It’s really a aggressive surroundings on the market within the crypto world. Not solely are there a gazillion blockchain tasks vying in your curiosity and cash, however there's additionally a plentiful selection of exchanges to select from, in contrast to conventional finance, the place only some hallowed ones really matter. (Assume New York Inventory Alternate, Chicago Mercantile Alternate, Tokyo Inventory Alternate and so forth.). Not solely that, centralised exchanges (CEX) and decentralised ones (DEX), born from the emergence of good contracts, are duking it out with one another for customers and liquidity too.

Since we’re nonetheless within the nascent interval of crypto's emergence, the place issues nonetheless haven't utterly stabilised but, institutional buyers nonetheless desire CEX over DEX, not only for the liquidity but additionally for the OTC (Over-the-counter) providers. It is because they often deal in giant orders which have the potential to make or break the market. Retail minnows such as you and me swim in the principle pool with everybody else. Nonetheless, "follow the money" is an oft-quoted phrase you would possibly've come throughout within the crypto world, and on this case, we comply with the place the institutional buyers love to do their enterprise.

On this article, we'll take an in-depth take a look at the Gemini alternate, one of the vital respected CEXs within the crypto world.

Gemini Alternate Abstract

| HEADQUARTERS: | New York, NY |

| YEAR ESTABLISHED: | 2015 |

| REGULATION: | New York State Division of Monetary Providers (NYSDFS) Listed as New York State Restricted Legal responsibility belief |

| SPOT CRYPTOCURRENCIES LISTED: | 123 tokens listed, together with the highest 10 crypto belongings and a few much less well-known ones like Clean Love Potion (SLP), Golem (GNT), Benefit Circle (MCU), Numeraire (NMR) to call a number of. |

| NATIVE TOKEN: | Gemini Greenback (GUSD) |

| MAKER/TAKER FEES: | Charges differ primarily based on buying and selling quantity and the platform used to carry out the trades. Retail dealer charges vary from $0.99 per commerce for buying and selling worth at <=$10 to 1.49% for trades > $200 whereas market maker/taker charges begin from 0.4% for makers and 0.2% for takers. Charges listed in: USD, AUD, CAD, COP, EUR, GBP, HKD and SGD. |

| SECURITY: | Accounts: 2FA, assist for {hardware} safety keys reminiscent of Yubikey and whitelisting of withdrawal addresses. Inner Controls: Multi-sig required to withdraw from chilly pockets storage and workers undergo background checks. Asset Safety: {Hardware} safety modules of their possession are at FIPS 140-2 Stage 3 score or greater. Compliance and Certification: SOC 1 Kind 2 examination, SOC 2 Kind 2 examination and ISO 27001 certification plus compliance with PCI DSS (Cost Card Trade Information Safety Customary). |

| BEGINNER-FRIENDLY: | low entry-barrier to start out buying and selling, clear interface making it straightforward to navigate |

| KYC/AML VERIFICATION: | Accessible |

| FIAT CURRENCY SUPPORT: | USD, AUD, CAD, COP, EUR, GBP, HKD and SGD |

| DEPOSIT/WITHDRAW METHODS: | Crypto/Fiat deposit and withdrawal accessible. |

What’s Gemini

The Gemini alternate is likely one of the most respected CEXs within the crypto sphere. Whereas it began as a US entity, it has rapidly moved into different areas worldwide, providing the power to onboard holders of GBP, EUR, AUD, HKD and SGD to make use of its providers. The platform has a wealthy providing of merchandise appropriate for all kinds of customers, from newcomers to seasoned buyers and merchants.

The alternate is based by the Winklevoss twins, Cameron and Tyler, greatest recognized for profitable a lawsuit towards Mark Zuckerberg for the thought of Fb. You possibly can watch an entertaining retelling of this story by watching The Social Community starring Jesse Eisenberg as Mark Zuckerberg. Armie Hammer performed the twins. Having received the courtroom case towards Zuckerberg, they acquired into crypto in 2013 and have been one of many earliest severe buyers in Bitcoin. In 2015, they based the Gemini alternate (named after the dual star signal).

Gemini Alternate Key Options

The Gemini platform presents a plethora of merchandise to cater to all kinds of patrons and buyers. Nonetheless, for this assessment, we're solely going to concentrate on these related to the alternate platform.

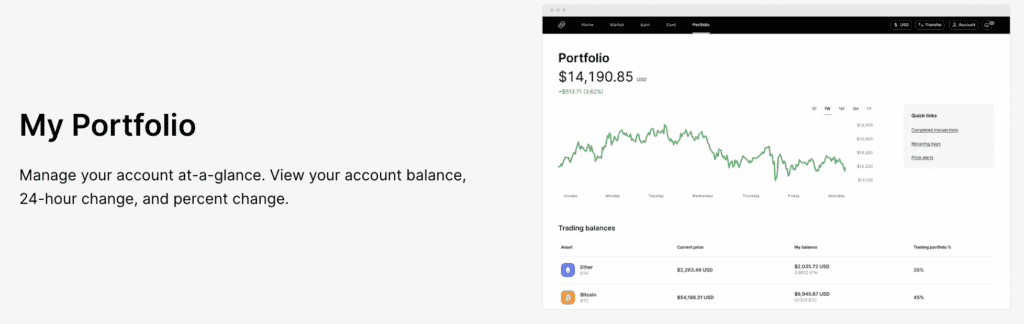

Net Dealer

This platform is utilized by retail merchants on the lookout for one thing uncomplicated and simple to navigate.

The homepage has all of the related data wanted, together with sources and high movers available in the market, along with your account data. This can be a good option to get your palms moist for these new to purchasing and promoting crypto. You can even set an alert that will provide you with a push notification when it hits your worth.

One cool characteristic is the power to arrange recurring buys. These are set primarily based on particular time intervals, reminiscent of weekly, bi-weekly, month-to-month and so forth. An effective way to DCA for individuals who wish to set and overlook and are actually in it for the lengthy haul.

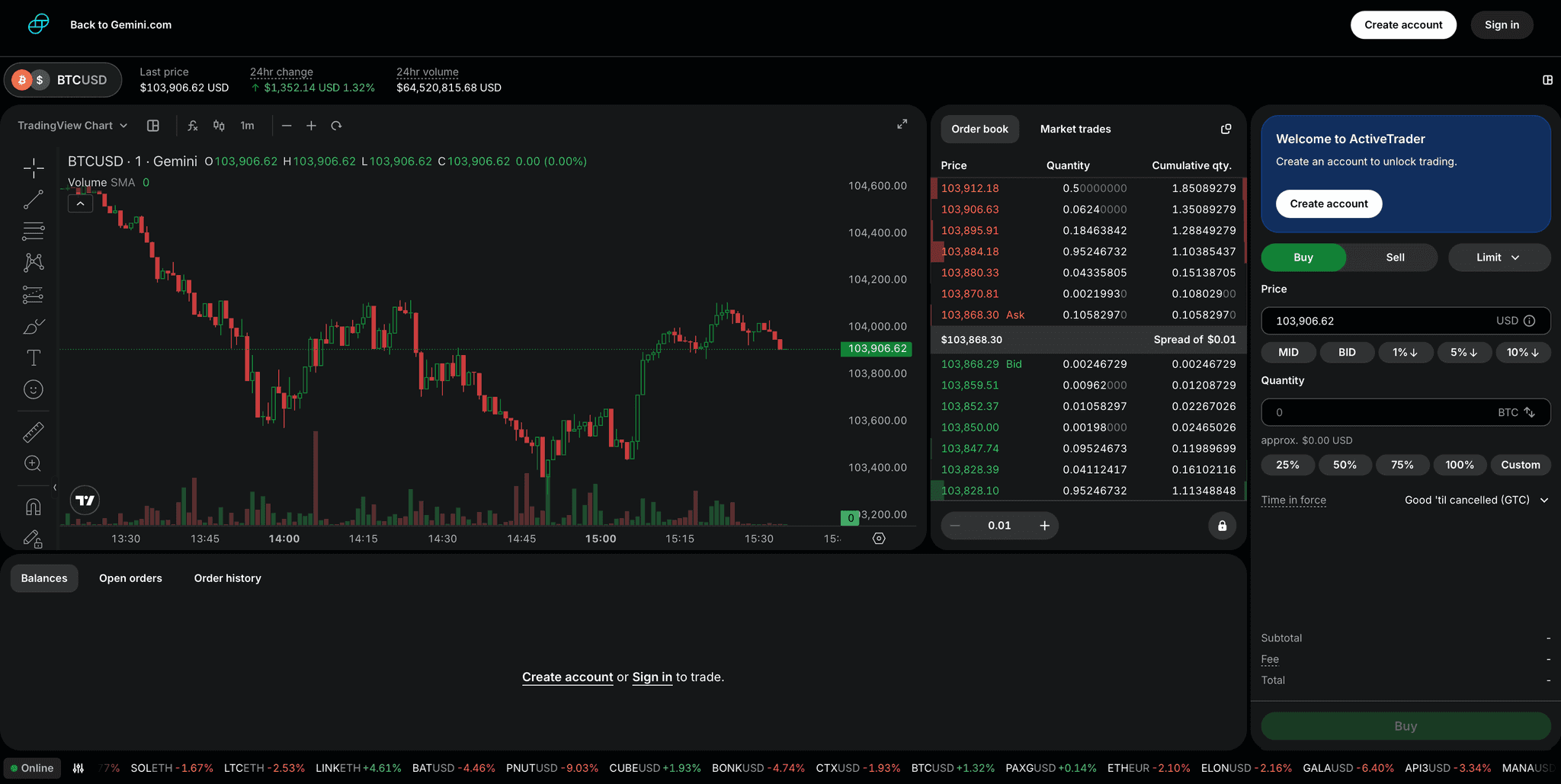

ActiveTrader

For these on the lookout for a bit extra firepower of their buying and selling, ActiveTrader is the model for you. I'd take into account this the professional model the place the coaching wheels are off, and you may go full velocity forward for some quick and livid buying and selling motion. Observe that it is advisable to request entry to it.

The sorts of orders you possibly can place by means of this website embrace:

- Restrict Order: That is an order positioned at a pre-specified worth & amount. It is going to get executed when the market strikes to that degree.

- Market Order: That is an order that might be positioned to be executed instantly. This implies it will likely be positioned on the present “bid” for a promote and the “offer” for a purchase.

- Maker-or-Cancel: With this, the order will solely be executed if it will get you the “maker” price we talked about above. If it can not place your order as a maker, then it’s cancelled.

- Instant-or-Cancel (IOC): With this order, it is going to execute all or a part of the order instantly. All these orders that can not be stuffed will subsequently be cancelled (partial orders).

- Fill-or-Kill (FOC): With this order kind, the order is executed instantly and completely or by no means. This differs from the IOC in that partial orders should not attainable.

There are two distinctive options not present in different exchanges provided by Gemini:

Public sale

Gemini holds each day auctions (incl. weekends and holidays) for the crypto belongings they checklist. The public sale is a good concept as a result of it creates a interval of elevated liquidity on the alternate, which merchants can use for worth discovery. You possibly can view the public sale schedule and particulars right here.

To take part on this public sale, swap the ActiveTrader interface to “Daily Auction” within the top-right nook. Right here you will note an outline of the outcomes of earlier auctions and the ensuing worth. Then, place an order to enter the public sale. These are referred to as “Auction-Only (AO)” Restrict orders. With these, you specify a worth/amount, and on the conclusion of the public sale, it’s settled on the stated worth or higher. Any parts that aren’t executed are cancelled.

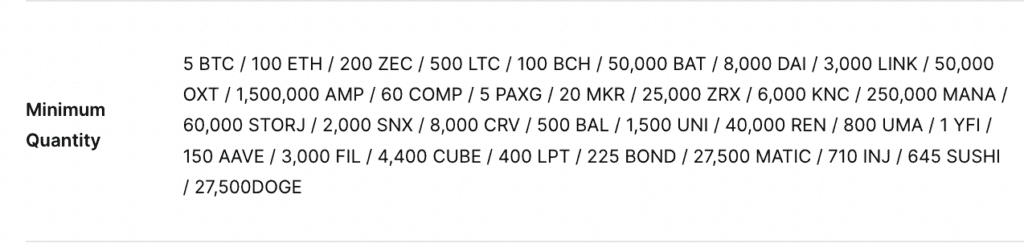

Block Commerce

Inserting giant orders can have an effect on the market worth. That is as a result of liquidity accessible on the order books, which can or might not have the ability to take up the requested quantity. Consequently, you may also get fairly a little bit of slippage within the order. Gemini permits you to place these orders through the Block Commerce perform, a bit like OTC orders to stop this from taking place. To qualify for a block commerce order, listed here are the minimal quantities required:

Just like the Public sale perform, navigate to the top-right nook to make use of the Block Commerce perform. When you're capable of place them any time, there’s a restriction for any orders positioned inside 10 minutes of an public sale arising.

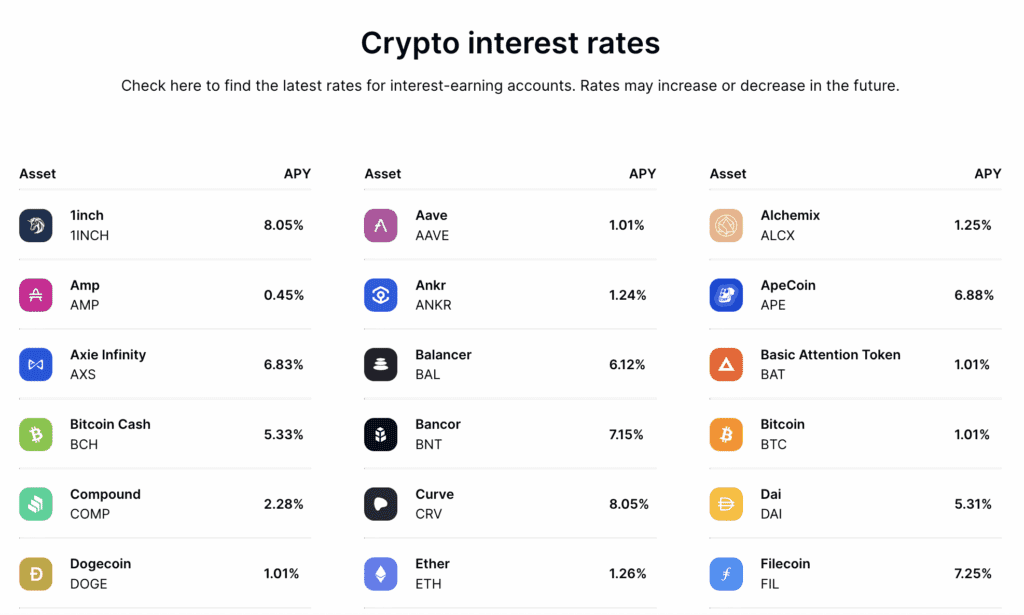

Gemini Earn

As an alternative of buying and selling your crypto, you can too reap the benefits of the staking product provided referred to as Gemini Earn. This lets you earn yield in your crypto when you're ready for the bull market to return roaring again. The charges aren't precisely spectacular although, I’ve to say:

Nonetheless, given what's been taking place with high-yield protocols just lately, it won’t essentially be a foul factor. Apart from, if you’ll find a number of gems that pay greater than 5% APY, it's nonetheless price contemplating. In any case, some yield is healthier than no yield.

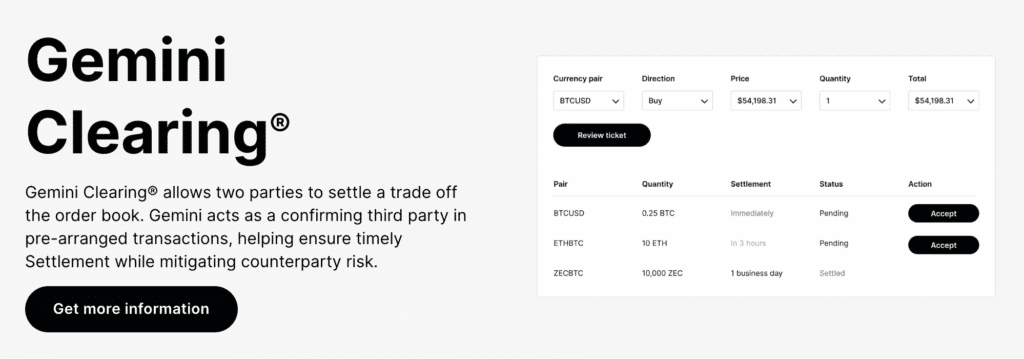

Gemini Clearing

One other distinctive characteristic of the Gemini platform is Gemini Clearing. This characteristic permits two events to mainly commerce with one another immediately with Gemini performing because the trusted third-party. Neither of the buying and selling events find out about one another. Their particulars are solely recognized to Gemini.

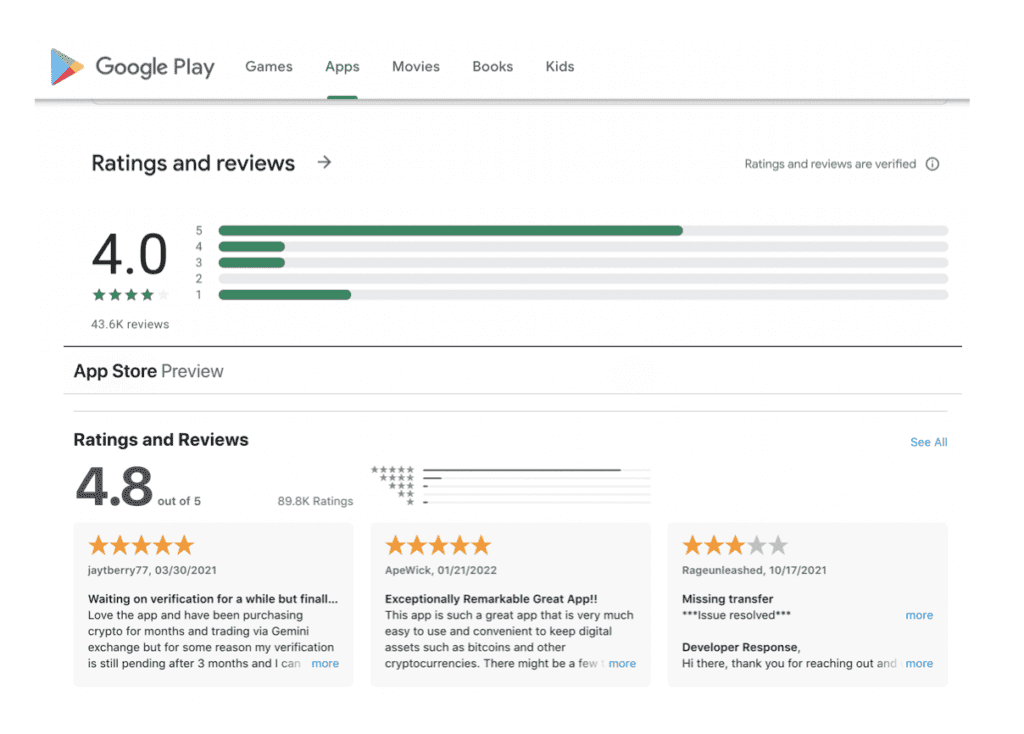

Gemini Cell

This can be a cell model of the Net Dealer but it surely doesn't have entry to the ActiveTrader. Constructed with the thought of enabling handy buying and selling for retail prospects, its performance are mainly the identical as what you are able to do on Net Dealer. The charges charged utilizing this platform is much like the online model, which you will note later for your self. How good is it? Effectively, we'll let the critiques communicate for themselves!

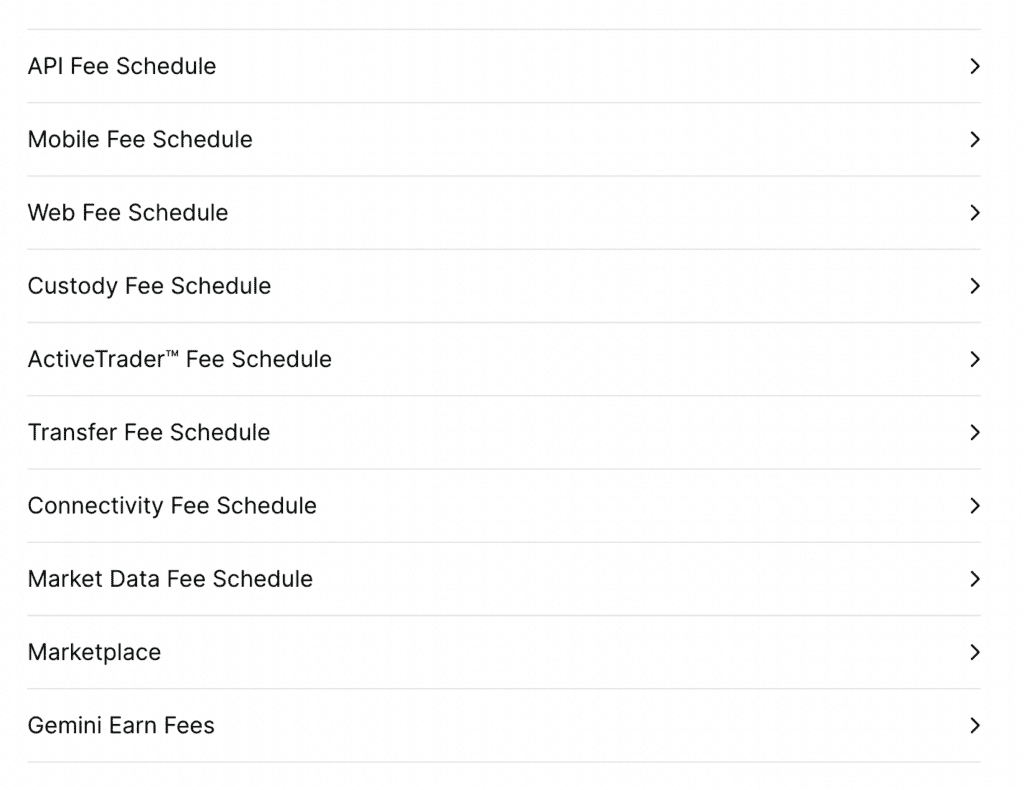

Gemini Charges

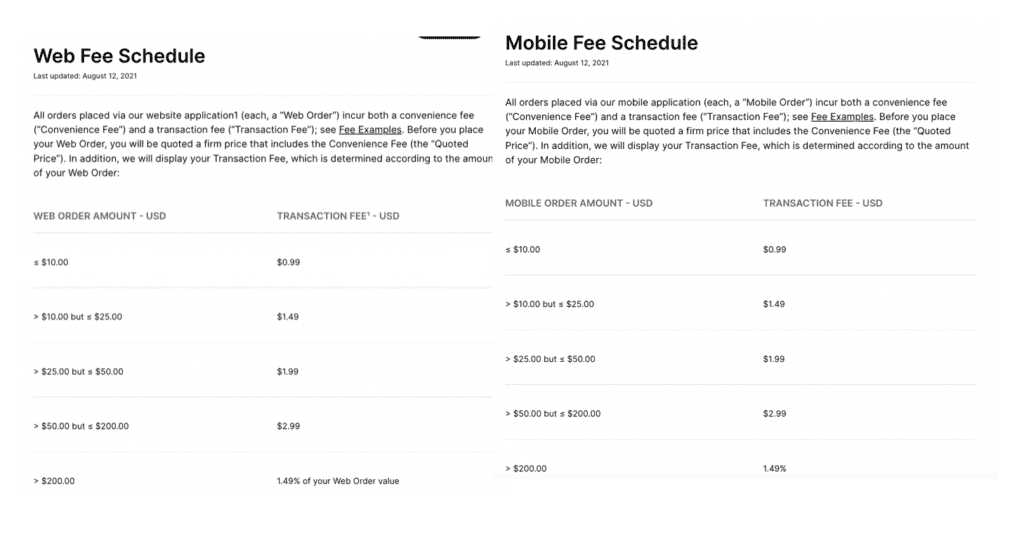

Most exchanges make their cash from charges, which characterize the principle supply of revenue. For Gemini, they actually throw out a full unfold on the subject of charges. That's as a result of they provide a wide range of them. Nonetheless, those that considerations most individuals utilizing the alternate are the cell and net app charges.

Not like different exchanges, Gemini makes a distinction relating to which platform you employ to make your trades. Every commerce carries a Comfort price and a Transaction price. Every quoted worth consists of the previous whereas the latter is a seperate line merchandise primarily based on the quantity of the order. Charges are additionally quoted within the fiat currencies supported by Gemini.

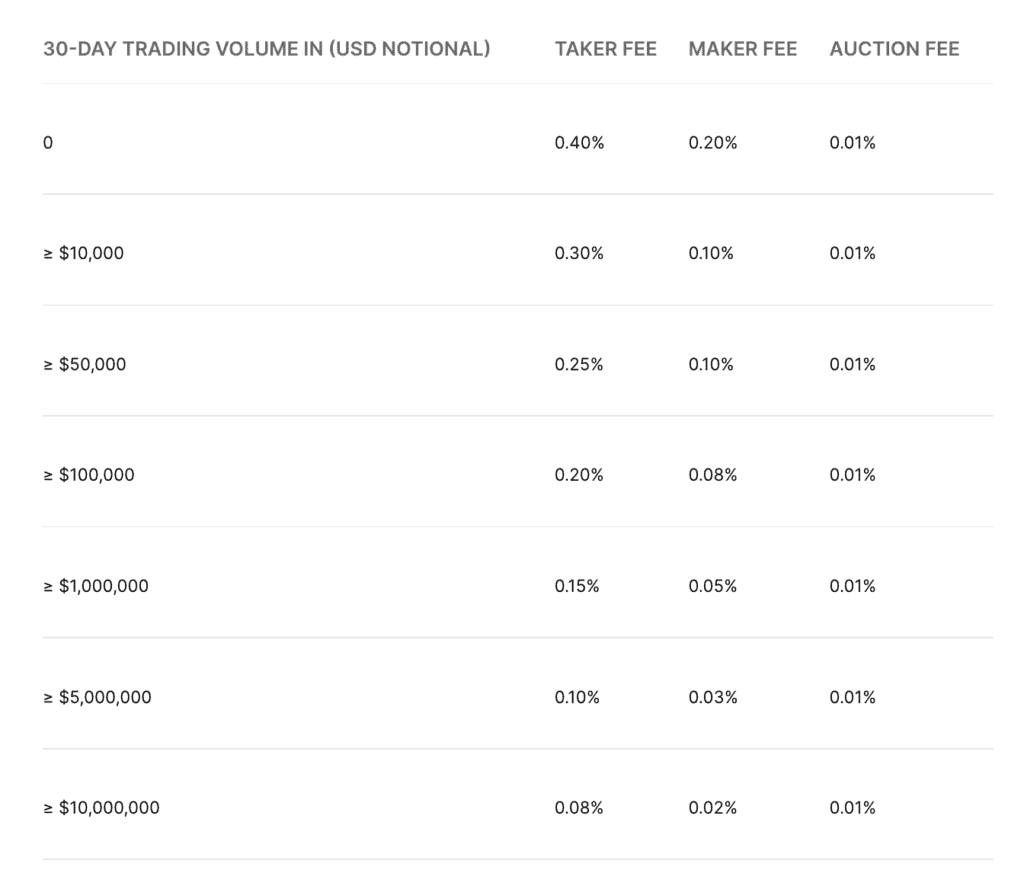

For merchants utilizing the ActiveTrader product, charges are calculated on a distinct scale. Volumes make a giant distinction in charges as you possibly can see within the chart beneath:

Observe: Maker charges refer to purchase orders as a result of they offer liquidity to the alternate. Taker charges are the promote orders as a result of they take away liquidity from the alternate.

I can't say that these are trader-friendly charges as one can simply discover cheaper ones elsewhere. Nonetheless, it might very effectively be that these charges pay for extra stable safety which is simply as vital. Maybe pay a bit extra for peace of thoughts?

Gemini additionally expenses API charges for individuals who do algorithmic buying and selling with bots. It's just about the identical because the maker/taker charges.

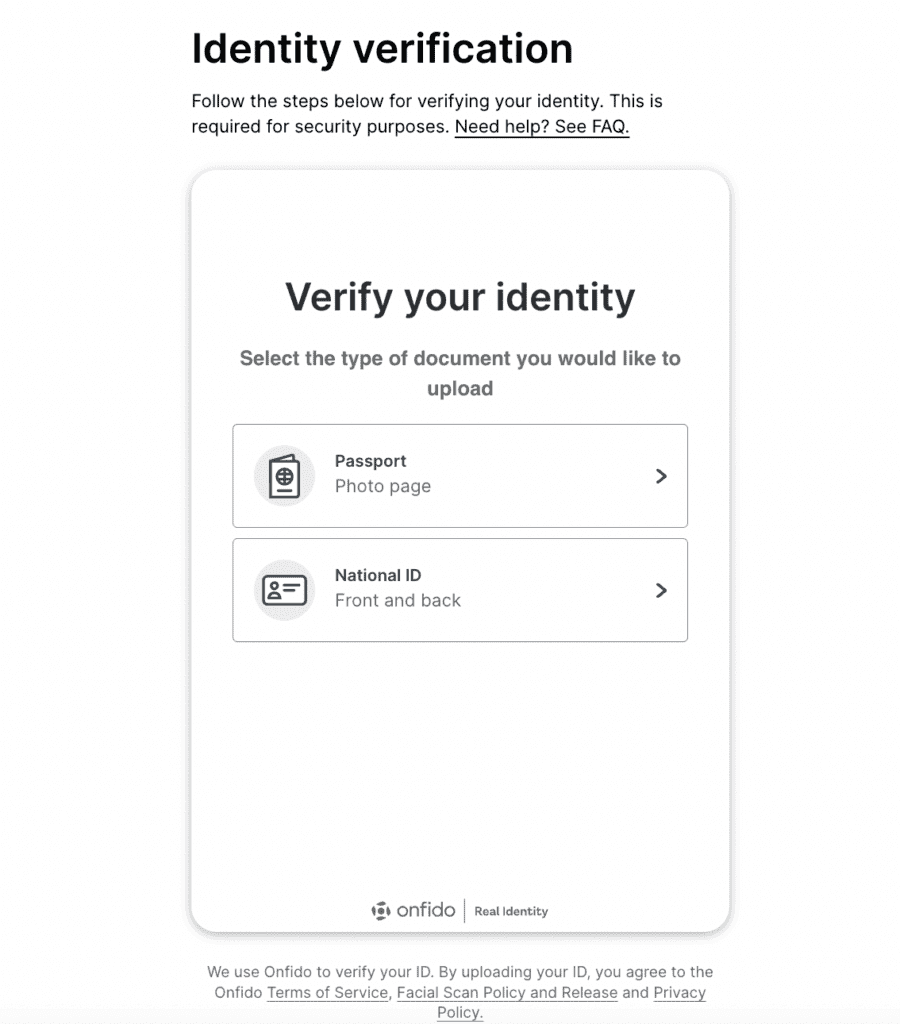

KYC and Account Verification

Gemini takes KYC critically as a part of their stance regarding compliance. Not like different exchanges that permits you to open an account with only a username and electronic mail deal with, whereas the KYC half will be achieved in a separate course of, Gemini insists on doing KYC as a part of the sign-up course of with no exceptions.

All through the sign-up course of, they are going to ship you an SMS code to confirm your telephone quantity and electronic mail verification for the e-mail deal with. When you've submitted the required paperwork, you’ll need to attend for them to manually course of your utility, which might take wherever from 2-5 days, relying on the variety of instances. For sure, signing up throughout a bear market will carry you quicker outcomes than throughout a bull market, so even when you’ve got no want to commerce now, it won’t be a foul concept to sign-up first and purchase later.

Safety

Gemini alternate prides itself on safety. This is likely one of the key promoting factors on their primary web page, with a complete web page dedicated to it. Given the extent of consideration they pay to their safety measures, it’s positively one thing price crowing about.

They outlined 4 primary areas of safety that ought to assist put anxious minds comfy. These are:

Account Management

Two-Issue Authentication (2FA) for account log-ins and withdrawals, assist for {hardware} safety keys reminiscent of Yubikey for added private safety, and the whitelisting of withdrawal addresses, making it troublesome for scammers so as to add withdrawal addresses in your behalf.

Inner Management

Gemini retains nearly all of the crypto in chilly wallets that requires a number of signatories to entry the funds. The personal keys to the wallets are saved offsite in a high-security facility, whereas the techniques can solely be accessed with {hardware} safety keys. This prevents phishing assaults. Allowing for that individuals are often the weakest hyperlink on the subject of safety breaches, all workers bear an ongoing background test throughout their employment with the corporate. Each founders are additionally unable to entry any of the net or chilly wallets collectively or individually, so that you don't want to fret about them working away along with your funds except they're in cahoots with different employees members.

Asset Safety

Their web site says, "The hardware security modules (HSMs) we rely upon have achieved a FIPS 140-2 Level 3 rating or higher." For you and me, who don't know what an HSM is, let's first begin with that. In keeping with Wikipedia, it’s "a physical computing device that safeguards and manages digital keys, performs encryption and decryption functions…" In different phrases, a chunk of {hardware} that retains personal keys protected by means of varied built-in safety mechanisms. Subsequently, the web site implies that there are totally different grades of the {hardware} and what they’ve is premium grade.

Not solely that, the situation of those HSMs are unfold out around the globe, requiring severe coordination efforts to realize entry to the keys and thus the funds. On high of that, Gemini additionally makes use of multi-sigs in order that nobody particular person/entity has full management of keys.

Premium grade personal key supervisor + various areas + multi-signatories = very low danger of funds being stolen.

Compliance

Gemini is taking part in very a lot by regulation guidelines on this part, and right here's how they accomplish that:

- Obtained the next certification:

- ISO 27001 – that is about data safety: solely approved personnel can entry and alter safe data.

- SOC 1 Kind 1 – a normal of economic operations compliance and buyer reporting, "designed to mitigate the risk of significant error, omission, or data loss." in line with their weblog on this subject.

- SOC 2 Kind 2 – achieved yearly, that is the following degree of compliance, exhibiting that Gemini has not solely met requirements however has constantly adopted them for an prolonged interval.

- Regulated in three areas: US (NY Division of Monetary Providers), Singapore (Financial Authority of Singapore) and the UK (UK Monetary Conduct Authority)

Additionally they take a proactive method to establish issues and weaknesses by means of:

- The hiring of unbiased third events to check the system's robustness by performing penetration checks, achieved yearly. Any vulnerabilities discovered are addressed by the administration promptly.

- Run a personal bounty program for moral hackers which they name Coordinated Disclosure Program. Anybody who has found vulnerabilities within the system is welcome to report them.

There's additionally a piece for folks to report scams and frauds, along with a hyperlink to a Belief and Security web page providing recommendation on stopping scams and the place to make a report if you happen to encounter one. That's first rate group service which additionally speaks to the platform's integrity. Not too many have this prominently displayed on their web site.

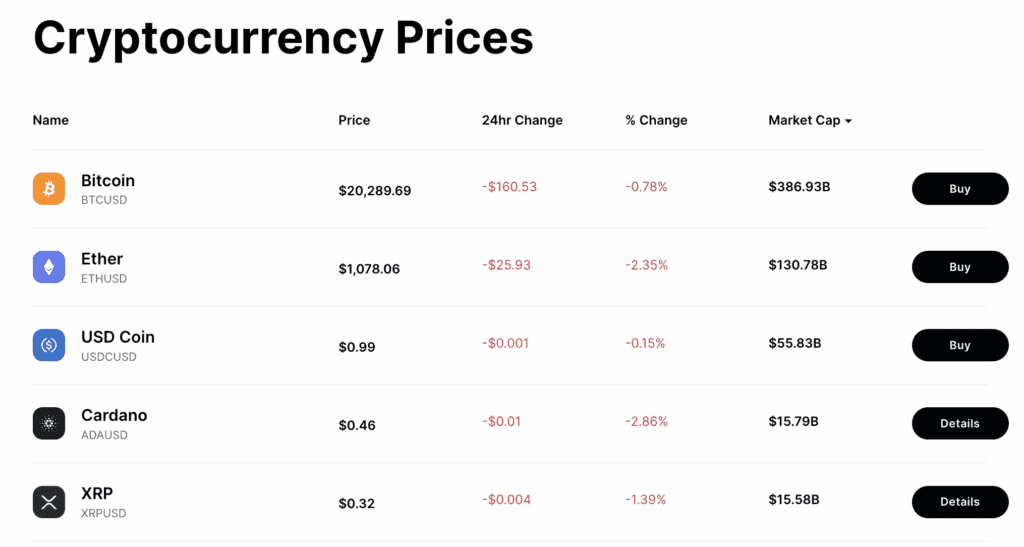

Cryptocurrencies Accessible at Gemini

In comparison with most of the different high exchanges, the choices on Gemini are a bit on the sunshine aspect as they provide fewer buying and selling pairs than most. The checklist you see beneath is a snapshot of what they provide, which is about 125 tokens with the highest 20 well-represented and some different different tokens that may be of curiosity to smaller niches.

The flip aspect is that they take a way more cautious view when deciding what to checklist on their platform. Although from a enterprise standpoint, they become profitable from every commerce that's made and should not essentially endorsing what they select to checklist, customers nonetheless understand the itemizing as an oblique sort of endorsement. On the very least, the considering that "if they did their due diligence by listing it, and I trust their diligence, I should be fine" could also be a extra prevalent view. In any case, there's solely a lot time one can do DYOR. If I can't belief the information offered by Glassnode or Dune Analytics, how else can I DYOR?

Deposits and Withdrawals at Gemini

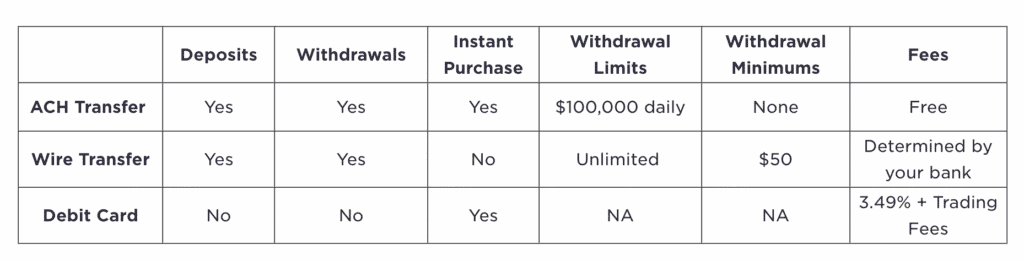

There are a myriad of the way to fund your Gemini account. If you’re new to crypto and need to get began shopping for crypto, listed here are your selections for making fiat forex deposits:

Please word that ACH Transfers are solely accessible for US prospects. Non-US prospects can solely use wire transfers to fund their accounts. These funds can be found instantly for buying and selling as soon as the Gemini account receives them. This might be wherever from the identical day (if transferred domestically earlier than 3 pm EST) or a number of days, relying on the interior processes of the sending financial institution.

Relating to withdrawals, funding achieved through ACH should wait 4 to 6 days earlier than the cash will present up in your account. As for wire transfers, once more, it is going to rely on the processing time in your financial institution. Whereas Gemini doesn't cost any wire charges, your native financial institution might determine to nip a little bit of a fee for facilitating the switch. TradFi, eh?

You can even buy crypto utilizing debit playing cards. Nonetheless, it will incur a 3.49% price along with buying and selling charges, so I'd see it as a last-ditch, determined strategy, like if the worth is just too good to go on. You can also't withdraw money to your debit card, solely to a checking account.

However, funding your account through crypto is comparatively simple. After signing in, navigate to the Custody part to generate a pockets deal with for the token of your selection. This would be the deposit deal with to obtain the token into your account.

High tip: When making transfers, at all times test the blockchain community supported by the alternate and the place the receiving pockets deal with is situated. If not sure, test this text on supported networks. Any tokens despatched through the incorrect community might lead to a lack of funds. For instance, sending MATIC tokens through the Polygon community to an ERC20 deal with is a standard error that warrants its personal article on the topic.

Gemini presents a pleasant contact with as much as 10 free month-to-month crypto withdrawals (50 if you’re an institutional consumer). Any quantity above that can rely on the asset as every has its personal withdrawal minimal.

Tokenomics: Gemini Greenback (GUSD)

As an alternative of issuing a local token, Gemini points its personal stablecoin often known as the Gemini Greenback (GUSD), an ERC20 token on the Ethereum blockchain. This can be a US dollar-pegged token used throughout the Gemini ecosystem for staking and yield technology. It can be used to offer liquidity in main DeFi protocols that assist the token, reminiscent of AAVE, Maker, and yEARN to call a number of. Mixed with Gemini Pay, you possibly can even use GUSD to pay for objects, giving it real-world utility, which isn’t one thing many tokens can do.

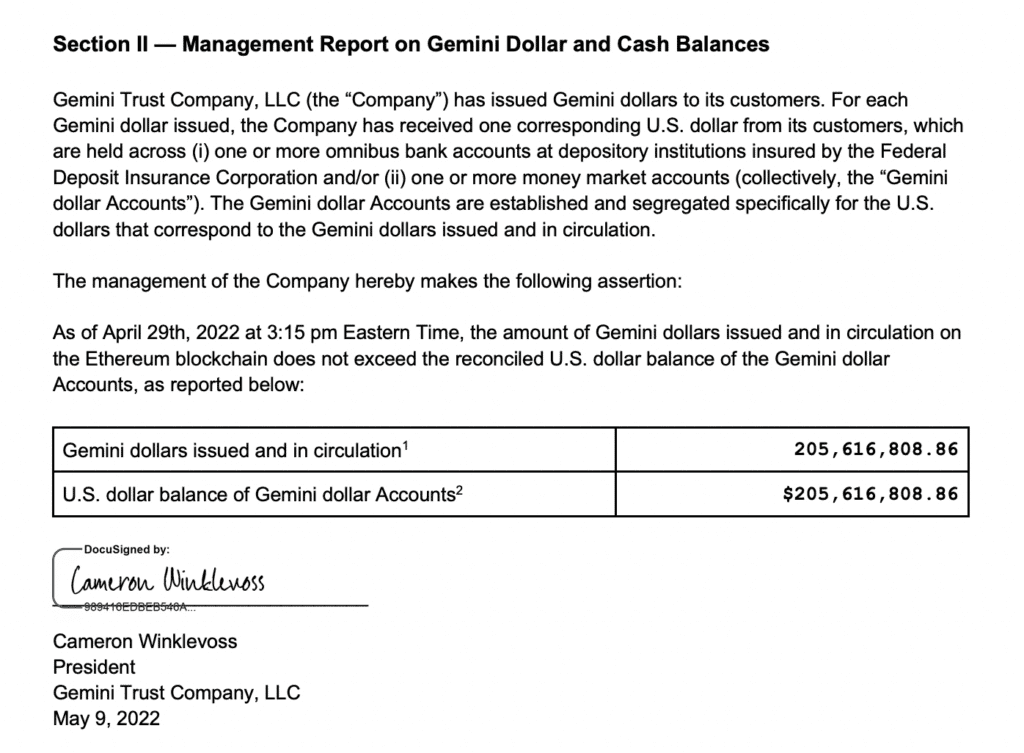

What additionally makes GUSD a solidly-backed asset is that every greenback backing GUSD is held in FDIC-insured banks, i.e. the US authorities will provide you with your cash if there’s a financial institution run). The web site lists the audits achieved every time, with a pattern beneath of the most recent audit:

The audits are achieved by an unbiased audit agency BPM LLC whereas the good contracts are audited by one other firm referred to as Path of Bits, an data safety analysis and improvement agency.

Gemini Buyer Help

The primary impression I get after I click on on the Help web page is the emphasis on self-help. The web page is neatly divided into varied classes serving as a navigation information for patrons on the lookout for solutions.

I like that there’s an Training part permitting customers to be taught extra about crypto in addition to the Gemini merchandise. The extra folks know, the savvier they get, which can assist them make higher funding selections. If all else fails, there's nonetheless the choice to speak with somebody, though you'd have to first show that the bot can't show you how to in any respect earlier than you get handed to an actual individual.

Gemini High Advantages Reviewed

Gemini has some nice issues going for it, which we are able to summarise right here in short:

- Sturdy safety – The alternate has not been hacked since its inception (knock on wooden), and it's obvious they've spared no effort on this space.

- Simple-to-read assist articles – that is useful for these new to crypto and is an effective supply of knowledge for them to start out their DYOR journey. They even have an schooling part referred to as Cryptopedia that gives fundamental basic details about blockchain and crypto. Lots of the contributors are from the blockchain tasks themselves, making for trusted studying.

- Multi-currency assist – whereas Gemini might not have US and worldwide variations like Binance, I respect that it's making an effort to succeed in out to non-US prospects whereas staying agency to its US roots. With GUSD, it not directly permits non-US prospects to carry USD in a US financial institution, which is kind of cool.

- Recurring purchase characteristic – that is great for patrons who need to DCA in with no need to test the market like a hawk.

- GUSD and Gemini Pay – regardless that that is largely accessible within the US, it lets folks see the advantages of crypto in a utilitarian format as an alternative of simply being a speculative commodity. This helps to unfold the crypto gospel positively.

What will be Improved

- Itemizing extra belongings – it will assist it to seize extra enterprise.

- Decrease buying and selling charges – it’s a very aggressive area it's working in so each little bit counts.

- Higher staking rewards – it's attainable that this half is just not an space of focus for the enterprise however certainly it may well't damage to boost the charges just a bit bit?

Gemini Evaluation Conclusion

Gemini is likely one of the few exchanges I've come throughout that doesn't attempt to dazzle you with a variety of bells and whistles. As an alternative, it locations itself on agency foundations by specializing in making the platform as stable as attainable, even when it implies that it's a bit behind the curve on the subject of having much less selection in its choices. Nonetheless, what it does supply can also be not one thing different exchanges would have, thus proving itself that it isn’t busy copycatting others but is aware of what must be accessible to stay aggressive.

Given the Winklevoss twins' household background and connections, a variety of the true cash might be made by institutional trades. As I discussed earlier within the article, we comply with the place the cash goes. The crypto world is stuffed with folks trying to make a fast buck and taking excessive dangers. Nonetheless, these individuals are additionally the identical who need to maintain an equally excessive likelihood of crashing and burning. Those that are really in it for the long term have the endurance to do issues correctly which is what Gemini has been doing and continues to do.

Incessantly Requested Questions

Is Gemini Crypto Reliable?

Sure. Their safety is as top-notch as you possibly can ever discover in a crypto firm and the twins are constructing a enterprise for the long-term, so it’s unlikely they are going to discover devious methods to abscond with the funds. Additionally they perceive that credibility is what separates them from different tasks.

Is Gemini higher than Coinbase?

Coinbase is actually the extra contentious of the 2 on this comparability. Gemini’s lower-key profile is to its benefit given the quantity of damaging press swirling Coinbase nowadays. By way of performance and useability, each are related with every having their very own strengths and weaknesses.

Is Gemini higher than OKX?

OKX presents much more bells and whistles with a greater variety of choices than Gemini, to not point out extra sorts of tokens. It is going to rely on the person’s choice. In case you’re not trying to attempt too many issues however need to have some pores and skin within the sport, Gemini is adequate. If you wish to go a bit extra degen, it’s possible you’ll desire OKX.

Is Gemini higher than Binance?

Just like OKX, Binance presents a variety of choices to attempt plenty of various things that will attraction extra to these with an adventurous spirit. Gemini has a barely higher popularity than Binance normally.