest between Bitcoin and Ethereum

Bitcoin is still the most popular cryptocurrency. It’s often seen as a currency that has a lot of potential. “digital gold.” Bitcoin is attractive to institutions because of its decentralized and finite nature. Ethereum, however, is appealing to institutions for its unique features. These include smart contracts, and its pivotal position in decentralized finance and non-fungible tokens (NFTs).

What are the possible long-term impacts of institutional crypto interest?

The impact of institutional interest in crypto on the financial landscape over time is significant. It represents a fusion between the traditional financial system and the crypto-market, which will change how assets are managed, valued, and traded globally. The potential for transformation lies in the convergence between innovation and legitimacy. This will pave the way to a more resilient and inclusive financial ecosystem.