The crypto margin market is not for everyone.

However, only those who can use it in an effective and efficient manner will benefit. risk controlled They can maximize their return on a certain amount of capital. This allows them to borrow money and trade with it.

The short sale is another great option for traders who want to take both a long and a short view of the asset.

This post will tell you all you need to about margin trading in crypto. You will get some useful hints, tips and information about the top places to invest on margin.

Margin Trading: What is it?

Margin Trading is the act of borrowing money to trade with. Trading with borrowed money is what margin trading is all about. "leverage" The margin (collateral), which you place down to trade, is typically a fractional amount of the required.

This is because you can increase your gains (or losses) based on a change in the value of an asset. It is for this reason that margin trading has been deemed arisky. The double-edged blade.

There will always be charges involved with margin trading, as you’re borrowing funds. This is interest rate or "overnight" The rates are based on the amount you owe.

Simple Example

Imagine that you wish to buy Bitcoin on margin. You will need to know the maximum leverage or minimum margin required by your exchange before you can take a position. Assume that the minimum margin is 20 %.

If you want to trade Bitcoin, you’ll need to deposit 20% of your notional amount. If you have a position of 10BTC, then 2BTC will be required as margin or collateral.

It also means the leverage of the position is five times. Leverage measures how your position reacts to changes in the value of the underlying asset. In this case, the position would move 5% if Bitcoin’s price moved by just 1% (approximate percentage).

It is now clear why margin trading has the potential to be both profitable and dangerous. Leverage can be up to 100 times for some exchanges or brokerages. The right trade could make or break your investment.

Some brokerage firms require what they call a "Maintenance Margin". It is the amount of money that needs to be kept in the margin balance once the position has been open. The trader may be notified by the broker if the margin falls below the minimum.

Pros & Cons of Margin Trading

Margin trading has many benefits that everyone agrees on:

- More Returns: It is obvious. The margin trading gives you leverage, meaning that your returns are X times greater than they would be without it. "X" What is the lever level?

- You can short the asset: You can also short an asset, which allows you to benefit from price drops.

- Trade Structured: Combining margin trading with different levels of leverage, buys/sells and other options allows investors to execute more complex trades. The strategies they can develop are similar to option trades.

The cryptocurrency market is a place where increasing profits also increases risk. Margin trading is not without risk.

- Larger Losses: We have already mentioned that leverage has a dual edge. You can certainly increase your upside returns by X, but there are also downside risks. magnify your losses. Without risk management, you could quickly exhaust your capital.

- Finance Cost You are at risk for a margin or liquidation call even if the asset you chose is going in the right direction. It is possible to have your position closed or called if you use leverage. You will need to pay interest if you borrow money to make the trade. It is the rate of rollover that will be applied to your position. You can lose money if you hold a large position open for a long time.

Margin trading involves risks, and these can be substantial if your strategy is not in place.

Most successful traders agree, however, that as long you manage your risks effectively, it is possible to make money. We will discuss this in more detail below, as part of our Margin Trading Tips.

Crypto Margin Trading Exchanges

Now that you’ve decided you want to get into margin trading, the next step is finding a platform which suits your individual needs. It is important to choose the platform best suited for your personal needs. It is crucial to do this because margins and futures offered by exchanges are often very high. Different in a vast way.

We have compiled a list below of some well-known platforms for crypto margin trading. The list below is by no means complete and may include other exchanges offering similar products. Make sure you do some research on these exchanges and brokers before you use their services.

BitMEX

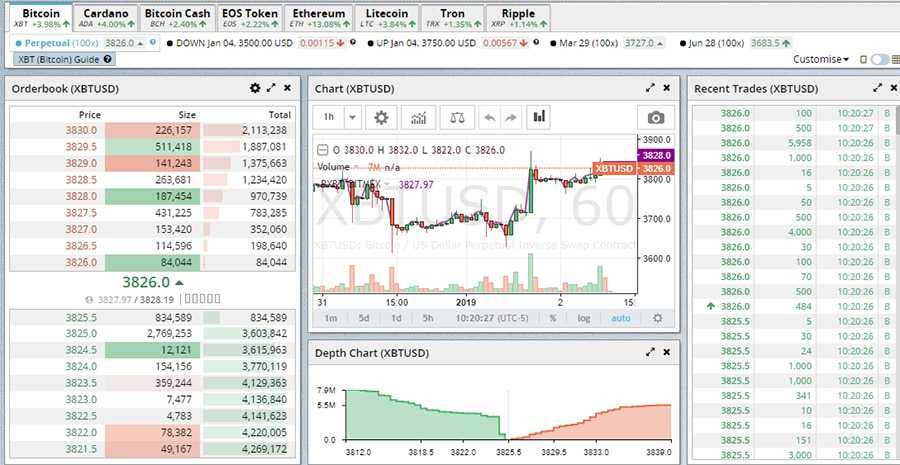

BitMEX, a derivatives trading platform and margin trader that is currently available on the market, has a great deal of recognition. The company has been in business since 2014. They are registered and based out of Hong Kong.

BitMEX offers Futures products. The products offered at BitMEX are Futures instruments. You can also read about future plans. On a Future price.

BitMEX offers a futures contract with spot prices. "perpetual swap".

It is basically a futures contract with no expiry date. This contract is marked to market daily based upon the movements in the price and never reaches a conclusion.

BitMEX has some pretty impressive leverage ratios. The minimum deposit for their BTC Futures Contract is just 1%. It implies 100x leverage for the asset.

BitMEX calculates the margin more precisely once your position is opened. You won't get a margin call from BitMEX but they will draw on your funds or, in the event of fund depletion, they will liquidate your position.

BitMEX has an array of cryptocurrency assets. Below is a table that lists the BitMEX coins, their trading fees and margins.

| Coin | Min Margin | Taker fee | Make Rebate | Payment Fee |

| Bitcoin | 1% | 0.0750% | (0.0250%) | 0.0500% |

| Ethereum | 2% | 0.2500% | (0.0500%) | NA |

| Litecoin | 3% | 0.2500% | (0.0500%) | NA |

| Bitcoin Cash | 5% | 0.2500% | (0.0500%) | NA |

| Cardano | 5% | 0.2500% | (0.0500%) | NA |

| Ripple | 5% | 0.2500% | (0.0500%) | NA |

You should also consider a number of things when trading at BitMEX. Many more options are available for risk management and trade functionality. You can read our BitMEX Review for a comprehensive overview.

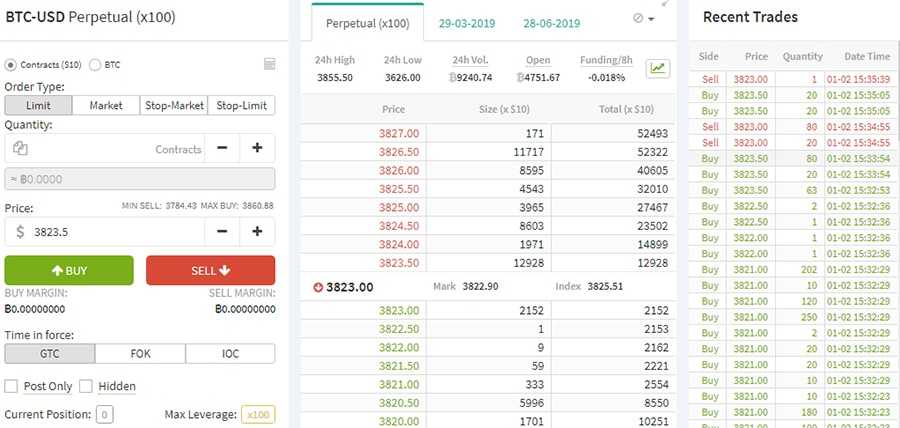

Deribit

Deribit has also been in business since 2016. Their headquarters are in Amsterdam.

Deribit, like BitMEX also offers futures contracts based on Bitcoin’s price. Deribit, however, is the only crypto-option exchange that’s fully functional. They offer a wide range of Bitcoin option instruments.

We won't go into too much detail on options here. Options aren’t really trading instruments that require margin. Although short-term options may be subject to margin requirements, they do not actually involve margin. For more details, you can also read our complete guide on cryptocurrency options.

Deribit, like BitMEX also offers a minimum 1% margin for their Bitcoin Futures. Note that the 1% is not always constant, and adjusts by a factor 0.5% with each 100BTC in the position.

Deribit, however, does not list their maintenance margin. The Maintenance Margin is defined at 0.55%, and it is scaled based on the size of a position.

Deribit’s margin is something that they offer that no other exchange offers. "portfolio margin". It is a very interesting feature, which allows traders to reduce margins on certain trades by using positions in other transactions.

Deribit has a comprehensive overview of their portfolio margins, options instruments or advanced platform.

Kraken

Kraken is a name that many of you will be familiar with if you have spent some time in the Bitcoin industry. Kraken is one of the older Bitcoin exchanges, having been launched in 2011. Kraken’s headquarters are in San Francisco, USA.

The company is best known as an actual crypto exchange, but they also offer similar services to margin trade. Users can borrow money to buy specific coins.

These margin requirements, unlike BitMEX or Deribit are actually quite mild. You can only post a minimum of 20% margin, which is equivalent to a 5x leverage. Nonetheless, it is possible to short crypto assets using borrowed funds.

Leverage limits and total borrowing limits will differ depending on the pair that you are trading, along with what level of verification you’ve reached. You can find out more about this by checking their margin borrowing limits.

You will pay a fixed fee to open the trade and a rollover fee every four hours. Opening and rollover charges are identical. 0.01% The XBT/USDT base positions are shown below. 0.02% All other base currencies.

For more details about Kraken’s trading platform, including their option for trading physical cryptocurrencies you can check out our review.

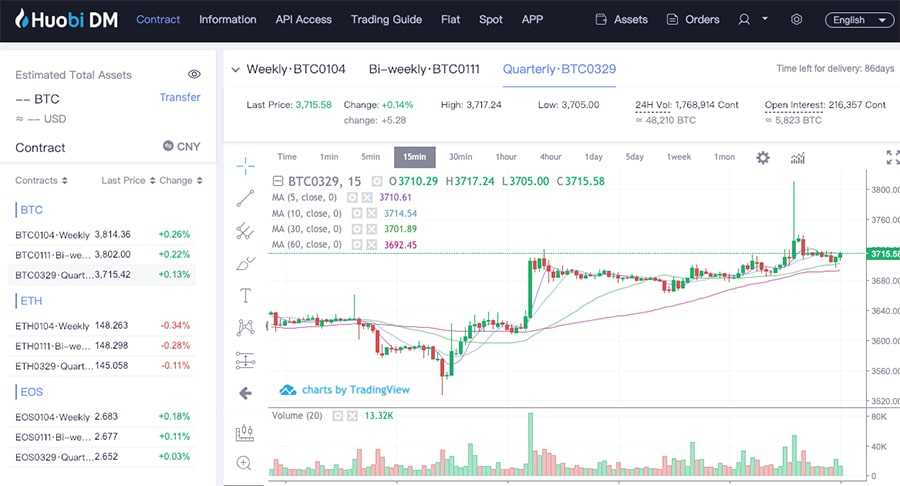

Huobi Pro

Huobi, like Kraken is a Bitcoin physical exchange which now offers crypto margin trading. Huobi started their service in China back in 2013. They now have their main offices in Singapore. Huobi has now opened a US subsidiary.

Huobi’s financial derivative and margin product is similar to BitMEX’s perpetual futures. Here is what the Huobi DM It was only launched recently as a standalone exchange service.

Huobi DM will also give you leveraged access to the underlying assets, just like a perpetual or spread betting products. These contracts have an expiration date and are settled on a weekly, biweekly or quarterly basis.

These contracts allow you to leverage up to 1X, 5X 10X or 20X. The maximum leverage is 20X. 20X Kraken’s prices are slightly higher than BitMEX, but lower than Deribit.

Huobi also operates a maintenance margin rate. Huobi uses this as an indicator for assessing the risk that a position will move too rapidly into a loss-making situation. Here is a formula that shows you how to calculate it on the exchange.

MMR = (Equity Balance / Used Margin) * 100% – Adjustment Factor

Margin call coefficient "Adjustment Factor" The amount you pay will depend on the level of risk and instrument. Huobi initiates a liquidation of your position when the maintenance margin rate drops below 0.

Huobi is more than a margin trader. There are many products available. We won't go into any of that detail over here but you can get more information in our Huobi Exchange review.

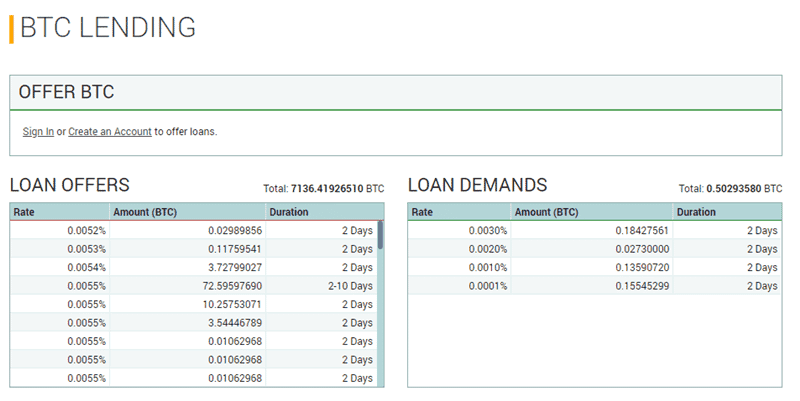

Poloniex

Poloniex, another exchange offering loan services to its traders. This exchange is US-based and was founded in 2014. Recently, they have been featured in the media as Circle Financial acquired them.

Poloniex offers both the option to lend funds for margin trading and to act as a counterparty by offering the funds. You can earn fees by being the one who lends crypto to someone else.

These are currently the lowest leverage limits offered by any exchange. They will only allow a maximum of BTC at the moment. 2.5X This implies a margin of initial 40%.

Poloniex is different from BitMEX Huobi Deribit in that it requires you to complete a KYC process before you are allowed to trade. While this may not be a deal breaker for some traders, there are many others who value their privacy and don't feel comfortable sharing this.

Poloniex US traders have yet another bad surprise. These traders were only recently denied access to their BTC margin and lending features.

Circle has probably implemented new rules after the purchase. This option is still available to traders based outside of the United States.

Poloniex, despite the bad news for US-based traders and its low leverage level, is an advanced exchange that covers a wide range of coins. For more details on the platform, trading products and other aspects of Poloniex please read our review.

Best Tips for Margin Trading

You should use risk management practices to place your trades if you decide to move to margin trading. You can make your margin trading more profitable by following these tips.

- Begin Small You should not start trading with leverage levels of 50-100X. You have to ease into it with lower leverage levels which don't have so much drawdown risk. It is possible that you will lose your confidence in the future if a heavily leveraged position wipes out all of your capital.

- Avoid Excessive Leverage: In line with what was said above, it is never necessary to exceed 50X leverage in any of these exchanges. There have even been studies that show that using too much leverage with assets such as Bitcoin is less than optimal, and could lead to premature liquidity. You should always remember that even if the trade you made goes the way you hoped, large leverage and short-term changes could cause you to lose your trade.

- Use Stop Losses: Stop losses are necessary in case a transaction goes the other way. Stop loss orders are available on all of the exchanges mentioned above. It is not possible to avoid them. Use technical analysis in your trading to determine where you place the stops. Stop losses are set by some exchanges. guaranteed Some require you to pay more for the privilege (which we highly suggest). Some charge you more (which we strongly suggest).

- You should only invest the amount you can afford. The obvious one but often missed by novice traders. It is important to have an amount that you are willing to invest on a certain exchange. You can also choose a strategy or a specific trade. Never chase losses and don't let your emotions get in the way of your margin trading.

Most of these tips relate to the cryptocurrency market in general. It is also about knowing what you do know, knowing what you don't and learning what you don't know. As long as you are aware of the basics, you will be fine.

You can also read our conclusion.

Margin trading in cryptocurrency is an excellent way to earn returns from funds you don’t own. In fact, banks use this method when your money is deposited in their bank accounts. Banks use these funds to boost their returns.

You are not a financial institution and the banks are supported by government agencies.

This does not negate the fact that financials should still be considered. If you follow a good crypto trading strategy, and use the correct risk management protocols to manage your trades then margin trading can be a very attractive option.

You should, of course, always be aware that Do Your Own Research. This is true especially for highly leveraged products with crypto margins.