The year 2024 was a rollercoaster for the crypto industry, marked by volatility and surprises—but it turned out to be unexpectedly positive in many ways.

The year saw a number of milestones, from Bitcoin’s $100,000 breakthrough following approval by BlackRock and Fidelity for spot ETFs to the European Union establishing a benchmark regulatory framework with its MiCA Framework. The year was also one of innovation with AI agents, and advances in chain abstraction. This bode well for the future of blockchain technology.

This article revisits 2024's defining moments, using hindsight to extract valuable lessons. We hope to provide readers with valuable insights by reflecting on the events of 2024.

Crypto's Power Shift: Institutions Rule, Regulations Fuel

In 2024 the crypto market experienced a massive transformation. Institutional investors took center stage, driving growth and legitimacy to unprecedented levels. Simultaneously the landscape changed as the key competitors stepped down, opening the door to new opportunities.

A new market is shaped by institutional dominance

The crypto market will undergo a major shift in 2024 as the institutional players take center stage and drive unprecedented growth.

Bitcoin Spot ETF Approvals

The U.S. Securities and Exchange Commission's approval of spot Bitcoin exchange-traded funds (ETFs) marked a pivotal moment. BlackRock and Fidelity, two financial giants in the world of finance, launched these exchange-traded funds (ETFs), giving traditional investors an avenue for gaining exposure to Bitcoin. This development propelled Bitcoin's price beyond $60,000, setting the stage for the elections to mark the $100,000 threshold, reflecting heightened market confidence and mainstream acceptance.

Large Bitcoin purchases

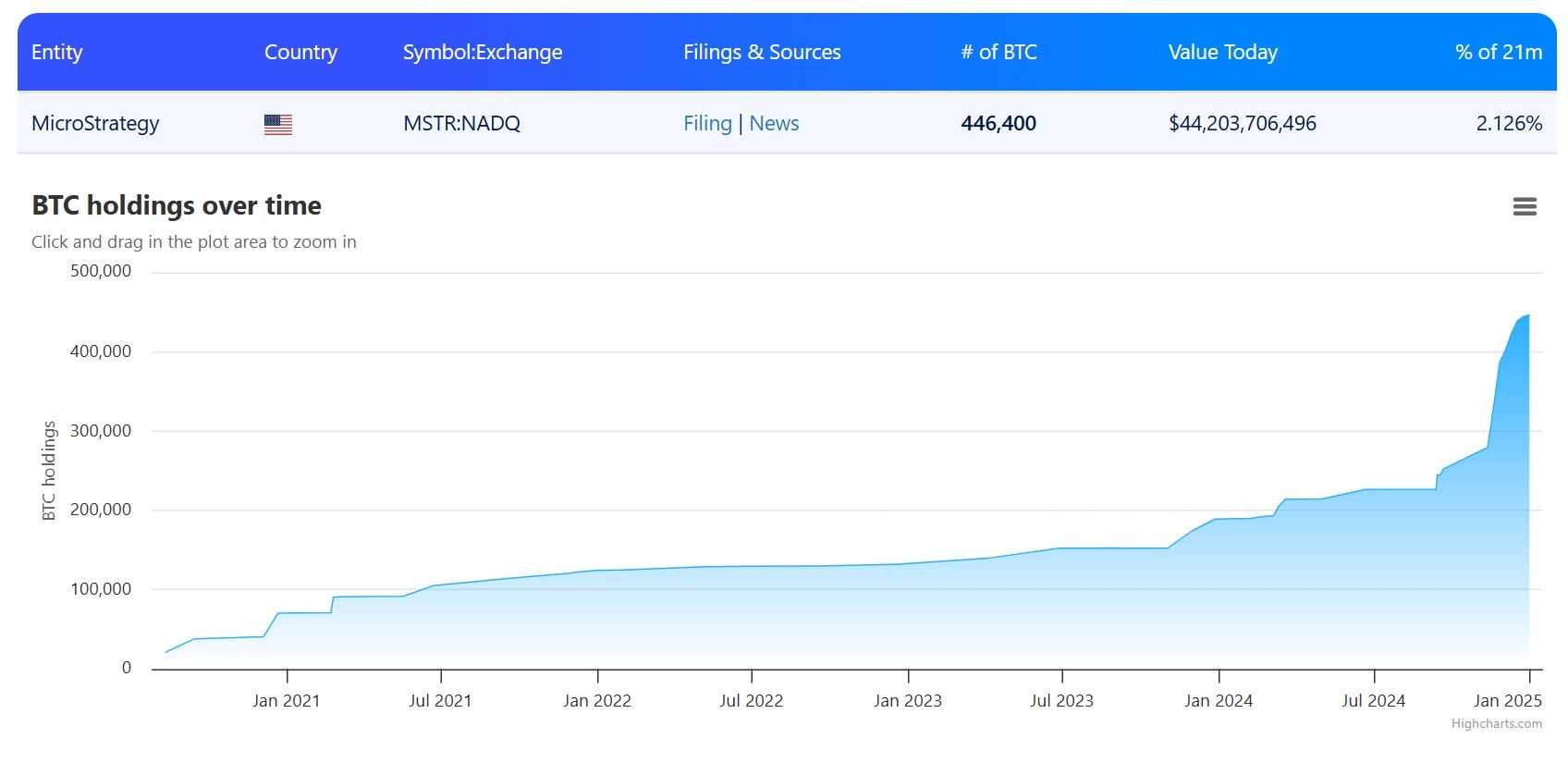

Under Michael Saylor's leadership, MicroStrategy continued its aggressive Bitcoin acquisition strategy. By December 2024, the company held approximately 446,400 BTC, acquired at an average price of $58,219 per Bitcoin, totaling over $23 billion in investment. In November 2024 MicroStrategy bought 27,200 Bitcoins at a cost of about $2,03 billion. This shows its commitment to Bitcoin as an asset for treasury reserves.

Tokenization of Real World Assets

The tokenization of real-world assets (RWAs) gained significant traction, bridging traditional finance and blockchain technology. Goldman Sachs, HSBC, and other institutions developed platforms that tokenized securities, bonds, and funds to increase liquidity and accessibility. This trend indicates a broader acceptance of blockchain's potential to revolutionize financial markets.

The journey is long, but the clear headwinds are evident.

Crypto landscapes experienced a significant change in 2024. Enemies stepped down and new promise were on the horizon.

Gary Gensler's Departure

Gary Gensler, the hard-nosed SEC chair known for his stringent stance on crypto, announced his resignation effective January 20, 2025, coinciding with President-elect Donald Trump's inauguration.

His departure was greeted with excitement by the crypto-community, who hoped it would herald a more relaxed regulatory environment. But his departure has also created a regulatory vacuum. It is unclear who will take over and how they’ll approach the issue.

Trump's Election Victory

Donald Trump's return to the Oval Office sent ripples through the crypto markets. The U.S. is the most important country for him. "crypto capital of the planet" and to establish a national Bitcoin reserve fueled by market optimism.

Bitcoin's price surged, reflecting the bullish sentiment. Yet, as of early January 2025, these promises remain just that—promises. Crypto world is watching closely, waiting for concrete policy changes to be implemented once Trump takes office.

Global Regulatory Momentum

Across the Atlantic, the European Union took strides in implementing the Markets in Crypto-Assets regulation (MiCA), that will take full effect in December 30th, 2024.

MiCA is designed to provide a comprehensive framework of crypto assets, and aims at harmonizing regulations between member states. It has been applauded as offering greater clarity to investors and promoting investment within the EU. This will help position Europe in the crypto world.

The conclusion of the article is:

In 2024, the end of the decade set in motion a period of radical change for crypto regulations. The industry is at a critical crossroads as strict regulators step down, and crypto leaders take their place. But the road from policy to promises is fraught. The crypto community is on tenterhooks as Trump gets ready to assume office. They are eager to know if regulatory clarity and the support they expect will be realized. The path ahead is still unexplored, and there are both challenges and opportunities.

Market Dynamics Reveal a Maturing Ecosystem

Crypto market showed its evolution in 2024. Its maturity was marked by volatility.

Prices can swing dramatically

Bitcoin's journey was nothing short of a rollercoaster. The U.S. Securities and Exchange Commission's approval of 11 spot Bitcoin ETFs in January 2024 ignited a surge, propelling prices to a multi-year high of $49,102. However, this euphoria was tempered by an 18% drop to $40,236, underscoring the market's sensitivity to regulatory decisions.

Political instability was a major factor in the rise of volatility. Donald Trump's election victory and his pro-crypto stance, including promises to make the U.S. the "crypto capital of the planet," Bitcoin surpassed $100,000 thanks to a surge of optimism. Markets remained tense, as they awaited the implementation of concrete policy.

Ethereum’s Performance is Underwhelming

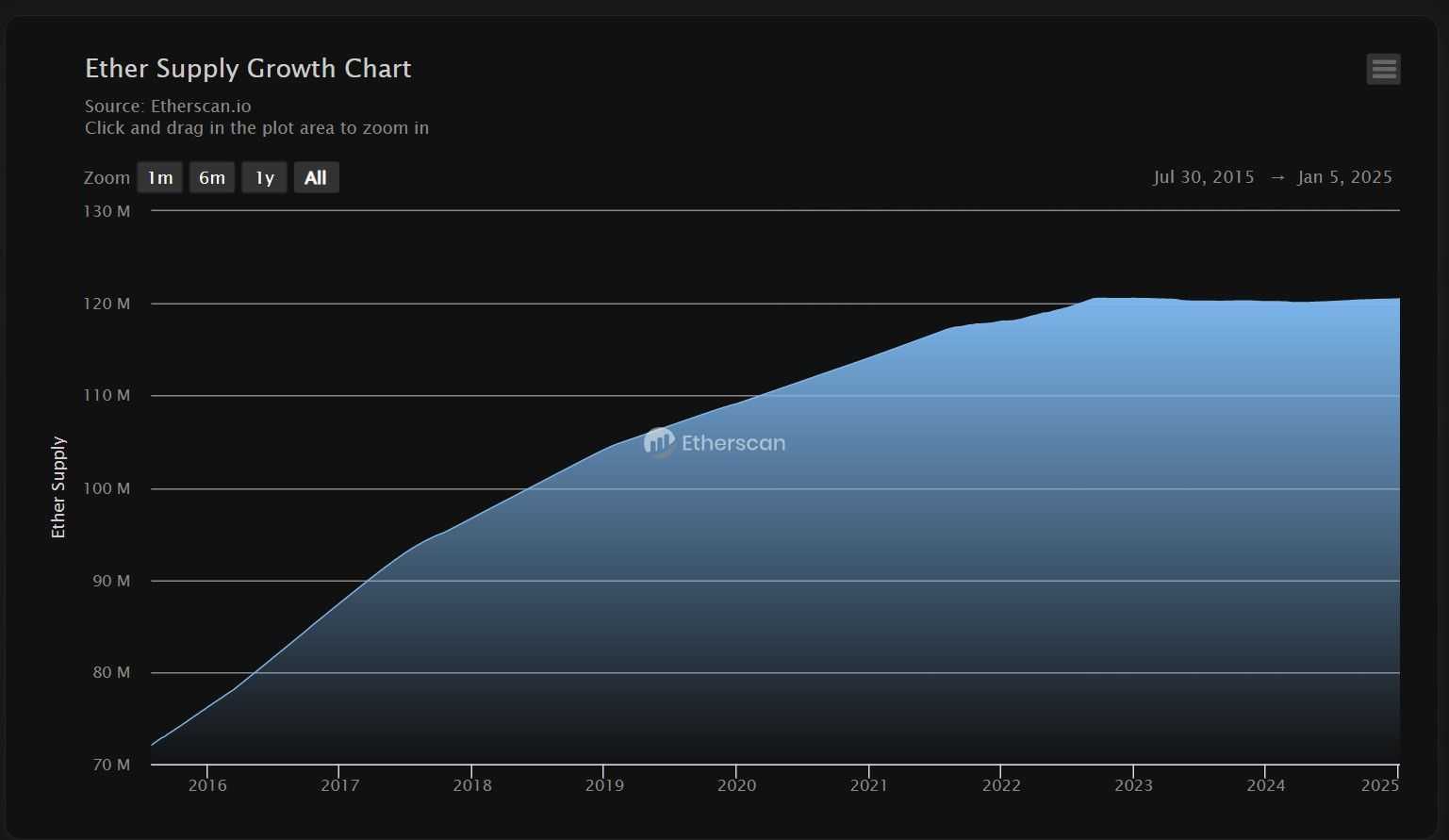

Ethereum was faced with its own unique set of problems. Layer 2 technologies, which are designed to increase scalability while reducing gas fees, have led to the migration of many transactions from mainnet. This shift resulted in gas fees plummeting to a five-year low, averaging around $0.14 per transaction. While this alleviated congestion, it also signaled a decreased demand for Ethereum's native gas tokens, raising questions about the platform's long-term value proposition.

The conclusion of the article is:

Events in 2024 show a market for crypto that has matured and is closely linked with external factors. These price fluctuations, which are affected by political and regulatory developments, show that volatility has become a part of the evolving crypto ecosystem.

Notably, the post-election surge following Trump's victory and SEC Chair Gary Gensler's resignation were among the most bullish events in recent years. But even during bullish periods, it is important to be cautious. Misjudging the market’s peak can result in significant losses. Ethereum's experience underscores the market's relentless pursuit of scalability, even if it means diminishing the role of foundational elements like gas tokens.

The Future is Technology-Driven

The crypto-landscape in 2024 was marked by stories that emphasized chain abstraction, and a move towards user-friendly and integrated ecosystems.

Multichain Ecosystems

Emerging Layer 1 projects like Sui, Cosmos, Polkadot, and Solana underscored the industry's drive for blockchain interoperability. Sui, for instance, reported an average transaction fee of $0.011 in 2024, making it 600% cheaper than Solana and over 86,000% cheaper than Ethereum. The scalability of the system and its cost-effectiveness are highlighted.

Chain Abstraction

Chain abstraction made significant strides in unifying Ethereum's fragmented rollup ecosystem. Omni's launch of its Core mainnet aimed to address challenges in cross-chain communication, introducing a universal gas resource to facilitate faster and more cost-effective transactions across the Ethereum ecosystem.

AI Integration in Crypto

The convergence of AI and blockchain was epitomized by projects like Virtuals Protocol, which enabled the creation of tokenized AI agents. Launched on Ethereum's Layer 2 Base network, Virtuals Protocol empowered users to create, monetize, and scale AI agents, contributing to its market cap surge to over $1.6 billion.

AI-driven meme coins, such as Goatseus Maximus(GOAT), have also been gaining traction. GOAT's market cap reached approximately $268 million, showcasing the viral potential of AI-agent interactions in the crypto space.

The conclusion of the article is:

The technological advancements of 2024 highlight the crypto ecosystem's commitment to improving user experience through interoperability and abstraction. Innovations like AI integration may have significant growth potential but are in the early stages of development, contributing to volatility. Investors need to be cautious when evaluating these new narratives, taking into account the inherent risks and opportunities of emerging technologies.

Wider Applications Showcase Adoption Potential

Blockchain technology will be widely adopted in 2024. It is expected to attract significant investments across many sectors.

Tokenization of Real World Assets

Tokenization has gained momentum in recent years, which allows fractional ownership of assets and enhances liquidity.

Decentralized Social Media

Users have embraced decentralized social networking sites in response to growing privacy concerns and the desire for centralized control. Platforms such as Farcaster and Bluesky gave users more autonomy and control over their content and data, while fostering communities that prioritized privacy.

GameFi Projects and Metaverse Projects resurgence

GameFi saw a revival with the integration of NFTs, virtual currencies and other technologies to improve user engagement. New participants were attracted by improved user experiences, innovative gameplay mechanics and the growing relevance of virtual worlds and blockchain-based games in an evolving digital landscape.

The conclusion of the article is:

The developments of 2024 underscore blockchain technology's expanding role in various industries. The tokenization of real-world assets bridges crypto and traditional finance, opening up new investment opportunities. Social media decentralized platforms give users greater control over online appearance.

The resurgence of GameFi and metaverse projects highlights virtual economies' ongoing relevance and potential. These applications, though they offer significant potential, are only in their initial stages. This contributes to volatility on the markets. Investors should be cognizant that these technologies are still in their nascent stages and carry associated risks.

AI Agents: The Emergence of AI Integration and Cryptography

In 2024, the fusion of artificial intelligence (AI) and blockchain technology gave rise to AI agents—autonomous software programs operating on decentralized networks. They use smart contracts, AI and blockchain technology to automate tasks and eliminate human involvement.

What are AI agents?

AI agents can be self-governing entities which perform complex tasks on Blockchain platforms. Integrating AI algorithms and smart contracts allows them to process large datasets, take informed decisions, execute autonomously, etc. Synergy between AI and smart contracts enables a wide range of applications, from automated trading through to decentralized government.

The Importance of 2024

AI agents were the focus of innovation by 2024. In 2024, projects such as Fetch.ai and ai16z explored the potential in a variety of domains including trading algorithms and supply chain management. The AI agent sector's market capitalization surged to $12.5 billion, reflecting growing investor interest.

Use Cases

- Data analysis and decision-making: AI agents process large datasets in order to optimize operations such as portfolio management for decentralized finance.

- Decentralized Automation These tools enabled automation of decentralized governance and logistics as well as AI-driven autonomous decentralized organizations (DAOs).

- Blockchain Technology: AI agents were used to identify vulnerabilities and enhance smart contract security.

Challenges

- Regulating and ethical concerns: The use of AI systems that are autonomous but decentralized raises questions regarding accountability and regulatory oversight.

- Techni-integration: Integration of AI and blockchain technology remains a major challenge.

Takeaway

The emergence of AI agents in 2024 demonstrated the transformative potential of combining blockchain's decentralization with AI's intelligence. This integration opened the door to new applications that redefined efficiency for various sectors. These technologies are still in their infancy, which contributes to volatility on the market. Investors must be careful when approaching this area, as there are both opportunities and risks. For more details on AI agents, check Coin Bureau's analysis.

The Key Takeaways and the Final Thoughts

Crypto landscape 2024 has been a transformative year, providing significant insight into blockchain technology, market dynamics and adoption trends. Each event, from institutional dominance and the rise of AI agents to the maturity of the ecosystem’s growing complexity. We can take a few key lessons from recent developments.

A new market is shaped by institutional dominance

Institutional players like BlackRock and MicroStrategy drove the market's revival, showcasing the growing acceptance of crypto as an asset class. Bitcoin ETFs gave the market unprecedented legitimacy. Large-scale institutional investments also showed that institutional dynamics were now driving the market, rather than retail. This shows the strength of "big money" in shaping market trends and reinforcing Bitcoin's position as a store of value.

Although the clouds part, there is still a road ahead that remains uncharted

While Gary Gensler's departure and Trump's pro-crypto stance brought optimism, regulatory clarity remains elusive. Global frameworks like the EU's MiCA provided a strong foundation. Yet, the U.S. does not have any rules in place. It teaches us, that while opponents may stand aside, actions must be taken to support market growth.

Market Dynamics Reveal a Maturing Ecosystem

Volatility is no longer a problem. External factors such as macroeconomic developments and political changes can cause price fluctuations. This is a sign of a mature ecosystem. However, Ethereum's challenges with Layer 2 adoption remind us that innovation often brings unintended consequences, like reduced demand for foundational assets.

The Future is Technology-Driven

In the past few years, chain abstraction, multichain eco-systems and AI integration have all been gaining popularity. These developments are a result of the need for seamless experiences and scalability. Although these developments are very exciting, the technology is still at an early stage, and requires patience from developers and investors.

Wider Applications Showcase Adoption Potential

Blockchain’s value is not just a theory. The real-world tokenization of assets, the decentralized nature of social media and GameFi’s resurgence have all proven its utility. The trends above showed how practical applications are driving broader adoption despite the fact that they face many technical and regulatory hurdles in their early stages.

AI Agents: The Emergence of AI Integration and Cryptography

AI agents showed the potential for combining AI intelligence with decentralization. Their use in automation, governance, and security highlights blockchain's ability to revolutionize various industries. But their growth raises regulatory and ethical questions.

Conclusions

Events in 2024 showed that crypto markets are not only surviving, but also thriving. Every lesson points to an ecosystem which is maturing and diversifying. It also becomes increasingly interwoven with the financial and technological landscape. To navigate opportunities and challenges, it is important to stay informed.

Common Questions

What Was the Most Important Event in 2024?

Donald Trump’s victory in the election was the most significant event for 2024. The pro-crypto policy, the promise to make the U.S. the crypto capital of the world, and the commitment to create a national Bitcoin Reserve fueled the market’s optimism. Bitcoin reached $100,000, changing the regulatory narrative.

How has AI affected the Crypto Industry

AI integration into crypto has revolutionized automation, especially through AI agents. Virtuals Protocol demonstrated blockchain synergy in the areas of trading, security and governance. Although promising, these developments also raised ethical and regulatory questions, highlighting the importance of cautious development.

What is the impact of regulation on crypto market?

There were both challenges and progress in the regulatory environment. Gary Gensler’s resignation raised expectations for greater leniency within the U.S. The EU’s MiCA, on the other hand, provided an extensive framework to encourage crypto adoption. However, the absence of U.S. concrete regulations has left us with uncertainty. This reminds us that regulatory transparency is vital for sustained growth.