DeFi is the king of DApps. DappRadar reports that the 10 most popular DApps in the world are decentralized finance applications. They’re ranked based on the value of tokens transferred from active wallets.

DeFi, unlike traditional finance welcomes everyone. DeFi eliminates the need for credit checks and extensive paperwork that is required by traditional financial services. Anyone with an online connection and digital wallet can use DeFi. Speaking of, check out our best hardware, desktop and mobile wallet picks if you're undecided on which one to choose.

Injective’s innovative platform solutions are in high demand as security and interoperability become more important.

In this Injective review, we'll delve into everything you need to know about the company.

Injective Review Summary:

Injective, a Cosmos Layer 1 Blockchain for creating financial applications that are able to access other blockchains.

| Headquarters | New York |

| The Year of Founded | 2018 |

| The Founders | Eric Chen Albert Chon |

| Native Token | INJ |

| The total funding | $57,6 Million |

What Are the Main Characteristics of Injectable?

- CosmWasm Compatible

- Bridge

- Staking

- Burn Auction

- Insurance funds

What are Injectables?

Injective’s blockchain platform is characterized by its pre-built modules. These include a decentralized orders book, and give developers the ability to develop sophisticated applications. It is an open platform for smart contracts.

Injective’s use of the Cosmos SDK along with the Tendermint Proof-of-Stake Consensus Framework ensures that transactions are finalized instantly. It is a leader in the facilitation of cross-chain, quick transactions on major Layer-1 network like Ethereum or Cosmos Hub.

Injective is an ecosystem of decentralized applications that is focused on creating a superior experience for users. Injective empowers people to allocate their capital efficiently by providing them with unrestricted, unlimited access to financial products, tools and services.

The Injective app has many advantages:

- Optimized for DEFI: Developers can use Injective’s pre-built primitives, such as a decentralized orderbook, to build mainstream DApps. They can use the order book for exchanges, predictions markets and other on-chain strategies.

- Interoperable: The platform is inherently interoperable and seamlessly integrates with multiple sovereign blockchain networks and features Inter-Blockchain Communication-enabled capabilities. Injective enables cross-chain transaction across multiple networks, including Ethereum, Moonbeam CosmosHub and Wormhole, as well as other Wormhole chains, such As Solana or Avalanche.

- CosmWasm – Create DApps with CosmWasm Injective offers support for CosmWasm. It is a platform that allows smart contract applications to be launched. Injective supports smart contracts that are compatible with CosmWasm supported chains.

- Launch Ethereum compatible tokens and IBC: This platform allows for the launch of Ethereum tokens and IBC compliant chains, since it is able to support cross-chain transaction with Ethereum as well as all IBC enabled chains. Injective tokens can be used across many networks.

You'll need a MetaMask, Ledger, Trezor or Trust Wallet, among others, to interact with Injective.

In April 2021 Injective raised $10 Million in a Private Placement from Mark Cuban, Pantera Capital, and BlockTower. It raised $40 Million in an August 2022 round, which was led by Jump Crypto.

“It’s really about bringing on valuable stakeholders rather than having more capital at hand.” – TechCrunch

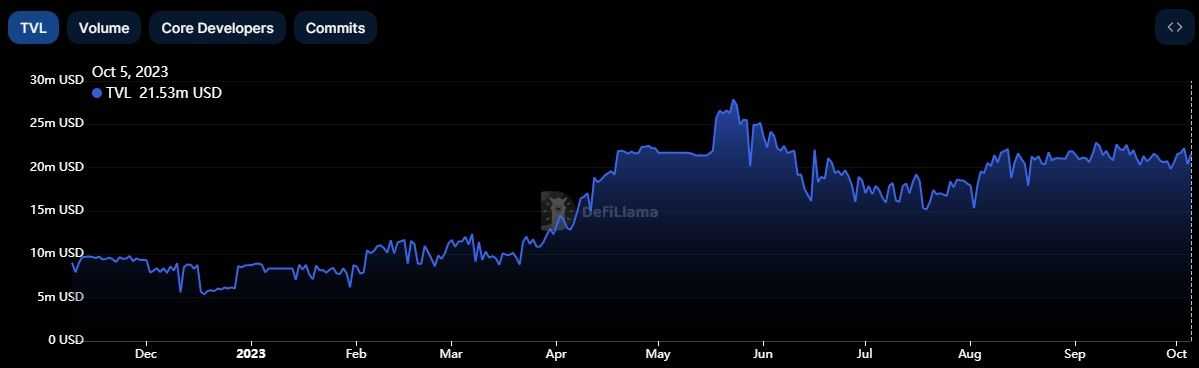

Injective is currently locked in a value total of 21.5 million dollars. TVL ranks Injective as the 47th-largest chain.

Binance, a crypto-heavyweight in the industry, is one of its biggest supporters.

Who founded Injective?

Injective was founded by Eric Chen and Albert Chon. Chon, today’s chief technology officer, is Chen’s CEO.

Chen worked as a research analyst at Innovating Capital, where he focused on protocol and trading strategy development. Chon's resume includes a stint at Amazon where he was a software development engineer. Chon completed his MS degree in Computer Science with a Specialization in Systems at Stanford.

Injective Review: Top Features

Here is an overview of Injective's top features:

CosmWasm Support

CosmWasm, a platform for smart contracts built specifically for the Cosmos eco-system. CosmWasm can be plugged into the Cosmos SDK as a plug-in module. This allows anyone building a chain using the Cosmos SDK the ability to include CosmWasm’s smart contracts without having to change existing logic.

Rust is currently the most used programming language for CosmWasm, but there's a possibility that other programming languages like AssemblyScript may be supported in the future.

Interoperability

Injective allows you to securely move crypto assets from popular blockchains and Web3 data into any Injective-built application. Injective ecosystem DApps can access Layer 1 chains to facilitate frictionless communication.

Injective Bridge can be used to send assets from and into Injective on the following blockchains

- Ethereum

- Solana

- Cosmos Hub

- Osmosis

- Evmos

- Axelar

- Moonbeam

- Persistence

- Secret Network

- Stride

- Crescent

- Sommelier

Staking

Injective is based on a Proof-of Stake system, where users stake their tokens at Injective Validators. These validators will validate the transactions while the user benefits by only contributing the assets.

The APR is currently 15.98%, and 44.22 million INJ (326.44 million USD) has been wagered.

You can track your reward status in Injective Hub’s stake section. After you earn enough rewards you may withdraw at any moment. In addition, you can instantly move staked INJ between validators. The unstaking period is 21 days long.

You can also check out the complete guide for staking cryptocurrency.

Burn Auctions

As an incentive mechanism to encourage exchanges (acting as relayers) to build on Injective and source trading activity, exchanges who originate orders into the shared orderbook on Injective's exchange protocol are rewarded with 40% of the trading fee arising from orders that they source. The remaining 60% is paid to Injective.

Every week an auction takes place to let community members bid using INJ for the trading fees that Injective collected during that particular week. The winning bidder is awarded the entire basket and all assets. In this way, the INJ supply is deflationary.

Insurance funds

In periods of extreme volatility, the loser of a margin trade may not have the funds to pay out the winner if the margin runs low. Positions can become bankrupt. If the trader's position is liquidated and the new trader takes it over at a worse price than the bankruptcy price, the insurance fund is utilized to cover the resulting deficit.

Injective’s insurance fund is not a common fund, as is the case with most other exchanges. Instead, a separate fund is created for every derivatives market that is launched. In this way, insurance risk is limited to the individual markets.

The insurance tokens are specific for each market. When an user accepts the risk of underwriting insurance on a derivatives market, he stakes the currency used as collateral. The pool tokens are pro-rata shares of ownership in the insurance fund. As an insurance fund increases in size from proceeds of liquidation, insurance fund holders profit by the rise in the value of their insurance fund stake.

Injective allows you to create derivatives markets using chain. Anyone can set up an insurance fund to cover a derivatives trading market and also become an underwriter. Underwriters can receive more money or less depending on their ownership percentage.

IMPORTANT: Trading margin is a very risky business. Click here to visit our Guide to complete the guide Learn more about crypto leverage.

INJ Token

INJ is Injective's native staking token, allowing holders to govern and decide the future of the protocol. Binance Launchpad released the token, marking its 16th Project.

Details about the sale in October 2020:

- Maximum Hard Cap: $3,6 Million

- Binance Launchpad Tokens: 9 million INJ (representing 9%) of total supply

- Price: 40 cents each INJ

- Token sale format: Lottery

- Lottery tickets with maximum winnings: 18,000.

- The winning ticket will be allocated either $200 or $500 INJ

- BNB Only

Tokenomics for INJ

INJ serves a variety of purposes. It is used as a governance tool and to incentivize DApp exchanges.

- Proof-of-stake security: Injective’s native INJ coin is the governing force behind its PoS blockchain. Injective PoS blockchain is governed by its native INJ token. At genesis the target INJ inflation will be 7% and it will reduce over time to only 2%. The total INJ supply may gradually be less than its initial supply because of the deflationary mechanisms.

- Collateral backing for derivatives: INJ will be utilized as an alternative to stablecoins as margin and collateral for Injective's derivatives markets. INJ may also be utilized as collateral in certain derivative markets or to stake insurance pools, where holders can earn an interest rate on their tokens.

INJ Token Performance

Launchpad investors received a 100% return on their investment in just one month. In November 2020 the token traded at $0.75.

By December 2020 the price had risen to around $1.50. It may have seemed tempting to take profits, but anyone who took them will regret it because by February 19, 2021 the token was worth $16.87.

Many may have bought at that price, then in the next month, prices dropped but they never went below $10. INJ instead resumed a rally that reached an all time high of $24.89 in April 2021.

CoinGecko ranks INJ at 60th place in terms of market capitalization. It has fallen 70% since its peak.

Injective Partnerships

Injective is involved in a variety of strategic alliances.

- Ecosystem Fund Pantera Capital and Kucoin Ventures have backed the $150 million Injective Ecosystem Fund. The fund will be used to accelerate projects focused on interoperable Infrastructure and DeFi.

- Espresso Systems: Injective worked with Espresso Systems, which is a protocol that helps create decentralized sequencers. Injective claimed that this partnership is a first step in bringing decentralization of rollups within its ecosystem.

- Hackathon: Injective launched the Illuminate Hackathon supported by Google Cloud and co-hosted with DoraHacks. This four-week Hackathon will be the launchpad of Web3 Finance applications, with $100,000 in prize money.

The Injective Review: Final Thoughts

Injective is a key player on the DeFi scene. Injective’s interoperable platform and innovative solutions not only allow for seamless cross-chain transaction, but it also creates a fertile soil for developing sophisticated financial apps. The company’s dedication to security, transparency and accessibility can be seen in features such as CosmWasm compatible, Injective Bridges, stake mechanisms, innovative auctions and insurance funds.

Injective's strategic partnerships and its backing from investors like Pantera Capital, Kucoin Ventures, and Jump Crypto underscore its potential and credibility within the blockchain space. The platform's native token, INJ, not only acts as a governance tool but also plays a vital role in the security and collateral backing of derivatives markets.

As the demand for secure and decentralized financial solutions grows, Injective's DeFi platform offers users a promising gateway to a decentralized financial future.

Common Questions

What are Injectables?

Injective, a blockchain layer 1 platform for decentralized financial applications (DeFi), is designed to build DeFi. The platform offers a number of prebuilt modules including a decentralized Order Book, giving developers tools for creating sophisticated financial apps. It is open to all smart contract platforms.

What is INJ and what role does it play within the Injective System?

INJ, Injective’s native stake token. Injective’s native staking token, INJ, serves many purposes including securing derivatives markets, incentivizing DApps on exchanges and governance. INJ holders can influence future protocol decisions and take part in governance processes.

What kind of financial products can be built on injective?

Injective is able to create a variety of financial products such as decentralized exchanges (DEX), prediction markets and different on-chain strategy. With its fully decentralized ordering system, developers can build decentralized apps (DApps), which are mainstream in the DeFi world.

Can I Stake INJ on Injective?

Injective is a proof of stake system that allows token holders to stake. Injective validators can validate transactions for Stakers and add to network security. The Injective Hub allows Stakers to monitor and withdraw their rewards.

What makes Injective different from other blockchain platforms?

Its innovative and interoperable solutions make Injective stand out. This enables immediate transaction completion using Cosmos SDK as well as Tendermint’s proof-of stake consensus framework. Injective also facilitates cross-chain, seamless transactions between major networks such as Ethereum and Cosmos hub, increasing its reach and usability.