Ethereum 2.0 is set to go live on the 1st of December 2020. Great! What does this mean? What is Ethereum 2.0 exactly? What is Ethereum 2.0? Is it even worth it? What’s the deal? “Ethereum 1.0” What is the status of Ethereum 2.0? What will Ethereum 2.0 mean for the Ethereum price?

Here are a few questions many people ask since the launch of Ethereum 2.0. We have kept an eye on the questions at Coin Bureau. You can find answers to some questions in our video on Ethereum 2.0. But others will need more explanation.

You will be able to answer all your questions about Ethereum 2.0 by the time you finish reading this article.

What is Ethereum

We recommend that you first read our article on Ethereum. Ethereum, in short, is both a cryptocurrency and a platform for building applications.

The applications built with Ethereum look and feel like those found on computers or the Internet. The difference is that applications built on Ethereum are decentralized – they are not kept on a single computer or server.

Ethereum applications are instead stored on multiple computers connected to the blockchain network. It is therefore virtually impossible that any application built on Ethereum will experience downtime. The regulators will also find it very difficult to limit access or shut these applications down.

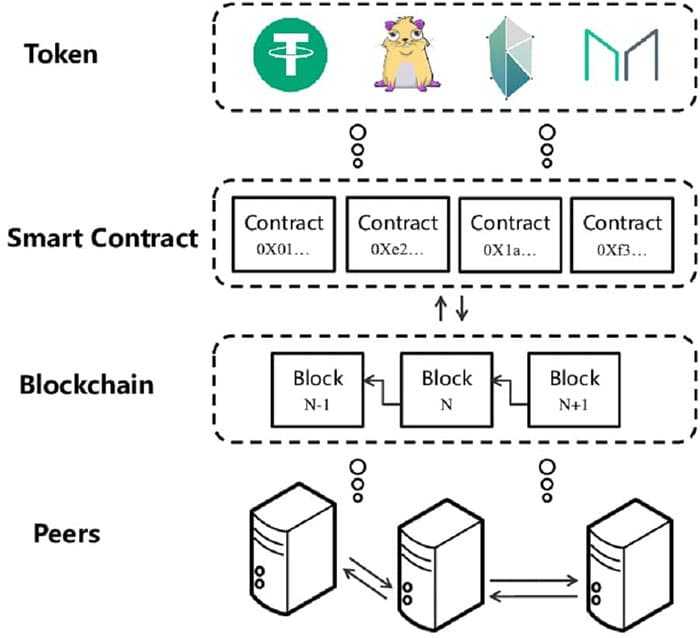

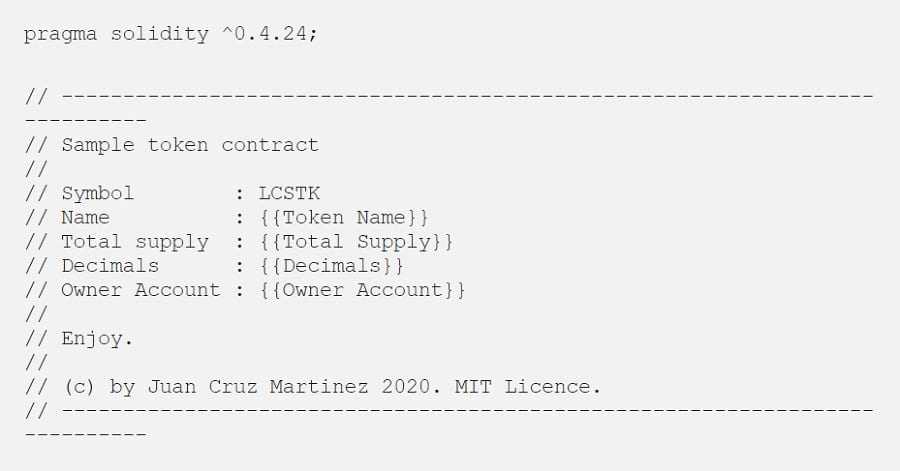

Ethereum lets you create digital tokens in addition to apps. You can create your own cryptocurrency using a kind of template instead of starting from scratch. “template” Ethereum is a cryptocurrency.

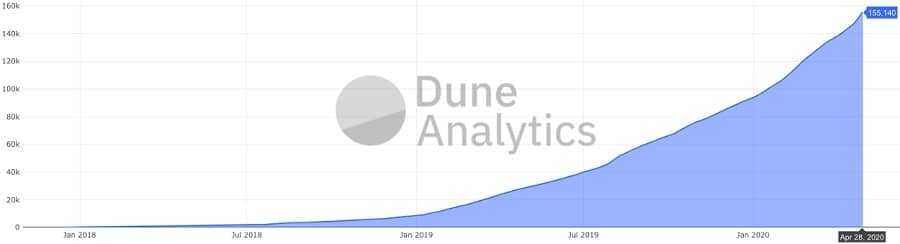

The ERC-20 template has been used to create over 200 000 tokens on Ethereum. Ampleforth, for example, has some very special qualities built into it.

Why Is Ethereum Important?

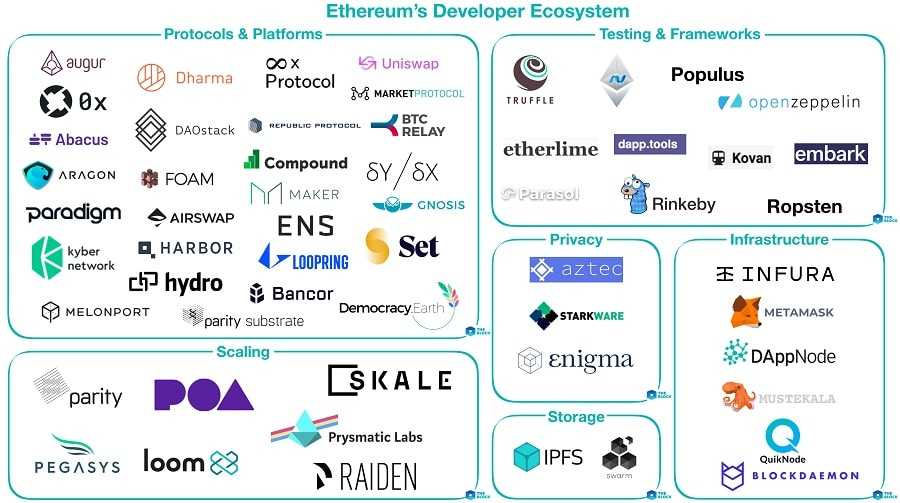

Ethereum’s market capitalization is not the only reason it is second in popularity. Ethereum has the largest cryptocurrency ecosystem, with over 50% of top 100 coins built as ERC-20 Tokens on its blockchain.

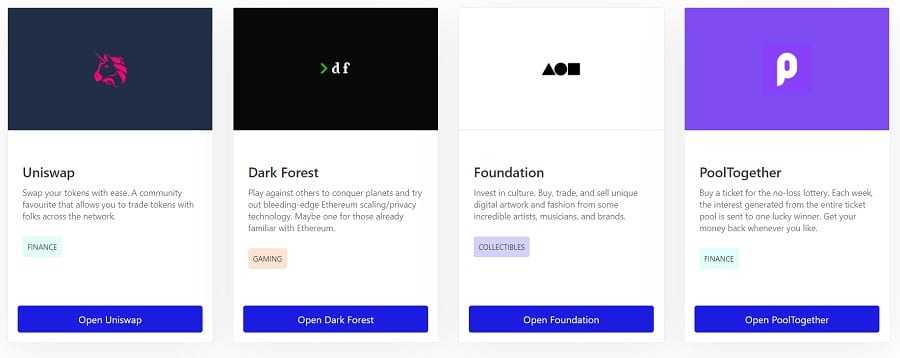

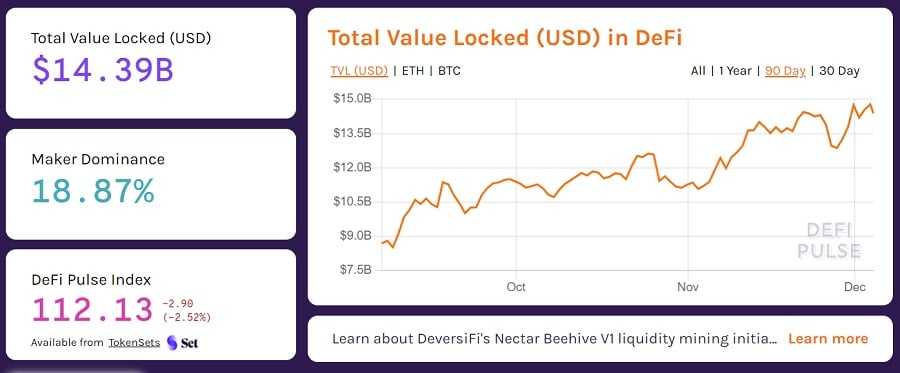

The most important thing to note is that almost all decentralized finance applications are built using Ethereum. DeFi space is made up of about a dozen applications which allow users to do such things as trade, lend and borrow ERC-20 coins without having to rely on a centralized entity, like a crypto exchange or a bank.

It turns out that cutting out the middleman can be quite profitable. The annual interest rate in Ethereum DeFi protocol can range from 3-10 000%+. (Though the extreme APYs tend to be rare and only last for a short time). DeFi has seen a growth of 15 billion dollar in the cryptocurrency space.

The ETH token can be used to pay Ethereum network charges, known as gas. These fees are measured in a unit named gwei. ETH demand increases as the number of applications and tokens grows. It is for this reason that some people believe Ethereum could one day overtake Bitcoin and become the biggest cryptocurrency.

Ethereum has also become the most popular smart contract platform on the planet. Understanding smart contracts is crucial as they offer limitless possibilities and have astronomical uses cases. They allow for traditional industries to be port into blockchain. Check out this educational article to learn more. Ethereum smart contracts – What is it?.

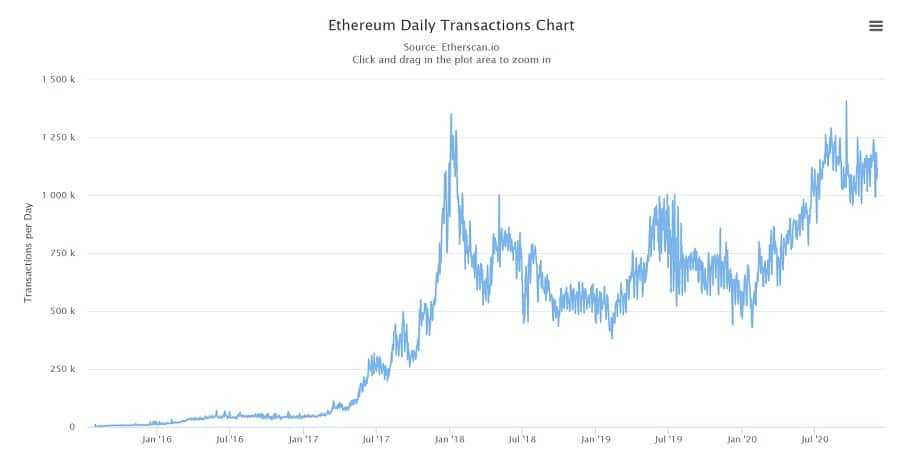

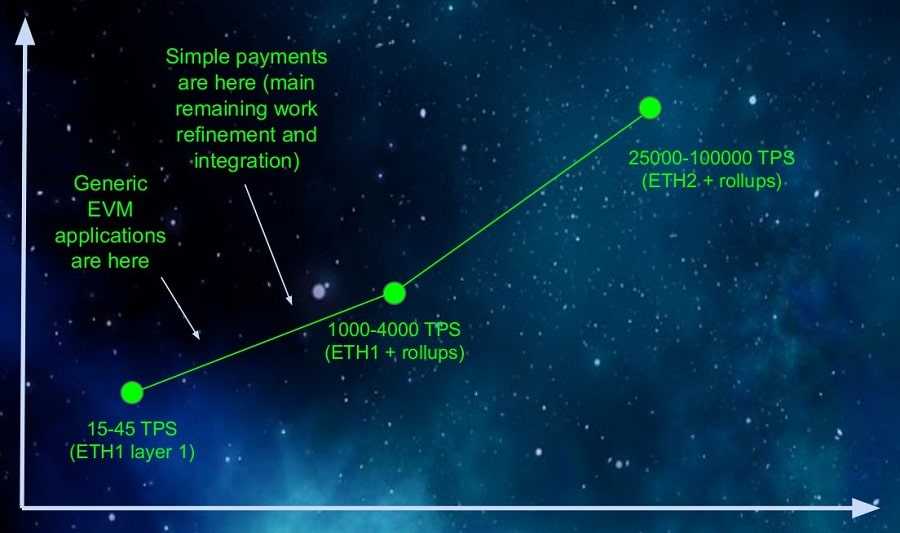

The Ethereum network is only able to handle 15 transactions per seconds. The ever increasing number of users using Ethereum apps is therefore not sustainable. Ethereum can’t scale and the number of users will soon be too high for it to handle. Since months, high network fees for Ethereum have been in the headlines.

Ethereum 2.0 is the answer.

What is Ethereum v2.0?

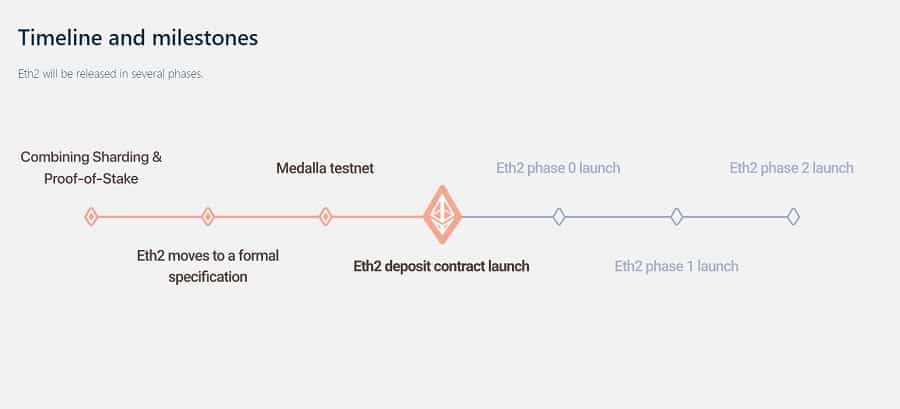

Ethereum 2.0 solves the scaling issue of Ethereum. Since 2015, when Ethereum was created under the name Serenity, it has been in development. Ethereum 2.0 is the next step in Ethereum’s evolution.

What is Ethereum 2.0?

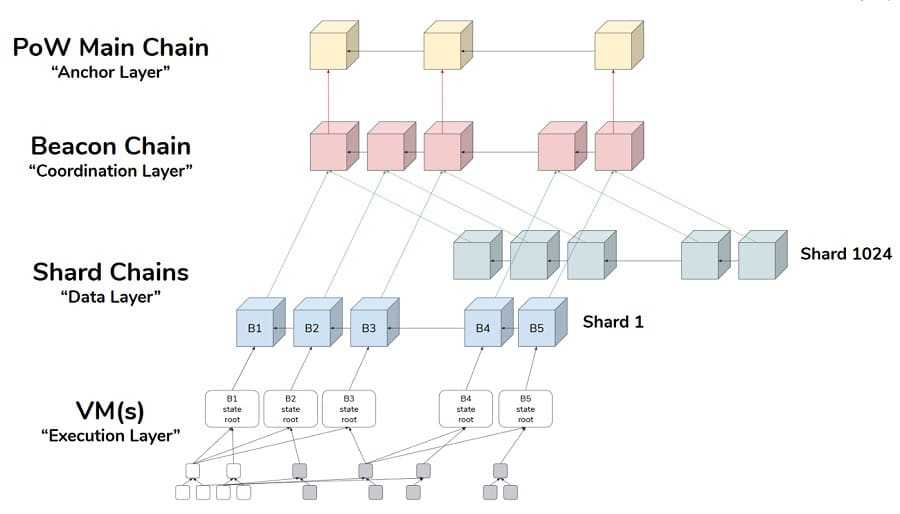

Beacon Chain is a brand new blockchain that Ethereum 2.0 uses. Beacon Chain makes use of a technique called sharding in order to improve Ethereum’s efficiency. It involves attaching shards (additional blockchains) to the main chain.

As you don’t rely on just one blockchain anymore to handle transactions, it is possible to assign certain applications to different shards. You could, for example, have a sharded chaid that’s exclusively dedicated to DeFi protocols, such as yEarn, or all virtual worlds built using Ethereum, like Decentraland.

Ethereum 2.0’s rollout is broken down into several stages. Although the Ethereum 2.0 Network technically launched on 1 December, it has a way to go until it becomes fully functional. You won’t be seeing applications on Ethereum or DeFi protocol anytime soon.

According to the current estimates, it will take approximately 2-3 years for Ethereum 2.0 to reach its full potential (when writing this article). Ethereum and Ethereum 2.o will run in parallel until they are completed. It will also have an interesting effect on the economics and price of the ETH crypto currency. They will be covered in detail later on.

Differences Between ETH 1.0 & ETH 2.0?

Ethereum 2.0 is different from Ethereum in terms of network speed as well as the way ETH currency is mined. Ethereum only processes 15 transactions a second. Ethereum 2.0, on the other hand, can theoretically handle around 100,000 transactions a second.

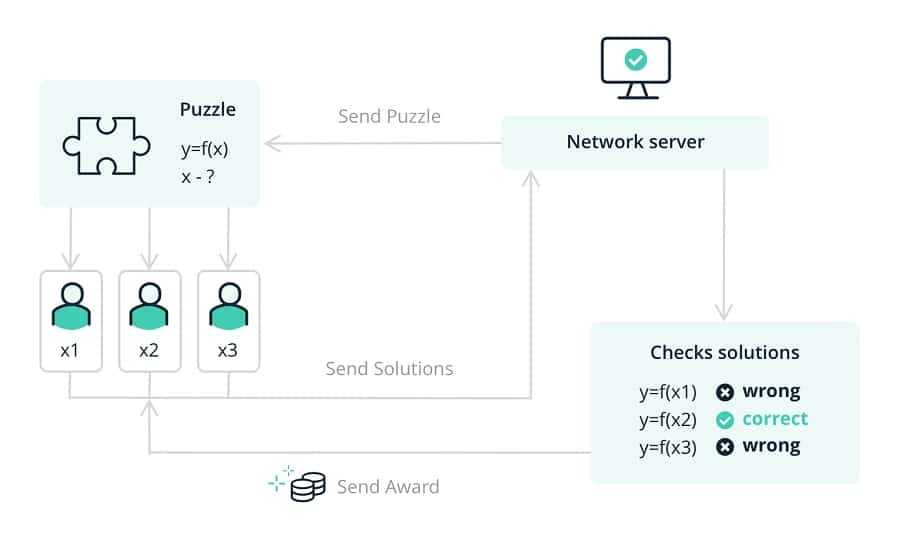

Ethereum rewards miners with new ETH for using their computer power to solve cryptographic puzzles and verify the transactions on the Ethereum Blockchain. It is known as proof-of-work mining, and is used to mine Bitcoin.

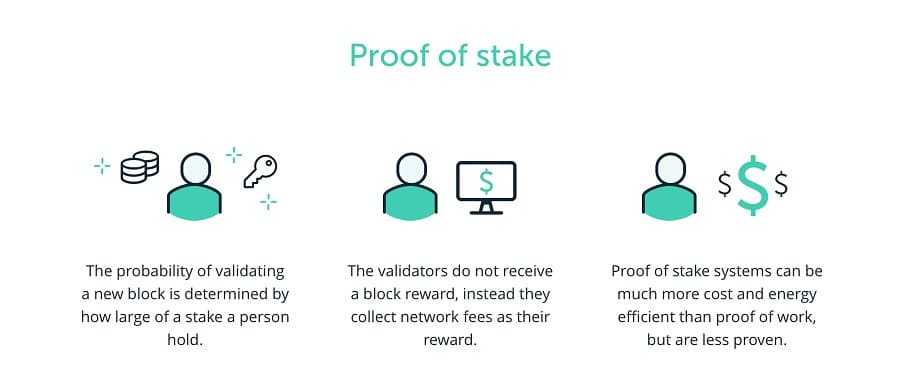

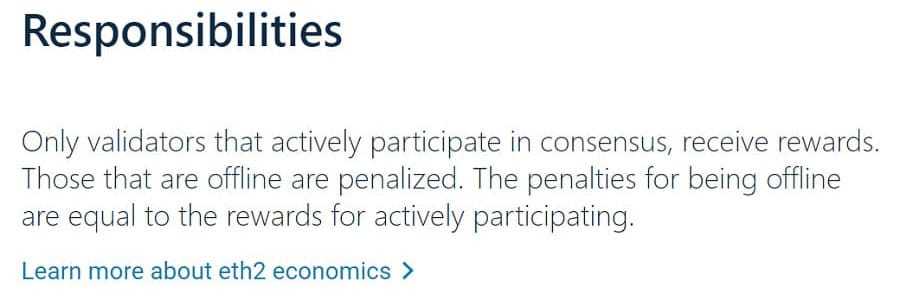

Ethereum 2.0 relies on proof-of-stake instead of proof-of work. In exchange for more ETH, you stake a significant amount of ETH and act as a “node” (on a computer). If you are offline too long, or try to manipulate a network you could lose all or part of your staked Ethereum.

Ethereum 2.0 Staking FAQs

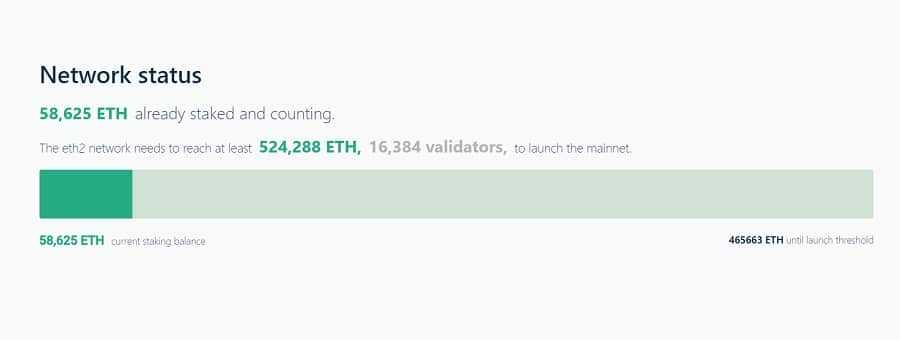

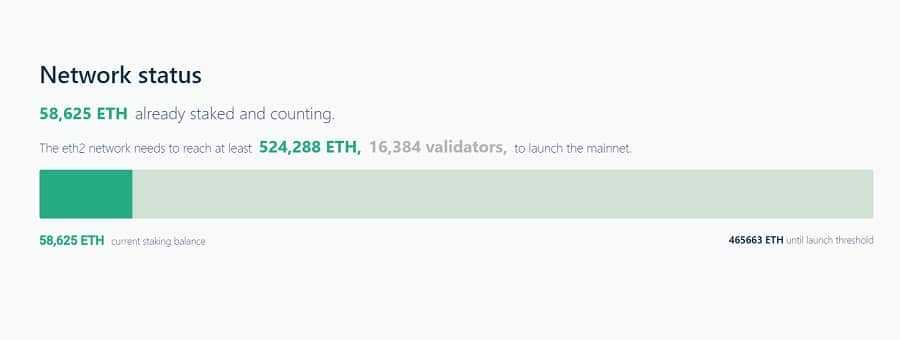

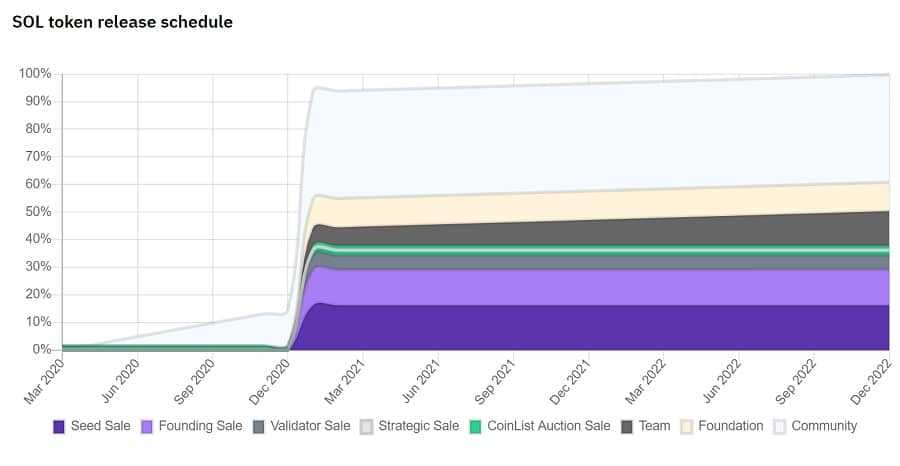

On November 4, 2020, following years of testing Ethereum 2, the Ethereum 2.0 staking contracts officially launched. It was sort of a “accumulation phase” The next phase of the project began when 16400 different validators staked a minimal amount, just above 525000 ETH.

The accumulation phase is necessary in order to make sure that the network has a sufficiently decentralized structure before it launches. Ethereum struggled at first to meet this level, but just before December 1, the required amount was reached.

Ethereum 2.0 Staking rewards

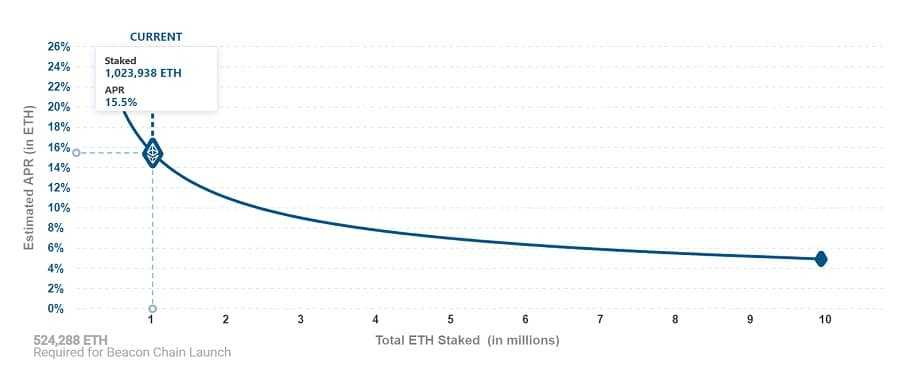

Staking rewards range between 22% and 5% annually (paid in ETH), based on the amount of ETH staked.

The annual return is lower the more ETH you stake on Ethereum 2.0. This schedule of rewards is designed to find a fine balance between incentivizing users to stake and protecting ETH currency from inflation.

What is the Ethereum 2.0 stake?

Two ways are available to stake Ethereum 2.0. You can run your validator node using 32 ETH and an internet connection with a decent speed. A moderately powerful PC is also required. By clicking on this link, you can find out all you need to know about running a validater node for Ethereum 2.0.

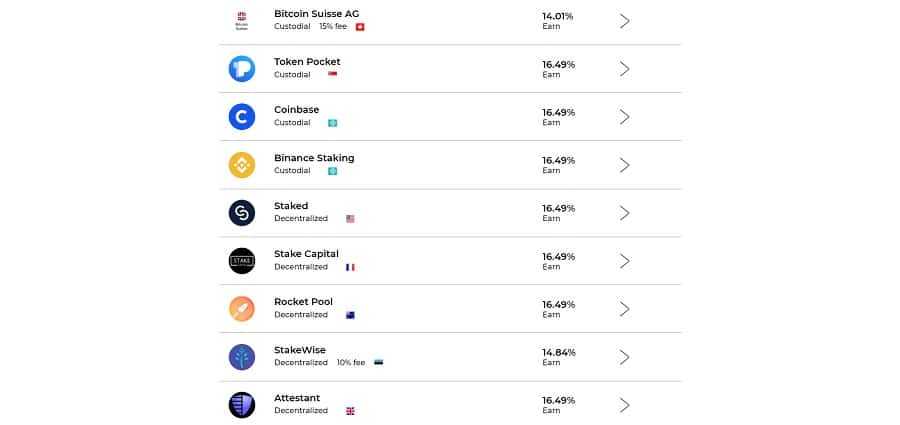

To stake Ethereum 2.0, the second method is by joining a pool. As of the date of this article, there were dozens of Ethereum 2.0 staking pool. Many major exchanges also support Ethereum stakes. Use an exchange such as Binance, Coinbase, Kraken to stake your Ethereum.

There are some things you must know before you sign.

Ethereum 2.0 Staking Terms

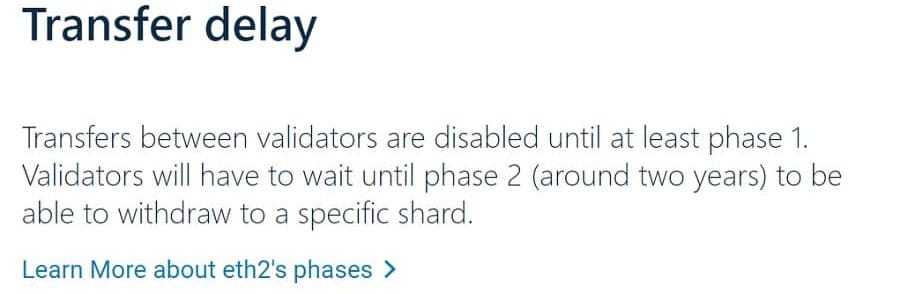

You should be aware of a couple things before investing in Ethereum 2.0. First, for now it’s a one way trip. In other words, once you commit your ETH to the Ethereum 2.0 network, there is no turning back – you cannot convert it back into 1.0 ETH.

If you run your own validator on Ethereum 2.0 and experience any downtime (e.g. If your internet is down, you may lose some of the ETH that you have staked. It is known as slashing and can happen by mistake if the network is down. You will not receive compensation.

The third thing is that you won’t be able move the ETH staked until Ethereum 2.0 is released, which should happen in 1-2 years. You will be unable to trade or withdraw your staked ETH. This is true unless you choose to stake your tokenized ETH 2.0 in a pool.

What is Tokenized Ethereum v2.0?

Also known as ETH 2.0 and Beacon Chain ETH tokenized Ethereum is an ERC-20 block on the Ethereum original blockchain that represents ETH which has been staked onto the 2.0 Network. It is a smart way to get around the lock-up period of 1-2 years for Ethereum 2.0.

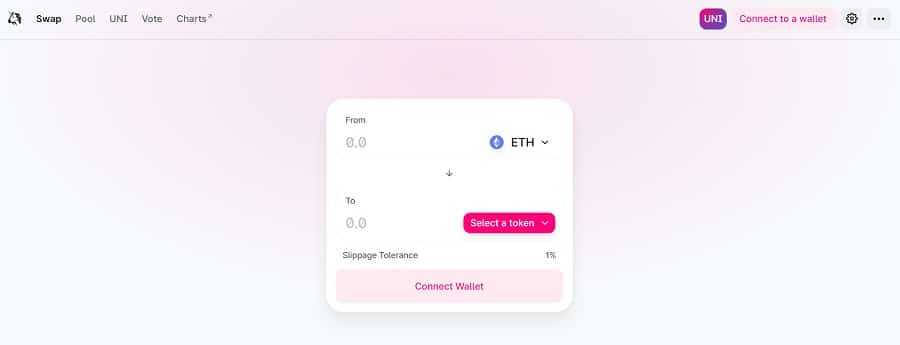

This tokenized ETH is basically a sort of IOU – you stake your ETH on Ethereum 2.0 in a special staking pool, and a custom Ethereum application created by the staking pool provider will mint (create) an ERC-20 version of the ETH you have staked in the 2.0 pool. This tokenized Ethereum is freely traded if desired (though you may need to trade it on a decentralized marketplace like Uniswap).

This tokenized Ethereum will earn a percentage of your staked Ethereum in real-time! This tokenized Ethereum 2.0 can be redeemed by the person who holds it when it is possible to transfer it within the next 1-2years.

It is in the interest of the pool operators to provide this tokenized Ethereum 2. This will attract more users to their pool and increase the pool’s stake rewards. You still retain access to the ETH you staked.

What is Ethereum 2.0 and how can I get it?

Although you can’t actually purchase Ethereum 2.0, you will very soon be able get a tokenized version of ETH staked on Ethereum 2.

Rocket Pool has been working on the necessary technology and is expecting to have tokenized Ethereum 2.0 available in early 2021. The FTX crypto exchange also considers launching a staked ETH token.

Why Should I stake Ethereum 2.0

It all depends on how long you plan to stay in the game. You will be best off not stake your ETH if you’re just trying to get a quick profit. You might be missing out on an excellent selling opportunity because your ETH will only work on the Ethereum 2.0 platform.

ETH that has been staked will be able to be sold by proxy at the right price if tokenization is made possible. Staking should not be an issue if you plan to stay in the game for a long time. It is important to note that the information provided here is not intended to be financial advice. The decision whether to stake or not is entirely yours.

Check out Ethereum Launchpad if you have any further questions regarding Ethereum 2.0 staking.

Does Ethereum 2.0 impact the price of Ethereum?

Short answer: yes. It is more difficult to determine how Ethereum 2.0’s impact on Ethereum will be. Here are a few scenarios to consider. In the near future, we are likely to see a combination of each of these.

Scenario #1: A reduced ETH supply increases the price of ETH

It is important to note that, as you’ve read above, all ETH staked in Ethereum 2.0 for 1-2 year will be locked. It means that any ETH staked will be effectively out of circulation. A limited supply would result in a price increase for Ethereum if demand remained the same.

As of the writing of this article, only a little over 1,000,000 ETH has been staked in the Ethereum 2.0 network. It is less than 1 percent of Ethereum’s entire supply. It is possible that this will not affect supply much. However, if it were to reach 10-20%, the supply would be severely restricted.

Scenario #2: Unsustainable price growth due to tokenized Ethereum 2.0

When you add tokenized Ethereum 2.0 to the mix, things get more complex. Tokenized ETH, which can accrue interest and is freely tradeable would be incredibly useful for those who use DeFi applications.

This demand would likely be high, and tokenized Ethereum 2 could be valued higher than Ethereum. The price difference would be a temporary one, as people would use their Ethereum to make tokenized Ethereum 2.0 they could sell for a higher premium.

It could be a mess if there is a sudden surge in demand for Ethereum 2.0 tokens.

The high demand of tokenized Ethereum 2.0 encourages more people to invest in the Ethereum 2.0 network. It also increases the value of ETH by reducing its supply. The tokenized Ethereum 2.0 becomes even more valuable. This leads to a higher demand for the product and more stakes.

To summarize, the tokenized Ethereum 2.0 system could drive the price of ETH to new heights, but in a manner that would be unsustainable, and even cause the network to crash.

This is because not enough people understand DeFi.

Scenario #3: Prices of ETH temporarily crash after Ethereum 2.0 can be traded

While you are reading this article, there is a tens-of-thousands validators earning interest on Ethereum 2.0. They are not able to sell the ETH they have earned… yet. If they can sell the ETH, there is no way that they’ll just keep it.

See, many validators of Ethereum 2.0 were or are Ethereum miners. It is their goal to profit and sell all the ETH they earn. They would want to get rid of all their ETH after two years with no profit.

The basic economics of the situation dictates that a massive amount of ETH sold all at once may cause its price to crash. It is likely that this would be temporary, but Ethereum developers could mandate a cooling-off period during which these validators are not allowed to transfer more than a specific amount of ETH.

Scenario 5: Ethereum prices Crash After Ethereum 2.0 Fails

It is a scenario that is unlikely, but one you should keep in mind. The price of ETH could be severely affected if something went horribly wrong with Ethereum 2. For the time being, Ethereum essentially has no competition – they are the largest cryptocurrency in their genre by far.

There is still technical competition from other projects, such as Cardano and Polkadot, which were created by ex-cofounders of Ethereum. In the event that anything went wrong during or after the switch from Ethereum to Ethereum 2, the faith and money invested would quickly change.

It begs to question how Ethereum will survive if it is so slow until Ethereum 2.0 has been completed.

What Happens To Ethereum

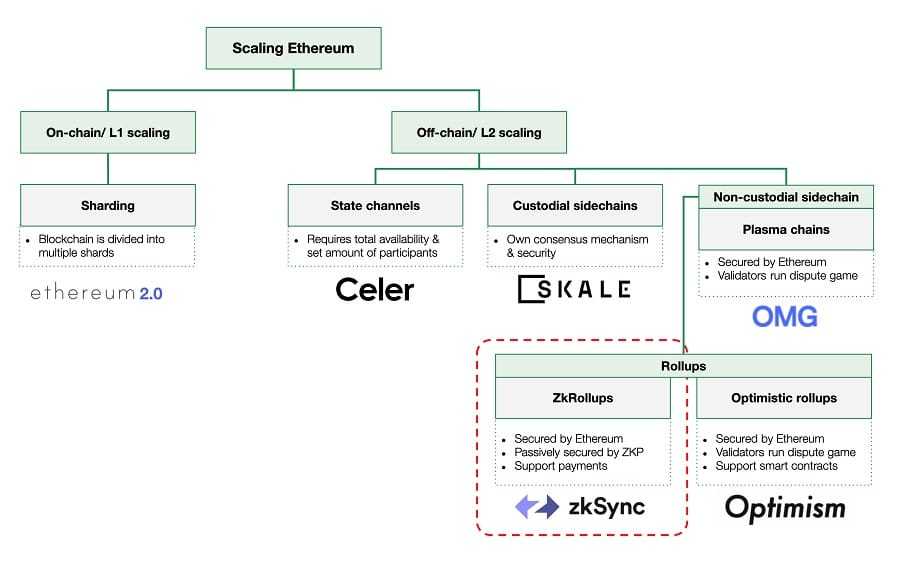

Ethereum won’t disappear for a few more years. It is largely due to Vitalik Anderin’s and other Ethereum developers’ plan to introduce layer-2 scaling onto the Ethereum network. This will, they believe, allow Ethereum to compete with other cryptocurrencies similar in nature until Ethereum 2.0 has been completed.

The majority of layer-2 scaling solutions involve processing a portion of transactions in a different blockchain, and recording them onto the Ethereum blockchain as one transaction. The scaling solutions that are used for these types of transactions can be referred to by the names rollups (also called zkrollups), zksnarks, and zksnarks.

Layer-2 scaling will boost Ethereum’s transactions every second from 15 up to 1-4000. OMG Network or Loopring are two layer 2 projects that you can check out if you’re curious about how it is done.

When Ethereum 2.0 is complete, it will be necessary to migrate everything that was built using Ethereum to Ethereum 2. This will begin before Ethereum 2.0 becomes available for public use and is the most critical moment in the life of the project.

Ethereum may lose ground if the migration process is turbulent, or there are significant problems with the 2.0 Network. Ethereum could surpass Bitcoin in terms of market capital if all goes according to plan.